UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

PENNYMAC MORTGAGE INVESTMENT TRUST

(Name of Issuer)

Common Shares of Beneficial Interest, par value $0.01 per share

(Title of Class of Securities)

70931T103

(CUSIP Number)

December 30, 2022

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule

is filed:

[X] Rule 13d-1(b)

[] Rule 13d-1(c)

[] Rule 13d-1(d)

*The remainder of this cover page shall be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter

the disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be

deemed to be "filed" for the purpose of Section 18 of the Securities Exchange

Act of 1934 ("Act") or otherwise subject to the liabilities of that section of

the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

Page 1 of 9

-----------------------

CUSIP No. 70931T103 13G

-----------------------

------------------------------------------------------------------------------

1. Name of Reporting Person

I.R.S. Identification No. of above Person

Goldman Sachs Asset Management

(Goldman Sachs Asset Management, L.P., together with GS

Investment Strategies, LLC, "Goldman Sachs Asset Management")

------------------------------------------------------------------------------

2. Check the Appropriate Box if a Member of a Group

(a) [_]

(b) [_]

------------------------------------------------------------------------------

3. SEC Use Only

------------------------------------------------------------------------------

4. Citizenship or Place of Organization

Delaware

------------------------------------------------------------------------------

5. Sole Voting Power

Number of 0

Shares ----------------------------------------------------------

6. Shared Voting Power

Beneficially

3,093,040

Owned by

----------------------------------------------------------

Each 7. Sole Dispositive Power

Reporting 0

Person ----------------------------------------------------------

8. Shared Dispositive Power

With:

3,287,120

------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

3,287,120

------------------------------------------------------------------------------

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

[_]

------------------------------------------------------------------------------

11. Percent of Class Represented by Amount in Row (9)

3.7 %

------------------------------------------------------------------------------

12. Type of Reporting Person

IA

------------------------------------------------------------------------------

****Please update the footnotes for cover page****

Page 2 of 9

|

Item 1(a). Name of Issuer:

PENNYMAC MORTGAGE INVESTMENT TRUST

Item 1(b). Address of Issuer's Principal Executive Offices:

3043 Townsgate Road

Westlake Village, CA 91361

Item 2(a). Name of Persons Filing:

GOLDMAN SACHS ASSET MANAGEMENT

Item 2(b). Address of Principal Business Office or, if none, Residence:

Goldman Sachs Asset Management

200 West Street

New York, NY 10282

Item 2(c). Citizenship:

GOLDMAN SACHS ASSET MANAGEMENT, L.P. - Delaware

GS INVESTMENT STRATEGIES, LLC - Delaware

Item 2(d). Title of Class of Securities:

Common Shares of Beneficial Interest, par value $0.01

per share

Item 2(e). CUSIP Number:

70931T103

Item 3. If this statement is filed pursuant to Rules 13d-1(b) or

13d-2(b) or (c), check whether the person filing is a:

(a).[_] Broker or dealer registered under Section 15 of the Act

(15 U.S.C. 78o).

(b).[_] Bank as defined in Section 3(a)(6) of the Act

(15 U.S.C. 78c).

(c).[_] Insurance company as defined in Section 3(a)(19) of the Act

(15 U.S.C. 78c).

(d).[_] Investment company registered under Section 8 of the

Investment Company Act of 1940 (15 U.S.C. 80a-8).

(e).[X] An investment adviser in accordance with

Rule 13d-1(b)(1)(ii)(E);

Goldman Sachs Asset Management, L.P.

GS Investment Strategies, LLC

(f).[_] An employee benefit plan or endowment fund in accordance

with Rule 13d-1(b)(1)(ii)(F);

(g).[_] A parent holding company or control person in accordance

with Rule 13d-1(b)(1)(ii)(G);

(h).[_] A savings association as defined in Section 3(b) of the

Federal Deposit Insurance Act (12 U.S.C. 1813);

(i).[_] A church plan that is excluded from the definition of an

investment company under Section 3(c)(14) of the

Investment Company Act of 1940 (15 U.S.C. 80a-3);

(j).[_] A non-U.S. institution in accordance with

Rule 13d-1(b)(1)(ii)(J);

(k).[_] A group, in accordance with Rule 13d-1(b)(1)(ii)

(A) through (K).

If filing as a non-U.S. institution in accordance with Rule

13d-1(b)(1)(ii)(J), please specify the type of institution:

Page 3 of 9

Item 4. Ownership.*

(a). Amount beneficially owned:

See the response(s) to Item 9 on the attached cover page(s).

