SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For November, 2024

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

| Earnings

Results 3Q24 Page 3 |

| | |

Adjusted EBITDA totaled R$ 10,586 million in 3Q24 (disregards

construction margin), up by R$ 8,200 million (+343.6%) over the R$ 2,387 million reported in 3Q23. Consequently, the adjusted EBITDA margin

reached 78.6% compared to 46.6% in 3Q23.

Excluding the non-recurring effects and the construction

margin, as described below, adjusted EBITDA totaled R$ 2,785 million in 3Q24, with an adjusted EBITDA margin of 60.0%.

Net income came to R$ 6,111 million in 3Q24, up by R$ 5,266

million (+622.2%) over the R$ 846 million recorded in 3Q23. Excluding the non-recurring effects and the construction margin, net income

totaled R$ 1,173 million in 3Q24

Financial Asset (indemnity)

With the completion of the privatization process and the

signing of the agreement with URAE-1, on July 23, 2024, the Company began to use the bifurcation model for assets related to the concession,

previously classified solely as intangible assets. This model consists of segregating assets that will be realized through tariffs (intangible

assets) and those that will be compensated (financial asset). The financial asset refers to reversible investments not fully amortized

by the end of the agreement (October 2060), which will be compensated according to the contractual provision. The recording of this financial

asset generated an impact of R$ 8,820 million on the period’s gross revenue. For further information, refer to Note 15 of the Quarterly

Information for September 2024.

Transition

The new management decided to review the expected continuity

of assets under construction (a loss of R$ 194 million). Furthermore, it reassessed the calculations of certain lawsuits (a provision

of R$ 309 million recorded under General Expenses and Financial Expenses). In addition, the new management incurred expenses with transition

consulting services as well as costs related to the privatization offering, totaling R$ 47 million, which are not expected to recur.

