The information in this preliminary

prospectus supplement is not complete and may be changed. This preliminary prospectus supplement is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-278823

Subject

to Completion

Preliminary Prospectus Supplement

Dated October 8, 2024

PROSPECTUS SUPPLEMENT

(To prospectus dated April 19, 2024)

ECOPETROL S.A.

US$ %

Notes due 20

The

US$ %

notes due 20 (the “notes”) will constitute our general senior, unsecured and unsubordinated

obligations and will rank pari passu, without any preferences among themselves, with all of our other present and future senior,

unsecured and unsubordinated obligations that constitute our External Indebtedness (as defined in the accompanying prospectus). Although

we are 88.49% owned by the Republic of Colombia, or the “Nation”, the Nation is not liable for our obligations under the

notes. The notes will be issued only in registered form in minimum denominations of US$1,000 and integral multiples of US$1,000 in excess

thereof.

The

notes will mature on ,

20 and will bear interest at the rate of %

per annum. Interest on the notes will be payable on and

of each year, beginning on ,

2025. We may redeem the notes, in whole or in part, at any time or from time to time prior to their maturity, at the redemption prices

set forth in “Description of the Notes—Optional Redemption”. Upon the occurrence of a change of control repurchase

event as set forth in “Description of the Notes—Certain Covenants—Repurchase of Notes upon a Change of Control Repurchase

Event”, we will be required to offer to repurchase the notes from holders at the repurchase price described herein.

We intend to apply to have

the notes approved for listing on the New York Stock Exchange, or the “NYSE”.

Investing in the notes

involves risks. See the “Risk Factors” sections of our Annual Report on Form 20-F for the fiscal year ended December 31,

2023 (our “2023 Annual Report”), filed on April 18, 2024 with the Securities and Exchange Commission (the “SEC”),

and beginning on page S-9 of this prospectus supplement.

| | |

| Per

Note | | |

Total |

| Initial

price to the public(1): | |

| % | | |

US$ |

| Underwriting

discount: | |

| % | | |

US$ |

| Proceeds,

before expenses, to Ecopetrol: | |

| % | | |

US$ |

(1)

Plus, accrued interest, if any, from ,

2024, if settlement occurs after that date.

Neither the SEC nor any state

securities commission has approved or disapproved of the notes or determined if this prospectus supplement or the accompanying prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The notes will not be authorized

by the Colombian Superintendency of Finance (Superintendencia Financiera de Colombia or the “SFC” by its acronym in

Spanish) and will not be registered under the Colombian National Registry of Securities and Issuers (Registro Nacional de Valores

y Emisores) or the Colombian Stock Exchange (Bolsa de Valores de Colombia or the “BVC” by its acronym in Spanish),

and, accordingly, the notes will not be offered or sold to persons in Colombia except in circumstances which do not result in a public

offering under Colombian law and in compliance with Part 4 of Decree 2555 of 2010.

The

underwriters expect that the notes will be ready for delivery only in book-entry form through the facilities of The Depository Trust

Company for the accounts of its participants, including Euroclear Bank S.A./N.V., as operator of the Euroclear System, and Clearstream

Banking, société anonyme, against payment in New York, New York on or about ,

2024.

Joint Book-Running Managers

| BBVA |

J.P.

Morgan |

Santander |

The date of this prospectus supplement is , 2024.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This document is divided

in two parts. The first is this prospectus supplement, which describes the specific terms of this offering. The second part, the accompanying

prospectus, gives more general information, some of which may not apply to this offering. This prospectus supplement also adds to, updates

and changes information contained in the accompanying prospectus. If the description of the offering varies between this prospectus supplement

and the accompanying prospectus, you should rely on the information in this prospectus supplement. The accompanying prospectus is part

of a shelf registration statement that we filed with the SEC on April 19, 2024. Under the shelf registration process, from time

to time, we may offer and sell debt securities, guaranteed debt securities, ordinary shares or preferred shares, or any combination thereof,

in one or more offerings.

In this prospectus supplement

we use the terms “Ecopetrol,” “Ecopetrol Group,” the “Company,” “we,” “us,”

and “our” and similar words to refer to Ecopetrol S.A., a Colombian mixed economy company, and its consolidated subsidiaries,

unless the context requires otherwise. References to “securities” include any security that we might offer under this prospectus

supplement and the accompanying prospectus. References to “US$”, “$” and “U.S. dollars” are to United

States dollars. References to “COP”, “COP$” and “pesos” are to Colombian pesos.

We have not authorized anyone

to provide any information or to make any representation other than those contained or incorporated by reference in this prospectus supplement,

the accompanying prospectus or in any free writing prospectus that we have prepared. We take no responsibility for and can provide no

assurance as to the reliability of, any other information that others may give you. We are not making an offer of these securities in

any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus supplement,

the accompanying prospectus, the documents incorporated by reference herein or in any free writing prospectus is accurate as of any date

other than the respective dates of such documents. Our business, financial condition, results of operations and prospects may have changed

since such dates.

THE NOTES ARE NOT INTENDED

TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY RETAIL INVESTOR

IN THE EUROPEAN ECONOMIC AREA (“EEA”). FOR THESE PURPOSES, A RETAIL INVESTOR MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A

RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU, AS AMENDED (“MIFID II”); (II) A

CUSTOMER WITHIN THE MEANING OF DIRECTIVE 2002/92/EC, AS AMENDED, WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED

IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT A QUALIFIED INVESTOR AS DEFINED IN DIRECTIVE 2003/71/EC,

AS AMENDED. CONSEQUENTLY, NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED, THE “EU PRIIPS REGULATION”)

FOR OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO RETAIL INVESTORS IN THE EEA HAS BEEN PREPARED AND THEREFORE OFFERING

OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY RETAIL INVESTOR IN THE EEA MAY BE UNLAWFUL UNDER THE EU PRIIPS REGULATION.

THE NOTES ARE NOT INTENDED

TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY RETAIL INVESTOR

IN THE UNITED KINGDOM (THE “UK”). FOR THESE PURPOSES, A RETAIL INVESTOR IN THE UK MEANS A PERSON WHO IS ONE (OR MORE) OF:

(I) A RETAIL CLIENT AS DEFINED IN POINT (8) OF ARTICLE 2 OF REGULATION (EU) NO 2017/565 AS IT FORMS PART OF DOMESTIC

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (THE “EUWA”); (II) A CUSTOMER WITHIN THE MEANING OF THE PROVISIONS

OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (THE “FSMA”) AND ANY RULES OR REGULATIONS MADE UNDER THE FSMA TO IMPLEMENT

DIRECTIVE (EU) 2016/97, WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2(1) OF

REGULATION (EU) NO 600/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA; OR (III) NOT A QUALIFIED INVESTOR AS

DEFINED IN ARTICLE 2 OF THE PROSPECTUS REGULATION AS IT FORMS PART OF DOMESTIC LAW BY VIRTUE OF THE EUWA (“UK PROSPECTUS

REGULATION”). CONSEQUENTLY, NO KEY INFORMATION DOCUMENT REQUIRED BY THE PRIIPS REGULATION AS IT FORMS PART OF UK DOMESTIC

LAW BY VIRTUE OF THE EUWA (THE “UK PRIIPS REGULATION”) FOR OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE

TO RETAIL INVESTORS IN THE UK UNITED KINGDOM HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE

TO ANY RETAIL INVESTOR IN THE UK UNITED KINGDOM MAY BE UNLAWFUL UNDER THE UK PRIIPS REGULATION.

