0000027996false00000279962025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2025

DELUXE CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| MN | 1-7945 | 41-0216800 |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

801 S. Marquette Ave., Minneapolis, MN | | 55402-2807 |

| (Address of principal executive offices) | (Zip Code) |

(651) 483-7111

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, par value $1.00 per share | DLX | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

Furnished as Exhibit 99.1 is the earnings release of Deluxe Corporation reporting results from fourth quarter and full year 2024.

The information in this Item 2.02 and Exhibit 99.1 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference into any filings under the Securities Act of 1933, as amended.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| 101.INS | | XBRL Instance Document – the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

| 101.SCH | | XBRL Taxonomy Extension Schema Document |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | | Cover page interactive data file (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 5, 2025

| | | | | | | | |

| DELUXE CORPORATION | |

| | |

| /s/ Jeffrey L. Cotter | |

| | |

| Jeffrey L. Cotter | |

| Senior Vice President, Chief | |

| Administrative Officer and | |

| General Counsel | |

Contact:

| | | | | | | | |

| Brian Anderson, VP, Strategy & Investor Relations | | Keith Negrin, VP, Communications |

| 651-447-4197 | | 612-669-1459 |

| brian.anderson@deluxe.com | | keith.negrin@deluxe.com |

DELUXE REPORTS FOURTH QUARTER AND FULL YEAR 2024 RESULTS;

PROVIDES FULL YEAR 2025 OUTLOOK

•Full year reported revenue decreased 3.2%, while comparable adjusted revenue decreased 1.2%.

•Full year net income was $52.9 million, improving from $26.2 million in 2023, on cost management and lower restructuring spend.

•Comparable adjusted EBITDA increased 3.9% to $406.5 million for the full year.

•Full year GAAP diluted EPS was $1.18 versus $0.59 in 2023; comparable adjusted diluted EPS improved 7.9% to $3.26.

•2024 cash from operating activities was $194.3 million; free cash flow increased 2.4% to $100.0 million.

•Total debt reduced by $89.8 million, while net debt reduced by $52.2 million.

Minneapolis – February 5, 2025 – Deluxe (NYSE: DLX), a trusted Payments and Data company, today reported operating results for its fourth quarter and year ended December 31, 2024.

“We drove four consecutive quarters of operating leverage in 2024, with comparable adjusted EBITDA growth outpacing our revenue trajectory for the second year in a row. We deployed our improving free cash flow to reduce net debt while continuing to invest for growth across our Payments and Data platforms and paying our regular dividend. All of this means our North Star earnings and cash flow acceleration plan is on-track,” said Barry McCarthy, President and CEO of Deluxe. “Our full-year mid-single-digit or greater revenue growth in both the Data Solutions and Merchant Services segments provides us momentum entering 2025."

“We were particularly pleased with our ability to expand our comparable adjusted EBITDA margin, as we materially lowered our Corporate expenses and improved our debt position during 2024. The company delivered solidly against each of our clear capital allocation priorities,” said Chip Zint, Senior Vice President and Chief Financial Officer of Deluxe. “Refinancing of our debt capital stack during the fourth quarter further positions the organization to support key growth opportunities over the coming years.”

Full Year 2024 Financial Highlights

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | |

| Full Year 2024 | | Full Year 2023 | | % Change |

| Revenue | $2,121.8 | | | $2,192.3 | | | (3.2 | %) |

| Comparable Adjusted Revenue | $2,111.0 | | | $2,136.5 | | | (1.2 | %) |

| Net Income | $52.9 | | | $26.2 | | | 101.9 | % |

| | | | | |

| Comparable Adjusted EBITDA | $406.5 | | | $391.2 | | | 3.9 | % |

| Diluted EPS | $1.18 | | | $0.59 | | | 100.0 | % |

| | | | | |

| Comparable Adjusted Diluted EPS | $3.26 | | | $3.02 | | 7.9 | % |

•Revenue for the full year decreased 3.2% from the previous year. Comparable adjusted revenue, reflecting the removal of business exits, decreased 1.2% compared to the previous year.

•Net income of $52.9 million was up from $26.2 million in 2023.

•Comparable adjusted EBITDA margin was 19.3%, up 100 basis points from the prior year.

