Unveils new strategy focused on both directly

licensing its patented Instant Underwriting technology to largest

mortgage originators and secondary market purchasers, and the

continued rollout of Instant Underwriting technology for its

Independent Agents to serve traditional channels

Continues making progress towards reaching

adjusted EBITDA profitability in 2023

Recently divested non-core Local retail

business to align with new strategy

Doma Holdings, Inc. (NYSE: DOMA) (“Doma” or the “Company”), a

leading force for disruptive change in the real estate industry,

today reported quarterly financial results and key operating data

for the three months ended June 30, 2023(1).

Second Quarter 2023 Business Highlights(2):

- Total revenues of $89 million, up 19% versus Q1 2023

- Retained premiums and fees of $31 million, up 22% versus Q1

2023

- Gross profit of $6 million, up 312% versus Q1 2023

- Adjusted gross profit of $9 million, up 97% versus Q1 2023

- Adjusted EBITDA loss of $14 million, compared to a loss of $22

million in Q1 2023

- Purchase closed orders up 26% versus Q1 2023, Refinance closed

orders down 16% versus Q1 2023, and Total closed orders up 12%

versus Q1 2023

“We’re excited to unveil a new strategy that will ensure our

patented technology helps address the significant home

affordability challenge facing millions of Americans. We believe

our strengthened focus on deploying our instant underwriting

technology on a broader scale, through both licensing our software

and working with our independent agent community, will enable us to

grow the business in a more capital-efficient manner,” said Max

Simkoff, CEO of Doma. “Initially as part of our new licensing

strategy, we will focus on licensing our technology directly to

several of the largest mortgage originators and secondary market

purchasers in the country, so that they can utilize our patented

underwriting technologies platform to instantly and safely ensure

clear title for their customers while significantly reducing the

amount of fees paid by consumers. We are in discussion with several

of these parties regarding a commercial framework that would allow

us to bring this model to life at a crucial period.”

Simkoff added, “With home affordability still at record lows,

there has never been a more critical time for us to realize our

bold vision and I can say that with our new go-forward strategy, we

have never been more strongly positioned to make a true impact and

to make homeownership more affordable. Aligned with this focus on

our underwriting business and the licensing of our technology, we

have now fully exited all Local retail operations nationwide. I

want to thank our local team for their hard work and dedication

over the years.”

“We remain focused on reaching our goal of achieving adjusted

EBITDA profitability this year and we were pleased to see an $8

million improvement in our adjusted EBITDA loss this quarter,” said

Mike Smith, Chief Financial Officer of Doma. “We expect to see a

further significant adjusted EBITDA improvement from Q2 to Q3,

driven by the continued benefit of the cost reduction actions

implemented at the end of 2022, cost savings related to our most

recent reductions, the sale of our Local business, and additional

savings as we continue to further streamline expenses. We believe

the steps we have taken reposition the business to succeed in any

macroeconomic environment, and we remain highly focused on

successfully executing on implementing our new strategy. We look

forward to providing updates over the coming quarters.”

(1)

Doma completed its business combination

with Capitol Investment Corp. V ("Capitol") on July 28, 2021. The

financial results and key operating data included in this fourth

quarter release include operating results of Doma prior to

completion of the business combination and operating results of the

combined company subsequent to completion of the business

combination.

(2)

Reconciliations of retained premiums and

fees, adjusted gross profit, and the other financial measures used

in this press release that are not calculated in accordance with

generally accepted accounting principles in the United States

(“GAAP”) to the nearest measures prepared in accordance with GAAP

have been provided in this press release in the accompanying

tables. An explanation of these measures is also included below

under the heading “Non-GAAP Financial Measures.”

