0001637207false00016372072025-02-252025-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

February 25, 2025

Date of Report (Date of earliest event reported)

Planet Fitness, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-37534 | | 38-3942097 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

4 Liberty Lane West

Hampton, NH 03842

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code: (603) 750-0001

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.0001 Par Value | PLNT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 25, 2025, Planet Fitness, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and year ended December 31, 2024. A copy of this press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 2.02.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | |

| PLANET FITNESS, INC. |

| | |

| By: | | /s/ Jay Stasz |

Name:

Title: | | Jay Stasz

Chief Financial Officer |

Dated: February 25, 2025

Exhibit 99.1

Planet Fitness, Inc. Announces Fourth Quarter and Year-End 2024 Results

Full-year system-wide same club sales increase of 5.0%

Net membership growth of 1 million since the end of 2023

Opened 150 new Planet Fitness clubs in 2024

Hampton, NH, February 25, 2025 - Today, Planet Fitness, Inc. (NYSE: PLNT) reported financial results for its fourth quarter and year ended December 31, 2024.

Fourth Quarter Fiscal 2024 Highlights

•Total revenue increased from the prior year period by 19.4% to $340.5 million.

•System-wide same club sales increased 5.5%.

•System-wide sales increased to $1.2 billion from $1.1 billion in the prior year period.

•Net income attributable to Planet Fitness, Inc. was $47.1 million, or $0.56 per diluted share, compared to $35.3 million, or $0.41 per diluted share, in the prior year period.

•Net income increased $10.8 million to $47.6 million, compared to $36.8 million in the prior year period.

•Adjusted net income(1) increased $6.6 million to $59.7 million, or $0.70 per diluted share(1), compared to $53.1 million, or $0.60 per diluted share, in the prior year period.

•Adjusted EBITDA(1) increased $16.5 million to $130.8 million from $114.3 million in the prior year period.

•86 new Planet Fitness clubs were opened system-wide during the period, which included 78 franchisee-owned and 8 corporate-owned clubs, bringing system-wide total clubs to 2,722 as of December 31, 2024.

•Ended the year with cash and marketable securities of $529.5 million, which includes cash and cash equivalents of $293.2 million, restricted cash of $56.5 million and marketable securities of $179.8 million.

Fiscal Year 2024 Highlights

•Total revenue increased from the prior year period by 10.3% to $1.2 billion.

•System-wide same club sales increased 5.0%.

•System-wide sales increased to $4.8 billion from $4.5 billion in the prior year period.

•Net income attributable to Planet Fitness, Inc. was $172.0 million, or $2.00 per diluted share, compared to $138.3 million, or $1.62 per diluted share, in the prior year period.

•Net income increased $27.2 million to $174.2 million, compared to $147.0 million in the prior year period.

•Adjusted net income(1) increased $24.7 million to $223.8 million, or $2.59 per diluted share(1), compared to $199.0 million, or $2.24 per diluted share, in the prior year period.

•Adjusted EBITDA(1) increased $52.3 million to $487.7 million from $435.4 million in the prior year period.

•150 new Planet Fitness clubs were opened system-wide during the period, which included 129 franchisee-owned and 21 corporate-owned clubs, bringing system-wide total clubs to 2,722 as of December 31, 2024.

“We had strong results in 2024 and closed out the year with 19.7 million members, posting revenue growth of more than 10% and growing Adjusted EBITDA by approximately 12%,” said Colleen Keating, Chief Executive Officer. “To further enhance the attractiveness of our returns for our franchisees, we rolled out a new economic model for opening and operating a Planet Fitness club and raised the new member Classic Card price for the first time in more than 25 years. Additionally, we continue to make meaningful progress executing our strategic imperatives of redefining our brand, enhancing member experience, refining our product and optimizing our format, and accelerating club openings. As consumers continue to prioritize health and wellness, we are well positioned to grow our brand, strengthen our industry leading position, and ultimately deliver increased shareholder value.”

1 Adjusted net income, Adjusted net income per share, diluted and Adjusted EBITDA are non-GAAP measures. For reconciliations of Adjusted net income and Adjusted EBITDA to U.S. GAAP (“GAAP”) net income and a computation of Adjusted net income per share, diluted, see “Non-GAAP Financial Measures” accompanying this press release.

Operating Results for the Fourth Quarter Ended December 31, 2024

For the fourth quarter of 2024, total revenue increased $55.4 million or 19.4% to $340.5 million from $285.1 million in the prior year period, including system-wide same club sales growth of 5.5%. By segment:

•Franchise segment revenue increased $10.8 million or 11.0% to $109.0 million from $98.2 million in the prior year period. Of the increase, $5.6 million was due to higher royalty revenue, of which $3.5 million was attributable to a franchise same club sales increase of 5.7%, $1.3 million was attributable to new clubs opened since October 1, 2023 before they move into the same club sales base and $0.7 million was from higher royalties on annual fees. There was also a $3.1 million increase in placement revenue and a $1.7 million increase in franchise and other fees, partially offset by a $1.3 million decrease in revenue associated with the sale of HVAC units to franchisees. Franchise segment revenue also included $1.9 million of higher National Advertising Fund (“NAF”) revenue;

•Corporate-owned clubs segment revenue increased $9.9 million or 8.5% to $126.3 million from $116.4 million in the prior year period. Of the increase, $3.6 million was attributable to corporate-owned clubs included in the same club sales base, of which $1.5 million was attributable to a same club sales increase of 4.4%, $0.9 million was attributable to higher annual fee revenue and $1.2 million was attributable to higher other fees. Additionally, $6.4 million was from new clubs opened since October 1, 2023 before they move into the same club sales base; and

•Equipment segment revenue increased $34.7 million or 49.2% to $105.1 million from $70.4 million in the prior year period. Of the increase, $30.4 million was due to higher revenue from equipment sales to existing franchisee-owned clubs, including additional strength equipment sold in the fourth quarter of 2024, and $4.3 million was due to higher revenue from equipment sales to new franchisee-owned clubs. In the fourth quarter of 2024, we had equipment sales to 77 new franchisee-owned clubs compared to 67 in the prior year period.

