Revenue up by +7%

Solid operational performance

Regulatory News:

Air Liquide (Paris:AI):

Key figures, Q1

2015

- Group revenue: +7.0%3,993 million euros

- of which Gas & Services: +6.3%3,632 million

euros

Q1 2015 highlights

- Major contract signed to build and operate the largest

oxygen production unit in the world, for Sasol in South Africa.

Total investment of around 200 million euros.

- Further acquisitions in Healthcare: Optimal Medical

Therapies, a home healthcare provider in Germany, and the hygiene

division of Bochemie, a major player in the Czech Republic.

- New developments in hydrogen energy for mobility: retail

hydrogen charging stations opened (Japan, Denmark) and a charging

station for a local authority (France); new contract for the

conversion of a fleet of forklifts to hydrogen (France).

Commenting on the first quarter 2015, Benoît Potier, Chairman

and CEO of Air Liquide, said:

“Growth this quarter was driven by the dynamism of Healthcare

and Electronics, and by developing economies, especially China

where sales rose by nearly +20% on a comparable basis.

Industrial demand was moderate at the start of the year. In

North America, the slowdown in the oil services industry, combined

with temporary plant turnarounds of several customers, had a

short-term impact on our Large Industries activities, while in

Western Europe, the manufacturing sector continues to improve in

several countries. Globally, the Group’s revenue growth outpaced

that of its market, against a backdrop of falling energy prices and

favorable exchange rates.

Operational performance remains solid; the Group continues to

generate efficiency gains and is also reinforcing its growth

initiatives.

Growth in the next few years will be supported by the recent

major new contract signings, the investment backlog of € 2.6

billion, and the innovations and technologies currently under

development.

Assuming a comparable economic environment, Air Liquide is

confident in its ability to deliver another year of net profit

growth in 2015.”

Q1 2015 Group revenue reached € 3,993 million, up

+7.0% on a reported basis and up +3.0% on a comparable

basis1 versus the 1st quarter of 2014. Sales in Gas &

Services, which amounted to € 3,632 million, rose by

+6.3% on a reported basis and by +2.6% on a comparable

basis. The positive currency effect (+7.3%) was partly offset by a

negative energy impact (-3.6%), which was particularly evident in

Large Industries.

On a comparable basis, Gas & Services revenue in

developing economies progressed by +9.4% while all

Gas & Services business lines reported revenue growth in

the 1st quarter 2015:

- Healthcare revenue, up significantly at +6.8%,

benefited from increased demand for home healthcare services and

from higher hygiene and specialty ingredient sales. Growth was also

supported by several acquisitions in Europe and in Canada. The

Healthcare business progressed in advanced and developing economies

alike.

- Revenue growth in Electronics was a robust

+14.4%, a progression in line with 2014 that attests to the

sector’s positive momentum. Sales grew in all of our product lines.

In advanced materials, which includes the ALOHA™ range and the

Voltaix offer, revenue grew by +49.0%. Sales were

particularly vigorous in China, in Taiwan, in Japan, and in the

United States.

In industry, the results were more contrasted.

- In Large Industries, revenue was virtually unchanged

(+0.2%) due to temporary plant turnarounds of several

customers in North America and Western Europe. However, a gradual

recovery in volumes began in late March in North America. This

quarter also saw the ramp-up of new production units in both China

and South America, while demand for air gases remained sustained in

Asia.

- In Industrial Merchant, where revenue was up a slight

+0.3%, the situation remains one of contrast with volumes

still low, especially in cylinders, but with positive pricing of

+1.1%. Improvement is visible in bulk sales in Europe, while in

North America oil services volumes are down. In Asia-Pacific, the

Australian market is still difficult, whereas volume growth remains

strong in Southeast Asia and in China.

Engineering and Technology revenue rose by +16.4%

on a comparable basis, reflecting the progress made on projects

underway for third-party customers.

Efficiency gains reached € 62 million, in line

with the annual target of more than € 250 million. The initiatives,

mainly in the area of procurement, logistics, and energy

efficiency, combined with ongoing efforts to align Group

structures, contributed to the good operational performance.

_____________________

1 adjusted for currency, energy (natural gas and electricity)

and significant M&A impacts

UPCOMING EVENTS

Annual General MeetingMay 6, 2015

Dividend ex-dateMay 18, 2015

Dividend payment dateMay 20, 2015

2015 1st half resultsJuly 30, 2015

World leader in gases, technologies and services for Industry

and Health, Air Liquide is present in 80 countries with more than

50,000 employees and serves more than 2 million customers and

patients. Oxygen, nitrogen and hydrogen have been at the core of

the company’s activities since its creation in 1902. Air Liquide’s

ambition is to be the leader in its industry, delivering long-term

performance and acting responsibly.

