UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: January 2025

Commission file number: 001-38350

Lithium Argentina AG

(Translation of Registrant's name into English)

Dammstrasse 19, 6300 Zug, Switzerland

(Address of Principal Executive Office)

900 West Hastings Street, Suite 300,

Vancouver, British Columbia,

Canada V6C 1E5

(North American Mailing Address)

Indicate by check mark whether the registrant files or will file annual reports under cover:

Form 20-F [X] Form 40-F [ ]

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: January 24, 2025 |

Lithium Argentina AG |

| |

|

|

| |

By: |

/s/ Alex Shulga |

| |

Name: |

Alex Shulga |

| |

Title: |

Vice President and Chief Financial Officer |

SECOND SUPPLEMENTAL INDENTURE

SECOND SUPPLEMENTAL INDENTURE dated as of January 23, 2025 (this "Supplemental Indenture") between LITHIUM ARGENTINA AG (formerly LITHIUM AMERICAS (ARGENTINA) CORP. and LITHIUM AMERICAS CORP.), a company organized and existing under the Swiss Code of Obligations, as issuer (the "Company"), and COMPUTERSHARE TRUST COMPANY, N.A., as trustee (the "Trustee").

Reference is made to the Indenture dated as of December 6, 2021, as amended by the First Supplemental Indenture dated October 3, 2023, between the Company and the Trustee (the "Original Indenture"). Capitalized terms used herein without definition shall have the respective meanings set forth or referred to in the Original Indenture. Except as otherwise specified herein, each reference herein to a "Section" or an "Article" is to such Section or Article of the Original Indenture.

RECITALS

WHEREAS, pursuant to the Company's Plan of Arrangement made effective as of January 23, 2025 (the "Arrangement"), the Company has undertaken a continuation from the Province of British Columbia, Canada into the jurisdiction of Zug, Canton of Zug, Switzerland pursuant to article 161 et seq. of the Swiss Federal Act on International Private Law and under articles 620 et seqq. of the Swiss Code of Obligations, as if the Company had been incorporated under the Swiss Code of Obligations (the "Continuation"), which became effective on January 23, 2025;

WHEREAS, pursuant to the Arrangement and upon effectiveness of the Continuation, (i) shareholders of the Company (the "Shareholders") continue to hold Common Shares with a nominal/par value per Common Share of US$0.01 of the Company (each, a "Continued Share") and (ii) the number of Common Shares a Shareholder owned (or had rights to acquire) and the percentage ownership such Shareholder had of the Company immediately prior to the Continuation did not change as a result of the Continuation, and each Shareholder holds that number of Continued Shares in the Company that is equal to the number of Common Shares such Shareholder held in the Company immediately prior to the effective time of the Continuation;

WHEREAS, the Continuation constitutes a Merger Event under the Original Indenture and Section 14.07(b) of the Original Indenture provides that in the case of any Merger Event, prior to or at the effective time of such Merger Event, the Company shall execute and deliver to the Trustee a supplemental indenture permitted under Section 10.01(h) of the Original Indenture which provides that upon such Merger Event, (i) subsequent conversions of Notes shall be into Reference Property in the manner set forth in Section 14.07 of the Original Indenture and (ii) subsequent anti-dilution and other adjustments shall be as nearly equivalent as is possible to the adjustments provided for in Article 14 of the Original Indenture;

WHEREAS, pursuant to Sections 1.01 and 17.03 of the Original Indenture, (i) the Trustee may from time to time by notice to the Holders and the Company designate additional or different addresses as the Corporate Trust Office for subsequent notices or communications and (ii) the Company may change its address for notices required or permitted to be given or served by the Trustee or by the Holders on the Company by filing a new address with the Trustee;

WHEREAS, pursuant to Section 10.01(h) of the Original Indenture, the Company and the Trustee, at the Company's expense, may from time to time and at any time in connection with any Merger Event enter into a supplemental indenture without consent of Holders to provide that the Notes are convertible into Reference Property, subject to the provisions of Section 14.02 of the Original Indenture;

WHEREAS, pursuant to Section 10.01(f) of the Original Indenture, the Company and the Trustee, at the Company's expense, may from time to time and at any time enter into a supplemental indenture without consent of Holders to make any change that does not adversely affect the rights of any Holder;

