0001083301FALSENasdaq00010833012024-05-232024-05-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 23, 2024

TERAWULF INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-41163 | 87-1909475 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

9 Federal Street

Easton, Maryland 21601

(Address of principal executive offices) (Zip Code)

(410) 770-9500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | WULF | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On May 23, 2024, TeraWulf Inc. (the “Company”) entered into Amendment No. 2 to that certain sales agreement, dated April 26, 2022, as amended by Amendment No. 1, dated August 11, 2023 (the “Sales Agreement”) with Cantor Fitzgerald & Co., ATB Capital Markets USA Inc., Compass Point Research & Trading, LLC, Northland Securities, Inc., Roth Capital Partners, LLC, Stifel Nicolaus Canada Inc. and Virtu Americas LLC (each, individually, an “Agent” and, collectively, the “Agents”), pursuant to which the Company may offer and sell, from time to time, through or to the Agents, shares of the Company’s common stock, par value $0.001 per share, having an aggregate offering price of up to $200.0 million (the “Shares”).

The Company is not obligated to sell any Shares under the Sales Agreement. Subject to the terms and conditions of the Sales Agreement, the Agents will use commercially reasonable efforts, consistent with their normal trading and sales practices, to sell Shares from time to time based upon the Company’s instructions, including any price, time or size limits or other customary parameters or conditions specified by the Company. Under the Sales Agreement, the Agents may sell Shares by any method permitted by law deemed to be an “at the market offering” under Rule 415(a)(4) under the Securities Act of 1933, as amended. The Company will pay the Agents a commission equal up to 3.0% of the gross sales price from each sale of Shares and provide the Agents with customary indemnification and contribution rights. The Sales Agreement may be terminated by the Agents or the Company at any time upon notice to the other party.

The issuance and sale, if any, of the Shares by the Company under the Sales Agreement will be made pursuant to the Company’s effective registration statement on Form S-3 (Registration Statement No. 333-262226) (as amended, the “Registration Statement”), filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 31, 2022, and declared effective on February 4, 2022. The offering is described in the Company’s Prospectus Supplement dated May 23, 2024, as filed with the SEC on May 23, 2024.

The foregoing description of the Sales Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Sales Agreement, a copy of which is filed as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference. The legal opinion of Paul, Weiss, Rifkind, Wharton & Garrison LLP, counsel to the Company, relating to the validity of the Shares being offered pursuant to the Sales Agreement is filed as Exhibit 5.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 1.1 | | |

| 5.1 | | |

| 23.1 | | |

| 104.1 | | Cover Page Interactive Data File (embedded within the inline XBRL document). |

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to

a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf and/or its business; (12) potential differences between the unaudited results disclosed in this release and the Company’s final results when disclosed in its Annual Report on Form 10-K as a result of the completion of the Company’s final adjustments, annual audit by the Company’s independent registered public accounting firm, and other developments arising between now and the disclosure of the final results; and (13) other risks and uncertainties detailed from time to time in the Company’s filings with the SEC. Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | |

| TERAWULF INC. |

| |

| By: | /s/ Patrick A. Fleury |

| Name: | Patrick A. Fleury |

| Title: | Chief Financial Officer |

Dated: May 23, 2024

Exhibit 1.1

Execution Version

AMENDMENT NO. 2 TO SALES AGREEMENT

May 23, 2024

Cantor Fitzgerald & Co.

110 E 59th Street

New York, NY 10022

ATB Capital Markets USA Inc.

Suite 3530, TD Bank Tower

66 Wellington Street West

Toronto, ON M5K 1A1

Compass Point Research & Trading, LLC

1055 Thomas Jefferson Street NW, Suite 303

Washington, DC 20007

Northland Securities, Inc.

150 South Fifth Street, Suite 3300

Minneapolis, Minnesota 55402

Roth Capital Partners, LLC

888 San Clemente Drive, Suite 400

Newport Beach, CA 92660

Stifel Nicolaus Canada Inc.