Non-GAAP Financial Measures

Some of the financial information and data contained in this

press release, such as retained premiums and fees, adjusted gross

profit and adjusted EBITDA, have not been prepared in accordance

with United States generally accepted accounting principles

("GAAP"). Retained premiums and fees is defined as revenue less

premiums retained by third-party agents. Adjusted gross profit is

defined as gross profit (loss), adjusted to exclude the impact of

depreciation and amortization. Adjusted EBITDA is defined as net

income (loss) before interest, income taxes, depreciation and

amortization, and further adjusted to exclude the impact of

stock-based compensation, severance costs, goodwill impairment,

long-lived asset impairment, the change in fair value of warrant

and sponsor covered shares liabilities, loss on sale of business,

gain on sale of title plant, and accelerated contract expense. Doma

believes that the use of retained premiums and fees, adjusted gross

profit and adjusted EBITDA provides additional tools to assess

operational performance and trends in, and in comparing Doma's

financial measures with, other similar companies, many of which

present similar non-GAAP financial measures to investors. Doma’s

non-GAAP financial measures may be different from non-GAAP

financial measures used by other companies. The presentation of

non-GAAP financial measures is not intended to be considered in

isolation or as a substitute for, or superior to, financial

measures determined in accordance with GAAP. Because of the

limitations of non-GAAP financial measures, you should consider the

non-GAAP financial measures presented herein in conjunction with

Doma’s financial statements and the related notes thereto. Please

refer to the non-GAAP reconciliations in this press release for a

reconciliation of these non-GAAP financial measures to the most

comparable financial measure prepared in accordance with GAAP.

Conference Call Information

Doma will host a conference call at 5:00 PM Eastern Time today

on Tuesday, August 8, to present its second quarter 2023 financial

results.

Dial-in Details: To access the call by phone, please go to this

link (registration link) and you will be provided with dial-in

details. To avoid delays, we encourage participants to dial into

the conference call fifteen minutes ahead of the scheduled start

time.

The live webcast of the call will be accessible on the Company’s

website at investor.doma.com. Approximately two hours after

conclusion of the live event, an archived webcast of the conference

call will be accessible from the Investor Relations section of the

Company’s website for twelve months.

About Doma Holdings, Inc.

Doma is a real estate technology company that is disrupting a

century-old industry by building an instant and frictionless home

closing experience for buyers and sellers. Doma uses proprietary

machine intelligence technology and deep human expertise to create

a vastly more simple and affordable experience for everyone

involved in a residential real estate transaction, including

current and prospective homeowners, mortgage lenders, title agents,

and real estate professionals. With Doma, what used to take days

can now be done in minutes, replacing an arcane and cumbersome

process with a digital experience designed for today’s world. To

learn more visit doma.com.

Forward-Looking Statements Legend

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

"estimate," "plan," "project," "forecast," "intend," "will,"

"expect," "anticipate," "believe," "seek," "target" or other

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. The

absence of these words does not mean that a statement is not

forward-looking. Such statements are based on the beliefs of, as

well as assumptions made by information currently available to Doma

management. These forward-looking statements include, but are not

limited to, statements regarding our ability to offer our

technology through, and enter into commercial relationships with,

primary and/or secondary mortgage market participants and/or their

customers, estimates and forecasts of financial and performance

metrics, projections of market opportunity, total addressable

market ("TAM"), market share and competition. These statements are

based on various assumptions, whether or not identified in this

press release, and on the current expectation of Doma’s management

and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on by

any investor as, a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict, will differ

from assumptions and are beyond the control of Doma.

These forward-looking statements are subject to a number of

risks and uncertainties, including changes in business, market,

financial, political and legal conditions; risks relating to the

uncertainty of the projected financial information with respect to

Doma; future global, regional or local economic, political, market

and social conditions, including due to the COVID-19 pandemic; the

development, effects and enforcement of laws and regulations,

including with respect to the title insurance industry; Doma’s

ability to manage its future growth or to develop or acquire

enhancements to its platform; the effects of competition on Doma’s

future business; the outcome of any potential litigation,

government and regulatory proceedings, investigations and

inquiries; and those other factors described in Part I, Item 1A -

“Risk Factors” of our Annual Report on Form 10-K for the year ended

December 31, 2022 and any subsequent reports filed by Doma from

time to time with the U.S. Securities and Exchange Commission (the

“SEC”).

If any of these risks materialize or Doma’s assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be

additional risks that Doma does not presently know or that Doma

currently believes are immaterial that could also cause actual

results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect Doma’s

expectations, plans or forecasts of future events and views as of

the date of this press release. Doma anticipates that subsequent

events and developments will cause Doma’s assessments to change.

However, while Doma may elect to update these forward-looking

statements at some point in the future, Doma specifically disclaims

any obligation to do so, except as required by law. These

forward-looking statements should not be relied upon as

representing Doma’s assessment as of any date subsequent to the

date of this press release. Accordingly, undue reliance should not

be placed upon the forward-looking statements.

