SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

FOMENTO ECONÓMICO

MEXICANO, S.A.B. DE C.V.

(Exact name of Registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of Registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, Nuevo León 64410

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the

information contained in this

Form, the registrant is also thereby furnishing

the information to the

Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes ¨

No x

If "Yes" is marked, indicate below the

file number assigned to the registrant in

connection with Rule 12g3-2(b): 82-_____________

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the

registrant has duly caused this report to be signed

on its behalf of the

undersigned, thereunto duly authorized.

| |

FOMENTO ECONÓMICO MEXICANO, S.A. DE C.V. |

| |

|

| |

By: |

/s/ Martin Felipe Arias Yaniz |

| |

Martin Felipe Arias Yaniz |

| |

Director of Finance and Corporate Development |

Date: May, 31, 2024

Exhibit 99.1

Fomento Económico Mexicano, S.A.B. de

C.V.

Code of Principles and Best Corporate Governance

Practices Questionnaire

Shareholders Meetings

The Shareholders Meeting is the supreme body

of the company. Even if said body meets in most cases on an annual basis, it is important that it acts with formality, transparency and

efficiency, since it’s a decision-making and basic control body for the lives of the companies, as well as for the protection of

the interests of all the shareholders.

| 6.1. |

Information and Agenda of the Shareholders Meeting |

Yes |

No |

Comments |

| 1. |

Is it avoided in the Agenda the grouping of matters related to different subjects? (Best Practice 1) |

X |

|

|

| 2. |

Is it avoided in the Agenda an item related to “Miscellaneous Matters”? (Best Practice 1) |

X |

|

|

| 3. |

Is the information with respect to each item in the Agenda available at least with fifteen calendar days in advance? (Best Practice 2) |

X |

|

|

| 4. |

Is there a form containing the detailed information and possible voting alternatives in which the shareholders may provide instructions to their legal representatives with respect to the direction of their corresponding vote for every item of the Agenda? (Best Practice 3) |

X |

|

|

| 5. |

In the information made available to the shareholders: |

|

|

|

| |

a. Does it include the proposal on the composition of the Board of Directors? (Best Practice 4) |

X |

|

|

| |

b. Does it include the curriculum of the candidates of the Board of Directors with enough information to evaluate their category and in such case their independence? (Best Practice 4) |

X |

|

|

| 6.2. |

Information and Communication between the Board of Directors and the Shareholders. |

Yes |

No |

Comments |

| 6. |

Does the Board of Directors, in its Annual Report to the Shareholders Meeting, includes relevant aspects of the responsibilities of the intermediate bodies or committees that perform the role of (Best Practice 5) : |

|

|

|

| |

a) Audit*** |

X |

|

|

| |

b) Evaluation and compensation |

X |

|

|

| |

c) Finance and planning |

X |

|

|

| |

d) Risk and Compliance |

X |

|

|

| |

e) Corporate practices*** |

X |

|

|

| |

f) Others (specify). |

|

|

|

| 7. |

Are the reports by each intermediate body or committee submitted to the Board, available to the shareholders together the materials for the Meeting, except for such information that should be retained as confidential information? (Best Practice 5) |

X |

|

In terms of article 28, section IV of the Mexican Securities Law, upon closing of each tax year, the Board of Directors must submit the reports submitted by the Audit Committee and the Corporate Practices and Nominations Committee to the Shareholders. |

| 8. |

Does the annual report submitted to the Shareholders Meeting include the names of the members of each intermediate body? (Best Practice 5) |

X |

|

|

| 9. |

Does the company have the necessary communication mechanisms that allows to maintain the shareholders, investors and interested third parties properly and generally informed? (Best Practice 6). If yes, please specify the mechanisms and if no, please explain why. |

X |

|

|

| |

a. Specify and/or Explain |

The company has an Investor Relations Department

that reports directly to the CFO of the company. In addition to the financial information, press releases and business model that the

company communicates to the investors through the Mexican Stock Exchange’s website, the Securities and Exchange Commission website

and its website (www.femsa.com) in the section named “Investors” it keeps financial information, press releases and

presentations made to investors and analysts in order to keep them informed about the business performance and financial situation of

the company.

Additionally,

the company presents a financial and non-financial information report on an annual basis (jointly, the “Annual Integrated Report

2023”) which details key information for decision making about economic, environmental, social and corporate governance aspects

aligned to the business strategy of the company. The document can be found at https://annualreport.femsa.com/pdf/FEMSA_IR23.pdf.

|

| 10 |

Is there a defined procedure for the prevention and peaceful and negotiated solution of shareholders’ and/or directors’ disputes, favoring alternative dispute resolution mechanisms? (Best Practice 7) |

|

X |

As a public listed company, the procedure to solve these disputes is provided in articles 38, 39 and 40 of the Mexican Securities Law (liability claims) and by article 51 of the Mexican Securities Law, as well as articles 201, 202, 203, 204, 205 and 206 of the Mexican General Corporations Law (opposition to the resolutions of the Shareholders’ Meetings). |

| |

|

|

|

|

|

|

|

***Mandatory task for companies whose shares are traded on the stock

market, which can be performed in a single committee or shared along with other tasks.

Board of Directors

The daily operation of a company is entrusted

to the Chief Executive Officer and his managing team, while the definition of the strategic vision, overseeing of the operation and approval

of the performance is entrusted to the Board of Directors.

In order to facilitate its duties, the Board can

be assisted by one or more intermediate bodies generally called committees, in charge of analyzing information and proposing actions in

specific matters relevant for the Board, in such a wat that the Board has more information for the decision-making to be more efficient.

