UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(RULE

14a-101)

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, For Use of the Commission Only (As Permitted

by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under Rule 14a-12 |

| VIVOS

THERAPEUTICS, INC. |

| (Name of Registrant as

Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing

Proxy Statement, if other than the Registrant) |

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee computed on table below per Exchange Act Rules

14a-6(i)(1) and 0-11. |

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of

the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

Vivos

Therapeutics, Inc.

Supplemental

Proxy Materials

For the Annual Meeting of Stockholders on September 22, 2023

September

6, 2023

Dear

Fellow Stockholders,

As

we approach our 2023 Annual Meeting of Stockholders on September 22, 2023, I am encouraged by the progress we have made this year. Vivos

has the right vision to address the national crisis of sleep apnea breathing related sleep conditions arising from certain dentofacial

abnormalities. Equally as important, Vivos has a growing product suite across a range of price points to deliver solutions that have

been proven time and time again in both clinical studies and in actual practice to reverse or eliminate sleep apnea in a majority of

patients without lifelong nightly intervention.

By

practically any measure, we believe our solutions are superior to everything else on the market. In general, Vivos treatment is less

expensive, less invasive, more effective, more comfortable, longer lasting, as safe as CPAP and safer than neuro stimulation implants.

Yet those technologies, despite being undesirable last resorts, continue to dominate the marketplace, and the companies behind them command

multi-billion dollar market capitalizations. We believe that dynamic is changing as more dentists, medical doctors, hospitals and other

healthcare providers and patients become aware of Vivos as a first-line solution. But we need your support — there are simply far

too many patients counting on us to prevail.

Before

the Labor Day holiday, we mailed you our 2023 Annual Meeting proxy statement describing several proposals to vote on at our September

22 annual meeting. Your vote is extremely important. Please take the time to vote today. We have retained Laurel Hill Advisory

Group as our proxy solicitor for this meeting. You may receive a call from Laurel Hill to offer assistance with your vote, and you can

also call Laurel Hill at (888) 742-1305 if you have any questions or need assistance with voting your proxy.

To

continue our momentum, we urge all our stockholders to vote “FOR” for each of the our proposals contained within the

proxy materials as each proposal is vital for our future success. Here’s why:

1.

Proposal 4 (Reverse Stock Split Proposal). Although listed as Proposal 4 in our proxy statement, this proposal

is perhaps the most important one we are putting before our stockholders this year as its passage will help ensure our continuing existence

as a Nasdaq-listed company. Technically, Proposal 4 is a proposal to approve an amendment to our Certificate of Incorporation

to effect a reverse stock split of our common stock at a ratio of between one-for-ten and one-for-thirty, with such ratio to be determined

at the sole discretion of our board of directors.

Nasdaq

requires listed companies to trade above $1.00 per share or risk being delisted. As previously reported, we have until September 20,

2023 to provide Nasdaq with a plan to get our stock price back up over that minimum price, and if that plan is accepted, we would likely

be given an additional 180 days to regain compliance with this rule. One way to regain compliance is to execute a reverse stock split.

As of this time, we do not know how much of a reverse split will be required, so we have asked stockholders to approve a split ratio

in a range, with the ultimate ratio being set be our Board of Directors (assuming stockholder approval of Proposal 4).

A

reverse split would affect our price per share but not the total value of all shares owned at the time of the split. By having our stock

priced well above $1.00, we would avoid delisting and could be considered “investment eligible” by many institutional investment

funds that are currently precluded from investing in stocks that trade below $1.00. Therefore, we highly recommend voting “FOR”

Proposal 4.

2.

Proposal 1 (Increase in the Size of Our Stock Option and Stock Issuance Plan). Proposal 1 is a proposal to increase the

number of shares of our common stock authorized to be issued pursuant to the 2019 Plan by 2,000,000 shares from an aggregate of 2,366,667

shares to an aggregate of 4,366,667 shares.

In

coming years, we will need to recruit and retain the highest caliber of healthcare executives who will take this company to the next

level, and that requires equity in the form of option and stock grants. We have not requested any additions to our 2019 Option and Stock

Issuance Plan since 2021, and we believe this increase is reasonable based on market standards. Proposal 1 is a request to add 2 million

shares to the Plan, and we recommend that you vote “FOR” this proposal.

3.

Proposal 2 (Election of Directors). Our Board of Directors is a multidisciplinary group of senior professionals who have

served this company with great dedication and distinction. All of our directors save one are “independent”. They are actively

assisting with government proposals, clinical research opportunities, and much more. Therefore, we highly recommend you vote “FOR”

Proposal No. 2 and elect all of our sitting directors to serve until our 2024 Annual Meeting of Stockholders or their successor is duly

elected and qualified, unless they resign, are removed or otherwise are disqualified from serving as a director of our company.

4.

Proposal 3 (Ratification of Auditors). Earlier this year, our management and Board came to conclusion that it was time

to change auditors. Moss Adams is a superb audit firm with plenty of public company experience, and to date our interactions with them

have been very positive. Therefore, we recommend that you vote “FOR” for Proposal No 3 to ratify the appointment by the Audit

Committee of our Board of Directors of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending

December 31, 2023.

I

wish to thank all of our stockholders for your continued support and look forward to the remainder of 2023 and beyond as we seek to fulfill

our mission and drive value for our investors.

Sincerely,

| /s/

Kirk Huntsman |

|

| R. Kirk Huntsman |

|

| Chairman and CEO |

|

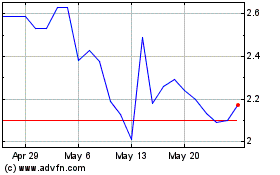

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Apr 2024 to May 2024

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From May 2023 to May 2024