Willis Lease Finance Corporation Appoints Amy Ruddock as Senior Vice President, Sustainable Aviation & Corporate Development

September 03 2024 - 6:00AM

Willis Lease Finance Corporation (NASDAQ: WLFC) (“WLFC”), the

leading lessor of commercial aircraft engines and provider of

global aviation service operations, is pleased to announce the

appointment of Dr. Amy Ruddock in the newly created role of Senior

Vice President, Sustainable Aviation & Corporate Development.

Amy will be responsible for delivering and growing WLFC’s

sustainable aviation business while also overseeing corporate

development.

Austin C. Willis, WLFC’s Chief Executive

Officer, commented on the appointment: “We are thrilled to welcome

Amy to our leadership team. As we continue to expand our services

businesses, we have recruited Amy for her deep expertise in

sustainable aviation and her proven track record in project

development and technology implementation. Amy will be instrumental

in driving Willis Sustainable Fuels’ UK Sustainable Aviation Fuel

project in Tees Valley, England, which is currently in the advanced

planning stage and supported by the UK’s Advanced Fuels Fund.

Additionally, she will contribute to broader global strategic

initiatives.

Amy most recently served as Vice President of

EMEA at Carbon Engineering, a leader in direct air capture

technology. Previously, as Vice President of Corporate Development

and Sustainability at Virgin Atlantic, she was significantly

involved in shaping the airline’s carbon strategy and its £1.2

billion ($1.55 billion) recapitalization during the COVID-19

pandemic. Prior to Virgin Atlantic, Amy spent a decade at Boston

Consulting Group, where she led aviation-focused projects across

EMEA and North America in strategy, transformation, operations and

commercial development. Amy holds a Ph.D. in Physical Chemistry and

Natural Sciences from the University of Cambridge.

“I am delighted to join WLFC at such an exciting

time for the aviation industry. With the Company’s innovative

spirit and ambition to play a leading role in industry

decarbonization, I look forward to contributing to WLFC’s continued

success and driving forward our shared vision for the future of

aviation,” said Amy Ruddock.

For more information on Willis Lease Finance

Corporation and the Company’s comprehensive aviation services,

visit www.wlfc.global.

Willis Lease Finance

Corporation

Willis Lease Finance Corporation (“WLFC”) leases

large and regional spare commercial aircraft engines, auxiliary

power units and aircraft to airlines, aircraft engine manufacturers

and maintenance, repair, and overhaul providers worldwide. These

leasing activities are integrated with engine and aircraft trading,

engine lease pools and asset management services through Willis

Asset Management Limited, as well as various end-of-life solutions

for engines and aviation materials provided through Willis

Aeronautical Services, Inc. Through Willis Engine Repair Center®,

Jet Centre by Willis, and Willis Aviation Services Limited, the

company’s service offerings include Part 145 engine maintenance,

aircraft line and base maintenance, aircraft disassembly, parking

and storage, airport FBO and ground and cargo handling

services.

Except for historical information, the matters

discussed in this press release contain forward-looking statements

that involve risks and uncertainties. Do not unduly rely on

forward-looking statements, which give only expectations about the

future and are not guarantees. Forward-looking statements speak

only as of the date they are made, and we undertake no obligation

to update them. Our actual results may differ materially from the

results discussed in forward-looking statements. Factors that might

cause such a difference include, but are not limited to: the

effects on the airline industry and the global economy of events

such as war, terrorist activity and the COVID-19 pandemic; changes

in oil prices, rising inflation and other disruptions to world

markets; trends in the airline industry and our ability to

capitalize on those trends, including growth rates of markets and

other economic factors; risks associated with owning and leasing

jet engines and aircraft; our ability to successfully negotiate

equipment purchases, sales and leases, to collect outstanding

amounts due and to control costs and expenses; changes in interest

rates and availability of capital, both to us and our customers;

our ability to continue to meet changing customer demands;

regulatory changes affecting airline operations, aircraft

maintenance, accounting standards and taxes; the market value of

engines and other assets in our portfolio; and risks detailed in

the Company’s Annual Report on Form 10-K and other continuing

reports filed with the Securities and Exchange Commission.

|

CONTACT: |

|

Lynn Mailliard KohlerManager Corporate

Communicationslkohler@willislease.com |

|

|

|

|

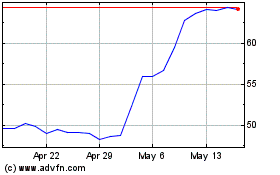

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Oct 2024 to Nov 2024

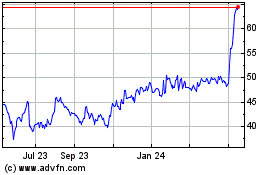

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Nov 2023 to Nov 2024