WHEREAS, the Company wishes to enter into this Supplemental Indenture (i) pursuant to Section 10.01(h) in order to reflect that the Notes are convertible into Reference Property, subject to the provisions of Section 14.02 of the Original Indenture and (ii) pursuant to Section 10.01(f) in order to amend the Form of Notice of Conversion attached as Attachment 1 to the Form of Note attached as Exhibit A to the Original Indenture in order to reflect certain Swiss mandatory law provisions; and

WHEREAS, (i) in connection with, and as required by, Sections 10.05 and 17.05 the Original Indenture, Dorsey & Whitney LLP has delivered an Opinion of Counsel regarding this Supplemental Indenture to the effect that the execution of this Supplemental Indenture is authorized or permitted by the Original Indenture and all conditions precedent provided for in Article 10 of the Original Indenture with respect to such execution have been complied with and (ii) in connection with, and as required by, Sections 10.05, 14.07(b) and 17.05 the Original Indenture, the Trustee has received an Officer's certificate delivered by the Company to the effect that the execution of this Supplemental Indenture is authorized or permitted by the Original Indenture and all conditions precedent provided for in Article 10 and Section 14.07 of the Original Indenture with respect to such execution have been complied with.

NOW THEREFORE, in consideration of the premises contained herein and other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Conversion Right. From and after the effective time of the Continuation, the consideration due upon conversion of any Notes shall be determined in the same manner as if each reference to any number of Common Shares in Article 14 of the Original Indenture were instead a reference to the corresponding number of Continued Shares that a Holder of such number of Common Shares equal to the Conversion Rate immediately prior to the effective time of the Continuation would have been entitled to receive upon effectiveness of the Continuation; provided, however, that at and after the effective time of the Continuation the Company shall continue to have the right to determine the form of consideration to be paid or delivered, as the case may be, upon conversion of Notes in accordance with Section 14.02 of the Original Indenture. Anti-dilution and other adjustments with respect to the Continued Shares shall be as nearly equivalent as is possible to the adjustments provided for in this Article 14 of the Original Indenture. For clarity, (i) with respect to the Continuation, a "unit of Reference Property" (as defined in the Indenture) means one (1) Continued Share and (ii) the initial Conversion Rate from and after the effective time of the Continuation will be 52.6019 Continued Shares.

2. Amendment of Form of Notice of Conversion. The Form of Notice of Conversion is amended and restated in its entirety in the form attached hereto as Annex A.

3. Corporate Trust Office. As of the date hereof, the address of the Corporate Trust Office shall be as follows: Computershare Trust Company, N.A., 1505 Energy Park Drive, St. Paul, Minnesota 55108, Attention: CCT Administrator for Lithium Argentina. This Supplemental Indenture shall serve as notice to Holders and the Company of the change as required by the Original Indenture.

4. Company Address for Notices, Etc. As of the date hereof, the address of the Company, for purposes of any notice or demand that by any provision of the Indenture is required or permitted to be given or served by the Trustee or by the Holders on the Company, shall be as follows: Lithium Argentina AG, Dammstrasse 19, 6300 Zug, Switzerland. This Supplemental Indenture shall serve as notice to the Holders and the Trustee of the change as required by the Original Indenture.

5. Effective Date. The effective date of this Supplemental Indenture shall be the date first written above.

6. Reference to "Indenture". Upon the effectiveness of this Supplemental Indenture, all references in the Original Indenture and the other transaction documents to the "Indenture" (including correlative references such as "hereof") shall be deemed to refer to the Original Indenture as amended by this Supplemental Indenture.

7. Effect of this Supplemental Indenture. Except as otherwise specified in this Supplemental Indenture, the Original Indenture shall remain in all respects unchanged and in full force and effect. This Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder of Notes heretofore or hereafter authenticated and delivered shall be bound hereby.

8. Successors and Assigns. All covenants and agreements in this Supplemental Indenture by the parties hereto shall bind their respective successors and assigns, whether or not so expressed.

