Topline Data from CAHmelia-204 Study of

Tildacerfont in Adult Congenital Adrenal Hyperplasia (CAH)

Anticipated in December 2024

Topline Data from CAHptain-205 Study of

Tildacerfont in Adult and Pediatric CAH Anticipated in December

2024

Cash Runway Through the End of 2025

Spruce Biosciences, Inc. (Nasdaq: SPRB), a late-stage

biopharmaceutical company focused on developing and commercializing

novel therapies for endocrine and neurological disorders with

significant unmet medical need, today reported financial results

for the third quarter ended September 30, 2024 and provided

corporate updates.

“We remain on track to report primary efficacy and safety data

plus interim data from the open-label extension of the CAHmelia-204

study of tildacerfont in adult CAH patients in December 2024. At

the same time, we will also report topline dose-ranging efficacy

and safety data from the CAHptain-205 study of tildacerfont in

adult and pediatric CAH patients,” said Javier Szwarcberg, M.D.,

M.P.H., Chief Executive Officer of Spruce. “It is an honor to

continue partnering with the CAH community to open a new chapter in

the management of CAH. We recognize the potentially transformative

impact of tildacerfont, and we have a strong sense of urgency to

deliver on our commitment to CAH patients.”

Corporate Updates

CAHmelia-204 Study of Tildacerfont in Adult CAH:

CAHmelia-204 is a Phase 2b, randomized, double-blind,

placebo-controlled clinical trial to evaluate the safety and

efficacy of tildacerfont in reducing supraphysiologic

glucocorticoid (GC) usage, a potentially registrational endpoint,

in 90 adults with classic CAH on supraphysiologic doses of GCs with

normal or near normal levels of androstenedione (A4) at baseline.

In the first part of the clinical trial, patients were randomized

to receive 200mg of tildacerfont once-daily (QD) or placebo for 24

weeks. During the second part of the clinical trial, all patients

received 200mg of tildacerfont QD for 52 weeks. Throughout the

trial, tapering of GCs is guided according to a pre-specified

algorithm and continue to physiologic replacement levels, as long

as patients remain well controlled based on standard biomarkers and

clinical assessments. The primary endpoint of this clinical trial

is the absolute change in daily GC dose in hydrocortisone

equivalents (HCe) from baseline through week 24.

CAHptain-205 Study of Tildacerfont in Adult and Pediatric

CAH: CAHptain-205 is a Phase 2 open-label clinical trial, which

utilizes a sequential nine cohort design, to evaluate the safety,

efficacy, and pharmacokinetics of tildacerfont in adults and

children between two and 17 years of age. Cohorts 1-3 evaluated

weight-adjusted doses of tildacerfont between 50mg QD and 200mg QD

in pediatric CAH patients between two and 17 years of age, and

assessed changes in androgen levels over 12 weeks of treatment as

well as the ability to reduce daily GC dose based on A4

normalization. Cohorts 4-9 are evaluating weight-adjusted doses of

tildacerfont of 200mg twice-daily (BID) and 400mg BID in adults and

children between two and 17 years of age and is assessing changes

in androgen levels over four weeks of treatment. An optional

open-label extension period will provide additional open-label

treatment with tildacerfont to provide long-term safety data for up

to two years.

Anticipated Upcoming

Milestones

- Topline results from the CAHmelia-204 clinical trial of

tildacerfont 200mg QD in adult classic CAH patients on

supraphysiologic doses of GCs with normal or near normal levels of

A4 anticipated in December 2024

- Topline results from the CAHptain-205 clinical trial of

tildacerfont 200mg BID and 400mg BID adult and pediatric cohorts

anticipated in December 2024

- End of Phase 2 (EOP2) meeting with the U.S. Food and Drug

Administration anticipated in the first half of 2025

Third Quarter 2024 Financial

Results

- Cash and Cash Equivalents: Cash and cash equivalents as

of September 30, 2024 were $60.1 million. Cash and cash equivalents

are expected to allow the company to fund its current operating

plan through the end of 2025.

- Collaboration Revenue: Collaboration revenue was $0.6

million and $4.2 million for the three and nine months ended

September 30, 2024, respectively, compared to $3.1 million and $7.2

million for the same periods in 2023. The collaboration revenue

reflects the partial recognition of the $15.0 million upfront

payment the company received in April 2023 in connection with the

collaboration and license agreement with Kaken Pharmaceutical.

- Research and Development (R&D) Expenses: R&D

expenses for the three and nine months ended September 30, 2024

were $6.6 million and $25.0 million, respectively, compared to

$13.5 million and $38.3 million for the same periods in 2023. The

overall decrease in R&D expenses was primarily driven by the

decrease in clinical development and manufacturing expenses related

to the termination of the CAHmelia-203 study, completion of

enrollment in the company’s CAHmelia-204 study, and completion of

the Phase 2 POWER study in polycystic ovary syndrome, offset by an

increase in expenses related to the ongoing CAHptain-205

study.

- General and Administrative (G&A) Expenses: G&A

expenses for the three and nine months ended September 30, 2024

were $3.5 million and $11.3 million, respectively, compared to $3.2

million and $9.7 million for the same periods in 2023.

- Total Operating Expenses: Total operating expenses for

the three and nine months ended September 30, 2024 were $10.0

million and $36.3 million, respectively, compared to $16.7 million

and $48.0 million for the same periods in 2023. Operating expenses

include non-cash stock-based compensation expenses of $1.1 million

and $4.4 million for the three and nine months ended September 30,

2024, respectively, compared to $1.1 million and $3.4 million for

the same periods in 2023.

