FALSE000006674000000667402024-08-012024-08-010000066740exch:XNYSus-gaap:CommonStockMember2024-08-012024-08-010000066740us-gaap:CommonStockMemberexch:XCHI2024-08-012024-08-010000066740exch:XNYSmmm:Notes1500PercentDue2026Member2024-08-012024-08-010000066740exch:XNYSmmm:Notes1750PercentDue2030Member2024-08-012024-08-010000066740mmm:Notes1.500PercentDue2031Memberexch:XNYS2024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 1, 2024

3M COMPANY

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | File No. 1-3285 | | 41-0417775 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

3M Center, St. Paul, Minnesota | | | | 55144-1000 |

(Address of Principal Executive Offices) | | | | (Zip Code) |

(Registrant’s Telephone Number, Including Area Code) (651) 733-1110

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, Par Value $.01 Per Share | | MMM | | New York Stock Exchange |

| | MMM | | Chicago Stock Exchange, Inc. |

1.500% Notes due 2026 | | MMM26 | | New York Stock Exchange |

1.750% Notes due 2030 | | MMM30 | | New York Stock Exchange |

1.500% Notes due 2031 | | MMM31 | | New York Stock Exchange |

Note: The common stock of the Registrant is also traded on the SIX Swiss Exchange.

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As reported in 3M Company’s press release dated August 1, 2024, the Board of Directors of the Company has appointed Anurag Maheshwari as the Company’s Executive Vice President and Chief Financial Officer, effective September 1, 2024.

Mr. Maheshwari, 50, currently serves as Executive Vice President and Chief Financial Officer for Otis Worldwide Corporation (Otis), a position he has held since August 2022 and will continue in until August 23, 2024. From February 2020 to August 2022, Mr. Maheshwari served as Vice President, Finance, Information Technology and Chief Transformation Officer for Otis in the Asia Pacific region.

Before joining Otis, Mr. Maheshwari served as Vice President, Investor Relations at Harris Corporation and then L3Harris from January 2017 to February 2020, leading the company's interaction with the investor community, while driving strategic investment planning and capital deployment.

Mr. Maheshwari began his career as a consultant before taking on several executive-level roles of increasing responsibility in strategy, business leadership, private equity and finance at United Technologies, Affinity Equity Partners and Harris Corporation.

Mr. Maheshwari joins 3M with proven experience as a chief financial officer and expertise across financial and business functions, including investor relations, strategic planning, capital deployment, operations and P&L ownership.

Mr. Maheshwari holds a master’s degree in finance from the Asian Institute of Management and a bachelor’s degree in economics from Bombay University.

Cash Compensation; Benefits. In connection with Mr. Maheshwari’s appointment, the Company extended an offer letter to him on July 26, 2024 (the “Offer Letter”), which he accepted. Under the terms of the Offer Letter, Mr. Maheshwari will receive an annual base salary of $1,050,000 and a target annual incentive compensation opportunity of $1,155,000, each of which will be prorated for 2024. He also will receive a hiring bonus of $3,150,000 and be eligible to participate in the Company’s long-term incentive compensation, retirement and other benefit plans and programs offered to the Company’s other senior executives. Mr. Maheshwari will be required to repay some (or all) of the hiring bonus, less any taxes withheld by the Company at the time of payment, if, before the third anniversary of his commencement of employment with the Company, he resigns from employment with the Company or the Company executes a written determination that he engaged in “Misconduct” (as defined in, and determined in accordance with, the 3M Company 2016 Long-Term Incentive Plan (the “2016 LTIP”)).

