Liberty Energy Inc. (NYSE: LBRT; “Liberty” or the “Company”)

announced today full year and fourth quarter 2024 financial and

operational results.

Summary Results and Highlights

- Revenue of $4.3 billion for the year ended December 31,

2024

- Net income of $316 million, or $1.87 fully diluted earnings per

share (“EPS”), for the year ended December 31, 2024

- Adjusted EBITDA1 of $922 million for the year ended December

31, 2024

- Achieved 17% Adjusted Pre-Tax Return on Capital Employed

(“ROCE”)2 and 21% Cash Return on Invested Capital (“CROCI”)3 for

the year ended December 31, 2024

- Distributed $175 million to shareholders in 2024 with the

repurchase of 3.8% of shares and quarterly cash dividends

- Fourth quarter 2024 revenue of $944 million and net income of

$52 million, or $0.31 fully diluted earnings per share

- Fourth quarter 2024 Adjusted EBITDA1 of $156 million

- Repurchased and retired 1.0% of shares outstanding during the

fourth quarter, and a cumulative 15.1% of shares outstanding since

reinstating the repurchase program in July 2022

- Raised quarterly cash dividend by 14% to $0.08 per share

beginning in the fourth quarter of 2024

- Accelerated digiTechnologiesSM commercial deployments with the

innovative digiPrime technology offering, making a revolutionary

step forward in frac technology optimizing efficiency and

emissions

- Achieved a record 7,143 pumping hours on a single fleet in the

year, averaging nearly 600 hours a month

- Expanded Liberty Power Innovations’ (“LPI”) natural gas

compression, fueling, and delivery services infrastructure to

optimal scale

- Announced LPI collaboration with DC Grid to provide advanced

power solutions for commercial fleet electric vehicle hubs and data

centers

“Liberty delivered strong leadership in technological innovation

and executional excellence in 2024. Solid financial performance and

several operational records were achieved, even as industry

activity softened through the year. Full year ROCE2 was 17%, and a

CROCI3 of 21% exceeded the 13-year S&P average,” commented Ron

Gusek, incoming chief executive officer. “We executed on our fleet

transition initiatives, cost optimization efforts using AI-enhanced

digital systems, and expansion of our natural gas fueling and

delivery capacity to optimal scale.”

“Entering 2025, we have two key strategic priorities: a

continued focus on technology innovation in completions services

and significant expansion of our burgeoning power generation

services business. As the preeminent completions service provider,

the innovation cycle in software, equipment, and design is driving

long-term margin enhancement, improvement in capital efficiency,

and lower emissions. This year, our pace of next generation

equipment deployment will moderate to four to five digiFleets,

alongside the retirement of legacy conventional equipment,”

continued Mr. Gusek.

“As we look ahead, the rising demand for electrons from the

proliferation of data centers, onshoring of manufacturing activity,

expansion in mining operations, and industrial electrification

provides a supportive backdrop to expand our power generation

business outside the oilfield. We are uniquely positioned to

rapidly deploy distributed modular power solutions with low

emission, scalable power infrastructure tailored to meet project

demands,” continued Mr. Gusek. “We have already successfully

deployed 130 MW primarily for completion services applications. By

the end of 2026, we expect to take delivery of an incremental 400

MW of power generation for commercial, merchant, and industrial

applications, with deployments commencing later this year.”

“We are relentlessly focused on long-term value creation,

balancing compelling growth opportunities with return of capital to

shareholders. Since July 2022, we have distributed $550 million to

shareholders through the retirement of 15% of shares outstanding

and quarterly cash dividends,” commented Mr. Gusek. “We have built

strong partnerships and investments across the energy corridor, in

geothermal, nuclear, battery, power generation technologies, and

the Australian Beetaloo basin assets. Today, we have an undeniable

opportunity to leverage our knowledge and expertise in energy

systems to meet incremental power demand with an advantaged

platform.”

Outlook

Frac markets reached a trough at the end of 2024 after

progressive quarterly declines in industry activity since early

2023. Early signs of an inflection in completions activity have now

emerged from 2024 lows. Oil producers, which comprise the vast

majority of frac activity, are working to simply maintain

production and returning to anticipated activity levels after the

year end slowdown. Improving natural gas fundamentals are

encouraging. For the full year, industry-wide lateral footage

completed is expected to be approximately flat with 2024.

