Form 8-K - Current report

October 29 2024 - 3:05PM

Edgar (US Regulatory)

Allison Transmission Holdings Inc false 0001411207 0001411207 2024-10-29 2024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 29, 2024

ALLISON TRANSMISSION HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-35456 |

|

26-0414014 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| One Allison Way, Indianapolis, Indiana |

|

|

|

46222 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (317) 242-5000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

ALSN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On October 29, 2024, Allison Transmission Holdings, Inc. (“Allison”) published an earnings release reporting its financial results for the three months ended September 30, 2024. A copy of the earnings release is attached as Exhibit 99.1 hereto. Following the publication of the earnings release, Allison will host an earnings call on October 29, 2024 at 5:00 p.m. EDT on which its financial results for the three months ended September 30, 2024 will be discussed. The investor presentation materials that will be used for the call are attached as Exhibit 99.2 hereto.

On October 29, 2024, Allison posted the materials attached as Exhibits 99.1 and 99.2 on its web site (www.allisontransmission.com).

As discussed on page 2 of Exhibit 99.2, the investor presentation contains forward-looking statements within the meaning of the federal securities laws. These statements are present expectations, and are subject to the limitations listed therein and in Allison’s other Securities and Exchange Commission filings, including that actual events or results may differ materially from those in the forward-looking statements.

The foregoing information (including the exhibits hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Allison Transmission Holdings, Inc. |

|

|

|

|

| Date: October 29, 2024 |

|

|

|

By: |

|

/s/ Eric C. Scroggins |

|

|

|

|

Name: |

|

Eric C. Scroggins |

|

|

|

|

Title: |

|

Vice President, General Counsel and Secretary |

Exhibit 99.1

Allison Transmission Announces Third Quarter 2024 Results

| * |

Record quarterly net sales of $824 million, up 12% year over year

|

| * |

Net Income of $200 million, up 27% year over year |

| * |

Diluted EPS of $2.27, a quarterly record, up 29% year over year |

| * |

Increasing full year 2024 revenue, earnings and cash flow guidance |

INDIANAPOLIS, October 29, 2024 – Allison Transmission Holdings Inc. (NYSE: ALSN), today reported third quarter net sales of

$824 million, a quarterly record driven by continued strength in our North America On-Highway, Defense and Outside North America On-Highway end markets.

David S. Graziosi, Chair and Chief Executive Officer of Allison Transmission commented, “Demonstrated through our third quarter 2024 results,

unprecedented demand for Class 8 vocational vehicles in our North America On-Highway end market continues to drive record performance for our business. Third quarter net sales increased 12 percent

year over year, surpassed by an even stronger increase in diluted EPS, up 29 percent year over year to a quarterly record of $2.27 per share.”

Graziosi continued, “Based on the ongoing strength in our North America On-Highway end market and a favorable

outlook for the remainder of the year, we are pleased to raise our full year 2024 revenue, earnings and cash flow guidance.”

Third Quarter

Financial Highlights

Net sales for the quarter were a record $824 million. Year over year results were led by:

| |

• |

|

An $81 million increase in net sales in the North America On-Highway

end market principally driven by strength in demand for Class 8 vocational vehicles and medium-duty trucks and price increases on certain products, |

| |

• |

|

A $10 million increase in net sales in the Defense end market principally driven by increased demand for

Tracked vehicle applications, and |

| |

• |

|

An $8 million increase in net sales in the Outside North America

On-Highway end market, leading to record third quarter net sales of $126 million, principally driven by higher demand in Asia and price increases on certain products, partially offset by lower demand in

Europe. |

Net income for the quarter was $200 million. Diluted EPS for the quarter was $2.27. Adjusted EBITDA, a non-GAAP financial measure, for the quarter was $305 million. Net cash provided by operating activities for the quarter was $246 million. Adjusted free cash flow, a

non-GAAP financial measure, for the quarter was $210 million.

1

Third Quarter Net Sales by End Market

|

|

|

|

|

|

|

|

|

|

|

|

|

| End Market |

|

Q3 2024

Net Sales ($M) |

|

|

Q3 2023

Net Sales ($M) |

|

|

Variance |

|

| North America On-Highway |

|

$ |

457 |

|

|

$ |

376 |

|

|

$ |

81 |

|

| North America Off-Highway |

|

$ |

1 |

|

|

$ |

9 |

|

|

($ |

8 |

) |

| Defense |

|

$ |

53 |

|

|

$ |

43 |

|

|

$ |

10 |

|

| Outside North America On-Highway |

|

$ |

126 |

|

|

$ |

118 |

|

|

$ |

8 |

|

| Outside North America Off-Highway |

|

$ |

19 |

|

|

$ |

19 |

|

|

$ |

0 |

|

| Service Parts, Support Equipment & Other |

|

$ |

168 |

|

|

$ |

171 |

|

|

($ |

3 |

) |

| Total Net Sales |

|

$ |

824 |

|

|

$ |

736 |

|

|

$ |

88 |

|

Third Quarter Financial Results

Gross profit for the quarter was $396 million, an increase of $39 million from $357 million for the same period in 2023. The increase in gross

profit was principally driven by increased net sales and price increases on certain products, partially offset by higher manufacturing expense.

Selling,

general and administrative expenses for the quarter were $85 million, a decrease of $1 million from $86 million for the same period in 2023. The decrease was principally driven by lower intangible amortization expense, partially

offset by increased commercial activities spending and higher incentive compensation expense.

Engineering – research and development expenses for

the quarter were $51 million, an increase of $2 million from $49 million for the same period in 2023.

Net income for the quarter was

$200 million, an increase of $42 million from $158 million for the same period in 2023. The increase was principally driven by higher gross profit and lower interest expense, net.

Net cash provided by operating activities was $246 million, an increase of $34 million from $212 million for the same period in 2023. The

increase was principally driven by higher gross profit, partially offset by higher operating working capital funding requirements and higher cash income taxes.

Third Quarter Non-GAAP Financial Measures

Adjusted EBITDA for the quarter was $305 million, an increase of $38 million from $267 million for the same period in 2023. The increase in

Adjusted EBITDA was principally driven by higher gross profit.

