UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 29, 2015 (July 28, 2015)

SOUTHERN COPPER CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-14066 |

|

13-3849074 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

1440 E. Missouri Ave., Suite 160, Phoenix, AZ 85014

(Address of principal executive offices, including zip code)

(602) 264-1375

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02 Results of Operations and Financial Condition

On July 28, 2015, Southern Copper Corporation (“SCC”) issued a press release announcing financial results for the quarter ended on June 30, 2015. In this press release, SCC reported that on July 23, 2015, its Board of Directors authorized a cash dividend of $0.10 per share of common stock. This dividend is payable on August 27, 2015 to shareholders of record at the close of business on August 13, 2015. A copy of this press release is attached hereto as Exhibit 99.1.

The information in this report and the exhibit attached hereto are being furnished and shall not be deemed as “filed” for purposes of Section 18 of the Securities Act of 1934. Accordingly, this information will not be incorporated by reference into any registration statement or other document filed by Southern Copper Corporation pursuant to the Securities Act of 1933 or the Securities Exchange Act of 1934, except as expressly stated in such filing.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits:

99.1 Press release of Southern Copper Corporation dated July 28, 2015, furnished pursuant to Item 2.02 of this Form 8-K.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SOUTHERN COPPER CORPORATION |

|

|

|

|

|

|

|

|

By: |

/s/ Raul Jacob |

|

|

Name: |

Raul Jacob |

|

|

Title: |

Vice President, Finance and Chief Financial Officer |

Date: July 29, 2015

3

INDEX TO EXHIBITS

|

Exhibits |

|

|

|

|

|

|

|

99.1 |

|

Press release of Southern Copper Corporation dated July 28, 2015, furnished pursuant to Item 2.02 of this Form 8-K. |

4

Exhibit 99.1

|

|

|

Investor Relations: |

|

July 28, 2015 - Southern Copper Corporation (NYSE and BVL: SCCO) |

|

|

|

|

|

|

|

|

Raul Jacob

(602) 264-1375 |

|

· First half of 2015 (“1H15”) net sales were $2,657.7 million, 6.5% lower than 1H14 net sales of $2,841.8 million, mainly due to lower metal prices of copper (-14.2%), molybdenum (-32.2%) and silver (-17.5%) partially offset by higher sales volumes of copper (+14.0%), zinc (+6.6%) and molybdenum (+1.7%). |

|

|

southerncopper@southernperu.com.pe

www.southerncoppercorp.com |

|

|

|

|

|

|

|

|

|

· EBITDAi in 1H15 was $1,193.4 million, 13.3% lower than the $1,376.8 million in 1H14. The margin decreased from 48.4% to 44.9%. |

· Net income in 1H15 was $577.1 million (21.7% of net sales), 12.6% lower than net income of $660.6 million (23.2% of net sales) in the 1H14.

· Copper mine production increased in 1H15 to 356,701 tons (+8.6%) from 328,519 tons in 1H14, mainly as a result of the production performance of the Buenavista mine, which increased production by 23,956 tons (+23.0%). The remaining 4,226 tons of additional copper production resulted from better ore grades and recoveries from our operations of Toquepala (+6.7%) and La Caridad (+2.3%).

· By-product production: Molybdenum production increased by 2.0% to 11,615 tons in 1H15 from 11,386 tons in 1H14 mainly due to higher production at our Peruvian mines due to higher grades which allowed us to offset lower production at the Buenavista operation. Mined silver production decreased by 3.3% in 1H15 compared with 1H14. Mined zinc production decreased 21.8% to 29,174 tons in 1H15 from 37,316 tons in 1H14, as a result of lower production at our IMMSA facilities principally due to flooding at the Santa Eulalia mine, which will be fully restored in the 4Q15. Refined zinc production was 50,028 tons in the 1H15, 3.2% higher than 1H14 production.

· Operating cash costii per pound of copper before by-products credits was $1.67 for the 1H15, a reduction of 12.6% when compared to the $1.91 per pound for the same period of 2014. Operating cash cost per pound, net of by-product credits, was $1.05 for 1H15, an increase of 5.8% compared to $1.00 in 1H14 mainly due to lower molybdenum and silver prices partially offset by higher zinc sales due to volume and prices. Cash cost for the 2Q15 was $1.67 per pound before by-products credits and $1.12 net of them.

