UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 10)

MORPHOSYS AG

(Name of Subject Company (Issuer))

NOVARTIS BIDCO AG

an indirect wholly owned subsidiary of

NOVARTIS AG

(Name of Filing Persons (Offerors))

Ordinary Shares, no Par Value

(Title of Class of Securities)

617760202

(CUSIP Number of Class of Securities)

Karen L. Hale

Chief Legal Officer

Novartis AG

Lichstrasse 35

CH-4056 Basel

Switzerland

Telephone: +41-61-324-1111

Fax: +41-61-324-7826

(Name, Address, and Telephone Number of Person

Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

| |

Jenny Hochenberg

Freshfields Bruckhaus Deringer US LLP

601 Lexington Ave.

New York, NY 10022

Telephone: +1 646 863-1626 |

|

|

Doug Smith

Freshfields Bruckhaus Deringer LLP

100 Bishopsgate

London EC2P 2SR

United Kingdom

+44 20 7936 4000 |

|

Check the appropriate boxes below to designate any transactions to

which the statement relates:

x third-party tender offer subject to Rule 14d-1.

¨

issuer tender offer subject to Rule 13e-4.

¨

going-private transaction subject to Rule 13e-3.

¨ amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final

amendment reporting the results of the tender offer: x

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

¨ Rule 13e-4(i)

(Cross-Border Issuer Tender Offer)

¨ Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

This Amendment No. 10 (this

“Amendment”) amends and supplements the Tender Offer Statement on Schedule TO filed with the Securities and Exchange

Commission (the “SEC”) on July 5, 2024 (together with any amendments and supplements hereto, the “Schedule

TO”) by (i) Novartis BidCo AG, a stock corporation organized under the laws of Switzerland (the “Bidder”)

and an indirect wholly owned subsidiary of Novartis AG, a company organized under the laws of Switzerland (“Novartis”),

and (ii) Novartis. This Schedule TO relates to the public delisting purchase offer by the Bidder for all no-par value bearer

shares (including the shares represented by American Depository Shares), not directly held by Novartis BidCo Germany AG, in MorphoSys

AG (“MorphoSys Shares”), a stock corporation established under the laws of Germany (“MorphoSys”),

at an offer price of EUR 68.00 per MorphoSys Share in cash, pursuant to the final terms and provisions set forth in the offer document

for the delisting purchase offer, dated July 4, 2024, a copy of which was filed as Exhibit (a)(1)(A) to the Schedule TO (together

with any amendments or supplements thereto, the “Offer Document”) and, where applicable, the related Declaration of

Acceptance or ADS Letter of Transmittal and the instructions thereto, copies of which were filed as Exhibits (a)(1)(B) and (a)(1)(E),

respectively, to the Schedule TO (together with any other related materials, as each may be amended or supplemented from time to time,

collectively constitute the “Delisting Purchase Offer”).

This Amendment is being filed

solely to amend and supplement items to the extent specifically provided herein. Except as otherwise set forth in this Amendment,

the information set forth in the Schedule TO, including all exhibits thereto, remains unchanged and is incorporated herein by reference

to the extent relevant to the items in this Amendment. This Amendment should be read together with the Schedule TO.

ITEMS 1 THROUGH 11.

Items 1 through 11 of the

Schedule TO are hereby amended and supplemented by adding the following:

On August 13, 2024, the Bidder

published an announcement in the German Federal Gazette (the “Announcement”) announcing that, until August 2, 2024,

24:00 hours (local time Frankfurt am Main, Germany) / 18:00 hours (local time New York, United States of America), the acceptance of the

Delisting Purchase Offer has been declared for a total of 1,037,601 MorphoSys Shares and for a further 179,325 MorphoSys Shares represented

by MorphoSys ADSs, i.e. for a total of 1,216,926 MorphoSys Shares. This corresponds to approximately 3.23% of the share capital and share

capital with voting rights of MorphoSys. The transfer of the 1,216,926 MorphoSys Shares to the Bidder took place on August 13, 2024.

An English translation of

the Announcement is filed hereto as Exhibit (a)(5)(M) and is incorporated herein by reference.

ITEM 12. EXHIBITS.