Adjusted free cash flow for the quarter was $210 million, an increase of

$28 million from $182 million for the same period in 2023. The increase was principally driven by higher net cash provided by operating activities, partially offset by higher capital expenditures.

2024 Guidance Update

Given third quarter 2024 results

and current end markets conditions, we are raising our full year 2024 guidance midpoints. Allison expects 2024 Net Sales in the range of $3,135 to $3,215 million, Net Income in the range of $675 to $725 million, Adjusted EBITDA in the

range of $1,115 to $1,175 million, Net Cash Provided by Operating Activities in the range of $740 to $800 million, Capital Expenditures in the range of $135 to $145 million, and Adjusted Free Cash Flow in the range of $605 to

$655 million.

2

Conference Call and Webcast

The Company will host a conference call at 5:00 p.m. EDT on Tuesday, October 29, 2024 to discuss its third quarter 2024 results. The dial-in phone number for the conference call is +1-877-425-9470 and the international dial-in number is +1-201-389-0878. A live webcast of the conference call will also be available

online at https://ir.allisontransmission.com.

For those unable to participate in the conference call, a replay will be available from 9:00 p.m. EDT on

October 29 until 11:59 p.m. EDT on November 12. The replay dial-in phone number is

+1-844-512-2921 and the international replay dial-in number is +1-412-317-6671. The replay passcode is 13749295.

About Allison Transmission

Allison

Transmission (NYSE: ALSN) is a leading designer and manufacturer of propulsion solutions for commercial and defense vehicles and the largest global manufacturer of medium- and heavy-duty fully automatic transmissions that Improve the

Way the World Works. Allison products are used in a wide variety of applications, including on-highway vehicles (distribution, refuse, construction, agriculture, fire and emergency), buses (school, transit

and coach), motorhomes, off-highway vehicles and equipment (energy, mining and construction applications) and defense vehicles (tactical wheeled and tracked). Founded in 1915, the company is headquartered

in Indianapolis, Indiana, USA. With a presence in more than 150 countries, Allison has regional headquarters in the Netherlands, China and Brazil, manufacturing facilities in the USA, Hungary and India, as well as

global engineering resources, including electrification engineering centers in Indianapolis, Indiana, Auburn Hills, Michigan and London in the United Kingdom. Allison also has more than 1,600 independent distributor and dealer

locations worldwide. For more information, visit https://allisontransmission.com.

Forward-Looking Statements

This press release contains forward-looking statements. The words “believe,” “expect,” “anticipate,” “intend,”

“estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking

statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause

actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date the

statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements are subject to

numerous risks and uncertainties, including, but not limited to: our participation in markets that are competitive; our ability to prepare for, respond to and successfully achieve our objectives relating to technological and market developments,

competitive threats and changing customer needs, including with respect to electric hybrid and fully electric commercial vehicles; increases in cost, disruption of supply or shortage of labor, freight, raw materials, energy or components used to

manufacture or transport our products or those of our customers or suppliers, including as a result of geopolitical risks, wars and pandemics; global economic volatility; general economic and industry conditions, including the risk of recession;

labor strikes, work stoppages or similar labor disputes, which could significantly disrupt our operations or those of our principal customers or suppliers; the highly cyclical industries in which certain of our end users operate; uncertainty in the

global regulatory and business environments in which we operate; the concentration of our net sales in our top five customers and the loss of any one of these; the failure of markets outside North America to increase adoption of fully automatic

transmissions; the success of our research and development efforts, the outcome of which is uncertain; U.S. and foreign defense spending; risks associated with our international operations, including acts of war and increased trade protectionism;

the discovery of defects in our products, resulting in delays in new model launches, recall campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and reputation; our ability to identify, consummate and

effectively integrate acquisitions and collaborations; and risks related to our indebtedness.

Use of Non-GAAP

Financial Measures

This press release contains information about Allison’s financial results and forward-looking estimates of financial results

which are not presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Such non-GAAP financial measures are reconciled to their closest GAAP financial

measures at the end of this press release. Non-GAAP financial measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may

not be comparable to other similarly titled measures of other companies.

3

We use Adjusted EBITDA and Adjusted EBITDA as a percent of net sales to measure our operating profitability.

We believe that Adjusted EBITDA and Adjusted EBITDA as a percent of net sales provide management, investors and creditors with useful measures of the operational results of our business and increase the period-to-period comparability of our operating profitability and comparability with other companies. Adjusted EBITDA as a percent of net sales is also used in the calculation of management’s incentive

compensation program. The most directly comparable GAAP measure to Adjusted EBITDA is Net income. The most directly comparable GAAP measure to Adjusted EBITDA as a percent of net sales is Net Income as a percent of net sales. Adjusted EBITDA is

calculated as the earnings before interest expense, net, income tax expense, amortization of intangible assets, depreciation of property, plant and equipment and other adjustments as defined by Allison Transmission, Inc.’s, the Company’s

wholly-owned subsidiary, Second Amended and Restated Credit Agreement. Adjusted EBITDA as a percent of net sales is calculated as Adjusted EBITDA divided by net sales.

We use Adjusted Free Cash Flow to evaluate the amount of cash generated by our business that, after the capital investment needed to maintain and grow our

business and certain mandatory debt service requirements, can be used for the repayment of debt, stockholder distributions and strategic opportunities, including investing in our business. We believe that Adjusted Free Cash Flow enhances the

understanding of the cash flows of our business for management, investors and creditors. Adjusted Free Cash Flow is also used in the calculation of management’s incentive compensation program. The most directly comparable GAAP measure to

Adjusted Free Cash Flow is Net cash provided by operating activities. Adjusted Free Cash Flow is calculated as Net cash provided by operating activities, after additions of long-lived assets.

