false000175982400017598242023-11-012023-11-010001759824altg:CommonStocksClassUndefinedMember2023-11-012023-11-010001759824us-gaap:PreferredStockMember2023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2023

ALTA EQUIPMENT GROUP INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-38864 |

|

83-2583782 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

13211 Merriman Road

Livonia, Michigan 48150

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (248) 449-6700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.0001 par value per share |

|

ALTG |

|

The New York Stock Exchange |

Depositary Shares representing a 1/1000th fractional interest in a share of 10% Series A Cumulative Perpetual Preferred Stock, $0.0001 par value per share |

|

ALTG PRA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events. *

On November 2, 2023, Alta Equipment Group Inc. (“Alta” or the “Company”) issued a press release announcing that it has acquired the stock of Ault Industries Inc. (“Ault”), a privately held Canadian crushing and screening equipment distributor with locations in Ontario, Quebec, and Maritime provinces for a total purchase price of $36.0 million, consisting of $23.2 million cash at close, a $2.2 million seller note, and $10.6 million worth of Alta’s common stock, which will be issued at $13 per share, equating to 819,398 shares vesting annually over a five-year period. The purchase price is subject to post-closing working capital adjustments. Ault generated approximately $50.3 million in revenue, $4.5 million in net income, and $7.5 million in adjusted EBITDA for the trailing twelve months through June 30, 2023. All amounts referenced herein are in USD currency. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The information furnished under Item 8.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information included in Item 8.01.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALTA EQUIPMENT GROUP INC. |

|

|

Dated: November 2, 2023 |

By: |

|

/s/ Ryan Greenawalt |

|

|

|

Name: Ryan Greenawalt |

|

|

|

Title: Chief Executive Officer |

Exhibit 99.1

Alta Equipment Group Acquires Ault Industries Expanding Construction Equipment Segment to Canada

•Expands product portfolio with new OEMs, including an exclusive distributorship with McCloskey

•Diversifies end markets with entrance into Ontario, Quebec, and the Maritime’s aggregate and mining industries

•Ault generated approximately $50.3 million in revenue, $4.5 million in net income, and $7.5 million in adjusted EBITDA (all amounts in USD currency) for the trailing twelve months through June 30, 2023 and is expected to be immediately accretive to the Company’s free cash flow conversion, profitability, earnings per share, and leverage ratios.

LIVONIA, Mich., – November 2, 2023 – Alta Equipment Group Inc. (NYSE: ALTG) (“Alta” or “the Company”) today announced that it has acquired Ault Industries Inc. (“Ault”), a privately held Canadian equipment distributor with locations in Ontario, Quebec, and Maritime provinces.

“The acquisition of Ault represents Alta’s first investment in Canada for our growing construction segment. We are extremely excited to partner with the Ault team as they have built a high-performing equipment dealership in the aggregate and mining space, a growing end market in their region and for Alta,” said Ryan Greenawalt, Chief Executive Officer of Alta. “In addition to entering the major construction markets of Toronto and Montreal, we also eagerly embrace a new relationship with McCloskey, a market-leading OEM in the crushing and screening product category. We extend a warm welcome to the Ault team as they become part of the Alta family.”

Strategic and Financial Highlights

•The acquisition expands Alta’s Construction Equipment segment into three of Canada’s largest markets.

•As part of the acquisition, Alta assumes Ault’s exclusive dealer agreement with McCloskey, a best-in-class product in the crushing and screening category.

•Given Ault’s strong financial performance and the structure of the deal, the Company expects the acquisition to be accretive to the Company’s EBITDA to cash flow conversion and earnings per share and leverage ratios.

Additional Transaction Details

•Total purchase price of $36.0 million, consisting of $23.2 million cash at close, a $2.2 million seller note, and $10.6 million worth of Alta’s common stock, which will be issued at $13 per share, equating to 819,398 shares vesting annually over a five-year period. The purchase price is subject to post-closing working capital adjustments.

•Ault’s brand name, employees, and management team will remain in place post-close.

•Including Ault, since the Company’s initial public offering in 2020, Alta has completed 16 acquisitions which have contributed $537 million in revenue, and $66 million in Adjusted EBITDA.

•More information on Ault, its products and applications can be found at https://ault.ca/en/.

About Alta Equipment Group Inc.

Alta owns and operates one of the largest integrated equipment dealership platforms in the U.S. and has a presence in Canada. Through its branch network, the Company sells, rents, and provides parts and service support for several categories of specialized equipment, including lift trucks and aerial work platforms, heavy and compact earthmoving equipment, environmental processing equipment, cranes, paving and asphalt equipment and other material handling and construction equipment. Alta has operated as an equipment dealership for 39 years and has developed a branch

1

network that includes over 80 total locations across Michigan, Illinois, Indiana, Ohio, Massachusetts, Maine, Connecticut, New Hampshire, Vermont, Rhode Island, New York, Virginia, Nevada and Florida and the Canadian provinces of Ontario, Quebec, and Maritime. Alta offers its customers a one-stop-shop for their equipment needs through its broad, industry-leading product portfolio. More information can be found at www.altaequipment.com.

