UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐ |

Preliminary Proxy Statement |

| |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ |

Definitive Proxy Statement |

| |

☐ |

Definitive Additional Materials |

| |

|

|

| |

☒ |

Soliciting Material Under Rule 14a-12 |

| ALCOA CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Persons(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

☐ |

Fee paid previously with preliminary materials: |

| |

|

|

| |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

|

|

| |

(1) |

Amount previously paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

Alcoa Corporation (“Alcoa”),

expects to file a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”) to be used to solicit

proxies to approve the issuance of shares of common stock of Alcoa in connection with a proposed transaction to acquire all of the shares

of Alumina Limited (“Alumina”) in an all-stock transaction (the “Proposed Transaction”) at a special meeting of

its stockholders.

Item 1: On February 27, 2024,

William Oplinger, Alcoa’s Chief Executive Officer, held a conference with investors at the 2024 BMO Global Metals, Mining &

Critical Minerals Conference. Excerpts from the transcript of the conference with respect to the Proposed Transaction is filed herewith as

Exhibit 1.

Item 2: On February 27, 2024,

Alcoa posted FAQs on a website it launched in connection with the Proposed Transaction, a copy of which is filed herewith as Exhibit 2.

Caution Concerning Forward-Looking Statements

This communication contains statements that relate

to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those containing such words as “aims,” “ambition,” “anticipates,”

“believes,” “could,” “develop,” “endeavors,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,”

“plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “strive,”

“targets,” “will,” “working,” “would,” or other words of similar meaning. All statements

by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the

ability of the parties to negotiate, enter into and complete the proposed transaction; the expected benefits of the proposed transaction,

the competitive ability and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite,

alumina, and aluminum, and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating

performance (including our ability to execute on strategies related to environmental, social and governance matters); statements about

strategies, outlook, and business and financial prospects; and statements about capital allocation and return of capital. These statements

reflect beliefs and assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future

developments, as well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not

guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult

to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions,

it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are

not limited to: (1) the outcome of any discussions between Alcoa and Alumina Limited with respect to the proposed transaction, including

the possibility that the parties will not agree to pursue a transaction or that the terms of any such transaction will be materially different

from those described herein, (2) the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions

to the proposed transaction; (3) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (4)

the risk that the proposed transaction may not be completed in the expected time frame or at all; (5) unexpected costs, charges or expenses

resulting from the proposed transaction; (6) uncertainty of the expected financial performance following completion of the proposed transaction;

(7) failure to realize the anticipated benefits of the proposed transaction; (8) the occurrence of any event that could give rise to termination

of the proposed transaction; (9) potential litigation in connection with the proposed transaction or other settlements or investigations

that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and

liability; (10) the impact of global economic conditions on the aluminum industry and aluminum end-use markets; (11) volatility and declines

in aluminum and alumina demand and pricing, including global, regional, and product-specific prices, or

significant changes in production costs which

are linked to LME or other commodities; (12) the disruption of market-driven balancing of global aluminum supply and demand by non-market

forces; (13) competitive and complex conditions in global markets; (14) our ability to obtain, maintain, or renew permits or approvals

necessary for our mining operations; (15) rising energy costs and interruptions or uncertainty in energy supplies; (16) unfavorable changes

in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (17) our ability to

execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated benefits

from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (18) our ability

to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions; (19) economic,

political, and social conditions, including the impact of trade policies and adverse industry publicity; (20) fluctuations in foreign

currency exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (21) changes in

tax laws or exposure to additional tax liabilities; (22) global competition within and beyond the aluminum industry; (23) our ability

to obtain or maintain adequate insurance coverage; (24) disruptions in the global economy caused by ongoing regional conflicts; ()5) legal

proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (26) climate change,

climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to extreme weather conditions;

(27) our ability to achieve our strategies or expectations relating to environmental, social, and governance considerations; (28) claims,

costs and liabilities related to health, safety, and environmental laws, regulations, and other requirements, in the jurisdictions in

which we operate; (29) liabilities resulting from impoundment structures, which could impact the environment or cause exposure to hazardous

substances or other damage; (30) our ability to fund capital expenditures; (31) deterioration in our credit profile or increases in interest

rates; (32) restrictions on our current and future operations due to our indebtedness; (33) our ability to continue to return capital

to our stockholders through the payment of cash dividends and/or the repurchase of our common stock; (34) cyber attacks, security breaches,

system failures, software or application vulnerabilities, or other cyber incidents; (35) labor market conditions, union disputes and other

employee relations issues; (36) a decline in the liability discount rate or lower-than-expected investment returns on pension assets;

and (37) the other risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal year ended December