161 Bay Street, Suite 3800

Toronto, Ontario M5J 2SI

Virtu Americas LLC

1633 Broadway

New York, NY 10019

Ladies and Gentlemen:

TeraWulf Inc., a Delaware corporation (the “Company”), together with Cantor Fitzgerald & Co. (“Cantor”), Northland Securities, Inc. (“Northland”) and Compass Point Research & Trading, LLC (“Compass Point”; each of Cantor, Northland and Compass Point individually an “Original Agent” and collectively, the “Original Agents”), are parties to that certain Sales Agreement dated April 26, 2022, as amended on August 11, 2023 (the “Original Agreement”). The Company and B. Riley Securities, Inc. (“B. Riley Securities”) mutually agreed to terminate the Original Agreement with respect to B. Riley Securities effective as of May 23, 2024. All capitalized terms not defined herein shall have the meanings ascribed to them in the Original Agreement. The Company and Original Agents desire to amend the Original Agreement as set forth in this Amendment No. 2 thereto (this “Amendment”) as follows:

1. The definitions of “Agent” and “Agents” in the first paragraph of the Original Agreement are hereby amended to remove B. Riley Securities and to include ATB Capital Markets USA Inc. (“ATB Capital Markets”), Roth Capital Partners, LLC (“Roth Capital Partners”), Stifel Nicolaus Canada Inc. (“Stifel Canada”) and Virtu Americas LLC (“Virtu” and together with the Original Agents, ATB Capital Markets, and Roth Capital Partners, the “Agents”).

2. Section 6(a) is hereby amended to replace:

“The Prospectus Supplement will name the Cantor, B. Riley Securities, Northland and Compass Point as the agents in the section entitled ‘Plan of Distribution.’”

With,

“The Prospectus Supplement will name the Cantor, ATB, Capital Markets, Compass Point, Northland, Roth Capital Partners, Stifel Canada and Virtu as the agents in the section entitled ‘Plan of Distribution.’”

3. Section 7(m) is hereby amended to replace:

“On or prior to the date of the first Placement Notice given hereunder the Company shall cause to be furnished to the Agents a written opinion and a negative assurance letter of Reed Smith LLP (“Company Counsel”), or other counsel reasonably satisfactory to the Agents, each in form and substance reasonably satisfactory to the Agents.”

With,

“On or prior to the date of the first Placement Notice given hereunder the Company shall cause to be furnished to the Agents a written opinion and a negative assurance letter of Paul, Weiss, Rifkind, Wharton & Garrison LLP (“Company Counsel”), or other counsel reasonably satisfactory to the Agents, each in form and substance reasonably satisfactory to the Agents.”

4. Section 14 of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“Notices. All notices or other communications required or permitted to be given by any party to any other party pursuant to the terms of this Agreement shall be in writing, unless otherwise specified, and if sent to the Agents, shall be delivered to:

Cantor Fitzgerald & Co.

110 E 59th Street

New York, NY 10022

Attention: Capital Markets

Facsimile: (212) 307-3730

and

Cantor Fitzgerald & Co.

110 E 59th Street

New York, NY 10022

Facsimile: (212) 829-4708

Attention: General Counsel

Email: legal-IBD@cantor.com

and:

ATB Capital Markets USA Inc.

Suite 3530, TD Bank Tower

66 Wellington Street West

Toronto, ON M5K 1A1

Attention: Adam Carlson

Telephone: (416) 716-3817

Email: acarlson@atb.com

and:

Compass Point Research & Trading, LLC

1055 Thomas Jefferson Street, NW

Suite 303

Washington, DC 20007

Attention: Equity Capital Markets

Email: syndicate@compasspointllc.com

With copies to:

Compass Point Research & Trading, LLC

1055 Thomas Jefferson Street, NW

Suite 303

Washington, DC 20007

Attention: Chief Operating Officer

Email: CNealon@compasspointllc.com

and:

Northland Securities, Inc.

150 South Fifth Street, Suite 3300

Minneapolis, Minnesota 55402

Attention: Ted Warner

Email: TWarner@northlandcapitalmarkets.com

and:

Roth Capital Partners, LLC

888 San Clemente Drive, Suite 400

Newport Beach, CA 92660

Attention: Managing Director

Email: atmdesk@roth.com

and:

Stifel Nicolaus Canada Inc.