· Acquisition of El Pilar copper project: On July 6, 2015, Southern Copper successfully completed the acquisition of El Pilar for a total consideration of $100 million in cash. El Pilar is a fully permitted, low capital intensity copper development project strategically located in Sonora, Mexico, approximately 45 kilometers from our Buenavista mine and 15 kilometers from the U.S. border. Its copper oxide mineralization contains estimated proven and probable reserves of 259 million tons of ore with an average copper grade of 0.30%. El Pilar will operate as a conventional open-pit mine and copper cathodes will be produced using the highly cost efficient and environmentally friendly SX-EW technology. Average annual production is currently estimated at 35,000 tons of copper cathodes over an initial 13-year mine life, with start of commercial operations forecasted by 2018. On a preliminary basis, we estimate a development investment of approximately $300 million and an average life-of-mine cash-costs of approximately $1.60 per pound. In the second half of 2015 the Company will commence a confirmatory exploration program together with a detailed engineering analysis to obtain synergies with our existing operations. We believe there are significant

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2015 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

optimization opportunities that could positively impact both capital investments and operational costs. El Pilar is an opportunistic acquisition that further reinforces Southern Copper’s disciplined growth strategy and focus on copper.

· Capital investments were $507.7 million for 1H15, 27.2% lower than 1H14, and represented 88.0% of net income. This decrease is explained by the near completion of the Buenavista expansions. We continue moving forward with our investment program to increase copper production capacity by approximately 90% from our 2013 production level of 617,000 tons to 1,165,000 tons by 2018.

· Dividends: On July 23, 2015, the Board of Directors authorized a dividend of $0.10 per share payable on August 27, 2015, to shareholders of record at the close of business on August 13, 2015.

Commenting on the Company’s results and outlook, Mr. German Larrea, Chairman of the Board, said “The equipment assembly at our new Buenavista concentrator has been successfully completed. Simultaneously, we have initiated integral testing of the different processes and commissioning of the facilities. As part of the ramp-up process, we expect to initiate concentrate production during the third quarter 2015 and reach full capacity by the fourth quarter of 2015. When completed, along with the SX-EW III already fully operational, we expect Buenavista’s annual production to increase from 182,200 tons in 2013 to approximately 510,000 tons of copper expected for next year, approximately 180% production growth.

Even though the current economic scenario is affecting metal prices, we believe this is a temporary headwind that will eventually fade, making the strong copper market fundamentals prevail. Further, we believe that Southern Copper´s excellent reserve base, low cash cost, conservative capital structure and growth program, makes us the industry´s best prepared company to weather this temporary downturn in metal prices.”