For the fourth quarter of 2024, net income attributable to Planet Fitness, Inc. was $47.1 million, or $0.56 per diluted share, compared to $35.3 million, or $0.41 per diluted share, in the prior year period. Net income was $47.6 million in the fourth quarter of 2024 compared to $36.8 million in the prior year period. Adjusted net income increased 12.4% to $59.7 million, or $0.70 per diluted share, compared to $53.1 million, or $0.60 per diluted share, in the prior year period. Adjusted net income has been adjusted to reflect a normalized income tax rate of 25.9% for both the fourth quarters of 2024 and 2023, respectively, and excludes certain non-cash and other items that we do not consider in the evaluation of ongoing operational performance (see “Non-GAAP Financial Measures”).

Segment Adjusted EBITDA represents our Adjusted EBITDA broken out by the Company’s reportable segments. Adjusted EBITDA is defined as net income before interest, taxes, depreciation and amortization, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing performance of the Company’s core operations, see “Non-GAAP Financial Measures” accompanying this press release.

Segment Adjusted EBITDA was as follows:

•Franchise Segment Adjusted EBITDA increased $6.7 million or 9.8% to $74.7 million. The increase was primarily the result of $10.8 million of higher franchise segment revenue as described above, partially offset by $1.8 million of higher NAF expense, $1.6 million of higher cost of revenue and $0.4 million of higher selling, general and administrative expense;

•Corporate-owned clubs Segment Adjusted EBITDA increased $0.8 million or 1.8% to $46.4 million. The increase was primarily attributable to $0.8 million from new clubs opened since October 1, 2023 before they move into the same club sales base.

•Equipment Segment Adjusted EBITDA increased $13.1 million or 78.3% to $29.9 million. The increase was primarily driven by higher equipment sales to existing and new franchisee-owned clubs, including additional strength equipment sold to existing franchisee-owned clubs in the fourth quarter of 2024, and higher margin equipment sales related to an updated equipment mix as a result of the adoption of the new growth model.

Operating Results for the Fiscal Year Ended December 31, 2024

For the fiscal year ended December 31, 2024, total revenue increased $110.3 million or 10.3% to $1.2 billion from $1.1 billion in the prior year period, including system-wide same club sales growth of 5.0%. By segment:

•Franchise segment revenue increased $35.3 million or 9.1% to $423.2 million from $387.9 million in the prior year period. Of the increase, $25.5 million was due to higher royalty revenue, of which $13.9 million was attributable to a franchise same club sales increase of 5.2%, $6.2 million was attributable to new clubs opened since January 1, 2023 before they move into the same club sales base and $5.4 million was from higher royalties on annual fees. There was also a $1.2 million increase in franchise and other fees and a $1.1 million increase in placement revenue, partially

offset by a $1.4 million decrease in revenue associated with the sale of HVAC units to franchisees. Franchise segment revenue also included $8.9 million of higher NAF revenue;

•Corporate-owned clubs segment revenue increased $53.0 million or 11.8% to $502.3 million from $449.3 million in the prior year period. Of the increase, $41.7 million was attributable to corporate-owned clubs included in the same club sales base, of which $23.6 million was attributable to a same clubs sales increase of 4.5%, $8.7 million was attributable to higher annual fee revenue and $9.4 million was attributable to higher other fees. Additionally, $11.3 million was from new clubs opened and acquired since January 1, 2023 before they move into the same club sales base.

•Equipment segment revenue increased $22.0 million or 9.4% to $256.1 million from $234.1 million in the prior year period. The increase was primarily attributable to higher revenue from equipment sales to existing franchisee-owned clubs of $28.3 million, including additional strength equipment sold in the fourth quarter of 2024, partially offset by lower revenue from equipment sales to new franchisee-owned clubs of $6.3 million. In the year ended December 31, 2024, we had equipment sales to 124 new franchisee-owned clubs compared to 135 in the prior year.

For the fiscal year ended December 31, 2024, net income attributable to Planet Fitness, Inc. was $172.0 million, or $2.00 per diluted share, compared to $138.3 million, or $1.62 per diluted share, in the prior year period. Net income was $174.2 million in the fiscal year ended December 31, 2024 compared to $147.0 million in the prior year period. Adjusted net income increased 12.4% to $223.8 million, or $2.59 per diluted share, compared to $199.0 million, or $2.24 per diluted share, in the prior year period. Adjusted net income has been adjusted to reflect a normalized income tax rate of 25.9% for both the fiscal years ended December 31, 2024 and 2023, respectively, and excludes certain non-cash and other items that we do not consider in the evaluation of ongoing operational performance (see “Non-GAAP Financial Measures”).

Segment Adjusted EBITDA was as follows:

•Franchise Segment Adjusted EBITDA increased $28.1 million or 10.3% to $301.1 million. The increase was primarily the result of $35.3 million of higher franchise segment revenue, as described above, and $3.1 million of lower selling, general and administrative expense, partially offset by $8.9 million of higher NAF expense;

•Corporate-owned clubs Segment Adjusted EBITDA increased $15.4 million or 8.9% to $188.8 million. The increase was primarily attributable to $21.1 million from corporate-owned clubs included in the same club sales base, partially offset by $3.4 million from the opening and operating of five clubs in Spain during 2024 and $2.3 million from new and acquired clubs since January 1, 2023 before they move into the same club sales base.

