The Nasdaq-listed B Corp, VivoPower International PLC (Nasdaq:

VVPR, “VivoPower”), announced today that its electric vehicle

subsidiary, Tembo e-LV B.V. (“Tembo”), has agreed to a further one

month extension of its exclusive heads of agreement with

Nasdaq-listed Cactus Acquisition Corporation I (Nasdaq: CCTS,

CCTSW, CCTSU, “CCTS”) to 31 August 2024.

The extension is intended to provide additional

time for Tembo to consummate a material transaction and update

disclosures before finalising a definitive business combination

agreement relating to the proposed transaction as well as the

independent fairness opinion.

About VivoPower

VivoPower is an award-winning global sustainable

energy solutions B Corporation company focused on electric

solutions for off-road and on-road customised and ruggedised fleet

applications as well as ancillary financing, charging, battery and

microgrids solutions. The Company’s core purpose is to provide its

customers with turnkey decarbonisation solutions that enable them

to move toward net-zero carbon status. VivoPower has operations and

personnel covering Australia, Canada, the Netherlands, the United

Kingdom, the United States, the Philippines, and the United Arab

Emirates.

About Tembo

Tembo electric utility vehicles (EUVs) are the

premier 100% electric solution for ruggedised and/or customised

applications for fleet owners in the mining, agriculture, energy

utilities, defence, police, construction, infrastructure,

government, humanitarian, and game safari industries. Tembo

provides safe, high-performance off-road and on-road electric

utility vehicles that meet exacting standards of safety,

reliability, and quality. Its core purpose is to provide safe and

reliable electrification solutions for utility vehicle fleet owners

globally, helping perpetuate useful life, reduce costs, maximise

return on assets, meet ESG goals and activate the circular economy.

Tembo is a subsidiary of the Nasdaq listed B Corporation, VivoPower

International PLC

Forward-Looking Statements

This communication includes certain statements

that may constitute “forward-looking statements” for purposes of

the U.S. federal securities laws. Forward-looking statements

include, but are not limited to, statements that refer to

projections, forecasts or other characterisations of future events

or circumstances, including any underlying assumptions. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “would” and similar expressions may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements may include, for example, statements

about the achievement of performance hurdles, or the benefits of

the events or transactions described in this communication and the

expected returns therefrom. These statements are based on

VivoPower’s management’s current expectations or beliefs and are

subject to risk, uncertainty, and changes in circumstances. Actual

results may vary materially from those expressed or implied by the

statements herein due to changes in economic, business, competitive

and/or regulatory factors, and other risks and uncertainties

affecting the operation of VivoPower’s business. These risks,

uncertainties and contingencies include changes in business

conditions, fluctuations in customer demand, changes in accounting

interpretations, management of rapid growth, intensity of

competition from other providers of products and services, changes

in general economic conditions, geopolitical events and regulatory

changes, and other factors set forth in VivoPower’s filings with

the United States Securities and Exchange Commission. The

information set forth herein should be read in light of such risks.

VivoPower is under no obligation to, and expressly disclaims any

obligation to, update or alter its forward-looking statements

whether as a result of new information, future events, changes in

assumptions or otherwise.

Additional Information and Where to Find It

If a definitive business combination agreement

relating to the proposed transaction is executed, a full

description of the terms of the transaction will be included in a

registration statement on Form F-4 (the “Registration Statement”),

which will include a proxy statement/prospectus, to be filed with

the U.S. Securities and Exchange Commission (the “SEC”).

Shareholders of CCTS and other interested persons are advised to

read, when available, the Registration Statement, including the

preliminary proxy statement/prospectus, any amendments thereto and

the definitive proxy statement/prospectus. CCTS, Tembo and

VivoPower may also file other documents with the SEC regarding the

proposed transaction. The definitive proxy statement/prospectus

will be sent to the shareholders of CCTS as of the record date

established for voting on the proposed transaction and will contain

important information about CCTS, VivoPower, Tembo, the proposed

transaction and other related matters. Shareholders of CCTS and

other interested persons will be able to obtain copies of the

Registration Statement, including the preliminary proxy

statement/prospectus contained therein, the definitive proxy

statements/prospectus and the other documents filed or that will be

filed with the SEC in connection with the proposed transaction,

without charge, once available, at the SEC’s website at

www.sec.gov.

Participants in the Solicitation

CCTS, Tembo, VivoPower and their respective

directors and officers may be deemed participants in the

solicitation of proxies of CCTS shareholders in connection with the

proposed transaction. More detailed information regarding the

directors and officers of CCTS, and a description of their

interests in CCTS, is contained in CCTS’s filings with the SEC,

including its Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, which was filed with the SEC on

April 15, 2024, and is available free of charge at the SEC’s

website at www.sec.gov. Information regarding the persons who may,

under SEC rules, be deemed participants in the solicitation of

proxies of CCTS’s shareholders in connection with the proposed

transaction and other matters to be voted upon at the meeting of

CCTS’s shareholders will be set forth in the Registration Statement

for the transaction when available.

No Offer or Solicitation

This press release shall not constitute a

solicitation of a proxy, consent, or authorization with respect to

any securities or in respect of the proposed transaction. This

press release shall also not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any states or jurisdictions in which such

offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10

of the Securities Act of 1933, as amended, or an exemption

therefrom.

Contact

Shareholder Enquiries

shareholders@vivopower.com

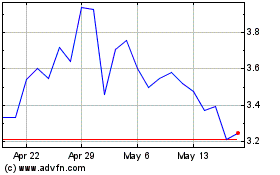

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

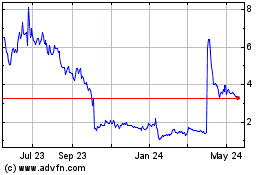

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Nov 2023 to Nov 2024