Annaly Capital Management, Inc. (NYSE: NLY) ("Annaly" or the

"Company") today announced its financial results for the quarter

ended September 30, 2024.

Financial Highlights

- GAAP net income of $0.05 per average common share for the

quarter

- Earnings available for distribution ("EAD") of $0.66 per

average common share for the quarter

- Economic return of 4.9% for the third quarter and 10.5%

year-to-date through the third quarter

- Book value per common share of $19.54

- GAAP leverage of 6.9x, down from 7.1x in the prior quarter;

economic leverage of 5.7x, down from 5.8x in the prior quarter

- Declared quarterly common stock cash dividend of $0.65 per

share

Business Highlights

Investment and Strategy

- Total portfolio of $81.8 billion, including $72.5 billion in

highly liquid Agency portfolio(1)

- Annaly's Agency portfolio increased by $6.4 billion

quarter-over-quarter as we deployed a portion of the $1.2 billion

in accretive common equity(2) raised since the beginning of the

quarter into high-quality, up-in-coupon specified pools and TBAs

- Annaly's Agency portfolio represents 61% of dedicated equity

capital(3), up from 58% in the prior quarter

- Proactively managed the hedge portfolio as the sharp decline in

interest rates pushed hedges to shorter tenors, modestly increasing

the hedge ratio to 101%

- Annaly's Residential Credit portfolio increased 9% to $6.5

billion(1) given continued record whole loan correspondent channel

activity; represents 18% of dedicated equity capital(3)

- Loan fundings have surpassed $15 billion since inception of the

correspondent channel in April 2021 and the $3 billion of whole

loans purchased during the third quarter represented a quarterly

record

- Annaly's Mortgage Servicing Rights ("MSR") portfolio ended the

quarter with $2.8 billion(1) in market value, relatively unchanged

quarter-over-quarter, representing 21% of dedicated equity

capital(3)

- Announced a strategic subservicing relationship with Rocket

Mortgage ("Rocket") whereby Rocket will handle servicing and

recapture activities for a portion of Annaly’s MSR portfolio

Financing and Capital

- $7.4 billion of total assets available for financing(4),

including cash and unencumbered Agency MBS of $4.7 billion

- Average GAAP cost of interest bearing liabilities decreased one

basis point to 5.42% and average economic cost of interest bearing

liabilities increased three basis points to 3.93%

quarter-over-quarter

- Annaly’s Residential Credit and MSR businesses increased

financing capacity by $560 million and $300 million, respectively,

through new and expanded credit facilities; total warehouse

capacity across both businesses of $5.0 billion, including $1.9

billion of committed capacity(5)

- Weighted average days to maturity for repurchase agreements

decreased to 34 days from 36 days in the prior quarter

- Annaly Residential Credit Group priced 18 whole loan

securitizations totaling $9.4 billion since the beginning of

2024(6)

- Annaly remains the largest non-bank issuer and the second

largest issuer overall of Prime Jumbo and Expanded Credit

MBS(7)

"Annaly delivered a 4.9% economic return in the third quarter

and 10.5% economic return for the first nine months of the year,

demonstrating the power of our diversified housing finance

portfolio," remarked David Finkelstein, Chief Executive Officer and

Chief Investment Officer. "Agency MBS benefited from the onset of

the Federal Reserve’s rate cutting cycle and we were able to deploy

equity capital raised during the quarter into the sector given

attractive new money returns. Meanwhile, our whole loan

correspondent channel continues to generate record production with

exceptional credit quality and our differentiated MSR portfolio has

consistently performed ahead of expectations. Looking ahead, we are

optimistic given the improving operating environment and believe

our portfolio is well-positioned to deliver strong risk-adjusted

returns."

(1)

Total portfolio represents Annaly’s investments that are on-balance

sheet as well as investments that are off-balance sheet in which

Annaly has economic exposure. Assets exclude assets transferred or

pledged to securitization vehicles of $21.0bn, include TBA purchase

contracts (market value) of $3.3bn, include unsettled MSR

commitments of $125mm, include $2.1bn of retained securities that

are eliminated in consolidation and are shown net of participations

issued totaling $0.5bn. MSR commitments represent the market value

of deals where Annaly has executed a letter of intent. There can be

no assurance whether these deals will close or when they will

close.

(2)

Amount includes $1.15 billion and $50 million raised during the

quarter and subsequent to quarter end, respectively, through the

Company’s at-the-market sales program for its common stock net of

sales agent commissions and other offering expenses.

(3)

Capital allocation for each of the investment strategies is

calculated as the difference between each investment strategy’s

allocated assets, which include TBA purchase contracts, and

liabilities.

(4)

Comprised of $6.5 billion of unencumbered assets, which represents

Annaly’s excess liquidity and defined as assets that have not been

pledged or securitized (generally including cash and cash

equivalents, Agency MBS, CRT, Non-Agency MBS, residential mortgage

loans, MSR, reverse repurchase agreements, other unencumbered

financial assets and capital stock), and $0.9 billion of fair value

of collateral pledged for future advances.

(5)

Includes a $300mm credit facility for Annaly’s MSR business that

closed subsequent to quarter end.

(6)

Includes a $636 million whole loan securitization that priced in

October 2024.

(7)

Issuer ranking data from Inside Nonconforming Markets for 2023 - Q3

2024 (October 11, 2024 issue).

Financial Performance

The following table summarizes certain key performance

indicators as of and for the quarters ended September 30, 2024,

June 30, 2024 and September 30, 2023:

September 30, 2024

June 30, 2024

September 30, 2023

Book value per common share

$

19.54

$

19.25

$

18.25

GAAP net income (loss) per average common

share (1)

$

0.05

$

(0.09

)

$

(1.21

)

Annualized GAAP return (loss) on average

equity (2)

2.77

%

(0.31

%)

(20.18

%)

GAAP leverage at period-end (3)

6.9:1

7.1:1

7.1:1

Net interest margin (4)

0.06

%

0.24

%

(0.20

%)

Average yield on interest earning assets

(5)

5.16

%

5.17

%

4.49

%

Average GAAP cost of interest bearing

liabilities (6)

5.42

%

5.43

%

5.27

%

Net interest spread

(0.26

%)

(0.26

%)

(0.78

%)

Non-GAAP metrics *

Earnings available for distribution per

average common share (1)

$

0.66

$

0.68

$

0.66

Annualized EAD return on average

equity

12.95

%

13.36

%

12.96

%

Economic leverage at period-end (3)

5.7:1

5.8:1

6.4:1

Net interest margin (excluding PAA)

(4)

1.52

%

1.58

%

1.48

%

Average yield on interest earning assets

(excluding PAA) (5)

5.25

%

5.14

%

4.46

%

Average economic cost of interest bearing

liabilities (6)

3.93

%

3.90

%

3.28

%

Net interest spread (excluding PAA)

1.32

%

1.24

%

1.18

%

*

Represents a non-GAAP financial measure.