Some of the market and industry

data contained or incorporated by reference in this prospectus supplement are based on independent industry publications or other publicly

available information, while other information is based on internal studies. Although we believe that these independent sources and our

internal data are reliable as of their respective dates, the information contained in them has not been independently verified. As a

result, you should be aware that the market and industry data contained in this prospectus supplement, and beliefs and estimates based

on such data, may not be reliable.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus supplement,

the accompanying prospectus and the documents incorporated by reference herein and therein contain both historical and forward-looking

statements. All statements that are not based on historical fact are, or may be deemed to be, forward-looking statements. Forward-looking

statements are not guarantees of future performance and reflect our current expectations concerning future results, events, objectives,

plans and goals and involve known and unknown risks, uncertainties and other factors that are difficult to predict, and which may cause

our actual results, performance or achievements to differ. These risks, uncertainties and other factors include, among others: changes

in international crude oil and gas prices, our exploration and production activities, including drilling; import and export activities;

our liquidity, cash flow and sources of funding; the results of our electric power transmission and toll roads activities through our

subsidiary, Interconexión Eléctrica S.A. E.S.P. (“ISA”); our projected and targeted capital expenditures

and other cost commitments and revenues; dates by which certain areas will be developed or will come on-stream; future growth and development

of the energy industry and its transition onto lower carbon sources of energy; general economic and business conditions, including increased

and prolonged inflation in Colombia and worldwide, volatility in crude oil and other commodity prices, refining margins and prevailing

exchange rates; competition; our ability to obtain financing; our ability to find, acquire or gain access to additional reserves and

our ability to develop existing reserves; uncertainties inherent in making estimates of our reserves; the modification, adjustment or

reduction of tariffs, rates or fees charged by the electricity transmission businesses in the countries where they operate; significant

political, economic and social developments in Colombia and other countries where we do business; natural disasters, pandemics and other

public health events; the ongoing Russian invasion of Ukraine; the Israeli-Palestinian armed conflict; other military operations, terrorist

acts, wars or embargoes; regulatory developments, including regulations related to climate change; receipt of government approvals and

licenses; technical difficulties; and other factors described in our press releases and filings with the SEC, including our 2023 Annual

Report and in the section entitled “Risk Factors” beginning on page S-9 of this prospectus supplement. The forward-looking

statements included or incorporated by reference in this prospectus supplement and the accompanying prospectus are qualified in their

entirety by this cautionary statement and are made only as of the dates of the respective documents. We do not have any obligation to

publicly update or revise any forward-looking statements to reflect subsequent events or circumstances or for any other reason. Accordingly,

undue reliance should not be placed on forward-looking statements.

OTHER

INFORMATION

Ecopetrol’s financial

information presented in this prospectus supplement has been prepared in accordance with International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting Standards Board (“IASB”). Ecopetrol also files financial information

with the SFC, which is prepared in accordance with Colombian IFRS. Ecopetrol’s financial information under Colombian IFRS filed

with the SFC is not directly comparable to its financial information presented under IFRS-IASB in this prospectus supplement or its filings

with the SEC.

SUMMARY

This section summarizes

key information contained elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying prospectus and

is qualified in its entirety by the more detailed information and financial statements included elsewhere, or incorporated by reference,

in this prospectus supplement and the accompanying prospectus. You should carefully review the entire prospectus supplement, including

the risk factors, the financial statements and the notes related thereto, the unaudited pro forma condensed combined financial statements

included herein, and the other documents incorporated by reference in this prospectus supplement and the accompanying prospectus, before

making an investment decision. Summaries in this prospectus supplement and the accompanying prospectus of certain documents that are

filed as exhibits to the registration statement of which this prospectus supplement is a part are qualified in their entirety by reference

to such documents.

Overview

We are the largest company

in Colombia and one of the most relevant integrated energy companies in Latin America, with a presence primarily in Colombia and activities

in the United States (U.S. Gulf of Mexico and Permian Basin), Brazil, Mexico, Peru, Chile and Bolivia. In Colombia, we are responsible

for more than 60% of the hydrocarbon production, transportation, logistics, and hydrocarbon refining systems, and hold a leading position

in the petrochemicals and gas distribution segment. Through ISA, we have a strong position in the electric power transmission business,

toll roads and telecommunications sectors throughout Latin America. The Nation currently owns 88.49% of our voting capital stock. We

are among the world’s largest public companies, ranking 316 on the Forbes 2024 Global 2000 Ranking, and the largest Colombian company

in this ranking.

Our address is Carrera 13

No. 36-24 Bogota, Colombia and our telephone number is +57 310 315 8600. Our website is www.ecopetrol.com.co. Information included

on or accessible through our website does not constitute a part of this prospectus supplement or the accompanying prospectus.

See the “Our Corporate

Strategy” and “Our Business Overview” sections of our 2023 Annual Report, filed on April 18, 2024 with the SEC,

for further information about us.

Recent Developments

Partial Redemption of Notes due 2026

On September 5, 2024,

Ecopetrol redeemed US$250,000,000 principal amount of its 5.375% Notes due 2026 at a redemption price equal to approximately US$1,014.95

per US$1,000 principal amount outstanding, plus accrued and unpaid interest. Following such redemption, the principal amount outstanding

of our 5.375% Notes due 2026 is US$1,250,000,000.

Senior Management Changes

On July 31, 2024, Ecopetrol

announced the appointment of (i) Mr. Alberto José Vergara Monterrosa as Corporate Director of Compliance, effective

as of August 1, 2024, and (ii) Mr. Camilo Barco Muñoz as Corporate Vice President of Finance and Sustainable Value

(or chief financial officer) of the Company, effective as of August 20, 2024.

Mr. Vergara Monterrosa

has been in charge of the Corporate Compliance Vice Presidency since April 2024 and the Corporate Compliance Directorate since June 6,

2024. He has over 23 years of experience in the hydrocarbons sector. He is a lawyer from the National University of Colombia, with specializations

in Contractual Law, Business Law, and Commercial Law, and holds a master's degree in Private Law.

Mr. Barco Muñoz

is a lawyer specializing in Financial Law, with studies in Corporate Finance and Capital Markets at the London School of Economics and

the Chicago Booth School of Business. He has 24 years of experience in the public and private sectors, notably serving as General Director

of State Participations at the Ministry of Finance and as Director of Investment Banking at BBVA Colombia. He was Senior Vice President

- Director of Investment Banking at Itaú Colombia. Previously, he was Managing Director / Country Head at Alvarez & Marsal,

Financial Vice President at ISA, and a member of the Board of Directors of Ecopetrol S.A.

Additionally, between April and

August 2024, the Company announced the following senior management changes:

| 1. | Felipe Trujillo López as Vice President

Commercial and Marketing, effective as of April 26, 2024; |

| 2. | Victoria Irene Sepúlveda Ballesteros

as Corporate Vice President of Human Resources, effective as of April 26, 2024; |

| 3. | María Cristina Toro Restrepo as

Legal Vice President, effective as of May 7, 2024; |

| 4. | Rafael Guzmán as Acting Chief Operating

Officer, effective as of May 11, 2024; |

| 5. | Sandra Lucía Rodríguez as

Corporate Vice President of Territorial Transformation and Health Safety and the Environment,

effective as of July 1, 2024; |

| 6. | Jaime Pineda as Vice President of Administration

and Services, effective as of July 1, 2024; |

| 7. | Sandra Lucía Rodríguez as

Corporate Vice President of Territorial Transformation and HSE, effective as of August 1,

2024; |

| 8. | Jaime Andrés García as Vice

President of Procurement and Services, effective as of September 2, 2024; and |

| 9. | Julián Lemos Valero as acting Corporate

Vice President of Strategy and New Businesses, effective September 16, 2024 |

The business experiences

of the individuals appointed to senior management roles have been described in current reports on Form 6-K furnished to the SEC

between the months of April and August 2024 and which are incorporated by reference herein.

Audit Committee

On June 28, 2024, Ecopetrol’s

Board of Directors appointed independent director Gonzalo Hernández Jiménez as a member of the Audit and Risk Committee.

On August 30, 2024, Ecopetrol announced that Juan José Echavarría and Luis Alberto Zuleta had presented their

resignations from Ecopetrol’s Board of Directors and committees; such resignations are expected to become effective on the date

in which the board approves the minutes for the meetings in which directors and audit committee members Juan José Echavarría

and Luis Alberto Zuleta last participated. Currently, the Audit and Risk Committee is composed of the following members: Luis Alberto

Zuleta Jaramillo (chairman), Álvaro Torres Macías, Guillermo García Realpe, Angela María Robledo Gómez,

Juan José Echavarría Soto and Gonzalo Hernández Jiménez.