31, 2023 and other reports filed by Alcoa with the SEC. These risks, as well as other risks associated with the proposed transaction,

will be more fully discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward-looking

statements, which speak only as of the date they are made. Alcoa disclaims any obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject

to the risks described above and other risks in the market. Neither Alcoa nor any other person assumes responsibility for the accuracy

and completeness of any of these forward-looking statements and none of the information contained herein should be regarded as a representation

that the forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This communication

does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates

to the proposed transaction. In connection with the proposed transaction, Alcoa plans to file with the SEC a proxy statement on Schedule

14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Alcoa

may file with the SEC and send to its shareholders in connection with the proposed transaction. The issuance of the stock consideration

in the proposed transaction will be submitted to Alcoa’s stockholders for their consideration. The Proxy Statement will contain

important information about Alcoa, the proposed transaction and related matters. Before making any voting decision, Alcoa’s stockholders

should read all relevant documents filed or to be filed with the SEC completely and in their entirety, including the Proxy Statement,

as well as any amendments or supplements to those documents, when they become available, because they will contain important information

about Alcoa and the proposed transaction. Alcoa’s stockholders will be able to obtain a free copy of the Proxy Statement, as well

as other filings containing information about Alcoa, free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement

and other documents filed by Alcoa with the SEC may be obtained, without charge, by contacting Alcoa through its website at https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons related

to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection with the proposed

transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of Alcoa is set forth

in the section entitled “Information about our Executive Officers” included in Alcoa’s annual report on Form

10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm),

and in the sections entitled “Director Nominees” and “Stock Ownership of Directors and Executive Officers”

included in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on March 16, 2023 (and which

is available at https://www.sec.gov/Archives/edgar/data/1675149/000119312523072587/d427643ddef14a.htm). Additional information regarding

the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant materials to be filed

with the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be obtained as

described in the preceding paragraph.

Exhibit 1

Alcoa Corporation

BMO Capital Markets Global Metals Mining &

Critical Minerals Conference

February 27, 2024, 2:30 PM GMT

CORPORATE PARTICIPANTS

William Oplinger - Alcoa Corporation, President & Chief

Executive Officer

CONFERENCE CALL PARTICIPANTS

Katja Jancic - BMO Capital Markets Equity Research - Analyst

PRESENTATION

Katja Jancic

Good morning, everyone. Next up is Alcoa, which ranks among the largest

aluminum and alumina producers globally, with assets in Australia, Europe, Iceland, South America and North America. This week, Alcoa

also announced that it's going to be purchasing its JV partner, Alumina Limited. And with that, today with us is President and CEO, Bill

Oplinger, and I'll turn it over to you, Bill.

William Oplinger

Thanks, Katja. So as Katja said, we announced a big transaction on Sunday

night. And if I'm not careful, I'm going to fall off this, but that's okay. So I figured probably a lot of questions in your mind around

the transaction. So I'll talk specifically around the transaction, try to take some of the questions off the table for you, and then I'll

sit down and have the fireside with Katja.

First of all, the transaction we announced that we're acquiring Alumina

Limited. With the transaction ratio, Alumina Limited shareholders would own 31.25% of the combined company. The Alcoa shareholders would

own 68.75% of the combined company. We will list our CDIs in Australia, so it will be exchanged between our shares and their shares, and

we'll have a listed CDI in Australia. We will pick up a small amount of debt, around $300 million of Alumina Limited debt. Enterprise

value is roughly $2.5 billion for the transaction.

I've been asked numerous times in the last 24 hours, why now? So let

me address the why now as the first part. If you understand the nature of the joint venture, both of these organizations were spun out

of larger organizations over time. So Alumina Limited was spun out of Western Mining back in, I believe, 2002. Alcoa Corp was spun out

of Alcoa Inc. back in 2016. The joint venture used to be a small part of a large organization called Alcoa Inc.

When we spun out of Alcoa Inc., the joint venture became a very large

part of a smaller company. We've looked at the transaction a number of times over the last 7 years. Both sides have actually engaged in

looking at the transaction. And essentially, there comes down to a small window of opportunity to get a transaction like this done. Both

shares have traded in concert over the last few months, and there was an opportunity for both sets of shareholders to have value created,

and I'll talk about why that is, but a very small window to get a transaction like this done.

So if I were talking to Alumina Limited shareholders, this transaction

is good for Alumina Limited shareholders for a number of reasons. First of all, they get a premium on the closing price from the shares

on Friday. So the exchange ratio as of Friday represented about a 13% premium. The transaction is also a premium on the 1-year VWAP on

the exchange ratio, the 2-year VWAP on the exchange ratio. In addition to that, they get exposure to the entirety of the

aluminum value chain. So as they look at the ownership that they will

have in Alcoa Corp, they will be owning 31.25% of a fully-integrated, upstream aluminum company. So it's important for them to understand

that they will get that value also.

