0001335258false00013352582024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

July 30, 2024

Live Nation Entertainment, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-32601 | | 20-3247759 |

(State or other jurisdiction

of incorporation) | | (Commission File No.) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| 9348 Civic Center Drive | | |

Beverly Hills, California | | 90210 |

| (Address of principal executive offices) | | (Zip Code) |

(310) 867-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $.01 Par Value Per Share | | LYV | | New York Stock Exchange |

| | | | |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On July 30, 2024, Live Nation Entertainment, Inc. issued a press release announcing its results of operations for the quarter ended June 30, 2024. A copy of that press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information contained in this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Exhibit Description |

| 99.1 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | |

Live Nation Entertainment, Inc. |

| |

By: | | /s/ Brian Capo |

| | Brian Capo |

| | Senior Vice President and

Chief Accounting Officer |

July 30, 2024

Exhibit 99.1

LIVE NATION ENTERTAINMENT

REPORTS SECOND QUARTER 2024 RESULTS

“We continue to see strong demand globally, with a growing variety of shows attracting both casual and diehard fans who are buying tickets at all price points, which speaks to the unique experience only live concerts can provide. Venue Nation’s strategic investments in hospitality and infrastructure are driving strong returns as more attendees maximize their onsite experiences. While operating income will be impacted negatively by one-time accruals, we are on track to deliver double-digit AOI growth for the year and look forward to a very busy 2025.” –Michael Rapino, President and CEO, Live Nation Entertainment

Quarterly Highlights: No Signs of Concerts Slowdown, Global Fan Demand Fuels Record Q2

(versus prior year, reported FX)

•Revenue up 7% to over $6 billion

•Operating income up 21% to $466 million

•Adjusted operating income up 21% to $716 million

•Record Q2 concerts adjusted operating income margin of 5.4%

•Fans continue to prioritize concert going and spending onsite:

◦Venue Nation hosted 24 million fans year-to-date, up 10%

◦Revenue from onsite spending at festivals and amphitheaters up double-digits year-to-date

•39 million fans globally at Live Nation concerts, up 5% with double-digit growth at Live Nation arenas and amphitheaters

•183 million fee-bearing tickets sold year-to-date, up 3% despite reduced stadium activity

•Onsite sponsorship from operated venues and festivals up 28% year-to-date

View how these results compare to past quarters in the 2Q24 Trended Results Grid:

https://investors.livenationentertainment.com/financial-information/financial-results

Key Metrics Point to Another Record Year in 2024

(based on leading indicators through mid-July vs same period last year)

•Momentum gains into the summer concerts season:

◦Year-to-date ticket sales for 2024 Live Nation concerts are 118 million, higher than 2023 with double-digit increases for arena, amphitheater, and theater and club shows

◦Confirmed shows for large venues (stadiums, arenas, and amphitheaters) up double-digits

◦Cancellation rates for North America concerts tracking lower than 2023 levels

•Venue Nation expands fan offerings and enhances hospitality:

◦Venue Nation to host over 60 million fans this year, up 10%+

◦Live Nation amphitheater average per fan spending on track to grow by approximately $2 per fan

◦Major festivals (over 100k fans) average per fan spending up double-digits year-to-date

◦Plans to open 14 major venues globally in 2024/25, continuing to expand the global market

•Growing global artist pipeline:

◦New artists touring up 130% year-to-date, with nearly half performing at On The Road Again venues

◦Across top 50 global tours, International artists have attracted 50% more fans year-to-date compared to 2019

•Ticketing international expansion continues, setting up for ongoing growth:

◦Approximately 17 million net new enterprise tickets signed year-to-date, with two-thirds from international markets

◦International markets remain a key driver of growth: ticket sales up 15% in Mexico year-to-date, over one million tickets sold in newly launched markets Brazil and Peru, and expansion into South Africa

◦Q4 onsale activity related to 2025 stadium shows expected to be strong, driving 2024 operating income and adjusted operating income growth

•Sponsorship highlights the unique reach of our global platforms:

◦Nearly all expected sponsorship commitments for the year booked, up double-digits

◦Onsite sponsorship expected to be the primary driver of 2024 growth, leveraging the strength of our venue platform and continued increase in global concert activity

Concerts Delivers Record Profitability (Q2 vs same period last year)

•Revenue up 8% to approximately $5 billion

•AOI up 61% to $271 million

•AOI margin of 5.4%, setting up for margin expansion in 2024 toward pre-pandemic levels

Arena and Amphitheater Shows Drive Fan Growth (Q2 vs same period last year)

•39 million fans attended approximately 15,000 Live Nation concerts globally, up 5% and 20% respectively:

◦Arena attendance up double-digits globally, led by the U.S. and Latin America

◦Amphitheater attendance up approximately 40%

◦Theater and club attendance up 15%

Ongoing Portfolio Enhancements Yield Attractive Returns

•Almost one-third of our amphitheaters have been refreshed since 2022, delivering an aggregate return of over 30% on 2022/23 projects, including new bar designs, upgraded VIP boxes, and other infrastructure upgrades

•Northwell at Jones Beach amphitheater opened in June following a significant renovation, and early shows are delivering average per fan revenue growth of $10, with increases across all spend categories including premium hospitality

•At the newly reopened Brooklyn Paramount, average event contribution margin is 60% higher than initial projections

Results Reflect Strong Demand and Venue Mix (Q2 vs same period last year)

•Revenue up 3% to $731 million

•AOI in line with last year at $293 million

•Full-year AOI margin expected to be consistent with last year

Despite Reduced Stadium Activity, Metrics Consistent with 2023 Levels (Q2 vs same period last year)

•Q2 among top five quarters for both transacted and reported ticket sales

•Approximately 78 million fee-bearing tickets sold, consistent with last year

•Fee-bearing Gross Transaction Value at $8.4 billion, consistent with last year

Sponsorship Growth Leverages Global Venue Platform (Q2 vs same period last year)

•Revenue up 3% to $312 million

•AOI up 10% to $223 million

•Full-year AOI margin expected to be consistent with last year

Global Partnerships Position Sponsorship for Ongoing Growth

•Expanded relationships with large brand partners including a multi-year, multi-festival partnership with Coca-Cola, an extension with Hulu to be the official streaming destination for three of the biggest festival brands (Bonnaroo, Lollapalooza, and Austin City Limits), and a partnership spanning more than 40 festivals in the U.S. with BeatBox

- - - - - - - - -

Capital Expenditures to Support Venue Expansion

•2024 capital expenditures currently estimated to be $650 million:

◦Three-quarters of total capex driven by Venue Nation: five venues account for approximately 40% of total venue spend

◦Changes to our prior projections are largely due to the pull forward of activity as well as additional venue opportunities, with major openings increasing from 12 to 14 venues over 2024/25

◦$100 million in committed capital from sponsorship agreements, joint venture partners, and other third parties, reducing cash outflow

Balance Sheet and Liquidity Strength Provide Flexibility

•Year-to-date net cash provided by operating activities of $1.4 billion and free cash flow—adjusted of $635 million

•Full-year AOI to free cash flow—adjusted conversion expected to be similar to 2023 levels

•Q2 ended with $6.4 billion in cash and cash equivalents, including $1.3 billion in ticketing client cash, $4.1 billion of event-related deferred revenue, and $1.7 billion in free cash

•Approximately $380 million of debt paydown year-to-date, representing most of our change in free cash

Below the Line Items

•An additional $94 million in accruals related to the Astroworld litigation, expected to represent remaining settlements, was recognized in Q2 for a total of $280 million this year

•Accretion of noncontrolling interests expected to grow in line with AOI for the full year

•Depreciation and amortization expected to be $75 million higher than 2023

•Interest and taxes for the full year expected to grow in line with AOI

Additional Financial Information

•Based on current projections, the impact of foreign exchange rates on revenue, operating income, and AOI for the full-year is expected to be immaterial, with a larger impact to net income

•2024 share count not expected to change materially from 2023

The company will webcast a teleconference today at 2:00 p.m. Pacific Time to discuss its financial performance, operational matters and potentially other material developments. Interested parties should visit the “News / Events” section of the company’s website at investors.livenationentertainment.com to listen to the webcast. Supplemental statistical and financial information to be provided on the call, if any, will be posted to the “Financial Info” section of the website. A replay of the webcast will also be available on the Live Nation website. The link to the 2Q24 Trended Results Grid is provided above for convenience and such grid is not a part of, or incorporated into, this press release or any SEC filings that include this press release.

Notice Regarding Financial Statements

The company has provided certain financial statements at the end of this press release for reference. These financial statements should be read in conjunction with the full financial statements, and the notes thereto, set forth in the company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission today and available on the SEC’s website at sec.gov.