Mr. Gonzalo Hernández

Jiménez’ business experience has been described in the 2023 Annual Report which has been incorporated by reference to this

prospectus supplement.

Concurrent Tender Offer

Concurrently with the offering

of the notes hereby, we commenced an offer to purchase for cash (the “Tender Offer”) any and all of the outstanding 5.375%

senior notes due 2026 (the “Target Notes”), pursuant to the terms of, and subject to the conditions set forth under, an offer

to purchase, dated as of October 8, 2024, and related documents (the “Tender Offer Documents”).

The Tender Offer is conditional,

among others, upon our receiving the financing necessary for the payment of the purchase price offered thereby and accrued interest to

tendering holders, plus fees and expenses and other general conditions set forth in the Tender Offer Documents. We may waive these and

other conditions at our sole discretion. It is expected that funds will be made available to us upon the issuance of the notes offered

hereby.

BBVA Securities Inc., J.P.

Morgan Securities LLC and Santander US Capital Markets LLC are acting as dealer managers under the Tender Offer. The Tender Offer is

being made pursuant to the terms of, and subject to the conditions set forth under the Tender Offer Documents. This Prospectus Supplement

is not an offer to purchase or a solicitation of an offer to sell the Target Notes and does not constitute a notice of redemption of

the Target Notes.

It is expected that all Target

Notes not tendered in connection with the Tender Offer will be redeemed by us pursuant to the terms of the governing indenture, subject

to the satisfaction of certain requirements thereunder. We expect to use a portion of the funds from the offering of the notes for such

redemption.

THE

OFFERING

The following is a brief

summary of certain terms of the notes. For a more complete description of the terms of the notes, including the covenants and events

of default contained in the indenture, see “Description of the Notes” in this prospectus supplement and “Description

of the Debt Securities” in the accompanying prospectus.

| Issuer |

Ecopetrol

S.A. |

Notes

|

US$

aggregate principal amount of %

notes due ,

20 . |

| Maturity |

,

20 . |

| Interest |

The

notes will bear interest from ,

2024, the date of original issuance of the notes at the rate of %

per annum, payable semiannually in arrears on each interest payment date. |

| Interest

Payment Dates |

and , of

each year, commencing on ,

2025. |

| Repurchase

of Notes upon a Change of Control Repurchase Event |

We

are required to make an offer to purchase all or any portion of notes outstanding held by holders upon the occurrence of a Change

of Control Repurchase Event (as defined in “Description of the Debt Securities” in the accompanying prospectus) at a

purchase price in cash equal to 101% of the principal amount of the notes so purchased, plus accrued and unpaid interest thereon

and any Additional Amounts (as defined below) to but excluding the date of such purchase. See “Description of the

Notes—Certain Covenants—Repurchase of Notes upon a Change of Control Repurchase Event” and “Risk Factors—Risk

factors related to the notes—We may not be able to repurchase the notes upon a change of control repurchase event”. |

| Optional

Redemption |

At any time prior to ,

20 ( months prior to the maturity date of the notes, the “Par Call

Date”), at our option, we may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price

equal to the greater of (1) (a) the sum of the present values of the remaining scheduled payments of principal and interest

thereon discounted to the redemption date (assuming the notes matured on the Par Call Date) on a semi-annual basis (assuming a 360-day

year consisting of twelve 30-day months) at the Treasury Rate plus basis

points, less (b) interest accrued to the date of redemption, and (2) 100% of the principal amount of the notes to be redeemed,

plus, in either case, accrued and unpaid interest on the notes to be redeemed to the redemption date.

On or after the Par Call Date, we may redeem

the notes from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed, plus, accrued

and unpaid interest thereon to the redemption date. Any notice of optional redemption may be subject to the satisfaction of one or

more conditions precedent. See “Description of the Notes—Optional Redemption.” |

| Withholding

Tax Redemption |

In

the event that, as a result of certain changes in law affecting Colombia or any political subdivision or taxing authority thereof

or therein, we become obliged to pay Additional Amounts, the notes will be redeemable, as a whole but not in part, at our option

at any time at 100% of their principal amount plus accrued and unpaid interest, if any. See “Description of the

Notes—Optional Redemption—Withholding Tax Redemption”. |

| Ranking |

The

notes will constitute our general senior, unsecured and unsubordinated obligations and will rank pari passu, without any preferences

among themselves, with all of our other present and future senior, unsecured and unsubordinated obligations that constitute our External

Indebtedness (as defined in “Description of the Debt Securities” in the accompanying prospectus). As of June 30,

2024, we had indebtedness of COP 115,019,566 million, all of which was unsecured debt, which we recognize in our consolidated financial

statements at its amortized cost, which corresponds to the present value of cash flows, discounted at the effective interest rate. |

| Use

of Proceeds |

We

expect the net proceeds from the sale of the notes will be approximately US$

(after giving effect to underwriters’ discounts but before expenses). We intend to use the net proceeds of this

offering to (i) purchase the Target Notes tendered pursuant to the Tender Offer (and pay related expenses thereunder); (ii) prepay

a portion of the outstanding principal amounts under the 2030 Loan Agreement; and/or (iii) finance expenditures outside our

investment plan. The outstanding principal amount of the Target Notes, which are scheduled to mature on June 26,

2026, is approximately US$1,250,000,000, we plan to give a notice of redemption of part or all of the Target Notes that are not tendered

in the Tender Offer pursuant to their terms promptly following the settlement of the offering of the notes. None of the

underwriters shall have any responsibility for the application of the net proceeds of the notes. |

| Further

Issues |

We

may from time to time, without notice to or the consent of the holders of the notes, create and issue additional debt securities

having the same terms (except for the issue date, the public offering price and the first interest payment date) and ranking equally

and ratably with the notes offered hereby in all respects, as described under “Description of the Notes—General”. Any

additional debt securities having such similar terms, together with the notes offered hereby, will constitute a single series of

securities under the indenture. |

| Denomination

and Form |

We

will issue the notes in the form of one or more fully registered global notes registered in the name of a nominee of The Depository

Trust Company (“DTC”). Beneficial interests in the notes will be represented through book-entry accounts of

financial institutions acting on behalf of beneficial owners as direct and indirect participants in DTC. Clearstream Banking,

société anonyme and Euroclear Bank, S.A./ N.V., as operator of the Euroclear System, will hold interests on behalf

of their participants through their respective U.S. depositaries, which in turn will hold such interests in accounts as participants

of DTC. Except in the limited circumstances described in this prospectus supplement, owners of beneficial interests in

the notes will not be entitled to have notes registered in their names, will not receive or be entitled to receive notes in definitive

form and will not be considered holders of notes under the indenture. The notes will be issued only in minimum denominations

of US$1,000 and integral multiples of US$1,000 in excess thereof. |

| Taxation |

For

a summary of certain United States federal tax and Colombian tax considerations relating to the purchase, ownership and disposition

of the notes, see “Taxation—U.S. Federal Income Tax Considerations” and “Taxation—Certain Colombian

Tax Considerations”, respectively. |

| Trustee |

The

Bank of New York Mellon. |

| Listing |

We

intend to have the notes approved for listing on the NYSE. |

| Governing

Law |

New

York. |

| Risk

Factors |

Investing

in the notes involves risks. See the “Risk Factors” sections of our 2023 Annual Report and beginning on page S-9

of this prospectus supplement, and other information included or incorporated by reference in this prospectus supplement for a description

of certain risks you should consider before investing in the notes. |

SUMMARY

SELECTED FINANCIAL AND OPERATING DATA

The following table sets

forth, for the periods and at the dates indicated, our summary historical financial data, which have been derived from our unaudited

interim condensed consolidated financial statements presented in Colombian pesos as of June 30, 2024 and our audited consolidated

financial statements presented in Colombian pesos as of December 31, 2023. The information included below and elsewhere in this

prospectus supplement is not necessarily indicative of our future performance. The tables set forth below are derived from, and should

be read in conjunction with, our unaudited interim condensed consolidated financial statements as of June 30, 2024 and for the six-month

periods ended June 30, 2024 and 2023 and the accompanying notes included in the current report on Form 6-K furnished to the

SEC on October 8, 2024 and incorporated by reference into this prospectus supplement.

