July 29, 2024 Second-quarter highlights

- Group sales amounted to EUR 4.5 billion, with comparable sales

growth of 2%

- Comparable order intake increased by 9%

- Income from operations EUR 816 million, including EUR 538

million insurance income*)

- Adjusted EBITA margin increased to 11.1% of sales

- Operating cash inflow of EUR 89 million, with a free cash

outflow of EUR 64 million

Roy Jakobs, CEO of Royal Philips:“I am

encouraged by our return to order intake growth this quarter,

primarily driven by North America. Within a challenging macro

environment we achieved strong margin improvement, supported by our

productivity program, solid operational cashflow due to improved

working capital management and comparable sales growth in line with

our plan.

Performance improvement was driven by progress on our execution

priorities and industry-leading innovations. These included

FDA-cleared AI tools within our next-generation cardiovascular

ultrasound platform to increase automation and productivity.

We continue to focus on enhancing execution, improving

end-to-end supply chain resilience and increasing agility and

productivity through simplifying our operating model. Patient

safety and quality remains our number one priority.”

Group and segment performance Group comparable

sales increased 2%, on the back of strong growth in Q2 2023. Growth

in mature and growth geographies was partly offset by the decline

in China. Comparable order intake grew 9% in the quarter and 3% in

the first half of 2024, reflecting quarterly unevenness in the

order-intake pattern. China remains a fundamentally attractive

growth market with strong underlying demand while the government’s

anti-corruption measures continued to impact short-term hospital

order lead times.

Adjusted EBITA margin for the group increased to 11.1% compared

with 10.1% in Q2 2023, with improvement across all businesses. Free

cash outflow was EUR 64 million and included payments of EUR 415

million in connection with the Respironics economic loss settlement

in the US, partly offset by initial receipt from insurers of EUR

150 million.

In the quarter S&P Global Ratings and Moody’s Ratings

upgraded their credit ratings outlook for Philips to stable.

Philips now has stable outlooks for its strong credit ratings

across all main global credit rating agencies. The relevant reports

and additional credit ratings information can be found here.

Diagnosis & Treatment comparable sales

increased 4%, on the back of double-digit growth in Q2 2023, with

growth across Image Guided Therapy and Precision Diagnosis.

Adjusted EBITA margin improved to 12.2%, mainly driven by improved

sales, pricing and productivity measures.

Connected Care comparable sales increased 2%,

driven by strong growth in Enterprise Informatics, while Monitoring

comparable sales growth was flat on the back of strong double-digit

growth in Q2 2023. Adjusted EBITA margin improved to 8.8%, mainly

driven by productivity measures and pricing.

Personal Health comparable sales increased 2%

globally, driven by sales growth outside of China. Adjusted EBITA

margin improved to 16.9%, mainly driven by operational improvements

and productivity measures. Productivity

Total productivity savings of EUR 195 million in the quarter:

operating model savings of EUR 57 million, procurement savings of

EUR 71 million, and other programs' savings of EUR 67 million.

Outlook Philips reiterates its confidence in

delivering the 2025 plan, acknowledging that uncertainties remain.

For the full year 2024, Philips continues to expect 3-5% comparable

sales growth, an Adjusted EBITA margin of 11-11.5%, and free cash

flow of EUR 0.9-1.1 billion.

The outlook excludes the potential impact of the ongoing Philips

Respironics-related legal proceedings, including the investigation

by the US Department of Justice.

Customer, innovation and ESG highlights

- Philips signed multi-year partnerships for monitoring and

image-guided therapy with several university hospitals in the

Netherlands and will provide patient monitors for the new Grand

Hôpital de Charleroi in Belgium, as well as roll out its ePatch and

AI-driven analytics platform across 14 hospitals in Spain.

- Philips secured customer wins in the US including a major

multi-year strategic partnership with Bon Secours Mercy Health, one

of the country’s largest health systems, standardizing innovative

patient monitoring solutions across its 49 hospitals, driving

better patient outcomes and reducing burdens on staff.