9. Execution in Counterparts. This instrument may be executed in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together constitute but one and the same instrument. Delivery of an executed signature page of this Supplemental Indenture by email, facsimile or other electronic transmission, including in .pdf format, shall be effective as delivery of a manually executed counterpart hereof. The words "execution," "signed," "signature," "delivery," and words of like import in or relating to this Indenture or any document to be signed in connection with this Supplemental Indenture (including, without limitation, the Notes and any Officer's Certificate) shall be deemed to include electronic signatures, including without limitation, digital signature provided by DocuSign or Adobe (or such other digital signature provider as specified in writing to Trustee by the authorized representative), each of which shall be of the same legal effect, validity or enforceability as a manually executed signature. The Company agrees to assume all risks arising out of the use of using digital signatures and electronic methods to submit communications to Trustee, including without limitation the risk of Trustee acting on unauthorized instructions, and the risk of interception and misuse by third parties.

10. Acceptance by Trustee. The Trustee accepts the amendments to the Original Indenture as set forth in this Supplemental Indenture and agrees to perform the duties of the Trustee upon the terms and conditions set forth herein and in the Original Indenture (and as amended hereby upon the effectiveness hereof). Without limiting the generality of the foregoing, the Trustee assumes no responsibility for the correctness of the recitals contained herein, which shall be taken as the statements of the Company, and the Trustee is not responsible for the terms or content of this Supplemental Indenture or their sufficiency for any purpose. In entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every applicable provision of the Original Indenture.

11. Execution, Delivery and Validity. The Company represents and warrants to the Trustee that this Supplemental Indenture has been duly and validly executed and delivered by the Company and is the legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms.

12. Governing Law. THIS SUPPLEMENTAL INDENTURE, AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS SUPPLEMENTAL INDENTURE, SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

13. Effect of Headings. The Article and Section headings herein are for convenience only and shall not affect the construction hereof.

14. Severability. In the event any provision of this Supplemental Indenture shall be invalid, illegal or unenforceable, then (to the extent permitted by law) the validity, legality or enforceability of the remaining provisions shall not in any way be affected or impaired.

[Signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed and delivered by their respective proper and duly authorized signatories as of the date first written above.

| |

LITHIUM ARGENTINA AG |

| |

as Issuer |

| |

|

|

| |

By: |

/s/ Alex Shulga |

| |

Name: |

Alex Shulga |

| |

Title: |

Vice President and Chief Financial Officer |

| |

COMPUTERSHARE TRUST COMPANY, N.A., |

| |

|

as Trustee |

| |

|

|

| |

By: |

/s/ Erika Mullen |

| |

|

Name: Erika Mullen |

| |

|

Title: Vice President |

ANNEX 1

[FORM OF NOTICE OF CONVERSION]

To: Computershare Trust Company, N.A.

1505 Energy Park Drive,

St. Paul, Minnesota 55108

Attention: CCT Administrator for Lithium Argentina

The undersigned registered owner of this Note hereby exercises the option to convert this Note, or the portion hereof (that is $1,000 principal amount or an integral multiple thereof) below designated, into cash, Common Shares or a combination of cash and Common Shares, as applicable, in accordance with the terms of the Indenture referred to in this Note, and directs that any cash payable and any Common Shares issuable out of the conditional share capital (bedingtes Aktienkapital) of the Company under article 6 of the Company's articles of association (Conditional Share Capital for Financing Purposes) and deliverable upon such conversion, together with any cash for any fractional share, and any Notes representing any unconverted principal amount hereof, be issued and delivered to the registered Holder hereof unless a different name has been indicated below.

If any Common Shares or any portion of this Note not converted are to be issued in the name of a Person other than the undersigned, the undersigned will pay all documentary, stamp or similar issue or transfer taxes, if any in accordance with Section 14.02(d) and Section 14.02(e) of the Indenture. Any amount required to be paid to the undersigned on account of interest accompanies this Note. Capitalized terms used herein but not defined shall have the meanings ascribed to such terms in the Indenture.

