0000078239FALSE00000782392024-05-302024-05-300000078239us-gaap:CommonStockMember2024-05-302024-05-300000078239pvh:A4.125SeniorNotesDue2029Member2024-05-302024-05-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 30, 2024

PVH CORP. /DE/

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | | 001-07572 | | | | 13-1166910 | |

| (State or other jurisdiction of incorporation) | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | |

| 285 Madison Avenue, | New York, | New York | | | | 10017 | |

| | | | | | | | |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code (212)-381-3500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $1 par value | PVH | New York Stock Exchange |

| 4.125% Senior Notes due 2029 | PVH29 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 4, 2024, PVH Corp. (the “Company“) announced that Martijn Hagman, Chief Executive Officer, Tommy Hilfiger Global and PVH Europe, will be leaving the Company. He will serve in an advisory capacity to facilitate a smooth transition.

Lea Rytz Goldman, Tommy Hilfiger Global President, leads the global brand, reporting directly to the Company’s Chief Executive Officer, Stefan Larsson. David Savman, the Company’s Chief Supply Chain Officer and one of the Company’s top leaders, will serve as Interim CEO for PVH Europe. The Company has launched a search for a new European leader.

The Company issued a press release announcing this leadership change, which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements And Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description of Exhibit |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PVH CORP.

By: /s/ Mark D. Fischer

Mark D. Fischer

Executive Vice President, General Counsel and

Secretary

Date: June 4, 2024

Exhibit 99.1

PVH Corp. Announces Leadership Update

NEW YORK--(BUSINESS WIRE)—June 4--PVH Corp. [NYSE: PVH] today announced that Martijn Hagman, CEO of Tommy Hilfiger Global and PVH Europe, will be leaving the Company. He will serve in an advisory capacity to facilitate a smooth transition.

Lea Rytz Goldman, Tommy Hilfiger Global President, leads the global brand, reporting directly to PVH CEO Stefan Larsson. David Savman, PVH’s Chief Supply Chain Officer, will serve as Interim CEO for PVH Europe. The Company has launched a search for a new European leader.

Larsson commented: “I want to thank Martijn for his significant contributions to PVH over the past 16 years, being a key leader in helping to build our European region into the market-leading and highly profitable multi-brand business we have today.” Regarding Savman’s appointment, Larsson continued, “Since David joined us, he has played a unique role in the Company as a key leader driving strong PVH+ Plan performance, all the way from product creation to marketplace execution.”

Hagman commented: “It is an honor to have been part of growing Calvin Klein and TOMMY HILFIGER in the region. There is so much opportunity and potential ahead, and I am excited to see both brands reach new levels of growth through the team’s continued strong execution.”

About PVH Corp.

PVH is one of the world's largest fashion companies, connecting with consumers in over 40 countries. Our global iconic brands include Calvin Klein and TOMMY HILFIGER. Our 140-year history is built on the strength of our brands, our team, and our commitment to drive fashion forward for good. That's the Power of Us. That's the Power of PVH.

Follow us on Facebook, Instagram, X and LinkedIn.

Investor Contact:

Sheryl Freeman

investorrelations@pvh.com

Media Contact:

communications@pvh.com

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995: Forward-looking statements in this press release and made during the conference call/webcast, including, without limitation, statements relating to the Company’s future revenue, earnings, plans, strategies, objectives, expectations and intentions are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements are inherently subject to risks