Initial Long-Term Incentive Awards. It is expected that Mr. Maheshwari will enter into an agreement upon his commencement of employment that protects 3M’s confidential information and includes non-competition and non-solicitation covenants that apply where permitted by applicable law (the “Protective Covenant Agreement”). In consideration of Mr. Maheshwari’s execution of the Protective Covenant Agreement and as an inducement for him to join 3M, the Offer Letter provides that he will receive (i) a special one-time make-whole restricted stock unit grant (the “Make-Whole RSU Award”) intended to replace the value of his equity awards and other compensation forfeited from his prior employer covering a number of shares of 3M common stock determined by dividing $4,500,000 by the closing sales price for a share of 3M common stock on the grant date, vesting in equal installments on each of the first three anniversaries of the grant date, (ii) a pro rata 2024 restricted stock unit grant (the “Pro Rata 2024 RSU Grant”) covering a number of shares of 3M common stock determined by dividing $666,667 by the closing sales price for a share of 3M common stock on the grant date, vesting in a single installment on the third anniversary of the grant date, (iii) a pro rata 2024 performance share award (the “Pro Rata 2024 PSA”) with a target number of performance shares determined by dividing $666,667 by the closing sales price for a share of 3M common stock on the grant date, vesting in a single installment on December 31, 2026. Each of the equity awards will be granted no later than 60 days following Mr. Maheshwari’s commencement of employment with the Company. The performance period and goals for the Pro Rata 2024 PSA will be the same as those of other annual grants made to 3M’s executive officers in 2024. The per share exercise price of the stock option will equal the closing sales price of a share of 3M common stock on the grant date.

Relocation Benefits. Mr. Maheshwari will be required to relocate to the Minneapolis-Saint Paul metropolitan area. In connection with his relocation and subject to his execution of a Relocation Repayment Agreement, Mr. Maheshwari will be entitled to receive the relocation benefits offered to executives at his level under the Company’s relocation policy, including movement of household goods, coverage of certain travel expenses, home marketing and sale assistance, an allowance for incidentals, temporary housing, support for finding and purchasing a new home, and tax restoration benefits for certain items. If Mr. Maheshwari voluntarily resigns or retires from employment with the Company before the second anniversary of the later of (i) the date he signs the Relocation Repayment Agreement or (ii) his hire date, he will be required to repay 3M all of the relocation expenses incurred on his behalf.

Severance. Mr. Maheshwari will be eligible to participate in the Company’s Executive Severance Plan (the “Severance Plan”), the benefits of which are described in the Company’s definitive proxy statement on Schedule 14A filed with the United States Securities and Exchange Commission (“SEC”) on March 27, 2024. A copy of the Severance Plan, as currently in effect, was included as Exhibit 10.15 to the Company’s annual report on Form 10-K filed with the SEC on February 7, 2024. In addition to such benefits, in the event that 3M terminates Mr. Maheshwari other than for Misconduct and Mr. Maheshwari signs (and does not revoke) a general release of claims against 3M and its affiliates, the restricted stock units subject to the Make-Whole RSU Award will remain outstanding and eligible to vest in accordance with their terms.

The foregoing description of the Offer Letter is qualified in its entirety by reference to the full text of the Offer Letter, a copy of which is attached hereto as Exhibit 99.1 and incorporated by reference in this Item 5.02.

Appointment of Interim Chief Financial Officer

Pending Mr. Maheshwari’s assumption of the CFO role on September 1, 2024, the Board of Directors of the Company has appointed Theresa (“Teri”) Reinseth as Interim Chief Financial Officer, effective August 1, 2024, as successor following the previously announced departure of Monish Patolawala, who served as the Company’s CFO through July 31, 2024. Ms. Reinseth, 51, currently serves as the Company’s Senior Vice President, Corporate Controller and Chief Accounting Officer, and has been in this role since April 1, 2019.

Item 7.01. Regulation FD Disclosure.

A copy of the press release dated August 1, 2024, is furnished as Exhibit 99.2 hereto.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| 3M COMPANY |

| |

| By: | /s/ Michael M. Dai |

| | |

| | Michael M. Dai |

| | Vice President, Associate General Counsel & Secretary |

Dated: August 1, 2024

July 26, 2024

Anurag Maheshwari

c/o 3M Company

3M Center

St. Paul, Minnesota 55144

Dear Anurag:

Congratulations! I am pleased to present this at will employment offer for you to join 3M Company (“3M” or the “Company”) as Executive Vice President and Chief Financial Officer reporting to 3M’s Chief Executive Officer.

Start Date; Work Location. Your first day of employment with the Company is expected to be September 1, 2024 (your actual first day of employment, the “Start Date”). Your primary work location will be 3M Headquarters in Saint Paul, Minnesota.

