|

JPMorgan Structured Investments —

|

PS-2

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

Reference Stock Issuer/Reference Stock

|

Bloomberg Ticker Symbol

|

Relevant Exchange

|

Stock Weight

|

Initial Stock Price

|

|

The Timken Company

|

Common shares, no par value

|

TKR UN

|

New York Stock Exchange

|

1.391611%

|

$69.13

|

|

Allegheny Technologies Incorporated

|

Common stock, par value $0.10 per share

|

ATI UN

|

New York Stock Exchange

|

1.160727%

|

$17.33

|

|

Umpqua Holdings Corporation

|

Common stock, no par value

|

UMPQ UW

|

NASDAQ Global Select Market

|

1.155375%

|

$19.28

|

|

Prosperity Bancshares, Inc.®

|

Common stock, par value $1.00 per share

|

PB UN

|

New York Stock Exchange

|

1.076104%

|

$65.56

|

|

Nabors Industries Ltd.

|

Common shares, par value $0.05 per share

|

NBR UN

|

New York Stock Exchange

|

1.030332%

|

$81.81

|

|

Dana Incorporated

|

Common stock, par value $0.01 per share

|

DAN UN

|

New York Stock Exchange

|

0.999186%

|

$21.92

|

|

Trinity Industries, Inc.

|

Common stock, par value $0.01 per share

|

TRN UN

|

New York Stock Exchange

|

0.946130%

|

$27.37

|

|

CNO Financial Group, Inc.

|

Common stock, par value $0.01 per share

|

CNO UN

|

New York Stock Exchange

|

0.899949%

|

$23.64

|

|

EnerSys

|

Common stock, par value $0.01 per share

|

ENS UN

|

New York Stock Exchange

|

0.750238%

|

$77.51

|

|

Patterson-UTI Energy, Inc.

|

Common stock, par value $0.01 per share

|

PTEN UW

|

NASDAQ Global Select Market

|

0.737765%

|

$8.10

|

|

Vishay Intertechnology, Inc.

|

Common stock, par value $0.10 per share

|

VSH UN

|

New York Stock Exchange

|

0.694892%

|

$20.81

|

|

Cabot Corporation

|

Common stock, par value $1.00 per share

|

CBT UN

|

New York Stock Exchange

|

0.616096%

|

$49.85

|

|

Worthington Industries, Inc.

|

Common shares, no par value

|

WOR UN

|

New York Stock Exchange

|

0.611861%

|

$53.53

|

|

American Axle & Manufacturing Holdings

|

Common stock, par value $0.01 per share

|

AXL UN

|

New York Stock Exchange

|

0.603199%

|

$8.24

|

|

BancorpSouth Bank

|

Common stock, par value $2.50 per share

|

BXS UN

|

New York Stock Exchange

|

0.456918%

|

$28.38

|

|

Columbia Banking System, Inc.

|

Common stock, no par value

|

COLB UW

|

The Nasdaq Stock Market LLC

|

0.437263%

|

$33.11

|

|

Century Aluminum Company

|

Common stock, par value $0.01 per share

|

CENX UW

|

NASDAQ Global Select Market

|

0.432619%

|

$12.72

|

|

Oil States International, Inc.

|

Common stock, par value $0.01 per share

|

OIS UN

|

New York Stock Exchange

|

0.210832%

|

$5.78

|

|

JPMorgan Structured Investments —

|

PS-3

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

What Is the Total Return on the

Notes at Maturity, Assuming a Range of Performances for the Basket?

The following table and examples illustrate the hypothetical

total return and the hypothetical payment at maturity on the notes. The “total return” as used in this pricing supplement

is the number, expressed as a percentage, that results from comparing the payment at maturity per $1,000 principal amount note to $1,000.

Each hypothetical total return or payment at maturity set forth below reflects the Maximum Return of 10.00%, the Contingent Buffer Amount

of 20.00% and the Starting Basket Level of 100. Each hypothetical total return or payment at maturity set forth below is for illustrative

purposes only and may not be the actual total return or payment at maturity applicable to a purchaser of the notes. The numbers appearing

in the following table and in the examples below have been rounded for ease of analysis.

|

Ending Basket Level

|

Basket Return

|

Total Return

|

|

180.00

|

80.00%

|

10.00%

|

|

170.00

|

70.00%

|

10.00%

|

|

160.00

|

60.00%

|

10.00%

|

|

150.00

|

50.00%

|

10.00%

|

|

140.00

|

40.00%

|

10.00%

|

|

130.00

|

30.00%

|

10.00%

|

|

120.00

|

20.00%

|

10.00%

|

|

110.00

|

10.00%

|

10.00%

|

|

105.00

|

5.00%

|

5.00%

|

|

102.50

|

2.50%

|

2.50%

|

|

100.00

|

0.00%

|

0.00%

|

|

97.50

|

-2.50%

|

0.00%

|

|

95.00

|

-5.00%

|

0.00%

|

|

90.00

|

-10.00%

|

0.00%

|

|

85.00

|

-15.00%

|

0.00%

|

|

80.00

|

-20.00%

|

0.00%

|

|

79.00

|

-21.00%

|

-21.00%

|

|

70.00

|

-30.00%

|

-30.00%

|

|

60.00

|

-40.00%

|

-40.00%

|

|

50.00

|

-50.00%

|

-50.00%

|

|

40.00

|

-60.00%

|

-60.00%

|

|

30.00

|

-70.00%

|

-70.00%

|

|

20.00

|

-80.00%

|

-80.00%

|

|

10.00

|

-90.00%

|

-90.00%

|

|

0.00

|

-100.00%

|

-100.00%

|

|

JPMorgan Structured Investments —

|

PS-4

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

Hypothetical Examples of Amount

Payable at Maturity

The following examples illustrate how the total payment

at maturity in different hypothetical scenarios is calculated.

Example 1: The level of the Basket increases from

the Starting Basket Level of 100.00 to an Ending Basket Level of 105.00.

Because the Ending Basket Level of 105.00 is greater

than the Starting Basket Level of 100.00 and the Basket Return is 5.00%, which does not exceed the Maximum Return of 10.00%, the investor

receives a payment at maturity of $1,050.00 per $1,000 principal amount note, calculated as follows:

$1,000 + ($1,000 × 5.00%)

= $1,050.00

Example 2: The level of the Basket decreases from

the Starting Basket Level of 100.00 to an Ending Basket Level 80.00.

Although the Basket Return is negative, because the

Ending Basket Level of 80.00 is less than the Starting Basket Level of 100.00 by up to the Contingent Buffer Amount of 20.00%, the investor

receives a payment at maturity of $1,000.00 per $1,000 principal amount note.

Example 3: The level of the Basket increases from

the Starting Basket Level of 100.00 to an Ending Basket Level of 140.00.

Because the Ending Basket Level of 140.00 is greater

than the Starting Basket Level of 100.00 and the Basket Return of 40.00% exceeds the Maximum Return of 10.00%, the investor receives a

payment at maturity of $1,100.00 per $1,000 principal amount note, the maximum payment at maturity.