and uncertainties, many of which cannot be predicted with accuracy, and some of which might not be anticipated, including, without limitation, (i) the Company’s plans, strategies, objectives, expectations and intentions are subject to change at any time at the discretion of the Company; (ii) the Company’s ability to realize anticipated benefits and savings from divestitures, restructurings and similar plans, such as the headcount cost reduction initiative announced in August 2022, the 2021 sale of assets of, and exit from, its Heritage Brands menswear and retail businesses, and the November 2023 sale of the Heritage Brands women’s intimate apparel business to focus on its Calvin Klein and Tommy Hilfiger businesses; (iii) the ability to realize the intended benefits from the acquisition of licensees or the reversion of licensed rights (such as the announced plan to bring in-house most of the product categories currently licensed to G-III Apparel Group, Ltd. upon the expirations over time of the underlying license agreements) and avoid any disruptions in the businesses during the transition from operation by the licensee to the direct operation by us; (iv) the Company has significant levels of outstanding debt and borrowing capacity and uses a significant portion of its cash flows to service its indebtedness, as a result of which the Company might not have sufficient funds to operate its businesses in the manner it intends or has operated in the past; (v) the levels of sales of the Company’s apparel, footwear and related products, both to its wholesale customers and in its retail stores and its directly operated digital commerce sites, the levels of sales of the Company’s licensees at wholesale and retail, and the extent of discounts and promotional pricing in which the Company and its licensees and other business partners are required to engage, all of which can be affected by weather conditions, changes in the economy (including inflationary pressures like those currently being seen globally), fuel prices, reductions in travel, fashion trends, consolidations, repositionings and bankruptcies in the retail industries, consumer sentiment and other factors; (vi) the Company’s ability to manage its growth and inventory; (vii) quota restrictions, the imposition of safeguard controls and the imposition of new or increased duties or tariffs on goods from the countries where the Company or its licensees produce goods under its trademarks, any of which, among other things, could limit the ability to produce products in cost-effective countries, or in countries that have the labor and technical expertise needed, or require the Company to absorb costs or try to pass costs onto consumers, which could materially impact the Company’s revenue and profitability; (viii) the availability and cost of raw materials; (ix) the Company’s ability to adjust timely to changes in trade regulations and the migration and development of manufacturers (which can affect where the Company’s products can best be produced); (x) the regulation or prohibition of the transaction of business with specific individuals or entities and their affiliates or goods manufactured in (or containing raw materials or components from) certain regions, such as the listing of a person or entity as a Specially Designated National or Blocked Person by the U.S. Department of the Treasury’s Office of Foreign Assets Control and the issuance of Withhold Release Orders by the U.S. Customs and Border Protection; (xi) changes in available factory and shipping capacity, wage and shipping cost escalation, and store closures in any of the countries where the Company’s or its licensees’ or wholesale customers’ or other business partners’ stores are located or products are sold or produced or are planned to be sold or produced, as a result of civil conflict, war or terrorist acts, the threat of any of the foregoing, or political or labor instability, such as the current war in Ukraine that led to the Company’s exit from its retail business in Russia and the cessation of its wholesale operations in Russia and Belarus, and the temporary cessation of business by many of its business partners in Ukraine;

(xii) disease epidemics and health-related concerns, such as the recent COVID-19 pandemic, which could result in (and, in the case of the COVID-19 pandemic, did result in some of the following) supply-chain disruptions due to closed factories, reduced workforces and production capacity, shipping delays, container and trucker shortages, port congestion and other logistics problems, closed stores, and reduced consumer traffic and purchasing, or governments implement mandatory business closures, travel restrictions or the like, and market or other changes that could result in shortages of inventory available to be delivered to the Company’s stores and customers, order cancellations and lost sales, as well as in noncash impairments of the Company’s goodwill and other intangible assets, operating lease right-of-use assets, and property, plant and equipment; (xiii) actions taken towards sustainability and social and environmental responsibility as part of the Company’s sustainability and social and environmental strategy may not be achieved or may be perceived to be falsely claimed, which could diminish consumer trust in the Company’s brands, as well as the Company’s brands’ value; (xiv) the failure of the Company’s licensees to market successfully licensed products or to preserve the value of the Company’s brands, or their misuse of the Company’s brands; (xv) significant fluctuations of the U.S. dollar against foreign currencies in which the Company transacts significant levels of business; (xvi) the Company’s retirement plan expenses recorded throughout the year are calculated using actuarial valuations that incorporate assumptions and estimates about financial market, economic and demographic conditions, and differences between estimated and actual results give rise to gains and losses, which can be significant, that are recorded immediately in earnings, generally in the fourth quarter of the year; (xvii) the impact of new and revised tax legislation and regulations; and (xviii) other risks and uncertainties indicated from time to time in the Company’s filings with the Securities and Exchange Commission.

The Company does not undertake any obligation to update publicly any forward-looking statement made in this press release.

v3.24.1.1.u2

Document and Entity Information Document

|

May 30, 2024 |

| Cover Page [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 30, 2024

|

| Entity Registrant Name |

PVH CORP. /DE/

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-07572

|

| Entity Tax Identification Number |

13-1166910

|

| Entity Address, Address Line One |

285 Madison Avenue,

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

212

|

| Local Phone Number |

381-3500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000078239

|

| Amendment Flag |

false

|

| Common Stock, $1 par value |

|

| Cover Page [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1 par value

|

| Trading Symbol |

PVH

|

| Security Exchange Name |

NYSE

|

| 4.125% Senior Notes due 2029 |

|

| Cover Page [Line Items] |

|

| Title of 12(b) Security |

4.125% Senior Notes due 2029

|

| Trading Symbol |

PVH29

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

pvh_CoverPageLineItems |

| Namespace Prefix: |

pvh_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pvh_A4.125SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

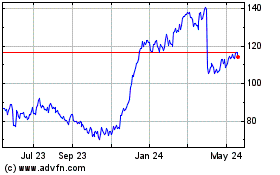

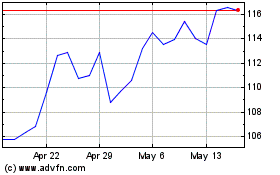

PVH (NYSE:PVH)

Historical Stock Chart

From May 2024 to Jun 2024

PVH (NYSE:PVH)

Historical Stock Chart

From Jun 2023 to Jun 2024