In the case of Definitive Notes, the certificate numbers of the Notes to be converted are as set forth below:

| Dated: |

|

|

| |

|

|

| |

|

|

| |

|

Signature(s) |

| |

|

|

| |

|

NOTICE: The above signature(s) of the Holder(s) hereof must correspond with the name as written upon the face of the Note in every particular without alteration or enlargement or any change whatever. |

| |

|

| Signature Guarantee |

|

| |

|

| Signature(s) must be guaranteed by an eligible Guarantor Institution (banks, stock brokers, savings and loan associations and credit unions) with membership in an approved signature guarantee medallion program pursuant to Securities and Exchange Commission Rule 17Ad-15 if shares of Common Shares are to be issued, or Notes are to be delivered, other than to and in the name of the registered holder. |

|

| |

|

| Fill in for registration of shares if to be issued, and Notes if to be delivered, other than to and in the name of the registered holder: |

|

| |

|

| (Name) |

|

| |

|

| (Street Address) |

|

| |

|

(City, State and Zip Code)

Please print name and address |

|

| |

|

| |

Principal amount to be converted and hereby set-off with the issue price of the Common Shares (if less than all): $ ,000 |

| |

|

| |

NOTICE: The above signature(s) of the Holder(s) hereof must correspond with the name as written upon the face of the Note in every particular without alteration or enlargement or any change whatever.

|

| |

|

| |

|

| |

Social Security or Other Taxpayer

Identification Number |

Notice to Holders - Second Supplemental Indenture

LITHIUM ARGENTINA AG

1.75% Convertible Senior Notes due 2027

CUSIP No.: 53680QAA61

NOTE: THIS NOTICE CONTAINS IMPORTANT INFORMATION THAT IS OF INTEREST TO

THE REGISTERED AND BENEFICIAL OWNERS OF THE SUBJECT NOTES. IF

APPLICABLE, ALL DEPOSITORIES, CUSTODIANS, AND OTHER INTERMEDIARIES

RECEIVING THIS NOTICE ARE REQUESTED TO EXPEDITE RE-TRANSMITTAL TO

BENEFICIAL OWNERS OF THE NOTES IN A TIMELY MANNER.

Lithium Argentina AG (formerly Lithium Americas (Argentina) Corp. and Lithium Americas Corp.), a company organized and existing under the Swiss Code of Obligations ("Company"), is party to an Indenture, dated December 6, 2021 (the "Indenture"), as amended by the first supplemental indenture dated October 3, 2023 and the second supplemental indenture dated January 23, 2025 (the "Second Supplemental Indenture"), between the Company and Computershare Trust Company N.A., as trustee (the "Trustee"), pursuant to which the Company issued its 1.75% Convertible Senior Notes due 2027 (the "Notes"). Capitalized terms used herein but not otherwise defined shall have the respective meanings given such terms in the Indenture.

Pursuant to the Company's Plan of Arrangement made effective as of January 23, 2025, the Company has undertaken a continuation from the Province of British Columbia, Canada into the jurisdiction of Zug, Canton of Zug, Switzerland (the "Continuation"). The Continuation constitutes a Merger Event under the Indenture and Section 14.07(b) of the Indenture provides that in the case of any Merger Event, prior to or at the effective time of such Merger Event, the Company shall execute and deliver to the Trustee a supplemental indenture permitted under Section 10.01(h) of the Indenture.

Pursuant to Section 14.07(b) of the Indenture, the Company hereby notifies you that the Company and the Trustee have entered into the Second Supplemental Indenture with respect to the Continuation in the form attached hereto.

For further information contact:

Investor Relations

Telephone: +011 (54) 5263-0616

Email: ir@lithium-argentina.com

Website: www.lithium-argentina.com

Dated: January 23, 2025

By: LITHIUM ARGENTINA AG

cc: Computershare Trust Company N.A., as Trustee

_______________________

1 The CUSIP numbers appearing herein has been included solely for the convenience of the Holders. Neither the Company nor the Trustee assumes any responsibility for the selection or use of such CUSIP number and makes no representation as to the correctness of the CUSIP number.

SECOND SUPPLEMENTAL INDENTURE

SECOND SUPPLEMENTAL INDENTURE dated as of January 23, 2025 (this "Supplemental Indenture") between LITHIUM ARGENTINA AG (formerly LITHIUM AMERICAS (ARGENTINA) CORP. and LITHIUM AMERICAS CORP.), a company organized and existing under the Swiss Code of Obligations, as issuer (the "Company"), and COMPUTERSHARE TRUST COMPANY, N.A., as trustee (the "Trustee").

Reference is made to the Indenture dated as of December 6, 2021, as amended by the First Supplemental Indenture dated October 3, 2023, between the Company and the Trustee (the "Original Indenture"). Capitalized terms used herein without definition shall have the respective meanings set forth or referred to in the Original Indenture. Except as otherwise specified herein, each reference herein to a "Section" or an "Article" is to such Section or Article of the Original Indenture.

