Form 8-K - Current report

August 06 2024 - 4:20PM

Edgar (US Regulatory)

false

0001603207

0001603207

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 6, 2024

NOTABLE

LABS, LTD.

(Exact

name of registrant as specified in charter)

| Israel |

|

001-36581 |

|

Not

Applicable |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| |

|

|

|

|

| 320

Hatch Drive |

|

|

| Foster

City, California |

|

|

|

94404 |

| (Address

of principal executive offices) |

|

|

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (415) 851-2410

N/A

(Former

name or former address, if changed since last report)

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary

Shares, par value NIS 0.35 each |

|

NTBL |

|

The

Nasdaq Capital Market |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

7.01 | Regulation

FD Disclosure. |

On

August 6, 2024, Notable Labs, Ltd. (the “Company”) issued a white paper presentation with respect to its volasertib Phase

2 trial design. The white paper presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein

by reference.

The

information in Item 7.01 of this Current Report on Form 8-K, including the information in the presentation attached as Exhibit 99.1 to

this Current Report on Form 8-K, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes

of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. Furthermore, the information in Item 7.01

of this Current Report on Form 8-K, including the information in the presentation attached as Exhibit 99.1 to this Current Report on

Form 8-K, shall not be deemed to be incorporated by reference in the filings of the Company under the Securities Act.

| Item

9.01. | Financial

Statements and Exhibits. |

(d)

Exhibits

| Exhibit

No. |

|

Description |

| |

|

|

| 99.1 |

|

White Paper presentation |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

|

NOTABLE

LABS, LTD. |

| |

|

|

|

| Date: |

August

6, 2024 |

By: |

/s/

Thomas A. Bock |

| |

|

Name: |

Thomas

A. Bock |

| |

|

Title: |

Chief

Executive Officer |

Exhibit

99.1

Notable’s

Volasertib Development Program to

Improve

the Standard of Care for Patients with Acute Myeloid Leukemia

Reflecting

Notable Labs Corporate Overview Deck of July 2024 incl. Scientific References

https://notablelabs.com/investor-presentation/notable-corporate-presentation

| ● | Acute

Myeloid Leukemia, AML, is a Devastating, Life-Threatening Disease that Replaces Normal Blood

and Bone Marrow Cells with Leukemia Cells |

| ○ | AML

is a disease of the bone marrow originating from the malignant transformation of precursors

of white blood cells. Leukemia cells (blasts) rapidly outgrow the normal elements of the

bone marrow (white blood cells, red blood cells, and platelets), resulting in the predominance

of leukemia cells in bone marrow and blood (“leukemia” = “white blood”)

and low counts of normal white cells (neutropenia), red cells (anemia), and platelets (thrombocytopenia). |

| ○ | Because

of this, patients with AML are at an increased risk of infections and bleeding. |

| ● | Treatment

Outcomes are Poor for >50% of Patients with AML (Slide 4, Ref. 1-5; Slide 16,

Ref. 1-9) |

| ○ | Only

a minority of AML patients can undergo bone marrow transplantation (BMT) due to lack of a

suitable donor or other medical conditions the patient may have. BMT is an aggressive treatment

that can lead to cure but carries a substantial risk including death from treatment effects. |

| ○ | Other

patients are left with non-curative options. If patients do not respond to first-line therapy,

or relapse after first-line therapy, available treatment options generally deliver an approximately

15% or less response rate. Patients typically relapse after first-line treatment within 1-2

years. |

| ● | Successful

AML Treatment is Associated by Neutropenia and Infections and Requires Modern Supportive

Care and the Prevention of Infections (References on slide below) |

| ○ | Leukemia

treatments eliminate leukemia blasts (on-target effect) and thus allow normal marrow to regrow

and regenerate white cells, red cells and platelets. Since leukemia blasts and normal blood

precursor cells share similarities, leukemia treatments also reduce normal blood cells in

which a patient’s immunity is reduced due to low white cell counts (neutropenia). |

| ○ | This

makes the continued and consistent use of modern anti-infectious prophylaxis (antibiotics

including antibacterial, antifungal, and possibly antiviral agents) critical. Otherwise,

patients will get infections and may die from them – despite the treatment’s

success of eliminating leukemia cells. |

| ● | To

improve the outcomes for patients with relapsed/refractory AML (R/R AML) and make an effective

treatment available quickly, Notable in-licensed and develops Volasertib |

| ○ | Leverages

extensive previous development by Boehringer Ingelheim and Notable’s Predictive Medicine