(b). Percent of Class:

See the response(s)to Item 11 on the attached cover page(s).

(c). Number of shares as to which such person has:

(i). Sole power to vote or to direct the vote: See the

response(s) to Item 5 on the attached cover page(s).

(ii). Shared power to vote or to direct the vote: See the

response(s) to Item 6 on the attached cover page(s).

(iii). Sole power to dispose or to direct the disposition

of: See the response(s) to Item 7 on the attached

cover page(s).

(iv). Shared power to dispose or to direct the disposition

of: See the response(s) to Item 8 on the attached

cover page(s).

Item 5. Ownership of Five Percent or Less of a Class.

If this statement is being filed to report the fact that as

of the date hereof the reporting persons have ceased to be

the beneficial owners of more than five percent of the class

of securities, check the following [X].

Item 6. Ownership of More than Five Percent on Behalf of Another

Person.

Clients of the Reporting Person(s) have or may have the

right to receive or the power to direct the receipt of

dividends from, or the proceeds from the sale of, securities

held in their accounts. Clients known to have such right or

power with respect to more than 5% of the class of

securities to which this report relates are:

NONE

Item 7. Identification and Classification of the Subsidiary Which

Acquired the Security Being Reported on by the Parent

Holding Company.

Not Applicable

Item 8. Identification and Classification of Members of the Group.

Not Applicable

Item 9. Notice of Dissolution of Group.

Not Applicable

Item 10. Certification.

By signing below I certify that, to the best of my knowledge

and belief, the securities referred to above were acquired

and are held in the ordinary course of business and were not

acquired and are not held for the purpose of or with the

effect of changing or influencing the control of the issuer

of the securities and were not acquired and are not held in

connection with or as a participant in any transaction

having that purpose or effect, other than activities solely

in connection with a nomination under Section 240.14a-11.

*In accordance with the Securities and Exchange Commission Release No.

34-39538 (January 12, 1998) (the "Release"), this filing reflects the

securities beneficially owned by certain operating units (collectively, the

"Goldman Sachs Reporting Units") of The Goldman Sachs Group, Inc. and its

subsidiaries and affiliates (collectively, "GSG"). This filing does not

reflect securities, if any, beneficially owned by any operating units of GSG

whose ownership of securities is disaggregated from that of the Goldman Sachs

Reporting Units in accordance with the Release. The Goldman Sachs Reporting

Units disclaim beneficial ownership of the securities beneficially owned by

(i) any client accounts with respect to which the Goldman Sachs Reporting Units

or their employees have voting or investment discretion or both, or with

respect to which there are limits on their voting or investment authority

or both and (ii) certain investment entities of which the Goldman Sachs

Reporting Units act as the general partner, managing general partner or other

manager, to the extent interests in such entities are held by persons other

than the Goldman Sachs Reporting Units.

Page 4 of 9

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in

this statement is true, complete and correct.

Date: January 30, 2023,

GOLDMAN SACHS ASSET MANAGEMENT, L.P.

By:/s/ Constance Birch

----------------------------------------

Name: Constance Birch

Title: Attorney-in-fact

|

GS INVESTMENT STRATEGIES, LLC

By:/s/ Constance Birch

----------------------------------------

Name: Constance Birch

Title: Attorney-in-fact

|

Page 5 of 9

INDEX TO EXHIBITS

Exhibit No. Exhibit

----------- -------

99.1 Joint Filing Agreement

99.2 Power of Attorney, relating to

GOLDMAN SACHS ASSET MANAGEMENT, L.P.

99.3 Power of Attorney, relating to

GS INVESTMENT STRATEGIES, LLC

|

Page 6 of 9

EXHIBIT (99.1)

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)(1) promulgated under the Securities

Exchange Act of 1934, the undersigned agree to the joint filing of a Statement

on Schedule 13G (including any and all amendments thereto) with respect to the

Common Shares of Beneficial Interest, par value $0.01 per share, of

PENNYMAC MORTGAGE INVESTMENT TRUST and further agree to the filing of

this agreement as an Exhibit thereto. In addition, each party to this Agreement

expressly authorizes each other party to this Agreement to file on its behalf

any and all amendments to such Statement on Schedule 13G.

Date: January 30, 2023,

GOLDMAN SACHS ASSET MANAGEMENT, L.P.