Please refer to the "Non-GAAP Financial Measures" section for

additional information.

(1)

Net of dividends on preferred stock.

(2)

Annualized GAAP return (loss) on average equity annualizes realized

and unrealized gains and (losses) which may not be indicative of

full year performance, unannualized GAAP return (loss) on average

equity is 0.69%, (0.08%), and (5.04%) for the quarters ended

September 30, 2024, June 30, 2024, and September 30, 2023,

respectively.

(3)

GAAP leverage is computed as the sum of repurchase agreements,

other secured financing, debt issued by securitization vehicles,

participations issued, and U.S. Treasury securities sold, not yet

purchased divided by total equity. Economic leverage is computed as

the sum of recourse debt, cost basis of to-be-announced ("TBA")

derivatives outstanding, and net forward purchases (sales) of

investments divided by total equity. Recourse debt consists of

repurchase agreements, other secured financing, and US Treasury

securities, sold, not yet purchased. Debt issued by securitization

vehicles and participations issued are non-recourse to the Company

and are excluded from economic leverage.

(4)

Net interest margin represents interest income less interest

expense divided by average Interest Earning Assets. Net interest

margin does not include net interest component of interest rate

swaps. Net interest margin (excluding PAA) represents the sum of

interest income (excluding PAA) plus TBA dollar roll income and

less economic interest expense divided by the sum of average

Interest Earning Assets plus average outstanding TBA contract

balances. PAA represents the cumulative impact on prior periods,

but not the current period, of quarter-over-quarter changes in

estimated long-term prepayment speeds related to the Company’s

Agency mortgage-backed securities.

(5)

Average yield on interest earning assets represents annualized

interest income divided by average interest earning assets. Average

interest earning assets reflects the average amortized cost of our

investments during the period. Average yield on interest earning

assets (excluding PAA) is calculated using annualized interest

income (excluding PAA).

(6)

Average GAAP cost of interest bearing liabilities represents

annualized interest expense divided by average interest bearing

liabilities. Average interest bearing liabilities reflects the

average balances during the period. Average economic cost of

interest bearing liabilities represents annualized economic

interest expense divided by average interest bearing liabilities.

Economic interest expense is comprised of GAAP interest expense,

the net interest component of interest rate swaps, and, beginning

with the quarter ended June 30, 2024, net interest on initial

margin related to interest rate swaps, which is reported in Other,

net in the Company’s Consolidated Statement of Comprehensive Income

(Loss). Prior period results have not been adjusted in accordance

with this change as the impact is not material. Net interest on

variation margin related to interest rate swaps was previously and

is currently included in the Net interest component of interest

rate swaps in the Company's Consolidated Statement of Comprehensive

Income (Loss) for all periods presented.

Other Information

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," or similar terms or variations on those

terms or the negative of those terms. Such statements include those

relating to the Company’s future performance, macro outlook, the

interest rate and credit environments, tax reform and future

opportunities. Actual results could differ materially from those

set forth in forward-looking statements due to a variety of

factors, including, but not limited to, changes in interest rates;

changes in the yield curve; changes in prepayment rates; the

availability of mortgage-backed securities ("MBS") and other

securities for purchase; the availability of financing and, if

available, the terms of any financing; changes in the market value

of the Company’s assets; changes in business conditions and the

general economy; the Company’s ability to grow its residential

credit business; the Company's ability to grow its mortgage

servicing rights business; credit risks related to the Company’s

investments in credit risk transfer securities and residential

mortgage-backed securities and related residential mortgage credit

assets; risks related to investments in mortgage servicing rights;

the Company’s ability to consummate any contemplated investment

opportunities; changes in government regulations or policy

affecting the Company’s business; the Company’s ability to maintain

its qualification as a REIT for U.S. federal income tax purposes;

the Company’s ability to maintain its exemption from registration

under the Investment Company Act of 1940; and operational risks or

risk management failures by us or critical third parties, including

cybersecurity incidents. For a discussion of the risks and

uncertainties which could cause actual results to differ from those

contained in the forward-looking statements, see "Risk Factors" in

our most recent Annual Report on Form 10-K and any subsequent

Quarterly Reports on Form 10-Q. The Company does not undertake, and

specifically disclaims any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

Annaly is a leading diversified capital manager with investment

strategies across mortgage finance. Annaly’s principal business

objective is to generate net income for distribution to its

stockholders and to optimize its returns through prudent management

of its diversified investment strategies. Annaly is internally

managed and has elected to be taxed as a real estate investment

trust, or REIT, for federal income tax purposes. Additional

information on the company can be found at www.annaly.com.

We use our website (www.annaly.com) and LinkedIn account

(www.linkedin.com/company/annaly-capital-management) as channels of

distribution of company information. The information we post

through these channels may be deemed material. Accordingly,

investors should monitor these channels, in addition to following

our press releases, SEC filings and public conference calls and

webcasts. In addition, you may automatically receive email alerts

and other information about Annaly when you enroll your email

address by visiting the "Investors" section of our website, then

clicking on "Investor Resources" and selecting "Email Alerts" to

complete the email notification form. Our website, any alerts and

social media channels are not incorporated by reference into, and

are not a part of, this document.

The Company prepares an investor presentation and supplemental

financial information for the benefit of its shareholders. Please

refer to the investor presentation for definitions of both GAAP and

non-GAAP measures used in this news release. Both the Third Quarter

2024 Investor Presentation and the Third Quarter 2024 Supplemental

Information can be found at the Company’s website (www.annaly.com)

in the "Investors" section under "Investor Presentations."

Conference Call

The Company will hold the third quarter 2024 earnings conference

call on October 24, 2024 at 9:00 a.m. Eastern Time. Participants

are encouraged to pre-register for the conference call to receive a

unique PIN to gain immediate access to the call and bypass the live

operator. Pre-registration may be completed by accessing the

pre-registration link found on the homepage or "Investors" section

of the Company's website at www.annaly.com, or by using the

following link: https://dpregister.com/sreg/10193341/fda88631c3.

