North American Construction Group Ltd. ("NACG")

(TSX:NOA.TO/NYSE:NOA) today announced results for the second

quarter ended June 30, 2024. Unless otherwise indicated,

financial figures are expressed in Canadian dollars, and

comparisons are to the prior period ended June 30, 2023.

Second Quarter

2024 Highlights:

- Combined revenue of

$329.7 million compared favorably to $278.6 million in the same

period last year, is a second quarter record and reflected best

operational quarter to date from the Australian fleet of the

MacKellar Group which was acquired on October 1, 2023.

- Reported revenue of

$276.3 million, compared to $195.2 million in the same period last

year, was primarily generated by strong equipment utilization of

82% in Australia but was offset by lower equipment operating hours

in the oil sands region due to adverse weather conditions in May

and June.

- Our net share of

revenue from equity consolidated joint ventures was $53.4 million

in Q2 2024 and compared to $83.4 million in the same period last

year as the increases at Fargo project in the current quarter were

offset by gold mine project scopes in Northern Ontario completed in

the prior quarter.

- Adjusted EBITDA of

$86.9 million and margin of 26.3% compared favorably to the prior

period operating metrics of $51.8 million and 18.6%, respectively,

as revenue increases drove higher gross EBITDA with margin

improvements driven by effective operations in Australia and

Canada.

- Combined gross

profit of $60.4 million and margin of 18.3% was impacted by a

one-time charge for equipment disposal. This margin compares

favorably to the 13.0% posted in the same period last year as

diversification efforts and effective operations contributed to

improved margins in the quarter.

- Cash flows generated

from operating activities of $59.0 million was higher than the

$40.2 million generated in the prior period as higher cash

generation from the strong EBITDA was offset by the temporary

impact of changes to working capital in the quarter.

- Free cash flow used

in the quarter was $1.5 million. Free cash flow prior to working

capital changes and increases in capital work in progress was over

$30 million resulting from strong revenues and margins offset by

our routine capital maintenance program.

- Net debt was $832.7

million at June 30, 2024, an increase of $109.3 million from

December 31, 2023, as year-to-date free cash flow usage and

growth asset purchases required debt financing. The cash-related

interest rate was 7.0% primarily driven by Bank of Canada posted

rates and correlated equipment financing rates.

- Additional

highlights: i) transport and delivery of approximately twenty haul

trucks from Canada to Australia remains on schedule with

commissioning expected in late Q3; ii) ERP implementation in

Australia targeting a go-live date in Q3; and iii) equipment

telematics progressed with the introduction of Hitachi

functionality in Canada and establishment of mobile data

infrastructure at mine sites in Australia.

In response to a challenging first half of 2024, the Company has

updated its full year expectations with the outlook for the second

half of 2024 remaining in line with original expectations set in

October 2023. The updated full year adjusted earnings range is

$3.95 to $4.15 per share and, with $1.56 generated in the first

half of the year, implies a second half range of approximately

$2.40 to $2.60 per share.

Joe Lambert, President and CEO, stated, "I am encouraged by the

underlying fundamentals of our business. Our drive for operational

excellence day-in day-out remains strong as ever and I am proud of

the operating culture we have here at NACG. In reviewing our medium

and long-term outlooks with our operational and estimating teams in

Australia and Canada, we have much to be excited about in the

second half of 2024, full year 2025 and beyond."

Consolidated Financial Highlights

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands, except per share amounts) |