Air Liquide ideas create value over the long term. At the core

of the company’s development are the commitment and constant

inventiveness of its people.

Air Liquide anticipates the challenges of its markets, invests

locally and globally, and delivers high-quality solutions to its

customers and patients, and the scientific community.

The company relies on competitiveness in its operations,

targeted investments in growing markets and innovation to deliver

profitable growth over the long-term.

Air Liquide’s revenue amounted to € 15.4 billion in 2014, and

its solutions that protect life and the environment represented

more than 40% of sales. Air Liquide is listed on the Paris Euronext

stock exchange (compartment A) and is a member of the CAC 40 and

Dow Jones Euro Stoxx 50 indexes.

2015 1st quarter revenue

In the first quarter 2015, sales were up +7.0% in a contrasted

global market environment. Growth benefited from a positive +7.3%

currency impact, partly offset by a negative -3.3% energy impact.

Comparable growth was up +3.0%.

The strong growth momentum seen in the past few quarters

continued in China (+19.9%(a)) and in Electronics (+14.4%(a)).

Sales in developing economies grew by +9.4%(a). Healthcare revenue

growth returned to historic levels (+6.8%(a)), partly due to

acquisitions completed in recent months. Growth in other business

lines saw a more moderate start to the year. Gas & Services

revenue grew by +2.6%(a), outperforming the +1.7% growth of global

industrial production (weighted for the Group’s industrial sales).

The sales are compared to a high level of activity in the 1st

quarter 2014.

Operating performance benefited from continuing efficiency

gains, the progressive results of the realignment plan, and the

narrowing of the gap between cost inflation and price rises. Cash

flows from operating activities before changes in working capital

remain solid, at 18.6% of sales, up +6.4% excluding currency

effects.

Investment decisions amounted to 733 million euros, a high level

comparable to that of the fourth quarter 2014. The investment

backlog was 2.6 billion euros while 12-month investment

opportunities amounted to 3 billion euros. The strong levels of

both the investment commitments and opportunities pave the way for

future growth.

Revenue

(in millions of euros)

Q1 2014 Q1 2015

Q1 2015/2014

reported

change

Q1 2015/2014

comparable

change(a)

Gas & Services 3,416 3,632 +6.3%

+2.6% Engineering & Technology 175 217

+24.0% +16.4% Other activities 143 144

+1.0% -3.6%

TOTAL REVENUE 3,734

3,993 +7.0% +3.0%

(a) comparable change: excluding the impact of currency, energy

and significant scope

Revenue analysis

Group

Group revenue for the 1st quarter 2015 reached 3,993

million euros, up +7.0% on a reported basis. Adjusted

for the positive currency and negative energy impacts, revenue grew

by +3.0% on a comparable basis. There was no significant

scope impact during the quarter.

Unless mentioned otherwise, all changes in revenue described

below are based on changes on a comparable basis, which excludes

currency, energy (natural gas and electricity) and significant

scope impacts. The energy impact may include other Large Industries

energy feedstocks in the future.

Gas & Services

In the 1st quarter 2015, Gas & Services revenue

amounted to 3,632 million euros, up +6.3% as

reported, benefiting from a positive +7.3% currency impact, partly

offset by a negative -3.6% energy impact. Comparable growth was up

+2.6%.

Revenue

(in millions of euros)

Q1 2014 Q1 2015

Q1 2015/2014

reported

change

Q1 2015/2014

comparable

change(a)

Europe

1,701 1,696 -0.3%

+1.3% Americas

814 895 +9.9%

+1.1% Asia-Pacific

816 946

+16.0% +6.9% Middle East and Africa

85

95 +12.1% +1.4%

Gas &

Services 3,416 3,632

+6.3% +2.6% Large Industries

1,285 1,264 -1.7% +0.2%

Industrial Merchant

1,229 1,327

+8.0% +0.3% Healthcare

626 685

+9.4% +6.8% Electronics

276

356 +29.0% +14.4%

(a) comparable: excluding the impact of currency, energy and

significant scope

Europe

At 1,696 million euros, revenue in Europe was up

+1.3%. The quarter benefited from a slight improvement in

liquid gas volumes, strong growth in sales in the Healthcare

segment, including the acquisitions signed at the end of 2014, and

activity momentum in developing economies.

Europe Gas & Services revenue

- Large Industries revenue was

down -3.5%, following temporary turnarounds for maintenance of

customer units, especially those that are consumers of hydrogen in

France and Belgium. Excluding these turnarounds and the remaining

impact of the disposal of the cogeneration plants end of 2013,

early 2014, sales were almost flat.