Our consolidated financial

statements for the years ended December 31, 2023, 2022 and 2021 included in the 2023 Annual Report and incorporated by reference

in this prospectus supplement were prepared in accordance with IFRS-IASB.

Our unaudited interim condensed

consolidated financial statements as of June 30, 2024 and for the six-month periods ended June 30, 2024 and 2023 were prepared

in accordance with IAS 34 – “Interim Financial Reporting” as issued by the IASB.

| | |

BALANCE

SHEET | |

| | |

As of June 30, | | |

As of Dec 31, | |

| | |

2024(1) | | |

2024 | | |

2023 | |

| | |

(in

thousands of

U.S. dollars) | | |

| (in

millions of Colombian pesos) | |

| Assets | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 3,191,116 | | |

| 13,236,875 | | |

| 12,336,115 | |

| Trade and other receivables | |

| 5,819,890 | | |

| 24,141,135 | | |

| 33,310,642 | |

| Inventories | |

| 2,740,698 | | |

| 11,368,526 | | |

| 10,202,448 | |

| Other financial assets | |

| 509,330 | | |

| 2,112,720 | | |

| 1,860,928 | |

| Current tax assets | |

| 1,902,854 | | |

| 7,893,114 | | |

| 8,111,079 | |

| Other assets | |

| 773,889 | | |

| 3,210,123 | | |

| 2,769,029 | |

| Assets held for sale | |

| 32,723 | | |

| 135,735 | | |

| 24,865 | |

| Total current assets | |

| 14,970,500 | | |

| 62,098,228 | | |

| 68,615,106 | |

| Non-current assets | |

| | | |

| | | |

| | |

| Trade and other receivables | |

| 7,302,075 | | |

| 30,289,298 | | |

| 29,781,088 | |

| Other financial assets | |

| 152,831 | | |

| 633,948 | | |

| 371,847 | |

| Investment in associates and joint

ventures | |

| 2,069,182 | | |

| 8,583,051 | | |

| 8,418,632 | |

| Property, plant and equipment | |

| 23,899,937 | | |

| 99,137,894 | | |

| 95,171,302 | |

| Natural and environmental resources | |

| 11,269,070 | | |

| 46,744,552 | | |

| 45,216,133 | |

| Right-of-use assets | |

| 183,363 | | |

| 760,598 | | |

| 841,636 | |

| Intangible assets | |

| 3,772,412 | | |

| 15,648,114 | | |

| 14,714,809 | |

| Non-current tax assets | |

| 3,101,992 | | |

| 12,867,186 | | |

| 10,530,057 | |

| Goodwill | |

| 1,208,463 | | |

| 5,012,754 | | |

| 4,846,667 | |

| Other assets | |

| 412,036 | | |

| 1,709,143 | | |

| 1,633,813 | |

| Non-current assets | |

| 53,371,361 | | |

| 221,386,538 | | |

| 211,525,984 | |

| Total assets | |

| 68,341,861 | | |

| 283,484,766 | | |

| 280,141,090 | |

| | |

BALANCE

SHEET | |

| | |

As of June 30, | | |

As of Dec

31, | |

| | |

| 2024(1) | | |

| 2024 | | |

| 2023 | |

| | |

| (in

thousands of

U.S. dollars) | | |

| (in

millions of Colombian pesos) | |

| Liabilities and Shareholders’ equity |

| Current liabilities |

| Loans and borrowings | |

| 3,866,694 | | |

| 16,039,201 | | |

| 15,550,008 | |

| Trade and other

payables | |

| 4,514,424 | | |

| 18,726,013 | | |

| 18,891,434 | |

| Provision for

employee benefits | |

| 689,324 | | |

| 2,859,345 | | |

| 3,059,204 | |

| Tax liabilities | |

| 349,688 | | |

| 1,450,519 | | |

| 2,869,225 | |

| Accrued liabilities

and provisions | |

| 300,493 | | |

| 1,246,455 | | |

| 1,595,249 | |

| Other

liabilities | |

| 371,001 | | |

| 1,538,925 | | |

| 1,599,443 | |

| Total

current liabilities | |

| 10,091,624 | | |

| 41,860,458 | | |

| 43,564,563 | |

| Non-current

liabilities | |

| | | |

| | | |

| | |

| Loans and borrowings | |

| 23,861,960 | | |

| 98,980,365 | | |

| 90,265,519 | |

| Trade and other

payables | |

| 3,533 | | |

| 14,654 | | |

| 27,280 | |

| Provision for

employee benefits | |

| 3,785,416 | | |

| 15,702,058 | | |

| 15,213,509 | |

| Deferred tax liabilities | |

| 3,351,957 | | |

| 13,904,051 | | |

| 13,567,513 | |

| Accrued liabilities

and provisions | |

| 3,657,684 | | |

| 15,172,220 | | |

| 14,547,391 | |

| Other

liabilities | |

| 630,308 | | |

| 2,614,541 | | |

| 2,702,835 | |

| Total

non-current liabilities | |

| 35,290,858 | | |

| 146,387,889 | | |

| 136,324,047 | |

| Total

liabilities | |

| 45,382,482 | | |

| 188,248,347 | | |

| 179,888,610 | |

| Equity | |

| | | |

| | | |

| | |

| Subscribed and

paid in capital | |

| 6,036,602 | | |

| 25,040,067 | | |

| 25,040,067 | |

| Additional paid

in capital | |

| 1,592,969 | | |

| 6,607,699 | | |

| 6,607,699 | |

| Reserves | |

| 5,823,571 | | |

| 24,156,407 | | |

| 17,922,725 | |

| Other comprehensive

income | |

| 2,271,654 | | |

| 9,422,910 | | |

| 8,674,648 | |

| Retained earnings | |

| 1,215,453 | | |

| 5,041,746 | | |

| 17,461,488 | |

| Equity attributable

to owners of parent | |

| 16,940,249 | | |

| 70,268,829 | | |

| 75,706,627 | |

| Non–controlling

interest | |

| 6,019,130 | | |

| 24,967,590 | | |

| 24,545,853 | |

| Total

equity | |

| 22,959,379 | | |

| 95,236,419 | | |

| 100,252,480 | |

| Total

liabilities and shareholders’ equity | |

| 68,341,861 | | |

| 283,484,766 | | |

| 280,141,090 | |

| (1) | Amounts stated in U.S. dollars have been

translated for the convenience of the reader at the rate of COP 4,148.04 to US$1.00,

which was the Representative Market Rate as of June 30, 2024, as reported and certified

