Third Quarter Highlights include:

- Reported revenues of $176.3 million, net loss of $5.1 million

and operating cash flow of $35.7 million;

- Delivered Adjusted EBITDA of $18.8 million and free cash flow

of $28.3 million;

- Returned $17.8 million of capital to shareholders in the

quarter through the quarterly dividend and share repurchases;

- Australian segment continues to deliver strong growth, with

revenues up 33% on a year-over-year basis, driven by both increased

occupancy at Civeo-owned villages and continued growth in our

integrated services offering; and

- Today announced a 33-month contract renewal with a major

Canadian oil sands producer to continue providing accommodations

and hospitality services through June 2027 with expected revenues

totaling approximately C$150 million.

Civeo Corporation (NYSE:CVEO) today reported financial and

operating results for the third quarter ended September 30,

2024.

“Our Australian segment continues to perform well generating

solid growth driven by increased billed rooms at our Civeo-owned

villages and new business with an existing integrated services

customer. As expected, the Canadian segment declined year-over-year

with the ongoing wind-down of Canadian LNG-related activity. This

decline was exacerbated by wildfire-related evacuations and delays

as well as the effect of the previously discussed pull-forward of

customer turnaround and operational activities. We are encouraged

by the multi-year contract renewal with a major Canadian oil sands

producer and believe this is a testament to our solid operational

execution and our strong customer relationships,” said Bradley J.

Dodson, Civeo's President and Chief Executive Officer.

Mr. Dodson added, “In the third quarter, we continued to take

advantage of the attractive valuation of our shares, and we

elevated our repurchases to approximately 515,000 common shares for

$14.2 million. We remain well positioned to invest in our growth

initiatives while maintaining attractive cash flow generation to

facilitate the continued return of capital to shareholders via

steady dividends and opportunistic share repurchases.”

Third Quarter 2024 Results

In the third quarter of 2024, Civeo generated revenues of $176.3

million and reported a net loss of $5.1 million, or $0.36 per

diluted share. During the third quarter of 2024, Civeo produced

operating cash flow of $35.7 million, Adjusted EBITDA of $18.8

million and free cash flow of $28.3 million.

By comparison, in the third quarter of 2023, Civeo generated

revenues of $183.6 million and reported net income of $9.0 million,

or $0.61 per diluted share. During the third quarter of 2023, Civeo

produced operating cash flow of $36.8 million, Adjusted EBITDA of

$34.2 million and free cash flow of $31.7 million.

The year-over-year decrease in Adjusted EBITDA in the third

quarter of 2024 was primarily driven by the expected wind-down of

Canadian LNG-related activity, lower Canadian oil sands turnaround

activity due to customers starting their maintenance projects

earlier in the year and lower Canadian occupancy related to the

recent wildfires. This decrease was partially offset by increased

billed rooms at the Australian owned-villages and increased

Australian integrated services revenues related to new business

with existing clients.

Business Segment Results

(Unless otherwise noted, the following discussion compares the

quarterly results for the third quarter of 2024 to the results for

the third quarter of 2023.)

Canada

During the third quarter of 2024, the Canadian segment generated

revenues of $57.7 million, operating loss of $8.3 million and

Adjusted EBITDA of $3.4 million, compared to revenues of $95.1

million, operating income of $10.8 million and Adjusted EBITDA of

$23.2 million in the third quarter of 2023.

The Canadian segment experienced a 39% period-over-period

decrease in revenues and an 85% decrease in Adjusted EBITDA driven

by the anticipated wind-down of LNG-related activity, including

$0.4 million of mobile camp demobilization costs, lower oil sands

turnaround activity due to customers starting their projects

earlier in the year and lower billed rooms as a result of the

Canadian wildfires. The company does not anticipate a material

impact from the wildfires in the fourth quarter.

Today, the Company announced the execution of an expected

contract renewal with a major oil sands producer to continue

providing accommodations and hospitality services through June 2027

with expected revenues totaling approximately C$150 million over 33

months.

Australia

During the third quarter of 2024, the Australian segment

generated revenues of $116.6 million, operating income of $12.3

million and Adjusted EBITDA of $22.5 million, compared to revenues

of $87.9 million, operating income of $9.1 million and Adjusted

EBITDA of $18.9 million in the third quarter of 2023.

