Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 09 2024 - 5:48AM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE

ACT OF 1934

Dated December 9, 2024

Commission File Number 1-14878

GERDAU S.A.

(Translation of Registrant’s Name into English)

Av. Dra. Ruth Cardoso, 8,501 – 8° andar

São Paulo, São Paulo - Brazil CEP

05425-070

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: December 9, 2024

| |

GERDAU S.A. |

| |

|

| |

By: |

/s/ Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President Investor Relations Director |

Exhibit 99.1

GERDAU S.A.

Corporate Tax ID (CNPJ/MF): 33.611.500/0001-19

Registry (NIRE): 35300520696

NOTICE TO THE MARKET

Gerdau S.A. (B3: GGBR / NYSE: GGB) (“Gerdau”

or "Company") informs its shareholders and the market in general that the Company, its subsidiary Gerdau Aços Longos

S.A. ("Gerdau Aços Longos"), and Newave Energia S.A. ("Newave Energia"), a company in which the Company holds

an indirect interest, will begin the construction of a new solar power generation park in Barro Alto, in the state of Goiás ("Barro

Alto Solar Park").

The Barro Alto Solar Park will have a total capacity

of approximately 452 megawatt-peak (MWp), divided into 7 (seven) Special Purpose Entities ("SPEs"). Each SPE will have equal

capacity to generate solar energy, and the total investment in the park will be approximately R$1.3 billion, with construction expected

to be completed in the first half of 2026.

Gerdau entered into instruments for the full acquisition

of 3 (three) SPEs of the Barro Alto Solar Park, thereby obtaining the right to the total energy to be generated by them, estimated at

approximately 43 megawatts average (MW average). Additionally, the Company and its subsidiaries will acquire 23MW average from the 4 (four)

SPEs of Newave Energia, due to its indirect participation in it. Consequently, once operational, the Barro Alto Solar Park should supply

an average of 66% of its renewable energy volume, corresponding to MW average, to Company's steel production units in Brazil, under a

self-production basis.

The acquisition of the 3 (three) SPEs by the Company

represents an investment of approximately R$600 million, of which R$300 million comes from its own capital (to be disbursed according

to the project execution schedule) and R$300 million from financing from the Superintendência de Desenvolvimento do Centro-Oeste

(Sudeco), operated by Banco do Brasil.

Due to the construction of the Barro Alto Solar

Park, the Company, through its subsidiary Gerdau Next S.A., will make an additional investment of R$41 million in Newave Energia, to be

paid in according to capital calls, following the construction schedule. Therefore, the Company will increase its shareholding, holding

a 40% of Newave Energia’s capital.

In addition, Gerdau will also increase its

long-term energy acquisition commitment, from 30% to 40% of the energy generated by Newave Energia and its subsidiaries, under a

self-production basis. As a result, Company will consume a total of MW average of energy generated by the Barro Alto (66MW average)

and Arinos (45MW average) Solar Parks, equivalent to approximately 23% of the Company's consumption in Brazil. The use of this

source should generate an estimated emission reduction of 65,000 tCO2e per year, contributing to the achievement of the Company's

greenhouse emission reduction targets.

Gerdau reaffirms its strategy to generate greater

competitiveness in its business costs through the adoption of clean energy, in line with the decarbonization process disclosed by the

Company.

São Paulo, December 6, 2024.

Rafael Dorneles Japur

Executive Vice-President and

Investor Relations Officer

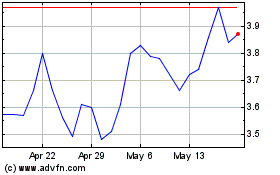

Gerdau (NYSE:GGB)

Historical Stock Chart

From Dec 2024 to Jan 2025

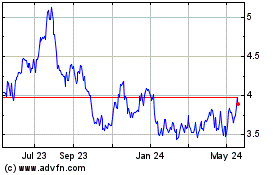

Gerdau (NYSE:GGB)

Historical Stock Chart

From Jan 2024 to Jan 2025