Platform |

| ○ | Volasertib,

a PLK-1 inhibitor, has shown pre-clinical and clinical activity and clinical potential across

blood cancers and solid tumors (Slide 18; Doehner Blood 2014/HemaSphere 2021, Schoeffski

Eur J Can 2012, Awada Inv New Drugs 2015) |

Non-confidential,

public information

Boehringer

Ingelheim’s (BI) Volasertib Development Results are Intriguing

| ● | Volasertib’s

AML Phase 2 trial in the US/Europe delivered an approximately 30% response rate and durable

responses with a statistically significant overall survival benefit (Slides 18,

19) |

| ○ | BI’s

survival result is very intriguing for two reasons. First, the survival advantage of the

~30% who responded led to a statistically significant survival benefit versus the control

arm across the trial. |

| ○ | The

statistically significant survival effect was demonstrated even though the trial was relatively

small with 87 patients, reinforcing the magnitude and robustness of the survival advantage. |

| ● | Volasertib’s

worldwide Phase 3 trial reproduced ~30% response rate but not a durable responses nor overall

survival benefit for two reasons (Slides 18, 19) |

| ● | BI’s

post hoc analysis demonstrated that inconsistent antibiotic prophylaxis in the global Phase

3 trial were likely key factors to infections and patient withdrawal (Slides and

ref. 18, 19) |

| ○ | Patients

with non-Western standard antibiotic prophylaxis were more likely to experience, infections,

infectious complications and subsequent withdraw from the global study or death. |

| ○ | This

appeared pronounced in smaller, lighter patients who received more Volasertib dosing relative

to their body weight than heavier patients (in BI’s Phase 2 and Phase 3 trials, all

patients received the same “fixed/flat” dose). Patients in Western countries

have higher average body weight than in South America or India, regions that participated

in the Phase 3 but not Phase 2 trial. |

| ○ | Based

on the post hoc analysis, Western standard antibiotic prophylaxis plus patient-tailored dosing

could have overcome the challenges seen in its Phase 3 trial and have the potential to not

only reproduce the Phase 2 results but also to enhance the ~30% response rate and overall

survival. |

| ○ | Tailored

dosing of cancer treatment is typical in oncology. |

| ● | BI

continued its Volasertib program with FDA-supported AML study including Western standard

antibiotic prophylaxis + patient-tailored dosing (Slide 20) |

| ○ | BI

began subsequent Phase 2 trials in AML and MDS and amended them to mandate Western standard

antibiotic prophylaxis and tailored dosing based on the patient’s body surface area

(BSA). |

| ○ | The

trials received FDA clearance, started patient enrollment, but were discontinued when BI

shifted resources to other therapeutic areas. |

| ○ | BI’s

data enables Notable’s opportunity to complete Volasertib’s development, leveraging

the extensive pre-work of BI and Notable’s platform to focus on the patients most likely

to respond. |

Non-confidential,

public information

| ● | Notable’s

Phase 2 trial design adopts BI’s enhancements and adds Notable’s Predictive Medicine

Platform (PMP) to further increase patient outcomes (Slide 22) |

| ○ | Notable’s

Phase 2 trial design is mitigating risk at several levels: |

| ○ | Antibiotic

Prophylaxis: Notable’s trial mandates Western standard infectious prevention/antibiotics

and is to be conducted in experienced leukemia centers in the US (NCCN guidelines: Prevention

of cancer treatment related infections, version 1.2024; nccn.org) |

| ○ | Tailored

Dosing: Notable’s trial design adopts tailored dosing by body surface area, as

per FDA-supported conclusions in BI’s post hoc analysis, thereby reducing the risk

of overdosing patients. |

| ○ | PMP

Platform: To further increase Volasertib clinical response rates and patient outcomes,

Notable’s Phase 2 trial will selectively enroll patients predicted to respond by the

PMP. |

Non-confidential,

public information

Volasertib’s

Treatment Response Pattern on the Predictive Medicine Platform (PMP) is Consistent with Pattern of 11 AML Treatments in Clinical Trials

| ● | Notable’s

PMP Demonstrated an Average 97% Predictive Precision for 11 AML Treatments in Published Clinical

