0000875320VERTEX PHARMACEUTICALS INC / MAfalse00008753202025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 4, 2025

Vertex Pharmaceuticals Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Massachusetts | 000-19319 | 04-3039129 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

50 Northern Avenue

Boston, Massachusetts 02210

(Address of principal executive offices) (Zip Code)

(617) 341-6100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, $0.01 Par Value Per Share | | VRTX | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 10, 2025, we issued a press release in which we reported our consolidated financial results for the three and twelve months ended December 31, 2024. A copy of that press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information set forth in Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 10, 2025, Vertex Pharmaceuticals Incorporated (the “Company”) announced the retirement of Stuart A. Arbuckle, the Company’s Executive Vice President and Chief Operating Officer, effective on July 1, 2025. The Company also announced the appointment of Charles F. Wagner, Jr. as Chief Operating Officer of the Company and the appointment of Duncan J. McKechnie as Chief Commercial Officer of the Company. Mr. Wagner will remain the Company’s Executive Vice President and Chief Financial Officer following his appointment. The appointment of Messrs. Wagner and McKechnie will be effective on July 1, 2025.

Mr. Wagner has held the position of Executive Vice President and Chief Financial Officer since April 2019. For additional biographical information on Mr. Wagner, please see the Company’s Form 10-K filed with the Securities and Exchange Commission on February 15, 2024.

In connection with his appointment, the Company entered into a new employment agreement and a new change of control agreement with Mr. Wagner, which will replace his current employment agreement and change of control agreement. The employment agreement provides for Mr. Wagner to receive a base salary of $1,000,000 and a target annual bonus of 100% of base salary. The employment agreement also provides that if the Company terminates Mr. Wagner’s employment without cause or if Mr. Wagner terminates his employment for good reason, subject to his execution of a release of claims, he will be entitled to receive (i) an amount equal to 100% of his base salary and target annual bonus and (ii) any annual bonus earned by Mr. Wagner in the year prior to the year in which the termination of his employment occurs, if not paid. Under the employment agreement, if Mr. Wagner’s employment is terminated due to his death or disability, he will be entitled to receive (i) a pro-rated annual bonus (based on actual performance) for the year in which the termination of employment occurs and (ii) consistent with programs applicable to all of the Company’s employees, accelerated vesting of all of his outstanding options and restricted stock unit awards (with any applicable performance vesting criteria (to the extent not yet achieved) being deemed achieved at target). Under Mr. Wagner’s change of control agreement with the Company, upon a termination without cause on a date within 90 days prior to or 12 months after a change of control or a termination of employment by Mr. Wagner for good reason as a result of an event constituting good reason that occurs on a date within such same period, subject to his execution of a release of claims, Mr. Wagner will receive (i) an amount equal to 100% of his base salary and target annual bonus, (ii) a pro-rated portion of the target annual bonus for the year in which his employment terminates and (iii) full vesting of all of his outstanding equity awards (with any applicable performance vesting criteria for awards for which the performance criteria have not been certified being

deemed achieved at target). On any termination described above, Mr. Wagner will be entitled to receive Company payment of medical, dental and life insurance premiums for 12 months following termination.

Mr. Wagner has a daughter employed by the Company in a non-executive position who received approximately $127,000 in total compensation in 2024 and also participated in our employee benefit plans on the same basis as other similarly situated employees in 2024.

The foregoing description of the agreements with Mr. Wagner does not purport to be complete and is qualified in its entirety by reference to the full text of the employment and change of control agreements will be filed as exhibits to the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.

In connection with his retirement, Mr. Arbuckle will be entitled to receive the retirement benefits set forth under his equity award agreements applicable to a “Qualified Participant.”

Mr. McKechnie has over 30 years’ experience in the industry, across a wide range of operational and strategic commercial roles in multiple disease areas and geographies at GlaxoSmithKline, Novartis and Vertex. He joined the Company approximately 12 years ago as Vice President, Global Commercial Strategy. He has served as SVP and Head of the North America Commercial team since November 2018. Mr. McKechnie has worked at the Company alongside Stuart Arbuckle for more than a decade and has played an instrumental role in architecting the successful launches of all the Company’s cystic fibrosis medicines. He has also overseen the U.S. launches of the Company’s first cell and gene therapy, CASGEVY, and of JOURNAVX, a non-opioid pain signal inhibitor representing the first new class of pain medicine approved in more than twenty years. Since April 2022, Mr. McKechnie has also overseen the Global Health Economics and Outcomes Research and Global Market Access and Value teams. Mr. McKechnie holds a Business & Marketing degree from the University of Plymouth in England.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description of Document |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File — the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| VERTEX PHARMACEUTICALS INCORPORATED |

| (Registrant) |

| |

Date: February 10, 2025 | /s/ Jonathan Biller |

| Jonathan Biller |

| Executive Vice President, Chief Legal Officer |

Vertex Reports Fourth Quarter and Full Year 2024 Financial Results

— Full year product revenue of $11.02 billion, a 12% increase compared to full year 2023 —

— Company provides full year 2025 total revenue guidance of $11.75 to $12.0 billion —

— ALYFTREK™ approved in the U.S. for patients ages 6+ with cystic fibrosis; JOURNAVX™ approved in the U.S. for moderate-to-severe acute pain —

— Diverse late-stage clinical pipeline accelerates with four programs in pivotal development —

— Stuart Arbuckle, Chief Operating Officer, announces intent to retire July 1, 2025; as part of planned transition, Charlie Wagner, Chief Financial Officer, to assume additional role of Chief Operating Officer; Duncan McKechnie, SVP and current head of North America Commercial, to assume role of Chief Commercial Officer (CCO) —

BOSTON -- Vertex Pharmaceuticals Incorporated (Nasdaq: VRTX) today reported consolidated financial results for the fourth quarter and full year ended December 31, 2024, and provided its full year 2025 financial guidance.