About Live Nation Entertainment:

Live Nation Entertainment, Inc. (NYSE: LYV) is the world’s leading live entertainment company comprised of global market leaders: Ticketmaster, Live Nation Concerts, and Live Nation Media & Sponsorship. For additional information, visit investors.livenationentertainment.com.

| | | | | |

Investor Contact: | Media Contact: |

Amy Yong | Kaitlyn Henrich |

IR@livenation.com | Media@livenation.com |

(310) 867-7143 | |

FINANCIAL HIGHLIGHTS – SECOND QUARTER

(unaudited; $ in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 Reported | | Q2 2023 Reported | | Growth | | Q2 2024 Currency Impacts | | Q2 2024 Constant Currency | | Growth at Constant Currency |

| Revenue | | | | | | | | | | | |

Concerts | $ | 4,987.0 | | | $ | 4,633.3 | | | 8 | % | | $ | 25.8 | | | $ | 5,012.8 | | | 8 | % |

Ticketing | 730.7 | | | 709.3 | | | 3 | % | | 3.8 | | | 734.5 | | | 4 | % |

Sponsorship & Advertising | 312.2 | | | 302.9 | | | 3 | % | | (1.1) | | | 311.1 | | | 3 | % |

Other and Eliminations | (6.5) | | | (14.8) | | | * | | 0.0 | | | (6.5) | | | * |

| $ | 6,023.4 | | | $ | 5,630.7 | | | 7 | % | | $ | 28.5 | | | $ | 6,051.9 | | | 7 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Consolidated Operating Income | $ | 465.8 | | | $ | 386.4 | | | 21 | % | | $ | 8.4 | | | $ | 474.2 | | | 23 | % |

| | | | | | | | | | | |

| Adjusted Operating Income (Loss) | | | | | | | | | | |

Concerts | $ | 270.7 | | | $ | 168.1 | | | 61 | % | | $ | 7.1 | | | $ | 277.8 | | | 65 | % |

Ticketing | 292.5 | | | 292.7 | | | — | % | | 1.6 | | | 294.1 | | | — | % |

Sponsorship & Advertising | 222.6 | | | 203.1 | | | 10 | % | | (0.5) | | | 222.1 | | | 9 | % |

Other and Eliminations | (8.2) | | | (18.2) | | | * | | 0.0 | | | (8.2) | | | * |

Corporate | (61.4) | | | (56.0) | | | (10) | % | | 0.0 | | | (61.4) | | | (10) | % |

| $ | 716.2 | | | $ | 589.7 | | | 21 | % | | $ | 8.2 | | | $ | 724.4 | | | 23 | % |

* Percentages are not meaningful

FINANCIAL HIGHLIGHTS – SIX MONTHS

(unaudited; $ in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 6 Months 2024 Reported | | 6 Months 2023 Reported | | Growth | | 6 Months 2024 Currency Impacts | | 6 Months 2024 Constant Currency | | Growth at Constant Currency |

| Revenue | | | | | | | | | | | |

Concerts | $ | 7,866.4 | | | $ | 6,914.5 | | | 14 | % | | $ | 35.4 | | | $ | 7,901.8 | | | 14 | % |

Ticketing | 1,453.9 | | | 1,387.1 | | | 5 | % | | 3.0 | | | 1,456.9 | | | 5 | % |

Sponsorship & Advertising | 523.5 | | | 473.0 | | | 11 | % | | (2.5) | | | 521.0 | | | 10 | % |

Other and Eliminations | (20.9) | | | (16.5) | | | * | | 0.0 | | | (20.9) | | | * |

| $ | 9,822.9 | | | $ | 8,758.1 | | | 12 | % | | $ | 35.9 | | | $ | 9,858.8 | | | 13 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Consolidated Operating Income | $ | 429.3 | | | $ | 529.1 | | | (19) | % | | $ | 21.4 | | | $ | 450.7 | | | (15) | % |

| | | | | | | | | | | |

| Adjusted Operating Income (Loss) | | | | | | | | | | |

Concerts | $ | 273.8 | | | $ | 168.9 | | | 62 | % | | $ | 15.7 | | | $ | 289.5 | | | 71 | % |

Ticketing | 576.6 | | | 563.7 | | | 2 | % | | 2.5 | | | 579.1 | | | 3 | % |

Sponsorship & Advertising | 352.6 | | | 298.7 | | | 18 | % | | 0.6 | | | 353.2 | | | 18 | % |

Other and Eliminations | (15.4) | | | (26.1) | | | * | | 0.1 | | | (15.3) | | | * |

Corporate | (104.0) | | | (95.8) | | | (9) | % | | 0.0 | | | (104.0) | | | (9 | %) |

| $ | 1,083.6 | | | $ | 909.4 | | | 19 | % | | $ | 18.9 | | | $ | 1,102.5 | | | 21 | % |