Pre-registration may be completed at any time, including up to and

after the call start time.

For participants who would like to join the call but have not

pre-registered, access is available by dialing 844-735-3317 within

the U.S., or 412-317-5703 internationally, and requesting the

"Annaly Earnings Call."

There will also be an audio webcast of the call on

www.annaly.com. A replay of the call will be available for one week

following the conference call. The replay number is 877-344-7529

for domestic calls and 412-317-0088 for international calls and the

conference passcode is 3078594. If you would like to be added to

the e-mail distribution list, please visit www.annaly.com, click on

Investors, then select Email Alerts and complete the email

notification form.

Financial Statements

ANNALY CAPITAL MANAGEMENT,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION

(dollars in thousands, except

per share data)

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023 (1)

September 30,

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Assets

Cash and cash equivalents

$

1,560,159

$

1,587,108

$

1,665,370

$

1,412,148

$

1,241,122

Securities

71,700,177

67,044,753

66,500,689

69,613,565

69,860,730

Loans, net

2,305,613

2,548,228

2,717,823

2,353,084

1,793,140

Mortgage servicing rights

2,693,057

2,785,614

2,651,279

2,122,196

2,234,813

Assets transferred or pledged to

securitization vehicles

21,044,007

17,946,812

15,614,750

13,307,622

11,450,346

Derivative assets

59,071

187,868

203,799

162,557

549,833

Receivable for unsettled trades

766,341

320,659

941,366

2,710,224

1,047,566

Principal and interest receivable

1,060,991

917,130

867,348

1,222,705

1,158,648

Intangible assets, net

10,088

10,761

11,433

12,106

12,778

Other assets

316,491

319,644

309,689

311,029

299,447

Total assets

$

101,515,995

$

93,668,577

$

91,483,546

$

93,227,236

$

89,648,423

Liabilities and stockholders’

equity

Liabilities

Repurchase agreements

$

64,310,276

$

60,787,994

$

58,975,232

$

62,201,543

$

64,693,821

Other secured financing

600,000

600,000

600,000

500,000

500,000

Debt issued by securitization vehicles

18,709,118

15,831,915

13,690,967

11,600,338

9,983,847

Participations issued

467,006

1,144,821

1,161,323

1,103,835

788,442

U.S. Treasury securities sold, not yet

purchased

2,043,519

1,974,602

2,077,404

2,132,751

—

Derivative liabilities

102,628

100,829

103,142

302,295

97,616

Payable for unsettled trades

1,885,286

1,096,271

2,556,798

3,249,389

2,214,319

Interest payable

276,397

369,106

350,405

287,937

198,084

Dividends payable

362,731

325,662

325,286

325,052

321,629

Other liabilities

219,085

174,473

146,876

179,005

173,608

Total liabilities

88,976,046

82,405,673

79,987,433

81,882,145

78,971,366

Stockholders’ equity

Preferred stock, par value $0.01 per share

(2)

1,536,569

1,536,569

1,536,569

1,536,569

1,536,569

Common stock, par value $0.01 per share

(3)

5,580

5,010

5,004

5,001

4,948

Additional paid-in capital

24,851,604

23,694,663

23,673,687

23,672,391

23,572,996

Accumulated other comprehensive income

(loss)

(712,203

)

(1,156,927

)

(1,281,918

)

(1,335,400

)

(2,694,776

)

Accumulated deficit

(13,238,288

)

(12,898,191

)

(12,523,809

)

(12,622,768

)

(11,855,267

)

Total stockholders’ equity

12,443,262

11,181,124

11,409,533

11,255,793

10,564,470

Noncontrolling interests

96,687

81,780

86,580

89,298

112,587

Total equity

12,539,949

11,262,904

11,496,113

11,345,091

10,677,057

Total liabilities and equity

$

101,515,995

$

93,668,577

$

91,483,546

$

93,227,236

$

89,648,423

(1)

Derived from the audited consolidated financial statements at

December 31, 2023.

(2)

6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable

Preferred Stock - Includes 28,800,000 shares authorized, issued and

outstanding. 6.50% Series G Fixed-to-Floating Rate Cumulative

Redeemable Preferred Stock - Includes 17,000,000 shares authorized,

issued and outstanding. 6.75% Series I Preferred Stock - Includes

17,700,000 shares authorized, issued and outstanding.

(3)

Includes 1,468,250,000 shares authorized. Includes 558,047,743

shares issued and outstanding at September 30, 2024, 501,018,415

shares issued and outstanding at June 30, 2024, 500,440,023 shares

issued and outstanding at March 31, 2024, 500,080,287 shares issued

and outstanding at December 31, 2023, 494,814,038 shares issued and

outstanding at September 30, 2023.

ANNALY CAPITAL MANAGEMENT,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(dollars in thousands, except

per share data)

(Unaudited)

For the quarters ended

September 30, 2024

June 30, 2024

March 31, 2024

December 31,

2023

September 30,

2023

Net interest income

Interest income

$

1,229,341

$

1,177,325

$

1,094,488

$

990,352

$

1,001,485

Interest expense

1,215,940

1,123,767

1,100,939

1,043,902

1,046,819

Net interest income

13,401

53,558

(6,451

)

(53,550

)

(45,334

)

Net servicing income

Servicing and related income

122,583

120,515

115,084

98,474

97,620

Servicing and related expense

12,988

12,617

12,216

11,219

9,623

Net servicing income

109,595

107,898

102,868

87,255

87,997

Other income (loss)

Net gains (losses) on investments and

other

1,723,713

(568,745

)

(994,127

)

1,894,744

(2,713,126

)

Net gains (losses) on derivatives

(1,754,010

)

430,487

1,377,144

(2,301,911

)

2,127,430

Other, net

27,438

24,791

23,367

22,863

26,250

Total other income (loss)

(2,859

)

(113,467

)

406,384

(384,304

)

(559,446

)

General and administrative

expenses

Compensation expense

34,453

33,274

28,721

29,502

30,064

Other general and administrative

expenses

9,468

11,617

9,849

9,399

9,845

Total general and administrative

expenses

43,921

44,891

38,570

38,901

39,909

Income (loss) before income

taxes

76,216

3,098

464,231

(389,500

)

(556,692

)

Income taxes

(6,135

)

11,931

(943

)

1,732

12,392

Net income (loss)

82,351

(8,833

)

465,174

(391,232

)

(569,084

)