|

|

2024 |

|

|

|

2023 |

(iv) |

|

|

2024 |

|

|

|

2023 |

(iv) |

|

Revenue |

|

$ |

276,314 |

|

|

$ |

195,188 |

|

|

$ |

573,340 |

|

|

$ |

439,517 |

|

| Total combined revenue(i) |

|

|

329,723 |

|

|

|

278,568 |

|

|

|

675,436 |

|

|

|

600,909 |

|

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

49,669 |

|

|

|

21,595 |

|

|

|

102,959 |

|

|

|

62,695 |

|

| Gross profit margin(i) |

|

|

18.0 |

% |

|

|

11.1 |

% |

|

|

18.0 |

% |

|

|

14.3 |

% |

| |

|

|

|

|

|

|

|

|

| Combined gross profit(i) |

|

|

60,350 |

|

|

|

36,258 |

|

|

|

122,575 |

|

|

|

92,177 |

|

| Combined gross profit

margin(i)(ii) |

|

|

18.3 |

% |

|

|

13.0 |

% |

|

|

18.1 |

% |

|

|

15.3 |

% |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

|

38,705 |

|

|

|

10,334 |

|

|

|

76,981 |

|

|

|

36,042 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA(i)(iii) |

|

|

86,881 |

|

|

|

51,833 |

|

|

|

180,132 |

|

|

|

136,456 |

|

| Adjusted EBITDA

margin(i)(iii) |

|

|

26.3 |

% |

|

|

18.6 |

% |

|

|

26.7 |

% |

|

|

22.7 |

% |

| |

|

|

|

|

|

|

|

|

| Net income |

|

|

14,007 |

|

|

|

12,262 |

|

|

|

25,376 |

|

|

|

34,108 |

|

| Adjusted net earnings(i) |

|

|

20,822 |

|

|

|

12,489 |

|

|

|

41,710 |

|

|

|

37,766 |

|

| |

|

|

|

|

|

|

|

|

| Cash provided by operating

activities |

|

|

59,013 |

|

|

|

40,185 |

|

|

|

70,879 |

|

|

|

72,009 |

|

| Cash provided by operating

activities prior to change in working capital(i) |

|

|

68,911 |

|

|

|

27,145 |

|

|

|

142,803 |

|

|

|

92,980 |

|

| |

|

|

|

|

|

|

|

|

| Free cash flow(i) |

|

|

(1,518 |

) |

|

|

(4,699 |

) |

|

|

(43,303 |

) |

|

|

(30,757 |

) |

| |

|

|

|

|

|

|

|

|

| Purchase of PPE |

|

|

75,307 |

|

|

|

38,419 |

|

|

|

141,960 |

|

|

|

74,915 |

|

| Sustaining capital

additions(i) |

|

|

37,313 |

|

|

|

38,311 |

|

|

|

97,190 |

|

|

|

85,502 |

|

| Growth capital

additions(i) |

|

|

19,943 |

|

|

|

2,748 |

|

|

|

39,550 |

|

|

|

2,748 |

|

| |

|

|

|

|

|

|

|

|

| Basic net income per

share |

|

$ |

0.52 |

|

|

$ |

0.46 |

|

|

$ |

0.95 |

|

|

$ |

1.29 |

|

|

Adjusted EPS(i) |

|

$ |

0.78 |

|

|

$ |

0.47 |

|

|

$ |

1.56 |

|

|

$ |

1.43 |

|

(i)See "Non-GAAP Financial Measures". (ii)Combined gross profit

margin is calculated using combined gross profit over total

combined revenue.(iii)Adjusted EBITDA margin is calculated using

adjusted EBITDA over total combined revenue.(iv)The prior year

amounts are adjusted to reflect a change in accounting policy. See

"Change in significant accounting policy - Basis of

presentation".

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Consolidated Statements of Cash Flows |

|

|

|

|

|

|

|

|

| Cash

provided by operating activities |

|

$ |

59,013 |

|

|

$ |

40,185 |

|

|

$ |

70,879 |

|

|

$ |

72,009 |

|

|

Cash used in investing activities |

|

|

(81,965 |

) |

|

|

(39,236 |

) |

|

|

(138,698 |

) |

|

|

(80,153 |

) |

|

Effect of exchange rate on changes in cash |

|

|

1,491 |

|

|

|

(417 |

) |

|

|

(877 |

) |

|

|

(362 |

) |

| Add

back of growth and non-cash items included in the above

figures: |

|

|

|

|

|

|

|

|

|

Growth capital additions(i)(ii) |

|

|

19,943 |

|

|

|

2,748 |

|

|

|

39,550 |

|

|

|

2,748 |

|

|

Capital additions financed by leases(i) |

|

|

— |

|

|

|

(7,979 |

) |

|

|

(14,157 |

) |

|

|

(24,999 |

) |

|

Free cash flow(i) |

|

$ |

(1,518 |

) |

|

$ |

(4,699 |

) |

|

$ |

(43,303 |

) |

|

$ |

(30,757 |

) |

(i)See "Non-GAAP Financial Measures".(ii)Included above in Cash

used in investing activities.

Declaration of Quarterly

Dividend

On July 31, 2024, the NACG Board of Directors declared a

regular quarterly dividend (the "Dividend") of ten Canadian cents

($0.10) per common share, payable to common shareholders of record

at the close of business on August 30, 2024. The Dividend will be

paid on October 4, 2024, and is an eligible dividend for Canadian

income tax purposes.

Financial Results for the Three Months Ended

June 30, 2024

Revenue for Q2 2024 of $276.3 million represented an increase of

$81.1 million (or 42%) from Q2 2023. The increase is primarily due

to the inclusion of results from the MacKellar Group ("MacKellar")

following its acquisition on October 1, 2023.

The Heavy Equipment - Australia segment showed strong

performance, driven by MacKellar’s Q2 results, which exceeded Q1

2024 by 9.9%, largely due to steady and consistent operating

conditions in particular at the Carmichael and Middlemount mine

sites. Equipment utilization for the quarter was 82% with May

posting a 89%, above the stated target for the Australian fleet of

85%. The month of June did experience some rains late in the month

bringing utilization to 79% in that month and tempering revenues

slightly. In addition to stable operating conditions during the

quarter, certain growth assets were commissioned in both Western

Australia and Queensland and had meaningful, but not full quarter,

contributions to top-line revenue. DGI Trading Pty Ltd. ("DGI")

posted another strong quarter and continues to benefit from

international demand for low-cost used components and major parts

required by heavy equipment fleets in the mining industry.