- Reinforcing its #1 global position in cardiovascular

ultrasound, Philips is launching its next-generation AI-enabled

cardiovascular ultrasound platform with new FDA-cleared AI tools

integrated into the company’s EPIQ CVx and Affiniti CVx ultrasound

system to advance cardiovascular imaging and increase automation

and productivity.

- Demonstrating its innovation leadership in minimally invasive

treatments, Philips announced the first implant of the Duo Venous

Stent System following pre-market approval from the US FDA. The

system’s flexible design allows clinicians to better treat patients

with deep venous disease.

- Philips unveiled a series of consumer health innovations in the

Greater China market, meeting key consumer needs across the region.

This includes the launch of the first medical-grade Philips Lumea

8000 Series IPL hair removal device with cooling technology, the

limited-edition Transformers-themed 5000, 7000 and 9000 series

shavers, and the new Sonicare 5300 power toothbrush.

- S&P recognized Philips as a leader in ESG as one of the

first ‘Light green’ scores in their newly launched Climate

Transition Assessment. Philips was also included in the ‘FTSE4Good’

ESG index, and NGO Health Care Without Harm confirmed that Philips

meets its Climate Excellence Standard for Health Care

Suppliers.

- Philips won 43 Red Dot design awards, including special

recognition for LumiGuide, the company’s 3D medical device guidance

solution that’s paving the way for radiation-free minimally

invasive surgery.

Capital allocation In the second quarter,

Philips completed the EUR 1.5 billion share repurchase program for

capital reduction purposes that was announced on July 26, 2021, and

canceled the 4,437,164 shares acquired this year. Philips also

distributed a dividend of EUR 0.85 per common share in the form of

shares only, resulting in the issuance of 30,860,582 new common

shares. Following the distribution of dividend and the cancellation

of shares, the total number of issued shares amounts to 939,939,384

common shares. More information is available via this link. *)

Related to Respironics product liability claim.

Click here to view the release online

For further information, please contact:

Elco van Groningen Philips External Relations

Tel.: +31 6 8103 9584 E-mail: elco.van.groningen@philips.com

Ben Zwirs Philips External Relations Tel.: +31 6

1521 3446 E-mail: ben.zwirs@philips.com Dorin Danu

Philips Investor Relations Tel.: +31 20 59 77055 E-mail:

dorin.danu@philips.com About Royal Philips Royal

Philips (NYSE: PHG, AEX: PHIA) is a leading health technology

company focused on improving people's health and well-being through

meaningful innovation. Philips’ patient- and people-centric

innovation leverages advanced technology and deep clinical and

consumer insights to deliver personal health solutions for

consumers and professional health solutions for healthcare

providers and their patients in the hospital and the home.

Headquartered in the Netherlands, the company is a leader in

diagnostic imaging, ultrasound, image-guided therapy, monitoring

and enterprise informatics, as well as in personal health. Philips

generated 2023 sales of EUR 18.2 billion and employs approximately

68,700 employees with sales and services in more than 100

countries. News about Philips can be found at

www.philips.com/newscenter.

Forward-looking statements and other important

information Forward-looking statements This document and

the related oral presentation, including responses to questions

following the presentation, contain certain forward-looking

statements with respect to the financial condition, results of

operations and business of Philips and certain of the plans and

objectives of Philips with respect to these items. Examples of

forward-looking statements include statements made about strategy,

estimates of sales growth, future Adjusted EBITA*), future

restructuring and acquisition related charges and other costs,

future developments in Philips’ organic business and the completion

of acquisitions and divestments. Forward-looking statements can be

identified generally as those containing words such as

“anticipates”, “assumes”, “believes”, “estimates”, “expects”,

“should”, “will”, “will likely result”, “forecast”, “outlook”,

“projects”, “may” or similar expressions. By their nature, these

statements involve risk and uncertainty because they relate to

future events and circumstances and there are many factors that

could cause actual results and developments to differ materially

from those expressed or implied by these statements. These factors

include but are not limited to: Philips’ ability to gain leadership

in health informatics in response to developments in the health

technology industry; Philips’ ability to keep pace with the

changing health technology environment; macroeconomic and

geopolitical changes; integration of acquisitions and their

delivery on business plans and value creation expectations;

securing and maintaining Philips’ intellectual property rights, and

unauthorized use of third-party intellectual property rights;