•Equipment Segment Adjusted EBITDA increased $15.4 million or 27.4% to $71.8 million. The increase was primarily driven by higher equipment sales to existing franchisee-owned clubs, including additional strength equipment sold to existing franchisee-owned clubs in the fourth quarter of 2024, and higher margin equipment sales related to an updated equipment mix as a result of the adoption of the new growth model.

2025 Outlook

For the year ending December 31, 2025, the Company expects the following:

•New equipment placements of approximately 130 to 140 in franchisee-owned locations

•System-wide new club openings of approximately 160 to 170 locations

The following are 2025 growth expectations over its 2024 results:

•System-wide same club sales growth in the 5% to 6% range

•Revenue to increase approximately 10%

•Adjusted EBITDA to increase approximately 10%

•Adjusted net income to increase in the 8% to 9% range

•Adjusted net income per share, diluted to increase in the 11% to 12% range, based on adjusted diluted weighted-average shares outstanding of approximately 84.5 million, inclusive of shares expected to be repurchased.

The Company also expects 2025 net interest expense to be approximately $86.0 million. It also expects capital expenditures to increase approximately 25% driven by additional clubs in our corporate-owned portfolio and depreciation and amortization to remain flat compared to 2024.

Presentation of Financial Measures

Planet Fitness, Inc. (the “Company”) was formed in March 2015 for the purpose of facilitating the initial public offering (the “IPO”) and related recapitalization transactions that occurred in August 2015, and in order to carry on the business of Pla-Fit Holdings, LLC (“Pla-Fit Holdings”) and its subsidiaries. As the sole managing member of Pla-Fit Holdings, the Company operates and controls all of the business and affairs of Pla-Fit Holdings, and through Pla-Fit Holdings, conducts its business. As a result, the Company consolidates Pla-Fit Holdings’ financial results and reports a non-controlling interest related to the portion of Pla-Fit Holdings not owned by the Company.

The financial information presented in this press release includes non-GAAP financial measures such as Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted, to provide measures that we believe are useful to investors in evaluating the Company’s performance. These non-GAAP financial measures are supplemental measures of the Company’s performance that are neither required by, nor presented in accordance with GAAP. These financial measures should not be considered in isolation or as substitutes for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. In addition, in the future, the Company may incur expenses or charges such as those added back to calculate Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted. The Company’s presentation of Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted, should not be construed as an inference that the Company’s future results will be unaffected by similar amounts or other unusual or nonrecurring items. See the tables at the end of this press release for a reconciliation of Adjusted EBITDA, Adjusted net income, and Adjusted net income per share, diluted, to their most directly comparable GAAP financial measure.

The non-GAAP financial measures used in our full-year outlook will differ from net income and net income per share, diluted, determined in accordance with GAAP in ways similar to those described in the reconciliations at the end of this press release. We do not provide guidance for net income or net income per share, diluted, determined in accordance with GAAP or a reconciliation of guidance for Adjusted net income and Adjusted net income per share, diluted, to the most directly comparable GAAP measure because we are not able to predict with reasonable certainty the amount or nature of all items that will be included in our net income and net income per share, diluted, for the year ending December 31, 2025. These items are uncertain, depend on many factors and could have a material impact on our net income and net income per share, diluted, for the year ending December 31, 2025, and therefore cannot be made available without unreasonable effort.

Same club sales refers to year-over-year sales comparisons for the same club sales base of both corporate-owned and franchisee-owned clubs, which is calculated for a given period by including only sales from clubs that had sales in the comparable months of both years. We define the same club sales base to include those clubs that have been open and for which monthly membership dues have been billed for longer than 12 months. We measure same club sales based solely upon monthly dues billed to members of our corporate-owned and franchisee-owned clubs.

Investor Conference Call

The Company will hold a conference call at 8:00AM (ET) on February 25, 2025 to discuss the news announced in this press release. A live webcast of the conference call will be accessible at www.planetfitness.com via the “Investor Relations” link. The webcast will be archived on the website for one year.

About Planet Fitness

Founded in 1992 in Dover, NH, Planet Fitness is one of the largest and fastest-growing franchisors and operators of fitness clubs in the world by number of members and locations. As of December 31, 2024, Planet Fitness had approximately 19.7 million members and 2,722 clubs in all 50 states, the District of Columbia, Puerto Rico, Canada, Panama, Mexico, Australia and Spain. The Company’s mission is to enhance people’s lives by providing a high-quality fitness experience in a welcoming, non-intimidating environment, which we call the Judgement Free Zone®. Approximately 90% of Planet Fitness clubs are owned and operated by independent business men and women.