The Heavy Equipment - Canada segment posted a decline in revenue

compared to the prior year as equipment utilization decreased to

42% from adverse weather conditions in May and June. Wildfire

protocols caused work stoppages in May and heavy rainfall in May

and June caused work shifts being cancelled due to mine site and

haul road conditions. It is estimated that the abnormally poor

weather conditions in the quarter affected top-line results by

approximately $20 million. Quarter over quarter, revenue decreased

30.6% and was primarily driven by changes in work completed at the

Fort Hills and Syncrude mines as volumes at the Millenium mine

remained consistent, in addition to the poor weather. Additionally,

the comparative quarter benefited from higher utilization rates

from NACG assets being operated at the gold mine in northern

Ontario, a project that concluded in late August 2023.

Combined revenue of $329.7 million represented a $51.2 million

(or 18%) increase from Q2 2023. Our share of revenue generated in

Q2 2024 by joint ventures and affiliates was $53.4 million,

compared to $83.4 million in Q2 2023. The completion of the gold

mine project in northern Ontario at the end of August 2023 was the

primary driver of this quarter over quarter variance. Offsetting

this variance was the Fargo-Moorhead flood diversion project which

completed another strong operational quarter, posted a 98% increase

from scopes completed in the prior quarter and surpassed the 40%

completion mark in June.

Adjusted EBITDA and the associated margin of $86.9 million and

26.3% exceeded our Q2 2023 results of $51.8 million and 18.6%,

respectively. Despite lower revenue in the oil sands region,

effective and efficient operation of the heavy equipment fleets in

Australia and Canada and the implemented reductions of variable and

fixed costs where necessary generated a strong EBITDA margin for Q2

2024. EBITDA margin for this quarter was relatively consistent with

Q1 2024 and is reflective of the underlying consistent business of

our heavy equipment fleets.

Depreciation of our equipment fleet was 14.3% of revenue in the

quarter but when factoring out the one-time loss on disposal,

averaged 12.8% for the quarter. Depreciation as a percentage of

revenue was 17.7% for the Heavy Equipment - Canada fleet which was

higher than our historical average as increased customer demand for

heavy equipment rentals has changed the revenue profile. The Heavy

Equipment - Australia fleet, which averaged approximately 9.4% of

revenue, was driven by MacKellar and reflected both productive

operations in the quarter as well as the depreciation of fair

market values allocated upon purchase. On a combined basis,

depreciation averaged 13.4% of combined revenue in the quarter as

the lower capital intensity in Fargo and Nuna joint ventures

modestly reduced the ratio.

General and administrative expenses (excluding stock-based

compensation) were $12.8 million, or 4.6% of revenue, compared to

$7.2 million, or 3.7% of revenue in Q2 2023. The increase in

expenses reflects the acquisition of the MacKellar Group. The

increase as a percentage of revenue, in particular from the Q1 rate

of 3.8%, equally reflects both the lower revenue in the quarter but

also the impacts of higher accounting, audit and legal costs

associated with the added first-year integration of the MacKellar

acquisition.

Cash related interest expense for the quarter was $13.6 million

at an average cost of debt of 7.0%, compared to 6.9% in Q2 2023, as

rates posted by the Bank of Canada directly impact our Credit

Facility and have a delayed impact on the rates for secured

equipment-backed financing. Total interest expense was $14.3

million in the quarter, compared to $7.5 million in Q2 2023 based

on the debt financing incurred upon acquisition of the MacKellar

Group on October 1, 2023.

Adjusted earnings per share ("EPS") of $0.78 on adjusted net

earnings of $20.8 million was up 66% from the prior year figure of

$0.47, consistent with the adjusted EBIT performance which was up

102.1% quarter over quarter. As mentioned above, the step-changes

in interest from the MacKellar acquisition offset EBIT performance

with the effective income tax rates being comparable for both

quarters. Weighted-average common shares levels for the second

quarters of 2024 and 2023 were relatively stable at 26,730,049 and

26,409,357, respectively, net of shares classified as treasury

shares.

Free cash flow for the three months ended June 30, 2024, was a

use of cash of $1.5 million. Adjusted EBITDA of $86.9 million less

sustaining capital additions of $37.3 million and cash interest

expense of $13.6 million generated $36.0 million of cash flow in

the quarter. The difference of $37.5 million is primarily related

to increases in working capital ($9.9 million) and capital work in

progress ($18.2 million) balances.

2024 Strategic Focus Areas

- Safety - now on an

international basis, maintain our uncompromising commitment to

health and safety while elevating the standard of excellence in the

field;

- Execution - enhance

equipment availability in Canada and Australia through in-house

fleet maintenance, reliability programs, technical improvements,

and management systems;

- Operational

excellence - with a specific focus on Nuna Group of Companies, put

into action practical and experienced-based protocols to ensure

predictable high-quality project execution;

- Integration -

implement ERP and best practices at MacKellar, including

identification of opportunities to better utilize our capital and

equipment in Australia;

- Diversification -

pursue diversification of customers and resources through strategic

partnerships, industry expertise and investment in Indigenous joint

ventures; and

- Sustainability -

further develop and deliver into our environmental, social, and

governance targets as disclosed and committed to in our annual

reporting.