| Earnings

Results 3Q24 Page 4 |

| | |

| 1. | Result for the period (Consolidated) |

R$ million

| |

|

3Q24 |

3Q23 |

Var. (R$) |

% |

9M24 |

9M23 |

Var. (R$) |

% |

| |

Revenue from sanitation services |

6,072 |

5,539 |

533 |

9.6 |

17,666 |

15,641 |

2,025 |

12.9 |

| |

Water/Sewage Contra Account (FAUSP) |

(157) |

- |

(157) |

- |

(157) |

- |

(157) |

- |

| |

Financial Asset (indemnity) |

8,820 |

- |

8,820 |

- |

8,820 |

- |

8,820 |

- |

| |

Taxes (PIS/COFINS/TRCF) |

(1,269) |

(419) |

(851) |

203.0 |

(2,164) |

(1,110) |

(1,054) |

94.9 |

| (=) |

Net revenue from sanitation services |

13,466 |

5,120 |

8,345 |

163.0 |

24,165 |

14,531 |

9,634 |

66.3 |

| |

Construction revenue |

1,531 |

1,333 |

199 |

14.9 |

4,142 |

3,776 |

366 |

9.7 |

| (=) |

Net operating income |

14,997 |

6,453 |

8,544 |

132.4 |

28,307 |

18,306 |

10,000 |

54.6 |

| |

Construction costs |

(1,497) |

(1,303) |

(194) |

14.9 |

(4,049) |

(3,691) |

(358) |

9.7 |

| |

Costs and expenses |

(3,481) |

(3,454) |

(27) |

0.8 |

(10,391) |

(10,537) |

147 |

(1.4) |

| |

Other operating income (expenses), net |

(170) |

6 |

(176) |

(2,928.3) |

(156) |

71 |

(227) |

(319.1) |

| |

Equity pickup |

9 |

7 |

2 |

31.3 |

26 |

23 |

2 |

10.4 |

| (=) |

Earnings before financial result, income tax, and social contribution |

9,858 |

1,709 |

8,150 |

477.0 |

13,737 |

4,172 |

9,565 |

229.3 |

| |

Financial result |

(525) |

(431) |

(94) |

21.7 |

(1,325) |

(705) |

(620) |

88.0 |

| (=) |

Earnings before income tax and social contribution |

9,333 |

1,278 |

8,056 |

630.6 |

12,412 |

3,467 |

8,945 |

258.0 |

| |

Income tax and social contribution |

(3,222) |

(431) |

(2,791) |

647.0 |

(4,268) |

(1,130) |

(3,137) |

277.6 |

| (=) |

Net income |

6,111 |

847 |

5,266 |

622.2 |

8,145 |

2,337 |

5,807 |

248.5 |

| |

Earnings per share (R$)* |

8.94 |

1.24 |

|

|

11.92 |

3.42 |

|

|

* Number of shares = 683,509,869

| Earnings

Results 3Q24 Page 5 |

| | |

R$ million

| |

|

3Q24 |

Adjustments |

Provisi-on |

3Q24 adjusted |

3Q23* |

Var. (R$) |

% |

| Financial Asset |

Asset Loss |

Expenses - Privatization Process |

Constru-ction |

| |

Revenue from sanitation services |

6,072 |

- |

- |

- |

- |

- |

6,072 |

5,539 |

533 |

9.6 |

| |

Water/Sewage Contra Account (FAUSP) |

(157) |

- |

- |

- |

- |

- |

(157) |

- |

(157) |

- |

| |

Financial Asset (indemnity) |

8,820 |

(8,820) |

- |

- |

- |

- |

- |

- |

- |

- |

| |

Taxes (PIS/COFINS/TRCF) |

(1,269) |

816 |

- |

- |

- |

- |

(453) |

(419) |

(34) |

8.1 |

| (=) |

Net revenue from sanitation services |

13,466 |

(8,004) |

- |

- |

- |

- |

5,462 |

5,120 |

342 |

6.7 |

| |

Construction revenue |

1,531 |

- |

- |

- |

(1,531) |

- |

- |

- |

- |

- |

| (=) |

Net operating income |

14,997 |

(8,004) |

- |

- |

(1,531) |

- |

5,462 |

5,120 |

342 |

6.7 |

| |

Construction costs |

(1,497) |

- |

- |

- |

1,497 |

- |

- |

- |

- |

- |

| |

Costs and expenses |

(3,481) |

|

50 |

18 |

- |

185 |

(3,229) |

(3,454) |

225 |

(6.5) |

| |

Other operating income (expenses), net |

(170) |

- |

144 |

35 |

- |

- |

9 |

6 |

3 |

46.7 |

| |

Equity pickup |

9 |

- |

- |

- |

- |

- |

9 |

7 |

2 |

28.6 |

| (=) |

Earnings before financial result, income tax, and social contribution |

9,858 |

(8,004) |

194 |

52 |

(34) |

185 |

2,251 |

1,679 |

572 |

34.1 |

| |

Financial result |

(525) |

- |

- |

- |

- |

124 |

(401) |

(431) |

30 |

(7.0) |

| (=) |

Earnings before income tax and social contribution |

9,333 |

(8,004) |

194 |

52 |

(34) |

309 |

1,850 |

1,248 |

602 |

48.3 |

| |

Income tax and social contribution |

(3,222) |

2,721 |

(66) |

(18) |

12 |

(105) |

(678) |

(432) |

(246) |

56.9 |

| (=) |

Net income |

6,111 |

(5,283) |

128 |

35 |

(22) |

204 |

1,173 |

816 |

357 |

43.7 |

| |

Earnings per share (R$)* |

8.94 |

|

|

|

|

|

1.72 |

1.19 |

|

|

* Balance adjusted for construction revenue and costs

| 3. | Adjusted EBITDA Reconciliation (Non-accounting measures) |

R$ million

| |

|

3Q24 adjusted |

3Q23** |

Var. (R$) |

% |

9M24 adjusted |

9M23** |

Var. (R$) |

% |

| |

Net income |

1,173 |

816 |

357 |

43.7 |

3,209 |

2,252 |

956 |

42.5 |

| |

IDP |

- |

- |

- |

- |

- |

530 |

(530) |

(100.0) |

| |

Agreement with AAPS |

- |

- |

- |

- |

162 |

- |

162 |

- |

| (=) |

Adjusted Net Income (excluding the IDP/retiree agreement) |

1,173 |

816 |

357 |

43.7 |

3,371 |

2,782 |

589 |

(57.5) |

| |

Income tax and social contribution |

677 |

431 |

245 |

56.9 |

1,504 |

1,130 |

373 |

33.0 |

| |

Financial result |

401 |

431 |

(30) |

(7.0) |

1,325 |

705 |

620 |

88.0 |

| |

Other operating income (expenses), net |

(9) |

(6) |

(3) |

46.7 |

335 |

(71) |

406 |

(570.9) |

| |

Depreciation and amortization |

543 |

714 |

(171) |

(23.9) |

2,106 |

2,041 |

65 |

3.2 |

| (=) |

Adjusted EBITDA* (excluding Construction Margin) |

2,785 |

2,386 |

398 |

16.7 |

8,478 |

6,057 |

2,420 |

40.0 |

| |

(%) Adjusted EBITDA margin (excluding Construction Margin) |

59.9 |

46.6 |

|

|

55.2 |

41.7 |

|

|

* The EBITDA and EBITDA margin above are not the same as those used for the purposes of covenants

** Balance adjusted for construction revenue and costs

| Earnings

Results 3Q24 Page 6 |

| | |

| 4. | Changes in the adjusted result |

| a.) | NET REVENUE FROM SANITATION SERVICES |

The net revenue from sanitation services, which excludes

construction revenue, totaled R$ 5,462 million in 3Q24, an increase of R$ 341 million (+6.7%) over the R$ 5,120 million recorded in 3Q23.

The main factors that led to the increase were:

| · | An impact of 4.6% in the consumption price/mix, mainly due to the net tariff adjustment of 3.6% (6.4% since May/24, net of FAUSP(*));

and |

| · | An increase of 2.0% in the total billed volume. |

In September 2024, an update to the Unified Registry (Cadastro

Único) database resulted in 500 thousand users qualifying for a differentiated tariff. The impact of this update was R$ 28 million,

reducing the Company’s revenue (a tariff impact of 0.5%).

R$ million

| |

3Q24 |

3Q23 |

Var. (R$) |

% |

| Net revenue from sanitation services |

5,462 |

5,120 |

341 |

6.7 |

| Billed volume (million m³) |

1,070 |

1,049 |

21 |

2.0 |

| Average tariff (R$/m3) |

5.11 |

4.88 |

0.22 |

4.6 |

(*) FAUSP (Support Fund for the Universalization of Sanitation in the

São Paulo State) – Amount referring to the difference between the tariff applied and the equilibrium tariff. For further

information refer to Note 27 of the Quarterly Information.

| Earnings

Results 3Q24 Page 7 |

| | |

The following tables show the water

and sewage billed volumes, on a quarter-over-quarter and year-over-year basis, per customer category:

