UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 17, 2024 (July 15, 2024)

ROYCE

GLOBAL TRUST, INC.

(Exact

name of registrant as specified in its charter)

| Maryland |

811-22532 |

27-5491330 |

(State

or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S.

Employer

Identification No.) |

| 745 Fifth Avenue |

|

| New York, New York |

10151 |

| (Address

of principal executive offices) |

(Zip

Code) |

| |

|

Registrant’s

telephone number, including area code: (212) 508-4500

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-

2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each

class |

Trading

Symbol(s)

|

Name of each exchange

on which registered |

Common

Stock |

RGT |

New

York Stock Exchange |

| |

|

|

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On

July 15, 2024, Royce Global Trust, Inc. (formerly Royce Global Value Trust, Inc.) issued a press release addressing certain portfolio

management changes.

| Item 9.01 | Financial

Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description |

| 99.1 |

Press Release, dated July 15, 2024 |

| |

|

| |

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

ROYCE GLOBAL

TRUST, INC.

By: /s/

Christopher D. Clark

Name: Christopher

D. Clark

Title: President

Date: July 17, 2024

Chuck Royce

to Become Senior Advisor at Royce Investment Partners

Last updated July 15, 2024

Chuck will become a Senior Advisor effective

September 30th, 2024, after completing his transition from day-to-day portfolio management responsibilities.

Celebrating his 51st year at Royce Investment Partners,

Chuck Royce will become a Senior Advisor at Royce Investment Partners (“Royce”) effective September 30th, 2024, after completing

his transition from day-to-day portfolio management responsibilities on the remaining funds where he currently serves. Chuck founded the

firm in 1972 with the acquisition of the management company that had the advisory contract for Pennsylvania Mutual Fund (now Royce

Small-Cap Fund ).

Chris Clark , Royce’s Chief Executive Officer

said, “Chuck’s transition is the culmination of a strategic succession plan, at both the executive and investment team levels,

that has been in place for nearly a decade. It has incorporated the addition of investment talent, the establishment of multigenerational

teams on our key Strategies, and substantial collaboration between Chuck and our investment staff to ensure consistency in the application

of our time-tested investment disciplines.”

These plans saw us establish new leadership structures,

including Management and Risk Committees and the promotion of Co- Chief Investment Officers. The firm has also worked diligently

during this period to add investment analysts and portfolio managers.

Chris noted, “It was critical that we develop

our investment teams in a way that maintained and enhanced the substantial domain knowledge and continuity of focus on the small-cap asset

class. I’m pleased to say that Royce now has the largest and most experienced investment team in our history, having added 15 investment

professionals over the last five years, giving the firm our strongest group ever.”

Chuck said, “The timing of this shift reflects

the confidence that Chris and I have in our investment teams and the firm as a whole. I’m extraordinarily proud of what

we’ve accomplished together, especially our long-term investment performance records, and in particular the 50-plus year record

of our flagship, Royce Small-Cap Fund (formerly Royce Pennsylvania Mutual Fund). Because we have been laying the groundwork for

several years to ensure a smooth transition and a promising road ahead, this is the appropriate time for me to step back from my active

involvement in portfolio management.” In his Senior Advisor role, Chuck will continue to mentor our investment teams, engage with

clients, and offer comments on the small-cap market.

Effective after the close of business on July 31st,

2024, Chuck will transition off two funds. On Royce Premier Fund , Lauren Romeo and Steven McBoyle continue as the Fund’s co-lead

portfolio managers, and Andrew Palen remains as assistant portfolio manager. Miles Lewis remains lead portfolio manager on Royce Small-Cap

Total Return Fund , while Joseph Hintz becomes portfolio manager, and Jag Sriram becomes assistant portfolio manager.

Effective after the close of business on September 30th,

2024, Chuck will transition off two more funds. On Royce Small-Cap Fund (formerly Royce Pennsylvania Mutual Fund), Portfolio Managers

Lauren Romeo, Steven McBoyle, Miles Lewis, Jay Kaplan , and Andrew Palen will be joined by Co-Chief Investment Officer, Francis Gannon

.. Also effective after the close of business on September 30th, 2024, Chuck will transition off Royce Dividend Value Fund . Miles Lewis

will become the Fund’s lead portfolio manager, joined by Joseph Hintz as portfolio manager and Jag Sriram as assistant portfolio

manager.

Effective after the close of business on September 30th,

2024, Chuck will also transition off our three closed-end funds: Francis Gannon will join the portfolio management team of Royce Small-Cap

Trust (formerly Royce Value Trust) with Portfolio Managers Lauren Romeo, Steven McBoyle, Andrew Palen, and George Necakov ; Jim Stoeffel

will become lead portfolio manager of Royce Micro-Cap Trust , with Brendan Hartman remaining portfolio manager, and Andrew Palen joining

as assistant portfolio manager; and Steven McBoyle will become portfolio manager of Royce Global Trust .

Important Disclosure

Information

An investor should consider the Fund’s investment

goals, risks, fees and expenses before investing. A prospectus containing this and other information is available at www.royceinvest.com.

Please read the prospectus carefully before investing or sending money. Royce Fund Services, LLC is the distributor of The Royce Fund

and Royce Capital Fund.

© 2024 Royce & Associates, LP, 745 Fifth Avenue,

New York, NY 10151, (800) 221-4268. Royce & Associates, LP, the investment advisor of The Royce Fund and Royce Capital Fund, is a

limited partnership organized under the laws of Delaware. Royce & Associates, LP, primarily conducts its business under the name Royce

Investment Partners. All rights reserved.

Distributor of The Royce Fund and Royce Capital Fund:

Royce Fund Services, LLC, a wholly owned subsidiary of Royce & Associates and a member of FINRA and SIPC . All series of The Royce

Funds are offered and sold only to persons residing in the United States and are offered by prospectus only. The prospectuses include

investment objectives, risks, fees, charges, expenses, and other information that you should read and consider carefully before investing.

Royce Value Trust, Royce Micro-Cap Trust, and Royce Global Value Trust are closed-end funds whose shares of common stock trade on the

NYSE. Royce Fund Services, LLC does not serve as a distributor or as an underwriter to or of these Royce closed-end funds. View our Policies

& Procedures , including, among others, our Sarbanes-Oxley Code of Ethics , Privacy Policy , and Proxy Voting Guidelines and Procedures

.. View our Customer Relationship Summary .

Any information, statements, and opinions set forth herein

are general in nature, are not directed to or based on the financial situation or needs of any particular investor, and do not constitute,

and should not be construed as, investment advice, a forecast of future events, a guarantee of future results, or a recommendation with

respect to any particular security or investment strategy. Investors seeking financial advice regarding the appropriateness of investing

in any securities or investment strategies should consult their financial professional.

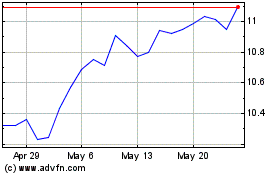

Royce Global (NYSE:RGT)

Historical Stock Chart

From Nov 2024 to Dec 2024

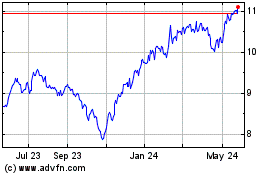

Royce Global (NYSE:RGT)

Historical Stock Chart

From Dec 2023 to Dec 2024