- In the Industrial Merchant

business line, sales were stable, as in the fourth quarter 2014,

following several quarters of decline. The situation in European

markets remains contrasted, but showed an improving trend. Liquid

volumes were slightly higher in Germany, France, Spain and Benelux,

while cylinder volumes remained weak in all markets except Spain

and the UK. Sales continued to grow steadily in developing

economies with liquid volumes up sharply. Regional price impact was

-0.4%.

- Healthcare recorded strong

growth, up +7.7%, partly due to acquisitions made in recent

months. Home Healthcare also continued to expand due to the steady

increase in the number of patients treated. In the medical gases

for hospitals segment, budgetary pressure continues to weigh on gas

volumes which remain slightly down. Hygiene and Specialty

Ingredients saw particularly strong growth, up +10% and +8%

respectively.

Americas

Gas & Services revenue in the Americas was

895 million euros, up +1.1%. Business was

relatively weak in the 1st quarter in Large Industries and

Industrial Merchant in North America, while sales continued to grow

in South America.

Americas Gas & Services Revenue

- Large Industries sales were down

-1.5%. Weaker volumes in North America were affected by

temporary turnarounds of about ten customer units and by a 15-day

turnaround for regulatory inspection of the hydrogen pipeline

network in the US. Volumes have increased progressively since the

end of March. Excluding these turnarounds, growth in the region

would have been +3.7%. Cogeneration sales were down in Canada.

Turnover was up +12.2% in South America, benefiting from the

ramp-up of a production unit in Brazil.

- Sales in the Industrial Merchant

business were up +1.0%. In North America, liquid volumes

(particularly nitrogen) were affected by the slowdown in the oil

well services. The cylinder business was slightly down in Canada.

Sales were up in South America, boosted by price increases, despite

a slowdown in activity in Brazil. Pricing was positive in all

countries, averaging +5.2% accross the region.

- Healthcare revenue was up

+3.9%. Excluding the impact of reclassification of a

business in the French West Indies as within the France perimeter,

growth would have been around +12%. Business was particularly

dynamic in Canada, benefiting from an acquisition, and in South

America, where medical gas volumes and the number of Home

Healthcare patients are increasing significantly.

- Electronics sales were up

+10.7%, helped by strong development (+41.4%) in Advanced

Materials which includes the ALOHATM range and products from

Voltaix, a company acquired in 2013. Equipment and Installation

sales, which are more cyclical, were relatively weak compared to

their record in the 1st quarter 2014. Carrier gases sales continued

to grow.

Asia-Pacific

Revenue in the Asia-Pacific region increased by

+6.9% to 946 million euros. Revenue was

up in Japan, due primarily to dynamic performance in Electronics,

although Industrial Merchant activity was stable. Developing

economies, notably China (up +19.9%), continued to grow steadily,

offsetting weaker activity in Australia due to pricing

pressure.

Asia-Pacific Gas & Services

Revenue

- Sustained by the ramp-up of new units

started up at the end of 2013 and beginning of 2014 in China,

Large Industries sales increased by +8.7%. Air gases

and hydrogen volumes expanded in the region. There were no unit

start-ups during the quarter.

- Industrial Merchant revenues

were stable, at +0.2% compared to the 1st quarter 2014.

Sales are continuing to increase in developing economies,

especially China, boosted by volume growth. Price pressure

intensified in the region (down -1.6%), mainly in Australia where

the competitive situation is challenging and in Singapore where

shipbuilders have been hit by the oil industry slowdown. Sales in

Japan were stable over the quarter.

- The Electronics business

continued to expand with sales up +15.7%. Revenue increased

in all countries in the region and particularly in Japan, China and

Taiwan, reflecting the ongoing momentum of the business. Carrier

gases benefited from the start-up and ramp-up of a number of plants

in China. Advanced Materials revenue rose significantly in the

region, notably in Japan and Korea.

- Healthcare sales rose by

+1.8%. Excluding the impact of reclassification in the

France perimeter of a business in French Overseas Territories,

growth would have been around +8%. Sales were particularly strong

in Australia, Hong Kong and Korea.

Middle East and Africa

Middle East and Africa revenue totaled 95 million

euros, up +1.4%. This contribution reflects ongoing

instability in the Middle East and a difficult economic environment

in North Africa, offset by a slight upturn in business in Egypt.

Sales grew rapidly in South Africa, driven mainly by the ramp-up of

a unit that started up in the 1st quarter 2014 and by robust

Industrial Merchant activity.

