false

0001862993

0001862993

2024-06-16

2024-06-16

0001862993

APCA:UnitsEachConsistingOfOneClassCommonStockAndOneHalfOfRedeemableWarrantMember

2024-06-16

2024-06-16

0001862993

us-gaap:CommonClassAMember

2024-06-16

2024-06-16

0001862993

APCA:RedeemableWarrantsExercisableForOneShareOfClassCommonStockMember

2024-06-16

2024-06-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 17, 2024 (June 16, 2024)

AP ACQUISITION CORP

(Exact name of registrant as specified in its

charter)

| Cayman

Islands |

|

001-41176

|

|

98-1601227 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification Number) |

10 Collyer Quay,

#14-06 Ocean Financial Center

Singapore |

049315 |

| (Address

of principal executive offices) |

(Zip

Code) |

+65-6808

6510

Registrant’s telephone number, including

area code

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each

exchange

on which

registered |

| Units,

each consisting of one Class A Ordinary Share, $0.0001 par value, and one-half of one redeemable warrant |

|

APCA-U |

|

New

York Stock Exchange |

| |

|

|

|

|

| Class

A Ordinary Shares included as part of the units |

|

APCA |

|

New

York Stock Exchange |

| |

|

|

|

|

| Redeemable

Warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of

$11.50 |

|

APCA-W |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act

of 1934.

Emerging

growth company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.02 Termination

of A Material Definitive Agreement.

As

previously announced, on June 16, 2023, (i) AP Acquisition Corp (the “Company”), (ii) JEPLAN Holdings, Inc.,

a Japanese corporation (kabushiki kaisha) incorporated under the laws of Japan, (iii) JEPLAN MS, Inc., an exempted company limited

by shares incorporated under the laws of the Cayman Islands and a direct wholly-owned subsidiary of JEPLAN Holdings, Inc. and (iv) JEPLAN, Inc.,

a Japanese corporation (kabushiki kaisha) incorporated under the laws of Japan,

entered into a Business Combination Agreement (as it may be amended, supplemented or otherwise modified from time to time, the “Business

Combination Agreement”).

On

June 16, 2024, the parties to the Business Combination Agreement and AP Sponsor LLC, a Cayman Islands limited liability company (the

“Sponsor”) entered into a termination agreement (the “Termination Agreement”), pursuant to which the parties agreed

to mutually terminate the Business Combination Agreement. The mutual termination of the Business Combination Agreement is effective as

of June 16, 2024.

As

a result of the termination of the Business Combination Agreement, the Business Combination Agreement is void and has no effect, without

any liability on the part of any party thereto or its respective affiliates, officers, directors or shareholders, except as provided in the Termination Agreement.

The

foregoing description of the Termination Agreement does not purport to be complete and is qualified in its entirety by reference to the

full text of the Termination Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated

by reference herein.

Item 8.01 Other Events.

On

June 14, 2024, the Company decided

that it will redeem all of its outstanding ordinary shares that were included in the units issued in its initial public offering (the

“Public Shares”), effective as of the closing of business on July 2, 2024, as the Company will not be able to consummate

an initial business combination (the “Business Combination”) on or before June 21, 2024.

In

accordance with the Company’s Amended and Restated Memorandum and Articles of Association, as amended, the Company shall: (1) cease

all operations except for the purpose of winding up; (2) as promptly as reasonably possible but not more than 10 business days thereafter,

redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account established

in connection with the Company’s initial public offering (the “Trust Account”), including interest earned on the funds

held in the Trust Account and not previously released to the Company (less taxes payable and up to $100,000 of interest to pay dissolution

expenses), divided by the number of then issued and outstanding public shares, which redemption will completely extinguish public shareholders’

rights as shareholders (including the right to receive further liquidating distributions, if any); and (3) as promptly as reasonably

possible following such redemption, subject to the approval of the Company’s remaining shareholders and the Company’s board

of directors, liquidate and dissolve, subject in each case to our obligations under Cayman Islands law to provide for claims of creditors

and the requirements of other applicable law. The Company will use the working capital and available

cash held outside the trust account to repay the Company’s transaction expenses that the Company has incurred in connection with

the Business Combination.

The

per-share redemption price for the Public Shares will be approximately US$11.48, before payment of taxes and dissolution expenses.

The

Public Shares will cease trading as of the close of business of June 21, 2024. As of the close of business of

July 2, 2024, the Public Shares will be deemed cancelled and will represent only the right to receive the redemption

amount.