•Comparable adjusted diluted EPS of $3.26 was up 7.9% year over year.

Fourth Quarter 2024 Financial Highlights

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | |

| 4th Quarter 2024 | | 4th Quarter 2023 | | % Change |

| Revenue | $520.5 | | | $537.4 | | | (3.1 | %) |

| Comparable Adjusted Revenue | $520.1 | | | $531.3 | | | (2.1 | %) |

| Net Income | $12.6 | | | $15.0 | | | (16.0 | %) |

| | | | | |

| Comparable Adjusted EBITDA | $103.4 | | | $102.6 | | | 0.8 | % |

| Diluted EPS | $0.28 | | | $0.34 | | | (17.6 | %) |

| | | | | |

| Comparable Adjusted Diluted EPS | $0.84 | | | $0.77 | | 9.1 | % |

•Revenue for the fourth quarter decreased 3.1% from the previous year. Comparable adjusted revenue, reflecting the removal of business exits, decreased 2.1% compared to the previous year.

•Net income of $12.6 million was down from $15.0 million in the fourth quarter of 2023.

•Comparable adjusted EBITDA margin was 19.9%, up 60 basis points from the prior year.

•Comparable adjusted diluted EPS of $0.84 was up 9.1% year over year.

Outlook

The Company expects the following for full-year 2025:

•Revenue of $2.090 to $2.155 billion

•Adjusted EBITDA of $415 to $435 million

•Adjusted diluted EPS of $3.25 to $3.55

•Free cash flow of $120 to $140 million

This guidance remains subject to, among other things, prevailing macroeconomic conditions, global instability, labor supply challenges, inflation, and the impact of other potential changes to the company's portfolio.

Capital Allocation and Dividend

The Board of Directors recently approved a regular quarterly dividend of $0.30 per share. The dividend will be payable on March 3, 2025, to shareholders of record as of market closing on February 18, 2025.

Earnings Call Information

Deluxe management will host a conference call today at 5:00 p.m. ET (4:00 p.m. CT) to review the financial results. Listeners can access the call by dialing 1-877-400-0505 (access code 1133292). The audio and accompanying slides will be available via a simultaneous webcast on the investor relations website at www.investors.deluxe.com. A replay will be available after 8:00 p.m. ET through midnight on February 12, 2025, via the webcast link and listen-by-phone option.

About Deluxe Corporation

Deluxe, a trusted Payments and Data company, champions business so communities thrive. Our solutions help businesses pay, get paid, and grow. For more than 100 years, Deluxe customers have relied on our solutions and platforms at all stages of their lifecycle, from start-up to maturity. Our powerful scale supports millions of small businesses, thousands of vital financial institutions, and hundreds of the world’s largest consumer brands, while processing more than $2 trillion in annual payment volume. Our reach, scale, and distribution channels position Deluxe to be our customers’ most trusted business partner. To learn how we can help your business, visit us at www.deluxe.com, www.facebook.com/deluxecorp, www.linkedin.com/company/deluxe, or www.x.com/deluxe.

Forward-Looking Statements

Statements made in this release concerning Deluxe, the company’s, or management’s intentions, expectations, outlook, or predictions about future results or events are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements reflect management’s current intentions or beliefs and are subject to risks and uncertainties that could cause