Engineering & Technology

Engineering & Technology revenue totaled

217 million euros, up +16.4% compared to

the 1st quarter 2014. This is the result of the steady progress of

projects under execution.

At 310 million euros, orders in the 1st quarter 2015

were higher than in the 1st quarter 2014 and mainly relate to Group

projects.

Other activities

Revenue

(in millions of euros)

Q1 2014 Q1 2015

Q1 2015/2014

reported

change

Q1 2015/2014

comparable

change (a)

Welding

96 93 - 3.6%

-4.5% Diving

47 51 +10.7%

-1.6%

TOTAL OTHERS 143 144

+1.0% -3.6% (a) comparable: excluding

currency impact

Other Activities revenue in the 1st quarter 2015 declined

by -3.6% to 144 million euros.

- Welding revenue decreased by

-4.5% in the 1st quarter, still impacted by the weakness of

the European economy.

- Diving (Aqua LungTM) saw a

decline in sales following the sale of a non-strategic business at

the end of 2014. Excluding this disposal, revenue increased

significantly.

Quarterly highlights

Industrial developments

New contracts were signed in Large Industries in both

developing and advanced economies in the 1st quarter 2015.

- In the United States, Air Liquide

entered into a new long-term agreement to supply Yuhang Chemical.

The Group will build a new Air Separation Unit (ASU), with total

capacity of 2,400 tonnes of oxygen per day, for the new large-scale

methanol production complex of the customer in St. James Parish,

Louisiana. The ASU will be connected to the Group’s extensive

pipeline system, providing enhanced reliability of supply. Air

Liquide will also license its leading MegaMethanol® Technology.

This agreement illustrates the value for the customer of a

complementary offer combining Group proprietary technologies with

long term oxygen supply.

- Air Liquide and Sasol, an international

integrated energy and chemicals company, signed a long-term

agreement for the supply of large quantities of industrial gases to

Sasol’s Secunda site in South Africa (around 140 km East of

Johannesburg). Air Liquide will invest around 200 million euros for

the construction of the largest Air Separation Unit (ASU) ever

built, with total capacity of 5,000 tonnes of oxygen per day

(equivalent to 5,800 tonnes per day at sea level), a milestone in

the history of industrial gas production. It is the first time

Sasol will outsource its oxygen needs to a specialist of industrial

gas production at its Secunda site.

- In Australia, Air Liquide announced a

new long-term agreement with Nyrstar, an integrated mining and

metals company. Air Liquide will invest 60 million euros in a 1,400

tonnes per day new Air Separation Unit (ASU), to help Nyrstar

reduce the environmental footprint of the site and to enhance both

efficiency and production capabilities.

New developments in Healthcare

In the 1st quarter 2015, Air Liquide pursued its external growth

strategy in Healthcare.

- In Germany, the Group strengthened its

Home Healthcare offering with the acquisition of Optimal Medical

Therapies (OMT). OMT provides services for around 5,000 patients

and is recognized for its expertise in home infusion services that

include immunotherapy, pain management, and the treatment of

pulmonary hypertension and Parkinson’s disease.

- Schülke, an Air Liquide Healthcare

entity specializing in hospital disinfection and hygiene, is

expanding its presence in Eastern Europe and widening its range of

complementary products through the acquisition of the Hygiene

division of Bochemie, a major player in the Czech Republic.

Hydrogen mobility

Air Liquide has pursued its developments in hydrogen

mobility.

- The Group has been chosen by FM

Logistic, an international logistics and supply chain group, to

provide support for its projected deployment of hydrogen-powered

forklift trucks on its sites. At its logistics platform located

near the city of Orléans (France), Air Liquide installed a hydrogen

charging station that will service FM Logistic’s forklifts equipped

with hydrogen fuel cells.

- Moreover, following the announcement of

such developments by the end of 2014, almost 40 million euros of

capital expenditures were initiated in the 1st quarter to hook up

new hydrogen filling stations in Germany, Denmark and the USA.

Bond issue

In January 2015, Air Liquide Finance innovated yet again with

the issue of its first Chinese renminbi-denominated bond on

the Taiwanese market (“Formosa Bond”) for a total of 500 million

Chinese renminbi, equivalent to 68 million euros. Air Liquide is

thus the first non-Taiwanese corporate to issue bonds in Chinese

renminbi on this market.

Investment cycle

Investment opportunities

12-month investment opportunities remained stable at

3.0 billion euros at the end of March 2015, with new projects

in the portfolio substantially offsetting those signed by the

Group, awarded to the competition or delayed. The large project

signed with SASOL at the start of the year was thus removed from

the opportunities portfolio.