| WATER AND SEWAGE BILLED VOLUME1 PER CUSTOMER CATEGORY – million m3 |

| |

Water |

|

Sewage |

|

Water + Sewage |

| Category |

3Q24 |

3Q23 |

% |

3Q24 |

3Q23 |

% |

3Q24 |

3Q23 |

% |

| Residential |

484.2 |

477.6 |

1.4 |

427.5 |

420.0 |

1.8 |

911.7 |

897.6 |

1.6 |

| Commercial |

47.7 |

47.1 |

1.3 |

46.4 |

45.4 |

2.2 |

94.1 |

92.5 |

1.7 |

| Industrial |

9.4 |

9.0 |

4.4 |

9.8 |

9.7 |

1.0 |

19.2 |

18.7 |

2.7 |

| Public |

12.9 |

12.3 |

4.9 |

11.7 |

11.1 |

5.4 |

24.6 |

23.4 |

5.1 |

| Total retail |

554.2 |

546.0 |

1.5 |

495.4 |

486.2 |

1.9 |

1,049.6 |

1,032.2 |

1.7 |

| Wholesale2 |

12.0 |

11.2 |

7.1 |

5.1 |

5.5 |

(7.3) |

17.1 |

16.7 |

2.4 |

| Overall Total |

566.2 |

557.2 |

1.6 |

500.5 |

491.7 |

1.8 |

1,066.7 |

1,048.9 |

1.7 |

| Olímpia |

1.3 |

- |

- |

1.6 |

- |

- |

2.9 |

- |

- |

| Consolidated Grand Total |

567.5 |

557.2 |

1.8 |

502.1 |

491.7 |

2.1 |

1,069.6 |

1,048.9 |

2.0 |

| |

Water |

|

Sewage |

|

Water + Sewage |

| Category |

9M24 |

9M23 |

% |

9M24 |

9M23 |

% |

9M24 |

9M23 |

% |

| Residential |

1,472.4 |

1,426.2 |

3.2 |

1,296.3 |

1,251.1 |

3.6 |

2,768.7 |

2,677.3 |

3.4 |

| Commercial |

142.6 |

141.2 |

1.0 |

138.2 |

134.6 |

2.7 |

280.8 |

275.8 |

1.8 |

| Industrial |

27.5 |

26.4 |

4.2 |

29.1 |

28.7 |

1.4 |

56.6 |

55.1 |

2.7 |

| Public |

37.7 |

34.6 |

9.0 |

34.0 |

31.1 |

9.3 |

71.7 |

65.7 |

9.1 |

| Total retail |

1,680.2 |

1,628.4 |

3.2 |

1,497.6 |

1,445.5 |

3.6 |

3,177.8 |

3,073.9 |

3.4 |

| Wholesale2 |

35.8 |

34.9 |

2.6 |

16.3 |

16.2 |

0.6 |

52.1 |

51.1 |

2.0 |

| Overall Total |

1,716.0 |

1,663.3 |

3.2 |

1,513.9 |

1,461.7 |

3.6 |

3,229.9 |

3,125.0 |

3.4 |

| Olímpia |

4.0 |

- |

- |

4.4 |

- |

- |

8.4 |

- |

- |

| Consolidated Grand Total |

1,720.0 |

1,663.3 |

3.4 |

1,518.3 |

1,461.7 |

3.9 |

3,238.3 |

3,125.0 |

3.6 |

1. Unaudited by external auditors

2 Wholesale includes volumes of reuse water and non-domestic sewage

| Earnings

Results 3Q24 Page 8 |

| | |

| c.) | COSTS, ADMINISTRATIVE, AND SELLING EXPENSES |

Costs, administrative, and selling expenses

decreased by R$ 226 million in 3Q24 (-6.6%).

R$ million

| |

3Q24 adjusted |

3Q23 |

Var. (R$) |

% |

9M24 adjusted |

9M23 |

Var. (R$) |

% |

| Salaries, payroll charges and benefits, and Pension plan obligations |

733 |

801 |

(68) |

(8.5) |

2,190 |

2,363 |

(173) |

(7.3) |

| General supplies |

93 |

96 |

(3) |

(4.2) |

268 |

274 |

(6) |

(2.1) |

| Treatment supplies |

121 |

113 |

8 |

6.4 |

386 |

417 |

(31) |

(7.3) |

| Services |

629 |

725 |

(96) |

(13.2) |

1,975 |

1,993 |

(18) |

(0.9) |

| Electricity |

402 |

368 |

34 |

9.3 |

1,184 |

1,151 |

33 |

2.9 |

| General expenses |

546 |

458 |

88 |

19.2 |

1,402 |

1,168 |

234 |

20.0 |

| Share of the municipal government in the collection (São Paulo) |

186 |

177 |

9 |

5.0 |

542 |

492 |

50 |

10.1 |

| Share of the municipal government in the collection (other municipalities) |

107 |

44 |

63 |

139.9 |

249 |

122 |

127 |

103.5 |

| Provisions |

153 |

164 |

(11) |

(6.9) |

358 |

328 |

30 |

9.4 |

| Other general expenses |

100 |

73 |

27 |

39.0 |

253 |

226 |

27 |

11.6 |

| Tax expenses |

22 |

23 |

(1) |

(3.9) |

61 |

64 |

(3) |

(3.8) |

| Depreciation and amortization |

543 |

714 |

(171) |

(23.9) |

2,106 |

2,041 |

65 |

3.2 |

| Allowance for doubtful accounts |

140 |

156 |

(16) |

(10.4) |

403 |

537 |

(134) |

(25.0) |

| Costs, administrative, and selling expenses |

3,229 |

3,454 |

(225) |

(6.5) |

9,975 |

10,008 |

(33) |

(0.3) |

SALARIES, PAYROLL CHARGES AND BENEFITS, AND PENSION

PLAN OBLIGATIONS

The R$ 68 million decrease (-8.5%) recorded in 3Q24 was mainly

due to:

| · | reduction of 13.1% in the average number of employees, with an impact of R$ 53 million; and |

| · | reduction of R$ 14 million in healthcare expenses. |

The aforementioned decreases were partially offset by the

2.0% application in February 2024 referring to the Career and Salary Plan, and the 2.77% salary adjustment in May 2024.

SERVICES

Services fell by R$ 96 million (-13.2%) in 3Q24, of which

mainly R$ 69 million in paving and replacement of sidewalks.

ELECTRICITY

Electricity expenses increased by R$ 34 million (+9.3%),

mainly due to higher consumption in operations at the reservoirs, due to the period of greater drought, generating a consumption 12% higher,

partially offset by gains in tariffs due to the improved mix of ACL (Free Contracting Environment) x ACR (Regulated Contracting Environment).

GENERAL EXPENSES

Increase of R$ 88 million (+19.2%), totaling R$ 546 million

in 3Q24, compared to the R$ 458 million reported in 3Q23, mainly due to the higher provision for transfer to the Municipal Funds for Environmental

Sanitation and Infrastructure, of R$ 71 million (pass-through), due to the new agreement of URAE-1.

Expenses with municipal transfers totaled R$ 292 million

in 3Q24, compared to the R$ R$ 221 million reported in 3Q23. Expenses with the use of water came to R$ 25 million in 3Q24, compared to

the R$ 28 million recorded in 3Q23.

| Earnings

Results 3Q24 Page 9 |

| | |

R$ milhões

| MUNICIPAL TRANSFERS |

| Municipality |

3Q24 |

3Q23 |

Var. (R$) |

% |

| Guarulhos |

9.2 |

- |

9.2 |

- |

| São Paulo |

185.6 |

176.8 |

8.8 |

5.0 |

| Osasco |

3.6 |

- |

3.6 |

- |

| Barueri |

3.4 |

- |

3.4 |

- |

| Suzano |

2.8 |

- |

2.8 |

- |

| Other municipalities |

87.5 |

44.4 |

43.1 |

97.1 |

| Total |

292.1 |

221.2 |

70.9 |

32.1 |

DEPRECIATION AND AMORTIZATION

Decrease of R$ 171 million (-16.9%), due to the signing of

the new agreement with URAE-1, effective until October 19, 2060, resulting in the reduction of the average amortization rate.