Example 4: The level of the Basket decreases from

the Starting Basket Level of 100.00 to an Ending Basket Level 60.00.

Because the Ending Basket Level of 60.00 is less than

the Starting Basket Level of 100.00 by more than the Contingent Buffer Amount of 20.00% and the Basket Return is -40.00%, the investor

receives a payment at maturity of $600.00 per $1,000 principal amount note, calculated as follows:

$1,000 + ($1,000 × -40.00%)

= $600.00

The hypothetical returns and hypothetical payments on

the notes shown above apply only if you hold the notes for their entire term. These hypotheticals do not reflect fees or expenses

that would be associated with any sale in the secondary market. If these fees and expenses were included, the hypothetical returns and

hypothetical payments shown above would likely be lower.

|

JPMorgan Structured Investments —

|

PS-5

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

Selected Purchase Considerations

|

|

·

|

CAPPED APPRECIATION POTENTIAL — The notes provide

the opportunity to earn an unleveraged return equal to any positive Basket Return, up to the Maximum Return of 10.00%. Accordingly, the

maximum payment at maturity will not be less than $1,100.00 per $1,000 principal amount note. Because the notes are our unsecured and

unsubordinated obligations, the payment of which is fully and unconditionally guaranteed by JPMorgan Chase & Co., payment of any amount

on the notes is subject to our ability to pay our obligations as they become due and JPMorgan Chase & Co.’s ability to pay its

obligations as they become due.

|

|

|

·

|

LOSS OF PRINCIPAL BEYOND BUFFER AMOUNT — We

will pay you your principal back at maturity if the Ending Basket Level is equal to or less than the Starting Basket Level by up to the

Contingent Buffer Amount of 20.00%. If the Ending Basket Level is less than the Starting Basket Level by more than the Contingent Buffer

Amount, for every 1% that the Ending Basket Level is less than the Starting Basket Level you will lose an amount equal to 1% of the principal

amount of your notes. Under these circumstances, you will lose more than 20.00% of your principal amount at maturity and may lose all

of your principal amount at maturity.

|

|

|

·

|

RETURN LINKED TO AN UNEQUALLY

WEIGHTED BASKET OF 49 REFERENCE STOCKS — The return on the notes is linked to the performance of an unequally weighted Basket

that consists of 49 Reference Stocks as set forth under “The Basket” on page PS-1 of this pricing supplement. Notwithstanding

the name of the Basket, there is no guarantee that the Basket will actually provide exposure to companies that may benefit from inflation,

or that there will be inflation, during the term of the notes. If exposure to inflation is a factor in your decision to invest in the

notes, you should consult with your legal or other advisers before making an investment in the notes.

|

|

|

·

|

TAX TREATMENT —

You should review carefully the section entitled “Material U.S. Federal Income Tax Consequences” in the accompanying product

supplement no. 4-II. The following discussion, when read in combination with that section, constitutes the full opinion of our special

tax counsel, Latham & Watkins LLP, regarding the material U.S. federal income tax consequences of owning and disposing of notes.

|

Based on current market conditions,

in the opinion of our special tax counsel it is reasonable to treat the notes as “open transactions” that are not debt instruments

for U.S. federal income tax purposes, as more fully described in “Material U.S. Federal Income Tax Consequences — Tax Consequences

to U.S. Holders — Notes Treated as Open Transactions That Are Not Debt Instruments” in the accompanying product supplement.

Assuming this treatment is respected, the gain or loss on your notes should be treated as long-term capital gain or loss if you hold your

notes for more than a year, whether or not you are an initial purchaser of notes at the issue price. However, the IRS or a court may not

respect this treatment, in which case the timing and character of any income or loss on the notes could be materially and adversely affected.

In addition, in 2007 Treasury and the IRS released a notice requesting comments on the U.S. federal income tax treatment of “prepaid

forward contracts” and similar instruments. The notice focuses in particular on whether to require investors in these instruments

to accrue income over the term of their investment. It also asks for comments on a number of related topics, including the character of

income or loss with respect to these instruments; the relevance of factors such as the nature of the underlying property to which the

instruments are linked; the degree, if any, to which income (including any mandated accruals) realized by non-U.S. investors should be

subject to withholding tax; and whether these instruments are or should be subject to the “constructive ownership” regime,

which very generally can operate to recharacterize certain long-term capital gain as ordinary income and impose a notional interest charge.

While the notice requests comments on appropriate transition rules and effective dates, any Treasury regulations or other guidance promulgated

after consideration of these issues could materially and adversely affect the tax consequences of an investment in the notes, possibly

with retroactive effect. You should consult your tax adviser regarding the U.S. federal income tax consequences of an investment in the

notes, including possible alternative treatments and the issues presented by this notice.

Section 871(m) of the Code and Treasury

regulations promulgated thereunder (“Section 871(m)”) generally impose a 30% withholding tax (unless an income tax treaty

applies) on dividend equivalents paid or deemed paid to Non-U.S. Holders with respect to certain financial instruments linked to U.S.

equities or indices that include U.S. equities. Section 871(m) provides certain exceptions to this withholding regime, including for instruments

linked to certain broad-based indices that meet requirements set forth in the applicable Treasury regulations (such an index, a “Qualified

Index”). Additionally, a recent IRS notice excludes from the scope of Section 871(m) instruments issued prior to January 1, 2023

that do not have a delta of one with respect to underlying securities that could pay U.S.-source dividends for U.S. federal income tax

purposes (each an “Underlying Security”). Based on certain determinations made by us, our special tax counsel is of the opinion

that Section 871(m) should not apply to the notes with regard to Non-U.S. Holders. Our determination is not binding on the IRS, and the

IRS may disagree with this determination. Section 871(m) is complex and its application may depend on your particular circumstances, including

whether you enter into other transactions with respect to an Underlying Security. You should consult your tax adviser regarding the potential

application of Section 871(m) to the notes.

Withholding under legislation commonly

referred to as “FATCA” may (if the notes are recharacterized as debt instruments) apply to amounts treated as interest paid

with respect to the notes, as well as to payments of gross proceeds of a taxable disposition, including redemption at maturity, of a note,

although under recently proposed regulations (the preamble to which specifies that taxpayers are permitted to rely on them pending finalization),

no withholding will apply to payments of gross proceeds (other than any amount treated as interest). You should consult your tax adviser

regarding the potential application of FATCA to the notes.

|

JPMorgan Structured Investments —

|

PS-6

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

Selected Risk Considerations

An investment in the notes involves significant risks.

Investing in the notes is not equivalent to investing directly in the Basket or the Reference Stocks. These risks are explained in more

detail in the “Risk Factors” section of the accompanying product supplement.