“2024 marked a year of tremendous growth for Vertex and we anticipate 2025 will be another important year with the landmark JOURNAVX approval and launch for moderate-to-severe acute pain; the launch of our fifth CF medicine, ALYFTREK; the continuing global launch of CASGEVY; and multiple ongoing pivotal trials. We are excited to drive diversification of the revenue base, disease areas of focus, R&D pipeline, and geographies to continue to deliver long-term value to both patients and shareholders,” said Reshma Kewalramani, M.D., Chief Executive Officer and President of Vertex.

Dr. Kewalramani added, “I would like to express my deep gratitude to Stuart for his exceptional leadership and many contributions to Vertex over the last 13 years. Stuart has had a profound impact on Vertex, having led the launch of every one of our CF medicines; our groundbreaking CRISPR/Cas9 gene-edited therapy, CASGEVY; and most recently, our novel non-opioid pain medicine, JOURNAVX. We are exceptionally well-positioned for continued success as Charlie assumes an expanded role, and Duncan’s broad and deep 30+ years of commercial experience – including the last 12 years working closely with Stuart – make him the ideal next CCO.”

Fourth Quarter 2024 Results

Product revenue increased 16% to $2.91 billion compared to the fourth quarter of 2023, primarily driven by the continued performance of TRIKAFTA®/KAFTRIO®. Net product revenue increased 17% to $1.84

billion in the U.S. due to continued strong patient demand and higher net realized pricing. Net product revenue increased 14% to $1.07 billion outside the U.S. on strong patient demand, including in both established and newer markets.

Combined GAAP and Non-GAAP R&D and SG&A expenses were $1.4 billion and $1.2 billion, respectively, compared to $1.2 billion and $984 million, respectively, in the fourth quarter of 2023. The increases were due to continued R&D investment in support of additional programs that have advanced to Phase 3 clinical development and increased commercial investment to support launches of Vertex's new therapies globally.

Acquired IPR&D (AIPR&D) expenses were $88 million compared to $18 million in the fourth quarter of 2023.

GAAP and Non-GAAP effective tax rates were 19.7% and 21.3%, respectively, compared to 15.6% and 16.3%, respectively, for the fourth quarter of 2023. The lower effective rates in the fourth quarter of 2023 included the benefit of higher U.S. R&D tax credits.

GAAP and Non-GAAP net income were $913 million and $1.0 billion, respectively, compared to $969 million and $1.1 billion, respectively, for the fourth quarter of 2023, as increased product revenue was more than offset by increased operating expenses, lower interest income and increased tax expense compared to the fourth quarter of 2023.

Full Year 2024 Results

Product revenue increased 12% to $11.02 billion compared to 2023, primarily driven by the continued performance of TRIKAFTA/KAFTRIO. Net product revenue increased 11% to $6.68 billion in the U.S. due to continued strong patient demand and higher net realized pricing. Net product revenue increased 13% to $4.34 billion outside the U.S. on strong patient demand in both established and newer markets.

Combined GAAP and Non-GAAP R&D and SG&A expenses were $5.1 billion and $4.2 billion, respectively, compared to $4.3 billion and $3.7 billion, respectively, in 2023. The increases were due to continued R&D investment in support of additional programs that have advanced into Phase 3 clinical development and increased commercial investment to support launches of Vertex's new therapies globally.

AIPR&D expenses were $4.6 billion compared to $527 million in 2023 due to $4.4 billion of AIPR&D expenses associated with Vertex’s acquisition of Alpine Immune Sciences during 2024.

GAAP and Non-GAAP effective tax rates were 315.5% and 91.0%, respectively, compared to 17.4% and 19.4%, respectively, in 2023. The higher 2024 effective rates were primarily due to the impact of non-deductible AIPR&D expenses, which significantly lowered Vertex’s pre-tax income in 2024. Please refer to Note 2 for further details on our GAAP to Non-GAAP tax adjustments.

GAAP net loss and Non-GAAP net income were $(536) million and $111 million, respectively, compared to net income of $3.6 billion and $4.0 billion, respectively, for 2023, reflecting strong operating results offset by the impact of higher AIPR&D expense related to the Alpine acquisition.

Cash, cash equivalents and total marketable securities as of December 31, 2024, were $11.2 billion, compared to $13.7 billion as of December 31, 2023. The reduction in Vertex’s cash, cash equivalents and marketable securities balance compared to December 31, 2023, was due to the cash consideration paid to acquire Alpine and repurchases of our common stock pursuant to our share repurchase program, partially offset by positive cash flows provided by other operating activities.

Full Year 2025 Financial Guidance

Vertex today provided full year 2025 financial guidance. Vertex’s total revenue guidance of $11.75 billion to $12.0 billion includes expectations for continued growth in CF, including the U.S. launch of ALYFTREK; as well as continued uptake of CASGEVY in multiple regions; and early contributions from the launch of JOURNAVX. Vertex’s guidance for both combined GAAP and Non-GAAP R&D, AIPR&D and SG&A expenses includes expectations for continued investment in multiple mid- and late-stage clinical development programs and commercial and manufacturing capabilities, and approximately $100 million of currently anticipated AIPR&D expenses.