Liquidity

Our current liquidity positions us well moving forward to fund

organic growth and the required correlated working capital

investments. Including equipment financing availability and

factoring in the amended Credit Facility agreement, total available

capital liquidity of $189.0 million includes total liquidity of

$145.9 million and $26.0 million of unused finance lease borrowing

availability as at June 30, 2024. Liquidity is primarily

provided by the terms of our $480.7 million credit facility which

allows for funds availability based on a trailing twelve-month

EBITDA as defined in the agreement.

|

|

|

|

June 30,2024 |

|

|

|

December 31,2023 |

|

|

Cash |

|

$ |

68,343 |

|

|

$ |

88,614 |

|

|

Credit Facility borrowing limit |

|

|

480,706 |

|

|

|

478,022 |

|

|

Credit Facility drawn |

|

|

(370,706 |

) |

|

|

(317,488 |

) |

|

Letters of credit outstanding |

|

|

(32,366 |

) |

|

|

(31,272 |

) |

|

Cash liquidity(i) |

|

$ |

145,977 |

|

|

$ |

217,876 |

|

|

Finance lease borrowing limit |

|

|

350,000 |

|

|

|

350,000 |

|

| Other

debt borrowing limit |

|

|

20,000 |

|

|

|

20,000 |

|

|

Equipment financing drawn |

|

|

(258,701 |

) |

|

|

(220,466 |

) |

|

Guarantees provided to joint ventures |

|

|

(68,325 |

) |

|

|

(74,831 |

) |

|

Total capital liquidity(i) |

|

$ |

188,951 |

|

|

$ |

292,579 |

|

(i)See "Non-GAAP Financial Measures".

NACG’s Outlook for 2024

The following table provides projected key measures for 2024.

These measures are predicated on contracts currently in place,

including expected renewals, and the heavy equipment fleet that we

own and operate.

|

Key measures |

|

2024 |

|

Combined revenue(i) |

|

$1.4 - $1.5B |

|

Adjusted EBITDA(i) |

|

$395 - $415M |

|

Sustaining capital(i) |

|

$150 - $170M |

|

Adjusted EPS(i) |

|

$3.95 - $4.15 |

| Free

cash flow(i) |

|

$100 - $120M |

| |

|

|

|

Capital allocation |

|

|

|

Growth spending(i) |

|

$55 - $70M |

|

Net debt leverage(i) |

|

Targeting 1.8x |

(i)See "Non-GAAP Financial Measures".

Conference Call and Webcast

Management will hold a conference call and

webcast to discuss our financial results for the quarter ended

June 30, 2024, tomorrow, Thursday, August 1, 2024, at

7:00 am Mountain Time (9:00 am Eastern Time).

The call can be accessed by dialing: Toll free:

1-800-717-1738Conference ID: 50329

A replay will be available through September 2, 2024, by

dialing: Toll Free: 1-888-660-6264 Conference ID: 50329Playback

Passcode: 50329The Q2 2024 earnings presentation for the webcast

will be available for download on the company’s website at

www.nacg.ca/presentations/

The live presentation and webcast can be accessed at:

North American Construction Group Ltd. Second Quarter Results

Conference Call Registration (onlinexperiences.com)

A replay will be available until September 2, 2024, using the

link provided.

Basis of Presentation

We have prepared our consolidated financial

statements in conformity with accounting principles generally

accepted in the United States ("US GAAP"). Unless otherwise

specified, all dollar amounts discussed are in Canadian dollars.

Please see the Management’s Discussion and Analysis ("MD&A")

for the quarter ended June 30, 2024, for further detail on the

matters discussed in this release. In addition to the MD&A,

please reference the dedicated Q2 2024 Results Presentation for

more information on our results and projections which can be found

on our website under Investors - Presentations.

Change in significant accounting policy

- Basis of presentation

During the first quarter of 2024, we changed our accounting

policy for the elimination of our proportionate share of profit

from downstream sales to affiliates and joint ventures to record

through equity earnings in affiliates and joint ventures on the

Consolidated Statements of Operations and Comprehensive Income.

Prior to this change, we eliminated our proportionate share of

profit on downstream sales to affiliates and joint ventures through

revenue and cost of sales. The change in accounting policy

simplifies the presentation for downstream profit eliminations and

has no cumulative impact on retained earnings. We have accounted

for the change retrospectively in accordance with the requirements

of US GAAP Accounting Standards Codification ("ASC") 250 by

restating the comparative period. For details of retrospective

changes, refer to note 16 in the Financial Statements.

Forward-Looking Information

The information provided in this release contains

forward-looking statements. Forward-looking statements include

statements preceded by, followed by or that include the words

"anticipate", "believe", "expect", "should" or similar expressions

and include all information provided under the above heading

"NACG's Outlook".