Investor Contact:

Stacey Caravella

investor@planetfitness.com

603-750-4674

Media Contacts:

McCall Gosselin, Planet Fitness

mccall.gosselin@pfhq.com

603-957-4650

Brittany Fraser, ICR

Brittany.Fraser@icrinc.com

917-658-8750

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include the Company’s statements with respect to expected future performance presented under the heading “2025 Outlook,” those attributed to the Company’s Chief Executive Officer in this press release, the Company’s expected membership growth and club growth, share repurchases and the timing thereof, ability to deliver future shareholder value, and other statements, estimates and projections that do not relate solely to historical facts. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “envision,” “estimate,” “expect,” “intend,” “may,” “might,” “goal,” “plan,” “prospect,” “predict,” “project,” “target,” “potential,” “assumption,” “will,” “would,” “could,” “should,” “continue,” “ongoing,” “contemplate,” “future,” “strategy” and similar references to future periods, although not all forward-looking statements include these identifying words. Forward-looking statements are not assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of the business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control. Actual results and financial condition may differ materially from those indicated in the forward-looking statements. Important factors that could cause our actual results to differ materially include competition in the fitness industry, the Company’s and franchisees’ ability to attract and retain members, the Company’s and franchisees’ ability to identify and secure suitable sites for new franchise clubs, changes in consumer demand, changes in equipment costs, the Company’s ability to expand into new markets domestically and internationally, operating costs for the Company and franchisees generally, availability and cost of capital for franchisees, acquisition activity, developments and changes in laws and regulations, our substantial increased indebtedness as a result of our refinancing and securitization transactions and our ability to incur additional indebtedness or refinance that indebtedness in the future, our future financial performance and our ability to pay principal and interest on our indebtedness, our corporate structure and tax receivable agreements, failures, interruptions or security breaches of the Company's information systems or technology, general economic conditions and the other factors described in the Company’s annual report on Form 10-K for the year ended December 31, 2023 and, once available, the Company's annual report on Form 10-K for the year ended December 31, 2024, as well as the Company’s other filings with the Securities and Exchange Commission. In light of the significant risks and uncertainties inherent in forward-looking statements, investors should not place undue reliance on forward-looking statements, which reflect the Company’s views only as of the date of this press release. Except as required by law, neither the Company nor any of its affiliates or representatives undertake any obligation to provide additional information or to correct or update any information set forth in this release, whether as a result of new information, future developments or otherwise.

Planet Fitness, Inc. and subsidiaries

Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| (in thousands, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Franchise | $ | 89,537 | | | $ | 80,604 | | | $ | 344,320 | | | $ | 317,917 | |

| National advertising fund revenue | 19,485 | | | 17,634 | | | 78,927 | | | 70,012 | |

Franchise segment | 109,022 | | | 98,238 | | | 423,247 | | | 387,929 | |

| Corporate-owned clubs | 126,311 | | | 116,411 | | | 502,287 | | | 449,296 | |

| Equipment | 105,117 | | | 70,437 | | | 256,120 | | | 234,101 | |

| Total revenue | 340,450 | | | 285,086 | | | 1,181,654 | | | 1,071,326 | |

| Operating costs and expenses: | | | | | | | |

| Cost of revenue | 80,494 | | | 57,465 | | | 197,122 | | | 190,026 | |

| Club operations | 74,388 | | | 65,608 | | | 290,507 | | | 253,619 | |

| Selling, general and administrative | 35,693 | | | 31,225 | | | 129,146 | | | 124,930 | |

| National advertising fund expense | 19,385 | | | 17,599 | | | 79,009 | | | 70,095 | |

| Depreciation and amortization | 40,116 | | | 39,159 | | | 160,346 | | | 149,413 | |

| Other losses, net | 628 | | | 2,674 | | | 1,326 | | | 10,379 | |

| Total operating costs and expenses | 250,704 | | | 213,730 | | | 857,456 | | | 798,462 | |

| Income from operations | 89,746 | | | 71,356 | | | 324,198 | | | 272,864 | |

| Other income (expense), net: | | | | | | | |

| Interest income | 6,428 | | | 5,402 | | | 23,115 | | | 17,741 | |

| Interest expense | (27,468) | | | (21,805) | | | (100,037) | | | (86,576) | |

| Other (expense) income, net | (1,680) | | | 2,881 | | | (548) | | | 3,512 | |

| Total other expense, net | (22,720) | | | (13,522) | | | (77,470) | | | (65,323) | |

| Income before income taxes | 67,026 | | | 57,834 | | | 246,728 | | | 207,541 | |

| Provision for income taxes | 18,619 | | | 19,657 | | | 68,443 | | | 58,512 | |

| Losses from equity-method investments, net of tax | (844) | | | (1,414) | | | (4,042) | | | (1,994) | |

| Net income | 47,563 | | | 36,763 | | | 174,243 | | | 147,035 | |

| Less net income attributable to non-controlling interests | 479 | | | 1,423 | | | 2,201 | | | 8,722 | |

| Net income attributable to Planet Fitness, Inc. | $ | 47,084 | | | $ | 35,340 | | | $ | 172,042 | | | $ | 138,313 | |

| Net income per share of Class A common stock: | | | | | | | |

| Basic | $ | 0.56 | | | $ | 0.41 | | | $ | 2.01 | | | $ | 1.63 | |

| Diluted | $ | 0.56 | | | $ | 0.41 | | | $ | 2.00 | | | $ | 1.62 | |

| Weighted-average shares of Class A common stock outstanding: | | | | | | | |

| Basic | 84,224 | | | 85,901 | | | 85,621 | | | 84,896 | |

| Diluted | 84,442 | | | 86,193 | | | 85,827 | | | 85,185 | |

Planet Fitness, Inc. and subsidiaries

Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| (in thousands, except per share amounts) | December 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 293,150 | | | $ | 275,842 | |

| Restricted cash | 56,524 | | | 46,279 | |

Short-term marketable securities | 114,163 | | | 74,901 | |

Accounts receivable, net of allowances for uncollectible amounts of $30 and $0 as of December 31, 2024 and 2023, respectively | 77,145 | | | 41,890 | |

