Nu Holdings Ltd. (NYSE: NU), (“Nu” or the “Company”), one of the

world’s largest digital financial services platforms, released

today its Third Quarter 2023 financial results. Financial results

are expressed in U.S. dollars and are presented in accordance with

International Financial Reporting Standards (IFRS). The full

earnings release has been made available on the Company’s Investor

Relations website at www.investors.nu, as well as the details of

the Earnings Conference Call Nu will hold today at 5:00 pm Eastern

time/7:00 pm Brasília time.

“Nu is on a remarkable upward trajectory, demonstrating solid

operating performance, continued growth, and increasingly robust

profitability. We reached 90 million customers in October, and

closed Q3’23 with ever-increasing principality and engagement

rates, cost to serve remaining below the dollar level, and

efficiency ratio further improving 40bp QoQ to 35.0%. ARPAC broke

double digits for the first time, at US$10.0, annualized ROE

achieved 21% and annualized adjusted ROE reached 25%, showcasing

our operational leverage. All of that led to a record revenue for

the period, surpassing the US$2 billion mark, resulting in a net

income of US$303 million and an adjusted net income of US$356

million. It’s important to note that we are achieving these strong

levels of profitability while keeping asset quality in line with

expectations and continuing to invest in product portfolio and geo

expansion,” said David Vélez, founder and CEO of Nubank.

Q3’23 Results Snapshot

Below are the Q3’23 performance highlights of Nu Holdings

Ltd.:

Operating Highlights:

- Customer growth: Nu added 5.4 million customers in Q3’23

and 18.7 million year-over-year (YoY), reaching a total of 89.1

million customers globally by September 30, 2023. This achievement

underscores Nu's position as one of the largest and fastest-growing

digital financial services platforms worldwide and the

fifth-largest financial institution in Latin America by number of

customers. In Brazil, Nu’s customer base reached 84 million by

September 30, 2023, accounting for 51% of the country’s adult

population, up from 49% in the previous quarter. Nu is the

fourth-largest financial institution by number of customers in the

country, according to Brazilian Central Bank data. When measured by

the number of customers with access to a credit product, Nu is the

second-largest. In October 2023, after the closing of Q3’23, Nu

surpassed the mark of 90 million customers globally and 85 million

in Brazil.

- Engagement and activity rates: Monthly Average Revenue

per Active Customer (ARPAC) reached a new milestone, breaking into

double digits at $10.0, an 18% expansion YoY on FX neutral basis

(FXN)1 and with more mature cohorts already above $26. Engagement

and principality also continued to increase, driving revenues up,

with Nu becoming the primary banking relationship for over 59% of

the monthly active customers that have been with Nu for over a

year, and activity rate2 growing to 82.8%. Moreover, Nucoin, a

free-of-charge native token that rewards users’ engagement through

a loyalty program launched in March 2023, reached 10.5 million

active customers.

- Low-cost operating platform: While ARPAC keeps expanding

quarter over quarter, Monthly Average Cost to Serve Per Active

Customer remained virtually unchanged and below the dollar level at

$0.9. The company’s efficiency ratio, which reflects Nu’s operating

leverage, continued to improve for the seventh consecutive quarter,

reaching another all-time low of 35.0%. This strengthens Nu’s

position as one of the most efficient companies in Latin

America.

- Asset Quality: Nu’s 15-90 NPL ratio hit 4.2%, decreasing

10 basis points quarter over quarter, in line with expectations.

The 90+ NPL ratio increased 20 basis points quarter over quarter to

6.1% given the expected stacking behavior of the early delinquency

buckets from previous periods. Much like in other quarters, Nu

continued to outperform the industry on a like-for-like basis,

across different income bands, and with an even more pronounced

comparative advantage for the lower income bands.