Key Operating and Financial Indicators

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

(Unaudited - in thousands, except

for open and closed order

numbers)

Key operating data:

Opened orders

8,368

25,231

18,308

60,423

Closed orders

7,036

18,799

13,316

46,146

GAAP financial data:

Revenue (1)

$

88,853

$

123,744

$

163,221

$

235,951

Gross profit (2)

$

5,747

$

7,143

$

7,143

$

14,277

Net loss (3)

$

(35,877

)

$

(58,652

)

$

(78,000

)

$

(108,678

)

Non-GAAP financial data (4):

Retained premiums and fees

$

30,689

$

49,106

$

55,873

$

100,711

Adjusted gross profit

$

8,818

$

10,890

$

13,289

$

21,260

Ratio of adjusted gross profit to retained

premiums and fees

29

%

22

%

24

%

21

%

Adjusted EBITDA

$

(13,707

)

$

(43,390

)

$

(35,298

)

$

(88,295

)

_________________

(1)

Revenue is comprised of (i) net premiums

written, (ii) escrow, other title-related fees and other, and (iii)

investment, dividend and other income.

(2)

Gross profit, calculated in accordance

with GAAP, is calculated as total revenue, minus premiums retained

by third-party agents, direct labor expense (including mainly

personnel expense for certain employees involved in the direct

fulfillment of policies) and direct non-labor expense (including

mainly title examination expense, provision for claims, and

depreciation and amortization). In our consolidated income

statements, depreciation and amortization is recorded under the

“other operating expenses” caption.

(3)

Net loss is made up of the components of

revenue and expenses.

(4)

Retained premiums and fees, adjusted gross

profit and adjusted EBITDA are non-GAAP financial measures.

Non-GAAP Financial Measures

Retained premiums and fees

The following table reconciles our retained premiums and fees to

our gross profit, the most closely comparable GAAP financial

measure, for the periods indicated:

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

(Unaudited - in thousands)

Revenue

$

88,853

$

123,744

$

163,221

$

235,951

Minus:

Premiums retained by Third-Party

Agents

58,164

74,638

107,348

135,240

Retained premiums and fees

$

30,689

$

49,106

$

55,873

$

100,711

Minus:

Direct labor

9,931

23,890

22,868

51,688

Provision for claims

5,780

6,310

9,739

10,921

Depreciation and amortization

3,071

3,747

6,146

6,983

Other direct costs (1)

6,160

8,016

9,977

16,842

Gross Profit

$

5,747

$

7,143

$

7,143

$

14,277

__________________

(1)

Includes title examination expense, office

supplies, and premium and other taxes.

Adjusted gross profit

The following table reconciles our adjusted gross profit to our

gross profit, the most closely comparable GAAP financial measure,

for the periods indicated:

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

(Unaudited - in thousands)

Gross Profit

$

5,747

$

7,143

$

7,143

$

14,277

Adjusted for:

Depreciation and amortization

3,071

3,747

6,146

6,983

Adjusted Gross Profit

$

8,818

$

10,890

$

13,289

$

21,260

Adjusted EBITDA

The following table reconciles our adjusted EBITDA to our net

loss, the most closely comparable GAAP financial measure, for the

periods indicated:

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

(Unaudited - in thousands)

Net loss (GAAP)

$

(35,877

)

$

(58,652

)

$

(78,000

)

$

(108,678

)

Adjusted for:

Depreciation and amortization

3,071

3,747

6,146

6,983

Interest expense

5,943

4,489

10,932

8,696

Income taxes

185

136

370

321

EBITDA

$

(26,678

)

$

(50,280

)

$

(60,552

)

$

(92,678

)

Adjusted for:

Stock-based compensation

1,293

8,255

6,990

19,648

Severance and interim salary costs

2,730

3,828

9,150

3,828

Long-lived asset impairment

1,290

—

1,471

—

Change in fair value of Warrant and

Sponsor Covered Shares liabilities

(108

)

(5,193

)

(123

)

(19,093

)

Loss on sale of business

11,591

—

11,591

—

Gain on sale of title plant

(3,825

)

—

(3,825

)

—

Adjusted EBITDA

$

(13,707

)

$

(43,390

)

$

(35,298

)

$

(88,295

)

The following table reconciles our adjusted gross profit to our

adjusted EBITDA, for the periods indicated:

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

(Unaudited - in thousands)

(Unaudited - in thousands)

Adjusted Gross Profit

$

8,818

$

10,890

$

13,289

$

21,260

Minus:

Customer acquisition costs

3,748

14,853

8,772

30,778

Other indirect costs (1)

18,777

39,427

39,815

78,777

Adjusted EBITDA

$

(13,707

)

$

(43,390

)

$

(35,298

)

$

(88,295

)

__________________

(1)

Includes corporate support, research and

development, and other operating costs.