The material factors or assumptions used to develop the above

forward-looking statements and the risks and uncertainties to which

such forward-looking statements are subject, are highlighted in the

MD&A for the three and six months ended June 30, 2024. Actual

results could differ materially from those contemplated by such

forward-looking statements because of any number of factors and

uncertainties, many of which are beyond NACG’s control. Undue

reliance should not be placed upon forward-looking statements and

NACG undertakes no obligation, other than those required by

applicable law, to update or revise those statements. For more

complete information about NACG, please read our disclosure

documents filed with the SEC and the CSA. These free documents can

be obtained by visiting EDGAR on the SEC website at

www.sec.gov or on the CSA website at www.sedarplus.com.

Non-GAAP Financial Measures

This press release presents certain non-GAAP financial measures

because management believes that they may be useful to investors in

analyzing our business performance, leverage and liquidity. The

non-GAAP financial measures we present include "adjusted EBIT",

"adjusted EBITDA", "adjusted EBITDA margin", "adjusted EPS",

"adjusted net earnings", "capital additions", "capital work in

progress", "cash provided by operating activities prior to change

in working capital", "combined gross profit", "combined gross

profit margin", "equity investment EBIT", "free cash flow",

"general and administrative expenses (excluding stock-based

compensation)", "gross profit margin", "growth capital", "margin",

"net debt", "sustaining capital", "total capital liquidity", "total

combined revenue", and "total debt". A non-GAAP financial measure

is defined by relevant regulatory authorities as a numerical

measure of an issuer's historical or future financial performance,

financial position or cash flow that is not specified, defined or

determined under the issuer’s GAAP and that is not presented in an

issuer’s financial statements. These non-GAAP measures do not have

any standardized meaning and therefore are unlikely to be

comparable to similar measures presented by other companies. They

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP. Each

non-GAAP financial measure used in this press release is defined

and reconciled to its most directly comparable GAAP measure in the

"Non-GAAP Financial Measures" section of our Management’s

Discussion and Analysis filed concurrently with this press

release.

Reconciliation of total reported revenue to total

combined revenue

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2024 |

|

|

|

2023 |

(ii) |

|

|

2024 |

|

|

|

2023 |

(ii) |

|

Revenue from wholly-owned entities per financial statements |

|

$ |

276,314 |

|

|

$ |

195,188 |

|

|

$ |

573,340 |

|

|

$ |

439,517 |

|

| Share

of revenue from investments in affiliates and joint ventures |

|

|

112,377 |

|

|

|

158,485 |

|

|

|

238,215 |

|

|

|

347,970 |

|

|

Elimination of joint venture subcontract revenue |

|

|

(58,968 |

) |

|

|

(75,105 |

) |

|

|

(136,119 |

) |

|

|

(186,578 |

) |

|

Total combined revenue(i) |

|

$ |

329,723 |

|

|

$ |

278,568 |

|

|

$ |

675,436 |

|

|

$ |

600,909 |

|

(i)See "Non-GAAP Financial Measures".(ii)The prior year amounts

are adjusted to reflect a change in accounting policy. See "Change

in significant accounting policy - Basis of presentation".

Reconciliation of reported gross profit to combined

gross profit

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2024 |

|

|

|

2023 |

(ii) |

|

|

2024 |

|

|

|

2023 |

(ii) |

|

Gross profit from wholly-owned entities per financial

statements |

|

$ |

49,669 |

|

|

$ |

21,595 |

|

|

$ |

102,959 |

|

|

$ |

62,695 |

|

|

Share of gross profit from investments in affiliates and joint

ventures |

|

|

10,681 |

|

|

|

14,663 |

|

|

|

19,616 |

|

|

|

29,482 |

|

|

Combined gross profit(i) |

|

$ |

60,350 |

|

|

$ |

36,258 |

|

|

$ |

122,575 |

|

|

$ |

92,177 |

|

(i)See "Non-GAAP Financial Measures".(ii)The prior year amounts

are adjusted to reflect a change in accounting policy. See "Change

in significant accounting policy - Basis of presentation".

