Form 8-K - Current report

November 28 2023 - 3:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November

24, 2023

Templeton Global Income Fund

(Exact name of registrant as specified in its

charter)

|

Delaware |

|

811-05459 |

|

22-2864496 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

|

| 300 S.E. 2nd Street |

|

Fort Lauderdale,

Florida 33301-1923 |

| (Address of principal executive offices) (Zip Code) |

| |

| (Registrant’s telephone number, including area code): (954) 527-7500 |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[_] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Shares, without par value |

GIM |

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company [_]

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [_]

Item 8.01 Other Events.

On November 24, 2023, Templeton Global Income Fund

(NYSE: GIM) (the “Fund”) announced an update regarding the upcoming adviser transition, whereby Saba Capital Management, L.P.

(“Saba”) will assume responsibility from Franklin Advisers, Inc. (“Franklin Advisers”), the current manager of

the Fund, for providing investment management services to the Fund (the “Adviser Transition”). The Adviser Transition will

occur on or about the close of business on December 31, 2023.

In connection with the Adviser Transition and management

of the Fund’s portfolio subsequent to the completion of the Adviser Transition, the Fund’s Board of Trustees has authorized

Franklin Advisers to begin liquidating the Fund’s portfolio to cash and cash equivalents prior to the completion of the Adviser

Transition. During this transition, the Fund will depart from its stated investment objective and policies to liquidate its holdings.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The exhibits listed on the Exhibit Index are

incorporated herein by reference.

| Exhibit Number |

Description |

| 99.1 |

Press Release dated November 24, 2023 - Templeton Global Income Fund Announces Update on Investment Adviser Transition to Saba Capital |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: November 28, 2023 |

Templeton Global Income Fund |

| |

|

| |

By: |

/s/ Pierre Weinstein |

| |

Name: |

Pierre Weinstein |

| |

Title: |

Chairman of the Board |

Templeton Global Income Fund

Announces

Update on Investment Adviser

Transition to Saba Capital

New York, NY – November 24, 2023 – Templeton

Global Income Fund (NYSE: GIM) (the “Fund”) today announced an update regarding the upcoming Adviser Transition, whereby Saba

Capital Management, L.P. ("Saba") will assume responsibility from Franklin Advisers, Inc. ("Franklin Advisers"), the

current manager of the Fund, for providing investment management services to the Fund (the “Adviser Transition”). The Adviser

Transition will occur on or about the close of business on December 31, 2023.

In connection with the Adviser Transition and management

of the Fund's portfolio subsequent to the completion of the Adviser Transition, the Fund’s Board of Trustees (the “Board”)

has authorized Franklin Advisers to begin liquidating the Fund's portfolio to cash and cash equivalents prior to the completion of the

Adviser Transition. During this transition, the Fund will depart from its stated investment objective and policies to liquidate its holdings.

The Adviser Transition follows the Fund’s previous

announcement of the results of its Special Meeting of Shareholders (the “Special Meeting”) held on October 25, 2023. At the

Special Meeting, the Fund’s shareholders voted in favor of: (1) the approval of a new investment management agreement between the

Fund and Saba; (2) the approval of making the Fund’s investment objective “non-fundamental” to provide the Fund with

greater investment flexibility; and (3) the removal of the Fund’s fundamental policy mandating that at least 65% of the Fund’s

total assets be invested in at least three countries and in various types of debt instruments.

Contacts

Longacre Square Partners

Greg Marose / Kate Sylvester, 646-386-0091

gmarose@longacresquare.com / ksylvester@longacresquare.com

Templeton Global Income (NYSE:GIM)

Historical Stock Chart

From Nov 2024 to Dec 2024

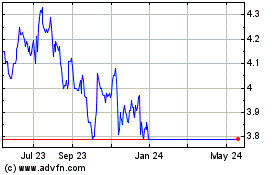

Templeton Global Income (NYSE:GIM)

Historical Stock Chart

From Dec 2023 to Dec 2024