On December 5, 2023, Ferguson plc (the “Company”) announced that

it was considering a new corporate structure to domicile the

Group’s ultimate parent company in the United States, which would

better align the Company’s headquarters and governance with its

operations and leadership. Having now fully considered the merits

and associated steps needed to achieve such an outcome, the

Company’s Board of Directors (the “Board”) has concluded that it

would be in the best interests of the Company and its shareholders

as a whole to proceed with establishing this new corporate

structure.

Transaction Process &

Timeline

The new corporate structure would be accomplished through a

merger process by which the Company would become a direct wholly

owned subsidiary of a new Delaware corporation (“US TopCo”). US

TopCo would list its common stock on both the New York Stock

Exchange (“NYSE”) (primary) and London Stock Exchange (“LSE”)

(secondary). Shareholders of the Company would receive one new US

TopCo share for each Company share held as of the business day

preceding the transaction effective date.

No additional equity would be raised by US TopCo as part of the

transaction.

The transaction will require filings, or registration, with US,

UK and Jersey regulators, and shareholders of the Company will be

asked to vote at a special meeting to approve it and on other

ancillary matters. Pursuant to the Company’s Articles of

Association and Jersey law, at least two-thirds of the total votes

cast by shareholders will be required to approve the

transaction.

The overall timeline for the transaction is expected to be:

- Mid/Late April 2024: Proxy Statement and Notice of Meeting

issued to shareholders

- Late May 2024: Special meeting of shareholders held in

London

- August 1, 2024: Effective date of the transaction; Company

shares exchanged for US TopCo shares; US TopCo shares begin trading

on the NYSE and LSE

No action is needed by shareholders at this time.

Natural Next Step

Since 2019, the Board has considered North America to be the

best long-term location for Ferguson and has worked methodically

and transparently with shareholders on this transformative journey,

creating an additional listing on the NYSE in 2021, and then moving

the Company’s primary listing from London to New York in 2022.

During this period, over two-thirds of our shareholding base has

become American, and the Company achieved U.S. domestic status

under Securities and Exchange Commission (“SEC”) rules as of August

1, 2023.

The Board believes that the establishment of US TopCo is the

next natural step and will simplify the Company’s corporate

governance requirements.

The Board also does not foresee any material downsides to making

this change. Tax reforms in the UK and Switzerland relating to

global minimum tax policies are already expected to reduce the

benefit of our current structure, such that the Company’s adjusted

effective tax rate (“AETR”) for the fiscal year ending July 31,

2025 would be approximately 26%. The Board considers any tax

impacts of establishing US TopCo, which will have a US tax

domicile, to be immaterial to that prospective AETR and the

Company’s financial results as a whole.

Additional Information

Forthcoming

More specific details about the transaction and any expected

impacts on the Company and its shareholders will be provided later

in the US registration statement, which will include a proxy

statement for the special meeting, and the UK prospectus.

The Company expects to provide a progress update on the

transaction on March 5, 2024 in connection with its Q2 earnings

release and conference call.

Important Information for Investors and

Shareholders

This communication does not constitute an offer to sell or the

solicitation of an offer to buy or exchange any securities or a

solicitation of any vote or approval in any jurisdiction. It does

not constitute a prospectus or prospectus equivalent document. No

offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the US

Securities Act of 1933, as amended.

In connection with the transaction described herein, US TopCo

and the Company intend to file relevant materials with the SEC,

including, among other filings, a US TopCo registration statement

on Form S-4 that will include a proxy statement of the Company that

also constitutes a prospectus of US TopCo, and a definitive proxy

statement/prospectus, which will be mailed to shareholders of the

Company. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO

READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL

BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors and security holders will be able to obtain free copies

of the registration statement and the proxy statement/prospectus

(when available) and other documents filed with the SEC by US TopCo

or the Company through the website maintained by the SEC at

http://www.sec.gov. Copies of the documents filed with the SEC by

US TopCo or the Company will be available free of charge on

Company’s website at corporate.ferguson.com under the tab

“Investors” and under the heading “Financial Information” and

subheading “SEC Filings” or by contacting the Company’s Company

Secretary in writing by mail at 1020 Eskdale Road, Winnersh

Triangle, Wokingham, Berkshire, RG41 5TS, United Kingdom; by email

at investor@ferguson.com; or by telephone at +44 (0) 118 927

3800.