By:/s/ Constance Birch

----------------------------------------

Name: Constance Birch

Title: Attorney-in-fact

|

GS INVESTMENT STRATEGIES, LLC

By:/s/ Constance Birch

----------------------------------------

Name: Constance Birch

Title: Attorney-in-fact

|

Page 7 of 9

EXHIBIT (99.2)

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that GS INVESTMENT STRATEGIES,

LLC (the "Company") does hereby make, constitute and appoint each of

Stephanie Snyder, Constance Birch, Kateryna Osmachko, Tony Kelly,

Imad Ismail, Jamie Minieri, Rachel Fraizer, and Terrance Grey,

(and any other employee of The Goldman Sachs Group, Inc.

or one of its affiliates designated in writing by one of the

attorneys-in-fact), acting individually, its true and lawful attorney,

to execute and deliver in its name and on its behalfwhether the

Company is acting individually or as representative of others, any and

all filings required to be made by the Company under the Securities

Exchange Act of 1934, (as amended, the "Act"), with respect to securities

which may be deemed to be beneficially owned by the Company under the Act,

giving and granting unto each said attorney-in-fact power and authority

to act in the premises as fully and to all intents and purposes as the

Company might or could do if personally present by one of its authorized

signatories, hereby ratifying and confirming all that said

attorney-in-fact shall lawfully do or cause to be done by virtue hereof.

THIS POWER OF ATTORNEY shall remain in full force and effect until either

revoked in writing by the undersigned or until such time as the person or

persons to whom power of attorney has been hereby granted cease(s) to be an

employee of The Goldman Sachs Group, Inc. or one of its affiliates.

IN WITNESS WHEREOF, the undersigned has duly subscribed these presents as of

October 31, 2022.

GS INVESTMENT STRATEGIES, LLC

By: /s/ Raanan A. Agus

____________________________

Name: Raanan A. Agus

Title: Authorized Signatory

|

Page 8 of 9

EXHIBIT (99.3)

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that GOLDMAN SACHS ASSET MANAGEMENT, L.P.

(the "Company") does hereby make, constitute and appoint each of Melissa

Stanford, Stephanie Snyder, Constance Birch, Kateryna Osmachko, Rachel

Fraizer, Jamie Minieri, Tony Kelly, Imad Ismail, Terrance Grey, and

Kshama Mishra (each, an "attorney-in-fact"), acting individually,

its true and lawful attorney, to execute and deliver in its name and on its

behalf whether the Company is acting individually or as

representative of others, any and all filings required to be made by the

Company under the Securities Exchange Act of 1934, (as amended, the "Act"),

with respect to securities which may be deemed to be beneficially owned by

the Company under the Act, giving and granting unto each said

attorney-in-fact power and authority to act in the premises as fully and to

all intents and purposes as the Company might or could do if personally

present by one of its authorized signatories, hereby ratifying and

confirming all that said attorney-in-fact shall lawfully do or cause to

be done by virtue hereof.

THIS POWER OF ATTORNEY shall take effect on December 13th, 2022 and remain

in full force and effect until the earlier of (i) December 13th, 2023 and (ii)

such time that it is revoked in writing; provided that in the event an

attorney-in-fact ceases to be an employee of the The Goldman Sachs Group, Inc.

or one of its affiliates or ceases to perform the function in connection with

which he/she was appointed attorney-in-fact prior to such time, this Power of

Attorney shall cease to have effect in relation to any remaining attorneys-in-

Fact upon such cessation but shall continue in full force and effect in relation

to any remaining attornyes-in-fact. The Company has unrestriced right

unilaterally to revoke this Power of Attorney.

This Power of Attorney shall be governed by, and construed in accordance with,

the laws of the State of New York, without regard to rules of conflicts of law.

IN WITNESS WHEREOF, the undersigned has duly subscribed these presents as of

December 13, 2022.

GOLDMAN SACHS ASSET MANAGEMENT, L.P.

By: GSAM HOLDINGS LLC., its General Partner

By: /s/ David Plutzer

____________________________

Name: David Plutzer

Title: Authorized Signatory

|

Page 9 of 9

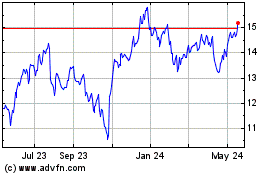

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

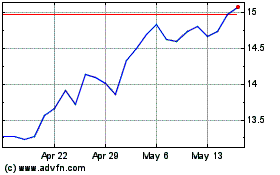

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Dec 2023 to Dec 2024