actual results or events to vary from stated expectations, which variations could be material and adverse. Factors that could produce such a variation include, but are not limited to, the following: changes in local, regional, national, and international economic or political conditions, including those resulting from heightened inflation, rising interest rates, a recession, or intensified international hostilities, and the impact they may have on the company, its data, customers, or demand for the company’s products and services; the effect of proposed and enacted legislative and regulatory actions affecting the company or the financial services industry as a whole; continuing cost increases and/or declines in the availability of data, materials, and other services; the company’s ability to execute its strategy and to realize the intended benefits; the inherent unreliability of earnings, revenue, and cash flow predictions due to numerous factors, many of which are beyond the company’s control; declining demand for the company’s checks, check-related products and services, and business forms; risks that the company’s strategies intended to drive sustained revenue and earnings growth, despite the continuing decline in checks and forms, are delayed or unsuccessful; intense competition; continued consolidation of financial institutions and/or bank failures, thereby reducing the number of potential customers and referral sources and increasing downward pressure on the company’s revenue and gross profit; risks related to acquisitions, including integration-related risks and risks that future acquisitions will not be consummated; risks that any such acquisitions do not produce the anticipated results or synergies; risks that the company’s cost reduction initiatives will be delayed or unsuccessful; risks related to any divestitures contemplated or undertaken by the company; performance shortfalls by one or more of the company’s major suppliers, licensors, data or service providers; continuing supply chain and labor supply issues; unanticipated delays, costs, and expenses in the development and marketing of products and services, including financial technology and treasury management solutions; the failure of such products and services to deliver the expected revenues and other financial targets; risks related to security breaches, computer malware, or other cyber-attacks; risks of interruptions to the company’s website operations or information technology systems; and risks of unfavorable outcomes and the costs to defend litigation and other disputes. The company’s forward-looking statements speak only as of the time made, and management assumes no obligation to publicly update any such statements. Additional information concerning these and other factors that could cause actual results and events to differ materially from the company’s current expectations are contained in the company’s Form 10-K for the year ended December 31, 2023, and other filings made with the SEC. The company undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events, new information, or future circumstances.

DELUXE CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF INCOME

(in millions, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $520.5 | | | $537.4 | | | $2,121.8 | | | $2,192.3 | |

Cost of revenue | (248.2) | | | (253.9) | | | (995.3) | | | (1,029.6) | |

| Gross profit | 272.3 | | | 283.5 | | | 1,126.5 | | | 1,162.7 | |

Selling, general and administrative expense | (213.5) | | | (229.1) | | | (909.2) | | | (956.1) | |

| Restructuring and integration expense | (12.7) | | | (18.2) | | | (48.6) | | | (78.2) | |

| Asset impairment charges | (1.0) | | | — | | | (7.7) | | | — | |

| Gain on sale of businesses and long-lived assets | 2.0 | | | 14.8 | | | 31.2 | | | 32.4 | |

| Operating income | 47.1 | | | 51.0 | | | 192.2 | | | 160.8 | |

| Interest expense | (32.4) | | | (31.7) | | | (123.3) | | | (125.6) | |

| Other income | 1.0 | | | 0.1 | | | 7.6 | | | 4.6 | |

| Income before income taxes | 15.7 | | | 19.4 | | | 76.5 | | | 39.8 | |

| Income tax provision | (3.1) | | | (4.4) | | | (23.6) | | | (13.6) | |

| Net income | 12.6 | | | 15.0 | | | 52.9 | | | 26.2 | |

| Non-controlling interest | — | | | — | | | (0.1) | | | (0.1) | |

| Net income attributable to Deluxe | $12.6 | | | $15.0 | | | $52.8 | | | $26.1 | |

| | | | | | | |

| Weighted average dilutive shares | 44.9 | | | 44.1 | | | 44.7 | | | 43.8 | |

| Diluted earnings per share | $0.28 | | | $0.34 | | | $1.18 | | | $0.59 | |

| Adjusted diluted earnings per share | $0.84 | | | $0.80 | | | $3.29 | | | $3.32 | |

| Comparable adjusted diluted earnings per share | $0.84 | | | $0.77 | | | $3.26 | | | $3.02 | |

| Depreciation and amortization expense | 37.8 | | | 44.7 | | | 165.5 | | | 169.7 | |

| EBITDA | 85.9 | | | 95.8 | | | 365.2 | | | 335.0 | |

| Adjusted EBITDA | 103.3 | | | 106.4 | | | 412.1 | | | 417.1 | |

| Comparable adjusted EBITDA | 103.4 | | | 102.6 | | | 406.5 | | | 391.2 | |

DELUXE CORPORATION

CONSOLIDATED CONDENSED BALANCE SHEETS

(dollars and shares in millions)

(Unaudited)