R$ million

| |

3Q24 |

3Q23 |

Var. (R$) |

% |

| Financial expenses, net of revenue |

(474) |

(333) |

(141) |

42.4 |

| Monetary and exchange variations, net |

(51) |

(98) |

48 |

(48.4) |

| Financial Result |

(525) |

(431) |

(94) |

21.7 |

Financial expenses, net

of revenue

R$ million

| |

3Q24 |

3Q23 |

Var. (R$) |

% |

| Financial expenses |

|

|

|

|

| Interest and charges on domestic borrowings and financing |

(346) |

(297) |

(49) |

16.3 |

| Interest and charges on international borrowings and financing |

(32) |

(22) |

(9) |

41.5 |

| Other financial expenses |

(226) |

(158) |

(68) |

42.8 |

| Total financial expenses |

(603) |

(478) |

(125) |

26.2 |

| Financial revenue |

129 |

145 |

(16) |

(10.8) |

| Financial expenses, net of revenue |

(474) |

(333) |

(141) |

42.4 |

The main impacts resulted from:

| · | Increase of R$ 49 million in interest and charges on domestic borrowings and financing, mainly due to the 31st and 32nd issues debentures; |

| · | Increase of R$ 9 million in interest and charges on international borrowings and financing, due to new IDB and IBRD fundraising; |

| · | Increase of R$ 68 million in other financial expenses, mainly due to the (i) R$ 97 million increase in interest on Public-Private

Partnership - PPP; (ii) R$ 19 million increase in interest on lawsuits; and (iii) non-recurring present value adjustment of performance

agreements in 3Q23, of R$ 42 million, as a result of the higher number of agreements that entered the payment phase; and |

| Earnings

Results 3Q24 Page 10 |

| | |

| · | Decrease of R$ 16 million in financial revenue, mainly due to higher present value adjustment of installment payment agreements, of

R$ 48 million, partially offset by the increase in revenue on financial investments in 3Q24, of R$ 40 million, due to the increase in

the applied balance. |

Monetary and exchange

variations, net

R$ million

| |

3Q24 |

3Q23 |

Var. (R$) |

% |

| Monetary and exchange variations on liabilities |

|

|

|

|

| Monetary variations on borrowings and financing |

(11) |

(15) |

3 |

(23.3) |

| Exchange variations on borrowings and financing |

(102) |

(50) |

(52) |

104.8 |

| Gains/(Losses) with derivative financial instruments |

42 |

- |

42 |

- |

| Other monetary variations |

(70) |

(69) |

(1) |

1.5 |

| Total monetary and exchange variations on liabilities |

(142) |

(133) |

(8) |

6.3 |

| Monetary and exchange variations on assets |

91 |

35 |

56 |

159.3 |

| Monetary and exchange variations, net |

(51) |

(98) |

48 |

(48.4) |

The positive effect of net monetary and exchange variations

in 3Q24 was R$ 48 million compared to 3Q23, especially due to:

| · | Increase of R$ 52 million in exchange variations on borrowings and financing, due to the higher appreciation of the Yen in 3Q24 (+10.0%),

compared to the appreciation recorded in 3Q23 (+0.5%); |

| · | Gains with derivative financial instruments, of R$ 42 million; and |

| · | An increase of R$ 56 million in monetary variations on assets, mainly due to higher monetary variation on agreements in 3Q24. |

| Operating Indicators * |

3Q24 |

3Q23 |

% |

| Water Connections1 |

9,428 |

9,402 |

0.3 |

| Sewage Connections1 |

8,139 |

8,089 |

0.6 |

| Number of Employees |

10,557 |

11,606 |

(9.0) |

1. Active connections in thousand units at the end of the

period.

* Unaudited by external auditors.

| Earnings

Results 3Q24 Page 11 |

| | |

| 7. | Borrowings and financing |

R$ thousand

| DEBT PROFILE |

| INSTITUTION |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 onwards |

TOTAL |

% of total |

| Local currency |

|

|

|

|

|

|

|

|

|

| Brazilian Federal Savings Bank |

29,484 |

122,498 |

130,139 |

138,245 |

146,724 |

152,541 |

975,248 |

1,694,878 |

7 |

| IDBs - National |

14,100 |

260,899 |

330,209 |

315,069 |

420,959 |

384,035 |

1,974,773 |

3,700,044 |

16 |

| IFC |

11,400 |

44,200 |

61,800 |

80,800 |

123,600 |

181,600 |

1,209,801 |

1,713,201 |

7 |

| Debentures |

228,197 |

1,320,005 |

3,717,187 |

1,399,392 |

669,215 |

1,305,585 |

3,234,778 |

11,874,359 |

50 |

| BNDES |

70,586 |

261,810 |

251,841 |

239,041 |

84,680 |

34,319 |

190,347 |

1,132,624 |

5 |

| FEHIDRO |

429 |

1,716 |

429 |

- |

- |

- |

- |

2,574 |

0 |

| Leases (Concession Agreements, Program Contracts, and Contract Asset)1 |

26,265 |

28,340 |

28,340 |

28,340 |

28,340 |

25,729 |

146,475 |

311,827 |

0 |

| Leases (Others)2 |

16,110 |

92,140 |

50,161 |

1,494 |

8,537 |

- |

- |

168,441 |

1 |

| Interest and Charges |

240,035 |

139,784 |

- |

- |

- |

- |

- |

379,819 |

2 |

| Total in local currency |

636,605 |

2,271,390 |

4,570,104 |

2,202,381 |

1,482,055 |

2,083,809 |

7,731,421 |

20,977,765 |

88 |

| Foreign currency |

|

|

|

|

|

|

|

|

|

| IDBs |

- |

77,815 |

43,638 |

43,638 |

43,638 |

43,638 |

607,397 |

859,764 |

4 |

| IBRDs |

- |

33,123 |

33,123 |

33,123 |

33,123 |

40,607 |

418,460 |

591,559 |

2 |

| JICAs |

5,490 |

163,179 |

163,179 |

163,179 |

163,179 |

163,076 |

580,950 |

1,402,232 |

6 |

| Interest and Other Charges |

22,649 |

3,263 |

- |

- |

- |

- |

- |

25,912 |

0 |

| Total in foreign currency |

28,139 |

277,380 |

239,940 |

239,940 |

239,940 |

247,321 |

1,606,807 |

2,879,467 |

12 |

| Total |

664,744 |

2,548,770 |

4,810,044 |

2,442,321 |

1,721,995 |

2,331,130 |

9,338,228 |

23,857,232 |

100 |

1 Refers to work contracts signed as Assets Lease;

2 Obligations related to leasing agreements, mainly vehicle leases.

Covenants

The table below shows the most restrictive

clauses in 3Q24:

| |

Covenants |

| Adjusted EBITDA / Adjusted Financial Expenses |

Equal to or higher than 2.80 |

| EBITDA / Financial Expenses Paid |

Equal to or higher than 2.35 |

| Adjusted Net Debt / Adjusted EBITDA |

Equal to or lower than 3.80 |

| Net Debt / Adjusted EBITDA |

Equal to or lower than 3.50 |

| Other Onerous Debt1 / Adjusted EBITDA |

Equal to or lower than 1.30 |

1. “Other Onerous Debts” correspond to the sum of pension plan obligations and healthcare plan, installment payment of tax

debts, and installment payment of debts with the electricity supplier.

In 3Q24 and 3Q23, the Company met the requirements of its

borrowings and financing agreements.

| Earnings

Results 3Q24 Page 12 |

| | |

Investments totaled R$ 1,444 million in 3Q24, while cash

disbursed for Investments, including from previous periods, totaled R$ 1,483 million.

The table below shows investments broken

down by water and sewage:

R$ million

| |

Water |

Sewage |

Total |

| Investments made |

708 |

736 |

1,444 |

Investments totaled R$ 4,161 million in 9M24, of which R$

1,926 million in water and R$ 2,235 million in sewage. The accumulated cash disbursed for Investments, including from previous periods,

totaled R$ 3,221 million.

| 9. | Public-Private Partnerships |

The chart below shows expenses with Public-Private Partnerships

in 3Q24, compared to the figures reported in 3Q23:

R$ thousand

| SÃO LOURENÇO PRODUCTION SYSTEM |

3Q24 |

3Q23 |

Var. (R$) |

% |

| General Supplies |

4,976 |

4,856 |

120 |

2.5 |

| Services |

10,499 |

10,245 |

254 |

2.5 |

| General Expenses |

1,375 |

1,342 |

33 |

2.5 |

| Amortization |

42,437 |

42,475 |

(38) |

(0.1) |

| Financial Expenses |

131,108 |

81,205 |

49,904 |

61.5 |

| Total |

190,394 |

140,122 |

50,273 |

35.9 |

| ALTO TIETÊ PRODUCTION SYSTEM |

3Q24 |

3Q23 |

Var. (R$) |

% |

| Amortization |

4,066 |

4,078 |

(13) |

(0.3) |

| Total |

4,066 |

4,078 |

(13) |

(0.3) |

| Total expenses with PPP |

194,460 |

144,200 |

50,260 |

34.9 |

| Earnings

Results 3Q24 Page 13 |

| | |

| Earnings

Results 3Q24 Page 14 |

| | |

Holding - Income Statement

| Brazilian Corporate Law |

|

R$ '000 |

| |

3Q24 |

3Q23 |

| Net Operating Income |

14,986,700 |

6,453,246 |

| Operating Costs |

(3,981,574) |

(3,944,519) |

| Gross Profit |

11,005,126 |

2,508,727 |

| Operating Expenses |

|

|

| Selling |

(198,230) |

(237,074) |

| Estimated losses with doubtful accounts |

(139,993) |

(156,664) |

| Administrative expenses |

(649,713) |

(419,083) |

| Other operating revenue (expenses), net |

(169,687) |

6,028 |

| Operating Income Before Shareholdings |

9,847,503 |

1,701,934 |

| Equity Result |

6,211 |

4,635 |

| Earnings Before Financial Results, net |

9,853,714 |

1,706,569 |

| Financial, net |

(460,604) |

(379,339) |

| Exchange gain (loss), net |

(60,646) |

(49,581) |

| Earnings before Income Tax and Social Contribution |

9,332,464 |

1,277,649 |

| Income Tax and Social Contribution |

|

|

| Current |

(433,782) |

(461,143) |

| Deferred |

(2,786,799) |

29,789 |

| Net Income for the period |

6,111,883 |

846,295 |

| Registered common shares ('000) |

683,509 |

683,509 |

| Earnings per shares - R$ (per share) |

8.94 |

1.24 |

| Depreciation and Amortization |

(591,655) |

(713,461) |

| Adjusted EBITDA |

10,615,056 |

2,414,002 |

| % over net revenue |

70.80% |

37.40% |

| Earnings

Results 3Q24 Page 15 |

| | |

Holding - Balance Sheet

| Brazilian Corporate Law |

|

|

R$ '000 |

| ASSETS |

09/30/2024 |

|

12/31/2023 |

| Current assets |

|

|

|

| Cash and cash equivalents |

2,393,258 |

|

838,338 |

| Financial investments |

1,269,031 |

|

2,425,921 |

| Trade receivables |

3,639,743 |

|

3,580,962 |

| Related parties and transactions |

272,623 |

|

261,273 |

| Inventories |

97,827 |

|

85,953 |

| Restricted cash |

29,596 |

|

54,944 |

| Currrent recoverable taxes |

183,724 |

|

494,645 |

| Derivative Financial Instruments |

171,250 |

|

- |

| Other assets |

104,138 |

|

37,296 |

| Total current assets |

8,161,190 |

|

7,779,332 |

| |

|

|

|

| Noncurrent assets |

|

|

|

| Financial investments |

753,137 |

|

- |

| Trade receivables |

336,577 |

|

272,436 |

| Related parties and transactions |

914,056 |

|

935,272 |

| Escrow deposits |

135,118 |

|

130,979 |

| Deferred income tax and social contribution |

- |

|

98,076 |

| National Water and Sanitation Agency – ANA |

1,957 |

|

2,673 |

| Other assets |

302,606 |

|

237,628 |

| |

|

|

|

| Equity investments |

224,245 |

|

161,863 |

| Investment properties |

46,642 |

|

46,678 |

| Contract assets |

6,827,740 |

|

7,393,096 |

| Financial assets |

16,244,999 |

|

|

| Intangible assets |

41,679,946 |

|

43,865,269 |

| Property, plant and equipment |

515,973 |

|

474,559 |

| Total noncurrent assets |

67,982,996 |

|

53,618,529 |

| |

|

|

|

| Total assets |

76,144,186 |

|

61,397,861 |

| |

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

| Current liabilities |

|

|

|

| Trade payables |

268,374 |

|

456,064 |

| Borrowings and financing |

2,637,216 |

|

2,616,406 |

| Accrued payroll and related charges |

641,154 |

|

807,440 |

| Taxes and contributions |

269,773 |

|

511,468 |

| Dividends and interest on capital payable |

744 |

|

837,391 |

| Provisions |

1,513,228 |

|

1,064,367 |

| Services payable |

811,788 |

|

749,226 |

| Public-Private Partnership – PPP |

444,264 |

|

487,926 |

| Program Contract Commitments |

35 |

|

21,969 |

| Earnings

Results 3Q24 Page 16 |

| | |

| Other liabilities |

583,910 |

|

779,424 |

| Total current liabilities |

7,170,486 |

|

8,331,681 |

| |

|

|

|

| Noncurrent liabilities |

|

|

|

| Borrowings and financing |

21,220,016 |

|

16,919,944 |

| Deferred income tax and social contribution |

2,656,048 |

|

- |

| Deferred Cofins and Pasep |

998,436 |

|

164,097 |

| Provisions |

827,895 |

|

762,065 |

| Pension obligations |

2,106,294 |

|

2,142,871 |

| Public-Private Partnership – PPP |

2,797,417 |

|

2,798,688 |

| Program Contract Commitments |

- |

|

12,047 |

| Other liabilities |

458,622 |

|

409,092 |

| Total noncurrent liabilities |

31,064,728 |

|

23,208,804 |

| |

|

|

|

| Total liabilities |

38,235,214 |

|

31,540,485 |

| |

|

|

|

| Equity |

|

|

|

| Paid-up capital |

15,000,000 |

|

15,000,000 |

| Profit reserve |

14,617,966 |

|

14,711,014 |

| Other comprehensive income |

146,362 |

|

146,362 |

| Retained earnings |

8,144,644 |

|

- |

| Total equity |

37,908,972 |

|

29,857,376 |

| |

|

|

|

| Total equity and liabilities |

76,144,186 |

|

61,397,861 |

| Earnings

Results 3Q24 Page 17 |

| | |

Holding - Cash Flow

| Brazilian Corporate Law |

|

|

R$ '000 |

| |

|

3Q24 |

|

3Q23 |

| Cash flow from operating activities |

|

|

|

| Profit before income tax and social contribution |

12,408,884 |

|

3,467,427 |

| Adjustment for Net income reconciliation: |

|

|

|

| Depreciation and amortization |

2,152,413 |

|

2,041,377 |

| Residual value of property, plant and equipment and intangible assets written-off |

5,750 |

|

7,241 |

| Allowance for doubtful accounts |

(402,156) |

|

536,895 |

| Provision and inflation adjustment |

651,916 |

|

331,157 |

| Interest calculated on loans and financing payable |

1,165,164 |

|

960,460 |

| Inflation adjustment and foreign exchange gains (losses) on loans and financing |

400,274 |

|

(174,497) |

| Interest and inflation adjustment losses |

11,795 |

|

13,976 |

| Interest and inflation adjustment gains |

(145,367) |

|

(88,031) |

| Financial charges from customers |

(363,520) |

|

(285,514) |

| Margin on intangible assets arising from concession |

(93,038) |

|

(84,577) |

| Provision for Consent Decree (TAC), Knowledge Retention Program (PRC) and Incentivized Dismissal Program (IDP) |