Risks Relating to the Notes Generally

|

|

·

|

YOUR INVESTMENT IN THE NOTES MAY RESULT IN A LOSS

— The notes do not guarantee any return of principal. The return on the notes at maturity is linked to the performance of the Basket

and will depend on whether, and the extent to which, the Basket Return is positive or negative. If the Ending Basket Level is less than

the Starting Basket Level by more than the Contingent Buffer Amount, you will lose 1% of the principal amount of the notes for every 1%

that the Ending Basket Level is less than the Starting Basket Level. Under these circumstances, you will lose more than 20.00% of your

principal amount at maturity and may lose all of your principal amount at maturity.

|

|

|

·

|

YOUR MAXIMUM GAIN ON THE NOTES IS LIMITED TO THE MAXIMUM

RETURN — If the Ending Basket Level is greater than the Starting Basket Level, for each $1,000 principal amount note, you will

receive at maturity $1,000 plus an additional return that will not exceed the Maximum Return of 10.00%, regardless of the appreciation

in the Basket, which may be significant.

|

|

|

·

|

CREDIT RISKS OF JPMORGAN FINANCIAL AND JPMORGAN CHASE

& CO. — The notes are subject to our and JPMorgan Chase & Co.’s credit risks, and our and JPMorgan Chase &

Co.’s credit ratings and credit spreads may adversely affect the market value of the notes. Investors are dependent on our and JPMorgan

Chase & Co.’s ability to pay all amounts due on the notes. Any actual or potential change in our or JPMorgan Chase & Co.’s

creditworthiness or credit spreads, as determined by the market for taking that credit risk, is likely to adversely affect the value of

the notes. If we and JPMorgan Chase & Co. were to default on our payment obligations, you may not receive any amounts owed to you

under the notes and you could lose your entire investment.

|

|

|

·

|

AS A FINANCE SUBSIDIARY, JPMORGAN FINANCIAL HAS NO

INDEPENDENT OPERATIONS AND HAS LIMITED ASSETS — As a finance subsidiary of JPMorgan Chase & Co., we have no independent

operations beyond the issuance and administration of our securities. Aside from the initial capital contribution from JPMorgan Chase &

Co., substantially all of our assets relate to obligations of our affiliates to make payments under loans made by us or other intercompany

agreements. As a result, we are dependent upon payments from our affiliates to meet our obligations under the notes. If these affiliates

do not make payments to us and we fail to make payments on the notes, you may have to seek payment under the related guarantee by JPMorgan

Chase & Co., and that guarantee will rank pari passu with all other unsecured and unsubordinated obligations of JPMorgan Chase &

Co.

|

|

|

·

|

THE BENEFIT PROVIDED BY THE CONTINGENT BUFFER AMOUNT

MAY TERMINATE ON THE FINAL ENDING AVERAGING DATE — If the Ending Basket Level is less than the Starting Basket Level by more

than the Contingent Buffer Amount, the benefit provided by the Contingent Buffer Amount will terminate and you will be fully exposed to

any depreciation of the Basket from the Starting Basket Level to the Ending Basket Level.

|

|

|

·

|

CORRELATION (OR LACK OF CORRELATION) OF THE REFERENCE

STOCKS — The notes are linked to an unequally weighted Basket consisting of 49 Reference Stocks. Price movements of the Reference

Stocks may or may not be correlated with each other. At a time when the value of one or more of the Reference Stocks increases, the value

of the other Reference Stocks may not increase as much or may even decline. Therefore, in calculating the Ending Basket Level, increases

in the value of one or more of the Reference Stocks may be moderated, or more than offset, by the lesser increases or declines in the

values of the other Reference Stocks. In addition, high correlation of movements in the values of the Reference Stocks during periods

of negative returns among the Reference Stocks could have an adverse effect on the payment at maturity on the notes. There can be no assurance

that the Ending Basket Level will be higher than the Starting Basket Level.

|

|

|

·

|

NO OWNERSHIP OR DIVIDEND RIGHTS IN THE REFERENCE STOCKS

— As a holder of the notes, you will not have any ownership interest or rights in any of the Reference Stocks, such as voting rights

or dividend payments. In addition, the issuers of the Reference Stocks will not have any obligation to consider your interests as a holder

of the notes in taking any corporate action that might affect the value of the relevant Reference Stocks and the notes.

|

|

|

·

|

NO INTEREST PAYMENTS — As a holder of the notes,

you will not receive any interest payments.

|

|

|

·

|

LACK OF LIQUIDITY — The notes will not be

listed on any securities exchange. JPMS intends to offer to purchase the notes in the secondary market but is not required to do so. Even

if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily. Because other dealers

are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on

the price, if any, at which JPMS is willing to buy the notes.

|

Risks Relating to Conflicts of Interest

|

|

·

|

POTENTIAL CONFLICTS — We and our affiliates

play a variety of roles in connection with the issuance of the notes, including acting as calculation agent and as an agent of the offering

of the notes, hedging our obligations under the notes and making the assumptions used to determine the pricing of the notes and the estimated

value of the notes when the terms of the notes are set, which we refer to as the estimated value of the notes. In performing these duties,

our and JPMorgan Chase & Co.’s economic interests and the economic interests of the calculation agent and other affiliates of

ours are potentially adverse to your interests as an investor in the notes. In addition, our

|

|

JPMorgan Structured Investments —

|

PS-7

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

and JPMorgan Chase & Co.’s business activities,

including hedging and trading activities, could cause our and JPMorgan Chase & Co.’s economic interests to be adverse to yours

and could adversely affect any payment on the notes and the value of the notes. It is possible that hedging or trading activities of ours

or our affiliates in connection with the notes could result in substantial returns for us or our affiliates while the value of the notes

declines. Please refer to “Risk Factors — Risks Relating to Conflicts of Interest” in the accompanying product supplement

for additional information about these risks.

We and/or our affiliates may also currently

or from time to time engage in business with the Reference Stock issuers, including extending loans to, or making equity investments in,

the Reference Stock issuers or providing advisory services to the Reference Stock issuers. In addition, one or more of our affiliates

may publish research reports or otherwise express opinions with respect to the Reference Stock issuers, and these reports may or may not

recommend that investors buy or hold the Reference Stocks. As a prospective purchaser of the notes, you should undertake an independent

investigation of the Reference Stock issuers that in your judgment is appropriate to make an informed decision with respect to an investment

in the notes.

Risks Relating to the Estimated

Value and Secondary Market Prices of the Notes

|

|

·

|

THE ESTIMATED VALUE OF THE NOTES IS LOWER THAN THE ORIGINAL

ISSUE PRICE (PRICE TO PUBLIC) OF THE NOTES — The estimated value of the notes is only an estimate determined by reference to

several factors. The original issue price of the notes exceeds the estimated value of the notes because costs associated with selling,

structuring and hedging the notes are included in the original issue price of the notes. These costs include the selling commissions,

the projected profits, if any, that our affiliates expect to realize for assuming risks inherent in hedging our obligations under the

notes and the estimated cost of hedging our obligations under the notes. See “The Estimated Value of the Notes” in this pricing

supplement.

|

|

|

·

|

THE ESTIMATED VALUE OF THE NOTES DOES NOT REPRESENT FUTURE

VALUES OF THE NOTES AND MAY DIFFER FROM OTHERS’ ESTIMATES — The estimated value of the notes is determined by reference

to internal pricing models of our affiliates when the terms of the notes are set. This estimated value of the notes is based on market

conditions and other relevant factors existing at that time and assumptions about market parameters, which can include volatility, dividend

rates, interest rates and other factors. Different pricing models and assumptions could provide valuations for the notes that are greater

than or less than the estimated value of the notes. In addition, market conditions and other relevant factors in the future may change,

and any assumptions may prove to be incorrect. On future dates, the value of the notes could change significantly based on, among other

things, changes in market conditions, our or JPMorgan Chase & Co.’s creditworthiness, interest rate movements and other relevant

factors, which may impact the price, if any, at which JPMS would be willing to buy notes from you in secondary market transactions. See

