Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 23 2024 - 3:05PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of August 2024

Commission

File Number 001-41231

TC

BIOPHARM (HOLDINGS) PLC

(Translation

of registrant’s name into English)

Maxim

1, 2 Parklands Way

Holytown,

Motherwell, ML1 4WR

Scotland,

United Kingdom

+44

(0) 141 433 7557

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

☒

Form 20-F ☐ Form

40-F

On

August 21, 2024, TC BioPharm (Holdings) plc (the “Company”) received a notice (the “Notice”) from the Listing

Qualifications Department (the “Staff”) of the Nasdaq Stock Market informing the Company that it has regained compliance

with the minimum equity requirement in Listing Rule 5550(b)(1) (the “Equity Rule”) and the bid price requirement in Listing

Rule 5550(a)(2) (the “Bid Price Rule”).

The

Company was under a Panel Monitor imposed by a prior Hearings Panel through July 26, 2024, pursuant to its authority under Listing Rule

5815(d)(4)(A), following the Company demonstrating compliance with the Equity Rule. In addition, pursuant to Listing Rule 5810(c)(3)(A)(iv),

the Company was not eligible for any compliance period specified in Rule 5810(c)(3)(A) due to the fact that the Company effected one

or more reverse stock splits over the prior two-year period with a cumulative ratio of 250 shares or more to one (the “Excessive

Reverse Stock Splits Rule”).

Normally,

in application of Listing Rule 5815(d)(4)(B), companies that have regained equity and/or bid price compliance, where the company was

ineligible for a second compliance period under the Excessive Reverse Stock Splits Rule, are imposed a Mandatory Panel Monitor. However,

considering the Company regained compliance with the Bid Price Rule ahead of the panel granting it an exception to cure its bid price

deficiency, the Notice stated that, pursuant to Listing Rule 5815(d)(4)(B), the Company will be subject to a Discretionary Panel Monitor

for a period of one year from the date of the Notice, to ensure that the Company maintains long-term compliance with the Equity Rule,

the Bid Price Rule, and all of the Exchange’s continued listing requirements.

If,

within that one-year monitoring period, the Staff finds the Company again out of compliance with any continued listing requirement, notwithstanding

Rule 5810(c)(2), the Company will not be permitted to provide the Staff with a plan of compliance with respect to any deficiency and

the Staff will not be permitted to grant additional time for the Company to regain compliance with respect to any deficiency, nor will

the Company be afforded an applicable cure or compliance period. Instead, the Staff will issue a Delist Determination Letter and the

Company will have an opportunity to request a new hearing with the initial Panel or a newly convened Hearings Panel if the initial Panel

is unavailable.

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

TC

BIOPHARM (HOLDINGS) PLC |

| |

|

| |

By: |

/s/

Martin Thorp |

| |

Name: |

Martin

Thorp |

| |

Title: |

Chief

Financial Officer |

| Date:

August 23, 2024 |

|

|

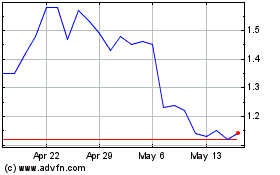

TC BioPharm (NASDAQ:TCBP)

Historical Stock Chart

From Oct 2024 to Nov 2024

TC BioPharm (NASDAQ:TCBP)

Historical Stock Chart

From Nov 2023 to Nov 2024