Attachments

| |

• |

|

Condensed Consolidated Statements of Operations |

| |

• |

|

Condensed Consolidated Balance Sheets |

| |

• |

|

Condensed Consolidated Statements of Cash Flows |

| |

• |

|

Reconciliation of GAAP to Non-GAAP Financial Measures

|

| |

• |

|

Reconciliation of GAAP to Non-GAAP Financial Measures for Full Year

Guidance |

Contacts

Jackie Bolles

Executive Director, Treasury and Investor Relations

jacalyn.bolles@allisontransmission.com

(317) 242-7073

Branden Harbin

Executive Director, Global Marketing and External Communications

branden.harbin@allisontransmission.com

(317) 242-2769

4

Allison Transmission Holdings, Inc.

Condensed Consolidated Statements of Operations

(Unaudited, dollars in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net sales |

|

$ |

824 |

|

|

$ |

736 |

|

|

$ |

2,429 |

|

|

$ |

2,260 |

|

| Cost of sales |

|

|

428 |

|

|

|

379 |

|

|

|

1,273 |

|

|

|

1,161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

396 |

|

|

|

357 |

|

|

|

1,156 |

|

|

|

1,099 |

|

| Selling, general and administrative |

|

|

85 |

|

|

|

86 |

|

|

|

253 |

|

|

|

265 |

|

| Engineering - research and development |

|

|

51 |

|

|

|

49 |

|

|

|

146 |

|

|

|

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

260 |

|

|

|

222 |

|

|

|

757 |

|

|

|

694 |

|

| Interest expense, net |

|

|

(21 |

) |

|

|

(27 |

) |

|

|

(68 |

) |

|

|

(83 |

) |

| Other income (expense), net |

|

|

10 |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

249 |

|

|

|

193 |

|

|

|

687 |

|

|

|

621 |

|

| Income tax expense |

|

|

(49 |

) |

|

|

(35 |

) |

|

|

(131 |

) |

|

|

(118 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

200 |

|

|

$ |

158 |

|

|

$ |

556 |

|

|

$ |

503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share attributable to common stockholders |

|

$ |

2.30 |

|

|

$ |

1.76 |

|

|

$ |

6.39 |

|

|

$ |

5.53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share attributable to common stockholders |

|

$ |

2.27 |

|

|

$ |

1.76 |

|

|

$ |

6.32 |

|

|

$ |

5.53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

Allison Transmission Holdings, Inc.

Condensed Consolidated Balance Sheets

(Unaudited, dollars in millions)

|

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents |

|

$ |

788 |

|

|

$ |

555 |

|

| Accounts receivable, net |

|

|

393 |

|

|

|

356 |

|

| Inventories |

|

|

326 |

|

|

|

276 |

|

| Other current assets |

|

|

85 |

|

|

|

63 |

|

|

|

|

|

|

|

|

|

|

| Total Current Assets |

|

|

1,592 |

|

|

|

1,250 |

|

| Property, plant and equipment, net |

|

|

780 |

|

|

|

774 |

|

| Intangible assets, net |

|

|

825 |

|

|

|

833 |

|

| Goodwill |

|

|

2,076 |

|

|

|

2,076 |

|

| Other non-current assets |

|

|

95 |

|

|

|

92 |

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

5,368 |

|

|

$ |

5,025 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

272 |

|

|

$ |

210 |

|

| Product warranty liability |

|

|

29 |

|

|

|

32 |

|

| Current portion of long-term debt |

|

|

5 |

|

|

|

6 |

|

| Deferred revenue |

|

|

45 |

|

|

|

41 |

|

| Other current liabilities |

|

|

212 |

|

|

|

212 |

|

|

|

|

|

|

|

|

|

|

| Total Current Liabilities |

|

|

563 |

|

|

|

501 |

|

| Product warranty liability |

|

|

32 |

|

|

|

27 |

|

| Deferred revenue |

|

|

93 |

|

|

|

89 |

|

| Long-term debt |

|

|

2,396 |

|

|

|

2,497 |

|

| Deferred income taxes |

|

|

505 |

|

|

|

519 |

|

| Other non-current liabilities |

|

|

158 |

|

|

|

159 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

3,747 |

|

|

|

3,792 |

|

| TOTAL STOCKHOLDERS’ EQUITY |

|

|

1,621 |

|

|

|

1,233 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY |

|

$ |

5,368 |

|

|

$ |

5,025 |

|

|

|

|

|

|

|

|

|

|

6

Allison Transmission Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited, dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net cash provided by operating activities |

|

$ |

246 |

|

|

$ |

212 |

|

|

$ |

590 |

|

|

$ |

546 |

|

| Net cash used for investing activities (a) |

|

|

(38 |

) |

|

|

(30 |

) |

|

|

(70 |

) |

|

|

(71 |

) |

| Net cash used for financing activities |

|

|

(69 |

) |

|

|

(31 |

) |

|

|

(287 |

) |

|

|

(205 |

) |

| Effect of exchange rate changes on cash |

|

|

1 |

|

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

140 |

|

|

|

150 |

|

|

|

233 |

|

|

|

269 |

|

| Cash and cash equivalents at beginning of period |

|

|

648 |

|

|

|

351 |

|

|

|

555 |

|

|

|

232 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

788 |

|

|

$ |

501 |

|

|

$ |

788 |

|

|

$ |

501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income taxes paid |

|

$ |

(51 |

) |

|

$ |

(43 |

) |

|

$ |

(150 |

) |

|

$ |

(164 |

) |

| Interest paid |

|

$ |

(29 |

) |

|

$ |

(31 |

) |

|

$ |

(91 |

) |

|

$ |

(95 |

) |

| Interest received from interest rate swaps |

|

$ |

3 |

|

|

$ |

3 |

|

|

$ |

10 |

|

|

$ |

8 |

|

| (a) Additions of long-lived assets |

|

$ |

(36 |

) |

|

$ |

(30 |

) |

|

$ |

(68 |

) |

|

$ |

(73 |

) |

7

Allison Transmission Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited, dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net income (GAAP) |