161 Bay Street, Suite 3800

Toronto, Ontario M5J 2SI

Attention: ECM Desk

Email: ECMCanada@stifel.com

and:

Virtu Americas LLC

1633 Broadway

New York, NY 10019

Attention: Virtu Capital Markets

Email: ATM@virtu.com

with a copy to:

Duane Morris LLP

1540 Broadway

New York, NY 10036

Attention: James T. Seery

Telephone: (973) 424-2088

Email: jtseery@duanemorris.com

and if to the Company, shall be delivered to:

9 Federal Street

Easton, Maryland 21601

Attention: Stefanie Fleischmann, Chief Legal Officer

Telephone: (410) 770-9500

Email: fleischmann@terawulf.com

with a copy to:

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, NY 10019

Attention: David Huntington

Telephone: (212) 373-3124

Email: dhuntington@paulweiss.com

Each party to this Agreement may change such address for notices by sending to the parties to this Agreement written notice of a new address for such purpose. Each such notice or other

communication shall be deemed given (i) when delivered personally, by email, or by verifiable facsimile transmission on or before 4:30 p.m., New York City time, on a Business Day or, if such day is not a Business Day, on the next succeeding Business Day, (ii) on the next Business Day after timely delivery to a nationally-recognized overnight courier and (iii) on the Business Day actually received if deposited in the U.S. mail (certified or registered mail, return receipt requested, postage prepaid). For purposes of this Agreement, “Business Day” shall mean any day on which the Exchange and commercial banks in the City of New York are open for business.

An electronic communication (“Electronic Notice”) shall be deemed written notice for purposes of this Section 14 if sent to the electronic mail address specified by the receiving party immediately above or as subsequently updated by the applicable party in writing. Electronic Notice shall be deemed received at the time the party sending Electronic Notice receives verification of receipt by the receiving party. Any party receiving Electronic Notice may request and shall be entitled to receive the notice on paper, in a nonelectronic form (“Nonelectronic Notice”) which shall be sent to the requesting party within ten (10) days of receipt of the written request for Nonelectronic Notice.”

5. Schedule 3 is updated to remove:

“B. Riley Securities

| | | | | |

Patrice McNicoll | pmcnicoll@brileyfin.com |

| |

Keith Pompliano | kpompliano@brileyfin.com |

| |

Scott Ammaturo | sammaturo@brileyfin.com |

with a copy to atmdesk@brileyfin.com”

6. Schedule 3 is updated to add:

“ATB Capital Markets

| | | | | |

Adam Carlson, Managing Director, Investment Banking | acarlson@atb.com |

| |

Jay Lewis, Head of Equity Capital Markets | jlewis2@atb.com |

| |

Ezra Chang, Director, Investment Banking | echang@atb.com |

| |

Gail O’Connor, Operations Manager | goconnor@atb.com |

Roth Capital Partners

| | | | | |

Kamal Masud, MD Investment Banking | kmasud@roth.com |

| |

Nazan Akdeniz, COO & MD Equity Capital Markets | nakdeniz@roth.com |

| |

Lou Ellis, MD Equity Capital Markets | lellis@roth.com |

Stifel Canada

| | | | | |

Ruben Sahakyan | rubens@stifel.com |

| |

Greg Mumford | gmumford@stifel.com |

with copies to ECMCanada@stifel.com

Virtu

| | | | | |

Jeff Lumby | JLumby@virtu.com |

| |

Joshua R. Feldman | JFeldman@virtu.com |

| |

Conor Lumby | CLumby@virtu.com |

With copies to: ATM@virtu.com”

7. All references to the individual Original Agents set forth in Schedule 1 and Exhibit 7(l) of the Original Agreement are updated to remove B. Riley Securities, Inc. and to include ATB Capital Markets USA Inc., Roth Capital Partners, LLC, Stifel Nicolaus Canada Inc. and Virtu Americas LLC.

8. All references to “April 26, 2022 (as amended by Amendment No. 1, dated August 11, 2023)” set forth in Schedule 1 and Exhibit 7(l) of the Original Agreement are revised to read “April 26, 2022 (as amended by Amendment No. 1, dated August 11, 2023 and Amendment No. 2 dated May 23, 2024)”.

9. Except as specifically set forth herein, all other provisions of the Original Agreement shall remain in full force and effect.

10. From and after the date hereof, ATB Capital Markets, Roth Capital Partners, Stifel Canada and Virtu shall each be considered to be an Agent under the Original Agreement, as amended hereby, and each of ATB Capital Markets, Roth Capital Partners, Stifel Canada and Virtu agrees to be bound by the terms of the Original Agreement, as amended hereby.

