Tradeweb Markets Inc. (Nasdaq: TW), a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets, today announced a strategic collaboration with Coremont, a

premier provider of cloud-based portfolio management software and

multi-asset class analytics.

Tradeweb and Coremont have joined forces with plans to integrate

Tradeweb’s global fixed income execution workflows into Coremont’s

Clarion platform, a leading portfolio management solution for asset

managers and hedge funds. The integration aims to enhance fixed

income trading workflows for buyside professionals by providing

Coremont clients with access to Tradeweb’s comprehensive execution

capabilities, initially for global swaps markets.

Enrico Bruni, Managing Director, Co-Head of Global Markets, at

Tradeweb, said: “Our collaboration with Coremont reflects our focus

on supporting innovation that accelerates the shift from complex

manual workflows to fully digitized processes for hedge funds and

leading asset managers globally. We look forward to supporting the

Coremont team in maximizing the potential of their portfolio

management solution and enhancing trading workflows for their

clients.”

Jev Mehmet, CEO at Coremont, said: “As a global leader in

electronic trading, Tradeweb brings unmatched expertise in driving

automation and digitization across markets, perfectly complementing

Coremont’s technology-driven strategy. We are excited about the

significant opportunities this collaboration can unlock and look

forward to leveraging Tradeweb’s insights to bring greater

connectivity, flexibility and liquidity to these markets.”

About Tradeweb Markets

Tradeweb Markets Inc. (Nasdaq: TW) is a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets. Founded in 1996, Tradeweb provides access to markets, data

and analytics, electronic trading, straight-through-processing and

reporting for more than 50 products to clients in the

institutional, wholesale, retail and corporates markets. Advanced

technologies developed by Tradeweb enhance price discovery, order

execution and trade workflows while allowing for greater scale and

helping to reduce risks in client trading operations. Tradeweb

serves more than 3,000 clients in more than 85 countries. On

average, Tradeweb facilitated more than $2.2 trillion in notional

value traded per day over the past four fiscal quarters. For more

information, please go to www.tradeweb.com.

About Coremont

Coremont provides institutional class portfolio management

software, delivering live risk, P&L and rich analytical tools

to asset managers across all asset classes including FX, rates,

credit, fixed income, equities and commodities, through its

flagship platform, Clarion. Clarion is powered by proprietary

pricing models and analytics libraries, offering market-leading

capabilities in derivatives modelling, expertly curated by a

seasoned team of quantitative specialists and risk professionals.

With offices in London, Connecticut and Hong Kong, Coremont helps

clients worldwide enhance their investment decision-making and risk

management processes. Information on Coremont’s services is

available at www.coremont.com.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the federal securities laws. Statements related to,

among other things, our outlook and future performance, the

industry and markets in which we operate, our expectations,

beliefs, plans, strategies, objectives, prospects and assumptions

and future events are forward-looking statements.

We have based these forward-looking statements on our current

expectations, assumptions, estimates and projections. While we

believe these expectations, assumptions, estimates and projections

are reasonable, such forward-looking statements are only

predictions and involve known and unknown risks and uncertainties,

many of which are beyond our control. These and other important

factors, including those discussed under the heading “Risk Factors”

in the documents of Tradeweb Markets Inc. on file with or furnished

to the SEC, may cause our actual results, performance or

achievements to differ materially from those expressed or implied

by these forward-looking statements. Given these risks and

uncertainties, you are cautioned not to place undue reliance on

such forward-looking statements. The forward-looking statements

contained in this release are not guarantees of future events or

performance and future events, our actual results of operations,

financial condition or liquidity, and the development of the

industry and markets in which we operate, may differ materially

from the forward-looking statements contained in this release. In

addition, even if future events, our results of operations,

financial condition or liquidity, and events in the industry and

markets in which we operate, are consistent with the

forward-looking statements contained in this release, they may not

be predictive of events, results or developments in future

periods.

Any forward-looking statement that we make in this release

speaks only as of the date of such statement. Except as required by

law, we do not undertake any obligation to update or revise, or to

publicly announce any update or revision to, any of the

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213884668/en/

Tradeweb Media Contacts: Daniel Noonan +1 646 767 4677

Daniel.Noonan@Tradeweb.com

Savannah Steele +1 646 767 4941 Savannah.Steele@Tradeweb.com

Tradeweb Investor Contacts: Ashley Serrao +1 646 430 6027

Ashley.Serrao@Tradeweb.com

Sameer Murukutla +1 646 767 4864

Sameer.Murukutla@Tradeweb.com

Coremont Media Contacts: Greg Henry

Gregory.Henry@coremont.com +1 475 550 7016

Layal Jaber Layal.Jaber@coremont.com +44 207 965 9771

enquiries@coremont.com +44 207 965 9500

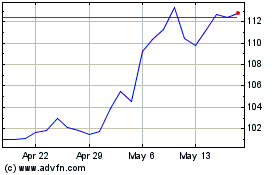

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Jan 2025 to Feb 2025

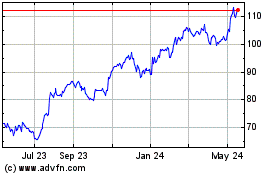

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Feb 2024 to Feb 2025