| Inventory | 6,146 | | | 4,677 | |

| Prepaid expenses | 21,499 | | | 13,842 | |

| Other receivables | 16,776 | | | 11,072 | |

| Income tax receivable | 2,616 | | | 3,314 | |

| Total current assets | 588,019 | | | 471,817 | |

Long-term marketable securities | 65,668 | | | 50,886 | |

| Investments, net of allowance for expected credit losses of $18,834 and $17,689 as of December 31, 2024 and 2023, respectively | 75,650 | | | 77,507 | |

| Property and equipment, net of accumulated depreciation of $370,118 and $322,958, as of December 31, 2024 and 2023, respectively | 423,991 | | | 390,405 | |

| Right-of-use assets, net | 395,174 | | | 381,010 | |

| Intangible assets, net | 323,318 | | | 372,507 | |

| Goodwill | 720,633 | | | 717,502 | |

| Deferred income taxes | 470,197 | | | 504,188 | |

| Other assets, net | 7,058 | | | 3,871 | |

| Total assets | $ | 3,069,708 | | | $ | 2,969,693 | |

| Liabilities and stockholders’ deficit | | | |

| Current liabilities: | | | |

| Current maturities of long-term debt | $ | 22,500 | | | $ | 20,750 | |

| Accounts payable | 32,887 | | | 23,788 | |

| Accrued expenses | 67,895 | | | 66,299 | |

| Equipment deposits | 1,851 | | | 4,506 | |

| Deferred revenue, current | 62,111 | | | 59,591 | |

| Payable pursuant to tax benefit arrangements, current | 55,556 | | | 41,294 | |

| Other current liabilities | 39,695 | | | 35,101 | |

| Total current liabilities | 282,495 | | | 251,329 | |

| Long-term debt, net of current maturities | 2,148,029 | | | 1,962,874 | |

| Lease liabilities, net of current portion | 405,324 | | | 381,589 | |

| Deferred revenue, net of current portion | 31,990 | | | 32,047 | |

| Deferred tax liabilities | 1,386 | | | 1,644 | |

| Payable pursuant to tax benefit arrangements, net of current portion | 411,360 | | | 454,368 | |

| Other liabilities | 4,497 | | | 4,833 | |

| Total noncurrent liabilities | 3,002,586 | | | 2,837,355 | |

| | | |

| Stockholders’ equity (deficit): | | | |

Class A common stock, $.0001 par value, 300,000 shares authorized, 84,323 and 86,760 shares issued and outstanding as of December 31, 2024 and 2023, respectively | 9 | | | 9 | |

Class B common stock, $.0001 par value, 100,000 shares authorized, 342 and 1,397 shares issued and outstanding as of December 31, 2024 and 2023, respectively | — | | | — | |

| Accumulated other comprehensive (loss) income | (2,348) | | | 172 | |

| Additional paid in capital | 609,115 | | | 575,631 | |

| Accumulated deficit | (822,156) | | | (691,461) | |

| Total stockholders’ deficit attributable to Planet Fitness, Inc. | (215,380) | | | (115,649) | |

| Non-controlling interests | 7 | | | (3,342) | |

| Total stockholders’ deficit | (215,373) | | | (118,991) | |

| Total liabilities and stockholders’ deficit | $ | 3,069,708 | | | $ | 2,969,693 | |

Planet Fitness, Inc. and subsidiaries

Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Years Ended December 31, |

| (in thousands) | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 174,243 | | | $ | 147,035 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 160,346 | | | 149,413 | |

| Amortization of deferred financing costs | 5,362 | | | 5,492 | |

| Loss on extinguishment of debt | 2,285 | | | — | |

| Accretion of marketable securities discount | (3,307) | | | (3,273) | |

| Losses from equity-method investments, net of tax | 4,042 | | | 1,994 | |

| Dividends accrued on held-to-maturity investment | (2,180) | | | (2,066) | |

Credit loss on held-to-maturity investment | 1,145 | | | 2,732 | |

| Deferred tax expense | 55,689 | | | 51,189 | |

Loss (gain) on re-measurement of tax benefit arrangement liability | 1,300 | | | (1,964) | |

| | | |

(Gain) loss on disposal of property and equipment | (671) | | | 61 | |

| | | |

| Equity-based compensation | 8,913 | | | 7,906 | |

| Other | 1,280 | | | (345) | |

| Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | (36,459) | | | 4,761 | |

| | | |

| Inventory | (1,484) | | | 599 | |

| Other assets and other current assets | (11,785) | | | 929 | |

| | | |

| Accounts payable and accrued expenses | 17,312 | | | (975) | |

| Other liabilities and other current liabilities | (519) | | | (8,106) | |

| Income taxes | 407 | | | 2,183 | |

| Payments pursuant to tax benefit arrangements | (44,946) | | | (34,797) | |

| Equipment deposits | (2,653) | | | (3,937) | |

| Deferred revenue | 2,775 | | | 3,942 | |

| Leases | 12,778 | | | 7,481 | |

| Net cash provided by operating activities | 343,873 | | | 330,254 | |

| Cash flows from investing activities: | | | |

| Additions to property and equipment | (155,061) | | | (135,986) | |

| Acquisitions of franchisees | — | | | (43,264) | |

| Proceeds from sale of property and equipment and insurance proceeds | 1,396 | | | 99 | |

| | | |

| Purchases of marketable securities | (155,423) | | | (203,285) | |

| Maturities of marketable securities | 103,672 | | | 80,490 | |

| Issuance of note receivable, related party | (2,145) | | | — | |

| Other investments | (1,150) | | | (38,045) | |

| Net cash used in investing activities | (208,711) | | | (339,991) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of long-term debt | 800,000 | | | — | |