In addition to that, they will get exposure to the new technologies

that we're coming out with in the metal space. So in my view, it's a good deal for the Alumina Limited shareholders. It's also a good

deal for the Alcoa shareholders. What it does is it provides us at Alcoa, exposure – greater exposure to the upstream part of the

business. So mining and refining, we will get the economic interest associated with those tons that previously Alumina Limited would get.

There's real synergies in the deal. So there's overhead reductions, but there's also capital structure synergies in the transaction. So

we will be able to generate those synergies once the deal is completed.

And then, I guess, lastly and most importantly, it really simplifies

the equity story for Alcoa Corp. If you're buying Alcoa Corp today, you need to thoroughly understand the joint venture structure. In

the future, once this joint venture is rolled up into Alcoa Corp, it just makes it a whole lot easier to understand our financials and

our overall equity story. And before I leave that, so it's good for Alumina Limited shareholders, it's good for Alcoa shareholders, but

in addition to that, I think it's good for the stakeholders in the various communities. It's essentially for us, a doubling down in places

like Western Australia and Brazil and in Guinea. So we'll be able to do really good things for the stakeholders and the community.

A couple of points on the transaction before I move on. We have support

from the largest shareholder of Alumina Limited. So Allan Gray has agreed to support the transaction. And the Alumina Limited Board is

going to recommend the transaction to their shareholders. So I think we're in good shape there. And if you ask me, what are the next steps?

Next steps are, we'll agree on a scheme of implementation agreement. So that will take us a little while. Both shareholders will vote

on both sides, and then we expect to close probably around 6 months from now. So overall, we think it's a great transaction for both sets

of shareholders. We think it will get done, and we're really pleased.

So with that, Katja, I will turn it over to you to ask me questions.

QUESTIONS AND ANSWERS

Katja Jancic

Okay. Thank you, Bill. And if anyone has questions, please send them

through the app. But the one I had regarding the deal on -- previously on the call, you mentioned it will open opportunity for growth.

Can you talk a bit more about that?

William Oplinger

So it will -- and I didn't highlight this, but it gives us, gives Alcoa

some flexibility around key strategic portfolio decisions. Right now, both parties have to agree on those portfolio decisions. So those

portfolio decisions that have to be agreed on by both parties are curtailments, closures, but also growth.

As I look forward into the future, one of the areas that we will be

very focused on, on growth is in the upstream -- part of the upstream, both in bauxite mining and refining. And I think there will be

growth opportunities, and this is not next month, it's not next quarter. So I don't want investors to be concerned that we're rushing

out to a huge growth story. But when you look at the growth of the primary aluminum business over the next 10 or 20 years, there will

be opportunities for us to plant the flag on more bauxite and potentially grow in the refining business. And this gives us the opportunity

to do that.

[…]

Katja Jancic

And then maybe shifting gears quickly to the permitting in Western Australia,

especially for the new mining regions. How is that progressing? And does it change in any ways if or when you acquired Alumina Limited?

William Oplinger

So I'll take the second question first. Really no impact on the acquisition

of Alumina Limited on day-to-day operations in AWAC. So our engagement with customers, with employees, with various stakeholders is not

going to change. If I bifurcate the permitting issue between what we went through last year and what process we're going to be going through

for the Part 4, we ended up getting our permits at the end of 2023 for continuing operations. As part of that, we had to make a number

of agreements with stakeholders around improvements in our processes. Those have begun immediately.

[…]

Exhibit 2

FAQ

When do you expect to close the transaction?

| · | On February 25, 2024, Alcoa and Alumina Limited entered in an “exclusivity

period” for 20 business days. It is expected that the terms of the all-scrip transaction will be finalized, and a scheme implementation

agreement entered into, during that time. |

| · | Once this agreement has been executed, the transaction would be subject to

the satisfaction of customary conditions as well as approval by both companies’ shareholders and receipt of certain regulatory approvals,

including approval by Australia's Foreign Investment Review Board. |

| · | We expect to satisfy and obtain the necessary conditions and approvals to

close the transaction within six months following the execution of the scheme implementation agreement. |

| · | As we work through this process, additional information will be made available

in our filings with the SEC, including a proxy statement relating to the transaction. |

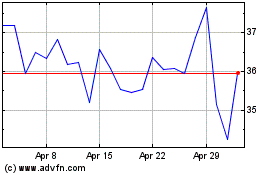

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

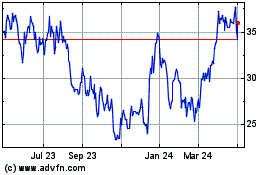

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024