Vertex’s financial guidance is summarized below:

| | | | | | | |

| | | FY 2025 |

| | | |

| Total revenue | | | $11.75 to $12.0 billion |

| | | |

| Combined GAAP R&D, AIPR&D and SG&A expenses * | | | $5.55 to $5.7 billion |

| Combined Non-GAAP R&D, AIPR&D and SG&A expenses * | | | $4.9 to $5.0 billion |

| Non-GAAP effective tax rate | | | 20.5% to 21.5% |

|

*The difference between the combined GAAP R&D, AIPR&D and SG&A expenses and the combined non-GAAP R&D, AIPR&D and SG&A expenses guidance relates primarily to $650 million to $700 million of stock-based compensation expense. |

| **Combined GAAP and Non-GAAP R&D, AIPR&D and SG&A expenses guidance includes approximately $100 million of AIPR&D expenses. |

Key Business Highlights

Marketed Products and Potential Near-Term Launch Opportunities

Cystic Fibrosis (CF) Portfolio

Vertex anticipates the number of CF patients taking its medicines will continue to grow through new approvals, including the recent ALYFTREK approval in the U.S.; reimbursement for the treatment of younger patients; patients living longer; and expansion into additional geographies. Recent and anticipated progress includes:

•Vertex increased its estimates for the number of people with cystic fibrosis in the U.S., Europe, Australia, and Canada from approximately 92,000 to approximately 94,000. Additionally, Vertex continues to secure formal reimbursement for eligible patients in multiple countries that collectively comprise approximately 15,000 additional patients, approximately 10,000 of whom are eligible for treatment with CFTR modulators. Vertex previously served many of these markets through named patient sales.

•Vertex secured U.S. Food and Drug Administration (FDA) approval on December 20, 2024, for ALYFTREK, the once-daily next-in-class combination CFTR modulator for the treatment of people with CF ages 6 years and older who have at least one F508del mutation or another mutation in the CFTR gene that is responsive to ALYFTREK, which includes a total of 303 CFTR mutations.

◦Additional regulatory reviews are underway for ALYFTREK in the United Kingdom (U.K.), European Union (EU), Canada, Switzerland, Australia and New Zealand.

•On December 20, 2024, Vertex received FDA approval for the expanded use of TRIKAFTA in patients with 94 additional non-F508del CFTR mutations. With this approval, approximately 300 people in the U.S. are newly eligible for a medicine that treats the underlying cause of their cystic fibrosis. TRIKAFTA is now approved in the U.S. for patients with a total of 272 CFTR mutations.

CASGEVY for the treatment of sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT)

CASGEVY is a non-viral, ex vivo, CRISPR/Cas9 gene-edited cell therapy for eligible patients with SCD or TDT that has been shown to reduce or eliminate vaso-occlusive crises (VOCs) for patients with SCD and transfusion requirements for patients with TDT. CASGEVY is approved in the U.S., Great Britain, the EU, the Kingdom of Saudi Arabia (KSA), the Kingdom of Bahrain (Bahrain), Canada, Switzerland, and the United Arab Emirates (UAE) for the treatment of both SCD and TDT. Following the foundational

launch year of 2024, Vertex is making progress bringing this transformative therapy to patients worldwide. Recent highlights include:

•Vertex recently announced a reimbursement agreement with NHS England for patients with SCD to access CASGEVY, consistent with the reimbursement agreement reached in August 2024 with NHS England for eligible patients with TDT to access CASGEVY.

•As of the end of 2024, Vertex has activated more than 50 authorized treatment centers (ATCs) globally and more than 50 patients have initiated cell collection.

•Vertex expects the number of new patients initiating cell collection to grow significantly throughout 2025.

JOURNAVX (suzetrigine) for the treatment of moderate-to-severe acute pain

JOURNAVX is a first-in-class, selective, non-opioid NaV1.8 pain signal inhibitor. Vertex continues to advance a portfolio of selective pain signal inhibitors, with potential to provide effective pain relief without the limitations of opioids and other available medicines.

•On January 30, 2025, the FDA approved JOURNAVX for the treatment of adults with moderate-to-severe acute pain. Vertex is working to secure broad stocking agreements for JOURNAVX with national retail pharmacies and regional pharmacy chains. Vertex expects to begin shipping JOURNAVX to pharmacies nationwide by the end of the month, with retail availability beginning shortly thereafter.

•Public policy efforts on both the federal and state levels in the U.S. continue to build momentum for providing equal access to non-opioid pain medicines:

◦ The Non-Opioids Prevent Addiction In the Nation (NOPAIN) Act became effective on January 1st, 2025. The NOPAIN Act mandates that Medicare provide a separate add-on payment in the hospital outpatient or surgical center setting for FDA-approved non-opioid treatments for pain. Vertex expects JOURNAVX to be included on the list of treatments that qualify for add-on payment under this act.

◦Additionally, the Alternatives to Pain Act, which had 78 co-sponsors from both parties last year, was recently reintroduced in the Senate and is expected to be reintroduced in the House of Representatives this month.

◦Since the start of 2025, 17 states have already introduced legislation to support the use of non-opioid treatment options, adding to the seven states that enacted legislation for Medicaid and state-regulated plans in 2024.

Select Clinical-Stage R&D Pipeline

Cystic Fibrosis

Vertex continues to pursue next-generation, oral, small molecule modulators for the ~90% of people with CF who may benefit from such an approach, as well as a nebulized mRNA therapy for the more than 5,000 people with CF who do not make CFTR protein and cannot benefit from CFTR modulators.

•Vertex is enrolling and dosing a Phase 3 study of ALYFTREK in children with cystic fibrosis ages 2 to 5 years who have at least one F508del mutation or a mutation responsive to triple combination CFTR modulators.

•Consistent with its commitment to serial innovation and bringing as many patients as possible to normal levels of CFTR function, Vertex continues to advance new oral small molecule combination therapies through preclinical and clinical development. The most advanced of the next generation of CFTR modulators have completed, or are in the process of completing, Phase 1 clinical trials.