Net income (loss) attributable to

noncontrolling interests

15,906

650

2,282

12,511

(6,879

)

Net income (loss) attributable to

Annaly

66,445

(9,483

)

462,892

(403,743

)

(562,205

)

Dividends on preferred stock

41,628

37,158

37,061

37,181

36,854

Net income (loss) available (related)

to common stockholders

$

24,817

$

(46,641

)

$

425,831

$

(440,924

)

$

(599,059

)

Net income (loss) per share available

(related) to common stockholders

Basic

$

0.05

$

(0.09

)

$

0.85

$

(0.88

)

$

(1.21

)

Diluted

$

0.05

$

(0.09

)

$

0.85

$

(0.88

)

$

(1.21

)

Weighted average number of common

shares outstanding

Basic

515,729,658

500,950,563

500,612,840

499,871,725

494,330,361

Diluted

516,832,152

500,950,563

501,182,043

499,871,725

494,330,361

Other comprehensive income

(loss)

Net income (loss)

$

82,351

$

(8,833

)

$

465,174

$

(391,232

)

$

(569,084

)

Unrealized gains (losses) on

available-for-sale securities

428,955

(54,243

)

(281,869

)

1,024,637

(825,286

)

Reclassification adjustment for net

(gains) losses included in net income (loss)

15,769

179,234

335,351

334,739

513,041

Other comprehensive income

(loss)

444,724

124,991

53,482

1,359,376

(312,245

)

Comprehensive income (loss)

527,075

116,158

518,656

968,144

(881,329

)

Comprehensive income (loss) attributable

to noncontrolling interests

15,906

650

2,282

12,511

(6,879

)

Comprehensive income (loss)

attributable to Annaly

511,169

115,508

516,374

955,633

(874,450

)

Dividends on preferred stock

41,628

37,158

37,061

37,181

36,854

Comprehensive income (loss)

attributable to common stockholders

$

469,541

$

78,350

$

479,313

$

918,452

$

(911,304

)

ANNALY CAPITAL MANAGEMENT,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(dollars in thousands, except

per share data)

For the nine months

ended

September 30, 2024

September 30, 2023

(unaudited)

(unaudited)

Net interest income

Interest income

$

3,501,154

$

2,741,229

Interest expense

3,440,646

2,799,063

Net interest income

60,508

(57,834

)

Net servicing income

Servicing and related income

358,182

265,683

Servicing and related expense

37,821

26,433

Net servicing income

320,361

239,250

Other income (loss)

Net gains (losses) on investments and

other

160,841

(4,020,362

)

Net gains (losses) on derivatives

53,621

2,702,003

Loan loss (provision) reversal

—

219

Other, net

75,596

50,853

Total other income (loss)

290,058

(1,267,287

)

General and administrative

expenses

Compensation expense

96,448

90,090

Other general and administrative

expenses

30,934

33,562

Total general and administrative

expenses

127,382

123,652

Income (loss) before income

taxes

543,545

(1,209,523

)

Income taxes

4,853

37,702

Net income (loss)

538,692

(1,247,225

)

Net income (loss) attributable to

noncontrolling interests

18,838

(7,797

)

Net income (loss) attributable to

Annaly

519,854

(1,239,428

)

Dividends on preferred stock

115,847

104,495

Net income (loss) available (related)

to common stockholders

$

404,007

$

(1,343,923

)

Net income (loss) per share available

(related) to common stockholders

Basic

$

0.80

$

(2.73

)

Diluted

$

0.80

$

(2.73

)

Weighted average number of common

shares outstanding

Basic

505,800,723

492,744,997

Diluted

506,618,143

492,744,997

Other comprehensive income

(loss)

Net income (loss)

$

538,692

$

(1,247,225

)

Unrealized gains (losses) on

available-for-sale securities

92,843

(443,957

)

Reclassification adjustment for net

(gains) losses included in net income (loss)

530,354

1,458,077

Other comprehensive income

(loss)

623,197

1,014,120

Comprehensive income (loss)

1,161,889

(233,105

)

Comprehensive income (loss) attributable

to noncontrolling interests

18,838

(7,797

)

Comprehensive income (loss)

attributable to Annaly

1,143,051

(225,308

)

Dividends on preferred stock

115,847

104,495

Comprehensive income (loss)

attributable to common stockholders

$

1,027,204

$

(329,803

)

Key Financial Data

The following table presents key metrics of the Company’s

portfolio, liabilities and hedging positions, and performance as of

and for the quarters ended September 30, 2024, June 30, 2024 and

September 30, 2023:

September 30, 2024

June 30, 2024

September 30, 2023

Portfolio related metrics

Fixed-rate Residential Securities as a

percentage of total Residential Securities

98

%

98

%

98

%

Adjustable-rate and floating-rate

Residential Securities as a percentage of total Residential

Securities

2

%

2

%

2

%

Weighted average experienced CPR for the

period

7.6

%

7.4

%

7.3

%

Weighted average projected long-term CPR

at period-end

11.9

%

8.5

%

7.1

%

Liabilities and hedging metrics

Weighted average days to maturity on

repurchase agreements outstanding at period-end

34

36

52

Hedge ratio (1)

101

%

98

%

115

%

Weighted average pay rate on interest rate

swaps at period-end (2)

3.05

%

3.13

%

2.61

%

Weighted average receive rate on interest

rate swaps at period-end (2)

4.94

%

5.30

%

5.27

%

Weighted average net rate on interest rate

swaps at period-end (2)

(1.89

%)

(2.17

%)

(2.66

%)

GAAP leverage at period-end (3)

6.9:1

7.1:1

7.1:1

GAAP capital ratio at period-end (4)

12.4

%

12.0

%

11.9

%

Performance related metrics

Book value per common share

$

19.54

$

19.25

$

18.25

GAAP net income (loss) per average common

share(5)

$

0.05

$

(0.09

)

$

(1.21

)

Annualized GAAP return (loss) on average

equity(6)

2.77

%

(0.31

%)

(20.18

%)

Net interest margin (7)

0.06

%

0.24

%

(0.20

%)

Average yield on interest earning assets

(8)

5.16

%

5.17

%

4.49

%

Average GAAP cost of interest bearing

liabilities (9)

5.42

%

5.43

%

5.27

%

Net interest spread

(0.26

%)

(0.26

%)

(0.78

%)

Dividend declared per common share

$

0.65

$

0.65

$

0.65

Annualized dividend yield (10)

12.95

%

13.64

%

13.82

%

Non-GAAP metrics *

Earnings available for distribution per

average common share (5)

$

0.66

$

0.68

$

0.66

Annualized EAD return on average equity

(excluding PAA)

12.95

%

13.36

%

12.96

%

Economic leverage at period-end (3)

5.7:1

5.8:1

6.4:1

Economic capital ratio at period end

(4)

14.6

%

14.2

%

13.1

%

Net interest margin (excluding PAA)

(7)

1.52

%

1.58

%

1.48

%

Average yield on interest earning assets

(excluding PAA) (8)

5.25

%

5.14

%

4.46

%

Average economic cost of interest bearing

liabilities (9)

3.93

%

3.90

%

3.28

%

Net interest spread (excluding PAA)

1.32

%

1.24

%

1.18

%

*

Represents a non-GAAP financial measure.