|

$ |

200 |

|

|

$ |

158 |

|

|

$ |

556 |

|

|

$ |

503 |

|

| plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

49 |

|

|

|

35 |

|

|

|

131 |

|

|

|

118 |

|

| Depreciation of property, plant and equipment |

|

|

28 |

|

|

|

28 |

|

|

|

82 |

|

|

|

81 |

|

| Interest expense, net |

|

|

21 |

|

|

|

27 |

|

|

|

68 |

|

|

|

83 |

|

| Amortization of intangible assets |

|

|

1 |

|

|

|

11 |

|

|

|

8 |

|

|

|

33 |

|

| Stock-based compensation expense (a) |

|

|

6 |

|

|

|

6 |

|

|

|

20 |

|

|

|

17 |

|

| UAW Local 933 contract signing incentives (b) |

|

|

— |

|

|

|

— |

|

|

|

14 |

|

|

|

— |

|

| Unrealized (gain) loss on marketable securities (c) |

|

|

(2 |

) |

|

|

2 |

|

|

|

8 |

|

|

|

(1 |

) |

| Pension plan settlement loss (d) |

|

|

— |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

| Unrealized loss on foreign exchange (e) |

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Equity earnings in equity method investments (f) |

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Technology-related investments loss (gain) (g) |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

(3 |

) |

| Loss associated with impairment of long-lived assets |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (Non-GAAP) |

|

$ |

305 |

|

|

$ |

267 |

|

|

$ |

895 |

|

|

$ |

831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales (GAAP) |

|

$ |

824 |

|

|

$ |

736 |

|

|

$ |

2,429 |

|

|

$ |

2,260 |

|

| Net income as a percent of net sales (GAAP) |

|

|

24.3 |

% |

|

|

21.5 |

% |

|

|

22.9 |

% |

|

|

22.3 |

% |

| Adjusted EBITDA as a percent of net sales

(Non-GAAP) |

|

|

37.0 |

% |

|

|

36.3 |

% |

|

|

36.8 |

% |

|

|

36.8 |

% |

| Net cash provided by operating activities (GAAP) |

|

$ |

246 |

|

|

$ |

212 |

|

|

$ |

590 |

|

|

$ |

546 |

|

| Deductions to Reconcile to Adjusted Free Cash Flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additions of long-lived assets |

|

|

(36 |

) |

|

|

(30 |

) |

|

|

(68 |

) |

|

|

(73 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted free cash flow (Non-GAAP) |

|

$ |

210 |

|

|

$ |

182 |

|

|

$ |

522 |

|

|

$ |

473 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Represents stock-based compensation expense (recorded in Cost of sales, Selling, general and administrative,

and Engineering — research and development). |

| (b) |

Represents non-recurring incentives (recorded in Cost of sales,

Selling, general and administrative, and Engineering — research and development) to eligible employees as a result of International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (“UAW”) Local 933

represented employees ratifying a four-year collective bargaining agreement effective through November 2027. |

| (c) |

Represents a (gain) loss (recorded in Other income (expense), net) related to an investment in the common stock

of Jing-Jin Electric Technologies Co. Ltd. |

| (d) |

Represents a non-cash settlement charge (recorded in Other income

(expense), net) for a pro rata portion of previously unrecognized pension plan actuarial net losses associated with the pension risk transfer of a portion of our salaried defined benefit pension plan obligations to a third-party insurance company.

|

| (e) |

Represents losses (recorded in Other income (expense), net) on intercompany financing transactions for our

India facility. |

| (f) |

Represents a loss (recorded in Other income (expense), net) related to equity earnings in equity method

investments. |

| (g) |

Represents a loss (gain) (recorded in Other income (expense), net) related to investments in co-development agreements to expand our position in propulsion solution technologies. |

8

Allison Transmission Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures for Full Year Guidance

(Unaudited, dollars in millions)

|

|

|

|

|

|

|

|

|

| |

|

Guidance |

|

| |

|

Year Ending December 31, 2024 |

|

| |

|

Low |

|

|

High |

|

| Net Income (GAAP) |

|

$ |

675 |

|

|

$ |

725 |

|

| plus: |

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

170 |

|

|

|

180 |

|

| Depreciation of property, plant and equipment |

|

|

113 |

|

|

|

113 |

|

| Interest expense, net |

|

|

90 |

|

|

|

90 |

|

| Amortization of intangible assets |

|

|

11 |

|

|

|

11 |

|

| Stock-based compensation expense (a) |

|

|

26 |

|

|

|

26 |

|

| UAW Local 933 contract signing incentives (b) |

|

|

14 |

|

|

|

14 |

|

| Unrealized loss on marketable securities (c) |

|

|

8 |

|

|

|

8 |

|

| Pension plan settlement loss (d) |

|

|

4 |

|

|

|

4 |

|

| Unrealized loss on foreign exchange (e) |

|

|

1 |

|

|

|

1 |

|

| Equity earnings in equity method investments (f) |

|

|

1 |

|

|

|

1 |

|

| Technology-related investments loss (g) |

|

|

1 |

|

|

|

1 |

|

| Loss associated with impairment of long-lived assets |

|

|

1 |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (Non-GAAP) |

|

$ |

1,115 |

|

|

$ |

1,175 |

|

|

|

|

|

|

|

|

|

|

| Net Cash Provided by Operating Activities (GAAP) |

|

$ |

740 |

|

|

$ |

800 |

|

| Deductions to Reconcile to Adjusted Free Cash Flow: |

|

|

|

|

|

|

|

|

| Additions of long-lived assets |

|

$ |

(135 |

) |

|

$ |

(145 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted Free Cash Flow (Non-GAAP) |

|

$ |

605 |

|

|

$ |

655 |

|

|

|

|

|

|

|

|

|

|

| (a) |

Represents stock-based compensation expense (recorded in Cost of sales, Selling, general and administrative,

and Engineering — research and development). |

| (b) |

Represents non-recurring incentives (recorded in Cost of sales,

Selling, general and administrative, and Engineering - research and development) to eligible employees as a result of UAW Local 933 represented employees ratifying a four-year collective bargaining agreement effective through November 2027.