Philips’ ability to meet expectations with respect to ESG-related

matters; failure of products and services to meet quality or

security standards, adversely affecting patient safety and customer

operations; breaches of cybersecurity; challenges in simplifying

our organization and our ways of working; the resilience of our

supply chain; attracting and retaining personnel; challenges in

driving operational excellence and speed in bringing innovations to

market; compliance with regulations and standards including

quality, product safety and (cyber) security; compliance with

business conduct rules and regulations including privacy and

upcoming ESG disclosure and due diligence requirements; treasury

and financing risks; tax risks; reliability of internal controls,

financial reporting and management process; and global inflation.

As a result, Philips’ actual future results may differ materially

from the plans, goals and expectations set forth in such

forward-looking statements. For a discussion of factors that could

cause future results to differ from such forward-looking

statements, see also the Risk management chapter included in the

Annual Report 2023. Reference is also made to section Risk

management in the Philips semi-annual report 2024.

Third-party market share data Statements regarding

market share contained in this document, including those regarding

Philips’ competitive position, are based on outside sources such as

specialized research institutes, as well as industry and dealer

panels, in combination with management estimates. Where information

is not yet available to Philips, market share statements may also

be based on estimates and projections prepared by management and/or

based on outside sources of information. Management’s estimates of

rankings are based on order intake or sales, depending on the

business. Market Abuse Regulation This press

release contains inside information within the meaning of Article

7(1) of the EU Market Abuse Regulation. Use of non-IFRS

information In presenting and discussing the Philips

Group’s financial position, operating results and cash flows,

management uses certain non-IFRS financial measures. These non-IFRS

financial measures should not be viewed in isolation as

alternatives to the equivalent IFRS measure and should be used in

conjunction with the most directly comparable IFRS measures.

Non-IFRS financial measures do not have standardized meaning under

IFRS and therefore may not be comparable to similar measures

presented by other issuers. A reconciliation of these non-IFRS

measures to the most directly comparable IFRS measures is contained

in this document. Further information on non-IFRS measures can be

found in the Annual Report 2023. Presentation All

amounts are in millions of euros unless otherwise stated. Due to

rounding, amounts may not add up precisely to totals provided. All

reported data is unaudited. Financial reporting is in accordance

with the accounting policies as stated in the Annual Report 2023.

Prior-period amounts have been reclassified to conform to the

current-period presentation; this includes immaterial

organizational changes. Effective Q1 2024, Philips has revised the

order intake policy to reflect the full contract value for software

contracts that start generating revenue within an 18-month horizon,

instead of only the next 18-months-to-revenue horizon. This change

has been implemented to better align with the specific business

model of our software businesses, simplify the order intake

process, and better align with peers. Prior-period comparable order

intake percentages have been restated accordingly. This revision

has not resulted in any material changes to the order intake

percentages for the periods presented. Per share calculations have

been adjusted retrospectively for all periods presented to reflect

the issuance of shares in the second quarter of 2024 in connection

with the 2023 share dividend. *) Non-IFRS financial measure. Refer

to Reconciliation of non-IFRS information.

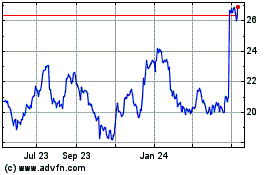

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Jan 2025 to Feb 2025

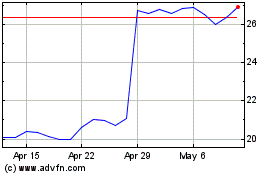

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Feb 2024 to Feb 2025