- Net Loss: Net loss for the three and nine months ended

September 30, 2024 was $8.7 million and $29.5 million,

respectively, compared to $12.4 million and $38.0 million for the

same periods in 2023.

Upcoming Investor

Conferences

Javier Szwarcberg, M.D., M.P.H., Chief Executive Officer, will

present at the Guggenheim Securities Healthcare Innovation

Conference on November 11, 2024, at 3:30 p.m. ET.

Interested parties can access the live webcast here. An archived

copy of the webcast will be available on the events section of the

company’s investor relations website for approximately 90 days.

About Spruce Biosciences

Spruce Biosciences is a late-stage biopharmaceutical company

focused on developing and commercializing novel therapies for

endocrine and neurological disorders with significant unmet medical

need. Spruce is developing its product candidate, tildacerfont, an

oral, second-generation CRF1 receptor antagonist, for the treatment

of congenital adrenal hyperplasia (CAH), polycystic ovary syndrome

(PCOS) and major depressive disorder (MDD). To learn more, visit

www.sprucebio.com and follow us on X, LinkedIn, Facebook and

YouTube.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements include statements

regarding, among other things, the design, results, conduct,

progress and timing of Spruce’s clinical trials; Spruce’s

expectations regarding reporting results of its clinical trials in

2024; Spruce’s plans to meet with the FDA to discuss the potential

registrational path forward of tildacerfont for adult and pediatric

classic CAH; and Spruce’s product candidate, strategy and

regulatory matters. Because such statements are subject to risks

and uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements. Words such

as “anticipate,” “continue,” “will,” “potential,” “on track,” and

similar expressions are intended to identify forward-looking

statements. These forward-looking statements are based upon

Spruce’s current expectations and involve assumptions that may

never materialize or may prove to be incorrect. Actual results

could differ materially from those anticipated in such

forward-looking statements as a result of various risks and

uncertainties, which include, without limitation, risks and

uncertainties associated with Spruce’s business in general, the

impact of geopolitical and macroeconomic events, and the other

risks described in Spruce’s filings with the U.S. Securities and

Exchange Commission. All forward-looking statements contained in

this press release speak only as of the date on which they were

made and are based on management’s assumptions and estimates as of

such date. Spruce undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made, except as required by

law.

SPRUCE BIOSCIENCES,

INC.

CONDENSED BALANCE

SHEETS

(unaudited)

(in thousands, except share

and per share amounts)

September 30,

December 31,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

60,055

$

96,339

Prepaid expenses

2,658

3,876

Other current assets

860

1,968

Total current assets

63,573

102,183

Right-of-use assets

998

1,181

Other assets

531

582

Total assets

$

65,102

$

103,946

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

1,799

$

3,332

Accrued expenses and other current

liabilities

7,740

14,600

Term loan, current portion

1,622

1,622

Deferred revenue, current portion

697

4,911

Total current liabilities

11,858

24,465

Lease liabilities, net of current

portion

809

1,019

Term loan, net of current portion

524

1,717

Other liabilities

273

236

Total liabilities

13,464

27,437

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value;

10,000,000 shares authorized and no shares issued or outstanding as

of September 30, 2024 and December 31, 2023

—

—

Common stock, $0.0001 par value;

200,000,000 shares authorized as of September 30, 2024 and December

31, 2023; 41,302,599 and 41,029,832 shares issued and outstanding

as of September 30, 2024 and December 31, 2023, respectively

4

4

Additional paid-in capital

278,343

273,737

Accumulated deficit

(226,709

)

(197,232

)

Total stockholders’ equity

51,638

76,509

Total liabilities and stockholders’

equity

$

65,102

$

103,946

SPRUCE BIOSCIENCES,

INC.

CONDENSED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

(in thousands, except share

and per share amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Collaboration revenue

$

602

$

3,073

$

4,214

$

7,202

Operating expenses:

Research and development

6,554

13,494

24,961

38,332

General and administrative

3,456

3,237

11,330

9,699

Total operating expenses

10,010

16,731

36,291

48,031

Loss from operations

(9,408

)

(13,658

)

(32,077

)

(40,829

)

Interest expense

(71

)

(119

)

(251

)

(377

)

Interest income and other expense, net

808

1,423

2,851

3,237

Net loss

(8,671

)

(12,354

)

(29,477

)

(37,969

)

Other comprehensive gain, net of tax:

Unrealized gain on available for sale

securities

—

52

—

555

Total comprehensive loss

$

(8,671

)

$

(12,302

)

$

(29,477

)

$

(37,414

)

Net loss per share, basic and diluted

$

(0.21

)

$

(0.30

)

$

(0.72

)

$

(1.01

)

Weighted-average shares of common stock

outstanding, basic and diluted

41,302,599

40,710,692

41,187,766

37,751,865

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111107317/en/

Media Katie Beach Oltsik Inizio Evoke Comms (937)

232-4889 Katherine.Beach@inizioevoke.com media@sprucebio.com

Investors Samir Gharib President and CFO Spruce

Biosciences, Inc. investors@sprucebio.com

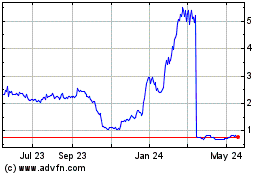

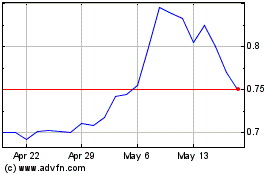

Spruce Biosciences (NASDAQ:SPRB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Spruce Biosciences (NASDAQ:SPRB)

Historical Stock Chart

From Nov 2023 to Nov 2024