Trials (Slides and ref. 12-13) |

| ○ | These

trials used patient samples to predict a patient’s clinical response using PMP, and

these PMP results were then compared to the actual patient outcomes. |

| ○ | 97%

of patients PMP-classified as predicted responders did clinically respond to their actual

cancer treatment (PPV of 0.97 reflects a 97% predictive precision/response rate in a clinical

trial). |

| ○ | These

trials were conducted at recognized, high-quality cancer centers such as Stanford University,

MD Anderson Cancer Center, and Texas Children’s Hospital. |

| ● | PMP

Identified 19/41 Highly Volasertib-Sensitive Samples from Patients with AML (Slide

14) |

| ○ | The

performance of PMP in potentially identifying volasertib-sensitive patients was assessed

on a cohort of 41 patient samples (bone marrow and/or peripheral blood) |

| ○ | A

subgroup of patient samples demonstrated high-sensitivity to volasertib (green box) |

| ○ | Importantly,

samples from relapsed/refractory AML patients demonstrated similar sensitivity to volasertib

when compared to newly diagnosed, de novo AML patient samples |

| ○ | Based

on these data from Volasertib on AML patient samples, and the translation of such data into

actual treatment response with 11 other AML treatments, Notable expects a positive clinical

outcome of its Phase 2 Volasertib trial. |

Non-confidential,

public information

| ● | In

R/R AML, A Mere 30% Response Rate by Volasertib Would Meaningfully Exceed Today’s Standard

of Care (Slide 6) |

| ○ | In

order to double the ~15% response rates of today’s R/R AML treatments, Notable’s

PMP would only have to achieve a 30% predictive precision, or response rate. As 11 other

treatments tested on Notable’s PMP correctly classified 97% of the clinical responders

as predicted responders, this appears feasible. |

| ● | Therefore,

Volasertib’s development program for patients with R/R AML not only has the potential

of creating substantial medical and commercial value, but includes risk mitigation through

enhanced trial design and the use of PMP |

Non-confidential,

public information

Forward

Looking Statements: This communication contains “forward-looking statements” within the meaning of the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995, including but not limited to, express or implied statements regarding Notable

Labs, Ltd.’s (“Notable”) future operations and goals; the potential benefits of any product candidates or platform

technologies of Notable; the timing of any clinical milestones of Notable’s therapeutic candidates; the cash runway of the company;

and other statements that are not historical fact. All statements other than statements of historical fact contained in this communication

are forward-looking statements. These forward-looking statements are made as of the date they were first issued, and were based on the

then-current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions of management. Forward-looking

statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Notable’s

control. Notable’s actual results could differ materially from those stated or implied in forward-looking statements due to a number

of factors, including but not limited to (i) uncertainties associated with Notable’s platform technologies, as well as risks associated

with the clinical development and regulatory approval of product candidates, including potential delays in the commencement, enrollment

and completion of clinical trials; (ii) risks related to the inability of Notable to obtain sufficient additional capital to continue

to advance these product candidates and any preclinical programs; (iii) uncertainties in obtaining successful clinical results for product

candidates and unexpected costs that may result therefrom; (iv) risks related to the failure to realize any value from product candidates

and preclinical programs being developed and anticipated to be developed in light of inherent risks and difficulties involved in successfully

bringing product candidates to market; (v) risks associated with Notable’s future financial and operating results, including its

ability to become profitable; (vi) Notable’s ability to retain key personnel; (vii) Notable’s ability to manage the requirements

of being a public company; (viii) Notable’s ability to obtain orphan drug designation, and the associated benefits, for any of

its drug candidates; (ix) Notable’s inability to obtain regulatory approval for any of its drug candidates; (x) changes in, or

additions, to international, federal, state or local legislative requirements, such as changes in or additions to tax laws or rates,

pharmaceutical regulations, and other regulations. Actual results and the timing of events could differ materially from those anticipated

in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully

described in periodic filings with the SEC, including the factors described in the section titled “Risk Factors” in the Annual

Report on Form 10-K of Notable Labs, Ltd. for the year ended December 31, 2023, and in other subsequent filings with the SEC. You should

not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated

in the forward-looking statements. Notable expressly disclaims any obligation or undertaking to release publicly any updates or revisions

to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based.

Non-confidential,

public information

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

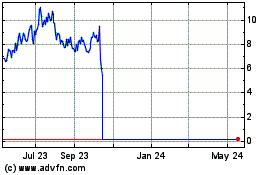

Vascular Biogenics (NASDAQ:VBLT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vascular Biogenics (NASDAQ:VBLT)

Historical Stock Chart

From Nov 2023 to Nov 2024