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| Cash and cash equivalents | $34.4 | | | $72.0 | |

| Other current assets | 577.2 | | | 689.0 | |

| Property, plant & equipment | 111.6 | | | 116.5 | |

| Operating lease assets | 49.4 | | | 59.0 | |

| Intangibles | 331.1 | | | 391.7 | |

| Goodwill | 1,422.7 | | | 1,430.6 | |

| Other non-current assets | 304.6 | | | 321.8 | |

| Total assets | $2,831.0 | | | $3,080.6 | |

| | | |

| Current portion of long-term debt | $37.1 | | | $86.2 | |

| Other current liabilities | 588.4 | | | 732.9 | |

| Long-term debt | 1,466.0 | | | 1,506.7 | |

| Non-current operating lease liabilities | 49.0 | | | 58.8 | |

| Other non-current liabilities | 69.6 | | | 91.4 | |

| Shareholders' equity | 620.9 | | | 604.6 | |

| Total liabilities and shareholders' equity | $2,831.0 | | | $3,080.6 | |

| | | |

| Net debt | $1,468.7 | | | $1,520.9 | |

| Shares outstanding | 44.3 | | | 43.7 | |

DELUXE CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(in millions)

(Unaudited)

| | | | | | | | | | | |

| Year Ended

December 31, |

| 2024 | | 2023 |

| Cash provided (used) by: | | | |

| Operating activities: | | | |

| Net income | $52.9 | | | $26.2 | |

| Depreciation and amortization of intangibles | 165.5 | | | 169.7 | |

| Asset impairment charges | 7.7 | | | — | |

| Gain on sale of businesses and long-lived assets | (31.2) | | | (32.4) | |

| Other | (0.6) | | | 34.9 | |

| Total operating activities | 194.3 | | | 198.4 | |

| Investing activities: | | | |

| | | |

| Proceeds from sale of businesses and long-lived assets | 23.3 | | | 53.6 | |

| Purchases of capital assets | (94.3) | | | (100.7) | |

| Other | 1.2 | | | 3.8 | |

| Total investing activities | (69.8) | | | (43.3) | |

| Financing activities: | | | |

| Net change in debt, including debt issuance costs | (97.5) | | | (55.2) | |

| Dividends | (54.2) | | | (53.3) | |

| Change in settlement processing obligations | (108.0) | | | 79.1 | |

| Other | (7.5) | | | (8.3) | |

| Total financing activities | (267.2) | | | (37.7) | |

Effect of exchange rate change on cash, cash equivalents, restricted cash and restricted cash equivalents | (6.1) | | | 3.2 | |

Net change in cash, cash equivalents, restricted cash and restricted cash equivalents | (148.8) | | | 120.6 | |

Cash, cash equivalents, restricted cash and restricted cash equivalents, beginning of year | 458.0 | | | 337.4 | |

| Cash, cash equivalents, restricted cash and restricted cash equivalents, end of year | $309.2 | | | $458.0 | |

Free cash flow | $100.0 | | | $97.7 | |

DELUXE CORPORATION

SEGMENT INFORMATION

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Merchant Services | $95.5 | | | $95.7 | | | $384.0 | | | $364.2 | |

| B2B Payments | 73.0 | | | 73.1 | | | 287.9 | | | 299.2 | |

| Data Solutions | 55.9 | | | 44.1 | | | 234.0 | | | 211.8 | |

| Print | 295.7 | | | 318.4 | | | 1,205.1 | | | 1,261.3 | |

Business exits(1) | 0.4 | | | 6.1 | | | 10.8 | | | 55.8 | |

| Total | $520.5 | | | $537.4 | | | $2,121.8 | | | $2,192.3 | |

| Comparable Adjusted Revenue | $520.1 | | | $531.3 | | | $2,111.0 | | | $2,136.5 | |

| | | | | | | |

| Adjusted EBITDA: | | | | | | | |

| Merchant Services | $20.2 | | | $21.3 | | | $78.5 | | | $74.4 | |

| B2B Payments | 14.5 | | | 17.3 | | | 57.1 | | | 62.0 | |

| Data Solutions | 12.3 | | | 7.3 | | | 60.5 | | | 46.3 | |

| Print | 94.4 | | | 102.9 | | | 376.6 | | | 400.9 | |

Business Exits(1) / Corporate | (38.1) | | | (42.4) | | | (160.6) | | | (166.5) | |