The slowing pace of activity in late 2024 resulted in near term

price pressure to start 2025, most notably impacting conventional

fleets. The fundamental outlook for next generation, higher quality

fleets remains strong, as operators continue to demand technologies

that provide significant emissions reductions, fuel savings, and

operational efficiency advantages. The growing complexities of

E&P demands and the continued drive for efficiency gains

necessitate continued investment in technology and partnerships

with high quality service companies. Liberty is well positioned to

meet this demand.

Fleet idling, attrition, and cannibalization of aging equipment

likely accelerate in the next two years as a large swath of

equipment reaches end of life. Concurrently, fleet sizes continue

to expand to meet increased horsepower requirements for higher

intensity fracs. These two dynamics imply the supply and demand

balance in horsepower is tighter than industry frac fleet counts

infer. An improvement in frac activity through the year could

support better pricing dynamics.

Global oil markets reflect ongoing uncertainties in geopolitics,

Chinese economic growth, OPEC+ production plans, and a change in

the domestic political climate, but the resulting commodity price

fluctuation has not led to a meaningful change in E&P activity

plans. Natural gas demand is supported by LNG export capacity

expansion and a large projected multi-year increase in North

American power consumption.

Power demand is rising at the fastest pace since the start of

the century, as accelerating demand from data centers is converging

with the reshoring of manufacturing activity and projected

increases from mining, electrification, and other commercial and

industrial applications. This pace of growth requires power

infrastructure solutions that can be adapted to the dynamic needs

of individual customers. Liberty is well positioned to meet this

demand with a modular solution that offers reliability, redundancy,

and the ability to accelerate deployment timelines and scale

alongside the growing load requirements for critical infrastructure

projects.

“Entering 2025, we are excited to lead the industry with

innovative and durable technologies that will drive our continued

success in the years ahead. We are investing to build truly

differential competitive advantages both in the completions arena

and in our new power business, to generate significant value for

our customers and our shareholders,” commented Mr. Gusek. “We

expect our investments today will lead to strong returns in the

coming years.”

“In the first quarter, we anticipate a modest sequential

increase in revenue and Adjusted EBITDA. For the completions

services business, we expect solid free cash flow generation as

capital expenditures moderate, even as pricing headwinds impact

profitability. As we embark on the next chapter of Liberty’s story,

we will also significantly grow our investment in power

infrastructure to take advantage of a generational opportunity in

power demand growth,” continued Mr. Gusek. “Liberty is a unique

technology growth company that is focused on providing both return

of and return on capital for shareholders.”

Share Repurchase Program

During the quarter ended December 31, 2024, Liberty repurchased

and retired 1,581,495 shares of Class A common stock at an average

of $17.88 per share, representing 1.0% of shares outstanding, for

approximately $28 million.

During the year ended December 31, 2024, Liberty repurchased and

retired 6,320,536 shares of Class A common stock at an average of

$20.14 per share, representing 3.8% of shares outstanding, for

approximately $127 million.

Liberty has cumulatively repurchased and retired 15.1% of shares

outstanding at program commencement on July 25, 2022. Total

remaining authorization for future common share repurchases is

approximately $294 million.

The shares may be repurchased from time to time in open market

transactions, through block trades, in privately negotiated

transactions, through derivative transactions or by other means in

accordance with federal securities laws. The timing, as well as the

number and value of shares repurchased under the program, will be

determined by the Company at its discretion and will depend on a

variety of factors, including management’s assessment of the

intrinsic value of the Company’s common stock, the market price of

the Company’s common stock, general market and economic conditions,

available liquidity, compliance with the Company’s debt and other

agreements, applicable legal requirements, and other

considerations. The exact number of shares to be repurchased by the

Company is not guaranteed, and the program may be suspended,

modified, or discontinued at any time without prior notice. The

Company expects to fund the repurchases by using cash on hand,

borrowings under its revolving credit facility and expected free

cash flow to be generated through the authorization period.