Item 12 of the Schedule TO

is hereby amended and supplemented by adding the following:

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 13, 2024

| |

NOVARTIS BIDCO AG |

| |

|

| |

By: |

/s/

David Quartner |

| |

|

Name: |

David Quartner |

| |

|

Title: |

As Attorney |

| |

|

| |

By: |

/s/

Tariq Elrafie |

| |

|

Name: |

Tariq Elrafie |

| |

|

Title: |

As Attorney |

| |

|

| |

NOVARTIS AG |

| |

|

| |

By: |

/s/

David Quartner |

| |

|

Name: |

David Quartner |

| |

|

Title: |

As Attorney |

| |

|

| |

By: |

/s/

Tariq Elrafie |

| |

|

Name: |

Tariq Elrafie |

| |

|

Title: |

As Attorney |

Exhibit (a)(5)(M)

– Convenience Translation –

(Only the German version is legally binding)

Novartis BidCo AG

Announcement pursuant to Section 23 para. 2

sentence 1 of the German Securities Acquisition

and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz – “WpÜG”)

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

(IN WHOLE OR IN PART) IN ANY OTHER JURISDICTION OR INTO OR FROM ANY OTHER JURISDICTION WHERE TO DO SO WOULD VIOLATE THE LAWS OF SUCH JURISDICTION.

On 11 April 2024, Novartis BidCo, Basel,

Switzerland (“Bidder”), has published the offer document regarding its takeover offer (cash offer) (the “Takeover

Offer”) to the shareholders of MorphoSys AG, Planegg, Germany (“MorphoSys”) for the acquisition of all no-par

value bearer shares (ISIN DE0006632003) (“MorphoSys Shares”) including all no-par value bearer shares represented

by American Depositary Shares (ISIN US6177602025) (“MorphoSys ADS”; the MorphoSys Shares and the MorphoSys ADSs

collectively the “MorphoSys Securities”) in MorphoSys against payment of a cash consideration in the amount of EUR

68.00 per MorphoSys Share. The acceptance period of the offer expired on 13 May 2024, 24:00 hours (local time Frankfurt am Main,

Germany) and 18:00 hours (local time New York, United States of America). The publication pursuant to Section 23 para. 1 sentence 1

no. 2 WpÜG was made on 16 May 2024. The additional acceptance period pursuant to Section 16 para. 2 sentence 1

WpÜG expired on 30 May 2024, 24:00 hours (local time Frankfurt am Main, Germany) / 18:00 hours (local time New York, United

States of America).

Outside the offer procedure, the Bidder published

the offer document regarding its public delisting purchase offer (cash offer) (the “Delisting Purchase Offer”) to the

shareholders of MorphoSys for the acquisition of all MorphoSys Shares not directly held by the Bidder, including all MorphoSys Shares

represented by MorphoSys ADSs, against payment of a cash consideration in the amount of EUR 68.00 per share on 4 July 2024.

The acceptance period of the Delisting Purchase Offer expired on 2 August 2024, 24:00 hours (local time Frankfurt am Main, Germany) /

18:00 hours (local time New York, United States of America).

Until 2 August 2024, 24:00 hours (local time Frankfurt

am Main, Germany) / 18:00 hours (local time New York, United States of America) and therefore after the publication of the offer document

of the Takeover Offer and prior to the expiry of one year after the publication pursuant to section 23 para. 1 sentence 1

no. 2 WpÜG, the acceptance of the Delisting Purchase Offer has been declared for a total of 1,037,601 MorphoSys Shares and for

a further 179,325 MorphoSys Shares represented by MorphoSys ADSs, i.e. for a total of 1,216,926 MorphoSys Shares. This corresponds to

approximately 3.23% of the share capital and share capital with voting rights of MorphoSys. The transfer of the 1,216,926 MorphoSys Shares

to the Bidder against payment of the offer price took place on 13 August 2024.

Basel, 13 August 2024

Novartis BidCo AG

Board of Directors

Important notice:

This

announcement is neither an offer to purchase nor a solicitation of an offer to sell shares in MorphoSys AG (“MorphoSys”).

The terms and conditions of the takeover offer, as well as further provisions concerning the takeover offer, are published in the offer

document, the publication of which has been permitted by the German Federal Financial Supervisory Authority (Bundesanstalt für

Finanzdienstleistungsaufsicht). Holders of MorphoSys Shares and MorphoSys ADSs (together “MorphoSys Securityholders”)

are strongly advised to read the offer document and all other documents regarding the takeover offer, as they contain important information.

The

offer relates to shares in a German company and is subject to the statutory provisions of the Federal Republic of Germany governing the

conduct of such an offer. For this reason, the offer will be carried out in accordance with the German Securities Acquisition and

Takeover Act (Wertpapiererwerbs- und Übernahmegesetz) (“WpÜG”) and the Regulation on the Content of

the Offer Document, the Consideration to be granted in Takeover Offers and Mandatory Offers and the Exemption from the Obligation to Publish

and Launch an Offer (Verordnung über den Inhalt der Angebotsunterlage, die Gegenleistung bei Übernahmeangeboten und Pflichtangeboten

und die Befreiung von der Verpflichtung zur Veröffentlichung und zur Abgabe eines Angebots – WpÜG-Angebotsverordnung)

(“WpÜG Offer Regulation”).