“The Estimated Value of the Notes” in this pricing supplement.

|

|

|

·

|

THE ESTIMATED VALUE OF THE NOTES IS DERIVED BY REFERENCE

TO AN INTERNAL FUNDING RATE — The internal funding rate used in the determination of the estimated value of the notes may differ

from the market-implied funding rate for vanilla fixed income instruments of a similar maturity issued by JPMorgan Chase & Co. or

its affiliates. Any difference may be based on, among other things, our and our affiliates’ view of the funding value of the notes

as well as the higher issuance, operational and ongoing liability management costs of the notes in comparison to those costs for the conventional

fixed income instruments of JPMorgan Chase & Co. This internal funding rate is based on certain market inputs and assumptions, which

may prove to be incorrect, and is intended to approximate the prevailing market replacement funding rate for the notes. The use of an

internal funding rate and any potential changes to that rate may have an adverse effect on the terms of the notes and any secondary market

prices of the notes. See “The Estimated Value of the Notes” in this pricing supplement.

|

|

|

·

|

THE VALUE OF THE NOTES AS PUBLISHED BY JPMS (AND WHICH

MAY BE REFLECTED ON CUSTOMER ACCOUNT STATEMENTS) MAY BE HIGHER THAN THE THEN-CURRENT ESTIMATED VALUE OF THE NOTES FOR A LIMITED TIME PERIOD

— We generally expect that some of the costs included in the original issue price of the notes will be partially paid back to

you in connection with any repurchases of your notes by JPMS in an amount that will decline to zero over an initial predetermined period.

These costs can include selling commissions, projected hedging profits, if any, and, in some circumstances, estimated hedging costs and

our internal secondary market funding rates for structured debt issuances. See “Secondary Market Prices of the Notes” in this

pricing supplement for additional information relating to this initial period. Accordingly, the estimated value of your notes during this

initial period may be lower than the value of the notes as published by JPMS (and which may be shown on your customer account statements).

|

|

|

·

|

SECONDARY MARKET PRICES OF THE NOTES WILL LIKELY BE LOWER

THAN THE ORIGINAL ISSUE PRICE OF THE NOTES — Any secondary market prices of the notes will likely be lower than the original

issue price of the notes because, among other things, secondary market prices take into account our internal secondary market funding

rates for structured debt issuances and, also, because secondary market prices may exclude selling commissions, projected hedging profits,

if any, and estimated hedging costs that are included in the original issue price of the notes. As a result, the price, if any, at which

JPMS will be willing to buy notes from you in secondary market transactions, if at all, is likely to be lower than the original issue

price. Any sale by you prior to the Maturity Date could result in a substantial loss to you. See the immediately following risk consideration

for information about additional factors that will impact any secondary market prices of the notes.

|

|

JPMorgan Structured Investments —

|

PS-8

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

The notes are not designed to be short-term

trading instruments. Accordingly, you should be able and willing to hold your notes to maturity. See “— Lack of Liquidity”

below.

|

|

·

|

SECONDARY MARKET PRICES OF THE NOTES WILL BE IMPACTED

BY MANY ECONOMIC AND MARKET FACTORS — The secondary market price of the notes during their term will be impacted by a number

of economic and market factors, which may either offset or magnify each other, aside from the selling commissions, projected hedging profits,

if any, estimated hedging costs and the price of one share of each Reference Stock.

|

Additionally, independent pricing vendors

and/or third party broker-dealers may publish a price for the notes, which may also be reflected on customer account statements. This

price may be different (higher or lower) than the price of the notes, if any, at which JPMS may be willing to purchase your notes in the

secondary market. See “Risk Factors — Risks Relating to the Estimated Value and Secondary Market Prices of the Notes —

Secondary market prices of the notes will be impacted by many economic and market factors” in the accompanying product supplement.

Risks Relating to the Basket

|

|

·

|

NO AFFILIATION WITH THE REFERENCE STOCK ISSUERS —

We are not affiliated with the issuers of the Reference Stocks. We assume no responsibility for the adequacy of the information about

the Reference Stock issuers contained in this pricing supplement. You should undertake your own investigation into the Reference Stocks

and their issuers. We are not responsible for the Reference Stock issuers’ public disclosure of information, whether contained in

SEC filings or otherwise.

|

|

|

·

|

THE ANTI-DILUTION PROTECTION FOR THE REFERENCE STOCKS

IS LIMITED AND MAY BE DISCRETIONARY — The calculation agent will make adjustments to the Stock Adjustment Factor for each Reference

Stock for certain corporate events affecting that Reference Stock. However, the calculation agent will not make an adjustment in response

to all events that could affect each Reference Stock. If an event occurs that does not require the calculation agent to make an adjustment,

the value of the notes may be materially and adversely affected. You should also be aware that the calculation agent may make adjustments

in response to events that are not described in the accompanying product supplement to account for any diluting or concentrative effect,

but the calculation agent is under no obligation to do so or to consider your interests as a holder of the notes in making these determinations.

|

|

|

·

|

THE INVESTMENT STRATEGY REPRESENTED BY THE BASKET

MAY NOT BE SUCCESSFUL — The Basket is comprised of the Reference Stocks of 49 U.S.-listed companies that may benefit from inflation

in the United States during the term of the note. You should undertake your own investigation into each Reference Stock and its issuer,

and you should make your own determination as to the potential effect of rising inflation in the United States on each Reference Stock

during the term of the note. There can be no assurance that the Basket Return will be positive during the term of the notes. It is possible

that the investment strategy represented by the Basket will not be successful and that the level of the Basket and the Basket Return will

be adversely affected. Moreover, there can be no assurance that the Reference Stocks will outperform other U.S.-listed companies with

potential exposure to inflation in the United States.

|

|

|

·

|

THE REFERENCE STOCKS ARE CONCENTRATED IN THE FINANCIALS,

INDUSTRIALS, ENERGY AND MATERIALS SECTORS — A substantial portion of the Reference Stocks has been issued by companies whose

business is associated with the financials, industrials, energy or materials sector. Because the value of the notes is determined by the

performance of the Basket consisting of the Reference Stocks, an investment in these notes will be concentrated in these sectors. As a

result, the value of the notes may be subject to greater volatility and be more adversely affected by a single positive or negative economic,

political or regulatory occurrence affecting these sectors than a different investment linked to securities of a more broadly diversified

group of issuers.

|

|

|

·

|

RISKS ASSOCIATED WITH NON-U.S. SECURITIES WITH RESPECT

TO THE ORDINARY SHARES OF LYONDELLBASELL INDUSTRIES N.V., THE ORDINARY SHARES OF TECHNIPFMC PLC, THE ORDINARY SHARES OF EATON CORPORATION