by the SFC. |

| | |

INCOME STATEMENT | |

| | |

For the

six-month period ended June 30, | |

| | |

| 2024(1) | | |

| 2024 | | |

| 2023 | |

| | |

| | | |

| | | |

| | |

| | |

| (unaudited) | | |

| | |

| | |

| (in

thousands of

U.S. dollars) | | |

| (in

millions of Colombian pesos) | |

| Revenue | |

| | | |

| | | |

| | |

| Domestic sales | |

| 7,951,815 | | |

| 31,174,949 | | |

| 37,475,818 | |

| Foreign

sales | |

| 8,354,737 | | |

| 32,754,597 | | |

| 35,746,506 | |

| Sales revenue | |

| 16,306,552 | | |

| 63,929,546 | | |

| 73,222,324 | |

| Cost of sales | |

| (10,111,899 | ) | |

| (39,643,519 | ) | |

| (44,265,231 | ) |

| Gross profit | |

| 6,194,653 | | |

| 24,286,027 | | |

| 28,957,093 | |

| Administrative

expenses | |

| (542,703 | ) | |

| (2,127,659 | ) | |

| (2,236,642 | ) |

| Operations and

project expenses | |

| (667,204 | ) | |

| (2,615,763 | ) | |

| (2,199,293 | ) |

| Other

operating expenses | |

| (52,269 | ) | |

| (204,919 | ) | |

| (233,276 | ) |

| Operating

income | |

| 4,932,477 | | |

| 19,337,686 | | |

| 24,287,882 | |

| Financial results | |

| | | |

| | | |

| | |

| Finance income | |

| 217,391 | | |

| 852,278 | | |

| 1,349,483 | |

| Finance expenses | |

| (1,272,731 | ) | |

| (4,989,720 | ) | |

| (5,446,231 | ) |

| Foreign

exchange (loss) gain | |

| 11,546 | | |

| 45,267 | | |

| 547,244 | |

| | |

| (1,043,794 | ) | |

| (4,092,175 | ) | |

| (3,549,504 | ) |

| Share of profits

of associates and joint ventures | |

| 98,532 | | |

| 386,291 | | |

| 497,135 | |

| Profit before

income tax expense | |

| 3,987,215 | | |

| 15,631,802 | | |

| 21,235,513 | |

| Income tax expense | |

| (1,763,566 | ) | |

| (6,914,028 | ) | |

| (6,763,926 | ) |

| Net profit | |

| 2,223,649 | | |

| 8,717,774 | | |

| 14,471,587 | |

| Net profit

attributable to: | |

| | | |

| | | |

| | |

| Owners of parent | |

| 1,694,268 | | |

| 6,642,349 | | |

| 11,931,149 | |

| Non–controlling

interest | |

| 529,381 | | |

| 2,075,425 | | |

| 2,540,438 | |

| Net profit | |

| 2,223,649 | | |

| 8,717,774 | | |

| 14,471,587 | |

| (1) | Amounts stated in U.S. dollars have been

translated for the convenience of the reader at the average exchange rate of COP 3,920.48

to US$1.00, which was the average Representative Market Rate from January 1, 2024 until

June 30, 2024, as reported by the SFC. |

The following table presents our operating data

for the periods indicated:

| | |

OPERATING DATA | |

| | |

For the six months

ended June 30 | | |

For the

year ended December 31, | |

| | |

2024 | | |

2023 | | |

2023 | | |

2022 | | |

2021 | |

| Refining | |

| | |

| | |

| | |

| | |

| |

| Capacity(1) | |

| 464.8 | | |

| 464.8 | | |

| 464.8 | | |

| 464.8 | | |

| 404.8 | |

| Throughput(1) | |

| 429.0 | | |

| 422.5 | | |

| 422.6 | | |

| 360.4 | | |

| 355.9 | |

| Capacity utilization

rate | |

| 92 | % | |

| 91 | % | |

| 91 | % | |

| 78 | % | |

| 88 | % |

| Proved reserves* | |

| | | |

| | | |

| | | |

| | | |

| | |

| Crude

oil(2) | |

| 1,469 | | |

| 1,515 | | |

| 1,469 | | |

| 1,515 | | |

| 1,449 | |

| Natural

gas(3) | |

| 414 | | |

| 496 | | |

| 414 | | |

| 496 | | |

| 553 | |

| Total

oil and natural gas proved reserves(4) | |

| 1,883 | | |

| 2,011 | | |

| 1,883 | | |

| 2,011 | | |

| 2,002 | |

| Production(5) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Oil | |

| 573.1 | | |

| 551.9 | | |

| 663.3 | | |

| 662.4 | | |

| 648.6 | |

| Gas | |

| 176.5 | | |

| 171.8 | | |

| 73.3 | | |

| 47.1 | | |

| 30.4 | |

| Total Production | |

| 749.6 | | |

| 723.7 | | |

| 736.6 | | |

| 709.5 | | |

| 679.0 | |

| Employees | |

| 19,572 | | |

| 19,199 | | |

| 19,657 | | |

| 18,903 | | |

| 18,378 | |

| Electric

Power Transmission and Toll Roads Concessions | |

| | | |

| | | |

| | | |

| | | |

| | |

| Transmission lines

(km) | |

| 49,398 | | |

| 49,303 | | |

| 49,426 | | |

| 48,766 | | |

| 48,330 | |

| (1) | In thousands of barrels per day (kbpd) as

of December 31 or June 30. See “Business Overview—Refining and Petrochemicals—Refining”

in the 2023 Annual Report. Includes NGL. |

| (2) | In millions of barrels as of December 31

or June 30. See “Business Overview—Exploration and Production—Reserves”

in the 2023 Annual Report. |

| (3) | In millions of barrels equivalent (boe) as

of December 31 or June 30. See “Business Overview—Exploration and Production—Reserves”

in the 2023 Annual Report. |

| (4) | In millions of barrels of oil equivalent

(boe) as of December 31 or June 30. See “Business Overview—Exploration

and Production—Reserves” in the 2023 Annual Report. |

| (5) | All production values are expressed in thousands

of barrels of oil equivalent per day. Gross production includes royalties and is prorated

by Ecopetrol's participation in each company. Gas includes gas and natural gas liquids. |

| * | Reserve data is calculated as of December 31

of the applicable prior year. Reserves information is calculated each year and is net after

royalties. Third parties audit 99% of our total proved reserves. |

RISK

FACTORS

You should consider carefully

all of the information set forth in this prospectus supplement, in the accompanying prospectus and any documents incorporated by reference

herein and, in particular, the risk factors described below, and in the Risk Factors section of our 2023 Annual Report before deciding

to invest in the notes. The risk factors described below and in the Risk Factors section of our 2023 Annual Report are not the only ones

we face. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, may also become important factors

that affect us.

Risk factors related to the notes

The

notes are effectively subordinated to the existing and future liabilities of our subsidiaries.

The notes will constitute

our general senior, unsecured and unsubordinated obligations and will rank pari passu, without any preferences among themselves,

with all of our other present and future senior unsecured and unsubordinated obligations that constitute our External Indebtedness. The

notes are not secured by any of Ecopetrol’s assets. Any future claims of secured lenders with respect to Ecopetrol’s assets

securing their loans will be prior to any claim of the holders of the notes with respect to those assets.

Ecopetrol’s subsidiaries

are separate and distinct legal entities from Ecopetrol. Ecopetrol’s subsidiaries have no obligation to pay any amounts due on

the notes or to provide Ecopetrol with funds to meet its payment obligations on the notes, whether in the form of dividends, distributions,

loans, guarantees or other payments. In addition, any payment of dividends, loans or advances by Ecopetrol’s subsidiaries could

be subject to statutory or contractual restrictions. Payments to Ecopetrol by its subsidiaries will also be contingent upon the subsidiaries’

earnings and business considerations. Ecopetrol’s right to receive any assets of any of its subsidiaries upon their bankruptcy,

liquidation or reorganization, and therefore the right of the holders of the notes to participate in those assets, will be effectively

subordinated to the claims of that subsidiary’s creditors, including trade creditors. In addition, even if Ecopetrol is a creditor

of any of its subsidiaries, its rights as a creditor would be subordinate to any security interest in the assets of its subsidiaries

and any indebtedness of its subsidiaries senior to that held by Ecopetrol. As of June 30, 2024, Ecopetrol had outstanding indebtedness

of COP 80,904,125 million and subsidiaries of Ecopetrol had additional outstanding indebtedness of COP 34,115,441 million, which we recognize

in our consolidated financial statements at its amortized cost, which corresponds to the present value of cash flows, discounted at the

effective interest rate (using an exchange rate of COP 4,148.04 to US$1.00 as of June 30, 2024). As of June 30, 2024, and after

giving effect to the issuance of the notes, Ecopetrol had outstanding indebtedness of COP 89,200,205 million and subsidiaries of Ecopetrol

had additional outstanding indebtedness of COP 34,115,441 million. None of the Ecopetrol indebtedness is secured, but the subsidiary

indebtedness will rank effectively senior to the notes offered hereby.

The indenture does not restrict the amount

of additional debt that we may incur or limit the granting of liens to secure indebtedness denominated in Pesos and does not provide

for cross acceleration of the notes to other indebtedness denominated in Pesos or for events of default in the event of insolvency or

liquidation of any of our subsidiaries.

