false000129894600012989462024-05-142024-05-140001298946us-gaap:CommonStockMember2024-05-142024-05-140001298946us-gaap:RedeemablePreferredStockMember2024-05-142024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 14, 2024

DiamondRock Hospitality Company

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-32514 | | 20-1180098 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

2 Bethesda Metro Center, Suite 1400

Bethesda, MD 20814

(Address of Principal Executive Offices) (Zip Code)

(Registrant’s telephone number, including area code): (240) 744-1150

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | DRH | | New York Stock Exchange |

| 8.250% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share | | DRH Pr A | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers

Appointment of Chief Accounting Officer

The Board of Directors of DiamondRock Hospitality Company (the “Company”) appointed Stephen Spierto to the position of Chief Accounting Officer, effective as of May 15, 2024. As Chief Accounting Officer, Mr. Spierto will serve as the Company’s principal accounting officer.

Mr. Spierto, age 34, joined the Company in November 2023 and previously served as Vice President, Corporate Controller of the Company from November 2023 until his May 2024 promotion to Chief Accounting Officer. As Vice President, Corporate Controller of the Company, Mr. Spierto was responsible for overseeing corporate accounting, financial reporting and technical accounting. Prior to joining the Company, Mr. Spierto spent 12 years in the real estate and hospitality audit practice at Ernst & Young, LLP, most recently as a Senior Manager. Mr. Spierto is a certified public accountant and earned a B.S. and Master’s in Accounting from the James Madison University.

In connection with Mr. Spierto’s appointment as Chief Accounting Officer, the Company expects to enter into an indemnification agreement with Mr. Spierto on terms consistent with those in the indemnification agreements between the Company and certain of its officers.

There are no arrangements or understandings between Mr. Spierto and any other persons pursuant to which he was appointed as the Company’s Chief Accounting Officer. Additionally, Mr. Spierto is not a party to any related party transactions required to be reported pursuant to Item 404(a) of Regulation S-K, nor does he have any family relationships with any of the Company’s directors or executive officers.

In connection with and effective as of Mr. Spierto’s appointment as Chief Accounting Officer, Briony R. Quinn, the Company’s Executive Vice President, Chief Financial Officer and Treasurer, will no longer serve as principal accounting officer. Ms. Quinn will continue to serve as principal financial officer.

Amended and Restated Severance Agreements

On May 14, 2024, the Company entered into amended and restated severance agreements with each of Jeffrey J. Donnelly, Justin Leonard and Briony Quinn (each, a “severance agreement” and, collectively, the “severance agreements”). The severance agreements are each effective as of May 14, 2024.

Pursuant to the severance agreements, each of Messrs. Donnelly and Leonard and Ms. Quinn will be entitled to receive cash severance benefits under his or her severance agreement if the Company terminates such executive’s employment without cause or such executive resigns with good reason. These severance agreements have so-called “double triggers” as the executives are not entitled to receive any cash severance benefits if, following a change of control, they remain in their position or they resign without demonstrating good reason. If the executive officers are entitled to receive cash severance benefits in connection with a termination following a change of control of the Company, they will receive a lump sum payment equal to three times the sum of (x) their then current base salary and (y) their target bonus under the Company’s annual cash incentive compensation program. If the executive’s employment is terminated without cause or the executive resigns with good reason not in connection with a change in control, they will be entitled to a lump sum payment equal to two times the sum of (x) their then current base salary and (y) their target bonus under the Company’s annual cash compensation program.

In addition, if the Company terminates such executive’s employment without cause or such executive resigns with good reason, or if the executive dies or becomes disabled, the executive (or his or her family) will be entitled to:

i. a pro-rated bonus for the year of termination under the Company’s cash incentive program based on actual achievement of the applicable performance metrics, provided, that any performance metrics based solely on the executive’s performance shall be deemed achieved at target levels;

ii. continued life, health and disability insurance coverage the executive, his or her spouse and dependents for eighteen months;

iii. in the cases of death or disability, the immediate vesting of all unvested restricted stock or LTIP unit awards subject to time-based vesting previously issued to the executive; and

iv. in the case of termination without cause or resignation with good reason, the immediate vesting of all unvested restricted stock or LTIP unit awards subject to time-based vesting that were granted to the executive in connection with the Company’s annual long-term incentive program, provided, that such vesting is subject to pro-ration for any awards that were granted to the executive less than 12 months prior to the date of termination.

If the Company terminates the executive’s employment without cause or such executive resigns with good reason, the executive can retain their PSU awards, but they will not receive any shares until the end of the performance period and the number of shares issued will equal the target amount. Upon a change in control, regardless of whether there has been a termination of employment, the Company will determine the number of PSUs earned based on the performance as of the date immediately prior to the change in control, but such awards may remain subject to service vesting for the remainder of the performance period, which vesting will be accelerated if there is a subsequent involuntary termination.

In the event that the executive retires and has been designated as an eligible retiree by the Company’s Board of Directors, the executive will be eligible to continue to vest in any outstanding unvested restricted stock, LTIP unit and PSU awards, but the executive will not receive any cash severance or any continued life, health, or disability coverage for themselves or their spouse or dependents.

The severance agreements each contain non-competition covenants that apply during the term and for 12 months after the expiration or termination of such executive’s employment with the Company to the extent that the executive receives a cash severance payment. The non-competition covenants restrict the executives from working for any lodging-oriented real estate investment company located in the United States. The non-competition covenants will not apply following a change of control. The severance agreements also contain non-solicitation and non-disparagement covenants, among other standard provisions.