Additionally, it must be ensured that there are clear rules regarding the composition and functioning of the Board and its intermediate

bodies.

| 7.1. Duties of the Board of Directors |

Yes |

No |

Comments |

| 11. |

Does the Board of Directors perform the following duties? (Best Practice 8) |

|

| a) |

Ensure that all shareholders |

|

|

|

| |

i. Have an equal treatment |

X |

|

|

| |

ii. Their rights are respected |

X |

|

|

| |

iii. Their interests are protected |

X |

|

|

| |

iv. Have access to the information of the company |

X |

|

|

| b) |

Ensures the creation of economic and social value for the shareholders, as well as the company’s continuance through time. |

X |

|

|

| c) |

Promotes that the company considers interested third parties in its decision-making. The following are considered as interested third parties: |

|

|

|

| |

i. Collaborators |

X |

|

|

| |

ii. Clients |

X |

|

|

| |

iii. Suppliers |

X |

|

|

| |

iv. Creditors |

X |

|

|

| |

v. The community where the company operates. |

X |

|

|

| |

vi. Other interested third parties |

X |

|

|

| d) |

Ensures the honest and responsible conduction of the company. |

X |

|

|

| e) |

Defines the strategic course. |

X |

|

|

| f) |

Supervises the operation of the company. |

X |

|

|

| g) |

Approves the business operations. |

X |

|

|

| h) |

Includes the innovation as part of the culture and way of thinking of the company. |

X |

|

|

| i) |

Appoints the Chief Executive Officer and senior officers of the company. |

X |

|

Appoints the Chief Executive Officer and establishes the policies for the election of the senior officers of the company. |

| j) |

Evaluates and approves the performance of the Chief Executive Officer and the senior officers of the company. |

X |

|

|

| k) |

Promotes: |

|

|

|

| |

i. the responsible issuance of information. |

X |

|

|

| |

ii. the responsible disclosure of information. |

X |

|

|

| |

iii. the transparent management of the company. |

X |

|

|

| l) |

Promotes the establishment of internal control mechanisms. |

X |

|

|

| m) |

Promotes the establishment of mechanisms to ensure information quality. |

X |

|

|

| n) |

Establishes the policies for related party transactions. |

X |

|

|

| o) |

Approves transactions with related parties. |

X |

|

|

| p) |

Promotes the establishment of a formal succession plan for |

|

|

|

| |

i. The Chief Executive Officer |

X |

|

|

| |

ii. High level officers |

X |

|

|

| q) |

Ensures the establishment of mechanisms for: |

|

|

|

| |

i. The identification of strategic risks; |

X |

|

|

| |

ii. Analysis of strategic risks; |

X |

|

|

| |

iii. Management of strategic risks; |

X |

|

|

| |

iv. Control of strategic risks; |

X |

|

|

| |

v. Adequate disclosure of strategic risks. |

X |

|

|

| r) |

Ensures the establishment of plans for the continuance of the business. |

X |

|

|

| s) |

Oversees the existence of information recovery plans in case of disasters. |

X |

|

There are recovery plans for our businesses and a program to implement recovery plans for our newly acquired businesses. |

| t) |

Promotes the company to be socially responsible. The way(s) in which the company is made socially responsible is (are): |

|

|

|

| i |

i. Community Actions; |

X |

|

We are committed to contributing to the economic

and social development of the communities in which we operate, creating value by generating prosperity and wellbeing This commitment is

aligned with the Sustainable Development Goals and our Sustainability Strategy, structured in three main pillars “Our People, Our

Community and Our Planet”, where within “Our community” covers three priority topics: Community Wellbeing, Economic

Development and Sustainable Sourcing.

In 2023 we invested 1,223 million pesos [Mexican

currency] in Our Community pillar, and completed more than 1,039 community actions, benefiting more than 2.8 million beneficiaries.

An important part of our social license to operate

is based on the relationships we build with our neighbors. Comprised of five steps for managing risks and community engagement, our MARRCO

model guides our value-generating engagement activities by revealing unique insights about how our operations impact the community, and

vice versa.

In 2023, we continued to expand MARRCO to new

geographies across our business units. MARRCO is currently deployed in Coca-Cola FEMSA, OXXO (in Mexico, Colombia, Chile and Peru), Tiendas

Bara, OXXO GAS, FEMSA Salud (in México, Ecuador, Colombia and Chile), Imbera and PTM.

We carry out engagement programs with all Business

Units, among which the following stand out:

|

| |

|

|

|

1. Retail Businesses: As part of the “Redondeo”

and “Dona tu Vuelto” programs, OXXO channeled Ps. 95.17 million to 378 local institutions, Farmacias YZA channeled

Ps. 4.04 million to 13 local institutions; and Maicao and Farmacias Cruz Verde in Chile collected Ps. 1.62 million CLP for 2 organizations.

2. Coca-Cola FEMSA: Through the “Escuelas

de lluvia” program the company provides clean water to Mexico schools affected by water scarcity through the installation of

a rainwater harvesting system and the implementation of an environmental education program. In 2023, eight rainwater harvesting systems

were installed across four Mexican states and supported the hygiene of 2,400 students.

3. Farmacias YZA: More than 6,500 free medical

consultations were provided to community members by Farmacias YZA healthcare professionals for the prevention and treatment of illnesses

and/or the early detection of certain health conditions.