Please refer to the "Non-GAAP Financial Measures" section for

additional information.

(1)

Measures total notional balances of interest rate swaps, interest

rate swaptions (excluding receiver swaptions), futures and U.S.

Treasury securities sold, not yet purchased, relative to repurchase

agreements, other secured financing, cost basis of TBA derivatives

outstanding and net forward purchases (sales) of investments;

excludes MSR and the effects of term financing, both of which serve

to reduce interest rate risk. Additionally, the hedge ratio does

not take into consideration differences in duration between assets

and liabilities.

(2)

Excludes forward starting swaps.

(3)

GAAP leverage is computed as the sum of repurchase agreements,

other secured financing, debt issued by securitization vehicles,

participations issued, and U.S. Treasury securities sold, not yet

purchased divided by total equity. Economic leverage is computed as

the sum of recourse debt, cost basis of to-be-announced ("TBA")

derivatives outstanding, and net forward purchases (sales) of

investments divided by total equity. Recourse debt consists of

repurchase agreements, other secured financing, and U.S. Treasury

securities sold, not yet purchased. Debt issued by securitization

vehicles and participations issued are non-recourse to the Company

and are excluded from economic leverage.

(4)

GAAP capital ratio is computed as total equity divided by total

assets. Economic capital ratio is computed as total equity divided

by total economic assets. Total economic assets include the implied

market value of TBA derivatives and are net of debt issued by

securitization vehicles.

(5)

Net of dividends on preferred stock.

(6)

Annualized GAAP return (loss) on average equity annualizes realized

and unrealized gains and (losses) which may not be indicative of

full year performance, unannualized GAAP return (loss) on average

equity is 0.69%, (0.08%) and (5.04%) for the quarters ended

September 30, 2024, June 30, 2024, and September 30, 2023,

respectively.

(7)

Net interest margin represents interest income less interest

expense divided by average interest earning assets. Net interest

margin does not include net interest component of interest rate

swaps. Net interest margin (excluding PAA) represents the sum of

interest income (excluding PAA) plus TBA dollar roll income less

economic interest expense divided by the sum of average interest

earning assets plus average TBA contract balances.

(8)

Average yield on interest earning assets represents annualized

interest income divided by average interest earning assets. Average

interest earning assets reflects the average amortized cost of our

investments during the period. Average yield on interest earning

assets (excluding PAA) is calculated using annualized interest

income (excluding PAA).

(9)

Average GAAP cost of interest bearing liabilities represents

annualized interest expense divided by average interest bearing

liabilities. Average interest bearing liabilities reflects the

average balances during the period. Average economic cost of

interest bearing liabilities represents annualized economic

interest expense divided by average interest bearing liabilities.

Economic interest expense is comprised of GAAP interest expense,

the net interest component of interest rate swaps, and, beginning

with the quarter ended June 30, 2024, net interest on initial

margin related to interest rate swaps, which is reported in Other,

net in the Company’s Consolidated Statement of Comprehensive Income

(Loss). Prior period results have not been adjusted in accordance

with this change as the impact is not material. Net interest on

variation margin related to interest rate swaps was previously and

is currently included in the Net interest component of interest

rate swaps in the Company's Consolidated Statement of Comprehensive

Income (Loss) for all periods presented.

(10)

Based on the closing price of the Company’s common stock of $20.07,

$19.06 and $18.81 at September 30, 2024, June 30, 2024 and

September 30, 2023, respectively.

The following table contains additional information on our

investment portfolio as of the dates presented:

For the quarters ended

September 30, 2024

June 30, 2024

September 30, 2023

Agency mortgage-backed securities

$

69,150,399

$

64,390,905

$

66,591,536

Residential credit risk transfer

securities

826,841

838,437

982,951

Non-agency mortgage-backed securities

1,616,696

1,702,859

2,063,861

Commercial mortgage-backed securities

106,241

112,552

222,382

Total securities

$

71,700,177

$

67,044,753

$

69,860,730

Residential mortgage loans

$

2,305,613

$

2,548,228

$

1,793,140

Total loans, net

$

2,305,613

$

2,548,228

$

1,793,140

Mortgage servicing rights

$

2,693,057

$

2,785,614

$

2,234,813

Residential mortgage loans transferred or

pledged to securitization vehicles

$

21,044,007

$

17,946,812

$

11,450,346

Assets transferred or pledged to

securitization vehicles

$

21,044,007

$

17,946,812

$

11,450,346

Total investment portfolio

$

97,742,854

$

90,325,407

$

85,339,029

Non-GAAP Financial Measures

To supplement its consolidated financial statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles ("GAAP"), the Company provides the following

non-GAAP measures:

- earnings available for distribution ("EAD");

- earnings available for distribution attributable to common

stockholders;

- earnings available for distribution per average common

share;

- annualized EAD return on average equity;

- economic leverage;

- economic capital ratio;

- interest income (excluding PAA);

- economic interest expense;

- economic net interest income (excluding PAA);

- average yield on interest earning assets (excluding PAA);

- average economic cost of interest bearing liabilities;

- net interest margin (excluding PAA); and

- net interest spread (excluding PAA).

These measures should not be considered a substitute for, or

superior to, financial measures computed in accordance with GAAP.

While intended to offer a fuller understanding of the Company’s

results and operations, non-GAAP financial measures also have

limitations. For example, the Company may calculate its non-GAAP

metrics, such as earnings available for distribution, or the PAA,

differently than its peers making comparative analysis difficult.

Additionally, in the case of non-GAAP measures that exclude the

PAA, the amount of amortization expense excluding the PAA is not

necessarily representative of the amount of future periodic

amortization nor is it indicative of the term over which the

Company will amortize the remaining unamortized premium. Changes to

actual and estimated prepayments will impact the timing and amount

of premium amortization and, as such, both GAAP and non-GAAP

results.