The

redemption amount will be payable to the holders of the Public Shares upon delivery of their shares or units. Beneficial owners of Public

Shares held in “street name”, however, will not need to take any action in order to receive the redemption amount.

There

will be no redemption rights or liquidating distributions with respect to the Company’s warrants, which will be terminated. The

Company’s initial shareholders have waived their redemption rights with respect to its outstanding ordinary shares issued

before the Company’s initial public offering.

The

Company expects that the New York Stock Exchange will file a Form 25 with the United

States Securities and Exchange Commission (the “SEC”) to delist the Company’s securities. The Company thereafter expects

to file a Form 15 with the SEC to terminate the registration of its securities under the Securities Exchange Act of 1934, as amended.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 17, 2024

| |

AP Acquisition Corp |

| |

|

| |

By: |

/s/ Keiichi

Suzuki |

| |

Name: |

Keiichi Suzuki |

| |

Title: |

Chief Executive Officer and Director |

Exhibit 10.1

EXECUTION VERSION

TERMINATION AGREEMENT

THIS TERMINATION AGREEMENT

(this “Agreement”) is made and entered into as of June 16, 2024, by and among (i) JEPLAN Holdings, Inc.,

a Japanese corporation (kabushiki kaisha) incorporated under the laws of Japan and a direct wholly-owned Subsidiary of the Company

(“PubCo”), (ii) JEPLAN, Inc., a Japanese corporation (kabushiki kaisha) incorporated under

the laws of Japan (the “Company”), (iii) AP Acquisition Corp, a Cayman Islands exempted company (“SPAC”),

(iv) JEPLAN MS, Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands and a direct wholly-owned

subsidiary of PubCo (“Merger Sub”), and (v) AP Sponsor LLC, a Cayman Islands limited liability company

(“Sponsor”). PubCo, the Company, SPAC, Merger Sub and Sponsor are collectively referred to herein individually

as a “Party” and collectively as the “Parties.” Capitalized terms used but not defined

herein shall have the meaning ascribed to such terms in the Business Combination Agreement (as defined below).

WHEREAS,

the Parties (other than Sponsor) are parties to that certain Business Combination Agreement, dated as of June 16, 2023 (the “Business

Combination Agreement”);

WHEREAS,

pursuant to Section 11.1(a) of the Business Combination Agreement, the Business Combination Agreement may be terminated and

the Transactions may be abandoned at any time prior to the Share Exchange Effective Time, by mutual written consent of the Company and

SPAC; and

WHEREAS,

the Parties desire to terminate the Business Combination Agreement and abandon the Transactions as set forth herein and in accordance

with Section 11.1(a) of the Business Combination Agreement.

NOW,

THEREFORE, in consideration of the premises set forth above, which are incorporated in this Agreement as if fully set forth

below, and the representations, warranties, covenants and agreements contained in this Agreement and the Business Combination Agreement,

and intending to be legally bound hereby, the Parties agree as follows:

ARTICLE I

Termination of Business Combination Agreement

1.1 Termination

of Business Combination Agreement. In accordance with Section 11.1(a) and subject to the terms and provisions of this Agreement,

the Business Combination Agreement shall be terminated by mutual written consent of the Parties effective as of the date of this Agreement.

The effect of the termination of the Business Combination Agreement pursuant to this Agreement shall be as set forth in Section 11.2

of the Business Combination Agreement.

1.2 Non-Disparagement.

Each Party hereby agrees that it shall not, and shall procure its Affiliates and Representatives not to, (a) make, publish or communicate

to any Person or in any public or private forum or through any medium, any disparaging, damaging or demeaning statements about any other

Party, such other Party’s Affiliates, or any of such other Party’s or its Affiliates’ respective officers, directors,

employees, agents or other Representatives; or (b) otherwise engage, directly or indirectly, in any communications with any Person

that may be disparaging to any other Party, such other Party’s Affiliates, or any of such other Party’s or its Affiliates’

respective officers, directors, employees, agents or other Representatives that may damage the reputation or goodwill of any of these

Persons, or that may place any of these Persons in any false or negative light. Each Party hereby represents to the other Parties that

it has not engaged in any of the actions and communications described in the foregoing clauses (a) and (b) of

this Section 1.2 prior to the date hereof.