* Percentages are not meaningful

Reconciliation of Adjusted Operating Income to Operating Income

(unaudited; $ in millions)

| | | | | | | | | | | | | | | | | |

| Q2 2024 | Q2 2023 | | 6 Months 2024 | 6 Months 2023 |

| (in millions) |

| Adjusted Operating Income | $ | 716.2 | | $ | 589.7 | | | $ | 1,083.6 | | $ | 909.4 | |

| | | | | |

| Acquisition expenses | (30.0) | | 24.8 | | | 0.6 | | 38.2 | |

| Amortization of non-recoupable ticketing contract advances | 21.2 | | 21.2 | | | 45.2 | | 41.6 | |

| Depreciation and amortization | 137.7 | | 136.5 | | | 270.3 | | 251.7 | |

| Gain on sale of operating assets | (0.8) | | (7.0) | | | (1.4) | | (6.5) | |

| Astroworld estimated loss contingencies | 94.0 | | — | | | 279.9 | | — | |

| Stock-based compensation expense | 28.3 | | 27.8 | | | 59.7 | | 55.3 | |

| Operating income | $ | 465.8 | | $ | 386.4 | | | $ | 429.3 | | $ | 529.1 | |

KEY OPERATING METRICS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q2 2024 | | Q2 2023 | | 6 Months 2024 | | 6 Months 2023 | | |

| (in thousands except estimated events) |

Concerts (1) | | | | | | | | | |

| Estimated events: | | | | | | | | | |

North America (2) | 9,990 | | | 8,111 | | | 17,167 | | | 14,420 | | | |

| International | 4,688 | | | 4,130 | | | 8,714 | | | 7,726 | | | |

| Total estimated events | 14,678 | | | 12,241 | | | 25,881 | | | 22,146 | | | |

| Estimated fans: | | | | | | | | | |

North America (2) | 23,187 | | | 18,474 | | | 34,078 | | | 26,131 | | | |

| International | 15,706 | | | 18,599 | | | 27,744 | | | 29,842 | | | |

| Total estimated fans | 38,893 | | | 37,073 | | | 61,822 | | | 55,973 | | | |

Ticketing (3) | | | | | | | | | |

| Estimated number of fee-bearing tickets | 78,470 | | | 78,879 | | | 155,048 | | | 151,145 | | | |

| Estimated number of non-fee-bearing tickets | 75,125 | | | 71,236 | | | 153,557 | | | 144,436 | | | |

| Total estimated tickets sold | 153,595 | | | 150,115 | | | 308,605 | | | 295,581 | | | |

_________

(1) Events generally represent a single performance by an artist. Fans generally represent the number of people who attend an event. Festivals are counted as one event in the quarter in which the festival begins, but the number of fans is based on the days the fans were present at the festival and thus can be reported across multiple quarters. Events and fan attendance metrics are estimated each quarter.

(2) North America refers to our events and fans within the United States and Canada.

(3) The fee-bearing tickets estimated above include primary and secondary tickets that are sold using our Ticketmaster systems or that we issue through affiliates. This metric includes primary tickets sold during the year regardless of event timing, except for our own events where our concert promoters control ticketing which are reported when the events occur. The non-fee-bearing tickets estimated above include primary tickets sold using our Ticketmaster systems, through season seat packages and our venue clients’ box offices, along with tickets sold on our “do it yourself” platform. These ticketing metrics are net of any refunds requested and any cancellations that occurred during the period and up to the time of reporting of these consolidated financial statements.

Reconciliations of Certain Non-GAAP Measures to Their Most Directly Comparable GAAP Measures

(unaudited; $ in millions)

Reconciliation of Free Cash Flow — Adjusted to Net Cash Provided by Operating Activities | | | | | | | | | | | |

| ($ in millions) | Q2 2024 | | Q2 2023 |

| Net cash provided by operating activities | $ | 412.1 | | | $ | 491.0 | |

| Add: Changes in operating assets and liabilities (working capital) | 92.7 | | | 34.7 | |

| Add: Changes in accrued liabilities for Astroworld estimated loss contingencies | 94.0 | | | — | |

| Free cash flow from earnings | $ | 598.8 | | | $ | 525.7 | |

| Less: Maintenance capital expenditures | (27.1) | | | (36.1) | |

| Distributions to noncontrolling interests | (115.7) | | | (82.7) | |

| Free cash flow — adjusted | $ | 456.0 | | | $ | 406.9 | |

| | | |

| Net cash used in investing activities | $ | (263.7) | | | $ | (239.4) | |

| | | |

| Net cash used in financing activities | $ | (164.6) | | | $ | (152.2) | |

Reconciliation of Free Cash Flow — Adjusted to Net Cash Provided by Operating Activities

| | | | | | | | | | | |

| ($ in millions) | 6 Months 2024 | | 6 Months 2023 |

| Net cash provided by operating activities | $ | 1,401.0 | | | $ | 1,646.8 | |

| Add: Changes in operating assets and liabilities (working capital) | (824.7) | | | (867.6) | |

| Add: Changes in accrued liabilities for Astroworld estimated loss contingencies | 279.9 | | | — | |

| Free cash flow from earnings | $ | 856.2 | | | $ | 779.2 | |

| Less: Maintenance capital expenditures | (49.6) | | | (44.7) | |

| Distributions to noncontrolling interests | (171.9) | | | (137.6) | |

| Free cash flow — adjusted | $ | 634.7 | | | $ | 596.9 | |

| | | |

| Net cash used in investing activities | $ | (434.4) | | | $ | (299.2) | |

| | | |

| Net cash provided by (used in) financing activities | $ | (643.0) | | | $ | 73.5 | |