Cash Dividend

During the quarter ended December 31, 2024, Liberty paid a

quarterly cash dividend of $0.08 per share of Class A common stock,

or approximately $13 million in aggregate to shareholders. During

the year ended December 31, 2024, Liberty paid cash dividends of

$48 million in aggregate to shareholders.

On January 22, 2025, the Board declared a cash dividend of $0.08

per share of Class A common stock, to be paid on March 20, 2025 to

holders of record as of March 6, 2025.

Future declarations of quarterly cash dividends are subject to

approval by the Board of Directors and to the Board’s continuing

determination that the declarations of dividends are in the best

interests of Liberty and its stockholders. Future dividends may be

adjusted at the Board’s discretion based on market conditions and

capital availability.

2024 Full Year Results

For the year ended December 31, 2024, revenues of $4.3 billion

decreased 9% from $4.7 billion for the year ended December 31,

2023.

Net income (after taxes) totaled $316 million for the year ended

December 31, 2024 compared to $556 million for the year ended

December 31, 2023.

Adjusted Net Income4 (after taxes) totaled $277 million for the

year ended December 31, 2024 compared to $558 million for the year

ended December 31, 2023.

Adjusted EBITDA1 of $922 million for the year ended December 31,

2024, decreased 24% from $1.2 billion for the year ended December

31, 2023. Please refer to the reconciliation of Adjusted EBITDA (a

non-GAAP measure) to net income (a GAAP measure) in this earnings

release.

Fully diluted earnings per share was $1.87 for the year ended

December 31, 2024 compared to $3.15 for the year ended December 31,

2023.

Adjusted Net Income per Diluted Share4 of $1.64 for the year

ended December 31, 2024 compared to $3.16 for the year ended

December 31, 2023.

Please refer to the tables at the end of this earnings release

for a reconciliation of Adjusted EBITDA, Adjusted Net Income, and

Adjusted Net Income per Diluted Share (each, a non-GAAP financial

measure) to the most directly comparable GAAP financial

measures.

Fourth Quarter Results

For the fourth quarter of 2024, revenue was $944 million, a

decrease of 12% from $1.1 billion in the fourth quarter of 2023 and

a decrease of 17% from $1.1 billion in the third quarter of

2024.

Net income (after taxes) totaled $52 million for the fourth

quarter of 2024 compared to $92 million in the fourth quarter of

2023 and $74 million in the third quarter of 2024.

Adjusted Net Income4 (after taxes) totaled $17 million for the

fourth quarter of 2024 compared to $93 million in the fourth

quarter of 2023 and $76 million in the third quarter of 2024.

Adjusted EBITDA1 of $156 million for the fourth quarter of 2024

decreased 38% from $253 million in the fourth quarter of 2023 and

decreased 37% from $248 million in the third quarter of 2024.

Please refer to the reconciliation of Adjusted EBITDA (a non-GAAP

measure) to net income (a GAAP measure) in this earnings

release.

Fully diluted earnings per share was $0.31 for the fourth

quarter of 2024 compared to $0.54 for the fourth quarter of 2023

and $0.44 for the third quarter of 2024.

Adjusted Net Income per Diluted Share4 of $0.10 for the fourth

quarter of 2024 compared to $0.54 for the fourth quarter of 2023

and $0.45 for the third quarter of 2024.

Balance Sheet and Liquidity

As of December 31, 2024, Liberty had cash on hand of $20

million, a small decrease from third quarter levels, and total debt

of $191 million drawn on the secured asset-based revolving credit

facility (“ABL Facility”), a $68 million increase from third

quarter. Total liquidity, including availability under the credit

facility, was $135 million as of December 31, 2024.

Conference Call

Liberty will host a conference call to discuss the results at

8:00 a.m. Mountain Time (10:00 a.m. Eastern Time) on Thursday,

January 30, 2025. Presenting Liberty’s results will be Ron Gusek,

incoming chief executive officer, and Michael Stock, Chief

Financial Officer.

Individuals wishing to participate in the conference call should

dial (833) 255-2827, or for international callers (412) 902-6704.

Participants should ask to join the Liberty Energy call. A live

webcast will be available at http://investors.libertyenergy.com.