Reconciliation of net income to adjusted net earnings,

adjusted EBIT, and adjusted EBITDA

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income |

|

$ |

14,007 |

|

|

$ |

12,262 |

|

|

$ |

25,376 |

|

|

$ |

34,108 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

Loss (gain) on disposal of property, plant and equipment |

|

|

32 |

|

|

|

(713 |

) |

|

|

293 |

|

|

|

500 |

|

|

Stock-based compensation (benefit) expense |

|

|

(1,859 |

) |

|

|

4,804 |

|

|

|

1,749 |

|

|

|

10,741 |

|

|

Change in fair value of contingent obligation from adjustments to

estimates |

|

|

7,420 |

|

|

|

— |

|

|

|

8,858 |

|

|

|

— |

|

|

Restructuring costs |

|

|

— |

|

|

|

— |

|

|

|

4,517 |

|

|

|

— |

|

|

Write-down on assets held for sale |

|

|

4,181 |

|

|

|

— |

|

|

|

4,181 |

|

|

|

— |

|

|

Loss on equity investment customer bankruptcy claim settlement |

|

|

— |

|

|

|

759 |

|

|

|

— |

|

|

|

759 |

|

|

Loss (gain) on derivative financial instruments |

|

|

273 |

|

|

|

(1,852 |

) |

|

|

273 |

|

|

|

(4,361 |

) |

|

Net unrealized (gain) loss on derivative financial instruments

included in equity earnings in affiliates and joint ventures |

|

|

(984 |

) |

|

|

(1,655 |

) |

|

|

970 |

|

|

|

(1,221 |

) |

|

Tax effect of the above items |

|

|

(2,248 |

) |

|

|

(1,116 |

) |

|

|

(4,507 |

) |

|

|

(2,760 |

) |

|

Adjusted net earnings(i) |

|

|

20,822 |

|

|

|

12,489 |

|

|

|

41,710 |

|

|

|

37,766 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

Tax effect of the above items |

|

|

2,248 |

|

|

|

1,116 |

|

|

|

4,507 |

|

|

|

2,760 |

|

|

Increase in fair value of contingent obligation from interest

accretion expense |

|

|

4,143 |

|

|

|

— |

|

|

|

8,098 |

|

|

|

— |

|

|

Interest expense, net |

|

|

14,339 |

|

|

|

7,511 |

|

|

|

29,936 |

|

|

|

14,822 |

|

|

Income tax expense |

|

|

5,152 |

|

|

|

1,757 |

|

|

|

9,557 |

|

|

|

10,159 |

|

|

Equity earnings in affiliates and joint ventures(iii) |

|

|

(6,629 |

) |

|

|

(9,344 |

) |

|

|

(5,117 |

) |

|

|

(18,686 |

) |

|

Equity investment EBIT(i)(iii) |

|

|

6,555 |

|

|

|

9,541 |

|

|

|

2,787 |

|

|

|

19,324 |

|

|

Adjusted EBIT(i) |

|

|

46,630 |

|

|

|

23,070 |

|

|

|

91,478 |

|

|

|

66,145 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

39,941 |

|

|

|

24,664 |

|

|

|

84,182 |

|

|

|

61,355 |

|

|

Write-down on assets held for sale |

|

|

(4,181 |

) |

|

|

— |

|

|

|

(4,181 |

) |

|

|

— |

|

|

Equity investment depreciation and amortization(i) |

|

|

4,491 |

|

|

|

4,099 |

|

|

|

8,653 |

|

|

|

8,956 |

|

|

Adjusted EBITDA(i) |

|

$ |

86,881 |

|

|

$ |

51,833 |

|

|

$ |

180,132 |

|

|

$ |

136,456 |

|

(i)See "Non-GAAP Financial Measures".

Reconciliation of equity earnings in affiliates and

joint ventures to equity investment EBIT

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2024 |

|

|

|

2023 |

(ii) |

|

|

2024 |

|

|

|

2023 |

(ii) |

|

Equity earnings in affiliates and joint ventures |

|

$ |

6,629 |

|

|

$ |

9,344 |

|

|

$ |

5,117 |

|

|

$ |

18,686 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Interest (income) expense, net |

|

|

(146 |

) |

|

|

(530 |

) |

|

|

(719 |

) |

|

|

(173 |

) |

|

Income tax expense |

|

|

72 |

|

|

|

722 |

|

|

|

(1,436 |

) |

|

|

846 |

|

|

Loss (gain) on disposal of property, plant and equipment |

|

|

— |

|

|

|

5 |

|

|

|

(175 |

) |

|

|

(35 |

) |

|

Equity investment EBIT(i) |

|

$ |

6,555 |

|

|

$ |

9,541 |

|

|

$ |

2,787 |

|

|

$ |

19,324 |

|

(i)See "Non-GAAP Financial Measures".(ii)The prior year amounts

are adjusted to reflect a change in accounting policy. See "Change

in significant accounting policy - Basis of presentation".

About the Company

North American Construction Group Ltd. is a premier provider of

heavy civil construction and mining services in Canada, the U.S.

and Australia. For 70 years, NACG has provided services to the

mining, resource and infrastructure construction markets.

For further information contact:

Jason VeenstraChief Financial OfficerNorth American Construction

Group Ltd.(780) 960-7171IR@nacg.cawww.nacg.caInterim Consolidated

Balance Sheets

(Expressed in thousands of Canadian

Dollars)(Unaudited)