The notes and indenture under

which the notes will be issued do not place any limitation on the amount of unsecured debt that may be incurred by us. Our incurrence

of additional debt may have important consequences for you as a holder of the notes, including making it more difficult for us to satisfy

our obligations with respect to the notes, a loss in the trading value of your notes, if any, and a risk that the credit rating of the

notes is lowered or withdrawn. Furthermore, there are no limits to the liens we may grant to secure indebtedness denominated in Pesos.

Therefore, payments under the notes will be effectively subordinated to any current or future secured Peso-denominated debt. In addition,

the notes only cross accelerate to indebtedness which is not denominated in Pesos and do not contain as events of default the insolvency

or liquidation of any of our subsidiaries. Additionally, involuntary filings against Ecopetrol under the bankruptcy or insolvency laws

of certain jurisdictions, if filed, would not constitute events of default under the indenture governing the notes.

Our credit ratings may not reflect all

risks of your investments in the notes and may adversely affect the rating and price of the notes.

Our credit ratings are an

assessment by rating agencies of our ability to pay our debts when due. Consequently, real or anticipated changes in our credit ratings

will generally affect the market value of the notes. These credit ratings may not reflect the potential impact of risks relating to structure

or marketing of the notes. Agency ratings are not a recommendation to buy, sell or hold any security, and may be revised or withdrawn

at any time by the issuing organization. Each agency’s rating should be evaluated independently of any other agency’s rating.

We may not be able to repurchase the notes

upon a change of control repurchase event.

Upon the occurrence of a

change of control repurchase event as set forth in “Description of the Notes—Certain Covenants—Repurchase of Notes

upon a Change of Control Repurchase Event”, we will be required to offer to repurchase all outstanding notes at 101% of their principal

amount plus accrued and unpaid interest, if any. The source of funds for any such purchase of the notes will be our available cash or

cash generated from our subsidiaries’ operations or other sources, including borrowings, sales of assets or sales of equity. We

may not be able to repurchase the notes upon a change of control repurchase event because we may not have sufficient financial resources

to purchase all of the notes that are tendered upon a change of control repurchase event. Our failure to repurchase the notes upon a

change of control repurchase event would cause a default under the indenture governing the notes. Any of our future debt agreements may

contain similar provisions.

Holders of the notes are not able to effect

service of process on us, our directors or executive officers within the United States, which may limit your recovery in any foreign

judgment you obtain against us.

We are a mixed-economy company

(sociedad de economía mixta) organized under the laws of Colombia. Most of our directors and executive officers reside

outside the United States. All or a substantial portion of our assets and the assets of these persons are located outside the United

States. As a result, it may not be possible for you to effect service of process within the United States upon us or these persons or

to enforce against us or them in U.S. courts judgments obtained in such courts predicated upon the civil liability provisions of the

U.S. federal securities laws. Colombian courts determine whether to enforce a U.S. judgment predicated on the U.S. securities laws through

a procedural system known as “exequatur”. For a description of these limitations, see “Enforcement of Civil Liabilities.”

We may claim immunity under the Foreign

Sovereign Immunities Act with respect to actions brought against us under the U.S. securities laws and your ability to sue or recover

may be limited under U.S. and Colombian law.

We reserve the right to plead

sovereign immunity under the United States Foreign Sovereign Immunities Act of 1976 with respect to actions brought against us under

United States federal securities laws or any state securities laws. Accordingly, you may not be able to obtain a judgment in a U.S. court

against us unless the U.S. court determines that we are not entitled to sovereign immunity with respect to that action. Moreover, you

may not be able to enforce a judgment against us in the United States except under the limited circumstances specified in the Foreign

Sovereign Immunities Act. Under Colombian law, we are subject to sovereign immunity before the Colombian courts regarding some specific

assets and legal proceedings. According to Colombian law these immunities cannot be waived, and you may not be able to enforce a judgment

against us in Colombian courts with respect to those assets.

We are not required to disclose as much

information to investors as a U.S. issuer is required to disclose.

We are subject to the reporting

requirements set by Law 964 of 2005, Decree 2555 of 2010, the SFC and the BVC. While we are also subject to some reporting requirements

under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), the corporate disclosure requirements that

apply to us may not be equivalent to the disclosure requirements that apply to a U.S. issuer and, as a result, you may receive less information

about us than you would receive from a U.S. issuer.

An active trading market for the notes

may not develop and changes in the financial markets or interest rates could adversely affect the market prices of the notes.

The notes constitute an issuance

of new securities with no established trading market. We intend to apply to have the notes approved for listing on the NYSE. Additionally,

while the underwriters have advised us that they currently intend to make a market in the notes, they are not obligated to do so and

may discontinue market-making activities in their sole discretion at any time without notice. In addition, their market-making activity

will be subject to limits imposed by the U.S. Securities Act of 1933, as amended (the “Securities Act”) and the Exchange

Act. We cannot assure you that any market for the notes will be developed or sustained. If an active market is not developed or sustained,

the market price and liquidity of the notes may be adversely affected. If a market for the notes does not develop, holders may not be

able to resell the notes for an extended period of time, if at all. In addition, the condition of the financial markets and prevailing

interest rates have fluctuated in the past and are likely to fluctuate in the future, which could have an adverse effect on the market

prices of the notes.

We may issue additional notes that are

treated for non-tax purposes as a single series with the notes offered hereby, but they may be treated for U.S. federal income tax purposes

as a separate series from the notes offered hereby.

We may issue additional notes

under the indenture that are treated for non-tax purposes as a single series with the notes offered hereby, but they may be treated for

U.S. federal income tax purposes as a separate series and not part of the same issue as the notes offered hereby. In such case, the additional

notes may be considered to have been issued with “original issue discount” for U.S. federal income tax purposes, which may

affect the market value of the notes offered hereby since such additional notes may not be distinguishable for non-tax purposes from

the notes offered hereby.

Because the notes are represented by global

securities registered in the name of a depositary, you will not be a “holder” under the indenture and your ability to pledge

the notes could be limited.

Because the notes are represented

by global securities registered in the name of a depositary, you will not be a “holder” under the indenture and your ability

to transfer or pledge the notes could be limited. The notes will be represented by one or more global securities registered in the name

of Cede & Co., as nominee for DTC. Except in the limited circumstances described in this prospectus supplement, owners of beneficial

interests in the global securities will not be entitled to receive physical delivery of notes in certificated form and will not be considered

“holders” of the notes under the indenture for any purpose. Instead, owners must rely on the procedures of DTC and its participants

to protect their interests under the indenture and to transfer their interests in the notes. Your ability to pledge your interest in

the notes to persons or entities that do not participate in the DTC system may also be adversely affected by the lack of a certificate.

Risks Related to Colombia and the Region’s Political and

Regional Environment

This section discusses potential risks related

to our extensive operations in Colombia, as well as our operations in other countries of Latin America.

Changes in economic policies in Colombia,

Peru, Brazil and Chile could materially adversely affect our business, financial condition and results of operations.

Our financial condition and

results of operations may be adversely affected by changes in the political climate of Colombia, Peru, Brazil and Chile to the extent

that such changes affect the economic policies, growth, stability, outlook or regulatory environment of these countries.

With respect to Colombia,

for the year ended December 31, 2023, revenues derived from Colombia represented 50% of our total revenues. The Colombian Government

has historically exercised substantial influence on the local economy, and governmental policies are likely to continue to have an important

effect on companies operating in Colombia and on market conditions. Natural resources are owned by the state, but they can be exploited

by a third party and pay grants to the Government for that exploitation. The President of Colombia and the Colombian Central Bank have

considerable power and independence as policymakers to determine governmental policies, regulations and actions relating to the economy

and may adopt policies that may negatively affect us. We cannot predict which policies will be adopted by the Government and whether

those policies would have a negative impact on the Colombian economy or our business and financial performance.