(261,362) |

|

571,275 |

| Equity result |

(16,344) |

|

(21,016) |

| Interest and inflation adjustment (Public-Private Partnership) |

392,251 |

|

366,143 |

| Provision from São Paulo agreement |

187,155 |

|

185,838 |

| Pension obligations |

146,617 |

|

155,763 |

| Deferred COFINS-PASEP - Financial Assets |

815,836 |

|

- |

| Derivative financial instruments |

(133,154) |

|

- |

| Updating financial assets (compensation) |

(8,819,847) |

|

- |

| Other adjustments |

14,560 |

|

17,629 |

| |

|

8,117,827 |

|

8,001,546 |

| Changes in assets |

|

|

|

| Trade accounts receivable |

659,383 |

|

(563,914) |

| Accounts receivable from related parties |

31,841 |

|

8,325 |

| Inventories |

(11,874) |

|

3,639 |

| Recoverable taxes |

310,921 |

|

(19,836) |

| Escrow deposits |

49,949 |

|

48,850 |

| Other assets |

(117,553) |

|

(93,738) |

| Changes in liabilities |

|

|

|

| Trade payables and contractors |

(438,317) |

|

(409,644) |

| Services payable |

(124,593) |

|

(152,533) |

| Accrued payroll and related charges |

58,616 |

|

(30,917) |

| Taxes and contributions payable |

(401,462) |

|

(168,118) |

| Deferred Cofins/Pasep |

18,503 |

|

214 |

| Provisions |

(137,225) |

|

(224,307) |

| Pension obligations |

(183,194) |

|

(179,036) |

| Other liabilities |

(200,013) |

|

(684,069) |

| Cash generated from operations |

7,632,809 |

|

5,536,462 |

| |

|

|

|

|

| Interest paid |

(1,551,550) |

|

(1,476,871) |

| Earnings

Results 3Q24 Page 18 |

| | |

| Income tax and contribution paid |

(1,350,349) |

|

(1,062,516) |

| |

|

|

|

|

| Net cash generated from operating activities |

4,730,910 |

|

2,997,075 |

| |

|

|

|

|

| Cash flows from investing activities |

|

|

|

| Acquisition of contract assets and intangible assets |

(5,882,964) |

|

(2,209,493) |

| Restricted cash |

25,348 |

|

(16,262) |

| Financial investments - Investment |

(5,206,300) |

|

331,342 |

| Financial investments - Redemption |

6,415,865 |

|

- |

| Financial Investments |

(753,137) |

|

- |

| Investments |

(40,234) |

|

(1,676) |

| Purchases of tangible assets |

(62,737) |

|

(88,242) |

| Net cash used in investing activities |

(5,504,159) |

|

(1,984,331) |

| |

|

|

|

|

| Cash flow from financing activities |

|

|

|

| Loans and financing |

|

|

|

| Proceeds from loans |

5,630,451 |

|

1,391,821 |

| Repayments of loans |

(1,862,689) |

|

(1,276,199) |

| Payment of interest on shareholders'equity |

(928,851) |

|

(823,671) |

| Public-Private Partnership – PPP |

(437,184) |

|

(502,375) |

| Program Contract Commitments |

(35,462) |

|

(76,917) |

| Paid derivative financial instruments |

(38,096) |

|

- |

| Net cash used in financing activities |

2,328,169 |

|

(1,287,341) |

| |

|

|

|

|

| Increase/(decrease) in cash and cash equivalents |

1,554,920 |

|

(274,597) |

| |

|

|

|

|

| Represented by: |

|

|

|

| Cash and cash equivalents at beginning of the year |

838,338 |

|

1,867,485 |

| Cash and cash equivalents at end of the year |

2,393,258 |

|

1,592,888 |

| Increase/(decrease) in cash and cash equivalents |

1,554,920 |

|

(274,597) |

| Earnings

Results 3Q24 Page 19 |

| | |

Consolidated - Income Statement

| Brazilian Corporate Law |

|

R$ '000 |

| |

3Q24 |

3Q23 |

| Net Operating Income |

14,996,842 |

6,453,246 |

| Operating Costs |

(3,987,397) |

(3,944,519) |

| Gross Profit |

11,009,445 |

2,508,727 |

| Operating Expenses |

|

|

| Selling |

(198,552) |

(237,074) |

| Estimated losses with doubtful accounts |

(140,315) |

(156,664) |

| Administrative expenses |

(651,484) |

(419,083) |

| Other operating revenue (expenses), net |

(169,685) |

6,028 |

| Operating Income Before Shareholdings |

9,849,409 |

1,701,934 |

| Equity Result |

8,794 |

6,711 |

| Earnings Before Financial Results, net |

9,858,203 |

1,708,645 |

| Financial, net |

(463,891) |

(381,415) |

| Exchange gain (loss), net |

(60,646) |

(49,581) |

| Earnings before Income Tax and Social Contribution |

9,333,666 |

1,277,649 |

| Income Tax and Social Contribution |

|

|

| Current |

(434,984) |

(461,143) |

| Deferred |

(2,786,799) |

29,789 |

| Net Income for the period |

6,111,883 |

846,295 |

| Registered common shares ('000) |

683,509 |

683,509 |

| Earnings per shares - R$ (per share) |

8.94 |

1.24 |

| Depreciation and Amortization |

(592,888) |

(713,461) |

| Adjusted EBITDA |

10,620,776 |

2,416,078 |

| % over net revenue |

70.8% |

37.4% |

| Earnings

Results 3Q24 Page 20 |

| | |

Consolidated - Balance Sheet

| Brazilian Corporate Law |

|

|

R$ '000 |

| ASSETS |

09/30/2024 |

|

09/30/2023 |

| Current assets |

|

|

|

| Cash and cash equivalents |

2,393,304 |

|

838,484 |

| Financial investments |

1,275,704 |

|

2,426,752 |

| Trade receivables |

3,645,752 |

|

3,584,287 |

| Related parties and transactions |

272,659 |

|

261,280 |

| Inventories |

98,121 |

|

86,008 |

| Restricted cash |

29,596 |

|

54,944 |

| Currrent recoverable taxes |

183,761 |

|

494,647 |

| Derivative Financial Instruments |

171,250 |

|

- |

| Other assets |

99,636 |

|

37,048 |

| Total current assets |

8,169,783 |

|

7,783,450 |

| |

|

|

|

| Noncurrent assets |

|

|

|

| Financial investments |

753,137 |

|

- |

| Trade receivables |

336,577 |

|

272,436 |

| Related parties and transactions |

914,056 |

|

935,272 |

| Escrow deposits |

135,118 |

|

130,979 |

| Deferred income tax and social contribution |

- |

|

98,076 |

| National Water and Sanitation Agency – ANA |

1,957 |

|

2,673 |

| Other assets |

137,023 |

|

159,017 |

| |

|

|

|

| Equity investments |

224,245 |

|

161,863 |

| Investment properties |

46,642 |

|

46,678 |

| Contract assets |

6,831,603 |

|

7,393,096 |

| Financial assets |

16,244,999 |

|

- |

| Intangible assets |

41,823,835 |

|

44,012,858 |

| Property, plant and equipment |

515,973 |

|

474,559 |

| Total noncurrent assets |

67,965,165 |

|

53,687,507 |

| |

|

|

|

| Total assets |

76,134,948 |

|

61,470,957 |

| |

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

| Current liabilities |

|

|

|

| Trade payables |

268,917 |

|

456,215 |

| Borrowings and financing |

2,637,216 |

|

2,616,406 |