•The multiple ascending dose (MAD) portion of the Phase 1/2 study of VX-522, a nebulized CFTR mRNA therapy, is underway, with data expected in the first half of 2025.

Sickle Cell Disease and Transfusion-Dependent Beta Thalassemia

•Vertex has completed enrollment of children 5 to 11 years of age with SCD or TDT in two global Phase 3 studies of CASGEVY and expects to complete dosing of this age group in 2025.

•Vertex continues to advance preclinical assets for gentler conditioning for CASGEVY, which could broaden the eligible patient population.

Acute Pain

•Vertex continues to enroll and dose a Phase 2 study of an oral formulation of VX-993, a next-generation selective NaV1.8 pain signal inhibitor, for the treatment of moderate-to-severe acute pain following bunionectomy surgery.

•Vertex continues to enroll and dose the Phase 1 trial of an intravenous formulation of VX-993.

Peripheral Neuropathic Pain (PNP)

•Vertex continues to enroll and dose patients with diabetic peripheral neuropathy (DPN) in a Phase 3 pivotal trial of suzetrigine. The FDA has granted suzetrigine Breakthrough Therapy Designation in DPN.

•In December 2024, Vertex announced results of the Phase 2 study of suzetrigine in painful lumbosacral radiculopathy (LSR), a form of peripheral neuropathic pain. The study met its primary endpoint, but the suzetrigine arm did not separate from the placebo reference arm. Pending

discussions with regulators on the regulatory package and optimized study design, Vertex plans to initiate a Phase 3 study of suzetrigine in LSR.

•Vertex continues to enroll and dose a Phase 2 study of the oral formulation of VX-993 for the treatment of DPN.

Consistent with its commitment to serial innovation and leadership in pain, Vertex continues to develop additional selective NaV1.8 and NaV1.7 pain signal inhibitors, for stand-alone use or in combination, for the treatment of acute and peripheral neuropathic pain.

APOL1-Mediated Kidney Disease (AMKD)

Vertex has discovered and advanced multiple oral, small molecule inhibitors of APOL1 function, pioneering a new class of medicines that targets the underlying genetic driver of this kidney disease.

•Vertex continues to enroll and dose patients with primary AMKD in the Phase 3 portion of the AMPLITUDE global Phase 2/3 pivotal clinical trial of inaxaplin, in which a 45 mg once-daily dose of inaxaplin is compared to placebo, on top of standard of care. Vertex expects to complete enrollment in the interim analysis cohort in 2025 and apply for potential accelerated approval in the U.S. after this cohort reaches 48 weeks of treatment, assuming a positive interim analysis.

•Vertex has initiated AMPLIFIED, a Phase 2 proof-of-concept study of inaxaplin in patients with AMKD and diabetes or other co-morbidities, who are not currently eligible for the AMPLITUDE Phase 2/3 pivotal trial, expanding the estimated potentially eligible population from 150,000 to 250,000 patients.

IgA Nephropathy (IgAN) and Other B Cell-Mediated Diseases

Vertex is developing povetacicept, a dual inhibitor of the BAFF and APRIL pathways, as a potentially best-in-class approach to treat immunoglobulin A (IgA) nephropathy. Vertex is also studying povetacicept in other serious B cell-mediated diseases, including autoimmune kidney diseases, such as primary membranous nephropathy, and autoimmune cytopenias.

•The global Phase 3 RAINIER study of povetacicept is enrolling and dosing patients with IgAN in the U.S., Europe and Asia. Vertex expects to complete enrollment in the interim analysis cohort in 2025 and apply for potential accelerated approval in the U.S. after this cohort reaches 36 weeks of treatment, assuming a positive interim analysis.

•Vertex is studying additional B cell-mediated renal diseases in the RUBY-3 basket study and hematologic conditions in the RUBY-4 basket study and expects data in some of these conditions over the course of 2025.

Type 1 Diabetes (T1D)

Vertex is evaluating stem cell-derived, fully differentiated islet cell therapies for patients suffering from T1D, with the goal of developing a potential one-time functional cure for this disease.

•Zimislecel (VX-880), fully differentiated islet cells with standard immunosuppression:

◦Vertex continues to enroll and dose the Phase 3 portion of the Phase 1/2/3 study of zimislecel in patients with T1D with severe hypoglycemic events and impaired awareness of hypoglycemia in the U.S., Canada, U.K., and EU. Vertex expects to complete enrollment and dosing of the pivotal study in 2025 and file for potential approval after patients have completed one year of insulin-free follow-up, assuming positive data.

◦Vertex has initiated a study of zimislecel in patients with T1D who have had a kidney transplant.

•VX-264, fully differentiated islet cells encapsulated in an immunoprotective device:

◦The clinical trial for VX-264, which encapsulates the same VX-880 islet cells in a novel device so that treatment with immunosuppressants is not required, is a global, multi-part, Phase 1/2 study.

◦Vertex expects to share Part B full-dose data from this study in 2025.

•Alternative immunosuppression:

◦Vertex is also pursuing research-stage programs to evaluate alternative approaches to immunosuppression that could be used with zimislecel.

•Hypoimmune, edited fully differentiated islet cells:

◦Vertex’s hypoimmune cell program involves editing the same stem cell-derived, fully differentiated VX-880 islet cells to protect the cells from the immune system, hence avoiding the need for immunosuppression. This research-stage program continues to make progress.

Myotonic Dystrophy Type 1 (DM1)

Vertex is evaluating multiple approaches that target the underlying cause of DM1, the most prevalent muscular dystrophy in adults, with ~110,000 people living with the disease in the U.S. and Europe and no approved therapies. Vertex’s lead approach, VX-670, in-licensed from Entrada Therapeutics, is an oligonucleotide linked to a cyclic peptide to promote effective delivery into the cell and its nucleus, and it holds the potential to address the underlying cause of DM1.