Doma Holdings, Inc.

Consolidated Statements of

Operations

Three Months Ended June

30,

Six Months Ended June

30,

(Unaudited - in thousands, except share

and per share information)

2023

2022

2023

2022

Revenues:

Net premiums written (1)

$

78,962

$

108,926

$

145,732

$

204,592

Escrow, other title-related fees and

other

8,292

14,366

14,890

30,479

Investment, dividend and other income

1,599

452

2,599

880

Total revenues

$

88,853

$

123,744

$

163,221

$

235,951

Expenses:

Premiums retained by Third-Party Agents

(2)

$

58,164

$

74,638

$

107,348

$

135,240

Title examination expense

4,164

5,146

6,164

11,127

Provision for claims

5,780

6,310

9,739

10,921

Personnel costs

27,622

73,233

68,191

151,026

Other operating expenses

13,924

23,637

29,363

46,391

Long-lived asset impairment

1,290

—

1,471

—

Gain on sale of title plant

(3,825

)

—

(3,825

)

—

Total operating expenses

$

107,119

$

182,964

$

218,451

$

354,705

Loss from operations

$

(18,266

)

$

(59,220

)

$

(55,230

)

$

(118,754

)

Other (expense) income:

Change in fair value of Warrant and

Sponsor Covered Shares liabilities

108

5,193

123

19,093

Interest expense

(5,943

)

(4,489

)

(10,932

)

(8,696

)

Loss on sale of business

(11,591

)

—

(11,591

)

—

Loss before income taxes

$

(35,692

)

$

(58,516

)

$

(77,630

)

$

(108,357

)

Income tax expense

(185

)

(136

)

(370

)

(321

)

Net loss

$

(35,877

)

$

(58,652

)

$

(78,000

)

$

(108,678

)

Earnings per share:

Net loss per share attributable to

stockholders - basic and diluted

$

(2.69

)

$

(4.51

)

$

(5.88

)

$

(8.38

)

Weighted average shares outstanding common

stock - basic and diluted

13,324,215

12,994,869

13,259,894

12,975,354

__________________

(1)

Net premiums written includes revenues

from a related party of $33.5 million and $33.7 million during the

three months ended June 30, 2023 and 2022, respectively. Net

premiums written includes revenues from a related party of $63.5

million and $61.3 million during the six months ended June 30, 2023

and 2022, respectively.

(2)

Premiums retained by Third-Party Agents

includes expenses associated with a related party of $27.1 million

and $27.2 million during the three months ended June 30, 2023 and

2022, respectively. Premiums retained by Third-Party Agents

includes expenses associated with a related party of $51.2 million

and $49.6 million during the six months ended June 30, 2023 and

2022, respectively.

Doma Holdings, Inc.

Consolidated Balance

Sheets

(Unaudited - in thousands, except share

information)

June 30, 2023

December 31,

2022

Assets

Cash and cash equivalents

$

77,610

$

78,450

Restricted cash

4,934

2,933

Investments:

Fixed maturities

Held-to-maturity debt securities, at

amortized cost (net of allowance for credit losses of $254 at June

30, 2023 and $440 at December 31, 2022)

41,578

90,328

Available-for-sale debt securities, at

fair value (amortized cost $58,106 at June 30, 2023 and $59,191 at

December 31, 2022)

57,021

58,254

Mortgage loans

46

297

Total investments

$

98,645

$

148,879

Trade and other receivables (net of

allowance for credit losses of $1,428 at June 30, 2023 and $1,488

at December 31, 2022)

24,963

21,292

Prepaid expenses, deposits and other

assets

5,468

8,124

Lease right-of-use assets

13,424

18,634

Fixed assets (net of accumulated

depreciation of $26,998 at June 30, 2023 and $24,532 at December

31, 2022)

36,497

39,383

Title plants

2,716

14,533

Goodwill

27,009

46,280

Total assets

$

291,266

$

378,508

Liabilities and stockholders’

equity

Accounts payable

$

2,128

$

2,909

Accrued expenses and other liabilities

19,478

28,892

Lease liabilities

21,740

27,489

Senior secured credit agreement, net of

debt issuance costs and original issue discount

153,164

154,790

Liability for loss and loss adjustment

expenses

83,660

82,070

Warrant liabilities

347

347

Sponsor Covered Shares liability

96

219

Total liabilities

$

280,613

$

296,716

Commitments and contingencies

Stockholders’ equity:

Common stock, 0.0001 par value; 80,000,000

shares authorized at June 30, 2023; 13,350,733 and 13,165,919

shares issued and outstanding as of June 30, 2023 and December 31,

2022, respectively

$

1

$

1

Additional paid-in capital

584,525

577,515

Accumulated deficit

(572,787

)

(494,787

)

Accumulated other comprehensive income

(1,086

)

(937

)

Total stockholders’ equity

$

10,653

$

81,792

Total liabilities and stockholders’

equity

$

291,266

$

378,508

Quarterly Results of Operations and Other Data

The following tables set forth our selected unaudited quarterly

consolidated statements of operations data for each of the quarters

indicated. The information for each quarter has been prepared on a

basis consistent with our audited consolidated financial

statements, and reflect, in the opinion of management, all

adjustments, which consist only of a normal, recurring nature that

are necessary for a fair statement of the financial information

contained in those financial statements. Our historical results are

not necessarily indicative of the results that may be expected in

the future. The following quarterly financial data should be read

in conjunction with our consolidated financial statements.

Consolidated Statements of Operations

Three Months Ended

(Unaudited - in thousands)

June 30,

2021

September

30, 2021

December

31, 2021

March 31,

2022

June 30,

2022

September

30, 2022

December

31, 2022

March 31,

2023

June 30,

2023

Revenues:

Net premiums written

$

109,271

$

141,491

$

116,598

$

95,666

$

108,926

$

94,488

$

86,173

$

66,770

$

78,962

Escrow, other title-related fees and

other

20,065

20,452

20,493

16,113

14,366

12,627

8,902

6,598

8,292

Investment, dividend and other income

650

639

588

428

452

741

1,299

1,000

1,599

Total revenues

$

129,986

$

162,582

$

137,679

$

112,207

$

123,744

$

107,856

$

96,374

$

74,368

$

88,853

Expenses:

Premiums retained by Third-Party

Agents

$

65,181

$

91,596

$

71,330

$

60,602

$

74,638

$

65,141

$

61,095

$

49,184

$

58,164

Title examination expense

5,500

5,289

6,495

5,981

5,146

3,709

3,425

2,000

4,164

Provision for claims

6,807

6,685

4,594

4,611

6,310

4,665

1,154

3,959

5,780

Personnel costs

53,954

62,410

78,306

77,793

73,233

60,481

48,432

40,569

27,622

Other operating expenses

17,181

21,693

26,912

22,754

23,637

20,656

26,172

15,439

13,924

Goodwill impairment

—

—

—

—

—

33,746

31,461

—

—

Long-lived asset impairment

—

—

—

—

—

—

32,027

181

1,290

Gain on sale of title plant

—

—

—

—

—

—

—

—

(3,825

)

Total operating expenses

$

148,623

$

187,673

$

187,637

$

171,741

$

182,964

$

188,398

$

203,766

$

111,332

$

107,119

Loss from operations

$

(18,637

)

$

(25,091

)

$

(49,958

)

$

(59,534

)

$

(59,220

)

$

(80,542

)

$

(107,392

)

$

(36,964

)

$

(18,266

)

Other income (expense):

Change in fair value of warrant and

Sponsor Covered Shares liabilities

—

(4,478

)

11,169

13,900

5,193

1,438

786

15

108

Interest expense

(4,451

)

(4,531

)

(4,519

)

(4,207

)

(4,489

)

(4,584

)

(4,800

)

(4,989

)

(5,943

)

Loss on sale of business

—

—

—

—

—

—

—

—

(11,591

)

Loss before income taxes

$

(23,088

)

$

(34,100

)

$

(43,308

)

$

(49,841

)

$

(58,516

)

$

(83,688

)

$

(111,406

)

$

(41,938

)

$

(35,692

)

Income tax expense

(211

)

(170

)

(421

)

(185

)

(136

)

(425

)

1,988

(185

)

(185

)

Net loss

$

(23,299

)

$

(34,270

)

$

(43,729

)

$

(50,026

)

$

(58,652

)

$

(84,113

)

$

(109,418

)

$

(42,123

)

$

(35,877

)

Reconciliation of GAAP to Non-GAAP Measures

The following tables present our reconciliation of GAAP measures

to non-GAAP measures for the historical periods indicated.

