Buenaventura Announces Third Quarter 2023 Results for Production and Volume Sold per Metal

October 19 2023 - 5:52PM

Business Wire

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced 3Q23 results for production and volume sold.

3Q23 Production per Metal(100% basis)

1Q23(Actual) 2Q23(Actual) 3Q23(Actual)

9M23(Actual)

2023 Updated Guidance

(1)(2)

Gold (Oz.) Orcopampa

19,996

19,975

20,576

60,547

72.0k - 80.0k

Tambomayo

10,600

10,896

8,127

29,623

35.0k - 40.0k

Coimolache

6,536

9,632

23,621

39,789

60.0k - 65.0k

El Brocal

4,421

4,377

5,833

14,631

19.0k - 22.0k

Silver (Oz.)

Uchucchacua

0

0

0

0

0.7M - 1.0M

Yumpag

0

0

0

0

1.6M - 1.8M

El Brocal

436,678

635,530

1,192,944

2,265,152

2.7M - 3.0M

Tambomayo

394,305

540,732

301,963

1,237,001

1.6M - 1.8M

Julcani

417,887

472,740

427,269

1,317,895

1.7M - 1.9M

Lead (MT)

El Brocal

0

1,275

885

2,160

5.0k - 6.0k

Uchucchacua

0

0

0

0

1.4k - 1.5k

Yumpag

0

0

0

0

0.3k - 0.4k

Tambomayo

1,324

924

603

2,851

2.9k - 3.2k

Zinc (MT)

El Brocal

0

3,812

2,849

6,661

15.0k - 20.0k

Uchucchacua

0

0

0

0

2.0k - 2.2k

Yumpag

0

0

0

0

-

Tambomayo

1,552

1,150

913

3,614

4.8k - 5.3k

Copper (MT)

El Brocal

12,238

13,213

18,826

44,277

53.0k - 58.0k

- Above 2023 projections are considered forward-looking

statements and represent management’s good faith estimates or

expectations of future production results as of September

2023.

- El Brocal stockpiled ore mined from its open pit during the

1Q23. Lead and zinc ore are being treated at the processing plant

starting in 2Q23. The underground mine will operate continuously

throughout 2023.

3Q23 Comments

Tambomayo:

- Gold, lead and zinc production was in line with 3Q23

expectations. 2023 gold, lead and zinc guidance remain

unchanged.

- Silver production was lower than expected during the quarter

due to a lower than planned mining rate within the mine's upper

zone, which required more extensive rehabilitation and support to

enable access to high-grade ore. 2023 silver guidance has been

updated.

Orcopampa:

- 3Q23 gold production was in line with 3Q23 expectations. 2023

gold guidance remains unchanged.

Coimolache:

- 3Q23 gold production exceeded expectations due increased

treated ore and higher gold grades. Increased production was also

due to increased ounce recovery and percolation times during the

quarter, as the Company is now fully recovering gold placed on the

leach pad during the first half of 2023. This is expected to

stabilize during 4Q23, with production in line with 3Q23. 2023 gold

guidance therefore remains unchanged.

Julcani:

- 3Q23 silver production was below projections due to a negative

geology reconciliation and decreased treated ore. 2023 silver

guidance has been updated.

- Exploration and preparation of Julcani’s Rosario sector, which

lies below the 610 level, began during 3Q23. This new zone includes

gold and copper which Buenaventura will begin processing during the

fourth quarter 2023. The Company will also submit a related

reserves and resources analysis by year end 2023.

Uchucchacua:

- Buenaventura submitted Uchucchacua’s updated mine plan to the

Peruvian Ministry of Energy and Mines on August 28, 2023.

Buenaventura initiated a short ore processing campaign at the

processing plant, ensuring the plants operational readiness to take

delivery of ore from Uchucchacua and Yumpag during the 4Q23 as

planned. Exploration and mine development progressed as scheduled

during 3Q23.

Yumpag:

- The Yumpag project’s Environmental Impact Assessment (EIA) was

approved on September 7, 2023. The Company promptly submitted a

request to the Peruvian Ministry of Energy and Mines to obtain the

necessary authorizations to initiate the deposit’s exploitation.

However, 4Q23 targeted production initiation remains unchanged, as

resumed activities at the Uchucchacua processing plant also enables

Buenaventura to perform metallurgical tests for up to 124,600 tons

of ore from the Yumpag project’s pilot stope.

- Yumpag’s ore concentrates will be processed at the Rio Seco

plant to reduce manganese content. The Rio Seco plant is scheduled

to resume operations in November 2023.

El Brocal:

- Gold production was lower than expected during the third

quarter due to mine plan rescheduling for the underground mine, to

prioritize higher copper grades. 2023 gold guidance has been

updated.

- 3Q23 silver production was in line with 3Q23 expectations. 2023

silver guidance remains unchanged.

- On October 3, 2023, Buenaventura submitted a notice to the

Peruvian Ministry of Energy and Mines (MINEM) for the temporary

suspension of mining activities at Colquijirca’s Tajo Norte mine

for up to three years due to a delay of Colquijirca’s Modification

of Environmental Impact Assessment approval.