•Vertex continues to enroll and dose the multiple ascending dose (MAD) portion of the global Phase 1/2 clinical trial for VX-670 in people with DM1, which will assess both safety and efficacy.

Autosomal Dominant Polycystic Kidney Disease (ADPKD)

Vertex is developing small molecule correctors that restore function to the variant polycystin 1 (PC1) protein, with the goal of addressing the underlying cause of ADPKD, the most common genetic kidney disease, affecting approximately 300,000 people in the U.S. and Europe.

•Vertex is approaching completion of a Phase 1 study in healthy volunteers for VX-407, a first-in-class small molecule corrector that targets the underlying cause of ADPKD in patients with a subset of variants in the PKD1 gene, which encodes the PC1 protein, estimated to be up to ~30,000 people (or ~10% of the overall patient population). Vertex expects to advance VX-407 into a Phase 2 proof-of-concept study in people with ADPKD in 2025.

External Innovation

Consistent with its strategy to develop transformative medicines for serious diseases, Vertex announced the following transactions:

•An exclusive collaboration and license agreement with Zai Lab for the development and commercialization of povetacicept in mainland China, Hong Kong, Macau, Taiwan, and Singapore, signed in January 2025.

•A strategic collaboration with Orna Therapeutics for the use of Orna’s lipid nanoparticle (LNP) technology to develop in vivo gene editing therapies for SCD and TDT.

Non-GAAP Financial Measures

In this press release, Vertex's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. In particular, non-GAAP financial results and guidance exclude from Vertex's pre-tax income (i) stock-based compensation expense, (ii) intangible asset amortization expense, (iii) gains or losses related to the fair value of the company's strategic investments, (iv) increases or decreases in the fair value of contingent consideration, (v) acquisition-related costs, and (vi) other adjustments. The company's non-GAAP financial results also exclude from its provision for income taxes the estimated tax impact related to its non-GAAP adjustments to pre-tax income (loss) described above and certain discrete items. For full year 2024, the company’s non-GAAP weighted-average common shares outstanding includes the estimated effect of potentially dilutive securities that was not used in the calculation of GAAP diluted weighted-average common shares outstanding because the company incurred a GAAP net loss for the period. These results should not be viewed as a substitute for the company’s GAAP results and are provided as a complement to results provided in accordance with GAAP. Management believes these non-GAAP financial measures help indicate underlying trends in the company's business, are important in comparing current results with prior period results and provide additional information regarding the company's financial position that the company believes is helpful to an understanding of its ongoing business. Management also uses these non-GAAP financial measures to establish budgets and operational goals that are communicated internally and externally, to manage the company's business and to evaluate its performance. The company’s calculation of non-GAAP financial measures likely differs from the calculations used by other companies. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached financial information.

The company provides guidance regarding combined R&D, AIPR&D and SG&A expenses and effective tax rate on a non-GAAP basis. Unless otherwise noted, the guidance regarding combined R&D, AIPR&D and SG&A expenses does not include estimates associated with any potential future business development transactions, including collaborations, asset acquisitions and/or licensing of third-party intellectual property rights. The company does not provide guidance regarding its GAAP effective tax rate because it is unable to forecast with reasonable certainty the impact of excess tax benefits related to stock-based compensation and the possibility of certain discrete items, which could be material.

Vertex Pharmaceuticals Incorporated

Consolidated Statements of Income

(in millions, except per share amounts)(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Product revenues, net | $ | 2,912.0 | | | $ | 2,517.7 | | | $ | 11,020.1 | | | $ | 9,869.2 | |

| | | | | | | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of sales | 423.4 | | | 368.0 | | | 1,530.5 | | | 1,262.2 | |

| Research and development expenses | 998.7 | | | 824.6 | | | 3,630.3 | | | 3,162.9 | |

| Acquired in-process research and development expenses | 87.5 | | | 17.8 | | | 4,628.4 | | | 527.1 | |

| Selling, general and administrative expenses | 377.6 | | | 369.1 | | | 1,464.3 | | | 1,136.6 | |

| Change in fair value of contingent consideration | (1.2) | | | (50.3) | | | (0.5) | | | (51.6) | |

| Total costs and expenses | 1,886.0 | | | 1,529.2 | | | 11,253.0 | | | 6,037.2 | |

| Income (loss) from operations | 1,026.0 | | | 988.5 | | | (232.9) | | | 3,832.0 | |

| Interest income | 128.2 | | | 179.5 | | | 598.1 | | | 614.7 | |

| Interest expense | (2.8) | | | (10.6) | | | (30.6) | | | (44.1) | |

| Other expense, net | (14.9) | | | (9.8) | | | (86.1) | | | (22.8) | |

| Income before provision for income taxes | 1,136.5 | | | 1,147.6 | | | 248.5 | | | 4,379.8 | |

| Provision for income taxes | 223.5 | | | 178.8 | | | 784.1 | | | 760.2 | |

| Net income (loss) | $ | 913.0 | | | $ | 968.8 | | | $ | (535.6) | | | $ | 3,619.6 | |

| | | | | | | |

| Net income (loss) per common share: | | | | | | | |

| Basic | $ | 3.55 | | | $ | 3.76 | | | $ | (2.08) | | | $ | 14.05 | |

| Diluted | $ | 3.50 | | | $ | 3.71 | | | $ | (2.08) | | | $ | 13.89 | |

| Shares used in per share calculations: | | | | | | | |

| Basic | 257.5 | | | 257.7 | | | 257.9 | | | 257.7 | |

| Diluted | 260.5 | | | 260.9 | | | 257.9 | | | 260.5 | |

Vertex Pharmaceuticals Incorporated

Product Revenues

(in millions)(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| TRIKAFTA/KAFTRIO | $ | 2,720.8 | | | $ | 2,333.3 | | | $ | 10,238.6 | | | $ | 8,944.7 | |

| Other product revenues (1) | 191.2 | | | 184.4 | | | 781.5 | | | 924.5 | |

| Product revenues, net | $ | 2,912.0 | | | $ | 2,517.7 | | | $ | 11,020.1 | | | $ | 9,869.2 | |

1: The three and twelve month periods ending December 31, 2024, included CASGEVY revenue of $8.0 million and $10.0 million, respectively.