| Total | $103.3 | | | $106.4 | | | $412.1 | | | $417.1 | |

| Comparable Adjusted EBITDA | $103.4 | | | $102.6 | | | $406.5 | | | $391.2 | |

| | | | | | | |

| Adjusted EBITDA Margin: | | | | | | | |

| Merchant Services | 21.2 | % | | 22.3 | % | | 20.4 | % | | 20.4 | % |

| B2B Payments | 19.9 | % | | 23.7 | % | | 19.8 | % | | 20.7 | % |

| Data Solutions | 22.0 | % | | 16.6 | % | | 25.9 | % | | 21.9 | % |

| Print | 31.9 | % | | 32.3 | % | | 31.3 | % | | 31.8 | % |

| Total | 19.8 | % | | 19.8 | % | | 19.4 | % | | 19.0 | % |

| Comparable Adjusted EBITDA | 19.9 | % | | 19.3 | % | | 19.3 | % | | 18.3 | % |

(1) Includes the North American web hosting and logo design businesses, which were sold in June 2023, and the payroll and human resources services business, which the company exited during 2024.

Effective January 1, 2024, the company revised its reportable business segments to align with structural and management reporting changes that better reflect its portfolio mix and offerings. The company did not operate under the new segment structure during 2023. Prior period segment information has been recast to reflect the current segment structure. The methodology utilized to determine segment operating performance did not change, and information regarding this methodology is provided in the Notes to Consolidated Financial Statements included in the company's Annual Report on Form 10-K for the year ended December 31, 2023.

DELUXE CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(in millions)

(Unaudited)

The company has not reconciled the adjusted EBITDA, adjusted diluted EPS, or free cash flow outlook for 2025 to the directly comparable GAAP financial measures because the company does not provide outlook guidance for the reconciling items between net income, adjusted net income, and adjusted EBITDA, and some of these reconciling items affect cash flows from operating activities. Due to the significant uncertainty and variability associated with certain forward-looking reconciling items such as asset impairment charges, restructuring and integration expense, gains and losses on sales of businesses and long-lived assets, and certain legal-related expenses, a reconciliation of the outlook for these non-GAAP financial measures to the corresponding GAAP measures is not available without unreasonable effort. The potential impact of these reconciling items is substantial and, based on past experience, could be material.

EBITDA, ADJUSTED EBITDA, AND ADJUSTED EBITDA MARGIN

Management believes that EBITDA, adjusted EBITDA, and adjusted EBITDA margin are useful metrics for evaluating the company's operating performance. These measures eliminate the effect of interest expense, income taxes, the accounting effects of capital investments (i.e., depreciation and amortization), and certain other items that may vary for reasons unrelated to current period operating performance. Management uses these measures to assess the operating results and performance of the business, perform analytical comparisons, and identify strategies to improve performance. Additionally, management believes that an increasing adjusted EBITDA and adjusted EBITDA margin indicate an increase in the company's value. It is important to note that management does not consider EBITDA or adjusted EBITDA to be measures of cash flow, as they do not account for certain cash requirements such as interest, income taxes, debt service payments, or capital investments. Management does not consider EBITDA, adjusted EBITDA, or adjusted EBITDA margin to be substitutes for operating income or net income. Instead, management believes that these amounts are useful performance measures that should be considered in addition to GAAP performance measures.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $12.6 | | | $15.0 | | | $52.9 | | | $26.2 | |

| Non-controlling interest | — | | | — | | | (0.1) | | | (0.1) | |

| Interest expense | 32.4 | | | 31.7 | | | 123.3 | | | 125.6 | |

| Income tax provision | 3.1 | | | 4.4 | | | 23.6 | | | 13.6 | |

| Depreciation and amortization expense | 37.8 | | | 44.7 | | | 165.5 | | | 169.7 | |

| EBITDA | 85.9 | | | 95.8 | | | 365.2 | | | 335.0 | |

| Asset impairment charges | 1.0 | | | — | | | 7.7 | | | — | |

| Restructuring and integration expense | 13.4 | | | 19.5 | | | 50.5 | | | 90.5 | |

| Share-based compensation expense | 5.0 | | | 4.6 | | | 19.9 | | | 20.5 | |

| | | | | | | |

| Certain legal-related expense | — | | | — | | | — | | | 2.2 | |

| Gain on sale of businesses and long-lived assets | (2.0) | | | (14.8) | | | (31.2) | | | (32.4) | |

| Loss on sale of investment securities | — | | | 1.3 | | | — | | | 1.3 | |

| Adjusted EBITDA | $103.3 | | | $106.4 | | | $412.1 | | | $417.1 | |

| Adjusted EBITDA as a percentage of revenue (adjusted EBITDA margin) | 19.8 | % | | 19.8 | % | | 19.4 | % | | 19.0 | % |