|

|

|

|

Second Quarter |

|

|

First Six Months |

|

|

|

|

|

2015 |

|

|

2014 |

|

|

Variance |

|

|

2015 |

|

|

2014 |

|

|

Variance |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

% |

|

|

|

|

|

|

|

|

$ |

|

|

% |

|

|

|

|

|

(in millions except per share amount and %s) |

|

|

Sales |

|

|

$1,382.9 |

|

$1,487.4 |

|

$(104.5) |

|

(7.0)% |

|

$2,657.7 |

|

$2,841.8 |

|

$(184.1) |

|

(6.5)% |

|

|

Cost of sales |

|

|

706.9 |

|

726.6 |

|

(19.7) |

|

(2.7)% |

|

1,386.7 |

|

1,368.5 |

|

18.2 |

|

1.3% |

|

|

Operating income |

|

|

503.1 |

|

597.2 |

|

(94.1) |

|

(15.8)% |

|

940.1 |

|

1,160.2 |

|

(220.1) |

|

(19.0)% |

|

|

Environmental remediation |

|

|

10.5 |

|

N/A |

|

10.5 |

|

100.0% |

|

16.5 |

|

N/A |

|

16.5 |

|

100.0% |

|

|

EBITDA1 |

|

|

637.4 |

|

707.6 |

|

(70.2) |

|

(9.9)% |

|

1,193.4 |

|

1,376.8 |

|

(183.4) |

|

(13.3)% |

|

|

EBITDA margin |

|

|

46.1% |

|

47.6% |

|

(1.5)% |

|

(3.2)pp |

|

44.9% |

|

48.4% |

|

(3.5)% |

|

(7.2)pp |

|

|

Net income |

|

|

$294.7 |

|

$337.3 |

|

$(42.6) |

|

(12.6)% |

|

$577.1 |

|

$660.6 |

|

$(83.5) |

|

(12.6)% |

|

|

Net income margin |

|

|

21.3% |

|

22.7% |

|

(1.4)% |

|

(6.2)pp |

|

21.7% |

|

23.2% |

|

(1.5)% |

|

(6.6)pp |

|

|

Income per share |

|

|

$ 0.37 |

|

$ 0.40 |

|

$(0.03) |

|

(7.5)% |

|

$ 0.72 |

|

$ 0.79 |

|

$ (0.07) |

|

(8.9)% |

|

|

Capital investments |

|

|

$284.9 |

|

$360.1 |

|

$(75.2) |

|

(20.9)% |

|

$507.7 |

|

$697.0 |

|

$(189.3) |

|

(27.2)% |

|

|

Exploration |

|

|

$ 12.1 |

|

$ 22.1 |

|

$(10.0) |

|

(45.2)% |

|

$ 22.4 |

|

$ 36.7 |

|

$ (14.3) |

|

(39.0)% |

|

1 http://www.southerncoppercorp.com/ENG/invrel/Pages/PGEbitda.aspx

|

2Q15 |

www.southerncoppercorp.com |

Page 2 of 9 |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2015 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Capital Investments

Mexican Projects

Buenavista Projects: We continue developing our $3.4 billion investment program at this unit which is expected to increase its copper production by approximately 180% as well as molybdenum production by 42%.

Mine Expansion: to date we have received sixty-one 400-ton capacity trucks, seven shovels and eight drills required for the mine expansion; with an investment of $510.9 million. All these assets are currently in operation.

The new Copper-Molybdenum Concentrator has an annual production capacity of 188,000 tons of copper and 2,600 tons of molybdenum. The project will also produce 2.3 million ounces of silver and 21,000 ounces of gold per year. The project has a 98% progress with an investment of $1,060.1 million out of the approved capital budget of $1,384 million. The project is expected to be completed in the 3Q15. All major equipment is on site and has been installed.

SX-EW III Plant: In July the Mexican authorities approved the initiation of activities in the Tinajas 2 leaching pad. This will allow the Company to achieve the designed annual production capacity of 120,000 tons of copper cathodes by the first quarter of 2016. As of June 30, 2015, we have invested $524.4 million in this project, including infrastructure, out of the approved capital budget of $524.5 million.

Crushing, Conveying and Spreading System for Leachable Ore (Quebalix IV): This project’s main objective is to reduce processing time as well as mining and hauling costs. It will also increase production by improving SX-EW copper recovery. It has a crushing and conveying capacity of 80 million tons per year and is expected to be completed by the 2Q16. The project has a 69% progress with an investment of $167.5 million out of the approved capital budget of $340 million.

The remaining projects to complete the $3.4 billion budgeted program include important investments in infrastructure (power lines and substations, water supply, tailings dam, mine equipment shops, internal roads, etc.) with a global progress of 65%.

Peruvian Projects

Toquepala Projects: Through June 30, 2015, we have invested $354.6 million in Toquepala projects. On April 14, 2015 the construction permit for the Toquepala expansion project was approved, allowing us to continue its development. Once in operation, the Toquepala expansion will increase annual production capacity by 100,000 tons of copper, from 135,000 tons in 2015 to 235,000 tons in 2017, and will also increase molybdenum production by 3,100 tons at an estimated capital cost of $1.2 billion. It is estimated that the project will generate 2,200 jobs during the construction phase and 300 additional jobs once finished, which will add to current 1,500 permanent employees at Toquepala. The project is expected to be completed by fourth quarter of 2017.

