Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

January 18 2024 - 3:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

| M.D.C. HOLDINGS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

https://www.linkedin.com/company/richmond-american/

https://www.linkedin.com/company/mdc-holdingsinc/posts/?feedView=all

Forward-Looking Statements

This communication includes certain disclosures which contain “forward-looking

statements” within the meaning of the federal securities laws, including but not limited to those statements related to the proposed

transaction, including financial estimates and statements as to the expected timing, completion and effects of the proposed transaction,

as well as the operations of our business following the completion of the proposed transaction. These forward-looking statements may be

identified by terminology such as “likely,” “predicts,” “continue,” “anticipates,” “believes,”

“confident,” “could,” “estimates,” “expects,” “intends,” “target,”

“potential,” “may,” “will,” “might,” “plans,” “path,” “should,”

“approximately,” “our planning assumptions,” “forecast,” “outlook” or the negative of

such terms and other comparable terminology. These forward-looking statements, including statements regarding the proposed transaction,

are based largely on information currently available to our management and our management's current expectations and assumptions, and

involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of M.D.C.

Holdings, Inc. (the “Company”) to be materially different from those expressed or implied by the forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements contained in this communication are reasonable,

we cannot guarantee future results. There is no assurance that our expectations will occur or that our estimates or assumptions will be

correct, and we caution investors and all others not to place undue reliance on such forward-looking statements.

Important factors, risks and uncertainties and other factors that may cause

actual results to differ materially from such plans, estimates or expectations include but are not limited to: (i) the completion of the

proposed transaction on the anticipated terms and timing, including obtaining required stockholder and regulatory approvals, and the satisfaction

of other conditions to the completion of the proposed transaction; (ii) potential litigation relating to the proposed transaction that

could be instituted against the Company or its directors, managers or officers, including the effects of any outcomes related thereto;

(iii) the risk that disruptions from the proposed transaction will harm the Company’s business, including current plans and operations,

including during the pendency of the proposed transaction; (iv) the ability of the Company to retain and hire key personnel; (v) the diversion

of management’s time and attention from ordinary course business operations to completion of the proposed transaction and integration

matters; (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed

transaction; (vii) legislative, regulatory and economic developments; (viii) potential business uncertainty, including changes to existing

business relationships, during the pendency of the proposed transaction that could affect the Company’s financial performance; (ix)

certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business

opportunities or strategic transactions; (x) unpredictability and severity of catastrophic events, including but not limited to acts of

terrorism, outbreaks of war or hostilities or the COVID-19 pandemic, as well as management’s response to any of the aforementioned

factors; (xi) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result

of unexpected factors or events; (xii) the occurrence of any event, change or other circumstance that could give rise to the termination

of the proposed transaction, including in circumstances requiring the Company to pay a termination fee; (xiii) those risks and uncertainties

set forth under the headings “Forward Looking Statements” and “Risk Factors” in the Company’s most recent

Annual Report on Form 10-K, as such risk factors may be amended, supplemented or superseded from time to time by other reports filed by

the Company with the SEC from time to time, which are available via the SEC’s website at www.sec.gov; and (xiv) those risks that

will be described in the proxy statement that will be filed with the SEC and available from the sources indicated below.

These risks, as well as other risks associated with the proposed transaction,

will be more fully discussed in the proxy statement that will be filed with the SEC in connection with the proposed transaction. There

can be no assurance that the proposed transaction will be completed, or if it is completed, that it will close within the anticipated

time period. These factors should not be construed as exhaustive and should be read in conjunction with the other forward-looking statements.

The forward-looking statements relate only to events as of the date on which the statements are made. The Company undertakes no duty to

update publicly any forward-looking statements except as required by law, whether as a result of new information, future events or otherwise.

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual

results may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should

not place undue reliance on any of our forward-looking statements. You should specifically consider the factors identified in this communication

that could cause actual results to differ. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for

us to predict those events or how they may affect the Company.

Important Information for Investors and Stockholders

This communication is being made in connection with the proposed transaction

involving the Company, Sekisui House and the other parties to the Merger Agreement. In connection with the proposed transaction, the

Company plans to file a proxy statement and certain other documents regarding the proposed transaction with the SEC. The definitive proxy

statement (if and when available) will be mailed to stockholders of the Company. This communication is not a substitute for the proxy

statement or any other document that the Company may file with the SEC or send to its stockholders in connection with the proposed transaction.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. BEFORE MAKING ANY VOTING

OR INVESTMENT DECISION, STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT THAT WILL BE FILED WITH THE SEC (INCLUDING ANY AMENDMENTS

OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY

WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Stockholders will be able

to obtain, free of charge, copies of such documents filed by the Company when filed with the SEC in connection with the proposed transaction

at the SEC’s website (http://www.sec.gov). In addition, the Company’s stockholders

will be able to obtain, free of charge, copies of such documents filed by the Company at the Company’s website (https://ir.richmondamerican.com/sec-filings).

Alternatively, these documents, when available, can be obtained free of charge from the Company upon written request to the Company at

4350 South Monaco Street, Suite 500, Denver, CO 80237.

Participants in the Solicitation

The Company and its directors, executive officers and certain other employees

may be deemed to be participants in the solicitation of proxies from stockholders of the Company in connection with the proposed transaction.

Information about the Company’s directors and executive officers is set forth in the Company’s proxy statement for its 2023

Annual Meeting of Stockholders, which was filed with the SEC on March 1, 2023. These documents are available free of charge at the SEC’s

web site at www.sec.gov and from the Company’s website (https://ir.richmondamerican.com/sec-filings). Additional information regarding

the identity of the participants, and their respective direct and indirect interests in the proposed transaction, by security holdings

or otherwise, will be set forth in the proxy statement and other relevant materials to be filed with the SEC in connection with the proposed

transaction (if and when they become available). You may obtain free copies of these documents using the sources indicated above.

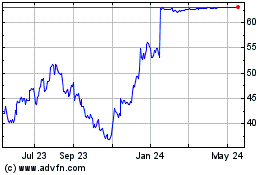

M D C (NYSE:MDC)

Historical Stock Chart

From Nov 2024 to Dec 2024

M D C (NYSE:MDC)

Historical Stock Chart

From Dec 2023 to Dec 2024