Cash Compensation. You will be provided an initial annual base salary of $1,050,000 paid in monthly installments and a short-term incentive compensation opportunity with a target value of $1,155,000 (110% of base salary) paid annually. The actual short-term incentive compensation you receive will be determined in accordance with the terms of the 3M Annual Incentive Plan or any successor thereto and may range from 0% to 200% of your weighted-average target for the performance period for a variety of reasons, including the performance of the Company or an assigned business unit against preestablished goals, your individual job performance, and your satisfaction of applicable vesting requirements. Your annual base salary and short-term incentive compensation opportunity will be prorated based on the portion of the year worked. Your base salary and target cash compensation will be reviewed at least annually and may be adjusted by the Company.

Hiring Bonus. You will receive a hiring bonus equal to $3,150,000 (“Hiring Bonus”), which will be paid after your Start Date and not more than thirty (30) days following 3M’s receipt of an executed copy of the enclosed Hiring Bonus Repayment Agreement. The Hiring Bonus Repayment Agreement requires you to repay some (or all) of the Hiring Bonus, less any taxes withheld by 3M at the time of payment, if, before the third anniversary of the Start Date, you resign from employment with 3M or the Company executes a written determination that you have engaged in “Misconduct” (as defined in, and determined in accordance with, the 3M Company 2016 Long-Term Incentive Plan (the “2016 LTIP”)). Note that you will not be eligible for the Hiring Bonus until you have started your employment with 3M and payment of the Hiring Bonus is expressly conditioned upon your execution of the enclosed Hiring Bonus Repayment Agreement during the thirty (30)-day period commencing with the Start Date.

Long-Term Incentives. You will be eligible to receive long-term incentive awards as determined by the Compensation and Talent Committee of 3M’s Board of Directors. These grants may be in the form of performance shares, stock options, restricted stock units, or other alternatives based on the Company’s common stock. The target value of the grants you receive will be determined by the Company’s Compensation and Talent Committee in its discretion taking into account a variety of factors, including changes in external market survey data and job performance.

The ultimate value of the grants you receive will depend on a number of factors, such as the performance of 3M and the value of its common stock. All long-term incentive awards you receive will be subject to the terms and conditions of the 2016 LTIP (or any successor thereto) and the applicable award agreement(s), including terms providing for the expiration or loss of grants or potential payments in the event of your termination of employment.

Initial Long-Term Incentive Awards. In consideration of your execution of the Employee Agreement and as an inducement to join 3M, no later than sixty (60) days following the Start Date, the Company will grant you a pro rata performance share award (“Pro Rata 2024 PSA”), a pro rata restricted stock unit award (“Pro Rata 2024 RSU Award”), and a special one-time make-whole restricted stock unit award (the “Make-whole RSU Award”) reflective of the terms set forth below.

Performance Share Awards. The Pro Rata 2024 PSA will cover a target number of performance shares determined by dividing $666,667 by the closing sales price for a share of 3M common stock on the grant date and rounding the result up to the nearest whole number; provided, however, that if the Start Date occurs after the first business day of September, the dollar amount used to determine the target number of performance shares will instead equal the result obtained by multiplying $179,166.67 by the number of whole calendar months remaining in 2024 as of the last business day preceding the Start Date. The performance period and goals for such award will be the same as those of the annual performance share awards made to 3M’s other executive officers. The award will vest in a single installment on December 31, 2026, subject to your continued employment.

RSU Awards. The Pro Rata 2024 RSU Award and Make-whole RSU Award will cover a number of shares of 3M common stock (each, a “Share”) determined by dividing $666,667 and $4,500,000, respectively, by the closing trading price of a share of 3M common stock on the grant date and rounding each result up to the nearest whole Share, as determined by 3M in accordance with FASB ASC Topic 718, excluding the effect of forfeitures; provided, however, that if the Start Date occurs after the first business day of September, the dollar amount used to determine the number of Shares covered by the Pro Rata 2024 RSU Award will instead equal the result obtained by multiplying $179,166.67 by the number of whole calendar months remaining in 2024 as of the last business day preceding the Start Date. Subject to your continued employment with 3M, the restricted stock units subject to the Pro Rata 2024 RSU Award will vest in a single lump sum on the third anniversary of the grant date and the restricted stock units subject to the Make-whole RSU Award will vest in equal installments on each of the first three anniversaries of the grant date. If 3M terminates your employment other than for Misconduct and you subsequently sign (and do not revoke) a general release of all claims against 3M and its current and former affiliates in a form, and by a date, prescribed by 3M in its sole discretion, then the Make-whole RSU Award will remain outstanding and eligible to vest in accordance with its terms as if you had not terminated employment.