| Accrued payroll and related charges |

641,154 |

|

807,440 |

| Taxes and contributions |

271,113 |

|

511,972 |

| Dividends and interest on capital payable |

744 |

|

837,391 |

| Provisions |

1,513,228 |

|

1,064,367 |

| Services payable |

812,990 |

|

750,732 |

| Public-Private Partnership – PPP |

444,264 |

|

487,926 |

| Program Contract Commitments |

35 |

|

21,969 |

| Earnings

Results 3Q24 Page 21 |

| | |

| Other liabilities |

583,910 |

|

853,424 |

| Total current liabilities |

7,173,571 |

|

8,407,842 |

| |

|

|

|

| Noncurrent liabilities |

|

|

|

| Borrowings and financing |

21,220,016 |

|

16,919,944 |

| Deferred income tax and social contribution |

2,656,048 |

|

- |

| Deferred Cofins and Pasep |

998,436 |

|

164,097 |

| Provisions |

827,895 |

|

762,065 |

| Pension obligations |

2,106,294 |

|

2,142,871 |

| Public-Private Partnership – PPP |

2,797,417 |

|

2,798,688 |

| Program Contract Commitments |

- |

|

12,047 |

| Other liabilities |

446,299 |

|

406,027 |

| Total noncurrent liabilities |

31,052,405 |

|

23,205,739 |

| |

|

|

|

| Total liabilities |

38,225,976 |

|

31,613,581 |

| |

|

|

|

| Equity |

|

|

|

| Paid-up capital |

15,000,000 |

|

15,000,000 |

| Profit reserve |

14,617,966 |

|

14,711,014 |

| Other comprehensive income |

146,362 |

|

146,362 |

| Retained earnings |

8,144,644 |

|

- |

| Total equity |

37,908,972 |

|

29,857,376 |

| |

|

|

|

| Total equity and liabilities |

76,134,948 |

|

61,470,957 |

| Earnings

Results 3Q24 Page 22 |

| | |

Consolidated - Cash Flow

| Brazilian Corporate Law |

|

|

R$ '000 |

| |

|

Jan-Sep 2024 |

|

Jan-Sep 2023 |

| Cash flow from operating activities |

|

|

|

| Profit before income tax and social contribution |

12,412,192 |

|

3,467,427 |

| Adjustment for Net income reconciliation: |

|

|

|

| Depreciation and amortization |

2,156,113 |

|

2,041,377 |

| Residual value of property, plant and equipment and intangible assets written-off |

5,750 |

|

7,241 |

| Allowance for doubtful accounts |

(402,156) |

|

536,895 |

| Provision and inflation adjustment |

651,916 |

|

331,157 |

| Interest calculated on loans and financing payable |

1,165,164 |

|

960,460 |

| Inflation adjustment and foreign exchange gains (losses) on loans and financing |

400,274 |

|

(174,497) |

| Interest and inflation adjustment losses |

11,795 |

|

13,976 |

| Interest and inflation adjustment gains |

(145,640) |

|

(88,031) |

| Financial charges from customers |

(363,520) |

|

(285,514) |

| Margin on intangible assets arising from concession |

(93,125) |

|

(84,577) |

| Provision for Consent Decree (TAC), Knowledge Retention Program (PRC) and Incentivized Dismissal Program (IDP) |

(261,362) |

|

571,275 |

| Equity result |

(25,601) |

|

(23,092) |

| Interest and inflation adjustment (Public-Private Partnership) |

392,251 |

|

366,143 |

| Provision from São Paulo agreement |

187,155 |

|

185,838 |

| Pension obligations |

146,617 |

|

155,763 |

| Deferred COFINS-PASEP - Financial Assets |

815,836 |

|

- |

| Derivative financial instruments |

(133,154) |

|

- |

| Updating financial assets (compensation) |

(8,819,847) |

|

- |

| Other adjustments |

14,560 |

|

17,629 |

| |

|

8,115,218 |

|

7,999,470 |

| Changes in assets |

|

|

|

| Trade accounts receivable |

656,705 |

|

(563,914) |

| Accounts receivable from related parties |

31,805 |

|

8,325 |

| Inventories |

(12,112) |

|

3,639 |

| Recoverable taxes |

310,885 |

|

(19,836) |

| Escrow deposits |

49,949 |

|

48,850 |

| Other assets |

(26,326) |

|

(17,660) |

| Changes in liabilities |

|

|

|

| Trade payables and contractors |

(437,925) |

|

(409,644) |

| Services payable |

(124,897) |

|

(152,533) |

| Accrued payroll and related charges |

58,616 |

|

(30,917) |

| Taxes and contributions payable |

(401,453) |

|

(168,118) |

| Deferred Cofins/Pasep |

18,503 |

|

214 |

| Provisions |

(137,225) |

|

(224,307) |

| Pension obligations |

(183,194) |

|

(179,036) |

| Other liabilities |

(274,013) |

|

(610,069) |

| Cash generated from operations |

7,644,536 |

|

5,684,464 |

| Earnings

Results 3Q24 Page 23 |

| | |

| |

|

|

|

|

| Interest paid |

(1,551,550) |

|

(1,476,871) |

| Income tax and contribution paid |

(1,352,831) |

|

(1,062,516) |

| |

|

|

|

|

| Net cash generated from operating activities |

4,740,155 |

|

3,145,077 |

| |

|

|

|

|

| Cash flows from investing activities |

|

|

|

| Acquisition of contract assets and intangible assets |

(5,886,740) |

|

(2,357,493) |

| Restricted cash |

25,348 |

|

(16,262) |

| Financial investments - Investment |

|

(5,218,947) |

|

- |

| Financial investments - Redemption |

6,422,943 |

|

331,342 |

| Financial Investments |

(753,137) |

|

- |

| Investments |

(40,234) |

|

(1,676) |

| Purchases of tangible assets |

(62,737) |

|

(88,242) |

| Net cash used in investing activities |

(5,513,504) |

|

(2,132,331) |

| |

|

|

|

|

| Cash flow from financing activities |

|

|

|

| Loans and financing |

|

|

|

| Proceeds from loans |

5,630,451 |

|

1,391,821 |

| Repayments of loans |

(1,862,689) |

|

(1,276,199) |

| Payment of interest on shareholders' equity |

(928,851) |

|

(823,671) |

| Public-Private Partnership – PPP |

(437,184) |

|

(502,375) |

| Program Contract Commitments |

(35,462) |

|

(76,917) |

| Paid derivative financial instruments |

(38,096) |

|

811 |

| Net cash used in financing activities |

2,328,169 |

|

(1,286,530) |

| |

|

|

|

|

| Increase/(decrease) in cash and cash equivalents |

1,554,820 |

|

(273,784) |

| |

|

|

|

|

| Represented by: |

|

|

|

| Cash and cash equivalents at beginning of the year |

838,484 |

|

1,867,485 |

| Cash and cash equivalents at end of the year |

2,393,304 |

|

1,593,701 |

| Increase/(decrease) in cash and cash equivalents |

1,554,820 |

|

(273,784) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: November 13, 2024

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Daniel Szlak

|

|

| |

Name: Daniel Szlak

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

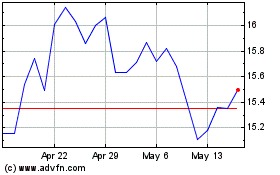

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Jan 2024 to Jan 2025