4. Fundación FEMSA, is our company’s

strategic philanthropic arm that invests in a proactive way in projects with a long-term positive impact. The strategy focuses on four

causes considered to be the main levers for change: Early Childhood, Water Security, Circular Economy, and Arts & Culture. In Early

Childhood, Fundación FEMSA partnered with the Tecnológico de Monterrey to inaugurate in 2023 a first-of-itskind academic

center in Monterrey, Mexico, focused on boys and girls in the first five years of their life. Fundación FEMSA is also committed

to promoting safe spaces where children can spend quality family time. In 2023, we inaugurated 53 public spaces in nine countries in Latin

America, serving more than 118,700 children and their families.

For more detail, you can review the Integrated

Annual Report 2023:

https://annualreport.femsa.com/pdf/FEMSA_IR23.pdf

|

| |

ii. Changes in mission and vision; |

X |

|

|

| |

iii. Changes in business strategy; |

X |

|

|

| |

iv. Consideration of stakeholders; |

X |

|

|

| |

v. Others: |

X |

|

Our sustainability strategy is integrated by three pillars: Our People, Our Planet and Our Community. The latter focused on working on three priority topics: Community Wellbeing, Sustainable Sourcing, and Economic Development. Through "Economic Development" we contribute to the economic, labor, financial and digital inclusion of the members of communities where we operate through our actions, partnerships, products and services. This includes purchasing from local suppliers, promoting entrepreneurship by investing in start-ups, and supporting the professionalization of the informal or non-institutionalized segments of the industries in which we participate. |

| u) |

Promotes the company to issue and disseminate its Code of Ethics and promotes the disclosure of inappropriate conduct as well as the protection of whistleblowers with concrete actions such as: |

X |

|

|

| |

i. Issuance of the Code of Ethics; |

X |

|

FEMSA’s Code of Ethics is the basis for our business conduct and is the foundation of our policies, procedures and guidelines. It has been approved by the Board of Directors, which has also approved its issuance and permanent updating, necessary as a result of the changes occurring in the social setting. Our Code of Ethics can be found at: https://www.femsa.com/wp-content/uploads/2022/10/FEMSA-Code_of_Ethics.pdf |

| |

ii. Internal and external dissemination and application of the Code; |

X |

|

|

| |

iii. Whistleblowing mechanisms of violations to the Code; |

X |

|

The reports for breaches to the Code of Ethics can be received through FEMSA’s Ethics Line, which is managed by a company unrelated to FEMSA. Collaborators, directors and third parties with whom FEMSA has a relationship, can use the FEMSA’s Ethics Line, and generate reports via website or phone call. |

| |

iv. Protection mechanisms for whistleblowers; |

X |

|

|

| |

v. Others: |

|

|

N/A |

| v) |

Verifies that the company has the necessary mechanisms that confirm the compliance of the different applicable legal provisions? |

X |

|

|

| w) |

Maintains a mechanism for the prevention of illegal operations and conflicts of interest. |

X |

|

|

| 12. |

In order of having clear lines of authority and responsibility, the activities of senior executive management are separated from those of the Board of Directors (Best Practice 9) |

X |

|

|

| 7.2. Composition of the Board of Directors |

Yes |

No |

Comments |

| 13. |

How many Proprietary Directors comprise the Board of Directors? (Best Practice 10, Mexican Securities Law)*** |

15 |

As of the date of the annual general shareholders’ meeting of the company held on March 22, 2024, the board of directors was composed by 15 proprietary directors, out of which 10 were appointed by the Series “B” and 5 by the Series “D”. |

| 14. |

If applicable, how many Alternate Directors comprise the Board of Directors? (Best Practice 11) |

14 |

|

| 15. |

If there are Alternate Directors, please indicate: |

|

|

|

| |

a. Does each Proprietary Director suggest who should be appointed as his/her Alternate Director? (Best Practice 11) |

X |

|

|

| |

b. Does each Independent Proprietary Director has an Alternate Director who is also independent? (Best Practice 11) |

|

X |

There are 4 Alternate Directors for the 5 Independent Proprietary Directors appointed by the Series “D”, who replace them indistinctly. |

| 16. |

Is there a communication process established among the Proprietary Directors and his/her Alternates that allows them to have an effective participation? (Best Practice 11) |

X |

|

|

| 17. |

Upon appointment, do Independent Directors deliver to the Chairman of the Meeting a Statement of compliance with the requirements of independence? (Best Practice 12) |

|

|

|

| |

a) Compliance with the independence requirements |

X |

|

|

| |

b) Statement as to being free from conflicts of interest |

X |

|

|

| |

c) Do not have their loyalty compromised |

X |

|

|

| 18. |

Do Independent Directors represent at least 25% of all the Directors? (Best Practice 13) |

X |

|

The Board of Directors has 7 Independent Directors that represent 46.6% of the total of Directors. |

| 19. |

From the total of the proprietary members of the Board of Directors, how many are (Best Practices 13): |

|

| |

a) Independent (Director who complies with the independence requirements.) |

4 |

|

| |

b) Equity (Shareholders, even if they belong to the Control Group of the company, but are not part of the management.) |

7 |

|

| |

c) Equity Independent (Shareholders without significant influence, and/or control power, and who are not linked to the management team of the company.) |

3 |

|

| |

d) Related (Director who is only an officer of the company.) |

0 |

|

| |

e) Equity Related (Shareholders who take part in the management team of the company.) |

1 |

1 Director who holds the position of Executive Chairman of the Board of Directors and additionally reports share ownership. |

| 20. |

Do the Independent and Equity Directors, as a whole, constitute at least 60% of the Board of Directors? (Best Practice 14) |