RECITALS

WHEREAS, pursuant to the Company's Plan of Arrangement made effective as of January 23, 2025 (the "Arrangement"), the Company has undertaken a continuation from the Province of British Columbia, Canada into the jurisdiction of Zug, Canton of Zug, Switzerland pursuant to article 161 et seq. of the Swiss Federal Act on International Private Law and under articles 620 et seqq. of the Swiss Code of Obligations, as if the Company had been incorporated under the Swiss Code of Obligations (the "Continuation"), which became effective on January 23, 2025;

WHEREAS, pursuant to the Arrangement and upon effectiveness of the Continuation, (i) shareholders of the Company (the "Shareholders") continue to hold Common Shares with a nominal/par value per Common Share of US$0.01 of the Company (each, a "Continued Share") and (ii) the number of Common Shares a Shareholder owned (or had rights to acquire) and the percentage ownership such Shareholder had of the Company immediately prior to the Continuation did not change as a result of the Continuation, and each Shareholder holds that number of Continued Shares in the Company that is equal to the number of Common Shares such Shareholder held in the Company immediately prior to the effective time of the Continuation;

WHEREAS, the Continuation constitutes a Merger Event under the Original Indenture and Section 14.07(b) of the Original Indenture provides that in the case of any Merger Event, prior to or at the effective time of such Merger Event, the Company shall execute and deliver to the Trustee a supplemental indenture permitted under Section 10.01(h) of the Original Indenture which provides that upon such Merger Event, (i) subsequent conversions of Notes shall be into Reference Property in the manner set forth in Section 14.07 of the Original Indenture and (ii) subsequent anti-dilution and other adjustments shall be as nearly equivalent as is possible to the adjustments provided for in Article 14 of the Original Indenture;

WHEREAS, pursuant to Sections 1.01 and 17.03 of the Original Indenture, (i) the Trustee may from time to time by notice to the Holders and the Company designate additional or different addresses as the Corporate Trust Office for subsequent notices or communications and (ii) the Company may change its address for notices required or permitted to be given or served by the Trustee or by the Holders on the Company by filing a new address with the Trustee;

WHEREAS, pursuant to Section 10.01(h) of the Original Indenture, the Company and the Trustee, at the Company's expense, may from time to time and at any time in connection with any Merger Event enter into a supplemental indenture without consent of Holders to provide that the Notes are convertible into Reference Property, subject to the provisions of Section 14.02 of the Original Indenture;

WHEREAS, pursuant to Section 10.01(f) of the Original Indenture, the Company and the Trustee, at the Company's expense, may from time to time and at any time enter into a supplemental indenture without consent of Holders to make any change that does not adversely affect the rights of any Holder;

WHEREAS, the Company wishes to enter into this Supplemental Indenture (i) pursuant to Section 10.01(h) in order to reflect that the Notes are convertible into Reference Property, subject to the provisions of Section 14.02 of the Original Indenture and (ii) pursuant to Section 10.01(f) in order to amend the Form of Notice of Conversion attached as Attachment 1 to the Form of Note attached as Exhibit A to the Original Indenture in order to reflect certain Swiss mandatory law provisions; and

WHEREAS, (i) in connection with, and as required by, Sections 10.05 and 17.05 the Original Indenture, Dorsey & Whitney LLP has delivered an Opinion of Counsel regarding this Supplemental Indenture to the effect that the execution of this Supplemental Indenture is authorized or permitted by the Original Indenture and all conditions precedent provided for in Article 10 of the Original Indenture with respect to such execution have been complied with and

(ii) in connection with, and as required by, Sections 10.05, 14.07(b) and 17.05 the Original Indenture, the Trustee has received an Officer's certificate delivered by the Company to the effect that the execution of this Supplemental Indenture is authorized or permitted by the Original Indenture and all conditions precedent provided for in Article 10 and Section 14.07 of the Original Indenture with respect to such execution have been complied with.