Other Terms and Conditions. The remaining terms and conditions of the Pro Rata 2024 PSA, Pro Rata 2024 RSU Award, and Make-whole RSU Award will be subject to the terms and conditions of the 2016 LTIP or any successor thereto and the applicable award agreements, including the expiration or forfeiture of grants upon termination of employment.

Relocation. For this role, your primary office location will be 3M Headquarters in Saint Paul, Minnesota. Therefore, you will be required to relocate to the area within twelve (12) months of acceptance of this offer. To help you and your family with the move, comprehensive relocation services will be made available in accordance with 3M's Relocation Policy. Enclosed is additional information about your relocation benefits. Please note that failure to relocate in a timely manner may result in termination of your employment. For more specific information about 3M's Relocation Policy, please contact SIRVA Relocation at (763) 525-3700 or toll free at (866) 317-0354.

Enclosed is a copy of 3M’s Relocation Repayment Agreement, which under certain circumstances requires you to repay 3M for relocation expenses incurred on your behalf. Your right to receive relocation benefits is expressly conditioned upon your execution of the enclosed Relocation Repayment Agreement.

Indemnification. As a senior executive of the Company, you will receive the same indemnification protections and directors’ and officers’ liability insurance coverage as that provided to the Company’s other senior executives.

Vacation. Executives are not required to track vacation usage. We acknowledge the demands and expectations of your role and support your use of judgment to take care of your well-being. It is anticipated that you will use around five weeks of vacation time annually.

Severance Benefits. You will be eligible to participate in any severance plan maintained by the Company at the time of your separation and made available to similarly situated executives.

Total Compensation Package. Our total compensation package is one of the many benefits of joining 3M. This package goes beyond your cash compensation and long-term incentives and includes a broad range of benefits and services that can be tailored to your current life situation and adjusted periodically to fit your needs. You will receive additional information following commencement of employment, and you can contact 3M Benefits Center at (844) 396-8946 with questions.

Employee Agreement. Prior to the Start Date, you will be asked to sign a 3M Employee Agreement, as a condition of your employment. A blank copy of this agreement is attached for your review. The original, signed agreement will be retained by 3M. Employment with the Company is “at will,” which means that either you or the Company may end the employment relationship at any time, for any reason or no reason, and with or without notice. Nothing in this offer of employment is intended to or does create an employment relationship that is not “at will.”

Stock Ownership Guidelines. You will be expected to maintain compliance with the Company’s Stock Ownership Guidelines, as in effect from time to time. Under the current terms of the guidelines, you will have five (5) years to accumulate ownership of shares of Company common stock having an aggregate market value equal to three (3) times your annual base salary. A copy of the Company’s current Stock Ownership Guidelines is enclosed for your review.

Recoupment Policy. As a senior leader of the Company, certain compensation paid or provided to you will be subject to the terms of the Company’s Recoupment Policy, as in effect from time to time. A copy of the policy as currently in effect is enclosed for your review.

Reservation of Rights. The Company reserves the right at any time to make changes to or terminate its compensation and benefit plans, including incentive compensation plans. These changes could impact your eligibility to receive compensation and benefits under these plans, the time and form of payment, as well as changes in the factors and formulas for measuring performance and converting that performance into payments. Any such changes could affect your ability to earn compensation (including incentive compensation) after the change(s) take effect. The Company also reserves the right to make changes in the allocation of your planned total cash compensation between base salary and short-term incentive compensation.