Revenue from the Australian segment increased 33%

period-over-period and Adjusted EBITDA was up 19% primarily driven

by a significant increase in integrated services activity from

existing clients and a 4% year-over-year increase to billed rooms,

building on a history of substantial multi-year growth.

Financial Condition and Capital

Allocation

As of September 30, 2024, Civeo had total liquidity of

approximately $211.8 million. Civeo's net debt on September 30,

2024 was $32.2 million, a $7.9 million decrease since June 30,

2024. Civeo reported a net leverage ratio of 0.3x as of September

30, 2024.

During the third quarter of 2024, Civeo invested $7.5 million in

capital expenditures compared to $9.5 million invested during the

third quarter of 2023. Capital expenditures in both periods were

primarily related to maintenance spending on the Company’s lodges

and villages. Capital expenditures in the third quarter of 2023

also included $3.6 million related to customer-funded

infrastructure upgrades at three Australian villages which were

reimbursed by our client.

The Company announced today that its board of directors has

declared a quarterly cash dividend of $0.25 per common share,

payable on December 16, 2024 to shareholders of record as of close

of business on November 25, 2024. For purposes of the Income Tax

Act (Canada), the Company has designated this dividend to be an

"eligible dividend."

In the third quarter of 2024, Civeo repurchased approximately

515,000 shares for approximately $14.2 million. On September 11,

the Board announced it renewed its share repurchase authorization

for the Company to repurchase up to 5% of its total common shares

outstanding over the next twelve months. The Company will continue

to be opportunistic about pursuing repurchases. The Board may

increase the number of common shares that may be repurchased under

the repurchase plan at any time. The repurchase plan does not

obligate Civeo to repurchase any particular number of shares, and

it may be suspended or terminated at any time.

Full Year 2024 Guidance

For the full year of 2024, Civeo is tightening its previously

provided revenue and Adjusted EBITDA guidance ranges to $675

million to $700 million and $83 million to $88 million,

respectively. The Company is maintaining its full year 2024 capital

expenditure guidance range of $30 million to $35 million.

Conference Call

Civeo will host a conference call to discuss its third quarter

2024 financial results today at 11:00 a.m. Eastern time. This call

is being webcast and can be accessed at Civeo's website at

www.civeo.com. Participants may also join the conference call by

dialing (877) 423-9813 in the United States or (201) 689-8573

internationally and asking for the Civeo call or using the

conference ID 13749748#. A replay will be available after the call

by dialing (844) 512-2921 in the United States or (412) 317-6671

internationally and using the conference ID 13749748#.

About Civeo

Civeo Corporation is a leading provider of hospitality services

with prominent market positions in the Canadian oil sands and the

Australian natural resource regions. Civeo offers comprehensive

solutions for lodging hundreds or thousands of workers with its

long-term and temporary accommodations and provides food services,

housekeeping, facility management, laundry, water and wastewater

treatment, power generation, communications systems, security and

logistics services. Civeo currently owns and operates a total of 24

lodges and villages in North America and Australia with an

aggregate of approximately 26,000 rooms. In addition, Civeo

operates and provides hospitality services at 22 customer-owned

locations with more than 18,000 rooms. Civeo is publicly traded

under the symbol CVEO on the New York Stock Exchange. For more

information, please visit Civeo's website at www.civeo.com.

Forward Looking Statements

This news release contains forward-looking statements within the

meaning of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements are

those that do not state historical facts and are, therefore,

inherently subject to risks and uncertainties. The forward-looking

statements herein, including the statements regarding Civeo’s

future plans and outlook, strategic priorities, guidance, current

trends, expectations with respect to future revenues, share

repurchases and dividends, and liquidity needs, are based on then

current expectations and entail various risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by these forward-looking statements. Such