NOW THEREFORE, in consideration of the premises contained herein and other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Conversion Right. From and after the effective time of the Continuation, the consideration due upon conversion of any Notes shall be determined in the same manner as if each reference to any number of Common Shares in Article 14 of the Original Indenture were instead a reference to the corresponding number of Continued Shares that a Holder of such number of Common Shares equal to the Conversion Rate immediately prior to the effective time of the Continuation would have been entitled to receive upon effectiveness of the Continuation; provided, however, that at and after the effective time of the Continuation the Company shall continue to have the right to determine the form of consideration to be paid or delivered, as the case may be, upon conversion of Notes in accordance with Section 14.02 of the Original Indenture. Anti-dilution and other adjustments with respect to the Continued Shares shall be as nearly equivalent as is possible to the adjustments provided for in this Article 14 of the Original Indenture. For clarity, (i) with respect to the Continuation, a "unit of Reference Property" (as defined in the Indenture) means one (1) Continued Share and (ii) the initial Conversion Rate from and after the effective time of the Continuation will be 52.6019 Continued Shares.

2. Amendment of Form of Notice of Conversion. The Form of Notice of Conversion is amended and restated in its entirety in the form attached hereto as Annex A.

3. Corporate Trust Office. As of the date hereof, the address of the Corporate Trust Office shall be as follows: Computershare Trust Company, N.A., 1505 Energy Park Drive, St. Paul, Minnesota 55108, Attention: CCT Administrator for Lithium Argentina. This Supplemental Indenture shall serve as notice to Holders and the Company of the change as required by the Original Indenture.

4. Company Address for Notices, Etc. As of the date hereof, the address of the Company, for purposes of any notice or demand that by any provision of the Indenture is required or permitted to be given or served by the Trustee or by the Holders on the Company, shall be as follows: Lithium Argentina AG, Dammstrasse 19, 6300 Zug, Switzerland. This Supplemental Indenture shall serve as notice to the Holders and the Trustee of the change as required by the Original Indenture.

5. Effective Date. The effective date of this Supplemental Indenture shall be the date first written above.

6. Reference to "Indenture". Upon the effectiveness of this Supplemental Indenture, all references in the Original Indenture and the other transaction documents to the "Indenture" (including correlative references such as "hereof") shall be deemed to refer to the Original Indenture as amended by this Supplemental Indenture.

7. Effect of this Supplemental Indenture. Except as otherwise specified in this Supplemental Indenture, the Original Indenture shall remain in all respects unchanged and in full force and effect. This Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder of Notes heretofore or hereafter authenticated and delivered shall be bound hereby.

8. Successors and Assigns. All covenants and agreements in this Supplemental Indenture by the parties hereto shall bind their respective successors and assigns, whether or not so expressed.

9. Execution in Counterparts. This instrument may be executed in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together constitute but one and the same instrument. Delivery of an executed signature page of this Supplemental Indenture by email, facsimile or other electronic transmission, including in .pdf format, shall be effective as delivery of a manually executed counterpart hereof. The words "execution," "signed," "signature," "delivery," and words of like import in or relating to this Indenture or any document to be signed in connection with this Supplemental Indenture (including, without limitation, the Notes and any Officer's Certificate) shall be deemed to include electronic signatures, including without limitation, digital signature provided by DocuSign or Adobe (or such other digital signature provider as specified in writing to Trustee by the authorized representative), each of which shall be of the same legal effect, validity or enforceability as a manually executed signature. The Company agrees to assume all risks arising out of the use of using digital signatures and electronic methods to submit communications to Trustee, including without limitation the risk of Trustee acting on unauthorized instructions, and the risk of interception and misuse by third parties.

10. Acceptance by Trustee. The Trustee accepts the amendments to the Original Indenture as set forth in this Supplemental Indenture and agrees to perform the duties of the Trustee upon the terms and conditions set forth herein and in the Original Indenture (and as amended hereby upon the effectiveness hereof). Without limiting the generality of the foregoing, the Trustee assumes no responsibility for the correctness of the recitals contained herein, which shall be taken as the statements of the Company, and the Trustee is not responsible for the terms or content of this Supplemental Indenture or their sufficiency for any purpose. In entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every applicable provision of the Original Indenture.

11. Execution, Delivery and Validity. The Company represents and warrants to the Trustee that this Supplemental Indenture has been duly and validly executed and delivered by the Company and is the legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms.

12. Governing Law. THIS SUPPLEMENTAL INDENTURE, AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS SUPPLEMENTAL INDENTURE, SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

13. Effect of Headings. The Article and Section headings herein are for convenience only and shall not affect the construction hereof.