Reconciliation of Free Cash to Cash and Cash Equivalents

| | | | | |

| ($ in millions) | June 30,

2024 |

| Cash and cash equivalents | $ | 6,398.7 | |

| Client cash | (1,305.9) | |

| Deferred revenue — event-related | (4,121.4) | |

| Accrued artist fees | (356.1) | |

| Collections on behalf of others | (105.3) | |

| Prepaid expenses — event-related | 1,180.5 | |

| Free cash | $ | 1,690.5 | |

Forward-Looking Statements, Non-GAAP Financial Measures and Reconciliations:

Certain statements in this press release, including the Supplemental Information that follows, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to statements regarding expected adjusted operating income growth in 2024 and preparations for a very busy 2025; no signs of concerts slowdown with key metrics pointing to another record year in 2024; current Venue Nation plans to open 14 major venues globally in 2024/25; the positioning of the company’s ticketing and sponsorship businesses for ongoing growth; expected Venue Nation fans in 2024; expected growth in Live Nation amphitheater average per fan spending in 2024; the expected strength of onsale activity in the fourth quarter of 2024 relating to 2025 stadium shows, which is anticipated to drive 2024 operating income and adjusted operating income growth; currently expected growth in onsite sponsorship in 2024; full-year margin expectations for the company’s Concerts, Ticketing, and Sponsorship segments; performance expectations for newly revamped Northwell at Jones Beach amphitheater; estimated capital expenditures in 2024; anticipated adjusted operating income to free cash flow—adjusted conversion in 2024; expectations for remaining Astroworld settlements; expected accretion of noncontrolling interests growth, depreciation and amortization, and interest and taxes growth in 2024; the projected impact of foreign exchange rates on revenue, operating income, and adjusted operating income for 2024, with a larger impact to net income expected; and expected 2024 share count.

Live Nation wishes to caution you that there are some known and unknown factors that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements, including but not limited to operational challenges in achieving strategic objectives and executing on the company's plans, the risk that the company's markets do not evolve as anticipated, the potential impact of any economic slowdown and operational challenges associated with selling tickets and staging events.

Live Nation refers you to the documents it files from time to time with the U.S. Securities and Exchange Commission, or SEC, specifically the section titled “Item 1A. Risk Factors” of the company’s most recent Annual Report filed on Form 10-K, and Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K, which contain and identify other important factors that could cause actual results to differ materially from those contained in the company’s projections or forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date on which they are made. All subsequent written and oral forward-looking statements by or concerning Live Nation are expressly qualified in their entirety by the cautionary statements above. Live Nation does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise.

This press release contains certain non-GAAP financial measures as defined by SEC Regulation G. A reconciliation of each such measure to its most directly comparable GAAP financial measure, together with an explanation of why management believes that these non-GAAP financial measures provide useful information to investors, is provided herein.

Adjusted Operating Income (Loss), or AOI, is a non-GAAP financial measure that we define as operating income (loss) before certain acquisition expenses (including ongoing legal costs stemming from the Ticketmaster merger, changes in the fair value of accrued acquisition-related contingent consideration obligations, and acquisition-related severance and compensation), amortization of non-recoupable ticketing contract advances, depreciation and amortization (including goodwill impairment), loss (gain) on disposal of operating assets, and stock-based compensation expense. We also exclude from AOI the impact of estimated or realized liabilities for settlements or damages arising out of the Astroworld matter that exceed our estimated insurance recovery, due to the significant and non-recurring nature of the matter. Ongoing legal costs associated with defense of these claims, such as attorney fees, are not excluded from AOI. We use AOI to evaluate the performance of our operating segments. We believe that information about AOI assists investors by allowing them to evaluate changes in the operating results of our portfolio of businesses separate from non-operational factors that affect net income (loss), thus providing insights into both operations and the other factors that affect reported results. AOI is not calculated or presented in accordance with GAAP. A limitation of the use of AOI as a performance measure is that it does not reflect the periodic costs of certain amortizing assets used in generating revenue in our business. Accordingly, AOI should be considered in addition to, and not as a substitute for, operating income (loss), net income (loss), and other measures of financial performance reported in accordance with GAAP. Furthermore, this measure may vary among other companies; thus, AOI as presented herein may not be comparable to similarly titled measures of other companies.