X |

|

They constitute 93.33% |

| 21 |

Is women inclusion considered in the Board of Directors? (Best practice 15) |

X |

|

|

| |

a) How many women participate in the Board of Directors? |

7 |

|

| |

i. Proprietary |

6 |

|

| |

ii. Alternate |

1 |

|

| |

b) In which category? |

|

|

|

| |

i. Independent |

X |

|

|

| |

ii. Equity |

X |

|

|

| |

iii. Equity Independent |

|

X |

|

| |

iv. Related |

|

X |

|

| |

v. Equity Related |

|

X |

|

| 22. |

Does the Annual Report presented by the Board of Directors indicate? (Best Practice 16) |

|

|

|

| |

a. The category of each director |

X |

|

In the information made available to the shareholders in preparation for the Annual Shareholders' Meeting, a reference to the independence status of each proposed director is included, as well as a brief reference to their professional experience. The Annual Shareholders' Meeting resolves and qualifies the independent condition of the directors. |

| |

b. The professional activity of each director |

X |

|

|

|

Note ***: The publicly traded companies may have a maximum of

21 Directors. |

|

|

|

| |

|

|

|

|

|

| 7.3. Structure of the Board of Directors. |

Yes |

No |

Comments |

| For the compliance of its duties, the Board of Directors may create one or more committees to support it. For each of the following duties, the comments section must indicate which body performs them, or in such case, explain why they do not. (Best practice 17) |

|

|

|

| 23. |

With the purpose of making better informed decisions, indicate if the following duties are performed by the Board of Directors (Best Practice 17): |

|

| a) Audit*** |

X |

|

|

| b) Evaluation and Compensation. |

X |

|

|

| c) Finance and Planning. |

X |

|

|

| d) Corporate Practices*** |

X |

|

|

| e) Risk and Compliance |

X |

|

|

| f) Others. (specify) |

|

|

|

| |

|

|

|

|

| 24. |

Indicate which intermediate body performs each of the following duties: |

|

| a) Audit*** |

a) Audit Committee |

| b) Evaluation and Compensation. |

b) Corporate Practices and Nominations Committee |

| c) Finance and Planning. |

c) Operations and Strategy Committee |

| d) Corporate Practices*** |

d)Corporate Practices and Nominations Committee |

| e) Risk and Compliance |

e) Audit Committee |

| f) Others. (specify) |

|

| 25. |

Indicate the number of the Proprietary Directors which comprise each

of the intermediate bodies (Best Practice 18)

a) Audit***

b) Evaluation and Compensation.

c) Finance and Planning.

d) Corporate Practices. ***

e) Risk and Compliance

f) Others. (specify in comments) |

a)2

b)0

c)6

d)2

e)0

|

|

N/A

N/A

|

| 26. |

How frequently do these intermediate bodies inform their activities to the Board of Directors? (Best Practice 18) |

|

| a) Audit*** |

a) Quarterly |

|

| b) Evaluation and Compensation. |

b) Other |

Not applicable |

| c) Finance and Planning. |

c) Quarterly |

|

| d) Corporate Practices. *** |

d)Quarterly |

|

| e) Risk and Compliance |

d)Quarterly |

|

| f) Others. (specify) |

|

|

| 27. |

Does the chairman of each intermediate body invite to its meetings, the officers of the company whose responsibilities are related to the duties of the intermediate body? (Best Practice 18) |

X |

|

|

|

| 28. |

Does each of the Independent Directors participate in any of the intermediate bodies? (Best Practice 18) |

X |

|

|

|

| 29. |

If the answer to the above question is negative, explain why. |

|

| 30. |

Is the intermediate body in charge of the audit task chaired by an Independent Director who has knowledge and experience in financial and accounting aspects? (Best Practice 1f8) |

X |

|

|

Víctor Alberto Tiburcio Celorio is the chairman of the Audit Committee and has a Public Accountant degree from Universidad Iberoamericana and an MBA from Instituto Tecnológico Autónomo de México and has extensive experience in accounting and audit matters. |

| 31. |

If the answer to the above question is negative, explain why. |

|

|

|

|

| |

|

|

|

|

***Mandatory task for companies whose shares are traded on the stock

market, which can be performed in a single committee or shared along with other tasks.

| 7.4. Operation of the Board of Directors. |

Yes |

No |

Comments |

| 32. |

How many meetings does the Board of Directors have during each fiscal year? (Best Practice 19) |

4 |

|

| 33. |

If the answer to the above question is less than 4, which would be the reason: |

|

| |

a. The information is not provided on time |

|

|

|

| |

b. By tradition |

|

|

|

| |

c. It is of no importance |

|

|

|

| |

d. Others (specify): |

|

|

|

| 34. |

Are there any provisions by which a Board of Directors meeting can be convened/called with the agreement of 25% of the Directors or the Chairman from another intermediate body? (Best Practice 20) |

X |

|

|

| 35. |

If the answer to the above question is affirmative, please describe such provisions. |

Article 27 of the Mexican Securities Law and article 26 of our bylaws, provided that the Chairman of the Corporate Practices and Nominations Committee, the Chairman of the Audit Committee or 25% of the directors can call for a meeting of the Board of Directors. |

| 36. |

How many days in advance do the members of the board have access to the information that is relevant and necessary for decision making, in accordance to the Agenda contained in the meetings call? (Best Practice 21) |

5 |

At least 5 business days in advance. |

| 37. |

Is there any mechanism that ensures that directors can evaluate matters requiring confidentiality? Even if they do not receive the necessary information with at least 5 business days before the meeting as provided for non-confidential affairs by the Code (Best Practice 21) |

X |

|

|

| 38. |

If the answer to the above question is affirmative, select which is(are) the mechanism(s)? |

