TaskUs, Inc. (Nasdaq: TASK), a leading provider of outsourced

digital services and next-generation customer experience to the

world’s most innovative companies, today announced its results for

the third quarter ended September 30, 2024.

- Total revenues of $255.3 million, 13.2% year-over-year

growth. Exceeding the top-end of our guidance by $9.3 million.

- Net income of $12.7 million, net income margin of

5.0%.

- Adjusted Net Income of $34.3 million, Adjusted Net

Income margin of 13.4%.

- Diluted EPS of $0.14, Adjusted EPS of $0.37.

- Adjusted EBITDA of $54.2 million, Adjusted EBITDA margin

of 21.2%. Exceeding our midpoint guidance by $1.5 million.

- Net cash provided by operating activities of $17.0

million, Free Cash Flow of $6.3 million and 11.6% conversion of

Adjusted EBITDA to Free Cash Flow. Adjusted Free Cash Flow of $9.1

million and 16.8% conversion of Adjusted EBITDA to Adjusted Free

Cash Flow.

"Our team has continued to deliver results that exceed

expectations. In Q3 we delivered the highest quarterly revenue in

our company’s history and returned to double-digit year-over-year

revenue growth of 13.2%. We expect another record-setting quarter

in Q4, as we once again deliver accelerating, double-digit growth,”

said Co-Founder and CEO, Bryce Maddock. “While many competitors

have struggled this year, we’ve taken the opportunity to go on the

offensive—investing in our specialized services, deploying new

technologies, and ramping up sales and marketing. This strategy has

driven results, enabling us to increase the midpoint of our

full-year guidance by $64 million since our initial 2024

guide."

Third Quarter 2024 Financial and Frontline Highlights

($ in thousands, except per share

amounts)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

% Change

2024

2023

% Change

Service revenue

$

255,345

$

225,626

13.2

%

$

720,743

$

690,101

4.4

%

Net income

$

12,699

$

9,772

30.0

%

$

37,011

$

29,413

25.8

%

Net income margin

5.0

%

4.3

%

5.1

%

4.3

%

Adjusted Net Income

$

34,277

$

29,961

14.4

%

$

90,184

$

94,294

(4.4

)%

Adjusted Net Income margin

13.4

%

13.3

%

12.5

%

13.7

%

Diluted EPS

$

0.14

$

0.10

40.0

%

$

0.40

$

0.30

33.3

%

Adjusted EPS

$

0.37

$

0.32

15.6

%

$

0.98

$

0.96

2.1

%

Adjusted EBITDA

$

54,215

$

52,452

3.4

%

$

156,072

$

161,781

(3.5

)%

Adjusted EBITDA margin

21.2

%

23.2

%

21.7

%

23.4

%

Net cash provided by operating

activities

$

17,019

$

21,682

(21.5

)%

$

98,230

$

103,895

(5.5

)%

Free Cash Flow

$

6,286

$

13,823

(54.5

)%

$

79,409

$

80,991

(2.0

)%

Conversion of Adjusted EBITDA to Free Cash

Flow

11.6

%

26.4

%

50.9

%

50.1

%

Adjusted Free Cash Flow

$

9,097

$

32,164

(71.7

)%

$

82,220

$

99,332

(17.2

)%

Conversion of Adjusted EBITDA to Adjusted

Free Cash Flow

16.8

%

61.3

%

52.7

%

61.4

%

- All three service lines delivered year-over-year revenue growth

in Q3. The growth rates in each service line are expected to

accelerate in Q4 of 2024.

- Increased our midpoint, full-year revenue guidance by $24

million this quarter, and $64 million since our initial 2024

guidance.

- Added 3,100 teammates since the second quarter, ending the

third quarter of 2024 with 54,800 teammates.

- Net Debt to Adjusted EBITDA leverage ratio was 0.4 times.

