Current Report Filing (8-k)

April 28 2023 - 4:24PM

Edgar (US Regulatory)

0001476034

false

0001476034

2023-04-26

2023-04-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): April 26, 2023

METROPOLITAN BANK HOLDING CORP.

(Exact Name of Registrant as Specified

in Its Charter)

| New York |

|

001-38282 |

|

13-4042724 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File No.) |

|

(I.R.S. Employer Identification No.) |

| 99 Park Avenue, |

|

|

| New York, New York |

|

10016 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(212)

659-0600

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c) |

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

MCB |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act

of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On

August 15, 2016, Metropolitan Bank Holding Corp. (the “Company”) made a loan to Mark DeFazio, the Company’s President,

Chief Executive Officer and Director, which was subsequently extended on August 15, 2021, in the amount of $780,000 and having an interest

rate of 2.1% per annum (the “2021 Loan”). On March 6, 2023, the Company purported to make a loan to Mr. DeFazio in

the amount of $7,468,000, with a fixed interest rate of 5.708% per annum (the “2023 Loan”), and Mr. DeFazio used substantially

all of the proceeds of the 2023 Loan to pay the exercise price in connection with the exercise of certain existing stock options (the

“Option Shares”) and satisfy withholding tax obligations in connection with such exercise (the “Option Exercise”).

In connection with the preparation of the proxy statement for the Company’s annual meeting of stockholders, the Company’s

management and Executive Committee of the Board of Directors, along with outside counsel, reevaluated the 2023 Loan as well as the 2021

Loan. As part of this reevaluation, the Company determined that the 2023 Loan and the 2021 Loan were likely impermissible under applicable

law and/or regulations.

As a result of these determinations, and to the

extent that the 2023 Loan and the Option Exercise were not void as a matter of law, on April 26, 2023, the Company and Mr. DeFazio entered

into a Rescission Agreement (the “Rescission Agreement”). The Rescission Agreement provided, among other things, (i) that

the 2023 Loan and the Option Exercise would be rescinded and deemed null and void, (ii) that payments made in respect of the 2023 Loan,

if any, would be returned, and (iii) that any dividends received by Mr. DeFazio in respect of the Option Shares have been returned or

repaid to the Company. In connection with the entry into the Rescission Agreement, Mr. DeFazio repaid, in full, the 2021 Loan.

The foregoing summary of the Rescission Agreement

is qualified in its entirety by reference to the terms of the actual Rescission Agreement, a copy of which is attached hereto as Exhibit

10.1, and is incorporated by reference into, this Item 1.01.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits.

* Pursuant to Item 601(a)(5) of Regulation S-K, schedules and similar

attachments to this exhibit have been omitted because they do not contain information material to an investment or voting decision and

such information is not otherwise disclosed in such exhibit. The Company will supplementally provide a copy of any omitted schedule or

similar attachment to the U.S. Securities and Exchange Commission or its staff upon request.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

METROPOLITAN BANK HOLDING CORP. |

|

| |

|

|

| |

|

|

| Dated: April 28, 2023 |

By: |

/s/ Gregory A. Sigrist |

|

| |

|

Gregory A. Sigrist |

|

| |

|

Executive Vice President and Chief Financial Officer |

|

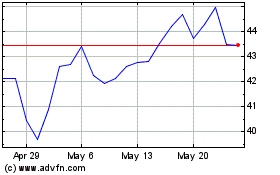

Metropolitan Bank (NYSE:MCB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Metropolitan Bank (NYSE:MCB)

Historical Stock Chart

From Jul 2023 to Jul 2024