3D Systems Corporation (NYSE:DDD) announced today its

financial results for the third quarter ended September 30, 2024.

Third Quarter Highlights (All numbers are

unaudited and are presented in millions, except per share amounts

or as otherwise noted)

- Revenue of $112.9 million decreased

9% year-over-year primarily driven by macro weakness in printer

sales, partially offset by approximately 10% growth in consumables

sales

- Healthcare Solutions revenue of

$55.1 million grew 5% year-over-year, led by strong growth in

Dental and Personalized Healthcare solutions

- Customer interest in 3D printing

applications continued to gain momentum, with revenues in the

Application Innovation Group (AIG) growing over 26% year-to-date

versus prior year across industrial markets

- Q3'24 gross profit margin of 36.9%

and Non-GAAP gross profit margin(1) of 37.6%

included a $3 million headwind related to an increase in inventory

reserves - if excluded, Non-GAAP gross profit margin was 40.2%

- Q3'24 net loss of $178.6 million,

diluted loss per share of $1.35, which includes $143.7 million

associated with the impairment of goodwill and other long-lived

assets. Non-GAAP diluted loss per share(1) of

$0.12

- Q3'24 negative Adjusted

EBITDA(1) of $14.3 million

- Updating guidance for remainder of

FY'2024 to now include expected full-year revenues within the range

of $440 million - $450 million

| Unaudited |

|

Three Months Ended September 30, |

|

Three Months Ended September 30, |

|

(in millions, except per share data) |

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

$ |

112.9 |

|

|

$ |

123.8 |

|

| Gross profit |

|

|

41.7 |

|

|

|

55.4 |

|

| Gross profit margin |

|

|

36.9 |

% |

|

|

44.7 |

% |

| Operating expense |

|

|

222.5 |

|

|

|

68.9 |

|

| Loss from operations |

|

|

(180.8 |

) |

|

|

(13.6 |

) |

| Net loss attributable to 3D

Systems Corporation |

|

|

(178.6 |

) |

|

|

(11.7 |

) |

| Diluted loss per share |

|

|

(1.35 |

) |

|

|

(0.09 |

) |

| |

|

|

|

|

| Non-GAAP measures for

year-over-year comparisons: (1) |

|

|

|

|

| Non-GAAP gross profit

margin |

|

|

37.6 |

% |

|

|

44.8 |

% |

| Non-GAAP operating

expense |

|

|

61.4 |

|

|

|

55.8 |

|

| Adjusted EBITDA |

|

|

(14.3 |

) |

|

|

4.7 |

|

| Non-GAAP diluted (loss) income

per share |

|

$ |

(0.12 |

) |

|

$ |

0.01 |

|

|

(1) |

See “Presentation of Information in this Press Release” below for a

description, and the Appendix for reconciliations of non-GAAP

measurements to the most closely comparable GAAP measures. |

Summary Comments on Results

Commenting on third quarter results, Dr. Jeffrey

Graves, president and CEO of 3D Systems said, “As recently shared,

our third quarter revenues continued to be impacted by sluggish

capital investments by our customers for new production capacity,

particularly in the Industrial markets, impacting the sale of new

printing systems. On a positive note however, capacity utilization

for our installed printer fleet broadly increased, translating into

an increase in consumable revenues, which grew nearly 10% on both

prior year and sequential comparisons. While 2024 has been a

challenging year for new printer system sales, we are increasingly

encouraged about the future, driven in large part by customer

demand for our Application Innovation Group, a group of highly

skilled process specialists who assist customers in developing new

applications for 3D printing. Year-to-date this group, which spans

both polymer and metal solutions, has experienced a rise of over

26% in revenues derived from new application development,

particularly in highly regulated markets such a semiconductor

equipment manufacturing, oil & gas, aerospace & defense

markets, and our medical markets. Much of this performance, and the

future growth potential it implies, has been fueled by an

aggressive cycle of innovation at our company, enabled by our

sustained focus on new product innovation across all of our major

polymer and metal printing solutions. As a result of this sustained

focus, which we believe differentiates us from many others in our

industry, we are on pace to deliver nearly 40 new products to

market since the third quarter of last year, and 25 in calendar

2024 alone. We believe no other company in our industry has matched

this output that we expect will pay dividends in growth and

profitability improvements as the economy rebounds in the

future.”