"In Q3, we continued to experience strong global demand from

both new and existing clients, generating $255.3 million in revenue

- the highest quarterly revenue in our history,” said Balaji Sekar,

Chief Financial Officer. “We saw broad-based growth across our

client verticals and delivery geographies, particularly in Latin

America and Europe. I am proud of the disciplined performance our

team delivered in a competitive market environment, resulting in a

year-over-year increase of more than 3% in our Adjusted EBITDA,

including the significant investments we continue to make in sales,

marketing, technology, and operations to support our ongoing

revenue growth acceleration. Looking ahead, we expect full-year

2024 revenues to range from $988 million to $990 million and to

deliver approximately $213 million in Adjusted EBITDA and $110

million Adjusted Free Cash Flow at the midpoint of our

guidance.”

Fourth Quarter and Full Year 2024 Outlook

For the fourth quarter and full year

2024, TaskUs expects its financial results to include1, 2:

2024 Outlook

Fourth Quarter

Full Year

Revenue (in millions)

$267.3 to $269.3

$988 to $990

Revenue change (YoY) at midpoint

14.5%

7.0%

Adjusted EBITDA Margin1

~21.1%

~21.5%

Adjusted Free Cash Flow (in millions)2

N/A

~$110

(1)

With respect to the non-GAAP Adjusted

EBITDA margin outlook provided above, a reconciliation to the

closest GAAP financial measure has not been provided as the

quantification of certain items included in the calculation of GAAP

net income (loss) cannot be calculated or predicted at this time

without unreasonable efforts. For example, the non-GAAP adjustment

for stock-based compensation expense requires additional inputs

such as number of shares granted and market price that are not

currently ascertainable, and the non-GAAP adjustment for foreign

currency gains or losses depends on the timing and magnitude of

changes in foreign currency exchange rates and cannot be accurately

forecasted. For the same reasons, the Company is unable to address

the probable significance of the unavailable information, which

could have a potentially unpredictable, and potentially

significant, impact on its future GAAP financial results.

(2)

Adjusted Free Cash Flow is calculated as

net cash provided by operating activities in the period minus cash

used for purchase of property and equipment in the period,

excluding certain non-recurring adjustments. At the midpoint of our

guidance, net cash provided by operating activities for the full

year 2024, excluding certain litigation-related payments, is

expected to be approximately $146 million and purchase of property

and equipment is expected to be approximately $36 million. Our

Adjusted Free Cash Flow guidance and expected net cash provided by

operating activities excludes the impact of certain litigation

costs, which are non-recurring and outside the ordinary course of

business, due to the unpredictability of the costs and timing of

payments.

Conference Call Information

TaskUs senior management will host a conference call today to

discuss the Company’s third quarter 2024 financial results and

financial outlook. This call is scheduled to begin at 5:00 pm ET.

Analysts and investors who wish to participate in the call can

register by visiting

https://register.vevent.com/register/BI8fce858f29da495b8940187fddefb841.

To listen to a live audio webcast, please visit TaskUs’ Investor

Relations website at IR.Taskus.com. A replay of the audio webcast

will be available on the same website for 12 months following the

call. At the time of the conference call and webcast, the Company

will post a slide presentation and other materials on its

website.

About TaskUs

TaskUs is a leading provider of outsourced digital services and

next-generation customer experience to the world’s most innovative

companies, helping its clients represent, protect, and grow their

brands. Leveraging a cloud-based infrastructure, TaskUs serves

clients in the fastest-growing sectors, including social media,

e-commerce, gaming, streaming media, food delivery and

ride-sharing, Technology, FinTech, and HealthTech. As of September

30, 2024, TaskUs had a worldwide headcount of approximately 54,800

people across 28 locations in 12 countries, including the United

States, the Philippines, and India.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include all statements that are

not historical facts, and further include, without limitation,

statements reflecting our current views with respect to, among

other things, our operations, our financial performance, our

industry, the impact of the macroeconomic environment on our

business, and other non-historical statements including the

statements in the “Fourth Quarter and Full Year 2024 Outlook”

section of this press release. In some cases, you can identify

these forward-looking statements by the use of words such as

“outlook,” “believes,” “expects,” “potential,” “continues,” “may,”

“will,” “should,” “could,” “seeks,” “predicts,” “intends,”