risks and uncertainties include, among other things, risks

associated with the general nature of the accommodations industry,

risks associated with the level of supply and demand for oil, coal,

iron ore and other minerals, including the level of activity,

spending and developments in the Canadian oil sands, the level of

demand for coal and other natural resources from, and investments

and opportunities in, Australia, and fluctuations or sharp declines

in the current and future prices of oil, natural gas, coal, iron

ore and other minerals, risks associated with failure by our

customers to reach positive final investment decisions on, or

otherwise not complete, projects with respect to which we have been

awarded contracts, which may cause those customers to terminate or

postpone contracts, risks associated with currency exchange rates,

risks associated with inflation and volatility in the banking

sector, risks associated with the company’s ability to integrate

any future acquisitions, risks associated with labor shortages,

risks associated with the development of new projects, including

whether such projects will continue in the future, risks associated

with the trading price of the company’s common shares, availability

and cost of capital, risks associated with general global economic

conditions, geopolitical events, inflation, global weather

conditions, natural disasters, including wildfires, global health

concerns, and security threats and changes to government and

environmental regulations, including climate change, and other

factors discussed in the “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and “Risk Factors”

sections of Civeo’s most recent annual report on Form 10-K and

other reports the company may file from time to time with the U.S.

Securities and Exchange Commission. Each forward-looking statement

contained herein speaks only as of the date of this release. Except

as required by law, Civeo expressly disclaims any intention or

obligation to revise or update any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Information

EBITDA, Adjusted EBITDA, free cash flow, net debt, bank-adjusted

EBITDA and net leverage ratio are non-GAAP financial measures. See

“Non-GAAP Reconciliation” below for definitions and additional

information concerning non-GAAP financial measures, including a

reconciliation of the non-GAAP financial information presented in

this press release to the most directly comparable financial

information presented in accordance with GAAP. Non-GAAP financial

information supplements and should be read together with, and is

not an alternative or substitute for, the Company’s financial

results reported in accordance with GAAP. Because non-GAAP

financial information is not standardized, it may not be possible

to compare these financial measures with other companies’ non-GAAP

financial measures.

- Financial Schedules Follow -

CIVEO CORPORATION

UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues

$

176,338

$

183,572

$

531,171

$

530,006

Costs and expenses:

Cost of sales and services

138,542

130,296

409,821

395,235

Selling, general and administrative

expenses

19,635

20,236

55,708

52,885

Depreciation and amortization expense

17,440

16,914

51,269

59,277

Impairment expense

—

—

7,823

—

(Gain) loss on sale of McClelland Lake

Lodge assets, net

171

—

(5,817

)

—

Other operating expense

506

87

992

302

176,294

167,533

519,796

507,699

Operating income

44

16,039

11,375

22,307

Interest expense

(1,725

)

(3,365

)

(6,288

)

(10,625

)

Interest income

50

44

147

126

Other income (expense)

204

(4,709

)

967

(1,832

)

Income (loss) before income taxes

(1,427

)

8,009

6,201

9,976

Income tax (expense) benefit

(3,862

)

1,214

(9,199

)

(2,897

)

Net income (loss)

(5,289

)

9,223

(2,998

)

7,079

Less: Net income (loss) attributable to

noncontrolling interest

(198

)

201

(1,001

)

(53

)

Net income (loss) attributable to Civeo

Corporation

$

(5,091

)

$

9,022

$

(1,997

)

$

7,132

Net income (loss) per share attributable

to Civeo Corporation common shareholders:

Basic

$

(0.36

)

$

0.61

$

(0.14

)

$

0.48

Diluted

$

(0.36

)

$

0.61

$

(0.14

)

$

0.47

Weighted average number of common shares

outstanding:

Basic

14,293

14,814

14,488

14,980

Diluted

14,293

14,891

14,488

15,051

CIVEO CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

September 30, 2024

December 31, 2023

(UNAUDITED)

Current assets:

Cash and cash equivalents

$

17,910

$

3,323

Accounts receivable, net

106,707

143,222

Inventories

8,769

6,982

Assets held for sale

—

5,873

Prepaid expenses and other current

assets

12,120

15,846

Total current assets

145,506

175,246

Property, plant and equipment, net

233,864

270,563

Goodwill, net

7,812

7,690

Other intangible assets, net

72,426

77,999

Operating lease right-of-use assets

10,985

12,286

Other noncurrent assets

7,043

4,278

Total assets

$

477,636

$

548,062

Current liabilities:

Accounts payable

$

48,497

$

58,699

Accrued liabilities

36,485

40,523

Income taxes payable

14,026

3,831

Deferred revenue

2,792

4,849

Other current liabilities

5,039

6,334

Total current liabilities

106,839

114,236

Long-term debt

50,078

65,554

Deferred income taxes

5,241

11,803

Operating lease liabilities

7,915

9,264

Other noncurrent liabilities

23,619

24,167

Total liabilities

193,692

225,024

Shareholders' equity:

Common shares

—

—

Additional paid-in capital

1,630,851

1,628,972

Accumulated deficit

(956,545

)

(919,023

)

Treasury stock

(10,130

)

(9,063

)

Accumulated other comprehensive loss

(382,017

)

(380,715

)

Total Civeo Corporation shareholders'

equity

282,159

320,171

Noncontrolling interest

1,785

2,867

Total shareholders' equity

283,944

323,038

Total liabilities and shareholders'

equity

$

477,636

$

548,062

CIVEO CORPORATION

UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

Nine Months Ended

September 30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

(2,998

)

$

7,079

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

51,269

59,277

Impairment charges

7,823

—

Deferred income tax expense (benefit)

(6,487

)

2,688

Non-cash compensation charge

1,879

3,297

(Gains) losses on disposals of assets

(6,134

)

2,264

Provision for credit losses, net of

recoveries

15

120

Other, net

1,886

1,900

Changes in operating assets and

liabilities:

Accounts receivable

35,771

(37,411

)

Inventories

(1,690

)

420

Accounts payable and accrued

liabilities

(13,586

)

4,767

Taxes payable

9,681

(5

)

Other current and noncurrent assets and

liabilities, net

(3,415

)

12,197

Net cash flows provided by operating

activities

74,014

56,593

Cash flows from investing activities:

Capital expenditures

(18,405

)

(21,179

)

Proceeds from dispositions of property,

plant and equipment

10,700

7,070

Other, net

183

—

Net cash flows used in investing

activities

(7,522

)

(14,109

)

Cash flows from financing activities:

Term loan repayments

—

(22,338

)

Revolving credit borrowings (repayments),

net

(9,246

)

(6,732

)

Debt issuance costs

(2,976

)

—

Dividends paid

(10,984

)

(3,731

)

Repurchases of common shares

(24,060

)

(9,222

)

Taxes paid on vested shares

(1,067

)

—

Net cash flows used in financing

activities

(48,333

)

(42,023

)

Effect of exchange rate changes on

cash

(3,572

)

(598

)

Net change in cash and cash

equivalents

14,587

(137

)

Cash and cash equivalents, beginning of

period

3,323

7,954

Cash and cash equivalents, end of

period

$

17,910

$

7,817

CIVEO CORPORATION

SEGMENT DATA

(in thousands)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues

Canada

$

57,736

$

95,144

$

204,423

$

280,067

Australia

116,622

87,885

316,967

247,418

Other

1,980

543

9,781

2,521

Total revenues

$

176,338

$

183,572

$

531,171

$

530,006

EBITDA (1)

Canada

$

3,171

$

18,154

$

31,944

$

49,983

Australia

22,421

18,785

58,494

52,600

Corporate, other and eliminations

(7,706

)

(8,896

)

(25,826

)

(22,778

)

Total EBITDA

$

17,886

$

28,043

$

64,612

$

79,805

Adjusted EBITDA (1)

Canada

$

3,434

$

23,201

$

26,454

$

55,320

Australia

22,474

18,869

64,417

52,817

Corporate, other and eliminations

(7,130

)

(7,906

)

(22,374

)

(20,167

)

Total adjusted EBITDA

$

18,778

$

34,164

$

68,497

$

87,970

Operating income (loss)

Canada

$

(8,282

)

$

10,811

$

(2,801

)

$

9,486

Australia

12,349

9,067

30,033

23,140

Corporate, other and eliminations

(4,023

)

(3,839

)

(15,857

)

(10,319

)

Total operating income (loss)

$

44

$

16,039

$

11,375

$

22,307

(1) Please see Non-GAAP Reconciliation

Schedule.