Dr. Graves continued, “Given our strong focus on

new product innovation, over the last two years we’ve also

completely altered our manufacturing model from nearly 100%

outsourced, to taking full responsibility for our integrated supply

chain by in-sourcing procurement, assembly operations and

logistics. This transition is now virtually complete, and, while it

required short-term increases in expenses and working capital, we

believe it is absolutely essential in driving smooth new product

introductions, high quality product and delivery performance and,

importantly, long-term customer satisfaction and gross margin

improvements as factory efficiencies increase. While weakness in

our end-markets over the last several quarters has muted these

benefits, as volumes recover we expect to realize them increasingly

over time. With our in-sourcing efforts now close to completion,

our near term focus has shifted to managing working capital and

capex spend to improve cash performance. This has been increasingly

effective as we entered the second half of the year, as

demonstrated by the stabilization of our cash reserves in the third

quarter. We were also pleased to deliver a sequential reduction in

operating expenses, in line with our previous expectations, and

expect the benefits of restructuring actions previously taken to

positively impact our cost structure in the quarters ahead.”

Dr. Graves concluded, “As we look to the end of

the year, the consistent fueling of our R&D engines as we moved

through a tougher macro environment period is now driving an

acceleration of exciting new customer applications, supported by

outstanding new products spanning from new printer hardware to

advanced engineering materials, to enhancement of our software

capabilities. We believe this positions us well as the geopolitical

and economic headwinds of the last 18 months ultimately begin to

recede. Given timing uncertainties and normal quarter-to-quarter

inventory management at year-end, we believe it is prudent to be

conservative in our outlook for the full year. As such, we are

updating our revenue expectations for the full year 2024 to be

between $440 million and $450 million. From an OPEX perspective, we

expect to see continued improvement consistent with our prior

comments, namely that OPEX will decrease again in Q4, to below $60

million. These combined factors should yield a sequential

improvement in Adjusted EBITDA and will place us on a trajectory

towards profitability in the quarters ahead. We will continue our

balanced view of short-term focus on cash performance and improving

profitability, while meeting the longer-term needs of our customers

from a technology and service perspective. In keeping our

customers’ production goals clearly in our sites each day, we

believe that substantial long-term value will be created for all of

our stakeholders in the years ahead.”

Summary of Third

Quarter Results

Revenue for the third quarter of 2024 decreased

approximately 9% to $112.9 million compared to the same period last

year, primarily driven by lower printer sales, partially offset by

approximately 10% growth in materials.

Gross profit margin for the third quarter of

2024 was 36.9% compared to 44.7% for the same period last year.

Non-GAAP gross profit margin was 37.6% compared to 44.8% for the

same period last year. Gross profit margin decreased primarily due

to unfavorable absorption associated with lower volumes and

approximately $3 million associated with an increase in inventory

reserves, partially offset by favorable mix. In addition, gross

profit margin from the prior year period includes approximately

$4.5 million of incremental revenue recognized by our Regenerative

Medicine business at 100% margin related to incremental milestone

recognition which did not repeat in the third quarter of 2024.

Operating expense for the third quarter of 2024

was $222.5 million compared to $68.9 million for the same period

last year and includes $143.7 million associated with the

impairment of goodwill and other long-lived assets taken during the

third quarter of 2024. Non-GAAP operating expense of $61.4 million

increased $5.6 million compared to the same period last year, while

improving $2.7 million on a sequential basis. The sequential

improvement was primarily driven by benefits associated with prior

restructuring actions.

Net loss attributable to 3D Systems Corporation

for the third quarter of 2024 was $178.6 million compared to a net

loss of $11.7 million for the same period last year. The decline

from prior year was primarily impacted by the previously referenced

$143.7 million associated with the impairment of goodwill and other

long-lived assets taken during the third quarter of 2024.

Adjusted EBITDA decreased by $19.1 million to a

loss of $14.3 million in the third quarter of 2024 compared to the

same period last year. The decrease in Adjusted EBITDA primarily

reflects lower revenue, lower gross margin and higher operating

expense. As previously noted, the third quarter of 2023 also

included the benefit of approximately $4.5 million of incremental

milestone recognition by our Regenerative Medicine business at 100%

margin that did not repeat in the third quarter of 2024.

Updating 2024 Outlook

Based on current macroeconomic and geopolitical

conditions, 3D Systems is updating its financial guidance for the

remainder of 2024 as follows:

- Revenues for the full-year 2024

within the range of $440 million - $450 million

- Non-GAAP gross profit margin for

the full-year 2024 within the range of 38% - 40%

- Maintain the expectation for

Non-GAAP operating expense of less than $60 million for Q4'24

- Adjusted EBITDA to improve

sequentially

Financial Liquidity

At September 30, 2024, the company had cash and

cash equivalents of $190.0 million, a decrease of $141.5 million

since December 31, 2023. The decrease resulted primarily due to

cash used in operations of $37.1 million, capital expenditures of

$10.8 million, and repayment on borrowings of $87.2 million. At

September 30, 2024, the company had total debt, net of deferred

financing costs of $211.7 million.