“trends,” “plans,” “estimates,” “anticipates,” “position us” or the

negative version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties. Accordingly, there are or will be important factors

that could cause actual outcomes or results to differ materially

from those indicated in these statements. These factors include but

are not limited to: the dependence of our business on key clients;

the risk of loss of business or non-payment from clients; our

failure to cost-effectively acquire and retain new clients; the

risk that we may provide inadequate service or cause disruptions in

our clients’ businesses or fail to comply with the quality

standards required by our clients under our agreements; utilization

of artificial intelligence by our clients or our failure to

incorporate artificial intelligence into our operations; our

inability to anticipate clients’ needs by adapting to market and

technology trends; unauthorized or improper disclosure of personal

or other sensitive information, or security breaches and incidents;

negative publicity or liability or difficulty recruiting and

retaining employees; our failure to detect and deter criminal or

fraudulent activities or other misconduct by our employees or third

parties; global economic and political conditions, especially in

the social media and meal delivery and transport industries from

which we generate significant revenue; the dependence of our

business on our international operations, particularly in the

Philippines and India; our failure to comply with applicable data

privacy and security laws and regulations; fluctuations against the

U.S. dollar in the local currencies in the countries in which we

operate; our inability to maintain and enhance our brand;

competitive pricing pressure; our dependence on senior management

and key employees; increases in employee expenses and changes to

labor laws; failure to attract, hire, train and retain a sufficient

number of skilled employees to support operations; our inability to

effectively expand our operations into countries or industries in

which we have no prior operating experience and in which we may be

subject to increased business, economic and regulatory risks;

reliance on owned and third-party technology and computer systems;

failure to maintain asset utilization levels, price appropriately

and control costs; the control of affiliates of Blackstone Inc. and

our Co-Founders over us; and the dual class structure of our common

stock. Additional risks and uncertainties include but are not

limited to those described under “Risk Factors” in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the Securities and Exchange Commission (the “SEC”) on

March 8, 2024, as such factors may be updated from time to time in

our periodic filings with the SEC, which are accessible on the

SEC’s website at www.sec.gov. These

factors should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in the Company’s SEC filings. TaskUs undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future developments or otherwise,

except as required by law.

Non-GAAP Measures

TaskUs supplements results reported in accordance with United

States generally accepted accounting principles (“GAAP”), with

non-GAAP financial measures, such as Adjusted Net Income, Adjusted

Net Income Margin, Adjusted EPS, EBITDA, Adjusted EBITDA, Adjusted

EBITDA Margin, Free Cash Flow, Adjusted Free Cash Flow, Conversion

of Adjusted EBITDA to Free Cash Flow and Conversion of Adjusted

EBITDA to Adjusted Free Cash Flow. Management believes these

measures help illustrate underlying trends in TaskUs’ business and

uses the measures to establish budgets and operational goals,

communicate internally and externally, and manage TaskUs’ business

and evaluate its performance. Management also believes these

measures help investors compare TaskUs’ operating performance with

its results in prior periods. TaskUs anticipates that it will

continue to report both GAAP and certain non-GAAP financial

measures in its financial results, including non-GAAP results that

exclude the impact of certain costs, losses and gains that are

required to be included in our profit and loss measures under GAAP.

Because TaskUs’ reported non-GAAP financial measures are not

calculated in accordance with GAAP, these measures are not

comparable to GAAP and may not be comparable to similarly described

non-GAAP measures reported by other companies within TaskUs’

industry. Consequently, TaskUs’ non-GAAP financial measures should

not be evaluated in isolation or supplant comparable GAAP measures,

but rather, should be considered together with the information in

TaskUs’ consolidated financial statements, which are prepared in

accordance with GAAP. Definitions of non-GAAP financial measures

and the reconciliations to the most directly comparable measures in

accordance with GAAP are provided in subsequent sections of this

press release narrative and supplemental schedules.

TaskUs, Inc.