Vertex Pharmaceuticals Incorporated

Reconciliation of GAAP to Non-GAAP Financial Information

(in millions, except percentages)(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

GAAP cost of sales | $ | 423.4 | | | $ | 368.0 | | | $ | 1,530.5 | | | $ | 1,262.2 | |

| Stock-based compensation expense | (2.0) | | | (2.1) | | | (7.5) | | | (7.5) | |

| Intangible asset amortization expense | (5.1) | | | (1.7) | | | (20.2) | | | (1.7) | |

Non-GAAP cost of sales | $ | 416.3 | | | $ | 364.2 | | | $ | 1,502.8 | | | $ | 1,253.0 | |

| | | | | | | |

| GAAP research and development expenses | $ | 998.7 | | | $ | 824.6 | | | $ | 3,630.3 | | | $ | 3,162.9 | |

| Stock-based compensation expense | (98.3) | | | (123.0) | | | (425.8) | | | (354.9) | |

| Intangible asset amortization expense | (0.6) | | | — | | | (1.5) | | | — | |

| Acquisition-related costs (3) | — | | | (2.8) | | | (172.3) | | | (11.3) | |

| Non-GAAP research and development expenses | $ | 899.8 | | | $ | 698.8 | | | $ | 3,030.7 | | | $ | 2,796.7 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| GAAP selling, general and administrative expenses | $ | 377.6 | | | $ | 369.1 | | | $ | 1,464.3 | | | $ | 1,136.6 | |

| Stock-based compensation expense | (67.5) | | | (83.5) | | | (265.2) | | | (218.8) | |

| Acquisition-related costs (3) | — | | | — | | | (36.5) | | | — | |

| Non-GAAP selling, general and administrative expenses | $ | 310.1 | | | $ | 285.6 | | | $ | 1,162.6 | | | $ | 917.8 | |

| | | | | | | |

| Combined non-GAAP R&D and SG&A expenses | $ | 1,209.9 | | | $ | 984.4 | | | $ | 4,193.3 | | | $ | 3,714.5 | |

| | | | | | | |

| GAAP other expense, net | $ | (14.9) | | | $ | (9.8) | | | $ | (86.1) | | | $ | (22.8) | |

| Decrease in fair value of strategic investments | 7.2 | | | 0.4 | | | 57.7 | | | 0.6 | |

| Non-GAAP other expense, net | $ | (7.7) | | | $ | (9.4) | | | $ | (28.4) | | | $ | (22.2) | |

| | | | | | | |

| GAAP provision for income taxes | $ | 223.5 | | | $ | 178.8 | | | $ | 784.1 | | | $ | 760.2 | |

| Tax adjustments (2) | 56.2 | | | 35.5 | | | 340.0 | | | 194.7 | |

| Non-GAAP provision for income taxes | $ | 279.7 | | | $ | 214.3 | | | $ | 1,124.1 | | | $ | 954.9 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| GAAP effective tax rate | 19.7 | % | | 15.6 | % | | 315.5 | % | | 17.4 | % |

| Non-GAAP effective tax rate | 21.3 | % | | 16.3 | % | | 91.0 | % | | 19.4 | % |

Vertex Pharmaceuticals Incorporated

Reconciliation of GAAP to Non-GAAP Financial Information (continued)

(in millions, except per share amounts)(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| GAAP operating income (loss) | $ | 1,026.0 | | | $ | 988.5 | | | $ | (232.9) | | | $ | 3,832.0 | |

| Stock-based compensation expense | 167.8 | | | 208.6 | | | 698.5 | | | 581.2 | |

| Intangible asset amortization expense | 5.7 | | | 1.7 | | | 21.7 | | | 1.7 | |

| Decrease in fair value of contingent consideration | (1.2) | | | (50.3) | | | (0.5) | | | (51.6) | |

| Acquisition-related costs (3) | — | | | 2.8 | | | 208.8 | | | 11.3 | |

| Non-GAAP operating income | $ | 1,198.3 | | | $ | 1,151.3 | | | $ | 695.6 | | | $ | 4,374.6 | |

| | | | | | | |

| GAAP net income (loss) | $ | 913.0 | | | $ | 968.8 | | | $ | (535.6) | | | $ | 3,619.6 | |

| | | | | | | |

| Stock-based compensation expense | 167.8 | | | 208.6 | | | 698.5 | | | 581.2 | |

| Intangible asset amortization expense | 5.7 | | | 1.7 | | | 21.7 | | | 1.7 | |

| Decrease in fair value of strategic investments | 7.2 | | | 0.4 | | | 57.7 | | | 0.6 | |

| Decrease in fair value of contingent consideration | (1.2) | | | (50.3) | | | (0.5) | | | (51.6) | |

| Acquisition-related costs (3) | — | | | 2.8 | | | 208.8 | | | 11.3 | |

| Total non-GAAP adjustments to pre-tax income | 179.5 | | | 163.2 | | | 986.2 | | | 543.2 | |

