Alta Equipment Group Inc. Announces Stock Repurchase Program

March 04 2020 - 7:30AM

Business Wire

Alta Equipment Group Inc. (NYSE: ALTG) today announced

that its Board of Directors has authorized a stock repurchase

program under which the Company can repurchase up to $10 million of

the currently outstanding shares of the Company’s common stock

through open market purchases, privately-negotiated transactions,

or otherwise in compliance with Rule 10b-18 under the Securities

Exchange Act of 1934.

The Board also authorized the Company to establish “Rule 10b5-1

trading plans.” Rule 10b5-1 trading plans allow companies to

repurchase shares at times when they might otherwise be prevented

from doing so by securities laws or because of self-imposed trading

blackout periods. Under any Rule 10b5-1 trading plan the Company

might adopt, the Company’s third-party broker, subject to

Securities and Exchange Commission regulations regarding certain

price, market, volume and timing constraints, would have authority

to purchase the Company’s common stock in accordance with the terms

of the plan.

Ryan Greenawalt, Alta’s Chief Executive Officer, stated, “The

stock repurchase program reflects our confidence in the strength of

our balance sheet, quality of our assets and our ongoing ability to

generate free cash flow. At current market price levels, we believe

the repurchase program is an excellent opportunity to buy our

common shares at a significant discount to their intrinsic value

and are an attractive investment. Our overall financial position,

as well as our cash flow from operations, will support this buyback

program and continue forward with our 2020-2021 operating

plans.”

The actual timing, number and value of shares repurchased under

the stock repurchase program will depend on a number of factors,

including constraints specified in any Rule 10b5-1 trading plans,

price, general business and market conditions, and alternative

investment opportunities. The share buyback program does not

obligate the Company to acquire any specific number of shares in

any period, and may be expanded, extended, modified or discontinued

at any time. Payment for shares repurchased under the program will

be funded using the Company's cash on hand.

About Alta Equipment Group Inc.

Alta owns and operates one of the largest integrated equipment

dealership platforms in the U.S. Through its branch network, the

Company sells, rents, and provides parts and service support for

several categories of specialized equipment, including lift trucks

and aerial work platforms, cranes, earthmoving equipment and other

industrial and construction equipment. Alta has operated as an

equipment dealership for 35 years and has developed a branch

network that includes 43 total locations across Michigan, Illinois,

Indiana, New England, New York and Florida. Alta offers its

customers a one-stop-shop for most of their equipment needs by

providing sales, parts, service, and rental functions under one

roof. More information can be found at www.altaequipment.com.

Forward-Looking Statements

This press release includes certain statements that may

constitute “forward-looking statements” for purposes of the federal

securities laws, including information regarding purchases by the

Company of its common stock pursuant to any Rule 10b5-1 trading

plans. Forward-looking statements include, but are not limited to,

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. By their nature,

forward-looking information and statements are subject to risks,

uncertainties, and contingencies, including changes in price and

volume and the volatility of the Company’s common stock; adverse

developments affecting either or both of prices and trading of

exchange-traded securities, including securities listed on the New

York Stock Exchange; and unexpected or otherwise unplanned or

alternative requirements with respect to the capital investments of

the Company. The Company does not undertake to update any forward

looking statements or information, including those contained in

this report.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200304005431/en/

Alta Equipment Group Inc. Investors: Bob Jones /

Taylor Krafchik Ellipsis IR@altaequipment.com (646) 776-0886

Media: Glenn Moore Alta Equipment

glenn.moore@altaequipment.com (248) 305-2134

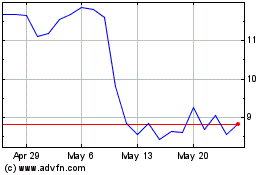

Alta Equipment (NYSE:ALTG)

Historical Stock Chart

From Jun 2024 to Jul 2024

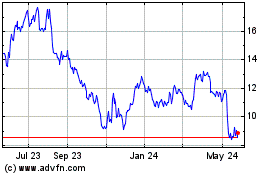

Alta Equipment (NYSE:ALTG)

Historical Stock Chart

From Jul 2023 to Jul 2024