ARTICLE II

Mutual Release

2.1 Company

Released Claims. The Company, PubCo and Merger Sub, for themselves, and on behalf of each of their respective Affiliates, equity holders,

partners, joint venturers, lenders, administrators, Representatives, shareholders, parents, Subsidiaries, officers, directors, attorneys,

agents, employees, legatees, devisees, executors, trustees, beneficiaries, insurers, predecessors, successors, heirs and assigns, hereby

absolutely, forever and fully release and discharge SPAC, Sponsor and their Affiliates and each of their respective present and former

direct and indirect equity holders, directors, officers, employees, predecessors, partners, shareholders, joint venturers, administrators,

representatives, Affiliates, attorneys, agents, brokers, insurers, parents, Subsidiaries, successors, heirs, and assigns, and each of

them, from all claims, contentions, rights, debts, liabilities, demands, accounts, reckonings, obligations, duties, promises, costs, expenses

(including, without limitation, attorneys’ fees and costs), liens, indemnification rights, damages, losses, actions, and causes

of action, of any kind whatsoever, whether due or owing in the past, present or future and whether based upon contract, tort, statute

or any other legal or equitable theory of recovery, and whether known or unknown, suspected or unsuspected, asserted or unasserted, fixed

or contingent, matured or unmatured, with respect to, pertaining to, based on, arising out of, resulting from, or relating to the Business

Combination Agreement, the other Transaction Documents and the Transactions (collectively, the “Company Released Claims”).

2.2 SPAC

Released Claims. SPAC and Sponsor, for themselves, and on behalf of each of their respective Affiliates, equity holders, partners,

joint venturers, lenders, administrators, Representatives, shareholders, parents, Subsidiaries, officers, directors, attorneys, agents,

employees, legatees, devisees, executors, trustees, beneficiaries, insurers, predecessors, successors, heirs and assigns, hereby absolutely,

forever and fully release and discharge the Company, PubCo, Merger Sub and their Affiliates and each of their respective present and former

direct and indirect equity holders, directors, officers, employees, predecessors, partners, shareholders, joint venturers, administrators,

representatives, Affiliates, attorneys, agents, brokers, insurers, parents, Subsidiaries, successors, heirs, and assigns, and each of

them, from all claims, contentions, rights, debts, liabilities, demands, accounts, reckonings, obligations, duties, promises, costs, expenses

(including, without limitation, attorneys’ fees and costs), liens, indemnification rights, damages, losses, actions, and causes

of action, of any kind whatsoever, whether due or owing in the past, present or future and whether based upon contract, tort, statute

or any other legal or equitable theory of recovery, and whether known or unknown, suspected or unsuspected, asserted or unasserted, fixed

or contingent, matured or unmatured, with respect to, pertaining to, based on, arising out of, resulting from, or relating to the Business

Combination Agreement, the other Transaction Documents and the Transactions (collectively, the “SPAC Released Claims”;

and together with the Company Released Claims, the “Released Claims”).

2.3 Further

Agreements. Each Party acknowledges and understands that there is a risk that subsequent to the execution of this Agreement, each

Party may discover, incur or suffer Released Claims that were unknown or unanticipated at the time of the execution of this Agreement,

and which, if known on the date of the execution of this Agreement, might have materially affected such Party’s decision to enter

into and execute this Agreement. Each Party further agrees that by reason of the releases contained herein, each Party is assuming the

risk of such unknown Released Claims and agrees that this Agreement applies thereto.

ARTICLE III

General Provisions.

3.1 Representations

of the Parties. Each Party hereby represents and warrants to each other Party that (a) this Agreement constitutes a valid and

binding obligation of such Party, enforceable against

such Party in accordance with its terms, subject

to the Enforceability Exceptions; and (b) such Party has full power and authority to execute, deliver and perform its obligations

under this Agreement. The execution, delivery and performance by such Party of this Agreement have been duly and validly authorized by

all necessary corporate or other action on the part of such Party; and (c) the execution and delivery of this Agreement by such Party

does not, and the performance by such Party of the transactions contemplated by this Agreement does not: (i) conflict with or violate

the Organizational Documents of such Party, (ii) conflict with or violate any Law applicable to such Party or by which any property

or asset of such Party is bound or affected, or (iii) result in any breach of or constitute a default (or an event which, with notice

or lapse of time or both, would become a default) under, or give to others any right of termination, amendment, acceleration or cancellation

of, or result in the creation of an Encumbrance (other than any Permitted Encumbrances) on any property or asset of such Party pursuant

to, any Contract to which such Party is bound.