|

| (c) |

Represents a loss (recorded in Other income (expense), net) related to an investment in the common stock of Jing-Jin Electric Technologies Co. Ltd. |

| (d) |

Represents a non-cash settlement charge (recorded in Other income

(expense), net) for a pro rata portion of previously unrecognized pension plan actuarial net losses associated with the pension risk transfer of a portion of our salaried defined benefit pension plan obligations to a third-party insurance company.

|

| (e) |

Represents losses (recorded in Other income (expense), net) on intercompany financing transactions for our

India facility. |

| (f) |

Represents a loss (recorded in Other income (expense), net) related to equity earnings in equity method

investments. |

| (g) |

Represents a loss (recorded in Other income (expense), net) related to investments in co-development agreements to expand our position in propulsion solution technologies. |

9

Q3 2024 Earnings Release October 29th,

2024 Dave Graziosi, Chair & CEO Fred Bohley, COO, CFO & Treasurer Exhibit 99.2

Safe Harbor Statement The following

information contains, or may be deemed to contain, “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995). The words “believe,” “expect,” “anticipate,”

“intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on

these forward-looking statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other

factors, which may cause actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements speak only as

of the date the statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements

are subject to numerous risks and uncertainties, including, but not limited to: our participation in markets that are competitive; our ability to prepare for, respond to and successfully achieve our objectives relating to technological and market

developments, competitive threats and changing customer needs, including with respect to electric hybrid and fully electric commercial vehicles; increases in cost, disruption of supply or shortage of labor, freight, raw materials, energy or

components used to manufacture or transport our products or those of our customers or suppliers, including as a result of geopolitical risks, wars and pandemics; global economic volatility; general economic and industry conditions, including the

risk of recession; labor strikes, work stoppages or similar labor disputes, which could significantly disrupt our operations or those of our principal customers or suppliers; the highly cyclical industries in which certain of our end users operate;

uncertainty in the global regulatory and business environments in which we operate; the concentration of our net sales in our top five customers and the loss of any one of these; the failure of markets outside North America to increase adoption of

fully automatic transmissions; the success of our research and development efforts, the outcome of which is uncertain; U.S. and foreign defense spending; risks associated with our international operations, including acts of war and increased trade

protectionism; the discovery of defects in our products, resulting in delays in new model launches, recall campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and reputation; our ability to identify,

consummate and effectively integrate acquisitions and collaborations; and risks related to our indebtedness. Allison Transmission cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or

that any long-term financial goals will be realized. All forward-looking statements included in this presentation speak only as of the date made, and Allison Transmission undertakes no obligation to update or revise publicly any such forward-looking

statements, whether as a result of new information, future events, or otherwise. In particular, Allison Transmission cautions you not to place undue weight on certain forward-looking statements pertaining to potential growth opportunities or

long-term financial goals set forth herein. Actual results may vary significantly from these statements. Allison Transmission’s business is subject to numerous risks and uncertainties, which may cause future results of operations to vary

significantly from those presented herein. Important factors that could cause actual results to differ materially are discussed in Allison Transmission’s Annual Report on Form 10-K for the year ended December 31, 2023.

Non-GAAP Financial Information We use

Adjusted EBITDA and Adjusted EBITDA as a percent of net sales to measure our operating profitability. We believe that Adjusted EBITDA and Adjusted EBITDA as a percent of net sales provide management, investors and creditors with useful measures of

the operational results of our business and increase the period-to-period comparability of our operating profitability and comparability with other companies. Adjusted EBITDA as a percent of net sales is also used in the calculation of

management’s incentive compensation program. The most directly comparable GAAP measure to Adjusted EBITDA is Net income. The most directly comparable GAAP measure to Adjusted EBITDA as a percent of net sales is Net Income as a percent of net

sales. Adjusted EBITDA is calculated as the earnings before interest expense, net, income tax expense, amortization of intangible assets, depreciation of property, plant and equipment and other adjustments as defined by Allison Transmission,

Inc.’s, the Company’s wholly-owned subsidiary, Second Amended and Restated Credit Agreement. Adjusted EBITDA as a percent of net sales is calculated as Adjusted EBITDA divided by net sales. We use Adjusted Free Cash Flow to evaluate the

amount of cash generated by our business that, after the capital investment needed to maintain and grow our business and certain mandatory debt service requirements, can be used for the repayment of debt, stockholder distributions and strategic

opportunities, including investing in our business. We believe that Adjusted Free Cash Flow enhances the understanding of the cash flows of our business for management, investors and creditors. Adjusted Free Cash Flow is also used in the calculation

of management’s incentive compensation program. The most directly comparable GAAP measure to Adjusted Free Cash Flow is Net cash provided by operating activities. Adjusted Free Cash Flow is calculated as Net cash provided by operating

activities, after additions of long-lived assets.

Call Agenda Q3 2024 Performance 2024

Guidance Update

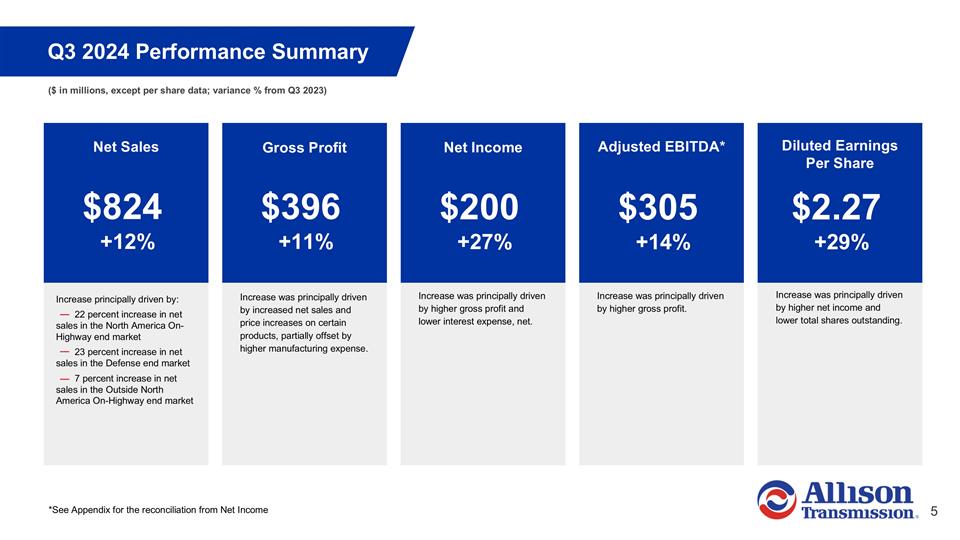

Q3 2024 Performance Summary *See

Appendix for the reconciliation from Net Income $824 $396 $200 $305 $2.27 ($ in millions, except per share data; variance % from Q3 2023) Increase was principally driven by increased net sales and price increases on certain products, partially