AOI margin is a non-GAAP financial measure that we calculate by dividing AOI by revenue. We use AOI margin to evaluate the performance of our operating segments. We believe that information about AOI margin assists investors by allowing them to evaluate changes in the operating results of our portfolio of businesses separate from non-operational factors that affect net income (loss), thus providing insights into both operations and the other factors that affect reported results. AOI margin is not calculated or presented in accordance with GAAP. A limitation of the use of AOI margin as a performance measure is that it does not reflect the periodic costs of certain amortizing assets used in generating revenue in our business. Accordingly, AOI margin should be considered in addition to, and not as a substitute for, operating income (loss) margin, and other measures of financial performance reported in accordance with GAAP. Furthermore, this measure may vary among other companies; thus, AOI margin as presented herein may not be comparable to similarly titled measures of other companies.

Constant Currency is a non-GAAP financial measure when applied to a GAAP financial measure. We calculate currency impacts as the difference between current period activity translated using the current period’s currency exchange rates and the comparable prior period’s currency exchange rates. We present constant currency information to provide a framework for assessing how our underlying businesses performed excluding the effect of foreign currency rate fluctuations.

Free Cash Flow — Adjusted, or FCF, is a non-GAAP financial measure that we define as net cash provided by (used in) operating activities less changes in operating assets and liabilities, less maintenance capital expenditures, less distributions to noncontrolling interest partners. We use FCF among other measures, to evaluate the ability of operations to generate cash that is available for purposes other than maintenance capital expenditures. We believe that information about FCF provides investors with an important perspective on the cash available to service debt, make acquisitions, and for revenue generating capital expenditures. FCF is not calculated or presented in accordance with GAAP. A limitation of the use of FCF as a performance measure is that it does not necessarily represent funds available for operations and is not necessarily a measure of our ability to fund our cash needs. Accordingly, FCF should be considered in addition to, and not as a substitute for, net cash provided by (used in) operating activities and other measures of financial performance reported in accordance with GAAP. Furthermore, this measure may vary among other companies; thus, FCF as presented herein may not be comparable to similarly titled measures of other companies.

Free Cash is a non-GAAP financial measure that we define as cash and cash equivalents less ticketing-related client funds, less event-related deferred revenue, less accrued expenses due to artists and cash collected on behalf of others, plus event-related prepaids. We use free cash as a proxy for how much cash we have available to, among other things, optionally repay debt balances, make acquisitions and fund revenue generating capital expenditures. Free cash is not calculated or presented in accordance with GAAP. A limitation of the use of free cash as a performance measure is that it does not necessarily represent funds available from operations and it is not necessarily a measure of our ability to fund our cash needs. Accordingly, free cash should be considered in addition to, and not as a substitute for, cash and cash equivalents and other measures of financial performance reported in accordance with GAAP. Furthermore, this measure may vary among other companies; thus, free cash as presented herein may not be comparable to similarly titled measures of other companies.

LIVE NATION ENTERTAINMENT, INC.

CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| (in thousands) |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 6,398,722 | | | $ | 6,231,866 | |

Accounts receivable, less allowance of $81,039 and $82,350, respectively | 2,464,042 | | | 2,069,054 | |

| Prepaid expenses | 1,671,514 | | | 1,147,581 | |

| Restricted cash | 10,818 | | | 7,090 | |

| Other current assets | 139,037 | | | 122,163 | |

| Total current assets | 10,684,133 | | | 9,577,754 | |

| Property, plant and equipment, net | 2,235,526 | | | 2,101,463 | |

| Operating lease assets | 1,587,875 | | | 1,606,389 | |

| Intangible assets | | | |

| Definite-lived intangible assets, net | 1,094,666 | | | 1,161,621 | |

| Indefinite-lived intangible assets, net | 380,847 | | | 377,349 | |

| Goodwill | 2,664,149 | | | 2,691,466 | |

| Long-term advances | 646,603 | | | 623,154 | |

| Other long-term assets | 1,160,185 | | | 934,849 | |

| Total assets | $ | 20,453,984 | | | $ | 19,074,045 | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities | | | |

| Accounts payable, client accounts | $ | 1,856,443 | | | $ | 1,866,864 | |

| Accounts payable | 250,917 | | | 267,493 | |

| Accrued expenses | 3,358,819 | | | 3,006,281 | |

| Deferred revenue | 4,798,752 | | | 3,398,028 | |

| Current portion of long-term debt, net | 1,137,272 | | | 1,134,386 | |

| Current portion of operating lease liabilities | 171,907 | | | 158,421 | |

| Other current liabilities | 53,039 | | | 128,430 | |

| Total current liabilities | 11,627,149 | | | 9,959,903 | |

| Long-term debt, net | 5,080,802 | | | 5,459,026 | |

| Long-term operating lease liabilities | 1,641,325 | | | 1,686,091 | |

| | | |

| Other long-term liabilities | 546,636 | | | 488,159 | |

| Commitments and contingent liabilities | | | |

| Redeemable noncontrolling interests | 1,007,099 | | | 893,709 | |

| Stockholders' equity | | | |

| | | |

| | | |

| Common stock | 2,307 | | | 2,298 | |

| Additional paid-in capital | 2,240,759 | | | 2,367,918 | |

| Accumulated deficit | (2,156,712) | | | (2,407,949) | |

| Cost of shares held in treasury | (6,865) | | | (6,865) | |

| Accumulated other comprehensive income (loss) | (122,756) | | | 27,450 | |

| Total Live Nation stockholders' equity | (43,267) | | | (17,148) | |

| Noncontrolling interests | 594,240 | | | 604,305 | |

| Total equity | 550,973 | | | 587,157 | |

| Total liabilities and equity | $ | 20,453,984 | | | $ | 19,074,045 | |

LIVE NATION ENTERTAINMENT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| | (in thousands, except share and per share data) |

| Revenue | $ | 6,023,416 | | | $ | 5,630,723 | | | $ | 9,822,945 | | | $ | 8,758,113 | | | |

| Operating expenses: | | | | | | | | | |

| Direct operating expenses | 4,408,209 | | | 4,164,778 | | | 7,054,666 | | | 6,280,367 | | | |

| Selling, general and administrative expenses | 926,222 | | | 868,595 | | | 1,907,781 | | | 1,558,916 | | | |

| Depreciation and amortization | 137,729 | | | 136,514 | | | 270,323 | | | 251,699 | | | |

| Gain on disposal of operating assets | (779) | | | (7,013) | | | (1,430) | | | (6,509) | | | |

| Corporate expenses | 86,216 | | | 81,478 | | | 162,293 | | | 144,493 | | | |

| Operating income | 465,819 | | | 386,371 | | | 429,312 | | | 529,147 | | | |

| Interest expense | 79,970 | | | 81,995 | | | 160,661 | | | 171,210 | | | |

| Loss on extinguishment of debt | — | | | — | | | — | | | 18,366 | | | |

| Interest income | (44,425) | | | (56,452) | | | (87,682) | | | (96,765) | | | |

| Equity in earnings of nonconsolidated affiliates | (5,376) | | | (5,558) | | | (5,460) | | | (9,665) | | | |

| | | | | | | | | |

| Other expense (income), net | (20,742) | | | (6,599) | | | (97,796) | | | 4,984 | | | |

| Income before income taxes | 456,392 | | | 372,985 | | | 459,589 | | | 441,017 | | | |

| Income tax expense | 80,164 | | | 41,648 | | | 115,578 | | | 65,488 | | | |

| Net income | 376,228 | | | 331,337 | | | 344,011 | | | 375,529 | | | |

| Net income attributable to noncontrolling interests | 78,258 | | | 37,655 | | | 92,774 | | | 85,016 | | | |

| Net income attributable to common stockholders of Live Nation | $ | 297,970 | | | $ | 293,682 | | | $ | 251,237 | | | $ | 290,513 | | | |

| | | | | | | | | |

| Basic net income per common share available to common stockholders of Live Nation | $ | 1.05 | | | $ | 1.04 | | | $ | 0.52 | | | $ | 0.78 | | | |

| Diluted net income per common share available to common stockholders of Live Nation | $ | 1.03 | | | $ | 1.02 | | | $ | 0.51 | | | $ | 0.78 | | | |

| | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic | 229,921,527 | | | 228,536,179 | | | 229,696,356 | | | 228,350,537 | | | |

| Diluted | 245,002,995 | | | 243,660,186 | | | 232,024,314 | | | 230,490,937 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Reconciliation to net income available to common stockholders of Live Nation: | | | | | | |

| Net income attributable to common stockholders of Live Nation | $ | 297,970 | | | $ | 293,682 | | | $ | 251,237 | | | $ | 290,513 | | | |

| Accretion of redeemable noncontrolling interests | (57,325) | | | (56,621) | | | (132,435) | | | (111,554) | | | |

| Net income available to common stockholders of Live Nation—basic | $ | 240,645 | | | $ | 237,061 | | | $ | 118,802 | | | $ | 178,959 | | | |