The webcast can be accessed for 90 days following the call. A

telephone replay will be available shortly after the call and can

be accessed by dialing (877) 344-7529, or for international callers

(412) 317-0088. The passcode for the replay is 8767950. The replay

will be available until February 6, 2025.

About Liberty

Liberty Energy Inc. (NYSE: LBRT) is a leading energy services

company. Liberty is one of the largest providers of completion

services and technologies to onshore oil, natural gas, and enhanced

geothermal energy producers in North America. Liberty also owns and

operates Liberty Power Innovations LLC, providing advanced

distributed power and energy storage solutions for the commercial

and industrial, data center, energy, and mining industries. Liberty

was founded in 2011 with a relentless focus on value creation

through a culture of innovation and excellence and the development

of next generation technology.

Liberty is headquartered in Denver, Colorado. For more

information, please visit www.libertyenergy.com and

www.libertypowerinnovations.com, or contact Investor Relations at

IR@libertyenergy.com.

1 “Adjusted EBITDA” is not presented in accordance with

generally accepted accounting principles in the United States

(“U.S. GAAP”). Please see the supplemental financial information in

the table under “Reconciliation of Net Income to EBITDA and

Adjusted EBITDA” at the end of this earnings release for a

reconciliation of the non-GAAP financial measure of Adjusted EBITDA

to its most directly comparable GAAP financial measure.

2 Adjusted Pre-Tax Return on Capital Employed is a non-U.S. GAAP

operational measure. Please see the supplemental financial

information in the table under “Calculation of Adjusted Pre-Tax

Return on Capital Employed” at the end of this earnings release for

a calculation of this measure.

3 Cash Return on Capital Invested (“CROCI”) is a non-U.S. GAAP

operational measure. Please see the supplemental financial

information in the table under “Calculation of Cash Return on

Capital Invested” at the end of this earnings release.

4 “Adjusted Net Income” and “Adjusted Net Income per Diluted

Share” are not presented in accordance with U.S. GAAP. Please see

the supplemental financial information in the table under

“Reconciliation of Net Income and Net Income per Diluted Share to

Adjusted Net Income and Adjusted Net Income per Diluted Share” at

the end of this earnings release for a reconciliation of the

non-GAAP financial measures of Adjusted Net Income and Adjusted Net

Income per Diluted Share to the most directly comparable GAAP

financial measures.

Non-GAAP Financial Measures

This earnings release includes unaudited non-GAAP financial and

operational measures, including EBITDA, Adjusted EBITDA, Adjusted

Net Income, Adjusted Net Income per Diluted Share, and Adjusted

Pre-Tax Return on Capital Employed (“ROCE”). We believe that the

presentation of these non-GAAP financial and operational measures

provides useful information about our financial performance and

results of operations. We define Adjusted EBITDA as EBITDA adjusted

to eliminate the effects of items such as non-cash stock-based

compensation, new fleet or new basin start-up costs, fleet lay-down

costs, gain or loss on the disposal of assets, unrealized gain or

loss on investments, net, bad debt reserves, transaction and other

costs, the loss or gain on remeasurement of liability under our tax

receivable agreements, and other non-recurring expenses that

management does not consider in assessing ongoing performance.

Our board of directors, management, investors, and lenders use

EBITDA and Adjusted EBITDA to assess our financial performance

because it allows them to compare our operating performance on a

consistent basis across periods by removing the effects of our

capital structure (such as varying levels of interest expense),

asset base (such as depreciation, depletion, and amortization) and

other items that impact the comparability of financial results from

period to period. We present EBITDA and Adjusted EBITDA because we

believe they provide useful information regarding the factors and

trends affecting our business in addition to measures calculated

under U.S. GAAP.

We present Adjusted Net Income and Adjusted Net Income per

Diluted Share because we believe such measures provide useful

information to investors regarding our operating performance by

excluding the after-tax impacts of unusual or one-time benefits or

costs, including items such as unrealized gain or loss on

investments, net and transaction and other costs, primarily because

management views the excluded items to be outside of our normal

operating results. We define Adjusted Net Income as net income

after eliminating the effects of such excluded items and Adjusted

Net Income per Diluted Share as Adjusted Net Income divided by the

number of weighted average diluted shares outstanding. Management

analyzes net income without the impact of these items as an

indicator of performance to identify underlying trends in our

business.