Proprietary Directors may request all the information they need to be able to discuss, evaluate and make decisions during the meeting. |

| |

a. By telephone. |

|

|

|

| |

b. By email. |

X |

|

|

| |

c. By intranet. |

|

|

|

| |

d. By printed document. |

|

|

|

| |

e. Others (specify): |

|

|

|

| 39. |

When first appointed, are new directors provided with the necessary information in order for them to be up to date on the matters of the company and so that they may fulfill their new responsibility? (Best Practice 22) |

X |

|

A new Director receives complete information on the Company’s condition, annual reports from prior fiscal years, and meetings are scheduled for such Director with senior executives, who explain in detail the Company’s conditions and answer any of the Director’s questions. |

| 7.5. Duties of the Directors |

Yes |

No |

Comments |

| 40. |

Is each member of the Board given the necessary information with respect to the obligations, responsibilities and rights that imply to be member of the Board of Directors of the company? (Best Practice 23) |

X |

|

|

| 41. |

Do Directors communicate to the Chairman and the other members of the Board of Directors any situation where it exists or that might derive in a conflict of interest, refraining from participating in the corresponding discussions? (Best Practice 24) |

X |

|

|

| 42. |

Do Directors use the company’s assets or services only for the performance of its corporate purpose? (Best Practice 24) |

X |

|

|

| 43. |

Where appropriate, are clear guidelines defined for when Directors exceptionally use the company’s assets for personal matters? (Best Practice 24) |

X |

|

|

|

44.

|

Do Directors invest time to their duties by attending at least 70% of the meetings to which they are called? (Best Practice 24) |

X |

|

The Board of Directors elected in the Annual General Meeting on March

31, 2023 had five meetings during 2023 and until February 2024, with an average board meeting attendance of 97.5%.

For more detail, you can review the Integrated Annual Report 2023:

https://annualreport.femsa.com/pdf/FEMSA_IR23.pdf

|

| 45. |

Is there a mechanism that ensures that the members of the Board maintain absolute confidentiality about all the information they receive in the performance of their duties, especially with respect to their own participation, and the participation of other board members, in the discussions that take place in the Board of Directors Meetings? (Best Practice 24) |

X |

|

|

| 46. |

If the answer to the above questions is affirmative, explain such mechanism. |

|

|

The Secretary of the Board periodically reminds Directors of the scope of their confidentiality obligations. |

| |

a. Confidentiality agreement. |

X |

|

|

| |

b. Exercise of their fiduciary duties. |

|

|

|

| |

c. Others. (specify) |

|

|

|

| 47. |

Do Proprietary Directors and, if applicable, their respective Alternate Directors, keep each other informed about the matters discussed in the meetings of the Board of Directors in which they participate? (Best Practice 24) |

X |

|

|

| 48. |

Do Proprietary Directors and, if applicable, their respective Alternate Directors, assist the Board of Directors with opinions and recommendations resulting from the analysis of the performance of the company; in order for the decisions to be taken be properly sustained? (Best Practice 24) |

X |

|

|

| 49. |

Is there a performance and compliance assessment mechanism of responsibilities and fiduciary duties of Directors? (Best Practice 24) |

X |

|

|

8. Auditing Duties

NOTE: In the comments section, indicate if the Audit duty is entrusted

to a specific intermediate body or if it is shared, mention the name of the intermediate body and other functions it performs.

| 8.1. General Duties |

Yes |

No |

Comments |

| 50. |

Does the intermediate body responsible for the audit duties perform the following tasks? (Best Practice 25) |

|

| a) |

Recommends to the Board of Directors: |

|

|

|

| |

i. The candidates for external auditors of the company |

X |

|

|

| |

ii. The hiring conditions |

X |

|

|

| |

iii. The scope of their professional services |

X |

|

|

| b) |

Recommends to the Board of Directors the approval of additional services to those of external auditing |

X |

|

|

| c) |

Oversees the compliance of external auditors’ professional services. |

X |

|

|

| d) |

Evaluates the performance of the company that provides the services of external auditing. |

X |

|

|

| e) |

Analyses the opinions or reports prepared by the external auditor, such as: |

|

|

|

| |

i. Rulings |

X |

|

|

| |

ii. Opinions. |

X |

|

|

| |

iii. Reports. |

X |

|

|

| |

iv. Statements. |

X |

|

|

| f) |

Meets at least once a year with the external auditor, without the attendance of officers of the company. |

X |

|

|

| g) |

It is the channel of communication between the Board of Directors and the external auditors. |

X |

|

Audit Committee composed by Independent Directors. |

| h) |

Ensures the independence and objectivity of the external auditors. |

X |

|

|

| i) |

Reviews |

|

|

|

| |

i. The work program. |

X |

|

|

| |

ii. The observation letters. |

X |

|

|

| |

iii. The reports of internal controls. |

X |

|

|

| j) |

Meets periodically with the internal auditors, without the attendance of the officers of the company to know: |

|

|

|

| |

i. The work program. |

X |

|

|

| |

ii. The comments and observations in the progress of their work. |

X |

|

|

| |

iii. Others: |

|

|

|

| k) |

Provides opinion to the Board of Directors about the policies and criteria used in preparation of the financial information, as well as its issuance process. |

X |

|

|

| l) |

Contributes in the definition of the general guidelines of internal control and internal auditing and evaluates its effectiveness. |

X |

|

|

| m) |

Verifies the compliance of the mechanisms established for strategic risk control of which the company is subject to. |

X |

|

|

| n) |

Coordinates the tasks of the External Auditor, Internal Auditor and the Statutory Auditor. |

X |

|

|

| o) |

Verifies the existence of the necessary mechanisms that allow the company to assure the compliance of the different provisions which it is subject to. |