Q3 2024

Conference Call and Webcast

The company will host a conference call and

simultaneous webcast to discuss these results on November 27, 2024,

which may be accessed as follows:

Date: Wednesday, November 27, 2024 Time: 8:30

a.m. Eastern TimeListen via webcast:

www.3dsystems.com/investorParticipate via telephone:

201-689-8345

A replay of the webcast will be available

approximately two hours after the live presentation at

www.3dsystems.com/investor.

Forward-Looking Statements

Certain statements made in this release that are

not statements of historical or current facts are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, performance or achievements of the company to be

materially different from historical results or from any future

results or projections expressed or implied by such forward-looking

statements. In many cases, forward looking statements can be

identified by terms such as “believes,” “belief,” “expects,” “may,”

“will,” “estimates,” “intends,” “anticipates” or “plans” or the

negative of these terms or other comparable terminology.

Forward-looking statements are based upon management’s beliefs,

assumptions and current expectations and may include comments as to

the company’s beliefs and expectations as to future events and

trends affecting its business and are necessarily subject to

uncertainties, many of which are outside the control of the

company. The factors described under the headings “Forward-Looking

Statements” and “Risk Factors” in the company’s periodic filings

with the Securities and Exchange Commission, as well as other

factors, could cause actual results to differ materially from those

reflected or predicted in forward-looking statements. Although

management believes that the expectations reflected in the

forward-looking statements are reasonable, forward-looking

statements are not, and should not be relied upon as a guarantee of

future performance or results, nor will they necessarily prove to

be accurate indications of the times at which such performance or

results will be achieved. The forward-looking statements included

are made only as the date of the statement. 3D Systems undertakes

no obligation to update or revise any forward-looking statements

made by management or on its behalf, whether as a result of future

developments, subsequent events or circumstances or otherwise,

except as required by law.

Presentation of Information in this

Press Release

3D Systems reports its financial results in

accordance with GAAP. Management also reviews and reports certain

non-GAAP measures, including: non-GAAP gross profit, non-GAAP gross

profit margin, non-GAAP operating expense, non-GAAP diluted income

(loss) per share, and Adjusted EBITDA. These non-GAAP measures

exclude certain items that management does not view as part of 3D

Systems’ core results as they may be highly variable, may be

unusual or infrequent, are difficult to predict and can distort

underlying business trends and results. Management believes that

the non-GAAP measures provide useful additional insight into

underlying business trends and results and provide meaningful

information regarding the comparison of period-over-period results.

Additionally, management uses the non-GAAP measures for planning,

forecasting and evaluating business and financial performance,

including allocating resources and evaluating results relative to

employee compensation targets. 3D Systems’ non-GAAP measures are

not calculated in accordance with or as required by GAAP and may

not be calculated in the same manner as similarly titled measures

used by other companies. These non-GAAP measures should thus be

considered as supplemental in nature and not considered in

isolation or as a substitute for the related financial information

prepared in accordance with GAAP.

To calculate the non-GAAP measures, 3D Systems

excludes the impact of the following items:

- amortization of intangible assets,

a non-cash expense, as 3D Systems’ intangible assets were primarily

acquired in connection with business combinations;

- costs incurred in connection with

acquisitions and divestitures, such as legal, consulting and

advisory fees;

- stock-based compensation expenses,

a non-cash expense;

- charges related to restructuring

and cost optimization plans, impairment charges, including

goodwill, and divestiture gains or losses;

- impact of equity method

investments;

- certain compensation expense

related to the 2021 Volumetric acquisition; and

- costs, including legal fees,

related to significant or unusual litigation matters.

Amortization of intangibles and acquisition and

divestiture-related costs are excluded from non-GAAP measures as

the timing and magnitude of business combination transactions are

not predictable, can vary significantly from period to period and

the purchase price allocated to amortizable intangible assets and

the related amortization period are unique to each acquisition.

Amortization of intangible assets will recur in future periods

until such intangible assets have been fully amortized. While

intangible assets contribute to the company’s revenue generation,

the amortization of intangible assets does not directly relate to

the sale of the company’s products or services. Additionally,

intangible assets amortization expense typically fluctuates based

on the size and timing of the company’s acquisition activity.

Accordingly, the company believes excluding the amortization of

intangible assets enhances the company’s and investors’ ability to

compare the company’s past financial performance with its current

performance and to analyze underlying business performance and

trends. Although stock-based compensation is a key incentive

offered to certain of our employees, the expense is non-cash in

nature, and we continue to evaluate our business performance

excluding stock-based compensation; therefore, it is excluded from

non-GAAP measures. Stock-based compensation expenses will recur in

future periods. Charges related to restructuring and cost

optimization plans, impairment charges, including goodwill,

divestiture gains or losses, and the costs, including legal fees,

related to significant or unusual litigation matters are excluded

from non-GAAP measures as the frequency and magnitude of these

activities may vary widely from period to period. Additionally,

impairment charges, including goodwill, are non-cash. Furthermore,

the company believes the costs, including legal fees, related to

significant or unusual litigation matters are not indicative of our

core business' operations. Finally, 3D Systems excludes contingent

consideration recorded as compensation expense related to the 2021

Volumetric acquisition from non-GAAP measures as management

evaluates financial performance excluding this expense, which is

viewed by management as similar to acquisition consideration.