We define ROCE as the ratio of adjusted pre-tax net income

(adding back income tax and certain adjustments that include tax

receivable agreement impacts, unrealized gain or loss on

investments, net, and transaction and other costs, when applicable)

for the twelve months ended December 31, 2024 to Average Capital

Employed. Average Capital Employed is the simple average of total

capital employed (both debt and equity) as of December 31, 2024 and

December 31, 2023. CROCI is defined as the ratio of Adjusted EBITDA

to the average of the beginning and ending period Gross Capital

Invested (total assets plus accumulated depreciation and depletion

less non-interest bearing current liabilities). ROCE and CROCI are

presented based on our management’s belief that these non-GAAP

measures are useful information to investors when evaluating our

profitability and the efficiency with which management has employed

capital over time. Our management uses ROCE for that purpose. ROCE

and CROCI are not measures of financial performance under U.S. GAAP

and should not be considered an alternative to net income, as

defined by U.S. GAAP.

Non-GAAP financial and operational measures do not have any

standardized meaning and are therefore unlikely to be comparable to

similar measures presented by other companies. The presentation of

non-GAAP financial and operational measures is not intended to be a

substitute for, and should not be considered in isolation from, the

financial measures reported in accordance with U.S. GAAP. See the

tables entitled Reconciliation and Calculation of Non-GAAP

Financial and Operational Measures for a reconciliation or

calculation of the non-GAAP financial or operational measures to

the most directly comparable GAAP measure.

Forward-Looking and Cautionary Statements

The information above includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical facts,

included herein concerning, among other things, statements about

our expected growth from recent acquisitions, expected performance,

future operating results, oil and natural gas demand and prices and

the outlook for the oil and gas industry, future global economic

conditions, improvements in operating procedures and technology,

our business strategy and the business strategies of our customers,

the deployment of fleets in the future, planned capital

expenditures, future cash flows and borrowings, pursuit of

potential acquisition opportunities, our financial position, return

of capital to stockholders, business strategy and objectives for

future operations, are forward-looking statements. These

forward-looking statements are identified by their use of terms and

phrases such as “may,” “expect,” “estimate,” “outlook,” “project,”

“plan,” “position,” “believe,” “intend,” “achievable,” “forecast,”

“assume,” “anticipate,” “will,” “continue,” “potential,” “likely,”

“should,” “could,” and similar terms and phrases. However, the

absence of these words does not mean that the statements are not

forward-looking. Although we believe that the expectations

reflected in these forward-looking statements are reasonable, they

do involve certain assumptions, risks and uncertainties. The

outlook presented herein is subject to change by Liberty without

notice and Liberty has no obligation to affirm or update such

information, except as required by law. These forward-looking

statements represent our expectations or beliefs concerning future

events, and it is possible that the results described in this

earnings release will not be achieved. These forward-looking

statements are subject to certain risks, uncertainties and

assumptions identified above or as disclosed from time to time in

Liberty's filings with the Securities and Exchange Commission. As a

result of these factors, actual results may differ materially from

those indicated or implied by such forward-looking statements.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, we do not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise. New factors emerge from time to time, and it is not

possible for us to predict all such factors. When considering these

forward-looking statements, you should keep in mind the risk

factors and other cautionary statements in “Item 1A. Risk Factors”

included in our Annual Report on Form 10-K for the year ended

December 31, 2023 as filed with the SEC on February 9, 2024 and in

our other public filings with the SEC. These and other factors

could cause our actual results to differ materially from those

contained in any forward-looking statements.

Liberty Energy Inc.