Our Board approved a project to improve the crushing process at Toquepala with the installation of a High Pressure Grinding Roll (HPGR) system, which will act as a quaternary crusher. The main objective is to ensure that the concentrator will operate at its maximum capacity of 60,000 tons per day, even with an increase of the ore material hardness index. Additionally, recoveries will be improved with a better ore crushing. We are finalizing commercial discussions with the selected vendor in order to initiate the project engineering and procurement. Once the engineering is sufficiently advanced we will start construction and plant assembly. The budget for this project is $40 million and it is expected to be completed by the first quarter of 2017.

|

2Q15 |

www.southerncoppercorp.com |

Page 3 of 9 |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2015 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Cuajone Projects: The project to improve slope stability at the south area of the Cuajone mine, will remove approximately 148 million tons of waste material. This project will improve mine design without reducing current production level. The mine equipment acquired includes one shovel, five 400-ton capacity trucks, one drill and auxiliary equipment which will be reallocated to the mine operations once this project is finished. Besides preparing the mine for the future, this investment will avoid a reduction in average ore grade. As of June 30, 2015, 29.5 million tons of waste material have been removed and this activity will continue for 3.5 additional years. As of June 30, 2015, we have invested $67.7 million in this project.

In-Pit Crushing and Conveyor (IPCC) Project: This project consists of installing a primary crusher at the Cuajone mine pit with a conveyor system for moving the ore to the concentrator. The project aims to optimize the hauling process by replacing rail haulage, thereby reducing operating and maintenance costs as well as the environmental impact of the Cuajone mine. The crusher will have a processing capacity of 43.8 million tons per year. We are completing the basic engineering and starting the detailed engineering. The main components, including the crusher and the overland belt, have been already acquired and we have started their installation. As of June 30, 2015, we have invested $58.1 million in this project out of the approved capital budget of $165.5 million. The project is expected to be completed by second quarter of 2017.

Tia Maria project: While we have received approval of Tia Maria´s Environmental Impact Assessment, the issuance of the project´s construction permit has been delayed pending the resolution of certain differences with community groups. The Peruvian government has recommended the establishment of a development dialogue roundtable for the resolution of these differences. As has always been done, the Company will invest responsibly and work hand-in-hand with the Peruvian communities. The Company has always acted with strict ethics and in absolute adherence of the law, with the utmost respect and confidence that Peru’s institutions will uphold the rule of law.

Tia Maria, when completed, will represent an investment of approximately $1.4 billion to produce 120,000 tons of copper cathodes per year. This project will use state of the art technology with the highest international environmental standards. The Company amended its Environmental Impact Assessment to use only seawater, transporting this more than 25 kilometers (15.5 miles) and at 1,000 meters (3,300 feet) above sea level, constructing a desalinization plant representing an additional investment of US$95 million for the productive process. In this manner, the Company guarantees that the Tambo Valley water resources will be used solely for farming and human consumption.

We expect the project to generate 3,500 jobs during the construction phase. When in operation, Tia Maria will directly employ 600 workers and indirectly another 2,000. Through its expected twenty-year life, the project related services will create significant business opportunities in the Arequipa region. In addition, the Company intends to implement social responsibility programs in the Arequipa region similar to those established in the communities near its other Peruvian operations.

Conference Call

The Company’s second quarter and first six months earnings conference call will be held on Thursday, July 30, 2015, beginning at 12:00 M. – EST (11:00 A.M. Lima and Mexico City time).

To participate:

|

Dial-in number: |

888-771-4371 in the U.S. |

|

|

847-585-4405 outside the U.S. |

|

|

Raul Jacob, SCC Vice President of Finance & CFO |

|

Conference ID: |

40347953 and “Southern Copper Corporation Second Quarter and Six Months 2015 Earnings Results” |

|

2Q15 |

www.southerncoppercorp.com |

Page 4 of 9

|

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2015 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Average Metal Prices