The matters discussed above are tax effected, as

applicable, in calculating non-GAAP diluted income (loss) per

share.

Adjusted EBITDA, defined as net income, plus

income tax (provision) benefit, interest and other income

(expense), net, stock-based compensation expense, amortization of

intangible assets, depreciation expense, and other non-GAAP

adjustments, all as described above, is used by management to

evaluate performance and helps measure financial performance

period-over-period.

A reconciliation of GAAP to non-GAAP measures is

provided in the accompanying schedules.

3D Systems does not provide forward-looking

guidance for certain measures on a GAAP basis. The company is

unable to provide a quantitative reconciliation of forward-looking

non-GAAP gross profit margin, Adjusted EBITDA, and non-GAAP

operating expense to the most directly comparable forward-looking

GAAP measures without unreasonable effort because certain items,

including litigation costs, acquisition expenses, stock-based

compensation expense, intangible assets amortization expense,

restructuring expenses, and goodwill impairment charges are

difficult to predict and estimate. These items are inherently

uncertain and depend on various factors, many of which are beyond

the company’s control, and as such, any associated estimate and its

impact on GAAP performance could vary materially.

About 3D Systems

More than 35 years ago, 3D Systems brought the

innovation of 3D printing to the manufacturing industry. Today, as

the leading additive manufacturing solutions partner, we bring

innovation, performance, and reliability to every interaction -

empowering our customers to create products and business models

never before possible. Thanks to our unique offering of hardware,

software, materials and services, each application-specific

solution is powered by the expertise of our application engineers

who collaborate with customers to transform how they deliver their

products and services. 3D Systems’ solutions address a variety of

advanced applications in Healthcare and Industrial Solutions

markets such as medical and dental, aerospace & defense,

automotive and durable goods. More information on the company is

available at www.3dsystems.com.

|

Tables Follow |

|

|

|

|

|

3D Systems CorporationUnaudited Condensed

Consolidated Balance SheetsSeptember 30,

2024 and December 31,

2023 |

|

|

| (in thousands, except

par value) |

September 30, 2024 |

|

December 31, 2023 |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

190,005 |

|

|

$ |

331,525 |

|

|

Accounts receivable, net of reserves — $2,137 and $3,389 |

|

99,224 |

|

|

|

101,497 |

|

|

Inventories |

|

134,926 |

|

|

|

152,188 |

|

|

Prepaid expenses and other current assets |

|

35,858 |

|

|

|

42,612 |

|

|

Total current assets |

|

460,013 |

|

|

|

627,822 |

|

| Property and equipment,

net |

|

53,907 |

|

|

|

64,461 |

|

| Intangible assets, net |

|

20,961 |

|

|

|

62,724 |

|

| Goodwill |

|

14,967 |

|

|

|

116,082 |

|

| Operating lease right-of-use

assets |

|

49,384 |

|

|

|

58,406 |

|

| Finance lease right-of-use

assets |

|

9,185 |

|

|

|

12,174 |

|

| Long-term deferred income tax

assets |

|

4,041 |

|

|

|

4,230 |

|

| Other assets |

|

45,818 |

|

|

|

44,761 |

|

|

Total assets |

$ |

658,276 |

|

|

$ |

990,660 |

|

|

LIABILITIES, REDEEMABLE NON-CONTROLLING INTEREST AND

EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Current operating lease liabilities |