3.2 Costs

and Expenses. Each Party shall bear the costs, expenses and fees (including fees and expenses of legal counsel and other advisors)

incurred by such Party in connection with the negotiation and execution of the Business Combination Agreement, the Transactions and each

other document and instrument contemplated thereby, including this Agreement and the transactions contemplated hereby, except that SPAC

and the Company shall each pay one-half of all printer fees, costs and expenses of Toppan Merrill LLC for the preparation of the Proxy/Registration

Statement and any Transactions-related filings to be made by SPAC or PubCo with the SEC (excluding (a) SPAC’s ongoing reporting

obligations under the Exchange Act and (b) SPAC’s printing and mailing costs associated with the distribution of the Proxy/Registration

Statement to its shareholders), in accordance with Section 12.6 (Expenses) of the Business Combination Agreement.

3.3 Miscellaneous.

The provisions of Sections 12.1 (Trust Account Waiver), 12.7 (Governing Law), 12.8 (Consent to Jurisdiction), 12.9

(Headings; Counterparts), 12.12 (Amendments), 12.13 (Publicity), 12.14 (Confidentiality), 12.15 (Severability)

and 12.16 (Enforcement) of the Business Combination Agreement are incorporated herein by reference, mutatis mutandis, as

if set forth in full herein.

[Signature pages follow]

IN WITNESS WHEREOF, each Party has duly executed and delivered this

Agreement, all as of the date first written above.

| JEPLAN, INC. |

|

| |

|

| Signature: |

/s/ Masaki Takao |

|

| |

|

| Name: |

Masaki Takao |

|

| |

|

| Title: |

Representative Director and Chief Executive Officer |

|

[Signature Page to Termination

Agreement]

IN WITNESS WHEREOF, each Party has duly executed and delivered this

Agreement, all as of the date first written above.

| JEPLAN HOLDINGS, INC. |

|

| |

|

| Signature: |

/s/ Masaki Takao |

|

| |

|

| Name: |

Masaki Takao |

|

| |

|

| Title: |

Representative Director |

|

[Signature Page to Termination

Agreement]

IN WITNESS WHEREOF, each Party has duly executed and delivered this

Agreement, all as of the date first written above.

| JEPLAN MS, INC. |

|

| |

| Signature: |

/s/ Masaki Takao |

|

| |

| Name: |

Masaki Takao |

|

| |

| Title: |

Director |

|

[Signature Page to Termination

Agreement]

IN WITNESS WHEREOF, each Party has duly executed and delivered this

Agreement, all as of the date first written above.

| AP ACQUISITION CORP |

|

| |

|

| Signature: |

/s/ Keiichi Suzuki |

|

| |

|

| Name: |

Keiichi Suzuki |

|

| |

|

| Title: |

Director |

|

[Signature Page to Termination

Agreement]

IN WITNESS WHEREOF, each Party has duly executed and delivered this

Agreement, all as of the date first written above.

| AP SPONSOR LLC |

|

| |

|

| Signature: |

/s/ Richard Lee

Folsom |

|

| |

|

| Name: |

Richard Lee Folsom |

|

| |

|

| Title: |

Manager |

|

[Signature Page to Termination

Agreement]

v3.24.1.1.u2

Cover

|

Jun. 16, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 16, 2024

|

| Entity File Number |

001-41176

|

| Entity Registrant Name |

AP ACQUISITION CORP

|

| Entity Central Index Key |

0001862993

|

| Entity Tax Identification Number |

98-1601227

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

10 Collyer Quay

|

| Entity Address, Address Line Two |

#14-06 Ocean Financial Center

|

| Entity Address, Country |

SG

|

| Entity Address, Postal Zip Code |

049315

|

| City Area Code |

+65

|

| Local Phone Number |

6808

6510

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share, $0.0001 par value, and one-half of one redeemable warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units,

each consisting of one Class A Ordinary Share

|

| Trading Symbol |

APCA-U

|

| Security Exchange Name |

NYSE

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class

A Ordinary Shares included as part of the units

|

| Trading Symbol |

APCA

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable

Warrants included as part of the units

|

| Trading Symbol |

APCA-W

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=APCA_UnitsEachConsistingOfOneClassCommonStockAndOneHalfOfRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=APCA_RedeemableWarrantsExercisableForOneShareOfClassCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

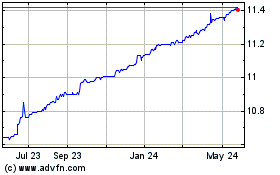

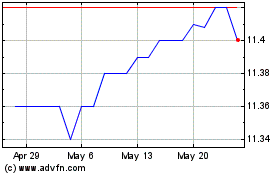

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Nov 2024 to Dec 2024

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Dec 2023 to Dec 2024