CIVEO CORPORATION

NON-GAAP

RECONCILIATIONS

(in thousands)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

Twelve Months Ended September

30,

2024

2023

2024

2023

2024

EBITDA (1)

$

17,886

$

28,043

$

64,612

$

79,805

$

113,744

Adjusted EBITDA (1)

$

18,778

$

34,164

$

68,497

$

87,970

$

87,021

Free Cash Flow (2)

$

28,278

$

31,721

$

66,309

$

42,484

Net Leverage Ratio (3)

0.3x

(1)

The term EBITDA is a non-GAAP financial

measure that is defined as net income (loss) attributable to Civeo

Corporation plus interest, taxes, depreciation and amortization.

The term Adjusted EBITDA is a non-GAAP financial measure that is

defined as EBITDA adjusted to exclude certain other unusual or

non-operating items. For the three months ended September 30, 2024,

Civeo revised its definition of Adjusted EBITDA to exclude non-cash

share-based compensation. Comparative periods presented were also

updated to reflect this revision. EBITDA and Adjusted EBITDA are

not measures of financial performance under generally accepted

accounting principles and should not be considered in isolation

from or as a substitute for net income or cash flow measures

prepared in accordance with generally accepted accounting

principles or as a measure of profitability or liquidity.

Additionally, EBITDA and Adjusted EBITDA may not be comparable to

other similarly titled measures of other companies. Civeo has

included EBITDA and Adjusted EBITDA as supplemental disclosures

because its management believes that EBITDA and Adjusted EBITDA

provide useful information regarding its ability to service debt

and to fund capital expenditures and provide investors a helpful

measure for comparing Civeo's operating performance with the

performance of other companies that have different financing and

capital structures or tax rates. Civeo uses EBITDA and Adjusted

EBITDA to compare and to monitor the performance of its business

segments to other comparable public companies and as a benchmark

for the award of incentive compensation under its annual incentive

compensation plan.

The following table sets forth a

reconciliation of EBITDA and Adjusted EBITDA to net income (loss)

attributable to Civeo Corporation, which is the most directly

comparable measure of financial performance calculated under

generally accepted accounting principles (in thousands)

(unaudited):

Three Months Ended

September 30,

Nine Months Ended

September 30,

Twelve Months Ended September

30,

2024

2023

2024

2023

2024

Net income (loss) attributable to Civeo

Corporation

$

(5,091

)

$

9,022

$

(1,997

)

$

7,132

$

21,028

Income tax expense (benefit)

3,862

(1,214

)

9,199

2,897

16,935

Depreciation and amortization

17,440

16,914

51,269

59,277

67,134

Interest income

(50

)

(44

)

(147

)

(126

)

(193

)

Interest expense

1,725

3,365

6,288

10,625

8,840

EBITDA

$

17,886

$

28,043

$

64,612

$

79,805

$

113,744

Adjustments to EBITDA

Impairment of long-lived assets (a)

—

—

7,823

—

9,218

Net (gain) loss on disposition of

McClelland Lake Lodge assets (b)

171

4,868

(5,817

)

4,868

(38,983

)

Share-based compensation (c)

721

1,253

1,879

3,297

3,042

Adjusted EBITDA

$

18,778

$

34,164

$

68,497

$

87,970

$

87,021

(a)

Relates to asset impairments in the first quarter of 2024 and

the fourth quarter of 2023. In the first quarter of 2024, we

recorded a pre-tax loss related to the impairment of long-lived

assets in our Australian segment of $5.7 million and a pre-tax loss

related to the impairment of long-lived assets in the U.S. of $2.1

million. In the fourth quarter of 2023, we recorded a pre-tax loss

related to the impairment of long-lived assets in the U.S. of $1.4

million.

(b)

Relates to proceeds received and expenses

incurred associated with the dismantlement and sale of the

McClelland Lake Lodge. In the third quarter of 2024, we recorded

expenses associated with the sale of our McClelland Lake Lodge of

$0.2 million, which are included in (Gain) loss on sale of

McClelland Lake Lodge assets, net on the unaudited statements of

operations. In the second quarter of 2024, we recorded expenses

associated with the sale of our McClelland Lake Lodge of $0.1

million, which are included in (Gain) loss on sale of McClelland

Lake Lodge assets, net on the unaudited statements of operations.

