Douglas Emmett Announces 2024 Tax Treatment of Dividends

January 20 2025 - 4:03PM

Business Wire

Douglas Emmett, Inc. (NYSE: DEI), a real estate investment trust

(REIT), announced today the tax treatment of its 2024 common stock

dividends as described below. Shareholders are encouraged to

consult with their personal tax advisors as to their specific tax

treatment of Douglas Emmett dividends.

Record Date

Paid Date

Dividend Per

Share

Ordinary

Income

Capital

Gain

Return of

Capital

Amount Qualifying as a Section

199A Dividend

12/29/23

01/17/24

$0.19

$0.0095

$0.00

$0.1805

$0.0095

03/28/24

04/16/24

$0.19

$0.0095

$0.00

$0.1805

$0.0095

06/28/24

07/16/24

$0.19

$0.0095

$0.00

$0.1805

$0.0095

09/30/24

10/16/24

$0.19

$0.0095

$0.00

$0.1805

$0.0095

Total:

$0.76

$0.0380

$0.00

$0.7220

$0.0380

As noted above, the common stock dividend paid on January 17,

2024, with a record date of December 29, 2023, has been allocated

entirely to 2024. The common stock dividend of $0.19 per share that

was paid on January 15, 2025, with a record date of December 31,

2024, will be allocated entirely to 2025.

About Douglas Emmett,

Inc.

Douglas Emmett, Inc. (DEI) is a fully integrated,

self-administered and self-managed real estate investment trust

(REIT), and one of the largest owners and operators of high-quality

office and multifamily properties located in the premier coastal

submarkets of Los Angeles and Honolulu. Douglas Emmett focuses on

owning and acquiring a substantial share of top-tier office

properties and premier multifamily communities in neighborhoods

that possess significant supply constraints, high-end executive

housing and key lifestyle amenities. For more information about

Douglas Emmett, please visit our website at

www.douglasemmett.com.

Safe Harbor Statement

Except for the historical facts, the statements in this press

release regarding Douglas Emmett’s business activities are

forward-looking statements based on the beliefs of, assumptions

made by, and information currently available to us about known and

unknown risks, trends, uncertainties and factors that are beyond

our control or ability to predict. Although we believe that our

assumptions are reasonable, they are not guarantees of future

performance and some will inevitably prove to be incorrect. As a

result, our actual future results can be expected to differ from

our expectations, and those differences may be material.

Accordingly, investors should use caution in relying on

forward-looking statements to anticipate future results or trends.

For a discussion of some of the risks and uncertainties that could

cause actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” in our Annual Report

on Form 10-K filed with the U.S. Securities and Exchange

Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250120399871/en/

Stuart McElhinney, Vice President – Investor Relations

310.255.7751 smcelhinney@douglasemmett.com

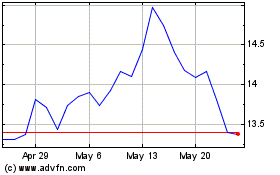

Douglas Emmett (NYSE:DEI)

Historical Stock Chart

From Jan 2025 to Feb 2025

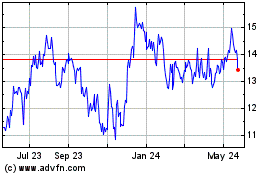

Douglas Emmett (NYSE:DEI)

Historical Stock Chart

From Feb 2024 to Feb 2025