$ |

9,628 |

|

|

$ |

9,924 |

|

|

Accounts payable |

|

42,414 |

|

|

|

49,757 |

|

|

Accrued and other liabilities |

|

44,882 |

|

|

|

49,460 |

|

|

Customer deposits |

|

8,655 |

|

|

|

7,599 |

|

|

Deferred revenue |

|

33,336 |

|

|

|

30,448 |

|

|

Total current liabilities |

|

138,915 |

|

|

|

147,188 |

|

| Long-term debt, net of

deferred financing costs |

|

211,682 |

|

|

|

319,356 |

|

| Long-term operating lease

liabilities |

|

51,000 |

|

|

|

56,795 |

|

| Long-term deferred income tax

liabilities |

|

5,214 |

|

|

|

5,162 |

|

| Other liabilities |

|

31,340 |

|

|

|

33,400 |

|

|

Total liabilities |

|

438,151 |

|

|

|

561,901 |

|

| Commitments and

contingencies |

|

|

|

| Redeemable non-controlling

interest |

|

2,093 |

|

|

|

2,006 |

|

| Stockholders’ equity: |

|

|

|

|

Common stock, $0.001 par value, authorized 220,000 shares; shares

issued 134,826 and 133,619 as of September 30, 2024 and December

31, 2023, respectively |

|

135 |

|

|

|

134 |

|

|

Additional paid-in capital |

|

1,588,911 |

|

|

|

1,577,519 |

|

|

Accumulated deficit |

|

(1,328,536 |

) |

|

|

(1,106,650 |

) |

|

Accumulated other comprehensive loss |

|

(42,478 |

) |

|

|

(44,250 |

) |

|

Total stockholders’ equity |

|

218,032 |

|

|

|

426,753 |

|

| Total liabilities, redeemable

non-controlling interest and stockholders’ equity |

$ |

658,276 |

|

|

$ |

990,660 |

|

|

|

|

3D Systems CorporationUnaudited Condensed

Consolidated Statements of OperationsThree and Nine Months

Ended September 30, 2024

and 2023 |

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| (in thousands, except

per share amounts) |

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

| Revenue: |

|

|

|

|

|

|

|

|

Products |

$ |

72,968 |

|

|

$ |

80,415 |

|

|

$ |

208,752 |

|

|

$ |

253,968 |

|

|

Services |

|

39,972 |

|

|

|

43,376 |

|

|

|

120,345 |

|

|

|

119,253 |

|

|

Total revenue |

|

112,940 |

|

|

|

123,791 |

|

|

|

329,097 |

|

|

|

373,221 |

|

| Cost of sales: |

|

|

|

|

|

|

|

|

Products |

|

47,533 |

|

|

|

47,427 |

|

|

|

129,571 |

|

|

|

153,442 |

|

|

Services |

|

23,694 |

|

|

|

21,014 |

|

|

|

69,793 |

|

|

|

67,315 |

|

|

Total cost of sales |

|

71,227 |

|

|

|

68,441 |

|

|

|

199,364 |

|

|

|

220,757 |

|

| Gross profit |

|

41,713 |

|

|

|

55,350 |

|

|

|

129,733 |

|

|

|

152,464 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

57,974 |

|

|

|

33,355 |

|

|

|

166,772 |

|

|

|

150,623 |

|

|

Research and development |

|

20,764 |

|

|

|

21,982 |

|

|

|

66,260 |

|

|

|

66,953 |

|

|

Asset impairment charges |

|

143,733 |

|

|

|

13,597 |

|

|

|

143,733 |

|

|

|

13,597 |

|

|

Total operating expenses |

|

222,471 |

|

|

|

68,934 |

|

|

|

376,765 |

|

|

|

231,173 |

|

| Loss from operations |

|

(180,758 |

) |

|

|

(13,584 |

) |

|

|

(247,032 |

) |

|

|

(78,709 |

) |

| Non-operating income

(expense): |

|

|

|

|

|

|

|

|

Foreign exchange loss, net |

|

(1,960 |

) |

|

|

(2,202 |

) |

|

|

(774 |

) |

|

|

(3,847 |

) |

|

Interest income |

|

1,550 |

|

|

|

5,841 |

|

|

|

5,800 |

|

|

|

15,730 |

|

|

Interest expense |

|

(606 |

) |

|

|

(932 |

) |

|

|

(1,944 |

) |

|

|

(2,612 |

) |

|

Other (loss) income, net |

|

(51 |

) |

|

|

(105 |

) |

|

|

21,719 |

|

|

|

420 |

|

|

Total non-operating (loss) income |

|

(1,067 |

) |

|

|

2,602 |

|

|

|

24,801 |

|

|

|

9,691 |

|

| Loss before income taxes |

|

(181,825 |

) |

|

|

(10,982 |

) |

|

|

(222,231 |

) |

|

|

(69,018 |

) |

| Benefit (provision) for income

taxes |

|

4,343 |

|

|

|

(174 |

) |

|

|

2,496 |

|

|

|

(404 |

) |

| Loss on equity method

investment, net of income taxes |

|

(1,254 |

) |

|

|

(605 |

) |

|

|

(2,403 |

) |

|

|

(747 |

) |

| Net loss before redeemable

non-controlling interest |

|

(178,736 |

) |

|

|

(11,761 |

) |

|

|

(222,138 |

) |

|

|

(70,169 |

) |

| Less: net loss attributable to

redeemable non-controlling interest |

|

(109 |

) |

|

|

(57 |

) |

|

|

(252 |

) |

|

|

(149 |

) |

| Net loss attributable to 3D

Systems Corporation |

$ |

(178,627 |

) |

|

$ |

(11,704 |

) |

|

$ |

(221,886 |

) |

|

$ |

(70,020 |

) |

| |

|

|

|

|

|

|

|

| Net loss per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(1.35 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1.69 |