These non-GAAP measures provide additional detail to enhance

investor understanding of the Company’s period-over-period

operating performance and business trends, as well as for assessing

the Company’s performance versus that of industry peers. Additional

information pertaining to the Company’s use of these non-GAAP

financial measures, including discussion of how each such measure

may be useful to investors, and reconciliations to their most

directly comparable GAAP results are provided below.

Earnings available for distribution, earnings available for

distribution attributable to common stockholders, earnings

available for distribution per average common share and annualized

EAD return on average equity

The Company's principal business objective is to generate net

income for distribution to its stockholders and to preserve capital

through prudent selection of investments and continuous management

of its portfolio. The Company generates net income by earning a net

interest spread on its investment portfolio, which is a function of

interest income from its investment portfolio less financing,

hedging and operating costs. Earnings available for distribution,

which is defined as the sum of (a) economic net interest income,

(b) TBA dollar roll income, (c) net servicing income less realized

amortization of MSR, (d) other income (loss) (excluding

amortization of intangibles, non-EAD income allocated to equity

method investments and other non-EAD components of other income

(loss)), (e) general and administrative expenses (excluding

transaction expenses and non-recurring items), and (f) income taxes

(excluding the income tax effect of non-EAD income (loss) items)

and excludes (g) the premium amortization adjustment ("PAA")

representing the cumulative impact on prior periods, but not the

current period, of quarter-over-quarter changes in estimated

long-term prepayment speeds related to the Company’s Agency

mortgage-backed securities is used by the Company's management and,

the Company believes, used by analysts and investors to measure its

progress in achieving its principal business objective.

The Company seeks to fulfill this objective through a variety of

factors including portfolio construction, the degree of market risk

exposure and related hedge profile, and the use and forms of

leverage, all while operating within the parameters of the

Company's capital allocation policy and risk governance

framework.

The Company believes these non-GAAP measures provide management

and investors with additional details regarding the Company’s

underlying operating results and investment portfolio trends by (i)

making adjustments to account for the disparate reporting of

changes in fair value where certain instruments are reflected in

GAAP net income (loss) while others are reflected in other

comprehensive income (loss) and (ii) by excluding certain

unrealized, non-cash or episodic components of GAAP net income

(loss) in order to provide additional transparency into the

operating performance of the Company’s portfolio. In addition, EAD

serves as a useful indicator for investors in evaluating the

Company's performance and ability to pay dividends. Annualized EAD

return on average equity, which is calculated by dividing earnings

available for distribution over average stockholders’ equity,

provides investors with additional detail on the earnings available

for distribution generated by the Company’s invested equity

capital.

The following table presents a reconciliation of GAAP financial

results to non-GAAP earnings available for distribution for the

periods presented:

For the quarters ended

September 30, 2024

June 30, 2024

September 30, 2023

(dollars in thousands, except

per share data)

GAAP net income (loss)

$

82,351

$

(8,833

)

$

(569,084

)

Adjustments to exclude reported

realized and unrealized (gains) losses

Net (gains) losses on investments and

other (1)

(1,724,051

)

568,874

2,710,208

Net (gains) losses on derivatives (2)

2,071,493

(132,115

)

(1,732,753

)

Other adjustments

Amortization of intangibles

673

673

2,384

Non-EAD (income) loss allocated to equity

method investments (3)

1,465

(523

)

(140

)

Transaction expenses and non-recurring

items (4)

4,966

5,329

1,882

Income tax effect of non-EAD income (loss)

items

(9,248

)

10,016

9,444

TBA dollar roll income (5)

(1,132

)

486

(1,016

)

MSR amortization (6)

(62,480

)

(56,100

)

(49,073

)

EAD attributable to noncontrolling

interests

(2,893

)

(3,362

)

(3,811

)

Premium amortization adjustment cost

(benefit)

21,365

(7,306

)

(6,062

)

Earnings available for distribution

*

382,509

377,139

361,979

Dividends on preferred stock

41,628

37,158

36,854

Earnings available for distribution

attributable to common stockholders *

$

340,881

$

339,981

$

325,125

GAAP net income (loss) per average

common share

$

0.05

$

(0.09

)

$

(1.21

)

Earnings available for distribution per

average common share *

$

0.66

$

0.68

$

0.66

Annualized GAAP return (loss) on

average equity (7)

2.77

%

(0.31

%)

(20.18

%)

Annualized EAD return on average equity

*

12.95

%

13.36

%

12.96

%

*

Represents a non-GAAP financial

measure.

(1)

Includes write-downs or recoveries on investments which are

reported in Other, net in the Company's Consolidated Statement of

Comprehensive Income (Loss).

(2)

The adjustment to add back Net (gains) losses on derivatives does

not include the net interest component of interest rate swaps which

is reflected in earnings available for distribution. The net

interest component of interest rate swaps totaled $317.5 million,

$298.4 million and $394.7 million for the quarters ended September

30, 2024, June 30, 2024 and September 30, 2023, respectively.

(3)

The Company excludes non-EAD (income) loss allocated to equity

method investments, which represents the unrealized (gains) losses

allocated to equity interests in a portfolio of MSR, which is a

component of Other, net.

(4)

Represents costs incurred in connection with securitizations of

residential whole loans.

(5)

TBA dollar roll income represents a component of Net gains (losses)

on derivatives.

(6)

MSR amortization utilizes purchase date cash flow assumptions and

actual unpaid principal balances and is calculated as the

difference between projected MSR yield income and net servicing

income for the period.

(7)

Annualized GAAP return (loss) on average equity annualizes realized

and unrealized gains and (losses) which may not be indicative of

full year performance, unannualized GAAP return (loss) on average

equity is 0.69%, (0.08%), and (5.04%) for the quarters ended

September 30, 2024, June 30, 2024, and September 30, 2023,

respectively.