Nearly two-thirds of the investment opportunity projects in the

12-month portfolio continue to be located in developing economies.

The North America weighting is stable. The portfolio also includes

nine takeovers representing approximately 12% of the total value of

investment opportunities.

Investment decisions and investment backlog

Industrial and financial investment decisions totaled

733 million euros during the quarter, which is a significant

level. Industrial decisions accounted for 80% of that amount.

The investment backlog totaled 2.6 billion euros, representing a

future contribution to revenue of approximately 1.1 billion euros

in the coming years.

Start-ups

Five new units were started up at the end of the 1st quarter

2015, the majority in North America, one Electronics unit in China

and one in Dormagen in Germany.

In 2015, start-ups and ramp-ups are expected to contribute

around 350 million euros to sales growth.

Operating performance

The Group’s efficiency gains in the quarter amounted to

62 million euros. The sustained effort of many projects

throughout the Group, principally in industrial operations

(production, logistics) this quarter, have contributed to this

performance. The adaptation plans initiated at the end of 2013 are

continuing to contribute to efficiencies this year and, with the

different reorganizations of our activities, account for some 20%

of the savings generated.

Cash flow from operating activities before changes in working

capital for the first three months of the year was solid, at 18.6%

of sales, up +6.4% excluding currency effects, more than covering

the 439 million euros of net industrial capital expenditure. The

Group’s financial structure remains solid.

Net capital expenditure, excluding transactions with minority

shareholders, was 532 million euros for the quarter.

Outlook

Growth this quarter was driven by the dynamism of Healthcare and

Electronics, and by developing economies, especially China where

sales rose by nearly +20% on a comparable basis.

Industrial demand was moderate at the start of the year. In

North America, the slowdown in the oil services industry, combined

with temporary plant turnarounds of several customers, had a

short-term impact on Large Industries activities, while in Western

Europe, the manufacturing sector continues to improve in several

countries. Globally, the Group’s revenue growth outpaced that of

its market, against a backdrop of falling energy prices and

favorable exchange rates.

Operational performance remains solid; the Group continues to

generate efficiency gains and is also reinforcing its growth

initiatives.

Growth in the next few years will be supported by the recent

major new contract signings, the investment backlog of € 2.6

billion, and the innovations and technologies currently under

development.

Assuming a comparable economic environment, Air Liquide is

confident in its ability to deliver another year of net profit

growth in 2015.

Appendix

Currency, energy (natural gas, electricity) and significant

M&A impacts

In addition to the comparison of published figures, financial

information for first quarter 2015 is provided before currency,

energy price fluctuations and significant M&A impacts. As of

January 1st, 2015, the energy impact includes impacts of natural

gas and electricity. In the future, it may also include other

energy Large Industries feedstocks.

Since gases for industry and health are rarely exported, the

impact of currency fluctuations on activity levels and results is

limited to euro translation impacts with respect to the financial

statements of subsidiaries located outside the Euro zone.

Fluctuations in natural gas and electricity prices are passed on to

customers through price indexation clauses.

Consolidated 2015 first quarter revenue includes the

following:

In millions of euros Revenue

Q1 2015

Q1

2015/2014

change

Currency Naturalgas

Electricity

Significant

scope

Q1 2015/2014

comparablechange

(a)

Group

3,993 +7.0% 271 (116)

(8) (0) +3.0% Gas & Services

3,632 +6.3% 251 (116) (8)

(0) +2.6%

(a) excluding currency, energy (natural gas and electricity) and

significant M&A impacts.

For the Group,

- The currency impact was +7.3%.

- The impact of natural gas price

fluctuations was -3.1%.

- The impact of electricity price

fluctuations was -0.2%.

- There was no significant M&A

impact.

For Gas & Services,

- The currency impact was +7.3%.

- The impact of natural gas price

fluctuations was -3.4%.

- The impact of electricity price

fluctuations was -0.2%.

- There was no significant M&A

impact.

This management report is also available on our website:

http://www.airliquide.com/en/investors/financial-presentations.html

Corporate CommunicationsAnnie Fournier, + 33 (0)1 40 62

51 31Caroline Philips, + 33 (0)1 40 62 50 84orInvestor

RelationsAude Rodriguez, +33 (0)1 40 62 57 08Virginia Jeanson,

+33 (0)1 40 62 57 37

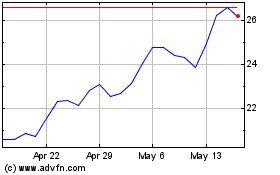

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024