offset by higher manufacturing expense. Increase was principally driven by higher gross profit and lower interest expense, net. Increase was principally driven by higher gross profit. Increase was principally driven by higher net income and lower

total shares outstanding. Increase principally driven by: 22 percent increase in net sales in the North America On-Highway end market 23 percent increase in net sales in the Defense end market 7 percent increase in net sales in the Outside North

America On-Highway end market +12% +11% +27% +14% +29% Gross Profit Diluted Earnings Per Share Net Income Net Sales Adjusted EBITDA*

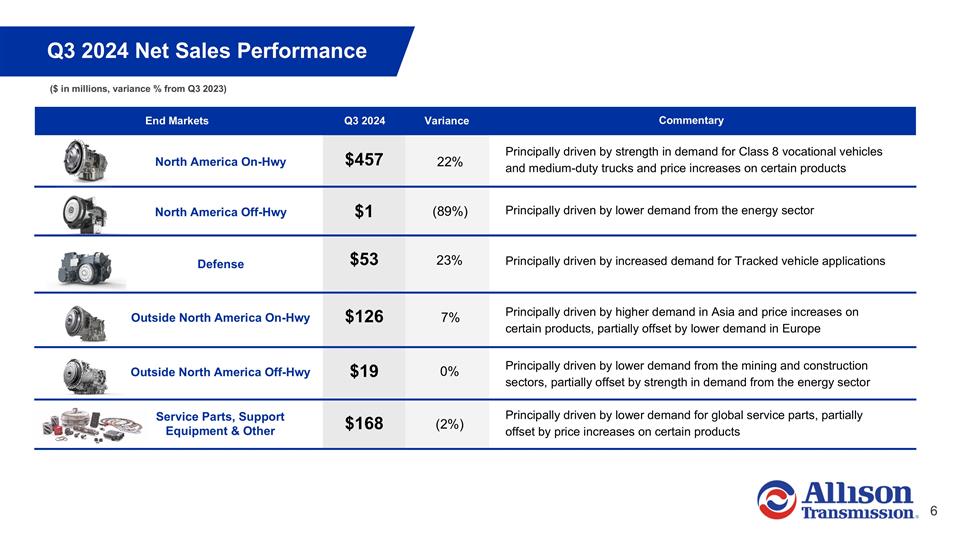

End Markets Q3 2024 Variance North

America On-Hwy $457 22% Principally driven by strength in demand for Class 8 vocational vehicles and medium-duty trucks and price increases on certain products North America Off-Hwy $1 (89%) Principally driven by lower demand from the energy sector

Defense $53 23% Principally driven by increased demand for Tracked vehicle applications Outside North America On-Hwy $126 7% Principally driven by higher demand in Asia and price increases on certain products, partially offset by lower demand in

Europe Outside North America Off-Hwy $19 0% Principally driven by lower demand from the mining and construction sectors, partially offset by strength in demand from the energy sector Service Parts, Support Equipment & Other $168 (2%) Principally

driven by lower demand for global service parts, partially offset by price increases on certain products Q3 2024 Net Sales Performance ($ in millions, variance % from Q3 2023) Commentary

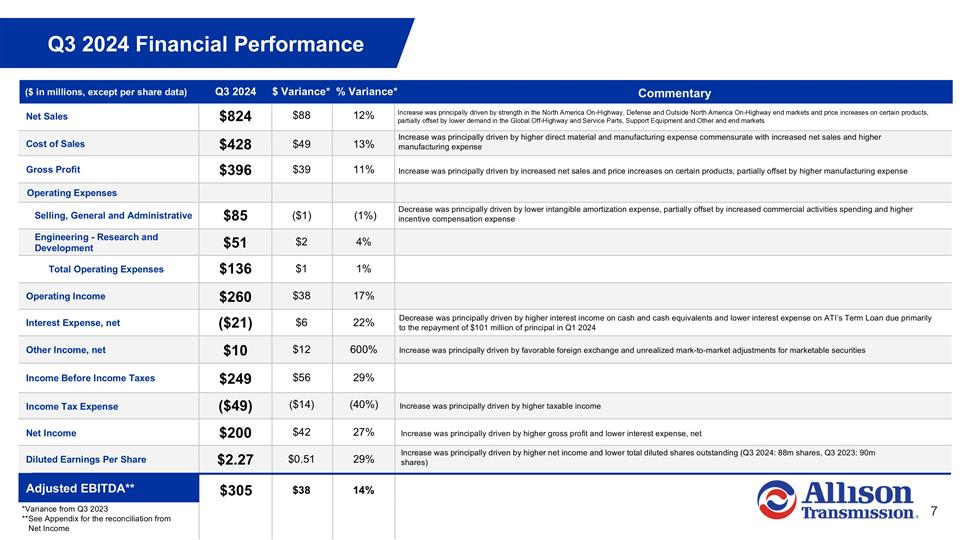

Increase was principally driven by

higher gross profit and lower interest expense, net Increase was principally driven by higher taxable income Increase was principally driven by favorable foreign exchange and unrealized mark-to-market adjustments for marketable securities Decrease

was principally driven by higher interest income on cash and cash equivalents and lower interest expense on ATI’s Term Loan due primarily to the repayment of $101 million of principal in Q1 2024 Increase was principally driven by strength in

the North America On-Highway, Defense and Outside North America On-Highway end markets and price increases on certain products, partially offset by lower demand in the Global Off-Highway and Service Parts, Support Equipment and Other and end markets