|

|

|

|

June 30,2024 |

|

|

|

December 31,2023 |

|

|

Assets |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash |

|

$ |

68,343 |

|

|

$ |

88,614 |

|

|

Accounts receivable |

|

|

142,451 |

|

|

|

97,855 |

|

|

Contract assets |

|

|

12,886 |

|

|

|

35,027 |

|

|

Inventories |

|

|

69,388 |

|

|

|

64,962 |

|

|

Prepaid expenses and deposits |

|

|

7,942 |

|

|

|

7,402 |

|

|

Assets held for sale |

|

|

10,707 |

|

|

|

1,340 |

|

|

|

|

|

311,717 |

|

|

|

295,200 |

|

|

Property, plant and equipment, net of accumulated depreciation of

$453,854 (December 31, 2023 – $423,345) |

|

|

1,204,091 |

|

|

|

1,142,946 |

|

|

Operating lease right-of-use assets |

|

|

13,962 |

|

|

|

12,782 |

|

|

Investments in affiliates and joint ventures |

|

|

81,206 |

|

|

|

81,435 |

|

| Other

assets |

|

|

5,666 |

|

|

|

7,144 |

|

|

Intangible assets |

|

|

8,066 |

|

|

|

6,971 |

|

|

Total assets |

|

$ |

1,624,708 |

|

|

$ |

1,546,478 |

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

119,742 |

|

|

$ |

146,190 |

|

|

Accrued liabilities |

|

|

57,100 |

|

|

|

72,225 |

|

|

Contract liabilities |

|

|

9 |

|

|

|

59 |

|

|

Current portion of long-term debt |

|

|

91,962 |

|

|

|

81,306 |

|

|

Current portion of contingent obligations |

|

|

32,350 |

|

|

|

22,501 |

|

|

Current portion of operating lease liabilities |

|

|

1,670 |

|

|

|

1,742 |

|

|

|

|

|

302,833 |

|

|

|

324,023 |

|

|

Long-term debt |

|

|

692,150 |

|

|

|

611,313 |

|

|

Long-term portion of contingent obligations |

|

|

81,478 |

|

|

|

93,356 |

|

|

Operating lease liabilities |

|

|

12,705 |

|

|

|

11,307 |

|

| Other

long-term obligations |

|

|

42,103 |

|

|

|

41,001 |

|

|

Deferred tax liabilities |

|

|

113,808 |

|

|

|

108,824 |

|

|

|

|

|

1,245,077 |

|

|

|

1,189,824 |

|

|

Shareholders' equity |

|

|

|

|

|

Common shares (authorized – unlimited number of voting common

shares; issued and outstanding – June 30, 2024 - 27,827,282

(December 31, 2023 – 27,827,282)) |

|

|

229,455 |

|

|

|

229,455 |

|

|

Treasury shares (June 30, 2024 - 1,097,940 (December 31, 2023 -

1,090,187)) |

|

|

(16,394 |

) |

|

|

(16,165 |

) |

|

Additional paid-in capital |

|

|

23,279 |

|

|

|

20,739 |

|

|

Retained earnings |

|

|

143,060 |

|

|

|

123,032 |

|

|

Accumulated other comprehensive income (loss) |

|

|

231 |

|

|

|

(407 |

) |

|

Shareholders' equity |

|

|

379,631 |

|

|

|

356,654 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

1,624,708 |

|

|

$ |

1,546,478 |

|

Interim Consolidated Statements of Operations andComprehensive

Income

(Expressed in thousands of Canadian Dollars, except per share

amounts)(Unaudited)

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

(i) |

|

|

2024 |

|

|

|

2023 |

(i) |

|

Revenue |

|

$ |

276,314 |

|

|

$ |

195,188 |

|

|

$ |

573,340 |

|

|

$ |

439,517 |

|

| Cost of sales |

|

|

187,022 |

|

|

|

149,241 |

|

|

|

386,817 |

|

|

|

316,085 |

|

|

Depreciation |

|

|

39,623 |

|

|

|

24,352 |

|

|

|

83,564 |

|

|

|

60,737 |

|

|

Gross profit |

|

|

49,669 |

|

|

|

21,595 |

|

|

|

102,959 |

|

|

|

62,695 |

|

| General and administrative

expenses |

|

|

10,932 |

|

|

|

11,974 |

|

|

|

25,685 |

|

|

|

26,153 |

|

| Loss

(gain) on disposal of property, plant and equipment |

|

|

32 |

|

|

|

(713 |

) |

|

|

293 |

|

|

|

500 |

|

|

Operating income |

|

|

38,705 |

|

|

|

10,334 |

|

|

|

76,981 |

|

|

|

36,042 |

|

| Interest expense, net |

|

|

14,339 |

|

|

|

7,511 |

|

|

|

29,936 |

|

|

|

14,822 |

|

| Equity earnings in affiliates

and joint ventures |

|

|

(6,629 |

) |

|

|

(9,344 |

) |

|

|

(5,117 |

) |

|

|

(18,686 |

) |

| Change in fair value of

contingent obligations |

|

|

11,563 |

|

|

|

— |

|

|

|

16,956 |

|

|

|

— |

|

| Loss

(gain) on derivative financial instruments |

|

|

273 |

|

|

|

(1,852 |

) |

|

|

273 |

|

|

|

(4,361 |

) |

|

Income before income taxes |

|

|

19,159 |

|

|

|

14,019 |

|

|

|

34,933 |

|

|

|

44,267 |

|

| Current income tax (benefit)