|

|

|

LME

Copper

($/lb.) |

|

COMEX Copper

($/lb.) |

|

Molybdenum

($/lb.) |

|

Zinc

($/lb.) |

|

Silver

($/oz.) |

|

Gold

($/oz.) |

|

1Q 2015 |

|

2.64 |

|

2.66 |

|

8.41 |

|

0.94 |

|

16.70 |

|

1,219.22 |

|

2Q 2015 |

|

2.75 |

|

2.77 |

|

7.45 |

|

1.00 |

|

16.38 |

|

1,192.82 |

|

6M 2015 |

|

2.69 |

|

2.72 |

|

7.93 |

|

0.97 |

|

16.54 |

|

1,206.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q 2014 |

|

3.19 |

|

3.24 |

|

9.93 |

|

0.92 |

|

20.46 |

|

1,293.95 |

|

2Q 2014 |

|

3.08 |

|

3.10 |

|

13.45 |

|

0.94 |

|

19.62 |

|

1,288.54 |

|

3Q 2014 |

|

3.17 |

|

3.16 |

|

12.62 |

|

1.05 |

|

19.63 |

|

1,281.92 |

|

4Q 2014 |

|

3.00 |

|

2.98 |

|

9.22 |

|

1.01 |

|

16.45 |

|

1,200.36 |

|

6M 2014 |

|

3.14 |

|

3.17 |

|

11.69 |

|

0.93 |

|

20.04 |

|

1,291.25 |

|

Average 2014 |

|

3.11 |

|

3.12 |

|

11.30 |

|

0.98 |

|

19.04 |

|

1,266.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variance: 2Q15 vs. 2Q14 |

|

(10.7)% |

|

(10.6)% |

|

(44.6)% |

|

6.4% |

|

(16.5)% |

|

(7.4)% |

|

Variance: 2Q15 vs. 1Q15 |

|

4.2% |

|

4.1% |

|

(11.4)% |

|

6.4% |

|

(1.9)% |

|

(2.2)% |

|

Variance: 6M15 vs. 6M14 |

|

(14.3)% |

|

(14.2)% |

|

(32.2)% |

|

4.3% |

|

(17.5)% |

|

(6.6)% |

Source: Silver – COMEX; Gold and Zinc – LME; Molybdenum – Metals Week Dealer Oxide

Production and Sales

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

|

2015 |

|

2014 |

|

|

% |

|

|

2015 |

|

2014 |

|

|

% |

|

Copper (tons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mined |

|

|

179,085 |

|

165,351 |

|

|

8.3% |

|

|

356,701 |

|

328,519 |

|

|

8.6% |

|

3rd party concentrate |

|

|

5,450 |

|

18 |

|

|

- |

|

|

5,466 |

|

2,246 |

|

|

143.4% |

|

Total production |

|

|

184,535 |

|

165,369 |

|

|

11.6% |

|

|

362,167 |

|

330,765 |

|

|

9.5% |

|

Smelted |

|

|

140,367 |

|

151,131 |

|

|

(7.1)% |

|

|

288,626 |

|

289,401 |

|

|

(0.3)% |

|

Refined and Rod |

|

|

196,091 |

|

189,659 |

|

|

3.4% |

|

|

398,678 |

|

358,779 |

|

|

11.1% |

|

Sales |

|

|

184,814 |

|

160,382 |

|

|

15.2% |

|

|

353,452 |

|

310,091 |

|

|

14.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Molybdenum (tons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mined |

|

|

5,759 |

|

5,821 |

|

|

(1.1)% |

|

|

11,615 |

|

11,386 |

|

|

2.0% |

|

Sales |

|

|

5,700 |

|

5,827 |

|

|

(2.2)% |

|

|

11,537 |

|

11,341 |

|

|

1.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zinc (tons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mined |

|

|

13,979 |

|

16,498 |

|

|

(15.3)% |

|

|

29,174 |

|

37,316 |

|

|

(21.8)% |

|

Refined |

|

|

24,548 |

|

23,709 |

|

|

3.5% |

|

|

50,028 |

|

48,464 |

|

|

3.2% |

|

Sales |

|

|

24,345 |

|

23,540 |

|

|

3.4% |

|

|

51,045 |

|

47,898 |

|

|

6.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silver (000sounces) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mined |

|

|

3,217 |

|

3,212 |

|

|

0.2% |

|

|

6,416 |

|

6,632 |

|

|

(3.3)% |

|

Refined |

|

|

3,012 |

|

3,399 |

|

|

(11.4)% |

|

|

6,271 |

|

6,180 |

|

|

1.5% |

|

Sales |

|

|

3,295 |

|

3,648 |

|

|

(9.7)% |

|

|

6,576 |

|

6,802 |

|

|

(3.3)% |

|

2Q15 |

www.southerncoppercorp.com |

Page 5 of 9

|

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2015 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Southern Copper Corporation