Selected Financial

Data

(unaudited)

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2024

2024

2023

2024

2023

Statement of Operations Data:

(amounts in thousands, except

for per share data)

Revenue

$

943,574

$

1,138,578

$

1,074,958

$

4,315,161

$

4,747,928

Costs of services, excluding depreciation,

depletion, and amortization shown separately

741,754

840,274

777,251

3,200,506

3,349,370

General and administrative

56,174

58,614

55,296

225,474

221,406

Transaction, severance, and other

costs

—

—

249

—

2,053

Depreciation, depletion, and

amortization

132,164

126,395

118,421

505,050

421,514

(Gain) loss on disposal of assets

(11,442

)

6,017

(13

)

(5,337

)

(6,994

)

Total operating expenses

918,650

1,031,300

951,204

3,925,693

3,987,349

Operating income

24,924

107,278

123,754

389,468

760,579

Loss (gain) on remeasurement of liability

under tax receivable agreements

3,210

—

(1,817

)

3,210

(1,817

)

Unrealized (gain) loss on investments

(44,753

)

2,727

—

(49,227

)

—

Interest expense, net

8,499

8,589

6,364

32,214

27,506

Net income before taxes

57,968

95,962

119,207

403,271

734,890

Income tax expense

6,075

22,158

26,824

87,261

178,482

Net income

51,893

73,804

92,383

316,010

556,408

Less: Net income attributable to

non-controlling interests

—

—

—

—

91

Net income attributable to Liberty Energy

Inc. stockholders

$

51,893

$

73,804

$

92,383

$

316,010

$

556,317

Net income attributable to Liberty Energy

Inc. stockholders per common share:

Basic

$

0.32

$

0.45

$

0.55

$

1.91

$

3.24

Diluted

$

0.31

$

0.44

$

0.54

$

1.87

$

3.15

Weighted average common shares

outstanding:

Basic

162,856

164,741

168,016

165,026

171,845

Diluted

167,163

168,595

172,661

169,398

176,360

Other Financial and Operational

Data

Capital expenditures (1)

$

188,148

$

162,835

$

133,610

$

627,057

$

576,389

Adjusted EBITDA (2)

$

155,740

$

247,811

$

252,507

$

921,593

$

1,213,068

(1)

Net capital expenditures presented above

include investing cash flows from purchase of property and

equipment, excluding acquisitions, net of proceeds from the sales

of assets.

(2)

Adjusted EBITDA is a non-GAAP financial

measure. See the tables entitled “Reconciliation and Calculation of

Non-GAAP Financial and Operational Measures” below.

Liberty Energy Inc.

Condensed Consolidated Balance

Sheets

(unaudited, amounts in

thousands)

December 31,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

19,984

$

36,784

Accounts receivable and unbilled

revenue

539,856

587,470

Inventories

203,469

205,865

Prepaids and other current assets

85,214

124,135

Total current assets

848,523

954,254

Property and equipment, net

1,890,998

1,645,368

Operating and finance lease right-of-use

assets

356,435

274,959

Other assets

200,438

158,976

Total assets

$

3,296,394

$

3,033,557

Liabilities and Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

571,305

$

572,029

Current portion of operating and finance

lease liabilities

95,218

67,395

Total current liabilities

666,523

639,424

Long-term debt, net of discount

190,500

140,000

Long-term operating and finance lease

liabilities

247,888

197,914

Deferred tax liability

137,728

102,340

Payable pursuant to tax receivable

agreements

74,886

112,471

Total liabilities

1,317,525

1,192,149

Stockholders’ equity:

Common stock

1,619

1,666

Additional paid in capital

977,484

1,093,498

Retained earnings

1,019,517

752,328

Accumulated other comprehensive loss

(19,751

)

(6,084

)

Total stockholders’ equity

1,978,869

1,841,408

Total liabilities and equity

$

3,296,394

$

3,033,557

Liberty Energy Inc.

Reconciliation and Calculation

of Non-GAAP Financial and Operational Measures

(unaudited, amounts in

thousands)

Reconciliation of Net Income to EBITDA

and Adjusted EBITDA

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2024

2024

2023

2024

2023

Net income

$

51,893

$

73,804

$

92,383

$

316,010

$

556,408

Depreciation, depletion, and

amortization

132,164

126,395

118,421

505,050

421,514

Interest expense, net

8,499

8,589

6,364

32,214

27,506

Income tax expense (benefit)

6,075

22,158

26,824

87,261

178,482

EBITDA

$

198,631

$

230,946

$

243,992

$

940,535

$

1,183,910

Stock-based compensation expense

10,094

8,121

9,288

32,412

33,026

Unrealized (gain) loss on investments,

net

(44,753

)

2,727

—

(49,227

)

—

Loss (gain) on disposal of assets

(11,442

)

6,017

(13

)