Condensed Consolidated

Statements of Income (unaudited)

(in thousands, except per share

data)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Service revenue

$

255,345

$

225,626

$

720,743

$

690,101

Operating expenses:

Cost of services

153,765

130,139

433,052

401,455

Selling, general, and administrative

expense

62,650

57,114

171,830

179,583

Depreciation

9,758

9,762

30,525

29,502

Amortization of intangible assets

4,988

5,027

14,955

15,276

Loss (gain) on disposal of assets

(10

)

640

(93

)

772

Total operating expenses

231,151

202,682

650,269

626,588

Operating income

24,194

22,944

70,474

63,513

Other expense (income), net

898

2,895

(2,007

)

34

Financing expenses

5,504

5,712

16,532

16,141

Income before income taxes

17,792

14,337

55,949

47,338

Provision for income taxes

5,093

4,565

18,938

17,925

Net income

$

12,699

$

9,772

$

37,011

$

29,413

Net income per common share:

Basic

$

0.14

$

0.11

$

0.42

$

0.31

Diluted

$

0.14

$

0.10

$

0.40

$

0.30

Weighted-average number of common shares

outstanding:

Basic

88,978,159

92,480,316

88,701,787

95,522,026

Diluted

92,579,919

94,035,111

92,019,911

97,729,230

TaskUs, Inc.

Condensed Consolidated Balance

Sheets (unaudited)

(in thousands)

September 30,

2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

180,381

$

125,776

Accounts receivable, net of allowance for

credit losses of $1,836 and $1,978, respectively

200,780

176,812

Income tax receivable

8,472

2,021

Prepaid expenses and other current

assets

29,777

23,909

Total current assets

419,410

328,518

Noncurrent assets:

Property and equipment, net

65,127

68,893

Operating lease right-of-use assets

47,352

44,326

Deferred tax assets

6,651

4,857

Intangibles

178,084

192,958

Goodwill

218,359

218,108

Other noncurrent assets

7,114

6,542

Total noncurrent assets

522,687

535,684

Total assets

$

942,097

$

864,202

Liabilities and Shareholders’

Equity

Liabilities:

Current liabilities:

Accounts payable and accrued

liabilities

$

38,464

$

26,054

Accrued payroll and employee-related

liabilities

59,514

40,291

Current portion of debt

13,122

8,059

Current portion of operating lease

liabilities

18,116

15,872

Current portion of income tax payable

6,239

7,451

Deferred revenue

3,646

4,077

Total current liabilities

139,101

101,804

Noncurrent liabilities:

Income tax payable

4,678

4,621

Long-term debt

246,325

256,166

Operating lease liabilities

31,677

31,475

Accrued payroll and employee-related

liabilities

5,212

3,978

Deferred tax liabilities

25,229

25,214

Other noncurrent liabilities

85

233

Total noncurrent liabilities

313,206

321,687

Total liabilities

452,307

423,491

Total shareholders’ equity

489,790

440,711

Total liabilities and shareholders’

equity

$

942,097

$

864,202

TaskUs, Inc.

Condensed Consolidated

Statement of Cash Flows (unaudited)

(in thousands)

Nine months ended September

30,

2024

2023

Cash flows from operating activities:

Net income

$

37,011

$

29,413

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

30,525

29,502

Amortization of intangibles

14,955

15,276

Amortization of debt financing fees

447

447

Loss (gain) on disposal of assets

(93

)

772

Benefit from credit losses

(25

)

—

Unrealized foreign exchange losses (gains)

on forward contracts

(166

)

6,020

Deferred taxes

(1,813

)

(255

)

Stock-based compensation expense

31,954

42,337

Changes in operating assets and

liabilities:

Accounts receivable

(23,452

)

(680

)

Prepaid expenses and other current

assets

(5,807

)

(4,403

)

Operating lease right-of-use assets

11,883

10,670

Other noncurrent assets

(809

)

(123

)

Accounts payable and accrued

liabilities

3,318

(9,063

)

Accrued payroll and employee-related

liabilities

20,904

(4,093

)

Operating lease liabilities

(12,423

)

(10,217

)

Income tax payable

(7,592

)

(1,278

)

Deferred revenue

(442

)

(278

)

Other noncurrent liabilities

(145

)

(152

)

Net cash provided by operating

activities

98,230

103,895

Cash flows from investing activities:

