Form 8-K - Current report

August 27 2024 - 3:27PM

Edgar (US Regulatory)

false

0001811074

0001811074

2024-08-27

2024-08-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 27, 2024

Texas

Pacific Land Corporation

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

1-39804 |

75-0279735 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

|

|

| 1700 Pacific Avenue, Suite 2900, |

|

|

| Dallas, Texas |

|

75201 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 214-969-5530

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

|

Common Stock , Par Value $0.001 per share

|

|

TPL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On August 27, 2024, Texas Pacific Land Corporation

(the “Company” or “TPL”) issued a press release announcing the acquisition of oil and gas mineral interests in

4,106 total net royalty acres located in Culberson County, Texas for $124 million in cash (the “Mineral Interest Acquisitions”).

The information contained in this Item 7.01 and

in the accompanying Exhibit 99.1 shall not be incorporated by reference into any filing of the Company, whether made before or after the

date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such

filing. The information in this Item 7.01 and the accompanying Exhibit 99.1 shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended.

The Mineral Interest Acquisitions were completed

in conjunction with Brigham Royalties Fund I Holdco, L.L.C., a subsidiary of Brigham Royalties, LLC (“Brigham Royalties”).

Robert Roosa, a member of the Company’s Board of Directors, is a partner in, and serves as the Chief Executive Officer of, Brigham

Royalties. Brigham Royalties originally identified the opportunity and, because of the size and concentration, invited the Company to

participate. Following the execution of the purchase and sale agreements (totaling 7,416 net royalty acres) related to the Mineral Interest

Acquisitions, a 55.4% interest in each was assigned to a subsidiary of the Company.

Each party paid a pro-rata share of the purchase

price and closing costs. TPL directly paid an aggregate of $275 per net mineral acre in commissions to certain Brigham Royalties employees

equal to the bonuses those employees would have received with respect to the Mineral Interest Acquisitions had they been completed by

Brigham Royalties. Those fees were significantly less than commissions TPL would have paid to other third parties for similar services.

TPL performed its own diligence and valuation and the Mineral Interest Acquisitions were approved by the Company’s Audit Committee

and full Board of Directors with Mr. Roosa abstaining. TPL did not pay any fees or commissions to Brigham Royalties or Mr. Roosa.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Texas

Pacific Land Corporation |

| |

|

|

August

27, 2024 |

By: |

/s/

Michael W. Dobbs |

| |

|

Name:

Michael W. Dobbs |

| |

|

Title: SVP, General Counsel

and Secretary |

Exhibit 99.1

TEXAS PACIFIC LAND CORPORATION ACQUIRES PERMIAN

MINERAL INTERESTS AND SURFACE ACREAGE IN CASH TRANSACTIONS

Acquisitions Add High-Quality Assets that

are Expected to Generate Attractive Returns

DALLAS, TX (August 27, 2024) –

Texas Pacific Land Corporation (NYSE: TPL) (the “Company” or “TPL”) today announced the closing of two acquisitions

for oil and gas mineral interests and surface acreage located in the Permian Basin for an aggregate $169 million in cash.

TPL acquired mineral interests across

approximately 4,106 net royalty acres located in Culberson County, Texas. The acquired mineral interests overlap existing TPL royalty

acreage in current and anticipated Drilling and Spacing Units (“DSU”), enhancing TPL’s net revenue interests in existing

and future oil and gas wells. The acreage is leased to and operated by Coterra Energy (NYSE: CTRA). In addition, the acquired mineral

interests overlap with TPL surface acreage.

The acquired surface asset spans approximately

4,120 acres in Martin County, Texas and is strategically located in the core of the Midland Basin. The asset generates numerous revenue

streams across water supply, produced water disposal, and multiple other surface-related activities, including royalties from a solids

waste landfill owned and operated by Waste Connections, Inc. (NYSE: WCN), and possesses significant additional commercial growth opportunities.

“Acquiring high-quality mineral

interests in the northern Delaware Basin and strategic surface acreage in the Midland Basin will immediately contribute to TPL’s

free cash flow,” said Tyler Glover, Chief Executive Officer of the Company. “The combined asset purchase price implies a greater

than 13% 2025 free cash flow yield at current strip prices giving credit to only existing production and line-of-sight wells and opportunities.

These bolt-on transactions, in addition to the cash flow currently generated, have excellent growth qualities commensurate with TPL’s

legacy portfolio. By owning overlapping and nearby surface and water assets, we believe we can accelerate development and generate incremental

value. Both assets were sourced through our industry and professional networks and were not part of a broad marketed process. These type

of premium assets located within the core subregions of the Permian Basin represent the growth opportunities available to TPL that can

provide a substantial incremental value driver to our legacy asset base.”

| Delaware Basin mineral interests |

About Texas Pacific Land Corporation

Texas Pacific Land Corporation is one of the largest

landowners in the State of Texas with approximately 873,000 acres of land in West Texas, with the majority of its ownership concentrated

in the Permian Basin. The Company is not an oil and gas producer, but its surface and royalty ownership provide revenue opportunities

throughout the life cycle of a well. These revenue opportunities include fixed fee payments for use of our land, revenue for sales of

materials (caliche) used in the construction of infrastructure, providing sourced water and/or treated produced water, revenue from our

oil and gas royalty interests, and revenues related to saltwater disposal on our land. The Company also generates revenue from pipeline,

power line and utility easements, commercial leases and temporary permits related to a variety of land uses including midstream infrastructure

projects and hydrocarbon processing facilities.

Visit TPL at http://www.TexasPacific.com.

Contact:

Investor Relations

IR@TexasPacific.com

v3.24.2.u1

Cover

|

Aug. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 27, 2024

|

| Entity File Number |

1-39804

|

| Entity Registrant Name |

Texas

Pacific Land Corporation

|

| Entity Central Index Key |

0001811074

|

| Entity Tax Identification Number |

75-0279735

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1700 Pacific Avenue

|

| Entity Address, Address Line Two |

Suite 2900,

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

214

|

| Local Phone Number |

969-5530

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock , Par Value $0.001 per share

|

| Trading Symbol |

TPL

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

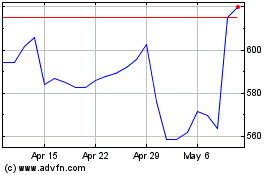

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Jan 2025 to Feb 2025

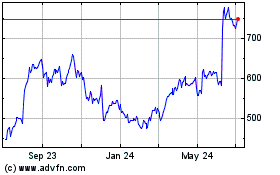

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Feb 2024 to Feb 2025