PLC AND THE COMMON SHARES OF NABORS INDUSTRIES LTD. — Each of the ordinary shares of LyondellBasell Industries N.V., the ordinary

shares of TechnipFMC plc, the ordinary shares of Eaton Corporation plc and the common shares of Nabors Industries Ltd. have been issued

by a non-U.S. company. Investments in securities linked to the value of such non-U.S. equity securities involve risks associated with

the home countries of the issuers of those non-U.S. equity securities.

|

|

|

·

|

LIMITED TRADING HISTORY WITH RESPECT TO THE ORDINARY

SHARES OF TECHNIPFMC PLC — On January 16, 2017, in connection with a business combination among FMC Technologies, Inc., Technip

S.A. and TechnipFMC plc, Technip S.A. merged with and into TechnipFMC plc and a wholly owned indirect subsidiary of TechnipFMC plc merged

with and into the FMC Technologies, Inc., with FMC Technologies, Inc. surviving as a wholly owned subsidiary of TechnipFMC plc. The ordinary

shares of TechnipFMC plc commenced trading on the New York Stock Exchange on January 17, 2017 and therefore has limited historical performance.

Accordingly, historical information for this Reference Stock is available only since the date listed above. Past performance should not

be considered indicative of future performance.

|

|

|

·

|

IN SOME CIRCUMSTANCES, THE PAYMENT YOU RECEIVE ON THE

NOTES MAY BE BASED ON THE VALUE OF CASH, SECURITIES (INCLUDING SECURITIES OF OTHER ISSUERS) OR OTHER PROPERTY DISTRIBUTED TO HOLDERS OF

A REFERENCE STOCK UPON THE OCCURRENCE OF A REORGANIZATION EVENT — Following certain corporate events relating to a Reference

Stock where its issuer is not the surviving

|

|

JPMorgan Structured Investments —

|

PS-9

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

entity, a liquidation of a Reference Stock issuer

or other reorganization events affect a Reference Stock issuer as described in the accompanying product supplement, a portion of any payment

on the notes may be based on the common stock (or other security) of a successor to that Reference Stock issuer or any cash or any other

assets distributed to holders of that Reference Stock in the relevant corporate event. The occurrence of these corporate events and the

consequent adjustments may materially and adversely affect the value of the notes. The specific corporate events that can lead to these

adjustments and the procedures for selecting the Exchange Property (as defined in the accompanying product supplement) are described in

the accompanying product supplement.

|

JPMorgan Structured Investments —

|

PS-10

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

The Basket and the Reference

Stocks

Public Information

All information contained in this pricing supplement on the Reference

Stocks and on the Reference Stock issuers is derived from publicly available sources, without independent verification. The table below

sets forth the Reference Stocks included in the Basket in alphabetical order by ticker symbol. Each Reference Stock is registered under

the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act”, and is listed on the exchange provided

in the table below, which we refer to as the relevant exchange for purposes of that Reference Stock in the accompanying product supplement.

Information provided to or filed with the SEC by a Reference Stock issuer pursuant to the Exchange Act can be located by reference to

the SEC file number provided in the table below, and can be accessed through www.sec.gov.

We do not make any representation that these publicly available documents

are accurate or complete. We obtained the closing prices below from Bloomberg, without independent verification. The closing prices below

may have been adjusted by Bloomberg for corporate actions, such as stock splits, public offerings, mergers and acquisitions, spin-offs,

delistings and bankruptcy.

|

Bloomberg Ticker Symbol

|

Reference Stock Issuer/Reference Stock

|

Relevant Exchange

|

SEC File

Number

|

Closing Price on September 14, 2021

|

|

AEL UN

|

American Equity Investment Life Holding Company

|

Common stock, par value $1.00 per share

|

New York Stock Exchange

|

001-31911

|

$29.51

|

|

AME UN

|

AMETEK, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-12981

|

$131.24

|

|

AMG UN

|

Affiliated Managers Group, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-13459

|

$157.77

|

|

ATI UN

|

Allegheny Technologies Incorporated

|

Common stock, par value $0.10 per share

|

New York Stock Exchange

|

001-12001

|

$17.33

|

|

AXL UN

|

American Axle & Manufacturing Holdings, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-14303

|

$8.24

|

|

BC UN

|

Brunswick Corporation

|

Common stock, par value $0.75 per share

|

New York Stock Exchange

|

001-1043

|

$97.01

|

|

BK UN

|

The Bank of New York Mellon Corporation

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-35651

|

$51.14

|

|

BXS UN

|

BancorpSouth Bank

|

Common stock, par value $2.50 per share

|

New York Stock Exchange

|

FDIC Certificate

No. 11813

|

$28.38

|

|

CBT UN

|

Cabot Corporation

|

Common stock, par value $1.00 per share

|

New York Stock Exchange

|

001-5667

|

$49.85

|

|

CE UN

|

Celanese Corporation

|

Common stock, par value $0.0001 per share

|

New York Stock Exchange

|

001-32410

|

$149.71

|

|

CENX UW

|

Century Aluminum Company

|

Common stock, par value $0.01 per share

|

NASDAQ Global Select Market

|

001-34474

|

$12.72

|

|

CNO UN

|

CNO Financial Group, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-31792

|

$23.64

|

|

COF UN

|

Capital One Financial Corporation

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-13300

|

$154.39

|

|

COLB UW

|

Columbia Banking System, Inc.

|

Common stock, no par value

|

The Nasdaq Stock Market LLC

|

000-20288

|

$33.11

|

|

DAN UN

|

Dana Incorporated

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-1063

|

$21.92

|

|

EMN UN

|

Eastman Chemical Company

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-12626

|

$104.50

|

|

ENS UN

|

EnerSys

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-32253

|

$77.51

|

|

ETN UN

|

Eaton Corporation plc

|

Ordinary shares, par value $0.01 per share

|

New York Stock Exchange

|

000-54863

|

$156.30

|

|

FLS UN

|

Flowserve Corporation

|

Common stock, par value $1.25 per share

|

New York Stock Exchange

|

001-13179

|

$35.53

|

|

FTI UN

|

TechnipFMC plc

|

Ordinary shares, par value $1.00 per share

|

New York Stock Exchange

|

001-37983

|

$6.86

|

|

GS UN

|

The Goldman Sachs Group, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-14965

|

$403.69

|

|

HES UN

|

Hess Corporation

|

Common stock, par value $1.00 per share

|

New York Stock Exchange

|

001-1204

|

$68.91

|

|

JEF UN

|

Jefferies Financial Group Inc.

|

Common shares, par value $1.00 per share

|

New York Stock Exchange

|

001-5721

|

$36.65

|

|

KBR UN

|

KBR, Inc.

|

Common stock, par value $0.001 per share

|

New York Stock Exchange

|

001-33146

|

$38.69

|

|

LYB UN

|

LyondellBasell Industries N.V.