X |

|

|

| p) |

The frequency with which it makes a review to inform the Board of Directors about the legal situation of the company. |

Biannual |

| q) |

Contributes in the establishment of policies for related party transactions. *** |

X |

|

|

| r) |

Analyses and evaluates transactions with related parties to recommend their approval to the Board of Directors. *** |

X |

|

|

| s) |

Decides on the hiring of third party experts to provide their opinion in respect to related party transactions or any other matter, which allows the adequate performance of its tasks.*** |

X |

|

|

| t) |

Verifies the compliance of the Code of Ethics. |

X |

|

|

| u) |

Verifies the compliance of the disclosure mechanism of improper actions and protection to whistleblowers. |

X |

|

|

| v) |

Supports the Board of Directors in the analysis of the business continuity plans and information recovery. |

X |

|

|

| Note***. Companies whose shares are traded on the stock market perform these recommendations through their Corporate Practices tasks. |

|

|

|

| 8.2. Selection of Auditors |

Yes |

No |

Comments |

|

51.

|

Does it abstain from hiring firms in which the fees of the external auditor and any other additional services rendered to the company represent more than 10% of their gross income? (Best Practice 26) |

X |

|

|

| 52. |

Rotation:

a) Is there a rotation of the partner who audits the financial statements

at least once every 5 years? (Best Practice 27) |

X |

|

|

| |

b) Is there a rotation of the team who audits the financial statements at least once every 5 years? (Best Practice 27) |

X |

|

|

| 53. |

Is the person who signs the opinion of the company’s annual statements different from the one who acts as statutory auditor? (Best Practice 28) *** |

|

X |

N/A, the Company does not have an statutory auditor. |

| 54. |

Is the profile of the statutory auditor disclosed in the annual report submitted to the Shareholders Meeting by the Board of Directors? (Best Practice 29) *** |

|

X |

N/A, the Company does not have an statutory auditor. |

| Note***. For a publicly traded company, this practice does not apply. |

|

|

|

| 8.3. Financial Information |

Yes |

No |

Comments |

| 55. |

Does the intermediate body that performs the audit duties, support, with its opinion, the Board of Directors in order for it to take decisions with reliable financial information? (Best Practice 30) |

X |

|

|

| 56. |

Such financial information, is signed by (Best Practice 30): |

|

|

|

| |

a) The Chief Executive Officer. |

X |

|

|

| |

b) The responsible officer of its elaboration. |

X |

|

|

| 57. |

The company has an internal audit department (Best Practice 31) |

X |

|

|

| 58. |

If the previous answer is affirmative, please indicate whether its general guidelines and work plans are approved by the Board of Directors. (Best Practice 31). |

X |

|

|

| 59. |

Does the intermediate body that performs the auditing duty provides its opinion previously to the Board of Directors for the approval of the accounting policies and criteria used in the making of the financial information of the company? (Best Practice 32) |

X |

|

|

| 60. |

Does the intermediate body that performs the auditing duty provide its opinion to the Board of Directors for the approval of the changes made to the accounting policies and criteria used in the making of the financial information of the company? (Best Practice 33) |

X |

|

|

| 61. |

Does the Board of Directors approve, with a previous opinion of the committee that performs the auditing duties, the necessary mechanisms to assure the quality of the financial information submitted to it? (Best Practice 34) |

X |

|

|

| 62. |

In the event that the financial information corresponds to intermediate periods during the fiscal year, does the committee performing the auditing duties supervise that it is made with the same policies, criteria and practices with which the annual information is prepared? (Best Practice 34) |

X |

|

|

| 8.4. Internal Control |

Yes |

No |

Comments |

| 63. |

Are the general guidelines of Internal Control and, if applicable, its reviews submitted to the approval of the Board of Directors, with the prior opinion of the intermediate body performing the auditing duties? (Best Practice 35) |

X |

|

|

| 64. |

Is the Board of Directors assisted in order to?: (Best Practice 36) |

|

|

|

| |

a) Ensure the effectiveness of the Internal Control |

X |

|

Internal audit representatives interact with the Audit Committee and with external auditors to analyze the effectiveness of the control system. Period reports are prepared which are sent to the members of the Audit Committee with the due anticipation before their meetings. |

| |

b) Ensure the process of issuance of the financial information |

X |

|

|

| 65. |

Do the internal and external auditors: (Best Practice 37) |

|

|

|

| |

a) Evaluate, according to their normal work plan, the effectiveness of the Internal Controls, as well as the process for the issuance of the financial information? |

X |

|

|

| |

b) Are the results included in the situations letter, discussed with them? |

X |

|

|

| 8.5. Related Parties |

Yes |

No |

Comments |

| 66. |

Does the intermediate body in charge of the auditing duties support the Board of Directors in? (Best Practice 38) *** |

|

|

|

| |

a) The establishment of guidelines for transactions with related parties. |

X |

|

|

| |

b) The analysis of the approval process of transactions with related parties. |

X |

|

|

| |

c) The analysis of hiring conditions of transactions with related parties. |

X |

|

|

| 67. |

Does the intermediate body in charge of the auditing duties assists the Board of Directors, in the analysis of proposals to make transactions with related parties outside of its ordinary course of business of the company? (Best Practice 39)*** |

X |

|

|

| 68. |

Are transactions with related parties, outside of the company’s ordinary course of business and may represent more than 10 per cent of the company’s consolidated assets, presented for approval to the Shareholders Meeting? (Best Practice 39)*** |

|

X |

According to our bylaws, the General Ordinary

Shareholders’ Meeting shall approve any transaction when it represents the 20% or more of the consolidated assets of the company.