- Lead and zinc production was lower than expected during the

quarter as the 20x30 mill PPM was completed in September, earlier

than originally planned, to proactively ensure certain detected

anomalies were rectified, avoiding potentially compromising the

transmission system. Lead and zinc production expected for 2023

will therefore be carried forward into early 2024. 2023 lead and

zinc guidance has been updated.

- 3Q23 copper production exceeded projections as underground mine

production ramp-up continued ahead of expectations during the

quarter. Transitional ore from the open pit also had a higher than

estimated copper content with improved metallurgical recovery.

Buenaventura maintains its targeted underground mine 10,000 tpd

exploitation rate for 4Q23.

3Q23 Payable Volume Sold

3Q23 Volume Sold per Metal(100% basis)

1Q23(Actual) 2Q23(Actual) 3Q23(Actual)

9M23(Actual) Gold (Oz.) Orcopampa

20,326

19,718

20,460

60,504

Tambomayo

9,360

9,868

7,421

26,649

Coimolache

6,854

8,170

21,237

36,261

El Brocal

2,595

2,427

3,553

8,575

Silver (Oz.)

Uchucchacua

130,642

150,637

85,499

366,778

Yumpag

0

0

0

0

El Brocal

379,158

508,257

986,583

1,873,998

Tambomayo

370,299

485,593

269,542

1,125,434

Julcani

412,890

449,841

388,854

1,251,585

Lead (MT) El Brocal

88

1,215

636

1,939

Uchucchacua

0

0

0

0

Yumpag

0

0

0

0

Tambomayo

1,189

808

525

2,521

Zinc (MT)

El Brocal

38

3,094

2,347

5,478

Uchucchacua

0

0

0

0

Tambomayo

1,269

895

682

2,846

Copper (MT)

El Brocal

11,748

12,355

17,786

41,889

Realized Metal Prices* 1Q23(Actual)

2Q23(Actual) 3Q23(Actual) 9M23(Actual) Gold

(Oz)

1,915

1,945

1,921

1,927

Silver (Oz)

22.5

24.27

25.67

24.30

Lead (MT)

2,139

1,846

2,225

2,030

Zinc (MT)

2,004

2,497

1,762

2,152

Copper (MT)

8,972

8,992

8,291

8,689

*Buenaventura consolidated figures.

Appendix

Appendix

1. 3Q23 Production per

Metal

(100% basis) 1Q23(Actual) 2Q23(Actual)

3Q23(Actual) 9M23(Actual) Gold (Oz.)

La Zanja

3,051

2,030

1,692

6,772

Silver (Oz.)

Orcopampa

7,618

7,242

7,168

22,028

La Zanja

6,630

5,322

3,681

15,633

Coimolache

25,485

64,084

87,185

176,755

Lead (MT)

Julcani

106

159

132

398

2. 3Q23 Volume Sold per Metal (100% basis)

1Q23(Actual) 2Q23(Actual) 3Q23(Actual)

6M23(Actual) Gold (Oz.) La Zanja

3,211

1,892

1,780

6,883

Silver (Oz.)

Orcopampa

6,699

6,023

6,710

19,432

La Zanja

10,942

11,589

6,442

28,973

Coimolache

24,909

57,608

82,379

164,895

Lead (MT)

Julcani

94

138

107

339

Company Description Compañía de Minas Buenaventura

S.A.A. is Peru’s largest, publicly traded precious and base metals

Company and a major holder of mining rights in Peru. The Company is

engaged in the exploration, mining development, processing and

trade of gold, silver and other base metals via wholly-owned mines

and through its participation in joint venture projects.

Buenaventura currently operates several mines in Peru (Orcopampa*,

Uchucchacua*, Julcani*, Tambomayo*, La Zanja*, El Brocal and

Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements This press

release may contain forward-looking information (as defined in the

U.S. Private Securities Litigation Reform Act of 1995) that involve

risks and uncertainties, including those concerning Cerro Verde’s

costs and expenses, results of exploration, the continued improving

efficiency of operations, prevailing market prices of gold, silver,

copper and other metals mined, the success of joint ventures,

estimates of future explorations, development and production,

subsidiaries’ plans for capital expenditures, estimates of reserves

and Peruvian political, economic, social and legal developments.

These forward-looking statements reflect the Company’s view with

respect to Cerro Verde’s future financial performance. Actual

results could differ materially from those projected in the

forward-looking statements as a result of a variety of factors

discussed elsewhere in this Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231019789398/en/

Contacts in Lima: Daniel Dominguez, Chief Financial Officer +51

(511) 419 2540

Gabriel Salas, Head of Investor Relations +51 (511) 419 2591 /

Gabriel.salas@buenaventura.pe

Contacts in NY: Barbara Cano +1 (646) 452 2334

barbara@inspirgroup.com

Company Website: www.buenaventura.com.pe/ir

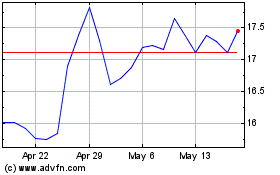

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Dec 2023 to Dec 2024