DELUXE CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (continued)

(in millions, except per share amounts)

(Unaudited)

ADJUSTED DILUTED EPS AND COMPARABLE ADJUSTED DILUTED EPS

Management believes that adjusted diluted EPS and comparable adjusted diluted EPS are valuable metrics for providing comparable information that assists in analyzing current period operating performance and assessing future operating performance. By excluding the impact of non-cash items or items that may not be indicative of current period operating performance, adjusted diluted EPS offers a useful view of underlying business performance. While it is reasonable to expect that one or more of the excluded items will occur in future periods, the amounts recognized may vary significantly. Comparable adjusted diluted EPS also excludes the impact of business exits, allowing management to evaluate comparable results on a year-over-year basis. Management does not consider adjusted diluted EPS or comparable adjusted diluted EPS to be substitutes for GAAP performance measures, but believes that they are useful performance measures that should be considered in addition to GAAP performance measures.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $12.6 | | | $15.0 | | | $52.9 | | | $26.2 | |

| Non-controlling interest | — | | | — | | | (0.1) | | | (0.1) | |

| Net income attributable to Deluxe | 12.6 | | | 15.0 | | | 52.8 | | | 26.1 | |

| Asset impairment charges | 1.0 | | | — | | | 7.7 | | | — | |

| Acquisition amortization | 13.3 | | | 16.0 | | | 55.5 | | | 74.8 | |

| Accelerated amortization | 0.1 | | | 2.5 | | | 16.9 | | | 2.5 | |

| Restructuring and integration expense | 13.4 | | | 19.5 | | | 50.5 | | | 90.5 | |

| Share-based compensation expense | 5.0 | | | 4.6 | | | 19.9 | | | 20.5 | |

| | | | | | | |

| Certain legal-related expense | — | | | — | | | — | | | 2.2 | |

| Gain on sale of businesses and long-lived assets | (2.0) | | | (14.8) | | | (31.2) | | | (32.4) | |

| Loss on sale of investment securities | — | | | 1.3 | | | — | | | 1.3 | |

| Loss on debt retirement | 1.9 | | | — | | | 1.9 | | | — | |

| Adjustments, pre-tax | 32.7 | | | 29.1 | | | 121.2 | | | 159.4 | |

Income tax provision impact of pretax adjustments(1) | (7.8) | | | (8.9) | | | (26.7) | | | (39.6) | |

| Adjustments, net of tax | 24.9 | | | 20.2 | | | 94.5 | | | 119.8 | |

Adjusted net income attributable to Deluxe available to common shareholders (A) | 37.5 | | | 35.2 | | | 147.3 | | | 145.9 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Business exits, pretax | 0.2 | | | (1.6) | | | (2.2) | | | (18.1) | |

Income tax provision impact of business exits(1) | — | | | 0.4 | | | 0.6 | | | 4.8 | |

| Business exits, net of tax | 0.2 | | | (1.2) | | | (1.6) | | | (13.3) | |

Comparable adjusted income attributable to Deluxe available to common shareholders (B) | $37.7 | | | $34.0 | | | $145.7 | | | $132.6 | |

| | | | | | | |

Weighted-average dilutive shares(2) (C) | 45.0 | | | 44.1 | | | 44.7 | | | 43.9 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Adjusted Diluted EPS (A) / (C) | $0.84 | | | $0.80 | | | $3.29 | | | $3.32 | |

Comparable Adjusted Diluted EPS (B) / (C) | $0.84 | | | $0.77 | | | $3.26 | | | $3.02 | |

(1) The tax effect of the pretax adjustments considers the tax treatment and related tax rate(s) that apply to each adjustment in the applicable tax jurisdiction(s). Generally, this results in a tax impact that approximates the U.S. effective tax rate for each adjustment. However, the tax impact of certain adjustments, such as share-based compensation expense, depends on whether the amounts are deductible in the respective tax jurisdictions and the applicable effective tax rate(s) in those jurisdictions.