Increase was principally driven by increased net sales and price increases on certain products, partially offset by higher manufacturing expense $824 $428 $396 $85 $51 Increase was principally driven by higher direct material and manufacturing

expense commensurate with increased net sales and higher manufacturing expense Decrease was principally driven by lower intangible amortization expense, partially offset by increased commercial activities spending and higher incentive compensation

expense Adjusted EBITDA** $136 Q3 2024 $ Variance* Commentary Q3 2024 Financial Performance $260 ($21) $10 $249 $88 $49 $39 ($1) $2 $1 Net Sales Cost of Sales Gross Profit Operating Expenses Selling, General and Administrative Engineering - Research

and Development Total Operating Expenses Operating Income Interest Expense, net Other Income, net Income Before Income Taxes Income Tax Expense Net Income Diluted Earnings Per Share ($49) $200 $2.27 $305 ($ in millions, except per share data) 12%

13% 11% (1%) 4% 1% % Variance* $38 17% $6 22% $12 600% $56 29% ($14) (40%) $42 27% Increase was principally driven by higher net income and lower total diluted shares outstanding (Q3 2024: 88m shares, Q3 2023: 90m shares) $0.51 29% *Variance from Q3

2023 **See Appendix for the reconciliation from Net Income 14% $38

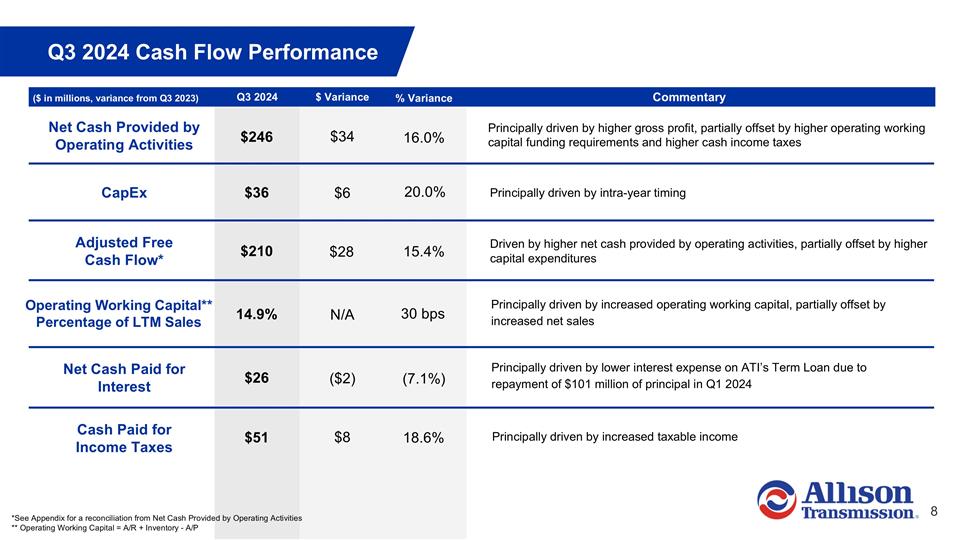

Net Cash Provided by Operating

Activities CapEx Adjusted Free Cash Flow* Operating Working Capital** Percentage of LTM Sales $34 $6 $28 N/A $246 $36 $210 14.9% Q3 2024 Cash Flow Performance Net Cash Paid for Interest ($2) $26 Q3 2024 Commentary ($ in millions, variance from Q3

2023) Cash Paid for Income Taxes $8 $51 *See Appendix for a reconciliation from Net Cash Provided by Operating Activities ** Operating Working Capital = A/R + Inventory - A/P Principally driven by higher gross profit, partially offset by higher

operating working capital funding requirements and higher cash income taxes Principally driven by intra-year timing Driven by higher net cash provided by operating activities, partially offset by higher capital expenditures Principally driven by

increased operating working capital, partially offset by increased net sales Principally driven by increased taxable income Principally driven by lower interest expense on ATI’s Term Loan due to repayment of $101 million of principal in Q1

