false

0001494530

0001494530

2024-05-31

2024-05-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 31, 2024

First Trust High Income Long/Short Fund

(Exact name of registrant as specified in its charter)

| Massachusetts |

811-22442 |

27-3072807 |

| (State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

| of incorporation) |

|

Identification No.) |

|

120 East Liberty Drive, Suite 400

Wheaton, Illinois

(Address of principal executive offices) |

60187

(zip code) |

Registrant’s telephone number, including area

code: (630) 765-8000

_____________________________________________________

(Former Name or Former Address, if Changed Since Last

Report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of class |

Trading Symbol |

Name of Exchange on which registered |

| Common stock, $0.01 par value per share |

FSD |

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

First Trust High Income Long/Short

Fund (“FSD”) is filing herewith a press release issued on May 31, 2024, as Exhibit 99.1. The press release was issued by

First Trust Advisors L.P. (“FTA”) to announce the results of the joint special meeting of shareholders of each of First

Trust High Income Long/Short Fund (NYSE: FSD) (“FSD”) and First Trust/abrdn

Global Opportunity Income Fund (NYSE: FAM) (“FAM” and collectively with FSD, the “Funds”) held on May

30, 2024. Details regarding the merger are contained in the press release included herein.

| Item 9.01 | Financial

Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: May 31, 2024 |

|

FIRST TRUST HIGH INCOME LONG/SHORT FUND |

| |

|

|

| |

By: |

/s/ W. Scott Jardine |

| |

Name |

W. Scott Jardine |

| |

Title: |

Secretary |

EXHIBIT INDEX

| PRESS RELEASE | | SOURCE: First Trust Advisors L.P. |

First

Trust Announces Results of Joint Special Meeting of Shareholders Relating to the Reorganizations of First Trust High Income Long/Short

Fund and First Trust/abrdn Global Opportunity Income Fund with and into abrdn Income Credit Strategies Fund

WHEATON, IL – (BUSINESS WIRE) –

May 31, 2024 – First Trust Advisors L.P. (“FTA”) announced today the results of the joint special meeting of shareholders

of each of First Trust High Income Long/Short Fund (NYSE: FSD) (“FSD”) and

First Trust/abrdn Global Opportunity Income Fund (NYSE: FAM) (“FAM” and collectively with FSD, the “Funds”)

held on May 30, 2024.

Shareholders of FSD,

a diversified, closed-end management investment company organized as a Massachusetts business trust, have approved the reorganization

of FSD with and into abrdn Income Credit Strategies Fund (“ACP”), a diversified, closed-end management investment company

organized as a Delaware statutory trust. As previously announced, the reorganization was approved by the Board of Trustees of FSD on October

23, 2023. Subject to the satisfaction of certain customary closing conditions, the reorganization of FSD into ACP is expected to close

by the end of July 2024, or as soon as practicable thereafter. No assurance can be given as to the exact closing of the transaction. Upon

the completion of the reorganization, which is expected to be tax-free, the assets of FSD will be transferred to, and the liabilities

of FSD will be assumed by, ACP. The shareholders of FSD will receive shares of ACP with a value equal to the aggregate net asset value

of the shares of FSD held by them.

The special meeting

of shareholders of FAM has been adjourned in order to permit additional solicitation of shareholders of FAM and to allow shareholders

additional time to vote on the reorganization of FAM with and into ACP. The special meeting of shareholders of FAM will reconvene on Tuesday,

June 18, 2024 at 12:30 Central time in the offices of FTA at 120 East Liberty Drive, Suite 400, Wheaton, Illinois (the “Meeting”).

Shareholders of record

of FAM as of the close of business on October 23, 2023, are entitled to vote at the Meeting. Whether or not shareholders plan to attend

the Meeting, it is important that their shares be represented and voted at the Meeting. Shareholders may vote their shares by one of the

methods described in the proxy materials previously mailed to them, which includes a combined proxy statement and prospectus (the “proxy

statement”). The proxy statement contains important information regarding the proposed reorganizations and shareholders of FAM are

urged to read the proxy statement and accompanying materials carefully. The proxy statement is also available at https://www.ftportfolios.com/Common/ContentFileLoader.aspx?ContentGUID=e7273425-e2a9-48b7-bb6d-73153c910a7a

and the Securities and Exchange Commission’s website at www.sec.gov. If shareholders have any questions

regarding the proposals, or need assistance voting, they may call EQ Fund Solutions, LLC at (866) 620-8437. The Board of Trustees of FAM

believes the reorganization is in the best interests of FAM and recommends that shareholders of FAM vote “FOR” the reorganization.

FTA is

a federally registered investment advisor and serves as the investment advisor of the Fund.

FTA and its affiliate First Trust Portfolios L.P. (“FTP”), a FINRA registered broker-dealer, are privately-held companies

that provide a variety of investment services. FTA has collective assets under management or supervision of approximately $218 billion

as of April 30, 2024 through unit investment trusts, exchange-traded funds, closed-end funds, mutual funds and separate managed accounts.

FTA is the supervisor of the First Trust unit investment trusts, while FTP is the sponsor. FTP is also a distributor of mutual fund shares

and exchange-traded fund creation units. FTA and FTP are based in Wheaton, Illinois.

In the United States, abrdn

is the marketing name for the following affiliated, registered investment advisers: abrdn Inc., abrdn Investments Limited, abrdn Asia

Limited, abrdn Private Equity (Europe) Limited and abrdn ETFs Advisors LLC.

Additional Information

/ Forward-Looking Statements

This press

release is not intended to, and shall

not, constitute an offer to purchase or sell

shares of the Funds or ACP; nor is this press release intended to solicit a proxy from any shareholder of FAM.

The Funds and their trustees and officers, FTA, abrdn and certain of their respective officers and employees, and other persons may be

deemed under the rules of the Securities and Exchange Commission to be participants in the solicitation of proxies from shareholders in

connection with the matters described above. Information about the trustees and officers of the Funds, FTA and its officers and employees,

and other persons may be found in the proxy statement. An investor should carefully consider

the investment objectives, risks, charges and expenses

of the Funds or ACP, as applicable, before investing.

Certain

statements made in this news release that are

not historical facts are referred to as “forward-looking

statements” under the U.S. federal securities

laws. Actual future results or occurrences may

differ significantly from those anticipated

in any forward-looking statements due to numerous factors.

Generally, the words “believe,” “expect,” “intend,” “estimate,”

“anticipate,” “project,” “will” and similar expressions identify forward-looking statements,

which generally are not historical in nature.

Forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ

from the historical experience of FTA and

the funds managed by FTA and

its present expectations or projections. You

should not place undue reliance on forward-looking

statements, which speak only as of the date

they are made. FTA, the Funds and ACP undertake

no responsibility to update publicly or revise any forward-looking

statements.

_______________________________________

CONTACT: Jeff Margolin – (630)

517-7643

_______________________________________

CONTACT: Daniel Lindquist – (630)

765-8692

_______________________________________

CONTACT: Chris Fallow – (630)

517-7628

___________________________________

SOURCE: First Trust Advisors L.P.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

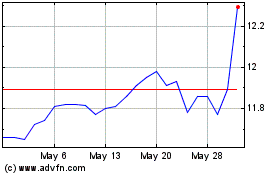

First Trust High Income ... (NYSE:FSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

First Trust High Income ... (NYSE:FSD)

Historical Stock Chart

From Feb 2024 to Feb 2025