Financial Highlights:

- Net & Adjusted Income: At a Holding level, Nu

continued to drive increased profitability and posted a Net Income

of $303.0 million for an annualized ROE of 21%, compared to a $7.8

million profit in Q3’22. Adjusted Net Income3, reached $355.6

million with an annualized adjusted ROE of 25%, compared to an

Adjusted Net Income of $63.1 million in Q3’22. It’s important to

note that Nu is achieving these strong levels of profitability

while maintaining substantial investments in future products and

geographic expansion, and simultaneously delivering a robust

revenue growth rate.

- Revenue: Nu posted $2.1 billion in revenues, a new

all-time record high, which represents a 53% increase FXN from

Q3’22 and a 4x increase in only two years FXN. This comes as a

result of the compounding effect of customer growth and higher

levels of customer monetization.

- Gross Profit: Nu’s Q3’23 gross profit expanded to $915

million, a 100% increase YoY FXN. Gross profit margin expanded once

more to 43% from 33% in Q3’22, solidifying the upward trajectory

initiated last year.

- Capital: Nu strengthened its position as one of the

best-capitalized players in the region with a Capital Adequacy

Ratio (CAR) in Brazil of 11%, well above the minimum required of

6.75% applicable to the conglomerate as of September 2023,

according to the Brazilian Central Bank resolution. Nu Holdings has

$2.3 billion in excess cash, which can be strategically allocated

to the markets and operating subsidiaries as Nu continues to

grow.

- Liquidity: On September 30, 2023, Nu had an

interest-earning portfolio (IEP) of $6.7 billion, while total

deposits were at $19.1 billion, up 26% YoY FXN. Nu continues

optimizing its balance sheet, as reflected in its 35%

loan-to-deposit ratio which increased from 25% a year ago.

Business highlights:

- Performance and Growth in Brazil: Nu’s growth trajectory

continues, surpassing 1.5 million new customers per month. Over the

past 12 months, Nu’s customer base in Brazil has outpaced that of

the five largest incumbent banks combined. This growth, both in

terms of size and engagement, combined with the operational

leverage of Nu’s platform and the maturation of early products, has

contributed to the significant acceleration of income growth.

- International Expansion: In Mexico, Nu’s customer base

grew to 4.3 million, driven by the rollout and expansion of the

savings account product Cuenta Nu, which currently has over 2.4

million customers, as well as the success of the member-get-member

program. In Colombia, Nu’s customer base expanded to around 800,000

customers, and, similarly to Mexico, the growth trajectory is

expected to accelerate with the upcoming launch of the savings

product.

- Multi-Product Platform: Nu’s product portfolio keeps

growing with credit cards, NuAccounts, and personal loans reaching

approximately 39 million, 65 million, and 7 million active

customers, respectively. There are currently over 1 million active

insurance policies, and over 12 million investment active

customers, which translates to Nu likely maintaining its

positioning as the largest digital investment platform in Latin

America in number of clients. Furthermore, in Brazil, Nu has made

substantial progress in broadening its product portfolio, with the

recent introduction of Payroll loans for federal public servants,

retired and pensioners who are beneficiaries of the INSS (National

Institute of Social Security) and FGTS-backed loans, as well as the

consolidation as leader of the Pix space with ~23% of all

transactions going through Nu.

Footnotes 1 FX neutral measures were calculated to

present what such measures in preceding periods/years would have

been had exchange rates remained stable from these preceding

periods/years until the date of the Company’s more recent financial

information. 2 Activity rate is defined as monthly active customers

divided by the total number of customers as of a specific date. 3

Adjusted Net Income is a non-IFRS measure calculated using Net

Income adjusted for expenses related to Nu's share-based

compensation as well as the hedge accounting and tax effects

related to these items, among others. For more information, please

see “Non-IFRS Financial Measures and Reconciliations – Adjusted Net

Income Reconciliation".

CONFERENCE EARNINGS CALL

DETAILS

Nu will hold a Conference Earnings Call

today at 5:00pm Eastern time/7:00pm Brasília time with simultaneous

translation in Portuguese and English.

To pre-register for this call, please

click here.