14. Severability. In the event any provision of this Supplemental Indenture shall be invalid, illegal or unenforceable, then (to the extent permitted by law) the validity, legality or enforceability of the remaining provisions shall not in any way be affected or impaired.

[Signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed and delivered by their respective proper and duly authorized signatories as of the date first written above.

| |

LITHIUM ARGENTINA AG as Issuer |

| |

|

|

| |

|

|

| |

By: |

/s/ Alex Shulga |

| |

|

Name: Alex Shulga |

| |

|

Title: Vice President and Chief Financial Officer |

| |

COMPUTERSHARE TRUST COMPANY, N.A., |

| |

|

as Trustee |

| |

|

|

| |

|

|

| |

By: |

/s/ Erika Mullen |

| |

|

Name: Erika Mullen |

| |

|

Title: Vice President |

ANNEX 1

[FORM OF NOTICE OF CONVERSION]

To: Computershare Trust Company, N.A. 1505 Energy Park Drive,

St. Paul, Minnesota 55108

Attention: CCT Administrator for Lithium Argentina

The undersigned registered owner of this Note hereby exercises the option to convert this Note, or the portion hereof (that is $1,000 principal amount or an integral multiple thereof) below designated, into cash, Common Shares or a combination of cash and Common Shares, as applicable, in accordance with the terms of the Indenture referred to in this Note, and directs that any cash payable and any Common Shares issuable out of the conditional share capital (bedingtes Aktienkapital) of the Company under article 6 of the Company's articles of association (Conditional Share Capital for Financing Purposes) and deliverable upon such conversion, together with any cash for any fractional share, and any Notes representing any unconverted principal amount hereof, be issued and delivered to the registered Holder hereof unless a different name has been indicated below.

If any Common Shares or any portion of this Note not converted are to be issued in the name of a Person other than the undersigned, the undersigned will pay all documentary, stamp or similar issue or transfer taxes, if any in accordance with Section 14.02(d) and Section 14.02(e) of the Indenture. Any amount required to be paid to the undersigned on account of interest accompanies this Note. Capitalized terms used herein but not defined shall have the meanings ascribed to such terms in the Indenture.

In the case of Definitive Notes, the certificate numbers of the Notes to be converted are as set forth below:

| Dated:_____________ |

|

|

| |

|

|

| |

|

|

| |

|

Signature(s) |

| |

|

|

| |

|

|

| |

|

NOTICE: The above signature(s) of the Holder(s) hereof must correspond with the name as written upon the face of the Note in every particular without alteration or enlargement or any change whatever. |

| |

|

|

| |

|

|

| Signature Guarantee |

|

|

| |

|

|

| Signature(s) must be guaranteed by an eligible Guarantor Institution (banks, stock brokers, savings and loan associations and credit unions) with membership in an approved signature guarantee medallion program pursuant to Securities and Exchange Commission Rule 17Ad-15 if shares of Common Shares are to be issued, or Notes are to be delivered, other than to and in the name of the registered holder. |

|

|

| |

|

|

| |

|

|

| Fill in for registration of shares if to be issued, and Notes if to be delivered, other than to and in the name of the registered holder: |

|

|

| |

|

|

| |

|

|

| (Name) |

|

|

| |

|

|

| |

|

|

| (Street Address) |

|

|

| |

|

|

| |

|

|

(City, State and Zip Code)

Please print name and address |

|

|

| |

|

|

| |

|

|

| |

|

Principal amount to be converted and hereby set-off with the issue price of the Common Shares (if less than all): $ ______,000 |

| |

|

|

| |

|

NOTICE: The above signature(s) of the Holder(s) hereof must correspond with the name as written upon the face of the Note in every particular without alteration or enlargement or any change whatever. |

| |

|

|

| |

|

|

| |

|

Social Security or Other Taxpayer

Identification Number

|

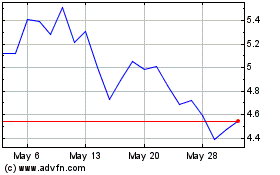

Lithium Americas Argentina (NYSE:LAAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lithium Americas Argentina (NYSE:LAAC)

Historical Stock Chart

From Feb 2024 to Feb 2025