|

Ordinary shares, par value €0.04 per share

|

New York Stock Exchange

|

001-34726

|

$93.83

|

|

MAN UN

|

ManpowerGroup Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-10686

|

$117.51

|

|

JPMorgan Structured Investments —

|

PS-11

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

Bloomberg Ticker Symbol

|

Reference Stock Issuer/Reference Stock

|

Relevant Exchange

|

SEC File

Number

|

Closing Price on September 14, 2021

|

|

MET UN

|

MetLife, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-15787

|

$60.78

|

|

MGM UN

|

MGM Resorts International

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-10362

|

$41.41

|

|

MRO UN

|

Marathon Oil Corporation

|

Common stock, par value $1.00 per share

|

New York Stock Exchange

|

001-1513

|

$11.73

|

|

MTB UN

|

M&T Bank Corporation

|

Common stock, par value $0.50 per share

|

New York Stock Exchange

|

001-9861

|

$133.67

|

|

NBR UN

|

Nabors Industries Ltd.

|

Common shares, par value $0.05 per share

|

New York Stock Exchange

|

001-32657

|

$81.81

|

|

NOV UN

|

NOV Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-12317

|

$13.53

|

|

OIS UN

|

Oil States International, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-16337

|

$5.78

|

|

OSK UN

|

Oshkosh Corporation

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-31371

|

$105.13

|

|

PB UN

|

Prosperity Bancshares, Inc.®

|

Common stock, par value $1.00 per share

|

New York Stock Exchange

|

001-35388

|

$65.56

|

|

PFG UW

|

Principal Financial Group, Inc.

|

Common stock, par value $0.01 per share

|

NASDAQ Global Select Market

|

001-16725

|

$65.14

|

|

PTEN UW

|

Patterson-UTI Energy, Inc.

|

Common stock, par value $0.01 per share

|

NASDAQ Global Select Market

|

001-39270

|

$8.10

|

|

PXD UN

|

Pioneer Natural Resources Company

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-13245

|

$152.95

|

|

TKR UN

|

The Timken Company

|

Common shares, no par value

|

New York Stock Exchange

|

001-1169

|

$69.13

|

|

TRN UN

|

Trinity Industries, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-6903

|

$27.37

|

|

TROW UW

|

T. Rowe Price Group, Inc.

|

Common stock, par value $0.20 per share

|

The Nasdaq Stock Market LLC

|

000-32191

|

$212.88

|

|

UMPQ UW

|

Umpqua Holdings Corporation

|

Common stock, no par value

|

NASDAQ Global Select Market

|

001-34624

|

$19.28

|

|

UNM UN

|

Unum Group

|

Common stock, par value $0.10 per share

|

New York Stock Exchange

|

001-11294

|

$26.08

|

|

URI UN

|

United Rentals, Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-14387

|

$331.30

|

|

VSH UN

|

Vishay Intertechnology, Inc.

|

Common stock, par value $0.10 per share

|

New York Stock Exchange

|

001-7416

|

$20.81

|

|

WEX UN

|

WEX Inc.

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

001-32426

|

$171.13

|

|

WOR UN

|

Worthington Industries, Inc.

|

Common shares, no par value

|

New York Stock Exchange

|

001-8399

|

$53.53

|

|

WWD UW

|

Woodward, Inc.

|

Common stock, par value $0.001455 per share

|

NASDAQ Global Select Market

|

000-08408

|

$122.82

|

|

X UN

|

United States Steel Corporation

|

Common stock, par value $1.00 per share

|

New York Stock Exchange and Chicago Stock Exchange

|

001-16811

|

$24.45

|

According to publicly available filings of the

relevant Reference Stock issuer with the SEC:

|

|

·

|

American Equity Investment Life Holding Company focuses on

the development and sale of fixed index and fixed rate annuity products.

|

|

|

·

|

AMETEK, Inc. is a global manufacturer of electronic instruments

and electromechanical devices with operations in North America, Europe, Asia and South America. Its predecessor was originally incorporated

in Delaware in 1930 under the name American Machine and Metals, Inc.

|

|

|

·

|

Affiliated Managers Group, Inc. is a partner to independent

active investment management firms globally. Their strategy is to generate long-term value by investing in a diverse array of partner-owned

investment firms through a partnership approach, and allocating resources to the areas of highest growth and return.

|

|

|

·

|

Allegheny Technologies Incorporated's strategy is to be an

aligned and integrated specialty materials and components company, solving the world’s challenges through materials science. Their

strategies target the products and global growth markets that require and value their technical and manufacturing capabilities.

|

|

|

·

|

American Axle & Manufacturing Holdings, Inc. is a global

supplier to the automotive industry that designs, engineers and manufactures driveline and metal forming products.

|

|

|

·

|

Brunswick Corporation designs, manufactures, and markets recreational

marine products, including leading marine propulsion products, parts and accessories, and boat brands, and operates service and shared

access businesses.

|

|

|

·

|

The Bank of New York Mellon Corporation is divided into two

business segments, Investment Services and Investment and Wealth Management. They also have another segment which includes a leasing portfolio,

corporate treasury activities (including their securities portfolio), derivatives and other trading activity, corporate and bank-owned

life insurance, renewable energy investments and certain business exits.

|

|

JPMorgan Structured Investments —

|

PS-12

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

|

·

|

BancorpSouth Bank conducts commercial banking and financial

services operations in Alabama, Arkansas, Florida, Louisiana, Mississippi, Missouri, Tennessee, Texas and Illinois.

|

|

|

·

|

Cabot Corporation is a global specialty chemicals and performance

materials company. Their principal products are rubber and specialty grade carbon blacks, specialty compounds, fumed metal oxides, activated

carbons, inkjet colorants, and aerogel.

|

|

|

·

|

Celanese Corporation is a global chemical and specialty materials

company. They are a producer of high performance engineered polymers that are used in a variety of high-value applications, as well as

a producer of acetyl products, which are intermediate chemicals for nearly all major industries.

|

|

|

·

|

Century Aluminum Company is a producer of primary aluminum

and operates aluminum reduction facilities, or "smelters," in the United States and Iceland.

|

|

|

·

|

CNO Financial Group, Inc. is a holding company for a group

of insurance companies operating throughout the United States that develop, market and administer health insurance, annuity, individual

life insurance and other insurance products.

|

|

|

·

|

Capital One Financial Corporation is a diversified financial

services holding company with banking and non-banking subsidiaries.

|

|

|

·

|

Columbia Banking System, Inc. is a registered bank holding

company whose wholly owned banking subsidiary is Columbia State Bank. They provide a full range of banking services to small and medium-sized

businesses, professionals and individuals throughout Washington, Oregon and Idaho.

|

|

|

·

|

Dana Incorporated provides power-conveyance and energy-management

solutions for vehicles and machinery. The company's portfolio improves the efficiency, performance, and sustainability of light vehicles,

commercial vehicles, and off-highway equipment.

|

|

|

·

|

Eastman Chemical Company is a global specialty materials company

that produces a broad range of products found in items people use every day.

|

|

|

·

|

EnerSys is a manufacturer, marketer and distributor of industrial

batteries. They also manufacture, market and distribute products such as battery chargers, power equipment, battery accessories, and outdoor

cabinet enclosures.

|

|

|

·

|

Eaton Corporation plc is a power management company. They

provide sustainable solutions that help their customers effectively manage electrical, hydraulic and mechanical power.