A replay of the webcast will be made

available after the call on the Investor Relations page: click

here.

Note on forward-looking statements and non-IFRS financial

measures This release speaks at the date hereof and the Company

is under no obligation to update or keep current the information

contained in this presentation. Any information expressed herein is

subject to change without notice. Any market or other third-party

data included in this presentation has been obtained by the Company

from third-party sources. While the Company has compiled and

extracted the market data, it can provide no assurances of the

accuracy and completeness of such information and takes no

responsibility for such data.

This release contains forward-looking statements. All statements

other than statements of historical fact contained in this

presentation may be forward-looking statements and include, but are

not limited to, statements regarding the Company’s intent, belief

or current expectations. These forward-looking statements are

subject to risks and uncertainties, and may include, among others,

financial forecasts and estimates based on assumptions or

statements regarding plans, objectives and expectations. Although

the Company believes that these estimates and forward-looking

statements are based upon reasonable assumptions, they are subject

to several risks and uncertainties and are made in light of

information currently available, and actual results may differ

materially from those expressed or implied in the forward-looking

statements due to various factors, including those risks and

uncertainties included under the captions “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in the prospectus dated December 8, 2021

filed with the Securities and Exchange Commission pursuant to Rule

424(b) under the Securities Act of 1933, as amended, and in the

Annual Report on Form 20-F for the year ended December 31, 2022,

which was filed with the Securities and Exchange Commission on

April 20, 2023. The Company, its advisers and each of their

respective directors, officers and employees disclaim any

obligation to update the Company’s view of such risks and

uncertainties or to publicly announce the result of any revision to

the forward-looking statements made herein, except where it would

be required to do so under applicable law. The forward-looking

statements can be identified, in certain cases, through the use of

words such as “believe,” “may,” “might,” “can,” “could,” “is

designed to,” “will,” “aim,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “forecast”, “plan”, “predict”, “potential”,

“aspiration,” “should,” “purpose,” “belief,” and similar, or

variations of, or the negative of such words and expressions. The

financial information in this document includes forecasts,

projections and other predictive statements that represent the

Company’s assumptions and expectations in light of currently

available information. These forecasts, projections and other

predictive statements are based on the Company’s expectations and

are subject to variables and uncertainties. The Company’s actual

performance results may differ. Consequently, no guarantee is

presented or implied as to the accuracy of specific forecasts,

projections or predictive statements contained herein, and undue

reliance should not be placed on the forward-looking statements in

this presentation, which are inherently uncertain.

In addition to IFRS financials, this presentation includes

certain summarized, non-audited or non-IFRS financial information.

These summarized, non-audited or non-IFRS financial measures are in

addition to, and not a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS. References

in this presentation to “R$” refer to the Brazilian Real, the

official currency of Brazil.

About Nu Nu is one of the world’s largest digital

financial services platforms, serving around 90 million customers

across Brazil, Mexico and Colombia. As one of the leading

technology companies in the world, Nu leverages proprietary

technologies and innovative business practices to create new

financial solutions and experiences for individuals and SMEs that

are simple, intuitive, convenient, low-cost, empowering and human.

Guided by a mission to fight complexity and empower people, Nu is

fostering the access to financial services across Latin America,

connecting profit and purpose to create value for its stakeholders

and have a positive impact on the communities it serves. For more

information, please visit www.nubank.com.br

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114401843/en/

Investors Relations Jorg Friedemann

investors@nubank.com.br

Media Relations Leila Suwwan press@nubank.com.br

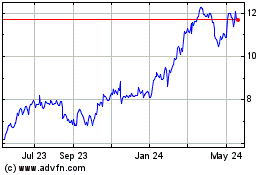

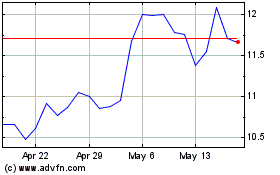

Nu (NYSE:NU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nu (NYSE:NU)

Historical Stock Chart

From Dec 2023 to Dec 2024