| | | |

| Proceeds from issuance of Class A common stock | 21,875 | | | 9,160 | |

| Principal payments on capital lease obligations | (98) | | | (193) | |

| Repayment of long-term debt and variable funding notes | (608,688) | | | (20,749) | |

| Payment of deferred financing and other debt-related costs | (12,055) | | | — | |

| Repurchase and retirement of Class A common stock | (300,205) | | | (125,030) | |

| Payment of share repurchase excise tax | (1,032) | | | — | |

| Distributions to members of Pla-Fit Holdings | (4,792) | | | (4,605) | |

Net cash used in financing activities | (104,995) | | | (141,417) | |

| Effects of exchange rate changes on cash and cash equivalents | (2,614) | | | 776 | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 27,553 | | | (150,378) | |

| Cash, cash equivalents and restricted cash, beginning of period | 322,121 | | | 472,499 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 349,674 | | | $ | 322,121 | |

| Supplemental cash flow information: | | | |

| Cash paid for interest | $ | 90,853 | | | $ | 81,184 | |

| Net cash paid for income taxes | $ | 12,072 | | | $ | 5,258 | |

| Non-cash investing activities: | | | |

| Purchases of property and equipment included in accounts payable and accrued expenses | $ | 11,423 | | | $ | 18,639 | |

| Fair value of clubs exchanged for equity-method investment | $ | — | | | $ | 17,000 | |

| | | |

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures

(Unaudited)

To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company uses the following non-GAAP financial measures: Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted (collectively, the “non-GAAP financial measures”). The Company believes that these non-GAAP financial measures, when used in conjunction with GAAP financial measures, are useful to investors in evaluating our operating performance. These non-GAAP financial measures presented in this release are supplemental measures of the Company’s performance that are neither required by, nor presented in accordance with GAAP. These financial measures should not be considered in isolation or as substitutes for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. In addition, in the future, the Company may incur expenses or charges such as those added back to calculate Adjusted EBITDA, Adjusted net income and Adjusted net income per share, diluted. The Company’s presentation of Adjusted EBITDA, Adjusted net income, and Adjusted net income per share, diluted, should not be construed as an inference that the Company’s future results will be unaffected by unusual or nonrecurring items.

Adjusted EBITDA and Segment Adjusted EBITDA

We refer to Adjusted EBITDA as we use this measure to evaluate our operating performance and we believe this measure is useful to investors in evaluating our performance. We define Adjusted EBITDA as net income before interest, taxes, depreciation and amortization, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing performance of the Company’s core operations. We believe that Adjusted EBITDA is an appropriate measure of operating performance because it eliminates the impact of other items that we believe reduce the comparability of our underlying core business performance from period to period and is therefore useful to our investors. Our Board of Directors uses Adjusted EBITDA as a key metric to assess the performance of management. Our Chief Operating Decision Maker also uses Segment Adjusted EBITDA, which is Adjusted EBITDA specific to each of our three reportable segments, to assess the financial performance of and allocate resources to our segments in accordance with ASC 280, Segment Reporting. Corporate overhead costs not directly attributable to any individual segment are not allocated to the three segments and are included in Corporate and Other Adjusted EBITDA within Adjusted EBITDA.

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures

(Unaudited)

A reconciliation of net income, the most directly comparable GAAP measure, to Adjusted EBITDA is set forth below.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 47,563 | | | $ | 36,763 | | | $ | 174,243 | | | $ | 147,035 | |

| Interest income | (6,428) | | | (5,402) | | | (23,115) | | | (17,741) | |

| Interest expense | 27,468 | | | 21,805 | | | 100,037 | | | 86,576 | |

| Provision for income taxes | 18,619 | | | 19,657 | | | 68,443 | | | 58,512 | |

| Depreciation and amortization | 40,116 | | | 39,159 | | | 160,346 | | | 149,413 | |

| EBITDA | 127,338 | | | 111,982 | | | 479,954 | | | 423,795 | |

Transaction fees and acquisition-related costs(1) | — | | | — | | | — | | | 394 | |

| | | | | | | |

Severance costs(2) | — | | | — | | | 1,602 | | | 1,220 | |

Executive transition costs(3) | 1,227 | | | 1,226 | | | 4,200 | | | 3,728 | |

Legal matters(4) | — | | | — | | | — | | | 6,250 | |

| Loss on adjustment of allowance for credit losses on held-to-maturity investment | 297 | | | 2,738 | | | 1,146 | | | 2,732 | |

| Dividend income on held-to-maturity investment | (562) | | | (576) | | | (2,180) | | | (2,066) | |

Tax benefit arrangement remeasurement(5) | 2,074 | | | (1,964) | | | 1,300 | | | (1,964) | |

| | | | | | | |

Amortization of basis difference of equity-method investments(6) | 240 | | | 438 | | | 949 | | | 438 | |

Other(7) | 211 | | | 490 | | | 739 | | | 849 | |

| Adjusted EBITDA | $ | 130,825 | | | $ | 114,334 | | | $ | 487,710 | | | $ | 435,376 | |

(1) Represents transaction fees and acquisition-related costs incurred in connection with our acquisition of franchisee-owned clubs.

(2) Represents severance related expenses recorded in connection with a reduction in force in 2024 and the elimination of the President and Chief Operating Officer position in 2023.

(3) Represents certain expenses recorded in connection with the departure of the former Chief Executive Officer, including costs associated with the search for, and stock-based compensation associated with certain equity awards granted to the Company’s new Chief Executive Officer and retention payments for certain key employees through the Chief Executive Officer transition.