|

|

|

·

|

Flowserve Corporation is a manufacturer and aftermarket service

provider of comprehensive flow control systems.

|

|

|

·

|

TechnipFMC plc is involved in the energy industry; delivering

projects, products, technologies, and services.

|

|

|

·

|

The Goldman Sachs Group, Inc. is a financial institution that

delivers a broad range of financial services across investment banking, securities, investment management and consumer banking to a large

and diversified client base that includes corporations, financial institutions, governments and individuals.

|

|

|

·

|

Hess Corporation is a global E&P company engaged in exploration,

development, production, transportation, purchase and sale of crude oil, natural gas liquids, and natural gas with production operations

located primarily in the United States (U.S.), Guyana, the Malaysia/Thailand Joint Development Area (JDA), Malaysia, and Denmark.

|

|

|

·

|

Jefferies Financial Group Inc. is engaged in investment banking

and capital markets, asset management and direct investing.

|

|

|

·

|

KBR, Inc. delivers scientific, technology and engineering

solutions to governments and companies around the world.

|

|

|

·

|

LyondellBasell Industries N.V. is a global, independent chemical

company.

|

|

|

·

|

ManpowerGroup Inc. offers a comprehensive range of workforce

solutions and services.

|

|

|

·

|

MetLife, Inc. is a financial services company, providing insurance,

annuities, employee benefits and asset management.

|

|

|

·

|

MGM Resorts International owns and operates integrated casino,

hotel and entertainment resorts.

|

|

|

·

|

Marathon Oil Corporation is an independent exploration and

production company incorporated in 2001, focused on U.S. resource plays: the Eagle Ford in Texas, the Bakken in North Dakota, STACK and

SCOOP in Oklahoma and Northern Delaware in New Mexico.

|

|

|

·

|

M&T Bank Corporation has two wholly owned bank subsidiaries:

Manufacturers and Traders Trust Company and Wilmington Trust, National Association. The banks collectively offer a wide range of retail

and commercial banking, trust and wealth management, and investment services to their customers.

|

|

|

·

|

Nabors Industries, Ltd. Is a land drilling contractor.

|

|

|

·

|

NOV Inc. is an independent equipment and technology provider

to the global energy industry.

|

|

|

·

|

Oil States International, Inc. through its subsidiaries, is

a global provider of manufactured products and services used in the drilling, completion, subsea, production and infrastructure sectors

of the oil and natural gas industry, as well as in the industrial and military sectors.

|

|

|

·

|

Oshkosh Corporation is a designer, manufacturer and marketer

of access equipment, specialty vehicles and truck bodies for the primary markets of access equipment, defense, fire & emergency, refuse

hauling, concrete placement as well as airport services.

|

|

|

·

|

Prosperity Bancshares, Inc.® is a registered

financial holding company that derives substantially all of its revenues and income from the operation of its bank subsidiary, Prosperity

Bank®. The Bank provides a wide array of financial products and services to businesses and consumers throughout Texas and

Oklahoma.

|

|

|

·

|

Principal Financial Group, Inc. is a global investment

management offering businesses, individuals and institutional clients a wide range of financial products and services, including retirement,

asset management and insurance through a diverse family of financial services companies.

|

|

|

·

|

Patterson-UTI Energy, Inc. is an oilfield services company

that primarily owns and operates a fleet of land-based drilling rigs in the United States and a fleet of pressure pumping equipment.

|

|

|

·

|

Pioneer Natural Resources Company is an independent oil and

gas exploration and production company that explores for, develops and produces oil, NGLs and gas within the United States, with operations

in the Permian Basin in West Texas.

|

|

|

·

|

The Timken Company designs and manages a growing portfolio

of engineered bearings and power transmission products and related services. The Company's portfolio includes Timken®,

Philadelphia Gear®, Drives®, Cone Drive®, Rollon®, Lovejoy®,

Diamond®, BEKA® and Groeneveld®.

|

|

|

·

|

Trinity Industries, Inc. wn businesses that are providers

of railcar products and services in North America.

|

|

|

·

|

T. Rowe Price Group, Inc. is a financial services holding

company that provides global investment management services through its subsidiaries to investors worldwide.

|

|

|

·

|

Umpqua Holdings Corporation is a bank holding company currently

designated as a financial holding company with two principal operating subsidiaries, Umpqua Bank and Umpqua Investments, Inc. The Bank's

wholly-owned subsidiary, Financial Pacific Leasing, Inc., is a commercial equipment leasing company.

|

|

JPMorgan Structured Investments —

|

PS-13

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

|

·

|

Unum Group is a provider of financial protection benefits

in the United States and the United Kingdom. Their products include disability, life, accident, critical illness, dental and vision, and

other related services. They market their products primarily through the workplace.

|

|

|

·

|

United Rentals, Inc. rents equipment to construction and industrial

companies, manufacturers, utilities, municipalities, homeowners and others.

|

|

|

·

|

Vishay Intertechnology, Inc. manufactures a portfolios of

discrete semiconductors and passive electronic components that support innovative designs in the automotive, industrial, computing, consumer,

telecommunications, military, aerospace, and medical markets.

|

|

|

·

|

WEX Inc. is a financial technology service provider having

simplified the complexities of payment systems across continents and industries.

|

|

|

·

|

Worthington Industries, Inc. is primarily a diversified metals

manufacturing company, focused on value-added steel processing and manufactured metal products.

|

|

|

·

|

Woodward, Inc. is an independent designer, manufacturer, and

service provider of control solutions for the aerospace and industrial markets.

|

|

|

·

|

United States Steel Corporation is a steelmaker operating

in the U.S. and Central Europe.

|

|

JPMorgan Structured Investments —

|

PS-14

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

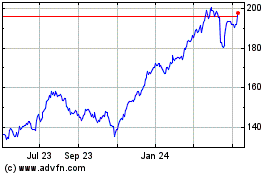

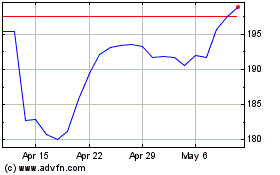

Historical Information Regarding

the Basket and the Reference Stocks

The following graphs show the historical weekly performance of

the Basket as a whole from January 8, 2016 through September 13, 2021, as well as the Reference Stocks (other than the ordinary shares

of TechnipFMC plc) from January 8, 2016 through September 13, 2021, the historical performance of the common stock of FMC Technologies,

Inc., par value $0.01 per share, based on the weekly historical closing prices of one share of the common stock of FMC Technologies, Inc.

from January 8, 2016 through January 13, 2017 and the ordinary shares of TechnipFMC plc based on the weekly historical closing prices

of one ordinary share from January 20, 2017 through September 13, 2021. The ordinary shares of TechnipFMC plc commenced trading on the

New York Stock Exchange on January 17, 2017 and therefore has limited historical performance. The graph of the historical Basket performance

assumes the closing level of the Basket on January 8, 2016 was 100 and the Stock Weights were as specified under “The Basket”

in this pricing supplement. For the avoidance of doubt, the performance in the Basket graph from January 8, 2016 to January 16, 2017 does

not include any performance for the ordinary shares of TechnipFMC plc during that time period.