The Board of Directors must approve transactions

with Related Parties if these exceed US$5,000,000.00. |

| Note***. Companies whose shares are traded on the stock market perform these recommendations through the Corporate Practices tasks. |

|

|

|

| |

|

|

|

|

| 8.6. Review of compliance with applicable provisions. |

Yes |

No |

Comments |

| 69. |

Does the intermediate body in charge of the auditing duties make sure of the existence of mechanisms that serve to determine if the company properly complies with legal provisions to which the company is subject to? (Best Practice 40) |

X |

|

|

| 70. |

If the answer to the above question is affirmative, select those mechanisms. |

|

| |

a) Due diligence. |

|

| |

b) Reports of pending legal matters. |

X |

|

|

| |

c) Others (specify): |

|

|

|

9.0 Evaluation and Compensation Tasks

NOTE: In the comments section, indicate if the Evaluation and Compensation

duty is entrusted to a specific intermediate body or if it is shared, mention the name of the intermediate body and other functions it

performs.

| 9.1. General Duties |

Yes |

No |

Comments |

| 71. |

Does the intermediate body in charge of the evaluation and compensation function submit to the Board of Directors, for its approval, the following? (Best Practice 41) |

|

|

|

| |

a) The criteria to appoint or remove the Chief Executive Officer and the senior officers of the company. *** |

X |

|

|

| |

b) The criteria for the evaluation and compensation of the Chief Executive Officer and the senior officers of the company. *** |

X |

|

|

| |

c) The criteria to determine the compensation of the Chief Executive Officer and senior officers of the company. |

X |

|

|

| |

d) The criteria to ensure that the talent and structure of the organization are aligned to the strategic plan approved by the Board of Directors. |

X |

|

|

| |

e) The criteria to define the profile, as well as the hiring, performance evaluation and compensation of the directors. |

X |

|

|

| |

f) The proposal made by the Chief Executive Officer regarding the structure and criteria for the compensation of the personnel. |

X |

|

|

| |

g) The Code of Ethics of the Company. |

X |

|

This task is performed by the Audit Committee. |

| |

h) The whistleblowing system for improper actions and protection to whistleblowers, as well as its proper functioning. |

X |

|

This task is performed by the Audit Committee. |

| |

i) The formal system of succession of the Chief Executive Officer and senior officers, and verifies its compliance. |

X |

|

|

| 72. |

Does the Chief Executive Officer and senior officers refrain from participating in the discussion of the matters mentioned in question 72, a), b) and c) with the purpose of preventing a possible conflict of interest? (Best Practice 42) |

X |

|

|

| Note***. Companies whose shares are traded on the stock market perform these recommendations through the Corporate Practices tasks. |

|

|

|

| 9.2. Operative Aspects |

Yes |

No |

Comments |

| 73. |

When determining the compensation of the Chief Executive Officer and senior officers, are their functions, expectations on objectives and evaluation of their performance, their contribution to the results and being aligned to the strategic plan of the company, considered? (Best Practice 43) |

X |

|

|

| 74. |

In the annual report submitted by the Board of Directors to the Shareholders Meeting, are the guidelines/policies used, and the components of the compensation package of the Chief Executive Officer and senior officers of the company, disclosed? (Best Practice 44) |

X |

|

|

| 75. |

Does the intermediate body in charge of the evaluation and compensation duties support the Board of Directors in previously reviewing the hiring conditions of the Chief Executive Officer and senior officers, in order to assure that their probable payments for severance of the company are in line with the guidelines approved by the Board of Directors? (Best Practice 45) |

X |

|

This task is performed by the Corporate Practices and Nominations Committee |

| 76 |

Does the intermediate body in charge of the evaluation and compensation duties support the Board of Directors in the definition of the directors’ profile, as well as their objectives, and the mechanism for their hiring, evaluation and compensation? (Best Practice 46) |

X |

|

This task is performed by the Corporate Practices and Nominations Committee |

| 77. |

With the purpose of ensuring a stable succession process, is there a formal plan of succession for the Chief Executive Officer and senior officers of the company aligned with the strategic plan? (Best Practice 47) |

X |

|

|

| 78. |

If the answer to the above question is negative, explain why or select one of the following reasons: |

|

| |

a) The company was recently created. |

|

| |

b) The Officers are young. |

|

| |

c) The Officers were recently hired. |

|

| |

d) It is not an important subject. |

|

| |

e) Others: (specify). |

|

| |

|

|

| 79 |

The family of shareholders of the company has an agreement that clearly states the way in which their interests will be represented at the Shareholders Meeting and in the Board of Directors? (Best practice 48) |

|

X |

|

10.0 Finance and Planning Duties

NOTE: In the comments section, indicate if

the Finance and Planning duties are entrusted to a specific intermediate body or if they are shared, mention the name of the intermediate

body and other functions it performs.

| 10.1. General Duties |

Yes |

No |

Comments |

| 80. |

Does the intermediate body in charge of the finance and planning duties perform the following tasks? (Best Practice 49) |

|

|

|

| a) |

Studies and proposes to the Board of Directors the company’s strategic course to ensure its stability and continuance over time. |

X |

|

|

| b) |

Analyzes and proposes general guidelines for the determination and monitoring of the strategic plan of the company. |

X |

|

The Operations and Strategy Committee analyzes and monitors main topics, particularly those related to significant transactions. |

| c) |

Ensure that the strategic plan consider the generation of economic and social value for the shareholders, as well as the sources of employment and the existence of interested third parties. |

X |

|

|

| d) |

Ensures that the strategic plan is aligned to the long-term course set forth by the Board of Directors. |