) |

|

$ |

(0.54 |

) |

|

Diluted |

$ |

(1.35 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1.69 |

) |

|

$ |

(0.54 |

) |

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

132,235 |

|

|

|

130,263 |

|

|

|

131,621 |

|

|

|

129,780 |

|

|

Diluted |

|

132,235 |

|

|

|

130,263 |

|

|

|

131,621 |

|

|

|

129,780 |

|

|

|

|

3D Systems CorporationUnaudited Condensed

Consolidated Statements of Cash FlowsNine Months

Ended September 30, 2024

and 2023 |

|

|

| |

Nine Months Ended |

| (in

thousands) |

September 30, 2024 |

|

September 30, 2023 |

| Cash flows from operating

activities: |

|

|

|

|

Net loss before redeemable non-controlling interest |

$ |

(222,138 |

) |

|

$ |

(70,169 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation, amortization and accretion of debt discount |

|

28,837 |

|

|

|

27,054 |

|

|

Stock-based compensation |

|

17,339 |

|

|

|

15,140 |

|

|

Loss on short-term investments |

|

— |

|

|

|

6 |

|

|

Non-cash operating lease expense |

|

7,370 |

|

|

|

6,552 |

|

|

Provision for inventory obsolescence |

|

10,332 |

|

|

|

6,061 |

|

|

Provision for bad debts |

|

148 |

|

|

|

197 |

|

|

Loss on the disposition of businesses, property, equipment and

other assets |

|

1,649 |

|

|

|

51 |

|

|

Gain on debt extinguishment |

|

(21,518 |

) |

|

|

— |

|

|

Provision (benefit) for deferred income taxes and reserve

adjustments |

|

451 |

|

|

|

141 |

|

|

Loss on equity method investment, net of taxes |

|

2,403 |

|

|

|

747 |

|

|

Asset impairment charges |

|

143,733 |

|

|

|

14,856 |

|

|

Changes in operating accounts: |

|

|

|

|

Accounts receivable |

|

2,594 |

|

|

|

(11,706 |

) |

|

Inventories |

|

5,972 |

|

|

|

(23,106 |

) |

|

Prepaid expenses and other current assets |

|

6,831 |

|

|

|

(2,790 |

) |

|

Accounts payable |

|

(7,201 |

) |

|

|

(7,717 |

) |

|

Deferred revenue and customer deposits |

|

4,533 |

|

|

|

1,351 |

|

|

Accrued and other liabilities |

|

(9,843 |

) |

|

|

(16,066 |

) |

|

All other operating activities |

|

(8,601 |

) |

|

|

(12,495 |

) |

|

Net cash used in operating activities |

|

(37,109 |

) |

|

|

(71,893 |

) |

| Cash flows from investing

activities: |

|

|

|

|

Purchases of property and equipment |

|

(10,798 |

) |

|

|

(20,995 |

) |

|

Sales and maturities of short-term investments |

|

— |

|

|

|

180,925 |

|

|

Proceeds from sale of assets and businesses, net of cash sold |

|

96 |

|

|

|

— |

|

|

Acquisitions and other investments, net of cash acquired |

|

(2,450 |

) |

|

|

(29,241 |

) |

|

Net cash (used in) provided by investing activities |

|

(13,152 |

) |

|

|

130,689 |

|

| Cash flows from financing

activities: |

|

|

|

|

Repayment of borrowings/long-term debt |

|

(87,218 |

) |

|

|

— |

|

|

Taxes paid related to net-share settlement of equity awards |

|

(2,526 |

) |

|

|

(4,752 |

) |

|

Other financing activities |

|

(1,003 |

) |

|

|

(463 |

) |

|

Net cash used in financing activities |

|

(90,747 |

) |

|

|

(5,215 |

) |

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

(530 |

) |

|

|

1,561 |

|

| Net (decrease) increase in