CONDENSED CONSOLIDATED STATEMENT OF EARNINGS

(Unaudited)

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

|

|

2015 |

|

2014 |

|

VAR % |

|

2015 |

|

2014 |

|

VAR % |

|

|

|

(in millions, except per share amount) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales: |

|

$1,382.9 |

|

$1,487.4 |

|

(7.0)% |

|

$2,657.7 |

|

$2,841.8 |

|

(6.5)% |

|

Operating cost and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation, amortization, and depletion shown separately below) |

|

706.9 |

|

726.6 |

|

(2.7)% |

|

1,386.7 |

|

1,368.5 |

|

1.3% |

|

Selling, general and administrative |

|

25.0 |

|

25.4 |

|

(1.6)% |

|

49.8 |

|

49.9 |

|

(0.2)% |

|

Depreciation, amortization and depletion |

|

125.3 |

|

116.1 |

|

7.9% |

|

242.2 |

|

226.5 |

|

6.9% |

|

Exploration |

|

12.1 |

|

22.1 |

|

(45.2)% |

|

22.4 |

|

36.7 |

|

(39.0)% |

|

Environmental remediation |

|

10.5 |

|

- |

|

100.0% |

|

16.5 |

|

- |

|

100.0% |

|

Total operating costs and expenses |

|

879.8 |

|

890.2 |

|

(1.2)% |

|

1,717.6 |

|

1,681.6 |

|

2.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

503.1 |

|

597.2 |

|

(15.8)% |

|

940.1 |

|

1,160.2 |

|

(19.0)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of capitalized interest |

|

(53.8) |

|

(36.9) |

|

45.8% |

|

(79.7) |

|

(77.5) |

|

2.8% |

|

Other income (expense) |

|

(1.5) |

|

(5.7) |

|

(73.7)% |

|

(5.4) |

|

(9.9) |

|

(45.5)% |

|

Interest income |

|

2.7 |

|

3.7 |

|

(27.0)% |

|

5.5 |

|

8.2 |

|

(32.9)% |

|

Income before income tax |

|

450.5 |

|

558.3 |

|

(19.3)% |

|

860.5 |

|

1,081.0 |

|

(20.4)% |

|

Income taxes |

|

157.1 |

|

225.8 |

|

(30.4)% |

|

286.2 |

|

429.9 |

|

(33.4)% |

|

Net income before equity earnings of affiliate |

|

293.4 |

|

332.5 |

|

(11.8)% |

|

574.3 |

|

651.1 |

|

(11.8)% |

|

Equity earnings of affiliate |

|

2.6 |

|

5.9 |

|

(55.9)% |

|

5.4 |

|

11.8 |

|

(54.2)% |

|

Net Income |

|

296.0 |

|

338.4 |

|

(12.5)% |

|

579.7 |

|

662.9 |

|

(12.6)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net income attributable to non-controlling interest |

|

1.3 |

|

1.1 |

|

18.2% |

|

2.6 |

|

2.3 |

|

13.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income attributable to SCC |

|

$294.7 |

|

$337.3 |

|

(12.6)% |

|

$577.1 |

|

$660.6 |

|

(12.6)% |

|

Per common share amounts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to SCC common shareholders – basic and diluted |

|

$0.37 |

|

$0.40 |

|

(7.5)% |

|

$0.72 |

|

$0.79 |

|

(8.9)% |

|

Dividends paid |

|

$0.10 |

|

$0.10 |

|

- |

|

$0.20 |

|

$0.22 |

|

(9.1)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding (Basic and diluted) |

|

|

798.2 |

|

|

833.4 |

|

|

|

|

801.8 |

|

|

833.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2Q15 |

www.southerncoppercorp.com |

Page 6 of 9

|

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2015 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Southern Copper Corporation