Purchase of property and equipment

(18,821

)

(22,904

)

Investment in loan receivable

—

(1,000

)

Net cash used in investing activities

(18,821

)

(23,904

)

Cash flows from financing activities:

Payments for deferred business acquisition

consideration

(144

)

(145

)

Payments on long-term debt

(5,063

)

(2,025

)

Proceeds from employee stock plans

3,301

554

Payments for taxes related to net share

settlement

(3,880

)

(2,035

)

Payments for stock repurchases

(15,468

)

(92,683

)

Net cash used in financing activities

(21,254

)

(96,334

)

Increase (decrease) in cash and cash

equivalents

58,155

(16,343

)

Effect of exchange rate changes on

cash

(3,550

)

(3,033

)

Cash and cash equivalents at beginning of

period

125,776

133,992

Cash and cash equivalents at end of

period

$

180,381

$

114,616

TaskUs, Inc.

Non-GAAP

Reconciliations

Adjusted EBITDA (unaudited)

(in thousands, except margin

amounts)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income

$

12,699

$

9,772

$

37,011

$

29,413

Provision for income taxes

5,093

4,565

18,938

17,925

Financing expenses

5,504

5,712

16,532

16,141

Depreciation

9,758

9,762

30,525

29,502

Amortization of intangible assets

4,988

5,027

14,955

15,276

EBITDA

$

38,042

$

34,838

$

117,961

$

108,257

Transaction costs(1)

—

—

—

245

Earn-out consideration(2)

—

(53

)

—

7,863

Foreign currency losses(3)

2,490

3,494

2,192

1,316

Loss (gain) on disposal of assets

(10

)

640

(93

)

772

Severance costs(4)

—

60

487

1,628

Litigation costs(5)

4,412

—

7,030

—

Stock-based compensation expense(6)

10,742

13,946

32,434

42,725

Interest income(7)

(1,461

)

(473

)

(3,939

)

(1,025

)

Adjusted EBITDA

$

54,215

$

52,452

$

156,072

$

161,781

Net Income Margin(8)

5.0

%

4.3

%

5.1

%

4.3

%

Adjusted EBITDA Margin(8)

21.2

%

23.2

%

21.7

%

23.4

%

(1)

Represents professional service fees

related to non-recurring transactions.

(2)

Represents earn-out consideration

recognized as compensation expense related to the acquisition of

heloo.

(3)

Realized and unrealized foreign currency

losses include the effect of fair market value changes of forward

contracts not designated as hedging instruments and remeasurement

of U.S. dollar-denominated accounts to foreign currency.

(4)

Represents severance payments as a result

of certain cost optimization measures we undertook during the

period to restructure support roles.

(5)

Represents only those litigation costs

that are considered non-recurring and outside of the ordinary

course of business.

(6)

Represents stock-based compensation

expense, as well as associated payroll tax.

(7)

Represents interest earned on short-term

savings, time-deposits and money market funds.

(8)

Net Income Margin represents net income

divided by service revenue and Adjusted EBITDA Margin represents

Adjusted EBITDA divided by service revenue.

TaskUs, Inc.

Non-GAAP

Reconciliations

Adjusted Net Income

(unaudited)

(in thousands, except margin

amounts)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income

$

12,699

$

9,772

$

37,011

$

29,413

Amortization of intangible assets

4,988

5,027

14,955

15,276

Transaction costs(1)

—

—

—

245

Earn-out consideration(2)

—

(53

)

—

7,863

Foreign currency losses(3)

2,490

3,494

2,192

1,316

Loss (gain) on disposal of assets

(10

)

640

(93

)

772

Severance costs(4)

—

60

487

1,628

Litigation costs(5)

4,412

—

7,030

—

Stock-based compensation expense(6)

10,742

13,946

32,434

42,725

Tax impacts of adjustments(7)

(1,044

)

(2,925

)

(3,832

)

(4,944

)

Adjusted Net Income

$

34,277

$

29,961

$

90,184

$

94,294

Net Income Margin(8)

5.0

%

4.3

%

5.1

%

4.3

%

Adjusted Net Income Margin(8)

13.4

%

13.3

%

12.5

%

13.7

%

(1)

Represents professional service fees

related to non-recurring transactions.