Direct Deposit. 3M is a direct deposit employer. Payments to employees are made via direct deposit. You will be expected to provide personal bank account information to 3M on the effective date of employment. 3M will respect and comply with your rights in accordance with Federal and state regulations.

Withholding. All compensation and benefits payable to you pursuant to the terms of this offer letter or otherwise will be subject to deduction of all Federal and state income taxes and all other taxes and amounts the Company may be required to collect or withhold.

Previous Agreement(s) with Other Employers. By accepting this offer, you are representing to 3M that you have checked, and you are subject to no binding contractual or other legal restrictions that would prevent you from performing the duties of the position offered to you. In addition to the other contingencies set forth in this offer, this offer is contingent upon 3M’s verification that you are not subject to any restrictions that would prevent you from performing (or make it unacceptably difficult for you to perform) the duties of the position being offered to you in 3M’s judgment. As part of this verification process, you agree to cooperate with 3M by providing it with all contracts and other information available to you regarding restrictions arising from your past employment or other work associations that remain in effect and may place legal restrictions on you. If there are contracts or other

restrictions that you cannot share with 3M due to confidentiality obligations or for some other reason, you agree to cooperate with 3M in identifying an alternative means (through legal counsel representing you or otherwise) for 3M to conduct the forgoing verification process to 3M’s satisfaction. Your actual start date will not be established until this verification review has been completed. The failure to provide full, accurate and complete information and cooperation in this verification review process may result in the withdrawal of this offer and/or termination of your employment with 3M if you are already employed when the failure is discovered.

Employment Eligibility Verification Form (Department of Justice I-9 Form). Federal law requires companies to verify that new employees are United States citizens or foreign nationals who are authorized to work in the United States. 3M must comply with this law. On the first day of your employment, the law requires you to do the following:

1.Complete section one of an Employment Eligibility Verification Form (Department of Justice Form I-9); and

2.Provide acceptable documents, which identify and certify that you are a citizen of the United States or a foreign national who is authorized to work in the United States. A 3M representative will examine and copy these documents.

Please review the acceptable list of I-9 documents and bring the necessary items to orientation on your first day of work or, if you are working remotely, follow the separate instructions that you will receive as part of your new employee paperwork. If you do not provide proper identification within three business days of your start date, we will be required by law to terminate your employment with 3M.

3M Company participates in E-Verify. E-Verify is an internet-based system operated by the Department of Homeland Security (DHS) in partnership with the Social Security Administration (SSA) that allows participating employers to electronically verify the employment eligibility of their newly hired employees. As a participant in E-Verify, 3M will provide the SSA and, if necessary, the DHS, with information from each new employee’s Form I-9 to confirm work authorization.

I trust this information will answer some of your questions, as well as convey our enthusiasm to bring you on board at 3M. If you have any outstanding questions on the content of this offer, please don’t hesitate to reach out to me directly. Alternatively, you can also contact Lisa Elvidge, Global Executive Recruiting, at (651) 271-6019 or via email at lmelvidge1@mmm.com.

Our culture fosters innovation to meet the needs of our customers, employees, investors, and community. We look forward to sharing a successful future with you, and we hope you will accept our offer of employment.

Sincerely,

/s/ Zoe Dickson

Zoe Dickson

Executive Vice President and

Chief Human Resources Officer

Enclosures

3M Appoints New Chief Financial Officer

Anurag Maheshwari to join 3M on September 1

ST. PAUL, Minn.— August 1, 2024—3M (NYSE:MMM) announced today that Anurag Maheshwari is appointed Executive Vice President and Chief Financial Officer (CFO), effective September 1, 2024.

Maheshwari currently serves as Executive Vice President and Chief Financial Officer for Otis Worldwide Corporation (Otis), a global leader in the manufacture, installation, and servicing of elevators and escalators, with customers and passengers in more than 200 countries and territories. He joins 3M with proven experience as a chief financial officer and expertise across financial and business functions, including strategic planning, operations, investor relations, capital deployment, business transformation, and P&L ownership.