We obtained the various closing prices below from the Bloomberg Professional®

service (“Bloomberg”), without independent verification. The closing prices may have been adjusted by Bloomberg for corporate

actions such as stock splits, public offerings, mergers and acquisitions, spin-offs, delistings and bankruptcy.

Since the commencement of trading of each Reference Stock, the price

of that Reference Stock has experienced significant fluctuations. The historical performance of each Reference Stock and the historical

performance of the Basket should not be taken as an indication of future performance, and no assurance can be given as to the closing

prices of each Reference Stock or the levels of the Basket on any Ending Averaging Date. There can be no assurance that the performance

of the Basket will result in the return of any of your principal amount.

|

JPMorgan Structured Investments —

|

PS-15

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-16

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-17

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-18

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-19

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-20

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-21

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

†The vertical dotted line in the graph indicates

January 17, 2017. In the graph, the performance to the left of the vertical dotted line reflects the common stock of FMC Technologies,

Inc. and the performance to the right of the vertical dotted line reflects the ordinary shares of TechnipFMC plc.

|

JPMorgan Structured Investments —

|

PS-22

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-23

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-24

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-25

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-26

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-27

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-28

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-29

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

|

JPMorgan Structured Investments —

|

PS-30

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

The Estimated Value of the Notes

The estimated value of the notes set forth on the cover of this

pricing supplement is equal to the sum of the values of the following hypothetical components: (1) a fixed-income debt component with

the same maturity as the notes, valued using the internal funding rate described below, and (2) the derivative or derivatives underlying

the economic terms of the notes. The estimated value of the notes does not represent a minimum price at which JPMS would be willing to

buy your notes in any secondary market (if any exists) at any time. The internal funding rate used in the determination of the estimated

value of the notes may differ from the market-implied funding rate for vanilla fixed income instruments of a similar maturity issued by

JPMorgan Chase & Co. or its affiliates. Any difference may be based on, among other things, our and our affiliates’ view of

the funding value of the notes as well as the higher issuance, operational and ongoing liability management costs of the notes in comparison

to those costs for the conventional fixed income instruments of JPMorgan Chase & Co. This internal funding rate is based on certain

market inputs and assumptions, which may prove to be incorrect, and is intended to approximate the prevailing market replacement funding

rate for the notes. The use of an internal funding rate and any potential changes to that rate may have an adverse effect on the terms

of the notes and any secondary market prices of the

|

JPMorgan Structured Investments —

|

PS-31

|

|

Capped Buffered Equity Notes Linked to a Basket of 49 Reference Stocks with Potential Exposure to Inflation

|

notes. For additional information, see “Selected Risk Considerations

— Risks Relating to the Estimated Value and Secondary Market Prices of the Notes — The Estimated Value of the Notes Is Derived

by Reference to an Internal Funding Rate” in this pricing supplement. The value of the derivative or derivatives underlying the

economic terms of the notes is derived from internal pricing models of our affiliates. These models are dependent on inputs such as the

traded market prices of comparable derivative instruments and on various other inputs, some of which are market-observable, and which

can include volatility, dividend rates, interest rates and other factors, as well as assumptions about future market events and/or environments.

Accordingly, the estimated value of the notes is determined when the terms of the notes are set based on market conditions and other relevant

factors and assumptions existing at that time. See “Selected Risk Considerations — Risks Relating to the Estimated Value and

Secondary Market Prices of the Notes — The Estimated Value of the Notes Does Not Represent Future Values of the Notes and May Differ

from Others’ Estimates” in this pricing supplement.

The estimated value of the notes will be lower than the original

issue price of the notes because costs associated with selling, structuring and hedging the notes are included in the original issue price

of the notes. These costs include the selling commissions paid to JPMS and other affiliated or unaffiliated dealers, the projected profits,

if any, that our affiliates expect to realize for assuming risks inherent in hedging our obligations under the notes and the estimated

cost of hedging our obligations under the notes. Because hedging our obligations entails risk and may be influenced by market forces beyond

our control, this hedging may result in a profit that is more or less than expected, or it may result in a loss. We or one or more of

our affiliates will retain any profits realized in hedging our obligations under the notes. See “Selected Risk Considerations —

Risks Relating to the Estimated Value and Secondary Market Prices of the Notes — The Estimated Value of the Notes Will Be Lower

Than the Original Issue Price (Price to Public) of the Notes” in this pricing supplement.

Secondary Market Prices of the Notes

For information about factors that will impact any secondary

market prices of the notes, see “Risk Factors — Risks Relating to the Estimated Value and Secondary Market Prices of the Notes

— Secondary market prices of the notes will be impacted by many economic and market factors” in the accompanying product supplement.

In addition, we generally expect that some of the costs included in the original issue price of the notes will be partially paid back

to you in connection with any repurchases of your notes by JPMS in an amount that will decline to zero over an initial predetermined period.

These costs can include selling commissions, projected hedging profits, if any, and, in some circumstances, estimated hedging costs and

our internal secondary market funding rates for structured debt issuances. This initial predetermined time period is intended to be the

shorter of six months and one-half of the stated term of the notes. The length of any such initial period reflects the structure of the

notes, whether our affiliates expect to earn a profit in connection with our hedging activities, the estimated costs of hedging the notes

and when these costs are incurred, as determined by our affiliates. See “Selected Risk Considerations — Risks Relating to

the Estimated Value and Secondary Market Prices of the Notes — The Value of the Notes as Published by JPMS (and Which May Be Reflected

on Customer Account Statements) May Be Higher Than the Then-Current Estimated Value of the Notes for a Limited Time Period” in this

pricing supplement.

Supplemental Use of Proceeds

The notes are offered to meet investor demand for products that

reflect the risk-return profile and market exposure provided by the notes. See “What Is the Total Return on the Notes at Maturity,

Assuming a Range of Performances for the Basket?” and “Hypothetical Examples of Amount Payable at Maturity” in this

pricing supplement for an illustration of the risk-return profile of the notes and “The Basket and the Reference Stocks” in

this pricing supplement for a description of the market exposure provided by the notes.

The original issue price of the notes is equal to the estimated

value of the notes plus the selling commissions paid to JPMS and other affiliated or unaffiliated dealers, plus (minus) the projected

profits (losses) that our affiliates expect to realize for assuming risks inherent in hedging our obligations under the notes, plus the

estimated cost of hedging our obligations under the notes.

Supplemental Plan of Distribution

We expect that delivery of the notes will be made against payment

for the notes on or about the Original Issue Date set forth on the front cover of this pricing supplement, which will be the third business

day following the Pricing Date of the notes (this settlement cycle being referred to as “T+3”). Under Rule 15c6-1 of the Securities

Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties

to that trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes on any date prior to two business days before

delivery will be required to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement and should

consult their own advisors.

Validity of the Notes and the Guarantee

In the opinion of Latham & Watkins LLP, as special product

counsel to JPMorgan Financial and JPMorgan Chase & Co., when the notes offered by this pricing supplement have been executed and issued