11. This Amendment together with the Original Agreement (including all exhibits attached hereto) constitutes the entire agreement and supersedes all other prior and contemporaneous agreements and undertakings, both written and oral, among the parties hereto with regard to the subject matter hereof. Neither this Amendment nor any term hereof may be amended except pursuant to a written instrument executed by the Company and the Agents. In the event that any one or more of the provisions contained herein, or the application thereof in any circumstance, is held invalid, illegal or unenforceable as written by a court of competent jurisdiction, then such provision shall be given full force and effect to the fullest possible extent that it is valid, legal and enforceable, and the remainder of the terms and provisions herein shall

be construed as if such invalid, illegal or unenforceable term or provision was not contained herein, but only to the extent that giving effect to such provision and the remainder of the terms and provisions hereof shall be in accordance with the intent of the parties as reflected in this Amendment. All references in the Original Agreement to the “Agreement” shall mean the Original Agreement as amended by this Amendment; provided, however, that all references to “date of this Agreement” in the Original Agreement shall continue to refer to the date of the Original Agreement.

12. EACH OF THE COMPANY (ON ITS BEHALF AND, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ON BEHALF OF ITS STOCKHOLDERS AND AFFILIATES) AND THE AGENTS HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AMENDMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

13. THIS AMENDMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF, THE STATE OF NEW YORK WITHOUT REGARD TO ITS CHOICE OF LAW PROVISIONS.

14. Each of the Company and the Agents agrees that any legal suit, action or proceeding arising out of or based upon this Amendment or the transactions contemplated hereby (“Related Proceedings”) shall be instituted in (i) the federal courts of the United States of America located in the City and County of New York, Borough of Manhattan or (ii) the courts of the State of New York located in the City and County of New York, Borough of Manhattan (collectively, the “Specified Courts”), and irrevocably submits to the exclusive jurisdiction (except for proceedings instituted in regard to the enforcement of a judgment of any Specified Court, as to which such jurisdiction is non-exclusive) of the Specified Courts in any such suit, action or proceeding. Service of any process, summons, notice or document by mail to a party’s address set forth in Section 10 of the Original Agreement, as amended by this Amendment, shall be effective service of process upon such party for any suit, action or proceeding brought in any Specified Court. Each of the Company and the Agents irrevocably and unconditionally waives any objection to the laying of venue of any suit, action or proceeding in the Specified Courts and irrevocably and unconditionally waives and agrees not to plead or claim in any Specified Court that any such suit, action or proceeding brought in any Specified Court has been brought in an inconvenient forum.

15. This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Delivery of an executed amendment by one party to the other may be made by facsimile transmission or electronic transmission (e.g., PDF).

[Remainder of Page Intentionally Blank]

If the foregoing correctly sets forth the understanding between the Company and the Agents, please so indicate in the space provided below for that purpose, whereupon this Amendment shall constitute a binding amendment to the Original Agreement between the Company and the Agents.

Very truly yours,

| | | | | |

CANTOR FITZGERALD & CO. |

| |

By: | /s/ Sameer Vasudev |

Name: Sameer Vasudev |

Title: Managing Director |

[Signature Page to Amendment No. 2 to Sales Agreement]

| | | | | |

ATB CAPITAL MARKETS USA INC. |

| |

By: | /s/ Adam Carlson |

Name: Adam Carlson |

Title: Managing Director, Investment Banking |

[Signature Page to Amendment No. 2 to Sales Agreement]

| | | | | | | | |

COMPASS POINT RESEARCH & TRADING, LLC |

| | |

By: | /s/ Christopher Nealon | |

Name: Christopher Nealon | |

Title: President & Chief Operating Officer | |

[Signature Page to Amendment No. 2 to Sales Agreement]

| | | | | | | | |

NORTHLAND SECURITIES, INC. |

| | |

By: | /s/ Ted G. Warner | |

Name: Ted G. Warner | |

Title: Head of Energy & Power Investment Banking | |

[Signature Page to Amendment No. 2 to Sales Agreement]

| | | | | |

ROTH CAPITAL PARTNERS, LLC |

| |

By: | /s/ Aaron M. Gurewitz |

Name: Aaron M. Gurewitz |

Title: President & Head of Investment Banking |

[Signature Page to Amendment No. 2 to Sales Agreement]

| | | | | |

STIFEL NICOLAUS CANADA INC. |

| |

By: | /s/ Ruben Sahakyan |

Name: Ruben Sahakyan |

Title: Director, Investment Banking |

[Signature Page to Amendment No. 2 to Sales Agreement]

| | | | | |

VIRTU AMERICAS LLC |

| |

By: | /s/ Joshua R. Feldman |

Name: Joshua R. Feldman |

Title: Managing Director |

[Signature Page to Amendment No. 2 to Sales Agreement]