Item 7.01. Regulation FD Disclosure

A copy of the press release issued by the Company to announce Mr. Spierto’s appointment to Chief Accounting Officer described above and the hiring of Anika Fischer as the Company's General Counsel is furnished as Exhibit 99.1 to this Current Report and incorporated by reference herein.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act of 1934, as amended, regardless of any incorporation by reference language in any such filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

ITEM 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this report:

Exhibit No. Description

101.SCH Inline XBRL Taxonomy Extension Schema Document

101.CAL Inline XBRL Taxonomy Extension Calculation Linkbase Document

101.DEF Inline XBRL Taxonomy Extension Definition Linkbase Document

101.LAB Inline XBRL Taxonomy Extension Label Linkbase Document

101.PRE Inline XBRL Taxonomy Extension Presentation Linkbase Document

104 Cover Page Interactive Data File

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | DIAMONDROCK HOSPITALITY COMPANY |

| | | |

| Dated: May 16, 2024 | | | | By: | | /s/ Briony R. Quinn |

| | | | | | Briony R. Quinn |

| | | | | | Executive Vice President, Chief Financial Officer and Treasurer |

COMPANY CONTACT

Briony Quinn

Chief Financial Officer

(240) 744-1196

FOR IMMEDIATE RELEASE

DIAMONDROCK HOSPITALITY COMPANY ANNOUNCES PROMOTION OF STEPHEN SPIERTO TO CHIEF ACCOUNTING OFFICER AND HIRING OF ANIKA FISCHER AS GENERAL COUNSEL

BETHESDA, Maryland, Thursday, May 16, 2024 – DiamondRock Hospitality Company (the “Company”) (NYSE: DRH), a lodging-focused real estate investment trust that owns a portfolio of 36 premium hotels and resorts in the United States, today announced the promotion of Stephen Spierto to Chief Accounting Officer effective as of May 15, 2024.

Mr. Spierto, age 34, joined the Company in November 2023 and previously served as Vice President, Corporate Controller of the Company from November 2023 until his May 2024 promotion to Chief Accounting Officer. As Vice President, Corporate Controller of the Company, Mr. Spierto was responsible for overseeing corporate accounting, financial reporting and technical accounting. Prior to joining the Company, Mr. Spierto spent 12 years in the real estate and hospitality audit practice at Ernst & Young, LLP, most recently as a Senior Manager. Mr. Spierto is a certified public accountant and earned a B.S. and Master’s in Accounting from the James Madison University.

In addition, the Company announced that Anika Fischer will join the Company as Senior Vice President and General Counsel on June 3, 2024. Ms. Fischer, age 35, will report directly to Jeffrey J. Donnelly, the Company’s Chief Executive Officer, and will assume legal responsibilities from William J. Tennis, the Company’s Executive Vice President and General Counsel, who previously announced his retirement effective as of June 30, 2024.

Prior to joining the Company, Ms. Fischer was Deputy General Counsel at Essex Property Trust, Inc., a multifamily REIT. During her nine-year tenure at Essex she led its legal department in capital markets transactions, securities and corporate governance matters and the teams responsible for closing and underwriting complex real estate transactions, including acquisitions, dispositions, structured finance, joint ventures, developments and financings. She was also a member of the Essex senior leadership team and sat on the insurance committee, environmental/social/governance committee and enterprise risk management committee. Ms. Fischer began her career as an associate at Kirkland & Ellis LLP in the Real Estate group. Ms. Fischer received her J.D., cum laude, from the University of Michigan Law School, and a B.A. from Wesleyan University.

“Steve is a valuable member of the team and has already proven his outstanding business acumen and deep understanding of our business in his short tenure with the Company. His promotion underscores his remarkable contributions to DiamondRock. We are also excited to welcome Anika, who brings both strategic judgement and a comprehensive legal expertise in the real estate sector. We look forward to working with both Steve and Anika to continue to position DiamondRock to be a top performer in the lodging sector,” stated Mr. Donnelly.

About the Company

DiamondRock Hospitality Company is a self-advised real estate investment trust (REIT) that is an owner of a leading portfolio of geographically diversified hotels concentrated in leisure destinations and top gateway markets. The Company currently owns 36 premium quality hotels with over 9,700 rooms. The Company has strategically positioned its portfolio to be operated both under leading global brand families as well as independent boutique hotels in the lifestyle segment. For further information on the Company and its portfolio, please visit DiamondRock Hospitality Company’s website at www.drhc.com.

v3.24.1.1.u2

Document and Entity Information

|

May 14, 2024 |

| Entity Listings [Line Items] |

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-32514

|

| Document Period End Date |

May 14, 2024

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Entity Registrant Name |

DiamondRock Hospitality Co

|

| Entity Address, Address Line One |

2 Bethesda Metro Center, Suite 1400

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

240

|

| Local Phone Number |

744-1150

|

| Entity Central Index Key |

0001298946

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

20-1180098

|

| Common Stock, $0.01 par value |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

DRH

|

| Security Exchange Name |

NYSE

|

| 8.250% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

8.250% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

| Trading Symbol |

DRH Pr A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

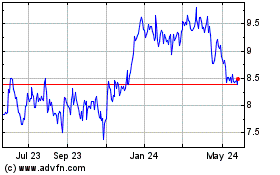

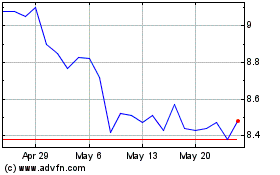

Diamondrock Hospitality (NYSE:DRH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Diamondrock Hospitality (NYSE:DRH)

Historical Stock Chart

From Feb 2024 to Feb 2025