cash, cash equivalents and restricted cash |

|

(141,538 |

) |

|

|

55,142 |

|

| Cash, cash equivalents and

restricted cash at the beginning of the year (a) |

|

333,111 |

|

|

|

391,975 |

|

| Cash, cash equivalents and

restricted cash at the end of the period (a) |

$ |

191,573 |

|

|

$ |

447,117 |

|

|

(a) |

The following table provides a reconciliation of cash, cash

equivalents, and restricted cash reported within the condensed

consolidated balance sheets to the total of such amounts reported

in the condensed consolidated statements of cash flows. |

| (in

thousands) |

September 30, 2024 |

|

December 31, 2023 |

|

September 30, 2023 |

|

December 31, 2022 |

|

Cash and cash equivalents |

$ |

190,005 |

|

$ |

331,525 |

|

$ |

445,554 |

|

$ |

388,134 |

| Restricted cash included in

prepaid expenses and other current assets |

|

122 |

|

|

119 |

|

|

118 |

|

|

114 |

| Restricted cash included in

other assets |

|

1,446 |

|

|

1,467 |

|

|

1,445 |

|

|

3,727 |

| Total cash, cash equivalents

and restricted cash shown in the condensed consolidated statements

of cash flows |

$ |

191,573 |

|

$ |

333,111 |

|

$ |

447,117 |

|

$ |

391,975 |

Amounts included in restricted cash as of September 30, 2024,

December 31, 2023 and September 30, 2023 primarily relate to

guarantees in the form of a standby letter of credit as security

for a long-term real estate lease. Amounts included in restricted

cash as of December 31, 2022 primarily relate to $3,435 deposited

into an escrow account relating to the initial investment in the

National Additive Manufacturing innovation ("NAMI") joint venture.

The remaining amounts in restricted cash in all periods presented

relate to collateral for letters of credit and bank guarantees.

| |

|

Appendix3D Systems

CorporationUnaudited Reconciliations of GAAP to

Non-GAAP MeasuresThree and Nine

Months Ended September 30,

2024, 2023 |

| |

| Gross

Profit and Gross Profit Margin (1) |

| |

Three Months Ended September 30, |

| (in

millions) |

|

2024 |

|

|

|

2023 |

|

|

|

Gross Profit |

|

Gross Profit Margin |

|

Gross Profit |

|

Gross Profit Margin |

|

GAAP |

$ |

41.7 |

|

36.9 |

% |

|

$ |

55.4 |

|

44.7 |

% |

|

Amortization expense included in Cost of sales |

|

0.3 |

|

|

|

|

0.1 |

|

|

|

Severance accrual adjustment |

|

0.5 |

|

|

|

|

— |

|

|

| Non-GAAP

(2) |

$ |

42.5 |

|

37.6 |

% |

|

$ |

55.5 |

|

44.8 |

% |

(1) Amounts in table may not foot due to rounding(2)

Calculated as non-GAAP gross profit as a percentage of total

revenue

| |

Nine Months Ended September 30, |

| (in

millions) |

|

2024 |

|

|

|

2023 |

|

|

|

Gross Profit |

|

Gross Profit Margin |

|

Gross Profit |

|

Gross Profit Margin |

|

GAAP |

$ |

129.7 |

|

|

39.4 |

% |

|

$ |

152.5 |

|

40.9 |

% |

|

Amortization expense included in Cost of sales |

|

0.8 |

|

|

|

|

|

0.1 |

|

|

|

Severance accrual adjustment |

|

(0.5 |

) |

|

|

|

|

— |

|

|

| Non-GAAP

(2) |

$ |

130.0 |

|

|

39.5 |

% |

|

$ |

152.6 |

|

40.9 |

% |

(1) Amounts in table may not foot due to rounding(2)

Calculated as non-GAAP gross profit as a percentage of total

revenue

Non-GAAP Operating

Expense(1)