(2) Weighted-average dilutive shares used in this calculation may differ from the GAAP EPS calculation due to differences in the amount of dilutive securities in each calculation.

DELUXE CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (continued)

(in millions)

(Unaudited)

COMPARABLE ADJUSTED REVENUE, COMPARABLE ADJUSTED EBITDA, AND COMPARABLE ADJUSTED EBITDA MARGIN

Management considers the measures of comparable adjusted revenue, comparable adjusted EBITDA, and comparable adjusted EBITDA margin, which exclude the impact of business exits, as important indicators for assessing, evaluating, and improving the company's performance. By excluding the effects of business exits, management can evaluate comparable results on a year-over-year basis. These measures allow management to compare operational performance across fiscal periods when acquisitions or business exits occur.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended

December 31, | | Year Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Revenue | | $520.5 | | | $537.4 | | | $2,121.8 | | | $2,192.3 | |

| Business exits | | (0.4) | | | (6.1) | | | (10.8) | | | (55.8) | |

| Comparable adjusted revenue | | $520.1 | | | $531.3 | | | $2,111.0 | | | $2,136.5 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Adjusted EBITDA(1) | | $103.3 | | $106.4 | | $412.1 | | $417.1 |

| Business exits | | 0.1 | | (3.8) | | (5.6) | | (25.9) |

| Comparable adjusted EBITDA | | $103.4 | | $102.6 | | $406.5 | | $391.2 |

| Comparable adjusted EBITDA margin | | 19.9 | % | | 19.3 | % | | 19.3 | % | | 18.3 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1) The reconciliation of adjusted EBITDA to net income can be found on a preceding page.

NET DEBT

Net debt is calculated by subtracting cash and cash equivalents from total debt. One limitation associated with using net debt is that by subtracting cash and cash equivalents, it may imply that management intends to use these funds to reduce outstanding debt. Additionally, net debt can suggest that the company's debt obligations are lower than what the most comparable GAAP measure indicates. Despite these limitations, management believes that net debt is a valuable metric for assessing the company's financial leverage and overall balance sheet health. It provides a measure of the company's debt burden considering the funds available to offset debt obligations.

| | | | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 | | |

| Total debt | $1,503.1 | | | $1,592.9 | | | |

| Cash and cash equivalents | (34.4) | | | (72.0) | | | |

| Net debt | $1,468.7 | | | $1,520.9 | | | |

DELUXE CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (continued)

(in millions)

(Unaudited)

FREE CASH FLOW

Free cash flow is calculated as net cash provided by operating activities minus purchases of capital assets. Management considers free cash flow to be an important indicator of cash available for servicing debt and for shareholders, after making necessary capital investments to maintain or expand the company's asset base. One limitation of using the free cash flow measure is that not all of the free cash flow is available for discretionary spending. The company may have mandatory debt payments and other cash requirements that must be deducted from available cash. Despite this limitation, management believes that the measure of free cash flow offers an additional metric to consistently compare cash generated by operations. It also provides insight into the cash flow available to fund various items such as dividends, mandatory and discretionary debt reduction, acquisitions or other strategic investments, and share repurchases.

| | | | | | | | | | | | | | | | | | |

| | | | Year Ended

December 31, |

| | | | | | 2024 | | 2023 |

| Net cash provided by operating activities | | | | | | $194.3 | | | $198.4 | |

| Purchases of capital assets | | | | | | (94.3) | | | (100.7) | |

| Free cash flow | | | | | | $100.0 | | | $97.7 | |

###

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

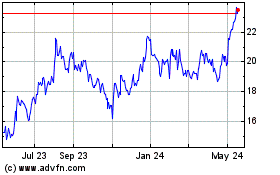

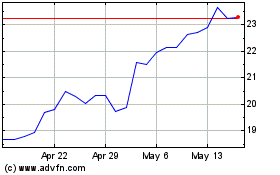

Deluxe (NYSE:DLX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Deluxe (NYSE:DLX)

Historical Stock Chart

From Feb 2024 to Feb 2025