(2)

Represents earn-out consideration

recognized as compensation expense related to the acquisition of

heloo.

(3)

Realized and unrealized foreign currency

losses include the effect of fair market value changes of forward

contracts not designated as hedging instruments and remeasurement

of U.S. dollar-denominated accounts to foreign currency.

(4)

Represents severance payments as a result

of certain cost optimization measures we undertook during the

period to restructure support roles.

(5)

Represents only those litigation costs

that are considered non-recurring and outside of the ordinary

course of business.

(6)

Represents stock-based compensation

expense, as well as associated payroll tax.

(7)

Represents tax impacts of adjustments to

net income which resulted in a tax benefit during the period,

including stock-based compensation expense, earn-out consideration,

litigation costs and severance. After these adjustments, we applied

a non-GAAP effective tax rate of 18.6% and 26.5% for the three

months ended September 30, 2024 and 2023, respectively, and 23.7%

and 23.0% for the nine months ended September 30, 2024 and 2023,

respectively, to non-GAAP income before income taxes.

(8)

Net Income Margin represents net income

divided by service revenue and Adjusted Net Income Margin

represents Adjusted Net Income divided by service revenue.

TaskUs, Inc.

Non-GAAP

Reconciliations

Adjusted EPS (unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

GAAP diluted EPS

$

0.14

$

0.10

$

0.40

$

0.30

Per share adjustments to net income(1)

0.23

0.22

0.58

0.66

Adjusted EPS

$

0.37

$

0.32

$

0.98

$

0.96

Weighted-average common shares outstanding

– diluted

92,579,919

94,035,111

92,019,911

97,729,230

(1)

Reflects the aggregate adjustments made to

reconcile net income to Adjusted Net Income, as noted in the above

table, divided by the GAAP diluted weighted-average number of

shares outstanding for the relevant period.

TaskUs, Inc.

Non-GAAP

Reconciliations

Free Cash Flow (unaudited)

(in thousands, except

percentages)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net cash provided by operating

activities

$

17,019

$

21,682

$

98,230

$

103,895

Purchase of property and equipment

(10,733

)

(7,859

)

(18,821

)

(22,904

)

Free Cash Flow

$

6,286

$

13,823

$

79,409

$

80,991

Payment for earn-out consideration

—

18,341

—

18,341

Payment for litigation costs

$

2,811

$

—

$

2,811

$

—

Adjusted Free Cash Flow

$

9,097

$

32,164

$

82,220

$

99,332

Conversion of Adjusted EBITDA to Free Cash

Flow(1)

11.6

%

26.4

%

50.9

%

50.1

%

Conversion of Adjusted EBITDA to Adjusted

Free Cash Flow(1)

16.8

%

61.3

%

52.7

%

61.4

%

(1)

Conversion of Adjusted EBITDA to Free Cash

Flow represents Free Cash Flow divided by Adjusted EBITDA

Conversion of Adjusted EBITDA to Adjusted Free Cash Flow represents

Adjusted Free Cash Flow divided by Adjusted EBITDA.

Definitions of Non-GAAP Metrics

EBITDA and Adjusted EBITDA

EBITDA is a non-GAAP profitability measure that represents net

income or loss for the period before the impact of the benefit from

or provision for income taxes, financing expenses, depreciation,

and amortization of intangible assets. EBITDA eliminates potential

differences in performance caused by variations in capital

structures (affecting financing expenses), tax positions (such as

the availability of net operating losses against which to relieve

taxable profits), the cost and age of tangible assets (affecting

relative depreciation expense) and the extent to which intangible

assets are identifiable (affecting relative amortization

expense).