From time to time, the Company enters into TBA forward contracts

as an alternate means of investing in and financing Agency

mortgage-backed securities. A TBA contract is an agreement to

purchase or sell, for future delivery, an Agency mortgage-backed

security with a specified issuer, term and coupon. A TBA dollar

roll represents a transaction where TBA contracts with the same

terms but different settlement dates are simultaneously bought and

sold. The TBA contract settling in the later month typically prices

at a discount to the earlier month contract with the difference in

price commonly referred to as the "drop". The drop is a reflection

of the expected net interest income from an investment in similar

Agency mortgage-backed securities, net of an implied financing

cost, that would be foregone as a result of settling the contract

in the later month rather than in the earlier month. The drop

between the current settlement month price and the forward

settlement month price occurs because in the TBA dollar roll

market, the party providing the financing is the party that would

retain all principal and interest payments accrued during the

financing period. Accordingly, TBA dollar roll income generally

represents the economic equivalent of the net interest income

earned on the underlying Agency mortgage-backed security less an

implied financing cost.

TBA dollar roll transactions are accounted for under GAAP as a

series of derivatives transactions. The fair value of TBA

derivatives is based on methods similar to those used to value

Agency mortgage-backed securities. The Company records TBA

derivatives at fair value on its Consolidated Statements of

Financial Condition and recognizes periodic changes in fair value

in Net gains (losses) on derivatives in the Consolidated Statements

of Comprehensive Income (Loss), which includes both unrealized and

realized gains and losses on derivatives.

TBA dollar roll income is calculated as the difference in price

between two TBA contracts with the same terms but different

settlement dates multiplied by the notional amount of the TBA

contract. Although accounted for as derivatives, TBA dollar rolls

capture the economic equivalent of net interest income, or carry,

on the underlying Agency mortgage-backed security (interest income

less an implied cost of financing). TBA dollar roll income is

reported as a component of Net gains (losses) on derivatives in the

Consolidated Statements of Comprehensive Income (Loss).

Premium Amortization Expense

In accordance with GAAP, the Company amortizes or accretes

premiums or discounts into interest income for its Agency

mortgage-backed securities, excluding interest-only securities,

multifamily and reverse mortgages, taking into account estimates of

future principal prepayments in the calculation of the effective

yield. The Company recalculates the effective yield as differences

between anticipated and actual prepayments occur. Using third-party

model and market information to project future cash flows and

expected remaining lives of securities, the effective interest rate

determined for each security is applied as if it had been in place

from the date of the security’s acquisition. The amortized cost of

the security is then adjusted to the amount that would have existed

had the new effective yield been applied since the acquisition

date. The adjustment to amortized cost is offset with a charge or

credit to interest income. Changes in interest rates and other

market factors will impact prepayment speed projections and the

amount of premium amortization recognized in any given period.

The Company’s GAAP metrics include the unadjusted impact of

amortization and accretion associated with this method. Certain of

the Company’s non-GAAP metrics exclude the effect of the PAA, which

quantifies the component of premium amortization representing the

cumulative impact on prior periods, but not the current period, of

quarter-over-quarter changes in estimated long-term CPR.

The following table illustrates the impact of the PAA on premium

amortization expense for the Company’s Residential Securities

portfolio and residential securities transferred or pledged to

securitization vehicles, for the quarters ended September 30, 2024,

June 30, 2024 and September 30, 2023:

For the quarters ended

September 30, 2024

June 30, 2024

September 30, 2023

(dollars in thousands)

Premium amortization expense

(accretion)

$

53,448

$

10,437

$

24,272

Less: PAA cost (benefit)

21,365

(7,306

)

(6,062

)

Premium amortization expense (excluding

PAA)

$

32,083

$

17,743

$

30,334

Economic leverage and economic capital ratios

The Company uses capital coupled with borrowed funds to invest

primarily in real estate related investments, earning the spread

between the yield on its assets and the cost of its borrowings and

hedging activities. The Company’s capital structure is designed to

offer an efficient complement of funding sources to generate

positive risk-adjusted returns for its stockholders while

maintaining appropriate liquidity to support its business and meet

the Company’s financial obligations under periods of market stress.

To maintain its desired capital profile, the Company utilizes a mix

of debt and equity funding. Debt funding may include the use of

repurchase agreements, loans, securitizations, participations

issued, lines of credit, asset backed lending facilities, corporate

bond issuance, convertible bonds or other liabilities. Equity

capital primarily consists of common and preferred stock.

The Company’s economic leverage ratio is computed as the sum of

recourse debt, cost basis of TBA derivatives outstanding, and net

forward purchases (sales) of investments divided by total equity.

Recourse debt consists of repurchase agreements, other secured

financing, and U.S. Treasury securities sold, not yet purchased.

Debt issued by securitization vehicles and participations issued

are non-recourse to the Company and are excluded from economic

leverage.

The following table presents a reconciliation of GAAP debt to

economic debt for purposes of calculating the Company’s economic

leverage ratio for the periods presented:

As of

September 30, 2024

June 30, 2024

September 30, 2023

Economic leverage ratio

reconciliation

(dollars in thousands)

Repurchase agreements

$

64,310,276

$

60,787,994

$

64,693,821

Other secured financing

600,000

600,000

500,000

Debt issued by securitization vehicles

18,709,118

15,831,915

9,983,847

Participations issued

467,006

1,144,821

788,442

U.S Treasury securities sold, not yet

purchased

2,043,519

1,974,602

—

Total GAAP debt

$

86,129,919

$

80,339,332

$

75,966,110

Less Non-Recourse Debt:

Debt issued by securitization vehicles

$

(18,709,118

)

$

(15,831,915

)

$

(9,983,847

)

Participations issued

(467,006

)

(1,144,821

)

(788,442

)

Total recourse debt

$

66,953,795

$

63,362,596

$

65,193,821

Plus / (Less):

Cost basis of TBA derivatives

$

3,333,873

$

1,639,941

$

1,965,117

Payable for unsettled trades

1,885,286

1,096,271

2,214,319

Receivable for unsettled trades

(766,341

)

(320,659

)

(1,047,566

)

Economic debt *

$

71,406,613

$

65,778,149

$

68,325,691

Total equity

$

12,539,949

$

11,262,904

$

10,677,057

Economic leverage ratio *

5.7:1

5.8:1

6.4:1

*

Represents a non-GAAP financial measure.

The following table presents a reconciliation of GAAP total

assets to economic total assets for purposes of calculating the

Company’s economic capital ratio for the periods presented:

As of

September 30, 2024

June 30, 2024

September 30, 2023

Economic capital ratio

reconciliation

(dollars in thousands)

Total GAAP assets

$

101,515,995

$

93,668,577

$

89,648,423

Less:

Gross unrealized gains on TBA derivatives

(1)

(2,869

)

(14,641

)

(7,232

)

Debt issued by securitization vehicles

(18,709,118

)

(15,831,915

)

(9,983,847

)

Plus:

Implied market value of TBA

derivatives

3,328,141

1,652,389

1,925,614

Total economic assets *

$

86,132,149

$

79,474,410

$

81,582,958

Total equity

$

12,539,949

$

11,262,904

$

10,677,057

Economic capital ratio *

14.6

%

14.2

%

13.1

%

*

Represents a non-GAAP financial

measure.