ACCEPTED as of the date

first-above written:

| | | | | | | | |

TERAWULF INC. |

| | |

| | |

By: | /s/ Patrick Fleury | |

Name: Patrik Fleury |

Title: Chief Financial Officer |

[Signature Page to Amendment No. 2 to Sales Agreement]

Exhibit 5.1

| | | | | | | | |

| PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP | BEIJING | TOKYO |

| HONG KONG | TORONTO |

| 1285 AVENUE OF THE AMERICAS | LONDON | WASHINGTON, DC |

| NEW YORK, NEW YORK 10019-6064 | LOS ANGELES | WILMINGTON |

| TELEPHONE (212) 373-3000 | SAN FRANCISCO | |

| | |

| DIRECT DIAL: (212) 373-3000 | | |

May 23, 2024

TeraWulf Inc.

9 Federal Street

Easton, Maryland 21601

Ladies and Gentlemen:

We have acted as special counsel to TeraWulf Inc., a Delaware corporation (the “Company”), in connection with the Registration Statement on Form S-3 (File No. 333-262226) (the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations thereunder (the “Rules”), which became effective on February 4, 2022. You have asked us to furnish our opinion as to the legality of shares (the “Shares”) of common stock of the Company, par value $0.001 per share (the “Common Stock”), having an aggregate offering price of up to $200,000,000, which are registered under the Registration Statement and which are subject to sale pursuant to the at the market issuance sales agreement, dated as of April 26, 2022, as amended by Amendment No. 1, dated as of August 11, 2023 and by Amendment No. 2, dated as of May 23, 2024, by and among the Company, Cantor Fitzgerald & Co., ATB Capital Markets USA Inc., Compass Point Research & Trading, LLC, Northland Securities, Inc., Roth Capital Partners, LLC, Stifel Nicolaus Canada Inc. and Virtu Americas LLC, each as sales agent and/or principal (the “Sales Agreement”).

PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP

In connection with the furnishing of this opinion, we have examined originals, or copies certified or otherwise identified to our satisfaction, of the following documents:

1. the Registration Statement;

2. the final prospectus supplement dated May 23, 2024 (the “Final Prospectus”); and

3. the Sales Agreement.

In addition, we have examined (i) such corporate records of the Company as we have considered appropriate, including a copy of the certificate of incorporation, as amended, and by-laws, as amended, of the Company certified by the Company as in effect on the date of this letter, and copies of resolutions of the board of directors of the Company relating to the issuance of the Shares, and (ii) such other certificates, agreements and documents as we deemed relevant and necessary as a basis for the opinions expressed below. We have also relied upon the factual matters contained in the representations and warranties of the Company made in the documents reviewed by us and upon certificates of public officials and the officers of the Company.

In our examination of the documents referred to above, we have assumed, without independent investigation, the genuineness of all signatures, the legal capacity of all individuals who have executed any of the documents reviewed by us, the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as certified, photostatic, reproduced or conformed copies of valid existing agreements or other

PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP

documents, the authenticity of all such latter documents and that the statements regarding matters of fact in the certificates, records, agreements, instruments and documents that we have examined are accurate and complete.

Based upon the above, and subject to the stated assumptions, exceptions and qualifications, we are of the opinion that the Shares have been duly authorized by all necessary corporate action on the part of the Company and, when issued, delivered and paid for as contemplated in the Registration Statement and in accordance with the terms of the Sales Agreement, the Shares will be validly issued, fully paid and non-assessable.

The opinion expressed above is limited to the Delaware General Corporation Law. Our opinion is rendered only with respect to the laws, and the rules, regulations and orders under those laws, that are currently in effect.

We hereby consent to the use of this opinion as an exhibit to the Company’s Current Report on Form 8-K filed by the Company with the Commission on the date hereof, and to the use of our name under the heading “Legal Matters” contained in the base prospectus included in the Registration Statement and in the Final Prospectus. In giving this consent, we do not thereby admit that we come within the category of persons whose consent is required by the Securities Act or the Rules.

| | |

| Very truly yours, |

|

|

| /s/ PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

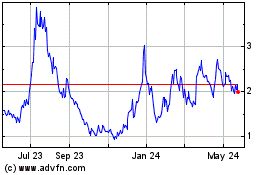

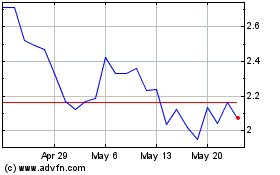

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From May 2024 to Jun 2024

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Jun 2023 to Jun 2024