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Alta’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside Alta’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: supply chain disruptions, inflationary pressures resulting from supply chain disruptions or a tightening labor market; negative impacts on customer payment policies and adverse banking and governmental regulations, resulting in a potential reduction to the fair value of our assets; the performance and financial viability of key suppliers, contractors, customers, and financing sources; economic, industry, business and political conditions including their effects on governmental policy and government actions that disrupt our supply chain or sales channels; our success in identifying acquisition targets and integrating acquisitions; our success in expanding into and doing business in additional markets; our ability to raise capital at favorable terms; the competitive environment for our products and services; our ability to continue to innovate and develop new business lines; our ability to attract and retain key personnel, including, but not limited to, skilled technicians; our ability to maintain our listing on The New York Stock Exchange; the impact of cyber or other security threats or other disruptions to our businesses; our ability to realize the anticipated benefits of acquisitions or divestitures, rental fleet and other organic investments or internal reorganizations; federal, state, and local government budget uncertainty, especially as it relates to infrastructure projects and taxation; currency risks and other risks associated with international operations; and other risks and uncertainties identified in this presentation or indicated from time to time in the section entitled “Risk Factors” in Alta’s annual report on Form 10-K and other filings with the U.S. Securities and Exchange Commission (the “SEC”). Alta cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. Alta does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

*Use of Non-GAAP Financial Measures

We disclose non-GAAP financial measures Adjusted EBITDA and EBITDA in this press release because we believe they are useful performance measures that assist in an effective evaluation of the acquisition and its expected impact on our operating performance when compared to our peers, without regard to financing methods or capital structure. We believe such measures are useful for investors and others in understanding and evaluating the acquisition and its expected impact on our operating results in the same manner as our management. However, such measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for, or in isolation from, net income (loss), revenue, operating profit, or any other operating performance measures calculated in accordance with GAAP.

We define Adjusted EBITDA as net income (loss) before interest expense (not including floorplan interest paid on new equipment), income taxes, depreciation and amortization, adjustments for certain one-time or non-recurring items and other adjustments. We exclude these items from net income (loss) in arriving at Adjusted EBITDA because these amounts are either non-recurring or can vary substantially within the industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. EBITDA is defined as net income (loss) before interest expense (not including floorplan interest paid on new equipment), income taxes, depreciation and amortization. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance. For example, items such as a company’s cost of

2

capital and tax structure as well as certain one-time or non-recurring items, are not reflected in Adjusted EBITDA. Our presentation of Adjusted EBITDA and EBITDA should not be construed as an indication that results will be unaffected by the items excluded from these metrics. Our computation of Adjusted EBITDA, and other non-GAAP measures, may not be identical to other similarly titled measures of other companies. Ault’s financial information has not been audited by Alta or its auditors and is subject to change. For a reconciliation of non-GAAP measures to their most comparable measures under GAAP, please see the table entitled “Reconciliation of Non-GAAP Financial Measures” at the end of this press release.

Contacts

Investors:

Kevin Inda

SCR Partners, LLC

IR@altg.com

(225) 772-0254

Media:

Glenn Moore

Alta Equipment

glenn.moore@altg.com

(248) 305-2134

Reconciliation of Non-GAAP Financial Measures

|

|

|

|

|

|

|

Twelve Months Ended June 30, 2023 |

|

(amounts in millions) |

|

|

|

Net income |

|

$ |

4.5 |

|

Depreciation and amortization |

|

|

2.4 |

|

Interest expense |

|

|

0.1 |

|

Income tax provision |

|

|

0.3 |

|

EBITDA (1) |

|

$ |

7.3 |

|

Other adjustments (2) |

|

|

0.2 |

|

Adjusted EBITDA (1) |

|

$ |

7.5 |

|

(1) Represents Non-GAAP measure

(2) Other adjustments primarily related to expected incremental cost reductions post-close

3

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=altg_CommonStocksClassUndefinedMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

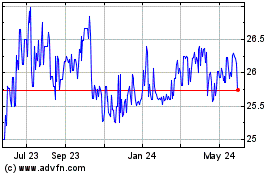

Alta Equipment (NYSE:ALTG-A)

Historical Stock Chart

From Dec 2024 to Jan 2025

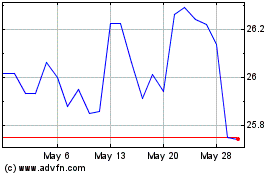

Alta Equipment (NYSE:ALTG-A)

Historical Stock Chart

From Jan 2024 to Jan 2025