| Tax adjustments (2) | (56.2) | | | (35.5) | | | (340.0) | | | (194.7) | |

| Non-GAAP net income | $ | 1,036.3 | | | $ | 1,096.5 | | | $ | 110.6 | | | $ | 3,968.1 | |

| | | | | | | |

| Net income (loss) per diluted common share: | | | | | | | |

| GAAP | $ | 3.50 | | | $ | 3.71 | | | $ | (2.08) | | | $ | 13.89 | |

| Non-GAAP | $ | 3.98 | | | $ | 4.20 | | | $ | 0.42 | | | $ | 15.23 | |

| Shares used in diluted per share calculations: | | | | | | | |

| GAAP | 260.5 | | | 260.9 | | | 257.9 | | | 260.5 | |

Estimated effect of potentially dilutive securities not used in GAAP diluted per share calculation (4) | — | | | — | | | 3.0 | | | — | |

| Non-GAAP | 260.5 | | | 260.9 | | | 260.9 | | | 260.5 | |

2: In the fourth quarter of 2024 and 2023, “Tax adjustments” included the estimated income taxes related to non-GAAP adjustments to the company's pre-tax income and excess tax benefits related to stock-based compensation. In 2024 and 2023, “Tax adjustments” also included discrete benefits related to prior tax years resulting from R&D tax credit studies.

3: In 2024, “Acquisition-related costs” were primarily related to compensation expense associated with cash-settled unvested Alpine equity awards.

4: In 2024, the company had a GAAP net loss and Non-GAAP net income. Therefore, the impact of potentially dilutive securities was excluded from the calculation of GAAP weighted-average common shares outstanding (“WASO”) but was included in the calculation of Non-GAAP WASO.

Vertex Pharmaceuticals Incorporated

Condensed Consolidated Balance Sheets

(in millions)(unaudited)

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Cash, cash equivalents and marketable securities | $ | 6,115.9 | | | $ | 11,218.3 | |

| Accounts receivable, net | 1,609.4 | | | 1,563.4 | |

| Inventories | 1,205.4 | | | 738.8 | |

| Prepaid expenses and other current assets | 665.7 | | | 623.7 | |

| Total current assets | 9,596.4 | | | 14,144.2 | |

| Property and equipment, net | 1,227.8 | | | 1,159.3 | |

| Goodwill and intangible assets, net | 1,913.9 | | | 1,927.9 | |

| Deferred tax assets | 2,331.1 | | | 1,812.1 | |

| Operating lease assets | 1,356.8 | | | 293.6 | |

| Long-term marketable securities | 5,107.9 | | | 2,497.8 | |

| Other long-term assets | 999.3 | | | 895.3 | |

| Total assets | $ | 22,533.2 | | | $ | 22,730.2 | |

| | | |

| Liabilities and Shareholders' Equity | | | |

| Accounts payable and accrued expenses | $ | 3,201.6 | | | $ | 3,020.2 | |

| Other current liabilities | 363.0 | | | 527.2 | |

| Total current liabilities | 3,564.6 | | | 3,547.4 | |

| Long-term operating lease liabilities | 1,544.4 | | | 348.6 | |

| Long-term finance lease liabilities | 112.8 | | | 376.1 | |

| Other long-term liabilities | 901.8 | | | 877.7 | |

| Shareholders' equity | 16,409.6 | | | 17,580.4 | |

| Total liabilities and shareholders' equity | $ | 22,533.2 | | | $ | 22,730.2 | |

| | | |

| Common shares outstanding | 256.9 | | | 257.7 | |

About Vertex

Vertex is a global biotechnology company that invests in scientific innovation to create transformative medicines for people with serious diseases. The company has approved medicines that treat the underlying causes of multiple chronic, life-shortening genetic diseases — cystic fibrosis, sickle cell disease and transfusion-dependent beta thalassemia — and continues to advance clinical and research programs in these diseases. Vertex also has a robust clinical pipeline of investigational therapies across a range of modalities in other serious diseases where it has deep insight into causal human biology, including acute and neuropathic pain, APOL1-mediated kidney disease, IgA nephropathy, autosomal dominant polycystic kidney disease, type 1 diabetes, myotonic dystrophy type 1 and alpha-1 antitrypsin deficiency.

Vertex was founded in 1989 and has its global headquarters in Boston, with international headquarters in London. Additionally, the company has research and development sites and commercial offices in North America, Europe, Australia, Latin America and the Middle East. Vertex is consistently recognized as one of the industry's top places to work, including 14 consecutive years on Science magazine's Top Employers list and one of Fortune’s 100 Best Companies to Work For. For company updates and to learn more about Vertex's history of innovation, visit www.vrtx.com or follow us on LinkedIn, Facebook, Instagram, YouTube and Twitter/X.