In

December 2023, the Minister of Mines and Energy, Andrés Camacho, announced the progress made by the Colombian Government

in relation to energy and hydrocarbons, as well as the challenges that are yet to be overcome in these sectors. The Colombian Government

is currently developing the “Roadmap for an Equitable Energy Transition,” and released a draft in August of 2023 for

comments and feedback by interested parties, after having presented the “Construction of principles, methodology and launch of

the Social Dialogue to define the Roadmap for the Just Energy Transition in Colombia” during the United Nations Conference on Climate

Change COP27 in Egypt in November 2022. This roadmap is being built through technical analysis and together with existing regulations

such as Law 2099 of 2021 and CONPES 4075 of 2022. Moreover, in 2022 the Colombian Government presented a bill to definitively prohibit

fracking in Colombia, which failed to be discussed and was turned down in June 2024. It is expected that a new bill in this regard

will be presented again in 2024. If presented, it would have to start a new bill approval process before the Colombian Congress. To the

same extent, it is expected that the Colombian Government pass a bill to amend the utilities law in effect (Law 142 of 1994), of which

a final draft and scope has not been made available yet. At this time, it is unclear how such policies may affect our business, what

form they could take, or whether we would need to adjust our business strategy to any such policies

Furthermore,

although throughout recent history Colombia’s elected governments (and the Colombian Congress as well) have generally pursued free

market economic policies with almost no economic interventions, we cannot predict which policies, if any, will be adopted by a new Government

and/or congress and whether those policies would have a negative impact on the Colombian economy or our business and financial performance.

See our 2023 Annual Report, section Business Overview—Applicable Laws and Regulations—Regulation of Exploration and

Production Activities—Business Regulation—Temporary regulation for the Comprehensive Research Pilot Projects (PPII).

On

August 2022, the MHCP submitted a tax reform bill to Congress proposing changes to the Colombian tax regime. The tax reform bill

was sanctioned by President Petro as Law 2277 of 2022 on December 13, 2022, and became effective starting January 1, 2023.

The tax reform includes, among others: (i) a new permanent equity tax applicable to Colombian individuals and non-residents, at

rates ranging from 0.5% to 1.5% based on the level of net equity at January 1st every year, (ii) an increase in the dividend

tax rate for local and foreign shareholders (0% to 39% progressive marginal rates for Colombian individuals with up to 19% tax credit,

and 20% flat withholding for non-resident shareholders), (iii) an increase in the long-term capital gains tax rate (increasing from

10% to 15%); (iv) the elimination of specific tax benefits and exemptions, (v) a minimum corporate income tax based on effective

tax rate (effective rate calculated on book profit should be at least 15%, considering certain adjustments to accounting profits and

certain exempted companies), (vi) the application of taxes based on significant economic presence (primarily for non-resident persons

and entities that provide digital services, but including other services and commercial activities), (vii) the elimination of the

ability to claim 50% of the Industry and Commerce Tax as an income tax credit, (viii) an income tax surcharge for companies engaged

in the extraction of crude oil and coal of 0%, 5%, 10% or 15% and, based on international prices, (ix) the introduction of a minimum

tax based on effective tax rate determined on accounting profits (initially, the tax reform treated royalties paid by oil &

gas companies to the Government as non-deductible for income tax purposes; however, the Colombian Constitutional Court ruled that the

limitation rule is unconstitutional, thus, not applicable, and in a final effort to mitigate the effect of this ruling to the public

finances, the Government recently requested the Constitutional Court to adjust, modify or defer its decision but the Constitutional Court

denied such request; therefore, for fiscal year 2023, the surtax of 5%, 10% or 15% will apply when the Brent price reaches US$ 65.43,

US$ 73.17 and US$ 79.92, respectively, according to ANH Resolution No. 0181 (revenues from the sale of natural gas are not subject

to this surtax)), (x) non-deductibility of royalties, and (xi) the modification of section 221 of Law 1819 of 2016, with an

adjustment to the taxable event and establishing that the national carbon tax will be levied on the carbon equivalent content (CO2eq)

of all fossil fuels, including all petroleum derivatives, fossil gas and solids used for combustion.

On

September 10, 2024, the MHCP submitted a new tax reform bill to Congress proposing changes to the Colombian tax regime. The tax

reform includes, among others, the following proposals: (i) replacement of the 35% corporate income tax with marginal rates ranging

from 27% to 34%, based on the taxpayer’s taxable income; (ii) financial institutions would be subject to these new rates plus

a five-point surcharge until 2027; (iii) companies, permanent establishments and foreign legal entities engaged in the extraction

of hard coal, lignite coal or crude oil will be subject to a 35% income tax rate, therefore, the marginal corporate income tax rate will

not be applicable to the mentioned activities. The additional points added to the corporate income tax rate for hard coal and lignite

extraction activities are aligned with the percentiles used to calculate crude oil extraction activities, which range from 5% to 15%,

(iv) companies and permanent establishments are included as liable for the equity tax in respect of their non-productive real fixed

assets, at a rate of 1.5% with no minimum threshold; (v) an increase in the long-term capital gains tax rate from 15% to 20%, (vi) an

increase in the minimum corporate income tax from 15% to 20%, (vii) presumptive interest rate for loans between entities and their

shareholders would double, and loans granted by and to permanent establishments would also produce presumptive interest, and (viii) carbon

tax will be applied uniformly to gas, coal, and petroleum derivatives. If the new tax reform bill is approved, tax rate increases and

adjustments would occur on January 1 of each year based on Tax Unit of the previous year plus one percent until it reaches the equivalent

of 3 Tax Units per ton of carbon equivalent. The tax reform proposal does not include any changes to withholdings on dividends or interests.

Additionally,

the pension reform bill was enacted by the Colombian Congress and sanctioned by President Petro as Law 2381 of 2024 on July 16,

2024. This law will become effective on July 1, 2025. Law 2381 amends the pension system by setting forth a “pillar system”

that divides the population into four categories based on the contributions made to the previous pension system and the capacity of individuals

over time to fulfil legal conditions —in terms of age and time contributing to the system— to earn pension rights. The

new system states asymmetric conditions in favor of women, indigenous, low-income groups and afro-descendants, which shall be regulated

further by the Government. Furthermore, Law 2381 removes current competition between the public pension fund and private pension funds.

Based on a threshold of 2.3 times minimum monthly legal wages, anybody who earns less than this amount must make monthly contributions

to the former, whereas the amounts earned above the threshold shall be managed by the private pension fund freely selected by each individual.

Contributions to the public pension fund will be managed by the Colombian Central Bank in line with decisions made by a Directive Committee

composed of several representatives of the National Government and expert individuals elected for five-year periods by the Board of Directors

of the Colombian Central Bank. The investment regime of the public pension fund, among other aspects of the new system, shall be regulated

by the Government as stated in Law 2381. Law 2181 is currently in force. However, several claims have been filed with the Colombian Constitutional

Court arguing that Law 2381 does not comply with the Colombian National Constitution. The merits of such claims will be reviewed and

decided by the Colombian Constitutional Court in the upcoming months in accordance with the legal procedure laid out to that end. In

addition, a bill for a labor reform (for more information related to the labor reform see our 2023 Annual Report - Risk

Review – Risk Factors – Risks Related to Our Business). As of the date hereof, it is unclear how this bill could

affect the Colombian economy or our business.

With

respect to Brazil, for the year ended December 31, 2023, revenues derived from

our consolidated subsidiaries in this country represented 4% of our total revenues. Brazilian markets have experienced heightened volatility

due the uncertainties from ongoing investigations on money laundering and corruption conducted by the Brazilian Federal Police and the

Office of the Brazilian Federal Prosecutor, including the Lava Jato investigation. These investigations adversely affected the Brazilian

economy and political scenario. We have no control over and cannot predict whether the ongoing investigations or allegations will result

in further political and economic instability, or if new allegations against government officials and/or companies will arise in the

future. Changes in economic or other policies by the government of the president Luiz Inácio Lula da Silva could negatively affect

our industry in general, or our Brazilian subsidiaries’ results of operations, in particular.