Certain Information Regarding

Participants

The Company, US TopCo, and their respective directors and

executive officers may be considered participants in the

solicitation of proxies from the shareholders of the Company in

connection with the transaction. Information about the directors

and executive officers of the Company is set forth in its Annual

Report on Form 10-K for the year ended July 31, 2023, which was

filed with the SEC on September 26, 2023 and its proxy statement

for its 2023 annual general meeting, which was filed with the SEC

on October 17, 2023, and its Current Report on Form 8-K, which was

filed with the SEC on January 12, 2024. To the extent holdings of

the Company’s securities by its directors or executive officers

have changed since the amounts set forth in such 2023 proxy

statement, such changes have been or will be reflected on Initial

Statements of Beneficial Ownership on Form 3 or Statements of

Beneficial Ownership on Form 4 filed with the SEC. Information

about the directors and executive officers of the Company and US

TopCo and other information regarding the potential participants in

the proxy solicitations and a description of their direct and

indirect interests, by security holdings or otherwise, will be

contained in the proxy statement/prospectus and other relevant

materials to be filed with the SEC regarding the transaction when

they become available. You may obtain these documents (when they

become available) free of charge through the website maintained by

the SEC at http://www.sec.gov and from the Company Secretary at the

Company as described above.

Cautionary Note Regarding Forward-Looking

Statements

Certain information in this announcement is forward-looking

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements relating to the process and timetable

for the transaction and the benefits of the new corporate

structure. Forward-looking statements cover all matters which are

not historical facts and speak only as of the date on which they

are made. Forward-looking statements can be identified by the use

of forward-looking terminology such as “intend,” “will,” “plan,”

“would,” “believe,” “expect,” “anticipate,” “may” or other

variations or comparable terminology. Many factors could cause

actual results to differ materially from those in such

forward-looking statements, including, but not limited to: the

transaction may be delayed, cancelled, suspended or terminated; the

conditions to the completion of the transaction, including

shareholder approval, may not be satisfied; the benefits of the

transaction may not be realized; weakness in the economy, market

trends, uncertainty and other conditions in the markets in which we

operate, and other factors beyond our control, including disruption

in the financial markets and any macroeconomic or other

consequences of political unrest, disputes or war; failure to

rapidly identify or effectively respond to direct and/or end

customers’ wants, expectations or trends, including costs and

potential problems associated with new or upgraded information

technology systems or our ability to timely deploy new omni-channel

capabilities; unsuccessful execution of our operational strategies;

changes in, interpretations of, or compliance with tax laws in the

US, the UK, Switzerland or Canada; adverse impacts caused by a

public health crisis; and other risks and uncertainties set forth

under the heading “Risk Factors” in our Annual Report on Form 10-K

filed with the SEC on September 26, 2023, and in other filings we

make with the SEC in the future. Forward-looking statements

regarding past trends or activities should not be taken as a

representation that such trends or activities will continue in the

future. Other than in accordance with our legal or regulatory

obligations, we undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240118422552/en/

Investor Inquiries Brian Lantz Vice President, IR and

Communications +1 224 285 2410 Brian.lantz@ferguson.com Pete

Kennedy Director, Investor Relations +1 757 603 0111

Peter.kennedy@ferguson.com Media Inquiries Christine Dwyer

Senior Director, Communications and Public Relations +1 757 469

5813 Christine.dwyer@ferguson.com

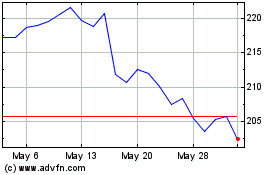

Ferguson Enterprises (NYSE:FERG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ferguson Enterprises (NYSE:FERG)

Historical Stock Chart

From Nov 2023 to Nov 2024