Retained premiums and fees

Three Months Ended

(Unaudited - in thousands)

June 30,

2021

September

30, 2021

December

31, 2021

March 31,

2022

June 30,

2022

September

30, 2022

December

31, 2022

March 31,

2023

June 30,

2023

Revenue

$

129,986

$

162,582

$

137,679

$

112,207

$

123,744

$

107,856

$

96,374

$

74,368

$

88,853

Minus:

Premiums retained by Third-Party

Agents

65,181

91,596

71,330

60,602

74,638

65,141

61,095

49,184

58,164

Retained premiums and fees

$

64,805

$

70,986

$

66,349

$

51,605

$

49,106

$

42,715

$

35,279

$

25,184

$

30,689

Minus:

Direct labor

20,902

23,948

26,787

27,798

23,890

20,220

14,665

12,937

9,931

Provision for claims

6,807

6,685

4,594

4,611

6,310

4,665

1,154

3,959

5,780

Depreciation and amortization

3,021

1,978

2,615

3,236

3,747

4,251

4,785

3,075

3,071

Other direct costs (1)

7,561

10,073

10,322

8,826

8,016

6,224

5,478

3,817

6,160

Gross Profit

$

26,514

$

28,302

$

22,031

$

7,134

$

7,143

$

7,355

$

9,197

$

1,396

$

5,747

__________________

(1)

Includes title examination expense, office

supplies, and premium and other taxes.

Adjusted gross profit

Three Months Ended

(Unaudited - in thousands)

June 30,

2021

September

30, 2021

December

31, 2021

March 31,

2022

June 30,

2022

September

30, 2022

December

31, 2022

March 31,

2023

June 30,

2023

Gross Profit

$

26,514

$

28,302

$

22,031

$

7,134

$

7,143

$

7,355

$

9,197

$

1,396

$

5,747

Adjusted for:

Depreciation and amortization

3,021

1,978

2,615

3,236

3,747

4,251

4,785

3,075

3,071

Adjusted Gross Profit

$

29,535

$

30,280

$

24,646

$

10,370

$

10,890

$

11,606

$

13,982

$

4,471

$

8,818

Adjusted EBITDA

Three Months Ended

(Unaudited - in thousands)

June 30,

2021

September

30, 2021

December

31, 2021

March 31,

2022

June 30,

2022

September

30, 2022

December

31, 2022

March 31,

2023

June 30,

2023

Net loss (GAAP)

$

(23,299

)

$

(34,270

)

$

(43,729

)

$

(50,026

)

$

(58,652

)

$

(84,113

)

$

(109,418

)

$

(42,123

)

$

(35,877

)

Adjusted for:

Depreciation and amortization

3,021

1,978

2,615

3,236

3,747

4,251

4,785

3,075

3,071

Interest expense

4,451

4,531

4,519

4,207

4,489

4,584

4,800

4,989

5,943

Income taxes

211

170

421

185

136

425

(1,988

)

185

185

EBITDA

$

(15,616

)

$

(27,591

)

$

(36,174

)

$

(42,398

)

$

(50,280

)

$

(74,853

)

$

(101,821

)

$

(33,874

)

$

(26,678

)

Adjusted for:

Stock-based compensation

3,713

3,004

11,040

11,393

8,255

7,746

6,293

5,697

1,293

Severance and interim salary costs

—

—

—

—

3,828

4,567

11,218

6,420

2,730

Goodwill impairment

—

—

—

—

—

33,746

31,461

—

—

Long-lived asset impairment

—

—

—

—

—

—

32,027

181

1,290

Change in fair value of warrant and

Sponsor Covered Shares liabilities

—

4,478

(11,169

)

(13,900

)

(5,193

)

(1,438

)

(786

)

(15

)

(108

)

Accelerated contract expense

—

—

—

—

—

—

5,221

—

—

Loss on sale of business

—

—

—

—

—

—

—

—

11,591

Gain on sale of title plant

—

—

—

—

—

—

—

—

(3,825

)

Adjusted EBITDA

$

(11,903

)

$

(20,109

)

$

(36,303

)

$

(44,905

)

$

(43,390

)

$

(30,232

)

$

(16,387

)

$

(21,591

)

$

(13,707

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230808063480/en/

Investor Contact: Carlee Herzog | Head of Investor

Relations for Doma | ir@doma.com

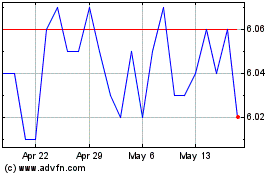

Doma (NYSE:DOMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Doma (NYSE:DOMA)

Historical Stock Chart

From Jan 2024 to Jan 2025