expense |

|

|

(1,469 |

) |

|

|

567 |

|

|

|

2,765 |

|

|

|

1,703 |

|

|

Deferred income tax expense |

|

|

6,621 |

|

|

|

1,190 |

|

|

|

6,792 |

|

|

|

8,456 |

|

|

Net income |

|

$ |

14,007 |

|

|

$ |

12,262 |

|

|

$ |

25,376 |

|

|

$ |

34,108 |

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

Unrealized foreign currency translation (gain) loss |

|

|

(1,331 |

) |

|

|

417 |

|

|

|

(638 |

) |

|

|

362 |

|

|

Comprehensive income |

|

$ |

15,338 |

|

|

$ |

11,845 |

|

|

$ |

26,014 |

|

|

$ |

33,746 |

|

|

Per share information |

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

0.52 |

|

|

$ |

0.46 |

|

|

$ |

0.95 |

|

|

$ |

1.29 |

|

|

Diluted net income per share |

|

$ |

0.47 |

|

|

$ |

0.42 |

|

|

$ |

0.86 |

|

|

$ |

1.12 |

|

(i)The prior year amounts are adjusted to reflect a change in

accounting policy. See "Accounting Estimates, Pronouncements and

Measures".

|

|

|

|

June 30,2024 |

|

|

|

December 31,2023 |

|

|

Assets |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash |

|

$ |

68,343 |

|

|

$ |

88,614 |

|

|

Accounts receivable |

|

|

142,451 |

|

|

|

97,855 |

|

|

Contract assets |

|

|

12,886 |

|

|

|

35,027 |

|

|

Inventories |

|

|

69,388 |

|

|

|

64,962 |

|

|

Prepaid expenses and deposits |

|

|

7,942 |

|

|

|

7,402 |

|

|

Assets held for sale |

|

|

10,707 |

|

|

|

1,340 |

|

|

|

|

|

311,717 |

|

|

|

295,200 |

|

|

Property, plant and equipment, net of accumulated depreciation of

$453,854 (December 31, 2023 – $423,345) |

|

|

1,204,091 |

|

|

|

1,142,946 |

|

|

Operating lease right-of-use assets |

|

|

13,962 |

|

|

|

12,782 |

|

|

Investments in affiliates and joint ventures |

|

|

81,206 |

|

|

|

81,435 |

|

| Other

assets |

|

|

5,666 |

|

|

|

7,144 |

|

|

Intangible assets |

|

|

8,066 |

|

|

|

6,971 |

|

|

Total assets |

|

$ |

1,624,708 |

|

|

$ |

1,546,478 |

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

119,742 |

|

|

$ |

146,190 |

|

|

Accrued liabilities |

|

|

57,100 |

|

|

|

72,225 |

|

|

Contract liabilities |

|

|

9 |

|

|

|

59 |

|

|

Current portion of long-term debt |

|

|

91,962 |

|

|

|

81,306 |

|

|

Current portion of contingent obligations |

|

|

32,350 |

|

|

|

22,501 |

|

|

Current portion of operating lease liabilities |

|

|

1,670 |

|

|

|

1,742 |

|

|

|

|

|

302,833 |

|

|

|

324,023 |

|

|

Long-term debt |

|

|

692,150 |

|

|

|

611,313 |

|

|

Long-term portion of contingent obligations |

|

|

81,478 |

|

|

|

93,356 |

|

|

Operating lease liabilities |

|

|

12,705 |

|

|

|

11,307 |

|

| Other

long-term obligations |

|

|

42,103 |

|

|

|

41,001 |

|

|

Deferred tax liabilities |

|

|

113,808 |

|

|

|

108,824 |

|

|

|

|

|

1,245,077 |

|

|

|

1,189,824 |

|

|

Shareholders' equity |

|

|

|

|

|

Common shares (authorized – unlimited number of voting common

shares; issued and outstanding – June 30, 2024 - 27,827,282

(December 31, 2023 – 27,827,282)) |

|

|

229,455 |

|

|

|

229,455 |

|

|

Treasury shares (June 30, 2024 - 1,097,940 (December 31, 2023 -

1,090,187)) |

|

|

(16,394 |

) |

|

|

(16,165 |

) |

|

Additional paid-in capital |

|

|

23,279 |

|

|

|

20,739 |

|

|

Retained earnings |

|

|

143,060 |

|

|

|

123,032 |

|

|

Accumulated other comprehensive income (loss) |

|

|

231 |

|

|

|

(407 |

) |

|

Shareholders' equity |

|

|

379,631 |

|

|

|

356,654 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

1,624,708 |

|

|

$ |

1,546,478 |

|

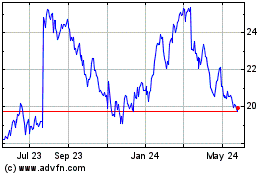

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Oct 2024 to Nov 2024

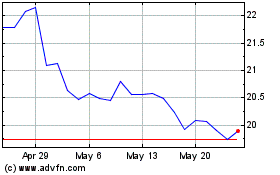

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Nov 2023 to Nov 2024