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating expense |

$ |

222.5 |

|

|

$ |

68.9 |

|

|

$ |

376.8 |

|

|

$ |

231.2 |

|

|

Amortization expense |

|

(8.1 |

) |

|

|

(3.1 |

) |

|

|

(12.4 |

) |

|

|

(9.6 |

) |

|

Stock-based compensation expense |

|

(5.8 |

) |

|

|

3.1 |

|

|

|

(17.4 |

) |

|

|

(15.1 |

) |

|

Acquisition and divestiture-related expense |

|

(0.6 |

) |

|

|

4.1 |

|

|

|

(0.8 |

) |

|

|

(0.1 |

) |

| Legal

and other expense |

|

(2.6 |

) |

|

|

(2.1 |

) |

|

|

(9.2 |

) |

|

|

(4.9 |

) |

|

Restructuring expense |

|

(0.2 |

) |

|

|

(1.5 |

) |

|

|

(1.4 |

) |

|

|

(6.7 |

) |

| Asset

impairment charges |

|

(143.7 |

) |

|

|

(13.6 |

) |

|

|

(143.7 |

) |

|

|

(14.2 |

) |

|

Non-GAAP operating expense |

$ |

61.4 |

|

|

$ |

55.8 |

|

|

$ |

191.9 |

|

|

$ |

180.6 |

|

(1) Amounts in table may not foot due to rounding

| |

|

Appendix3D Systems

CorporationUnaudited Reconciliations of GAAP to

Non-GAAP MeasuresThree and Nine

Months Ended September 30,

2024, 2023 |

| |

| Net Loss

to Adjusted EBITDA (1) |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss

attributable to 3D Systems Corporation |

$ |

(178.6 |

) |

|

$ |

(11.7 |

) |

|

$ |

(221.9 |

) |

|

$ |

(70.0 |

) |

| Interest

(income) expense, net |

|

(0.9 |

) |

|

|

(4.9 |

) |

|

|

(3.9 |

) |

|

|

(13.1 |

) |

|

Provision for income taxes |

|

(4.3 |

) |

|

|

0.2 |

|

|

|

(2.5 |

) |

|

|

0.4 |

|

|

Depreciation expense |

|

4.6 |

|

|

|

5.1 |

|

|

|

14.5 |

|

|

|

15.7 |

|

|

Amortization expense |

|

8.4 |

|

|

|

3.2 |

|

|

|

13.3 |

|

|

|

9.7 |

|

|

EBITDA |

|

(170.9 |

) |

|

|

(8.2 |

) |

|

|

(200.5 |

) |

|

|

(57.4 |

) |

|

Stock-based compensation expense |

|

5.8 |

|

|

|

(3.1 |

) |

|

|

17.4 |

|

|

|

15.1 |

|

|

Acquisition and divestiture-related expense |

|

0.6 |

|

|

|

(4.1 |

) |

|

|

0.8 |

|

|

|

0.1 |

|

| Legal

and other related costs |

|

2.6 |

|

|

|

2.1 |

|

|

|

9.2 |

|

|

|

4.9 |

|

|

Restructuring expense |

|

0.7 |

|

|

|

1.5 |

|

|

|

0.8 |

|

|

|

6.7 |

|

| Net loss

attributable to redeemable non-controlling interest |

|

(0.1 |

) |

|

|

(0.1 |

) |

|

|

(0.3 |

) |

|

|

(0.1 |

) |

| Loss on

equity method investments, net of tax |

|

1.3 |

|

|

|

0.6 |

|

|

|

2.4 |

|

|

|

0.7 |

|

| Gain on

repurchase of debt |

|

— |

|

|

|

— |

|

|

|

(21.5 |

) |

|

|

— |

|

| Asset

impairment charges |

|

143.7 |

|

|

|

13.6 |

|

|

|

143.7 |

|

|

|

14.2 |

|

| Other

non-operating expense (income) |

|

2.0 |

|

|

|

2.3 |

|

|

|

0.6 |

|

|

|

3.4 |

|

|

Adjusted EBITDA |

$ |

(14.3 |

) |

|

$ |

4.7 |

|

|

$ |

(47.3 |

) |

|

$ |

(12.3 |

) |

(1) Amounts in table may not foot due to rounding

| |

|

Appendix3D Systems

CorporationUnaudited Reconciliations of GAAP to

Non-GAAP MeasuresThree and Nine

Months Ended September 30,

2024, 2023 |

| |

| Diluted

Loss per Share (1) |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in dollars) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Diluted

loss per share |

$ |

(1.35 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1.69 |

) |

|

$ |

(0.54 |

) |

|

Stock-based compensation expense |

|

0.04 |

|

|

|

(0.02 |

) |

|

|

0.13 |

|

|

|

0.12 |

|

|

Amortization expense |

|

0.06 |

|

|

|

0.02 |

|

|

|

0.10 |

|

|

|

0.07 |

|

|

Acquisition and divestiture-related expense |

|

— |

|

|

|

(0.03 |

) |

|

|

0.01 |

|

|

|

— |

|

|

Legal expense |

|

0.02 |

|

|

|

0.02 |

|

|

|

0.07 |

|

|

|

0.04 |

|

|

Asset impairment charges |

|

1.09 |

|

|

|

0.10 |

|

|

|

1.09 |

|

|

|

0.11 |

|

|

Restructuring expense |

|

0.01 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.05 |

|

|

Gain on repurchase of debt |

|

— |

|

|

|

— |

|

|

|

(0.16 |

) |

|

|

— |

|

|

Loss on equity method investment and other |

|

0.01 |

|

|

|

— |

|

|

|

0.02 |

|

|

|

0.01 |

|

| Non-GAAP

diluted loss per share |

$ |

(0.12 |

) |

|

$ |

0.01 |

|

|

$ |

(0.42 |

) |

|

$ |

(0.15 |

) |

(1) Amounts in table may not foot due to rounding

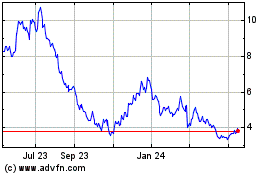

3D Systems (NYSE:DDD)

Historical Stock Chart

From Nov 2024 to Dec 2024

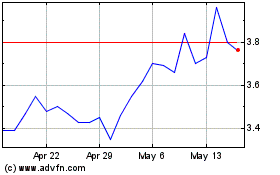

3D Systems (NYSE:DDD)

Historical Stock Chart

From Dec 2023 to Dec 2024