(5,337

)

(6,994

)

(Gain) loss on remeasurement of liability

under tax receivable agreements

3,210

—

(1,817

)

3,210

(1,817

)

Fleet start-up costs

—

—

—

—

2,082

Transaction, severance, and other

costs

—

—

249

—

2,053

Provision for credit losses

—

—

808

—

808

Adjusted EBITDA

$

155,740

$

247,811

$

252,507

$

921,593

$

1,213,068

Reconciliation of Net Income and Net

Income per Diluted Share to Adjusted Net Income and Adjusted Net

Income per Diluted Share

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2024

2024

2023

2024

2023

Net income

$

51,893

$

73,804

$

92,383

$

316,010

$

556,408

Adjustments:

Less: Unrealized (gain) loss on

investments, net

(44,753

)

2,727

—

(49,227

)

—

Add back: Transaction and other costs

—

—

249

—

2,053

Total adjustments, before taxes

(44,753

)

2,727

249

(49,227

)

2,053

Income tax expense (benefit) of

adjustments

(9,582

)

656

55

(10,633

)

499

Adjusted Net Income

$

16,722

$

75,875

$

92,577

$

277,416

$

557,962

Diluted weighted average common shares

outstanding

167,163

168,595

172,661

169,398

176,360

Net income per diluted share

$

0.31

$

0.44

$

0.54

$

1.87

$

3.15

Adjusted Net Income per Diluted Share

$

0.10

$

0.45

$

0.54

$

1.64

$

3.16

Calculation of Adjusted Pre-Tax Return

on Capital Employed

Twelve Months Ended

December 31,

2024

2023

Net income

$

316,010

Add back: Income tax expense

87,261

Add back: Loss on remeasurement of

liability under tax receivable agreements (1)

3,210

Less: Unrealized gain on investments,

net

(49,227

)

Adjusted Pre-tax net income

$

357,254

Capital Employed

Total debt, net of discount

$

190,500

$

140,000

Total equity

1,978,869

1,841,408

Total Capital Employed

$

2,169,369

$

1,981,408

Average Capital Employed (2)

$

2,075,389

Adjusted Pre-Tax Return on Capital

Employed (3)

17

%

(1)

Loss on remeasurement of the liability

under tax receivable agreements is a result of a change in the

estimated future effective tax rate and should be excluded in the

determination of pre-tax return on capital employed.

(2)

Average Capital Employed is the simple

average of Total Capital Employed as of December 31, 2024 and

2023.

(3)

Adjusted Pre-tax Return on Capital

Employed is the ratio of adjusted pre-tax net income for the twelve

months ended December 31, 2024 to Average Capital Employed.

Calculation of Cash Return on Capital

Invested

Twelve Months Ended

December 31,

2024

2023

Adjusted EBITDA (1)

$

921,593

Gross Capital Invested

Total assets

$

3,296,394

$

3,033,557

Add back: Accumulated depreciation,

depletion, and amortization

1,917,551

1,501,685

Less: Accounts payable and accrued

liabilities

571,305

572,029

Total Gross Capital Invested

$

4,642,640

$

3,963,213

Average Gross Capital Invested (2)

$

4,302,927

Cash Return on Capital Invested (3)

21

%

(1)

Adjusted EBITDA is a non-GAAP financial

measure. See the tables entitled “Reconciliation and Calculation of

Non-GAAP Financial and Operational Measures” above.

(2)

Average Gross Capital Invested is the

simple average of Gross Capital Invested as of December 31, 2024

and 2023.

(3)

Cash Return on Capital Invested is the

ratio of Adjusted EBITDA, as reconciled above, for the twelve

months ended December 31, 2024 to Average Gross Capital

Invested.