(4) Represents costs associated with legal matters in which the Company is a defendant. In 2023, this represents an increase in the legal reserve, net of legal fees paid, related to preliminary terms of a settlement agreement (the “Preliminary Settlement Agreement”). The legal reserve was subsequently paid in 2023.

(5) Represents a gain (loss) related to the adjustment of our tax benefit arrangements primarily due to changes in our deferred state tax rate.

(6) Represents the Company’s pro-rata portion of the basis difference related to intangible asset amortization expense in its equity method investees, which is included within losses from equity-method investments, net of tax on our consolidated statements of operations.

(7) Represents certain other gains and charges that we do not believe reflect our underlying business performance.

A reconciliation of Segment Adjusted EBITDA to Adjusted EBITDA is set forth below.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Years Ended December 31, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

Adjusted EBITDA | | | | | | | |

| Franchise segment | $ | 74,744 | | | $ | 68,090 | | | $ | 301,122 | | | $ | 273,008 | |

| Corporate-owned clubs segment | 46,397 | | | 45,571 | | | 188,751 | | | 173,322 | |

| Equipment segment | 29,918 | | | 16,777 | | | 71,778 | | | 56,362 | |

Segment Adjusted EBITDA | 151,059 | | | 130,438 | | | 561,651 | | | 502,692 | |

Corporate and other Adjusted EBITDA(1) | (20,234) | | | (16,104) | | | (73,941) | | | (67,316) | |

Adjusted EBITDA(2) | $ | 130,825 | | | $ | 114,334 | | | $ | 487,710 | | | $ | 435,376 | |

(1) Corporate and other Adjusted EBITDA includes adjusted corporate overhead costs, such as payroll and related benefit costs and professional services that are not directly attributable to any individual segment and thus are unallocated.

(2) Segment Adjusted EBITDA plus the Adjusted EBITDA of corporate and other is equal to Adjusted EBITDA. Adjusted EBITDA is a metric that is not presented in accordance with GAAP. Refer to “—Non-GAAP Financial Measures” for a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure.

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures

(Unaudited)

Adjusted Net Income and Adjusted Net Income per Diluted Share

Our presentation of Adjusted net income assumes that all net income is attributable to Planet Fitness, Inc., which assumes the full exchange of all outstanding Holdings Units for shares of Class A common stock of Planet Fitness, Inc., adjusted for certain non-cash and other items that we do not believe directly reflect our core operations. Adjusted net income per share, diluted, is calculated by dividing Adjusted net income by the total weighted-average shares of Class A common stock outstanding plus any dilutive options and restricted stock units as calculated in accordance with GAAP and assuming the full exchange of all outstanding Holdings Units and corresponding Class B common stock as of the beginning of each period presented. Adjusted net income and Adjusted net income per share, diluted, are supplemental measures of operating performance that do not represent and should not be considered alternatives to net income and earnings per share, as calculated in accordance with GAAP. We believe Adjusted net income and Adjusted net income per share, diluted, supplement GAAP measures and enable us to more effectively evaluate our performance period-over-period.

A reconciliation of net income, the most directly comparable GAAP measure, to Adjusted net income, and the computation of Adjusted net income per share, diluted, are set forth below.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| (in thousands, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 47,563 | | | $ | 36,763 | | | $ | 174,243 | | | $ | 147,035 | |

| Provision for income taxes | 18,619 | | | 19,657 | | | 68,443 | | | 58,512 | |

Transaction fees and acquisition-related costs(1) | — | | | — | | | — | | | 394 | |

| | | | | | | |

Severance costs(2) | — | | | — | | | 1,602 | | | 1,220 | |

Executive transition costs(3) | 1,227 | | | 1,226 | | | 4,200 | | | 3,728 | |

Legal matters(4) | — | | | — | | | — | | | 6,250 | |

| Loss on adjustment of allowance for credit losses on held-to-maturity investment | 297 | | | 2,738 | | | 1,146 | | | 2,732 | |

| Dividend income on held-to-maturity investment | (562) | | | (576) | | | (2,180) | | | (2,066) | |

Tax benefit arrangement remeasurement(5) | 2,074 | | | (1,964) | | | 1,300 | | | (1,964) | |

| | | | | | | |

Amortization of basis difference of equity-method investments(6) | 240 | | | 438 | | | 949 | | | 438 | |

Other(7) | 211 | | | 490 | | | 739 | | | 849 | |

Loss on extinguishment of debt(8) | — | | | — | | | 2,285 | | | — | |

Purchase accounting amortization(9) | 10,918 | | | 12,955 | | | 49,190 | | | 51,440 | |

| Adjusted income before income taxes | 80,587 | | | 71,727 | | | 301,917 | | | 268,568 | |

Adjusted income taxes(10) | 20,863 | | | 18,577 | | | 78,163 | | | 69,559 | |

| Adjusted net income | $ | 59,724 | | | $ | 53,150 | | | $ | 223,754 | | | $ | 199,009 | |

| Adjusted net income per share, diluted | $ | 0.70 | | | $ | 0.60 | | | $ | 2.59 | | | $ | 2.24 | |

Adjusted weighted-average shares outstanding, diluted(11) | 84,845 | | | 88,441 | | | 86,537 | | | 88,920 | |

(1) Represents transaction fees and acquisition-related costs incurred in connection with our acquisition of franchisee-owned clubs.

(2) Represents severance related expenses recorded in connection with a reduction in force in 2024 and the elimination of the President and Chief Operating Officer position in 2023.