X |

|

|

| e) |

Evaluates and provides an opinion with respect to the investment and financing policies of the company proposed by the senior management. |

X |

|

|

| f) |

Provides an opinion with respect to the premises of the annual budget and the follow-up of its execution, as well as its control system. |

X |

|

The Operations and Strategy Committee provides its opinion about matters related mainly to the macroeconomic environment and its principal assumptions. |

| 10.2. Operative Aspects |

Yes |

No |

Comments |

| 81. |

Does the intermediate body in charge of finance and planning duties assists the Board of Directors so that a session is dedicated to defining or updating the long-term course of the company? (Best Practice 50) |

X |

|

|

| 82. |

Does the intermediate body in charge of finance and planning duties supports the Board of Directors in reviewing the strategic plan submitted by the senior management for approval? (Best Practice 51) |

X |

|

|

| 83. |

Does the intermediate body in charge of finance and planning

duties supports the Board of Directors in the analysis of the guidelines submitted by the Chief Executive Officer for its approval regarding:

(Best Practice 52)

a) The management

of treasury

b) The entering

into financial derivative agreements

c) The capital

expenditures

d) New liabilities

e) Are aligned with

the Strategic Plan

f) Are

within the ordinary course of business of the company? |

X

X

X

X

X

X |

|

|

| 84. |

The intermediate body in charge of finance and planning duties ensures that the premises of the annual budget are aligned to the strategic plan? (Best Practice 53) |

X |

|

|

11. Risk and Compliance Duties

NOTE: In the comments section, indicate if the Risk and Compliance

duties are entrusted to a specific intermediate body or if they are shared, mention the name of the intermediate body and other functions

it performs.

| 11.1 General Duties |

Yes |

No |

Comments |

| 85. |

The body in charge of the Risk and Compliance duties carries out the following activities (Best Practice 54) |

|

|

| |

a) Evaluates the mechanisms presented by the Management for the identification, analysis, administration and control of the risks to which the company is subject to and gives its opinion to the Board of Directors |

X |

|

This task is performed by the Audit Committee |

| |

b) Analyzes the risks identified by the Management |

X |

|

This task is performed by the Audit Committee |

| |

c) Determines the strategic risks to which the Board of Directors will follow up to. |

X |

|

This task is performed by the Audit Committee |

| |

d) Determines the financial and operational risks to which the Management will follow up to. |

X |

|

This task is performed by the Operations and Strategy Committee |

| |

e) Evaluates the criteria presented by the Chief Executive Officer for the disclosure of the risks to which the company is subject to and gives its opinion to the Board of Directors |

X |

|

This task is performed by the Audit Committee |

| |

f) Knows the legal provisions to which the company is subject to and follows up strictly to its compliance. |

X |

|

This task is performed by the Audit Committee |

| |

g) Knows the pending legal matters and gives its opinion to the Board of Directors. |

X |

|

This task is performed by the Audit Committee |

| 11.2 Operative Aspects |

Yes |

No |

Comments |

| 86. |

Does the Board of Directors review at least once a year the company’s strategic risks evaluation to ensure the company’s stability and continuance in time? (Best practice 55) |

X |

|

|

| 87. |

Does the intermediate body support the Board of Directors in the follow-up to the identified strategic risks’ mitigation? (Best practice 56) |

X |

|

|

| 88. |

Does the intermediate body support the Board of Directors in the evaluation of mechanisms for: (Best practice 57) |

|

|

|

| |

a) Risk identification |

X |

|

|

| |

b) Risk analysis |

X |

|

|

| |

c) Risk management |

X |

|

|

| |

d) Risk control |

X |

|

|

| 89. |

Does the Chief Executive Officer present a report on the situation that management keeps for each of the identified risks, at each session to the Board of Directors? (Best Practice 58) |

|

|

|

| |

a) The Chief Executive Officer’s report to the Board of Directors includes the identified risks’ management and is approved by the Board of Directors |

X |

|

|

| |

b) The Chief Executive Officer’s report to the Board of Directors includes new identified risks |

X |

|

|

| 90. |

The intermediate body oversees that all legal provisions to which the company is subject to are complied with? (Best practice 59) |

|

|

|

| |

a) Takes note of a detailed report of all legal provisions to which the company is subject to and the contingent or non-compliance effects? |

X |

|

|

| |

b) Is there a formal process to ensure the compliance with the legal obligations to which the company is subject to? Explain how |

X |

|

The Audit Committee reviews the effectiveness of the system established by the company, to ensure compliance with applicable laws and accounting, tax and legal regulations, as well as the reports on results of the investigations undertook by Management in any case of non-compliance. |

| |

c) How frequently is the Board of Directors informed on this subject (number of times per year)? |

2 |

At least twice a year. |

| 91. |

Is the Board of Directors informed on all the company’s pending litigation and its potential risk? (Best Practice 60) |

|

|

|

| |

a) Does the Chief Executive Officer periodically informs the status of all of the company’s litigation? |

X |

|

|

| |

b) Is there a formal process to follow-up to all the pending litigation? Explain how. |

X |

|

Follow-up process by the legal department, with quarterly reports to the Audit Committee and the Board of Directors. |

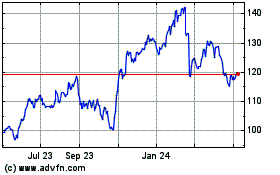

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Oct 2024 to Nov 2024

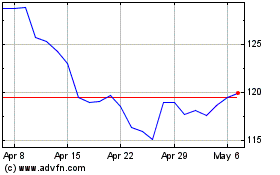

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Nov 2023 to Nov 2024