Reconciliation of Historical Net Income

(Loss) to EBITDA and Adjusted EBITDA

Year Ended December

31,

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

Net income (loss)

$

556,408

$

400,302

$

(187,004

)

$

(160,674

)

$

74,864

$

249,033

$

168,501

$

(60,560

)

$

(9,061

)

$

34,519

$

8,881

$

25,807

Depreciation, depletion, and

amortization

421,514

323,028

262,757

180,084

165,379

125,110

81,473

41,362

36,436

21,749

12,881

5,875

Interest expense, net

27,506

22,715

15,603

14,505

14,681

17,145

12,636

6,126

5,501

3,610

1,139

—

Income tax (benefit) expense

178,482

(793

)

9,216

(30,857

)

14,052

40,385

—

—

—

—

—

—

EBITDA

$

1,183,910

$

745,252

$

100,572

$

3,058

$

268,976

$

431,673

$

262,610

$

(13,072

)

$

32,876

$

59,878

$

22,901

$

31,682

Stock-based compensation expense

33,026

23,108

19,946

17,139

13,592

5,450

—

—

—

—

—

—

Fleet start-up costs

2,082

17,007

2,751

12,175

4,519

10,069

13,955

4,280

1,044

4,502

2,711

—

Transaction, severance, and other

costs

2,053

5,837

15,138

21,061

—

834

4,015

5,877

446

—

—

—

(Gain) loss on disposal of assets

(6,994

)

(4,603

)

779

(411

)

2,601

(4,342

)

148

(2,673

)

423

494

—

—

Provision for credit losses

808

—

745

4,877

1,053

—

—

—

6,424

—

—

—

Loss (gain) on remeasurement of liability

under tax receivable agreements

(1,817

)

76,191

(19,039

)

—

—

—

—

—

—

—

—

—

Gain on investments

—

(2,525

)

—

—

—

—

—

—

—

—

—

—

Adjusted EBITDA

$

1,213,068

$

860,267

$

120,892

$

57,899

$

290,741

$

443,684

$

280,728

$

(5,588

)

$

41,213

$

64,874

$

25,612

$

31,682

Calculation of Historical Cash Return

on Capital Invested

Year Ended December

31,

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

Adjusted EBITDA (1)

$

1,213,068

$

860,267

$

120,892

$

57,899

$

290,741

$

443,684

$

280,728

$

(5,588

)

$

41,213

$

64,874

$

25,612

31,682

Gross Capital Invested

Total assets

$

3,033,557

$

2,575,932

$

2,040,660

$

1,889,942

$

1,283,429

$

1,116,501

$

852,103

$

451,845

$

296,971

$

331,671

$

174,813

$

107,225

$

35,699

Add back: Accumulated depreciation,

depletion, and amortization

1,501,685

1,141,656

863,194

622,530

455,687

307,277

198,453

117,779

77,057

40,715

19,082

6,196

321

Less: Accounts payable and accrued

liabilities

572,029

609,790

528,468

311,721

226,567

219,351

220,494

118,949

52,688

99,005

26,600

13,275

1,718

Total Gross Capital Invested

$

3,963,213

$

3,107,798

$

2,375,386

$

2,200,751

$

1,512,549

$

1,204,427

$

830,062

$

450,675

$

321,340

$

273,381

$

167,295

$

100,146

$

34,302

Average Gross Capital Invested (2)

$

3,535,506

$

2,741,592

$

2,288,069

$

1,856,650

$

1,358,488

$

1,017,245

$

640,369

$

386,008

$

297,361

$

220,338

$

133,721

67,224

Cash Return on Capital Invested (3)

34

%

31

%

5

%

3

%

21

%

44

%

44

%

(1

)%

14

%

29

%

19

%

47

%

(1)

Adjusted EBITDA is a non-GAAP financial

measure. See the tables entitled “Reconciliation and Calculation of

Historical Non-GAAP Financial and Operational Measures” above.

(2)

Average Gross Capital Invested is the

simple average of Gross Capital Invested as of the end of the

current year and prior year.

(3)

Cash Return on Capital Invested is the

ratio of Adjusted EBITDA, as reconciled above, for the year then

ended to Average Gross Capital Invested.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129912964/en/

Michael Stock Chief Financial Officer

Anjali Voria, CFA Director of Investor Relations

303-515-2851 IR@libertyenergy.com

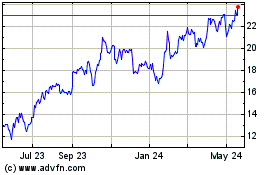

Liberty Energy (NYSE:LBRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Liberty Energy (NYSE:LBRT)

Historical Stock Chart

From Feb 2024 to Feb 2025