UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-32199

SFL Corporation Ltd.

--------------------------------------------------------------------------------

(Translation of registrant's name into English)

Par-la-Ville Place

14 Par-la-Ville Road

Hamilton, HM 08, Bermuda

--------------------------------------------------------------------------------

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto as Exhibit 1 is a copy of the press release of SFL Corporation Ltd. (NYSE: SFL) (“SFL” or the “Company”), dated September 11, 2024, announcing that it has successfully placed NOK 750 million senior unsecured bonds due September 25, 2029.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | SFL CORPORATION LTD. | |

| | | | | |

| Date: | September 12, 2024 | By: | /s/ Ole B. Hjertaker | |

| | | Name: | Ole B. Hjertaker | |

| | | Title: | SFL Management AS | |

| | | | (Principal Executive Officer) | |

EXHIBIT 1

SFL – Successful Placement of Five Year Senior Unsecured Bonds

SFL Corporation Ltd. (NYSE: SFL) (the “Company” or “SFL”) today successfully placed NOK 750 million senior unsecured bonds due September 25, 2029. The bonds will pay a quarterly coupon of the 3 month Norwegian Interbank Offered Rate (NIBOR) + 3.25 % per annum.

Net proceeds from the bond issuance will intendedly be applied against the call of the net outstanding amount of the Company’s existing NOK 600 million senior unsecured bonds maturing in January 2025, with ISIN NO0010872997 (the “Existing Bonds”), at the prevailing call price, and general corporate purposes.

Arctic Securities, DNB Markets and SEB acted as Joint Bookrunners in the placement of the bond offering. Fearnley Securities and Pareto Securities acted as co-managers.

SFL further announces that it has notified Nordic Trustee AS that it is exercising the call option to redeem all outstanding Existing Bonds.

Reference is made to the attached notice from Nordic Trustee AS for further information about the exercised call option.

September 11, 2024

The Board of Directors

SFL Corporation Ltd.

Hamilton, Bermuda

Investor and Analyst Contacts:

Aksel Olesen, Chief Financial Officer, SFL Management AS

+47 23 11 40 36

André Reppen, Chief Treasurer & Senior Vice President, SFL Management AS

+47 23 11 40 55

Marius Furuly, Senior Vice President – Energy, SFL Management AS

+47 23 11 40 16

Media Contact:

Ole B. Hjertaker, Chief Executive Officer, SFL Management AS +47 23 11 40 11

About SFL

SFL has a unique track record in the maritime industry and has paid dividends every quarter since its initial listing on the New York Stock Exchange in 2004. The Company’s fleet of vessels is comprised of tanker vessels, bulkers, container vessels, car carriers and offshore drilling rigs. SFL’s long term distribution capacity is supported by a portfolio of long term charters and significant growth in the asset base over time. More information can be found on the Company’s website: www.sflcorp.com

Cautionary Statement Regarding Forward Looking Statements

This press release may contain forward looking statements. These statements are based upon various assumptions, many of which are based, in turn, upon further assumptions, including SFL management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although SFL believes that these assumptions were reasonable when made, because assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond its control, SFL cannot give assurance that it will achieve or accomplish these expectations, beliefs or intentions.

Important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward looking statements include the strength of world economies, fluctuations in currencies and interest rates, general market conditions in the seaborne transportation industry, which is cyclical and volatile, including fluctuations in charter hire rates and vessel values, changes in demand in the markets in which the Company operates, including shifts in consumer demand from oil towards other energy sources or changes to trade patterns for refined oil products, changes in market demand in countries which import commodities and finished goods and changes in the amount and location of the production of those commodities and finished goods, technological innovation in the sectors in which we operate and quality and efficiency requirements from customers, increased inspection procedures and more restrictive import and export controls, changes in the Company’s operating expenses, including bunker prices, dry-docking and insurance costs, performance of the Company’s charterers and other counterparties with whom the Company deals, the impact of any restructuring of the counterparties with whom the Company deals, and timely delivery of vessels under construction within the contracted price, governmental laws and regulations, including environmental regulations, that add to our costs or the costs of our customers, potential liability from pending or future litigation, potential disruption of shipping routes due to accidents, political instability, terrorist attacks, piracy or international hostilities, the length and severity of the ongoing coronavirus outbreak and governmental responses thereto and the impact on the demand for commercial seaborne transportation and the condition of the financial markets, and other important factors described from time to time in the reports filed by the Company with the United States Securities and Exchange Commission. SFL disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

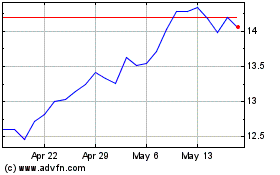

SFL (NYSE:SFL)

Historical Stock Chart

From Nov 2024 to Dec 2024

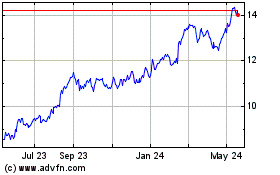

SFL (NYSE:SFL)

Historical Stock Chart

From Dec 2023 to Dec 2024