CONDENSED CONSOLIDATED BALANCE SHEET

(Unaudited)

|

|

|

June 30, |

|

December 31, |

|

June 30, |

|

|

|

|

2015 |

|

2014 |

|

2014 |

|

|

|

|

(in millions) |

|

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$1,572.3 |

|

$364.0 |

|

$1,335.4 |

|

|

Restricted cash |

|

7.4 |

|

19.4 |

|

- |

|

|

Short-term investments |

|

573.4 |

|

338.6 |

|

289.9 |

|

|

Accounts receivable |

|

581.8 |

|

621.9 |

|

649.2 |

|

|

Inventories |

|

826.5 |

|

836.5 |

|

754.6 |

|

|

Other current assets |

|

302.1 |

|

309.4 |

|

259.2 |

|

|

Total current assets |

|

3,863.5 |

|

2,489.8 |

|

3,288.3 |

|

|

|

|

|

|

|

|

|

|

|

Property, net |

|

7,691.7 |

|

7,436.4 |

|

6,933.7 |

|

|

Related parties receivable |

|

161.2 |

|

161.2 |

|

161.2 |

|

|

Leachable material, net |

|

630.7 |

|

512.7 |

|

495.2 |

|

|

Intangible assets, net |

|

125.2 |

|

123.6 |

|

121.3 |

|

|

Deferred income tax |

|

605.2 |

|

553.9 |

|

213.8 |

|

|

Other assets |

|

271.1 |

|

249.1 |

|

244.5 |

|

|

Total assets |

|

$13,348.6 |

|

$11,526.7 |

|

$11,458.0 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Current portion of long-term debt |

|

$200.0 |

|

$200.0 |

|

$200.0 |

|

|

Accounts payable |

|

548.9 |

|

549.7 |

|

509.1 |

|

|

Income taxes |

|

42.5 |

|

80.1 |

|

67.4 |

|

|

Accrued workers’ participation |

|

88.0 |

|

198.0 |

|

120.9 |

|

|

Other accrued liabilities |

|

136.1 |

|

123.1 |

|

104.1 |

|

|

Total current liabilities |

|

1,015.5 |

|

1,150.9 |

|

1,001.5 |

|

|

|

|

|

|

|

|

|

|

|

Long-term debt |

|

5,952.2 |

|

3,980.9 |

|

3,979.9 |

|

|

Deferred income taxes |

|

384.6 |

|

385.5 |

|

271.8 |

|

|

Other liabilities |

|

41.5 |

|

56.7 |

|

76.5 |

|

|

Asset retirement obligation |

|

113.1 |

|

116.1 |

|

151.5 |

|

|

Total non-current liabilities |

|

6,491.4 |

|

4,539.2 |

|

4,479.7 |

|

|

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Common stock |

|

3,351.3 |

|

3,353.5 |

|

3,359.4 |

|

|

Treasury stock |

|

(2,312.4) |

|

(1,900.6) |

|

(1,290.7) |

|

|

Accumulated comprehensive income |

|

4,768.5 |

|

4,351.6 |

|

3,878.1 |

|

|

Total stockholders’ equity |

|

5,807.4 |

|

5,804.5 |

|

5,946.8 |

|

|

Non-controlling interest |

|

34.3 |

|

32.1 |

|

30.0 |

|

|

Total equity |

|

5,841.7 |

|

5,836.6 |

|

5,976.8 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$13,348.6 |

|

$11,526.7 |

|

$11,458.0 |

|

As of June 30, 2015, December 31, 2014 and June 30, 2014 there were 798.0 million, 812.6 million and 833.0 million shares outstanding, respectively.

|

2Q15 |

www.southerncoppercorp.com |

Page 7 of 9

|

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2015 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Southern Copper Corporation

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW

(Unaudited)