(3) Represents certain expenses recorded in connection with the departure of the former Chief Executive Officer, including costs associated with the search for, and stock-based compensation associated with certain equity awards granted to the Company’s new Chief Executive Officer and retention payments for certain key employees through the Chief Executive Officer transition.

(4) Represents costs associated with legal matters in which the Company is a defendant. In 2023, this represents an increase in the legal reserve, net of legal fees paid, related to the “Preliminary Settlement Agreement. The legal reserve was subsequently paid in 2023.

(5) Represents a gain (loss) related to the adjustment of our tax benefit arrangements primarily due to changes in our deferred state tax rate.

(6) Represents the Company’s pro-rata portion of the basis difference related to intangible asset amortization expense in its equity method investees, which is included within losses from equity-method investments, net of tax on our consolidated statements of operations.

(7) Represents certain other gains and charges that we do not believe reflect our underlying business performance.

(8) Represents a loss on extinguishment of debt as a result of the repayment of the 2018-1 Class A-2-I notes prior to the anticipated repayment date.

(9) Includes $1.3 million, $3.1 million, $10.6 million and $12.4 million of amortization of intangible assets, other than favorable leases, for the three months and years ended December 31, 2024 and 2023, respectively, recorded in connection with the 2012 Acquisition, and $9.6 million, $9.9 million, $38.6 million and $39.1 million of amortization of intangible assets for the three months and years ended December 31, 2024

Planet Fitness, Inc. and subsidiaries

Non-GAAP Financial Measures

(Unaudited)

and 2023, respectively, created in connection with historical acquisitions of franchisee-owned clubs. The adjustment represents the amount of actual non-cash amortization expense recorded, in accordance with GAAP, in each period.

(10) Represents corporate income taxes at an assumed effective tax rate of 25.9% for both the three months and years ended December 31, 2024 and 2023, applied to adjusted income before income taxes.

(11) Assumes the full exchange of all outstanding Holdings Units and corresponding shares of Class B common stock for shares of Class A common stock of Planet Fitness, Inc.

A reconciliation of net income per share, diluted, to Adjusted net income per share, diluted is set forth below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2024 | | Three Months Ended December 31, 2023 |

| (in thousands, except per share amounts) | Net income | | Weighted Average Shares | | Net income per share, diluted | | Net income | | Weighted Average Shares | | Net income per share, diluted |

Net income attributable to Planet Fitness, Inc.(1) | $ | 47,084 | | | 84,442 | | | $ | 0.56 | | | $ | 35,340 | | | 86,193 | | | $ | 0.41 | |

Net income attributable to non-controlling interests(2) | 479 | | | 403 | | | | | 1,423 | | | 2,248 | | | |

| Net income | 47,563 | | | | | | | 36,763 | | | | | |

Adjustments to arrive at adjusted income before income taxes(3) | 33,024 | | | | | | | 34,964 | | | | | |

| Adjusted income before income taxes | 80,587 | | | | | | | 71,727 | | | | | |

Adjusted income taxes(4) | 20,863 | | | | | | | 18,577 | | | | | |

| Adjusted net income | $ | 59,724 | | | 84,845 | | | $ | 0.70 | | | $ | 53,150 | | | 88,441 | | | $ | 0.60 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2024 | | Year Ended December 31, 2023 |

| (in thousands, except per share amounts) | Net income | | Weighted Average Shares | | Net income per share, diluted | | Net income | | Weighted Average Shares | | Net income per share, diluted |

Net income attributable to Planet Fitness, Inc.(1) | $ | 172,042 | | | 85,827 | | | $ | 2.00 | | | $ | 138,313 | | | 85,185 | | | $ | 1.62 | |

Net income attributable to non-controlling interests(2) | 2,201 | | | 709 | | | | | 8,722 | | | 3,735 | | | |

| Net income | 174,243 | | | | | | | 147,035 | | | | | |

Adjustments to arrive at adjusted income before income taxes(3) | 127,674 | | | | | | | 121,533 | | | | | |

| Adjusted income before income taxes | 301,917 | | | | | | | 268,568 | | | | | |

Adjusted income taxes(4) | 78,163 | | | | | | | 69,559 | | | | | |

| Adjusted net income | $ | 223,754 | | | 86,537 | | | $ | 2.59 | | | $ | 199,009 | | | 88,920 | | | $ | 2.24 | |

(1) Represents net income attributable to Planet Fitness, Inc. and the associated weighted average shares of Class A common stock outstanding.

(2) Represents net income attributable to non-controlling interests and the assumed exchange of all outstanding Holdings Units and corresponding shares of Class B common stock for shares of Class A common stock of Planet Fitness, Inc. as of the beginning of the period presented.

(3) Represents the total impact of all adjustments identified in the adjusted net income table above to arrive at adjusted income before income taxes.

(4) Represents corporate income taxes at an assumed effective tax rate of 25.9% for both the three months and years ended December 31, 2024 and 2023, applied to adjusted income before income taxes.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

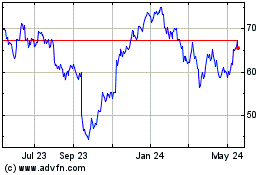

Planet Fitness (NYSE:PLNT)

Historical Stock Chart

From Jan 2025 to Feb 2025

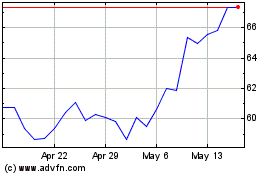

Planet Fitness (NYSE:PLNT)

Historical Stock Chart

From Feb 2024 to Feb 2025