Furthermore,

the offer is carried out in accordance with the securities laws of the United States of America (“United States”),

including the provisions applicable to tender offers of the U.S. Securities Exchange Act of 1934, as amended (“U.S. Exchange

Act”) and the rules and regulations promulgated thereunder. In order to reconcile certain areas where German law and U.S. law

conflict, Novartis BidCo AG (“Bidder”) applied for exemptive or no-action relief from the U.S. Securities and Exchange

Commission (“SEC”) prior to the publication of the offer document, which was granted on 9 April 2024 (in total the

“U.S. Offer Rules”). Against this background, the Bidder is exempt from compliance with certain provisions of the U.S.

Exchange Act for tender offers. As a result, the offer is principally subject to disclosure requirements and other procedural requirements

(e.g. with respect to settlement, withdrawal rights and acceptance periods) of the Federal Republic of Germany, which differ not insignificantly

from the corresponding U.S. laws.

The

Bidder and its affiliates within the meaning of US law (“Affiliates”) or brokers (acting as agents of the Bidder

or its Affiliates) may acquire, or make arrangements to acquire, MorphoSys Shares other than in the course of the offer, via the stock

exchange at market prices or outside the stock exchange on negotiated terms during the period in which the offer remains open for acceptance

or afterwards, provided that (i) such acquisitions or arrangements to acquire (if made during the pendency of the offer) are made outside

of the United States; and (ii) such acquisitions or arrangements to acquire comply with the applicable statutory provisions, in particular

the WpÜG and, to the extent applicable, the U.S. Offer Rules. This also applies to other securities convertible into, exchangeable

for or exercisable for shares of MorphoSys. The Offer Price must be adjusted to any higher purchase price or an additional payment claim

in respect of tendered MorphoSys Shares arises in the amount of the difference between the offer price and the higher purchase price paid

outside the offer. To the extent such acquisitions should occur, information about them, including the number and price of the acquired

MorphoSys Shares, will be published according to the applicable statutory provisions, especially Sec. 23 para. 2 WpÜG in conjunction

with Sec. 14 para. 3 sentence 1 WpÜG, in the German Federal Gazette (Bundesanzeiger) and on the internet at www.novartis.com/investors/morphosys-acquisition.

In addition, the financial advisors of the Bidder may also act in the ordinary course of trading in securities of MorphoSys, which may

include purchases or agreements to purchase such securities.

MorphoSys

Securityholders who are residing in the United States, or another country outside of the Federal Republic of Germany, may have

difficulties to enforce rights and claims arising under (i) the laws of the country of residency or (ii) U.S. federal securities

laws (e.g., because MorphoSys is incorporated in the Federal Republic of Germany, the Bidder is incorporated in Switzerland and some or

all of the Bidder’s officers and directors may be residents of a country other than the country of residency of the MorphoSys Securityholders).

A MorphoSys Securityholder may not be able to sue, in a court in the country of residency, a foreign company or its officers or directors

for violations of the laws of the country of residency. Further, it may be difficult to compel a foreign company and its Affiliates to

subject themselves to a judgment of a court of the country of residency.

The receipt of the offer price pursuant to the

offer may be a taxable transaction under applicable tax laws, including those of the country of residence. It is strongly recommended

to consult an independent professional advisor immediately regarding the tax consequences of acceptance of the offer. None of the Bidder,

any persons acting jointly with the Bidder within the meaning of Sec. 2 para. 5 sentence 1 and sentence 3 WpÜG or any of

the Bidder’s or their directors, officers or employees accept responsibility for any tax effects on or liabilities of any person

as a result of the acceptance of the offer.

This publication is available

on

the internet at: www.novartis.com/investors/morphosys-acquisition

on:

13 August 2024.

Basel, 13 August 2024

Novartis BidCo AG

Board of Directors

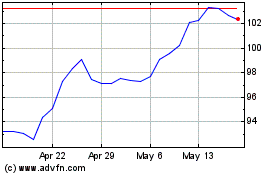

Novartis (NYSE:NVS)

Historical Stock Chart

From Jan 2025 to Feb 2025

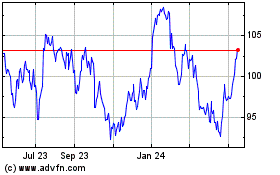

Novartis (NYSE:NVS)

Historical Stock Chart

From Feb 2024 to Feb 2025