2024 $ Variance % Variance 16.0% 30 bps 20.0% 15.4% (7.1%) 18.6%

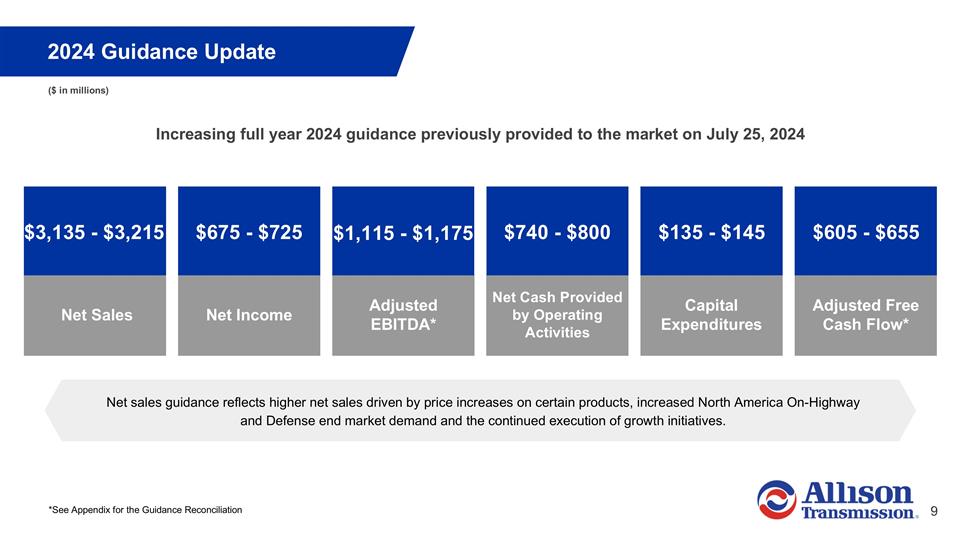

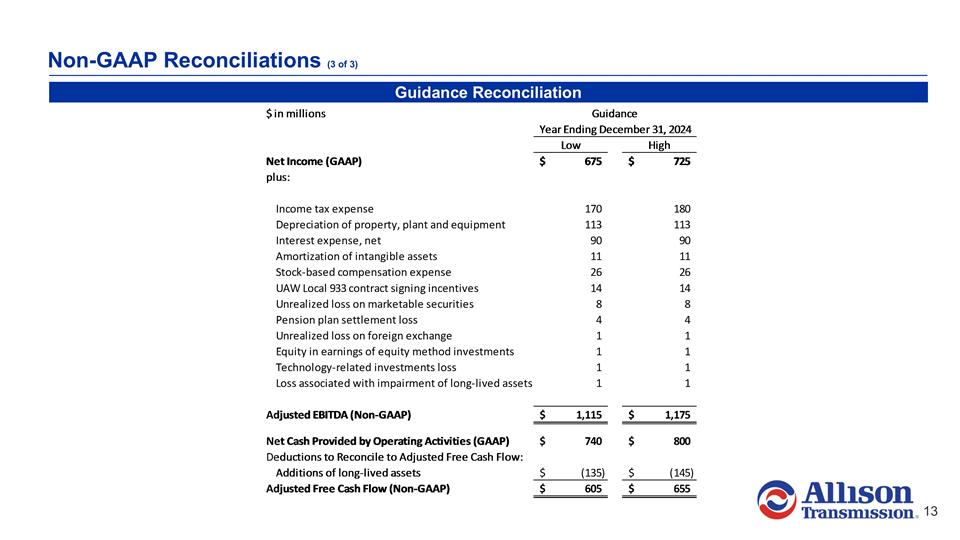

Increasing full year 2024 guidance

previously provided to the market on July 25, 2024 2024 Guidance Update *See Appendix for the Guidance Reconciliation Net Income Net Cash Provided by Operating Activities $3,135 - $3,215 Capital Expenditures Adjusted Free Cash Flow* Adjusted EBITDA*

Net Sales $675 - $725 $1,115 - $1,175 $740 - $800 $135 - $145 $605 - $655 ($ in millions) Net sales guidance reflects higher net sales driven by price increases on certain products, increased North America On-Highway and Defense end market demand

and the continued execution of growth initiatives.

Appendix Non-GAAP Financial

Information

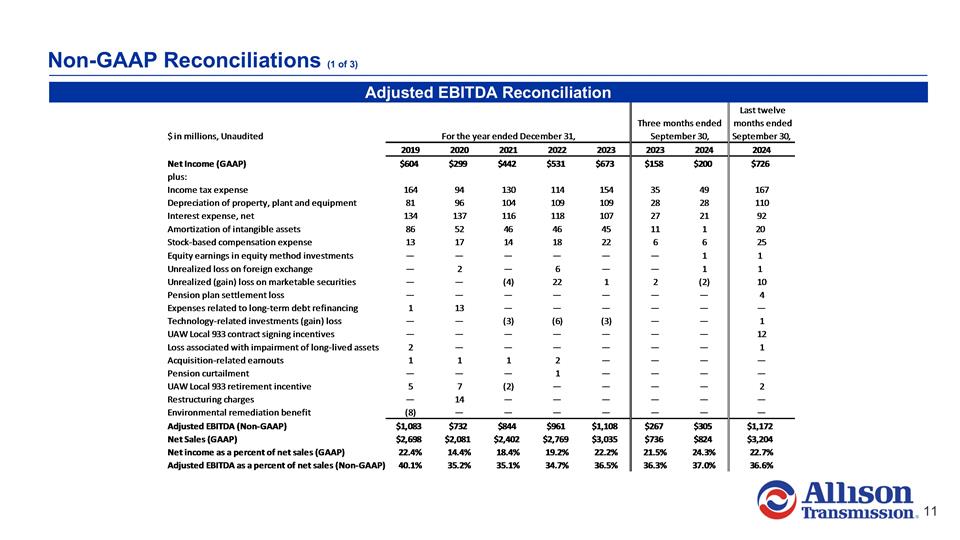

Non-GAAP Reconciliations (1 of 3)

Adjusted EBITDA Reconciliation

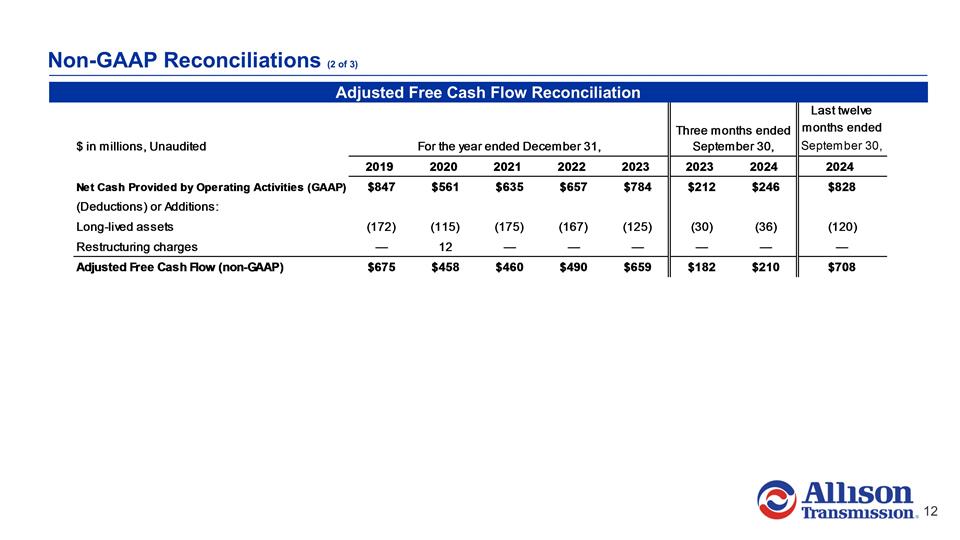

Adjusted Free Cash Flow

Reconciliation Non-GAAP Reconciliations (2 of 3)

Guidance Reconciliation Non-GAAP

Reconciliations (3 of 3)

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Transmission (NYSE:ALSN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Transmission (NYSE:ALSN)

Historical Stock Chart

From Nov 2023 to Nov 2024