Adjusted EBITDA is a non-GAAP profitability measure that

represents EBITDA before certain items that are considered to

hinder comparison of the performance of our businesses on a

period-over-period basis or with other businesses. During the

periods presented, we excluded from Adjusted EBITDA transaction

costs, earn-out consideration, the effect of foreign currency gains

and losses, gains and losses on disposals of assets, non-recurring

severance costs, certain non-recurring litigation costs,

stock-based compensation expense and associated employer payroll

tax and interest income, which include costs that are required to

be expensed in accordance with GAAP. Our management believes that

the inclusion of supplementary adjustments to EBITDA applied in

presenting Adjusted EBITDA are appropriate to provide additional

information to investors about certain material non-cash items and

about unusual items that we do not expect to continue at the same

level in the future.

Adjusted EBITDA Margin represents Adjusted EBITDA divided by

service revenue.

Adjusted Net Income

Adjusted Net Income is a non-GAAP profitability measure that

represents net income or loss for the period before the impact of

amortization of intangible assets and certain items that are

considered to hinder comparison of the performance of our

businesses on a period-over-period basis or with other businesses.

During the periods presented, we excluded from Adjusted Net Income

amortization of intangible assets, transaction costs, earn-out

consideration, the effect of foreign currency gains and losses,

gains and losses on disposals of assets, non-recurring severance

costs, certain non-recurring litigation costs, stock-based

compensation expense and associated employer payroll tax and the

related effect on income taxes of certain pre-tax adjustments,

which include costs that are required to be expensed in accordance

with GAAP. Our management believes that the inclusion of

supplementary adjustments to net income applied in presenting

Adjusted Net Income are appropriate to provide additional

information to investors about certain material non-cash items and

about unusual items that we do not expect to continue at the same

level in the future.

Adjusted Net Income Margin represents Adjusted Net Income

divided by service revenue.

Adjusted EPS

Adjusted EPS is a non-GAAP profitability measure that represents

earnings available to shareholders excluding the impact of certain

items that are considered to hinder comparison of the performance

of our business on a period-over-period basis or with other

businesses. Adjusted EPS is calculated as Adjusted Net Income

divided by our diluted weighted-average number of shares

outstanding. Our management believes that the inclusion of

supplementary adjustments to earnings per share applied in

presenting Adjusted EPS are appropriate to provide additional

information to investors about certain material non-cash items and

about unusual items that we do not expect to continue at the same

level in the future.

Free Cash Flow

Free Cash Flow is a non-GAAP liquidity measure that represents

our ability to generate additional cash from our business

operations. Free Cash Flow is calculated as net cash provided by

operating activities in the period minus cash used for purchase of

property and equipment in the period. Our management believes that

the inclusion of this non-GAAP measure, when considered with our

GAAP results, provides management and investors with an additional

understanding of our ability to generate additional cash for

ongoing business operations and other capital deployment.

Adjusted Free Cash Flow is a non-GAAP liquidity measure that

represents Free Cash Flow before the payment of earn-out

consideration and certain litigation costs, that are considered

non-recurring and outside of the ordinary course of business, which

would hinder comparison of the performance of our business on a

period-over-period basis or with other businesses. Our management

believes that the inclusion of these supplementary adjustments to

Free Cash Flow are appropriate to provide additional information to

investors about these unusual items that we do not expect to

continue at the same level in the future.

Conversion of Adjusted EBITDA to Free Cash Flow represents Free

Cash Flow divided by Adjusted EBITDA. Conversion of Adjusted EBITDA

to Adjusted Free Cash Flow represents Adjusted Free Cash Flow

divided by Adjusted EBITDA.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107389315/en/

Investor Contact Trent Thrash IR@taskus.com

Media Contact Heidi Lemmetyinen

heidi.lemmetyinen@taskus.com

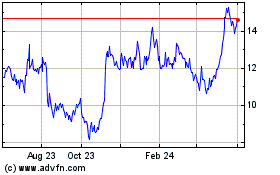

TaskUs (NASDAQ:TASK)

Historical Stock Chart

From Feb 2025 to Mar 2025

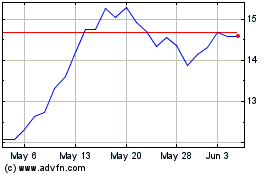

TaskUs (NASDAQ:TASK)

Historical Stock Chart

From Mar 2024 to Mar 2025