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that are subject to risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including all statements regarding the intent, belief, or current expectation of Vertex and members of the Vertex senior management team. Forward-looking statements are not purely historical and may be accompanied by words such as “anticipates,” “may,” “forecasts,” “expects,” “intends,” “plans,” “potentially,” “believes,” “seeks,” “estimates,” and other words and terms of similar meaning. Such statements include, without limitation, Dr. Kewalramani's statements in this press release, the information provided regarding future financial performance and operations, the section captioned “Full Year 2025 Financial Guidance” and statements regarding (i) expectations for Vertex’s continued growth in CF, including through the launch of ALYFTREK, reimbursement for younger patients, patients living longer and expansion into additional geographies, and Vertex’s continued efforts to secure formal reimbursement for eligible patients in multiple countries, (ii) the beliefs regarding anticipated benefits of CASGEVY, and expectations that the number of new patients initiating cell collection will grow significantly, (iii) expectations regarding the potential benefits and commercial success of JOURNAVX for the treatment of moderate-to-severe acute pain, including beliefs regarding the efficacy and safety of JOURNAVX, beliefs that JOURNAVX has potential to provide effective pain relief without the limitations of opioids and other available medicines, expectations that JOURNAVX will be included on the list of treatments that quality for add-on payment under the NOPAIN Act, work to secure broad stocking agreements for JOURNAVX with national retail pharmacies and regional pharmacy chains, and expectations to begin shipping JOURNAVX to pharmacies nationwide by the end of the month, with retail availability beginning shortly thereafter, (iv) expectations for and status of the commercial launch of the ALYFTREK, expectations for and status of the Phase 3 study of ALYFTREK in children 2 to 5 years of age, and plans to continue to advance new oral small molecule combination therapies for the treatment of CF, (v) expectations for VX-522, including the potential benefits of this nebulized mRNA therapy and expectations to have data in the first half of 2025, (vi) expectations regarding the SCD and TDT program, including expectations to complete dosing in studies evaluating CASGEVY in children 5 to 11 years of age in 2025, and that a gentler conditioning for CASGEVY could broaden the eligible patient population, (vii) plans with respect to the studies of the intravenous and oral formulation of VX-993 for the treatment of acute pain, (viii) expectations for the status of the Phase 3 study of suzetrigine for people with DPN,

plans to initiate a Phase 3 study for suzetrigine for people with painful LSR pending discussions with regulators, and plans to continue to develop NaV1.8 and NaV1.7 inhibitors for both acute pain and PNP, (ix) expectations regarding the AMPLITUDE trial, including expectations for completion of enrollment in the interim analysis cohort in 2025 and, assuming a positive interim analysis, application for potential accelerated approval in the U.S., and expectations regarding the AMPLIFIED trial, (x) expectations with respect to povetacicept, including beliefs about its potential benefits and therapeutic scope, study designs, expectations regarding the Phase 3 RAINIER study, including expectations for completion of enrollment in the interim analysis cohort in 2025 and, assuming a positive interim analysis, application for potential accelerated approval in the U.S., and beliefs with respect to the RUBY-3 and RUBY-4 basket studies, including the expectation of data in some conditions over the course of 2025, (xi) expectations regarding the Phase 3 portion of the study evaluating zimislecel, including the expectations to complete enrollment and dosing in the ongoing study in 2025 and, assuming positive data, file for potential approval after patients have completed one year of insulin-free follow-up, expectations regarding the VX-264 trial, including expectations to share initial data in 2025, and plans to pursue alternative approaches to immunosuppression, (xii) expectations for the potential benefits and clinical status of VX-670 for the treatment in people with DM1, and (xiii) expectations regarding the ADPKD program, including the potential benefits of VX-407, beliefs regarding the targeted patient population, and expectations to advance VX-407 into a Phase 2 proof-of-concept study in 2025. While Vertex believes the forward-looking statements contained in this press release are accurate, these forward-looking statements represent the company's beliefs only as of the date of this press release and there are a number of risks and uncertainties that could cause actual events or results to differ materially from those expressed or implied by such forward-looking statements. Those risks and uncertainties include, among other things, that the company's expectations regarding its 2025 full year revenues, expenses and effective tax rates may be incorrect (including because one or more of the company's assumptions underlying its expectations may not be realized), that we may be unable to successfully commercialize ALYFTREK as a treatment for CF or JOURNAVX as a treatment for acute pain, that external factors may have different or more significant impacts on the company's business or operations than the company currently expects, that data from preclinical testing or clinical trials, especially if based on a limited number of patients, may not be indicative of final results or available on anticipated timelines, that patient enrollment in the company’s trials may be delayed, that the company may not realize the anticipated benefits from collaborations with third parties, that data from the company's development programs may not support registration or further development of its potential medicines in a timely manner, or at all, due to safety, efficacy or other reasons, and that anticipated commercial launches may be delayed, if they occur at all. Forward-looking statements in this press release should be evaluated together with the many uncertainties that affect Vertex’s business, particularly those risks listed under the heading “Risk Factors” and the other cautionary factors discussed in Vertex’s periodic reports filed with the SEC, including Vertex’s annual report on Form 10-K and its quarterly reports on Form 10-Q and current reports on Form 8-K, all of which are filed with the Securities and Exchange Commission (SEC) and available through the company's website at www.vrtx.com and on the SEC’s website at www.sec.gov. You should not place undue reliance on these statements, or the scientific data presented. Vertex disclaims any obligation to update the information contained in this press release as new information becomes available.

Conference Call and Webcast

The company will host a conference call and webcast at 4:30 p.m. ET. To access the call, please dial (833) 630-2124 (U.S.) or +1(412) 317-0651 (International) and reference the “Vertex Pharmaceuticals Fourth Quarter 2024 Earnings Call.”

The conference call will be webcast live and a link to the webcast can be accessed through Vertex's website at www.vrtx.com in the "Investors" section. To ensure a timely connection, it is recommended that participants register at least 15 minutes prior to the scheduled webcast. An archived webcast will be available on the company's website.

(VRTX-E)

Vertex Contacts:

Investor Relations:

Susie Lisa, CFA, 617-341-6108

Manisha Pai, 617-961-1899

Miroslava Minkova, 617-341-6135

Media:

617-341-6992

mediainfo@vrtx.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

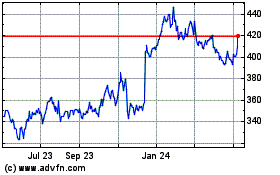

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Jan 2025 to Feb 2025

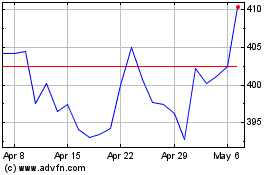

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Feb 2024 to Feb 2025