|

|

|

Three months ended

June 30, |

|

Six months ended

June 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

(in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$296.0 |

|

$338.4 |

|

$579.7 |

|

$663.0 |

|

|

Depreciation, amortization and depletion |

|

125.3 |

|

116.1 |

|

242.3 |

|

226.5 |

|

|

Deferred income tax |

|

(40.2) |

|

27.4 |

|

(64.9) |

|

(56.8) |

|

|

Change in operating assets and liabilities |

|

(37.1) |

|

(145.0) |

|

(203.8) |

|

(138.6) |

|

|

Other, net |

|

(9.2) |

|

(3.4) |

|

(20.1) |

|

(12.3) |

|

|

Net cash provided by operating activities |

|

334.8 |

|

333.5 |

|

533.2 |

|

681.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

Capital investments |

|

(284.9) |

|

(360.1) |

|

(507.7) |

|

(697.0) |

|

|

Sale (purchase) of short-term investment, net |

|

(489.5) |

|

(16.9) |

|

(234.8) |

|

(81.6) |

|

|

Other, net |

|

2.9 |

|

4.6 |

|

3.0 |

|

4.8 |

|

|

Net cash used in investing activities |

|

(771.5) |

|

(372.4) |

|

(739.5) |

|

(773.8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

Debt incurred (repaid) |

|

1,929.8 |

|

- |

|

1,979.8 |

|

- |

|

|

Dividends paid |

|

(79.8) |

|

(83.3) |

|

(160.3) |

|

(183.3) |

|

|

Distributions to non-controlling interest |

|

(0.2) |

|

(0.2) |

|

(0.4) |

|

(0.5) |

|

|

SCC common shares buyback |

|

(44.5) |

|

(13.0) |

|

(414.6) |

|

(65.5) |

|

|

Capitalization of debt issuance cost |

|

(9.7) |

|

- |

|

(9.7) |

|

- |

|

|

Other |

|

0.3 |

|

0.2 |

|

0.3 |

|

0.2 |

|

|

Net cash provided by (used in) financing activities |

|

1,795.9 |

|

(96.3) |

|

1,395.1 |

|

(249.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

21.0 |

|

(2.5) |

|

19.6 |

|

3.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

$1,380.2 |

|

$(137.7) |

|

$1,208.4 |

|

$(337.3) |

|

|

2Q15 |

www.southerncoppercorp.com |

Page 8 of 9

|

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2015 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Company Profile

Southern Copper Corporation (SCC) is one of the largest integrated copper producers in the world and we believe we currently have the largest copper reserves in the industry. The Company is a NYSE and Lima Stock Exchange listed company that is 86.2% owned by Grupo Mexico, a Mexican company listed on the Mexican stock exchange. The remaining 13.8% ownership interest is held by the international investment community. The Company operates mining units and metallurgical facilities in Mexico and Peru and conducts exploration activities in Argentina, Chile, Ecuador, Mexico and Peru.

SCC Corporate Address

USA

1440 E Missouri Ave, Suite 160

Phoenix, AZ 85014, U. S. A.

Phone: (602) 264-1375

Fax: (602) 264-1397

Mexico

Campos Eliseos N° 400

Colonia Lomas de Chapultepec

Delegacion Miguel Hidalgo

C.P. 11000 - MEXICO

Phone: (5255) 1103-5000

Fax: (5255) 1103-5567

Peru

Av. Caminos del Inca 171

Urb. Chacarilla del Estanque

Santiago de Surco

Lima 33 – PERU

Phone: (511) 512-0440

Fax: (511) 512-0492

###

This news release contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. In addition to the risks and uncertainties noted in this news release, there are certain factors that could cause results to differ materially from those anticipated by some of the statements made. These factors include those listed in the Company’s most recently filed quarterly reports on Form 10-Q and annual report on Form 10-K. The Company expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based.

i EBITDA is a common non-GAAP measure useful for our management as an indicator of Company’s ability to produce income from its operations. See reconciliation of EBITDA to GAAP net earnings on our website http://www.southerncoppercorp.com/ENG/invrel/Pages/PGEbitda.aspx.

ii Operating cash cost is a non-GAAP measure useful as a management tool to track our performance and better allocate our resources. It is also useful to readers of the financial statements for analysis and comparability purposes. See reconciliation of operating cash cost to GAAP cost of sales on our website http://www.southerncoppercorp.com/ENG/invrel/Pages/PGEbitda.aspx.

|

2Q15 |

www.southerncoppercorp.com |

Page 9 of 9

|

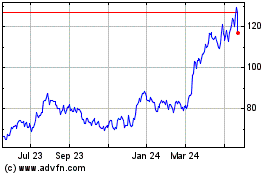

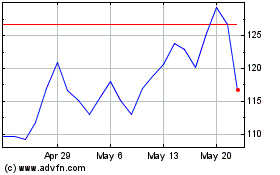

Southern Copper (NYSE:SCCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Southern Copper (NYSE:SCCO)

Historical Stock Chart

From Apr 2023 to Apr 2024