In the first quarter of 2024, we recorded gains associated with the

sale of the McClelland Lake Lodge of $6.1 million, which are

included in (Gain) loss on sale of McClelland Lake Lodge assets,

net on the unaudited statements of operations. In the fourth

quarter of 2023, we recorded gains associated with the sale of the

McClelland Lake Lodge of $33.2 million, which are included in

(Gain) loss on sale of McClelland Lake Lodge assets, net ($23.5

million) and Other income ($9.7 million) on the unaudited

statements of operations. In the third quarter of 2023, we recorded

expenses associated with the sale of our McClelland Lake Lodge of

$4.9 million, which are included in Other income (expense) on the

unaudited statements of operations.

(c)

Represents share-based compensation

expense associated with performance share awards, restricted share

awards, restricted share units and deferred share awards.

(2)

The term Free Cash Flow is a non-GAAP financial measure that is

defined as net cash flows provided by operating activities less

capital expenditures plus proceeds from asset sales. Free Cash Flow

is not a measure of financial performance under generally accepted

accounting principles and should not be considered in isolation

from or as a substitute for cash flow measures prepared in

accordance with generally accepted accounting principles or as a

measure of profitability or liquidity. Additionally, Free Cash Flow

may not be comparable to other similarly titled measures of other

companies. Civeo has included Free Cash Flow as a supplemental

disclosure because its management believes that Free Cash Flow

provides useful information regarding the cash flow generating

ability of its business relative to its capital expenditure and

debt service obligations. Civeo uses Free Cash Flow to compare and

to understand, manage, make operating decisions and evaluate

Civeo's business.

The following table sets forth a

reconciliation of Free Cash Flow to Net Cash Flows Provided by

Operating Activities, which is the most directly comparable measure

of financial performance calculated under generally accepted

accounting principles (in thousands) (unaudited):

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net Cash Flows Provided by Operating

Activities

$

35,671

$

36,832

$

74,014

$

56,593

Capital expenditures

(7,476

)

(9,462

)

(18,405

)

(21,179

)

Proceeds from dispositions of property,

plant and equipment

83

4,351

10,700

7,070

Free Cash Flow

$

28,278

$

31,721

$

66,309

$

42,484

(3)

The term net leverage ratio is a non-GAAP

financial measure that is defined as net debt divided by

bank-adjusted EBITDA. Net debt, bank-adjusted EBITDA and net

leverage ratio are not financial measures under GAAP and should not

be considered in isolation from or as a substitute for total debt,

net income (loss) or cash flow measures prepared in accordance with

GAAP or as a measure of profitability or liquidity. Additionally,

net debt, bank-adjusted EBITDA and net leverage ratio may not be

comparable to other similarly titled measures of other companies.

Civeo has included net debt, bank-adjusted EBITDA and net leverage

ratio as a supplemental disclosure because its management believes

that this data provides useful information regarding the level of

the Company’s indebtedness and its ability to service debt.

Additionally,

per Civeo’s credit agreement, the Company

is required to maintain a net leverage ratio below 3.0x every

quarter to remain in compliance with the credit agreement.

The following table sets forth a

reconciliation of net debt, bank-adjusted EBITDA and net leverage

ratio to the most directly comparable measures of financial

performance calculated under GAAP (in thousands) (unaudited):

As of September 30,

2024

Total debt

$

50,078

Less: Cash and cash equivalents

17,910

Net debt

$

32,168

Adjusted EBITDA for the twelve months

ended September 30, 2024 (a)

$

87,021

Adjustments to Adjusted EBITDA

Interest income

193

Incremental adjustments for McClelland

Lake Lodge disposition (b)

13,781

Bank-adjusted EBITDA

$

100,995

Net leverage ratio (c)

0.3x

(a) See footnote 1 above for

reconciliation of Adjusted EBITDA to net income (loss) attributable

to Civeo Corporation

(b) Related to incremental adjustments

associated with the sale of the McClelland Lake Lodge assets as

required by our credit facility

(c) Calculated as net debt divided by

bank-adjusted EBITDA

CIVEO CORPORATION

NON-GAAP RECONCILIATIONS -

GUIDANCE

(in millions)