| Convertible debt interest, net of tax | 10,790 | | | 10,804 | | | — | | | — | | | |

| Net income available to common stockholders of Live Nation—diluted | $ | 251,435 | | | $ | 247,865 | | | $ | 118,802 | | | $ | 178,959 | | | |

| | | | | | | | | |

LIVE NATION ENTERTAINMENT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | | | |

| | 2024 | | 2023 | | | | | | |

| (in thousands) | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net income | $ | 344,011 | | | $ | 375,529 | | | | | | | |

| Reconciling items: | | | | | | | | | |

| Depreciation | 146,168 | | | 127,670 | | | | | | | |

| Amortization | 124,155 | | | 124,029 | | | | | | | |

| Amortization of non-recoupable ticketing contract advances | 45,241 | | | 41,597 | | | | | | | |

| Deferred income tax expense (benefit) | (6,078) | | | 5,430 | | | | | | | |

| Amortization of debt issuance costs and discounts | 7,881 | | | 8,949 | | | | | | | |

| Loss on extinguishment of debt | — | | | 18,366 | | | | | | | |

| Stock-based compensation expense | 59,738 | | | 55,333 | | | | | | | |

| Unrealized changes in fair value of contingent consideration | (28,573) | | | 20,100 | | | | | | | |

| Gain on mark-to-market of investments in nonconsolidated affiliates | (100,153) | | | (26,408) | | | | | | | |

| Equity in losses of nonconsolidated affiliates, net of distributions | 5,671 | | | 9,019 | | | | | | | |

| Provision for uncollectible accounts receivable | (9,806) | | | 20,120 | | | | | | | |

| | | | | | | | | |

| Other, net | (11,972) | | | (512) | | | | | | | |

| Changes in operating assets and liabilities, net of effects of acquisitions and dispositions: | | | | | | | | | |

| Increase in accounts receivable | (436,458) | | | (395,516) | | | | | | | |

| Increase in prepaid expenses and other assets | (646,147) | | | (836,672) | | | | | | | |

| Increase in accounts payable, accrued expenses and other liabilities | 391,059 | | | 298,718 | | | | | | | |

| Increase in deferred revenue | 1,516,217 | | | 1,801,097 | | | | | | | |

| Net cash provided by operating activities | 1,400,954 | | | 1,646,849 | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | |

| Advances of notes receivable | (75,973) | | | (118,973) | | | | | | | |

| Collections of notes receivable | 21,290 | | | 8,286 | | | | | | | |

| Investments made in nonconsolidated affiliates | (30,593) | | | (26,336) | | | | | | | |

| Purchases of property, plant and equipment | (333,689) | | | (202,531) | | | | | | | |

| Cash acquired from (paid for) acquisitions, net of cash paid (acquired) | (17,579) | | | 69,359 | | | | | | | |

| Purchases of intangible assets | (5,390) | | | (35,088) | | | | | | | |

| | | | | | | | | |

| Other, net | 7,529 | | | 6,077 | | | | | | | |

| Net cash used in investing activities | (434,405) | | | (299,206) | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | |

| Proceeds from long-term debt, net of debt issuance costs | 886 | | | 986,766 | | | | | | | |

| Payments on long-term debt | (377,132) | | | (614,030) | | | | | | | |

| Contributions from noncontrolling interests | 28 | | | 14,716 | | | | | | | |

| Distributions to noncontrolling interests | (171,908) | | | (137,609) | | | | | | | |

| Purchases of noncontrolling interests, net | (47,980) | | | (88,239) | | | | | | | |

| | | | | | | | | |

| Payments for capped call transactions | — | | | (75,500) | | | | | | | |

| Proceeds from exercise of stock options | 12,819 | | | 4,999 | | | | | | | |

| Taxes paid for net share settlement of equity awards | (38,551) | | | (8,464) | | | | | | | |

| Payments for deferred and contingent consideration | (20,390) | | | (9,440) | | | | | | | |

| Other, net | (748) | | | 315 | | | | | | | |

| Net cash provided by (used in) financing activities | (642,976) | | | 73,514 | | | | | | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (152,989) | | | 103,111 | | | | | | | |

| Net increase in cash, cash equivalents, and restricted cash | 170,584 | | | 1,524,268 | | | | | | | |

| Cash, cash equivalents and restricted cash at beginning of period | 6,238,956 | | | 5,612,374 | | | | | | | |

| Cash, cash equivalents and restricted cash at end of period | $ | 6,409,540 | | | $ | 7,136,642 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

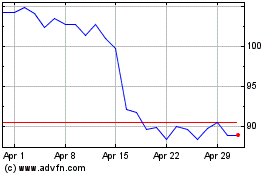

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Dec 2023 to Dec 2024