(1)

Included in Derivative assets in the Company’s Consolidated

Statements of Financial Condition.

Interest income (excluding PAA), economic interest expense

and economic net interest income (excluding PAA)

Interest income (excluding PAA) represents interest income

excluding the effect of the PAA, and serves as the basis for

deriving average yield on interest earning assets (excluding PAA),

net interest spread (excluding PAA) and net interest margin

(excluding PAA), which are discussed below. The Company believes

this measure provides management and investors with additional

detail to enhance their understanding of the Company’s operating

results and trends by excluding the component of premium

amortization expense representing the cumulative impact on prior

periods, but not the current period, of quarter-over-quarter

changes in estimated long-term prepayment speeds related to the

Company’s Agency mortgage-backed securities (other than

interest-only securities, multifamily and reverse mortgages), which

can obscure underlying trends in the performance of the

portfolio.

Economic interest expense includes GAAP interest expense, the

net interest component of interest rate swaps (which includes net

interest on variation margin related to interest rate swaps) and

net interest on initial margin related to interest rate swaps,

which is reported in Other, net in the Company’s Consolidated

Statement of Comprehensive Income (Loss). The Company uses interest

rate swaps to manage its exposure to changing interest rates on its

repurchase agreements by economically hedging cash flows associated

with these borrowings. Accordingly, adding the net interest

component of interest rate swaps to interest expense, as computed

in accordance with GAAP, reflects the total contractual interest

expense and thus, provides investors with additional information

about the cost of the Company's financing strategy. The Company may

use market agreed coupon ("MAC") interest rate swaps in which the

Company may receive or make a payment at the time of entering into

such interest rate swap to compensate for the off-market nature of

such interest rate swap. In accordance with GAAP, upfront payments

associated with MAC interest rate swaps are not reflected in the

net interest component of interest rate swaps in the Company's

Consolidated Statements of Comprehensive Income (Loss).

Similarly, economic net interest income (excluding PAA), as

computed below, provides investors with additional information to

enhance their understanding of the net economics of our primary

business operations.

For the quarters ended

September 30, 2024

June 30, 2024

September 30, 2023

Interest income (excluding PAA)

reconciliation

(dollars in thousands)

GAAP interest income

$

1,229,341

$

1,177,325

$

1,001,485

Premium amortization adjustment

21,365

(7,306

)

(6,062

)

Interest income (excluding PAA)

*

$

1,250,706

$

1,170,019

$

995,423

Economic interest expense

reconciliation

GAAP interest expense

$

1,215,940

$

1,123,767

$

1,046,819

Add:

Net interest component of interest rate

swaps and net interest on initial margin related to interest rate

swaps (1)

(333,696

)

(317,297

)

(394,677

)

Economic interest expense *

$

882,244

$

806,470

$

652,142

Economic net interest income (excluding

PAA) reconciliation

Interest income (excluding PAA) *

$

1,250,706

$

1,170,019

$

995,423

Less:

Economic interest expense *

882,244

806,470

652,142

Economic net interest income (excluding

PAA) *

$

368,462

$

363,549

$

343,281

*

Represents a non-GAAP financial

measure.

(1)

Interest on initial margin related to interest rate swaps is

reported in Other, net in the Company’s Consolidated Statement of

Comprehensive Income (Loss).

Average yield on interest earning assets (excluding PAA), net

interest spread (excluding PAA), net interest margin (excluding

PAA) and average economic cost of interest bearing

liabilities

Net interest spread (excluding PAA), which is the difference

between the average yield on interest earning assets (excluding

PAA) and the average economic cost of interest bearing liabilities,

which represents annualized economic interest expense divided by

average interest bearing liabilities, and net interest margin

(excluding PAA), which is calculated as the sum of interest income

(excluding PAA) plus TBA dollar roll income less economic interest

expense divided by the sum of average interest earning assets plus

average TBA contract balances, provide management with additional

measures of the Company’s profitability that management relies upon

in monitoring the performance of the business.

Disclosure of these measures, which are presented below,

provides investors with additional detail regarding how management

evaluates the Company’s performance.

For the quarters ended

September 30, 2024

June 30, 2024

September 30, 2023

Economic metrics (excluding

PAA)

(dollars in thousands)

Average interest earning assets

$

95,379,071

$

91,008,934

$

89,300,922

Interest income (excluding PAA) *

$

1,250,706

$

1,170,019

$

995,423

Average yield on interest earning assets

(excluding PAA) *

5.25

%

5.14

%

4.46

%

Average interest bearing liabilities

$

87,819,655

$

81,901,233

$

77,780,989

Economic interest expense *

$

882,244

$

806,470

$

652,142

Average economic cost of interest bearing

liabilities *

3.93

%

3.90

%

3.28

%

Economic net interest income (excluding

PAA) *

$

368,462

$

363,549

$

343,281

Net interest spread (excluding PAA) *

1.32

%

1.24

%

1.18

%

Interest income (excluding PAA) *

$

1,250,706

$

1,170,019

$

995,423

TBA dollar roll income

(1,132

)

486

(1,016

)

Economic interest expense *

(882,244

)

(806,470

)

(652,142

)

Subtotal

$

367,330

$

364,035

$

342,265

Average interest earnings assets

$

95,379,071

$

91,008,934

$

89,300,922

Average TBA contract balances

973,713

998,990

2,960,081

Subtotal

$

96,352,784

$

92,007,924

$

92,261,003

Net interest margin (excluding PAA)

*

1.52

%

1.58

%

1.48

%

*

Represents a non-GAAP financial measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022372933/en/

Annaly Capital Management, Inc. Investor Relations 1-888-8Annaly

www.annaly.com

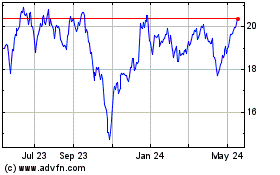

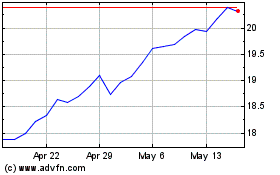

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Feb 2024 to Feb 2025