Before being named Otis’ CFO in July 2022, Maheshwari spent two years in the Asia Pacific region at Otis, serving as Vice President, Finance, Information Technology and Chief Transformation Officer. Prior to joining Otis, Maheshwari served as Vice President, Investor Relations, at Harris Corporation and then L3Harris from January 2017 to February 2020, leading the company's interaction with the investor community, while driving strategic investment planning and capital deployment. He began his career as a consultant before taking on several executive-level roles of increasing responsibility in strategy, business leadership, private equity, and finance at United Technologies, Affinity Equity Partners, and Harris Corporation. Maheshwari holds a master’s degree in finance from the Asian Institute of Management and a bachelor’s degree in economics from Bombay University.

“I am thrilled to welcome Anurag to 3M and to our leadership team,” said Bill Brown, 3M Chief Executive Officer. “I have known and worked with him for more than twenty years and am confident that his leadership and expertise will play a vital role in driving profitable growth at 3M, achieving operational excellence across the enterprise, and advancing our capital allocation priorities.”

“I am excited to join 3M, a company I have long admired as one of the most innovative in the world,” said Maheshwari. “I look forward to working again with Bill and partnering with the team to advance the company’s priorities and make a positive impact for our customers, employees, and shareholders.”

As 3M’s CFO, Maheshwari will lead the Company’s global finance organization and will be responsible for business finance, accounting, treasury, financial planning and analysis, tax, and investor relations, in addition to transformation, country governance, and 3M’s global service centers.

Pending Maheshwari’s assumption of the CFO role on September 1, 3M announced the appointment of Teri Reinseth as Interim Chief Financial Officer, effective August 1, 2024. Reinseth currently serves as the Company’s Senior Vice President, Corporate Controller and Chief Accounting Officer, and has been in this role since April 1, 2019.

About 3M 3M believes science helps create a brighter world for everyone. By unlocking the power of people, ideas, and science to reimagine what's possible, our global team uniquely addresses the opportunities and challenges of our customers, communities, and planet. Learn how we're working to improve lives and make what's next at 3M.com/news

Media Contacts

Investor Contacts:

Bruce Jermeland, 651-733-1807

or

Diane Farrow, 612-202-2449

or

Eric Herron, 651-233-0043

Media Contact:

Sean Lynch, Slynch2@mmm.com

v3.24.2.u1

Cover Page

|

Aug. 01, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity Registrant Name |

3M COMPANY

|

| Entity File Number |

1-3285

|

| Entity Tax Identification Number |

41-0417775

|

| Entity Address, Address Line One |

3M Center

|

| Entity Address, City or Town |

St. Paul

|

| Entity Address, Postal Zip Code |

55144-1000

|

| City Area Code |

651

|

| Local Phone Number |

733-1110

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000066740

|

| DELAWARE |

DE

|

| Entity Address, State or Province |

MN

|

| Common Stock, Par Value $.01 Per Share | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, Par Value $.01 Per Share

|

| Trading Symbol |

MMM

|

| Security Exchange Name |

NYSE

|

| Common Stock, Par Value $.01 Per Share | Chicago Stock Exchange, Inc. |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, Par Value $.01 Per Share

|

| Trading Symbol |

MMM

|

| Security Exchange Name |

CHX

|

| 1.500% Notes due 2026 | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Notes due 2026

|

| Trading Symbol |

MMM26

|

| Security Exchange Name |

NYSE

|

| 1.750% Notes due 2030 | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.750% Notes due 2030

|

| Trading Symbol |

MMM30

|

| Security Exchange Name |

NYSE

|

| 1.500% Notes due 2031 | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Notes due 2031

|

| Trading Symbol |

MMM31

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mmm_Notes1500PercentDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mmm_Notes1750PercentDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mmm_Notes1.500PercentDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

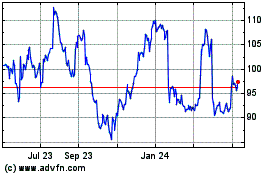

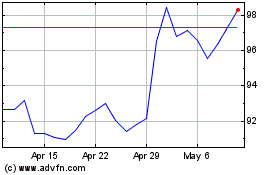

3M (NYSE:MMM)

Historical Stock Chart

From Nov 2024 to Dec 2024

3M (NYSE:MMM)

Historical Stock Chart

From Dec 2023 to Dec 2024