(unaudited)

Year Ending December 31,

2024

EBITDA Range (1)

$

78.2

$

83.2

Adjusted EBITDA Range (1)

$

83.0

$

88.0

(1)

The following table sets forth a reconciliation of estimated

EBITDA and Adjusted EBITDA to estimated net loss, which is the most

directly comparable measure of financial performance calculated

under generally accepted accounting principles (in millions)

(unaudited):

Year Ending December 31,

2024

(estimated)

Net loss

$

(11.8

)

$

(8.8

)

Income tax expense

12.0

14.0

Depreciation and amortization

70.0

70.0

Interest expense

8.0

8.0

EBITDA

$

78.2

$

83.2

Adjustments to EBITDA

Impairment expense

7.8

7.8

Net gain on disposition of McClelland Lake

Lodge assets

(6.0

)

(6.0

)

Share-based compensation

3.0

3.0

Adjusted EBITDA

$

83.0

$

88.0

CIVEO CORPORATION

SUPPLEMENTAL QUARTERLY SEGMENT

AND OPERATING DATA

(U.S. dollars in thousands,

except for room counts and average daily rates)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Supplemental Operating Data - Canadian

Segment

Revenues

Accommodation revenue (1)

$

48,747

$

71,417

$

180,793

$

208,000

Mobile facility rental revenue (2)

123

17,314

1,473

54,752

Food and other services revenue (3)

8,866

6,413

22,157

17,315

Total Canadian revenues

$

57,736

$

95,144

$

204,423

$

280,067

Costs

Accommodation cost

$

38,762

$

46,063

$

132,679

$

150,592

Mobile facility rental cost

361

11,636

4,413

37,736

Food and other services cost

8,385

5,867

20,839

15,701

Indirect other cost

2,544

2,406

8,227

7,693

Total Canadian cost of sales and

services

$

50,052

$

65,972

$

166,158

$

211,722

Average daily rates (4)

$

100

$

98

$

97

$

98

Billed rooms (5)

483,767

726,364

1,846,163

2,093,459

Canadian dollar to U.S. dollar

$

0.733

$

0.746

$

0.735

$

0.743

Supplemental Operating Data -

Australian Segment

Revenues

Accommodation revenue (1)

$

51,370

$

46,012

$

147,391

$

130,953

Food and other services revenue (3)

65,252

41,873

169,576

116,465

Total Australian revenues

$

116,622

$

87,885

$

316,967

$

247,418

Costs

Accommodation cost

$

24,783

$

22,404

$

70,990

$

63,670

Food and other services cost

58,787

38,898

154,218

110,132

Indirect other cost

3,497

2,293

9,009

6,646

Total Australian cost of sales and

services

$

87,067

$

63,595

$

234,217

$

180,448

Average daily rates (4)

$

79

$

74

$

78

$

76

Billed rooms (5)

647,358

623,436

1,886,647

1,734,004

Australian dollar to U.S. dollar

$

0.670

$

0.655

$

0.662

$

0.669

(1)

Includes revenues related to lodge and

village rooms and hospitality services for owned rooms for the

periods presented.

(2)

Includes revenues related to mobile assets

for the periods presented.

(3)

Includes revenues related to food

services, laundry and water and wastewater treatment services, and

facilities management for the periods presented.

(4)

Average daily rate is based on billed

rooms and accommodation revenue.

(5)

Billed rooms represents total billed days

for owned assets for the periods presented.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030544227/en/

Regan Nielsen Civeo Corporation Vice President, Corporate

Development & Investor Relations 713-510-2400

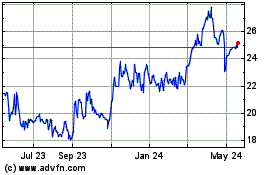

Civeo (NYSE:CVEO)

Historical Stock Chart

From Dec 2024 to Jan 2025

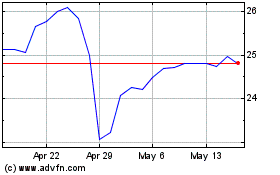

Civeo (NYSE:CVEO)

Historical Stock Chart

From Jan 2024 to Jan 2025