With

respect to Peru, for the year ended December 31, 2023, revenues derived from our

consolidated subsidiaries in this country represented 2% of our total revenues. Peru’s most recent general presidential elections

took place in April 2021. Following a run-off between the two top contenders on June 6, 2021, Pedro Castillo was elected as

Peru’s president. On December 7, 2022, Mr. Castillo announced his intention to dissolve the Peruvian Congress and to

intervene, among others, the Peruvian judicial branch and Superior Court. Mr. Castillo’s actions were deemed to constitute

an attempted coup, which led to his destitution and arrest. Mr. Castillo was succeeded by his then vice-president, Dina Boluarte.

Following Mr. Castillo’s destitution, a wave of protests in support of Mr. Castillo erupted across the country, which

led President Boluarte to declare a state of emergency across several regions in Peru on December 12, 2022 and call for congressional

approval of a bill to permit early elections in 2024. After several legislative attempts to approve early elections, on June 15,

2023, President Boluarte declared that elections would not be held early, and that she would hold office until July 28, 2026. These

events have further increased the environment of political uncertainty in Peru and gave way to further discussions about a possible reform

of the Peruvian Constitution, which is based on free market, contractual liberty, and minimal governmental intervention in the economy.

There is uncertainty as to whether President Boluarte will obtain the required qualified majorities in order to modify the Peruvian Constitution.

We cannot assure that policies against free market and minimal intervention of the government in the Peruvian economy will not be taken

by the new administration or any new congress. Any changes in the Peruvian economy or the Peruvian government’s economic policies

may have a negative effect on our business, financial condition, and results of operations. Changes in economic or other policies by

the Peruvian government or other political developments in Peru could adversely affect the business, financial condition, and results

of operations of our subsidiaries.

With

respect to Chile, for the year ended December 31, 2023, revenues derived from

our consolidated subsidiaries in this country represented 2% of our total revenues. In 2019, following social unrest and protests, the

Chilean government called for a constitutional assembly to reform the Chilean constitution. In May 2021, the Chilean government

established a constitutional assembly to write a new constitution, which was rejected by 61.86% of the votes cast on a referendum that

took place on September 4, 2022. On January 17, 2023, Law No. 21,533 was published in the Official Gazette of Chile, setting

forth the procedure for the drafting and approval of the new Constitution. Law No. 21,533 contains 12 fundamental principles and

criteria for the drafting of the potential new Constitution. It also provides for an experts’ commission (the “Experts’

Commission”) of 24 members that were appointed by the Chilean Congress, in proportion to the current political forces and parties

represented in Congress, which was in charge of preparing a pre-draft of a constitutional text. This pre-draft in under discussion of

the constitutional council (Consejo Constitucional) elected on May 7, 2023 (the “Constitutional Council”). On

October 30, 2023, the Constitutional Council approved the draft of the new constitution and delivered it to President Gabriel Boric

on November 7, 2023. On December 17, 2023, approximately 6.9 million people voted to reject the draft of the new constitution,

representing approximately 55.7% of all votes cast. As a result, the constitution enacted in 1980 will remain in force. Additionally,

the Chilean government announced that the process for the promulgation of a new constitution was closed and no initiatives on this matter

would be proposed during the current presidential term, which ends on March 11, 2026. We cannot predict what policies will be adopted

by Mr. Boric’s government and whether those policies would have a negative impact on the Chilean economy or our industry sector

in Chile or our Chilean subsidiaries’ business and financial performance.

We cannot provide any assurances

that political or social developments in Colombia, Peru, Brazil, or Chile over which we have no control, will not have an adverse effect

on our respective economic situations and will not adversely affect the business, financial condition and results of operations of our

consolidated subsidiaries and their ability to pay dividends or make other distributions to us. This could have a material adverse effect

on our business, results of operations, financial condition.

Concerning

our operations in the United States of America, we do not expect a material risk for Ecopetrol’s operations in the country as a

result of the 2024 presidential elections in November 2024, regardless of the outcome.

USE

OF PROCEEDS

We expect the net proceeds

from the sale of the notes will be approximately US$

(after giving effect to underwriters’ discounts but before expenses). We intend to use the net proceeds of this offering to (i) purchase

the Target Notes tendered pursuant to the Tender Offer (and pay related expenses thereunder); (ii) prepay a portion of the outstanding

principal amounts under the 2030 Loan Agreement; and/or (iii) finance expenditures outside our investment plan. The outstanding

principal amount of the Target Notes, which are scheduled to mature on June 26, 2026, is approximately US$1,250,000,000, we plan

to give a notice of redemption of part or all of the Target Notes that are not tendered in the Tender Offer pursuant to their terms promptly

following the settlement of the offering of the notes. Certain underwriters or their affiliates may hold Target Notes to be redeemed

with the proceeds of this offering or may be lenders under the credit facilities being repaid, and therefore may receive a portion of

proceeds if the Target Notes are redeemed or the credit facilities repaid. None of the underwriters shall have any responsibility for

the application of the net proceeds of the notes.

EXCHANGE

RATES AND CONTROLS

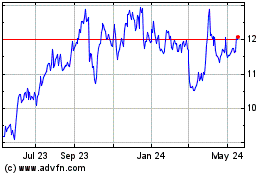

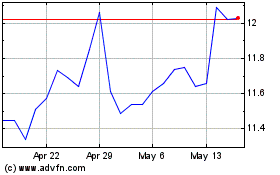

Exchange Rates

On

October 7, 2024, the Representative Market Rate was COP 4,173.66 per US$1.00. The Federal Reserve Bank of New York

does not report a noon-buying rate for Pesos. The SFC calculates the Representative Market Rate based on the weighted averages of

the buy/sell foreign exchange rates quoted daily by foreign exchange rate market intermediaries including financial institutions for

the purchase and sale of U.S. dollars.

The following table sets

forth the high, low, average and period-end exchange rate for Pesos/U.S. dollar Representative Market Rate for each of the last ten

months.

| | |

Exchange

Rates | |

| | |

High | | |

Low | | |

Average | | |

Period-End | |

| December 2023 | |

| 4,045.22 | | |

| 3,822.05 | | |

| 3,948.21 | | |

| 3,822.05 | |

| January 2024 | |

| 3,969.50 | | |

| 3,822.05 | | |

| 3,915.20 | | |

| 3,925.60 | |

| February 2024 | |

| 3,975.74 | | |

| 3,889.05 | | |

| 3,931.44 | | |

| 3,933.56 | |

| March 2024 | |

| 3,948.67 | | |

| 3,842.30 | | |

| 3,899.34 | | |

| 3,842.30 | |

| April 2024 | |

| 3,964.59 | | |

| 3,763.43 | | |

| 3,867.98 | | |

| 3,873.44 | |

| May 2024 | |

| 3,902.63 | | |

| 3,814.94 | | |

| 3,869.10 | | |

| 3,874.32 | |

| June 2024 | |

| 4,175.96 | | |

| 3,860.92 | | |

| 4,042.80 | | |

| 4,148.04 | |

| July 2024 | |

| 4,148.04 | | |

| 3,944.97 | | |

| 4,036.92 | | |

| 4,089.05 | |

| August 2024 | |

| 4,184.30 | | |

| 4,011.37 | | |

| 4,065.55 | | |

| 4,160.31 | |

| September 2024 | |

| 4,285.61 | | |

| 4,139.43 | | |

| 4,182.51 | | |

| 4,164.21 | |

| October 2024 (through October 7,

2024) | |

| 4,224.21 | | |

| 4,173.66 | | |

| 4,189.24 | | |

| 4,173.66 | |

Source: SFC.

Exchange Controls

Colombia has not had exchange

controls since 1991. However, pursuant to Colombian foreign exchange regulations certain transactions must be conducted in the foreign

exchange market and, in some cases, subject to registration before the Colombian Central Bank. In addition, the Colombian Government,

as regulator of international investments, or the Colombian Central Bank, as foreign exchange regulator, have, periodically, in certain

circumstances, imposed capital controls, including deposit requirements for borrowers in foreign currency. However, as of the date hereof,

there are no exchange controls and borrowers currently have no deposit requirements in Colombia, but there can be no assurance that they

will not exist in the future.

CAPITALIZATION

The following table sets forth