Distribution Amounts and Dates Declared for: Tortoise Energy

Infrastructure Corp. (NYSE: TYG) Tortoise Midstream Energy Fund,

Inc. (NYSE: NTG) Tortoise Pipeline & Energy Fund, Inc. (NYSE:

TTP) Tortoise Energy Independence Fund, Inc. (NYSE: NDP) Tortoise

Power and Energy Infrastructure Fund, Inc. (NYSE: TPZ)

Tortoise and the Board of its closed-end funds announced

significant increases to distributions for its closed-end funds. As

previously announced, the funds have adopted managed distribution

policies and those policies have been reviewed and modified to

provide more of the fund total return in the form of distributions.

These increases are the product of the 26-week average NAV ended

November 30, 2021 and the distribution target ranges outlined

below. The funds have also implemented a discount management

program that aims to further enhance shareholder value.

Tortoise closed-end funds distribution details are as

follows:

Fund

Ticker

Distribution

Amount

% Increase

Distribution Target of Average

NAV

Distribution

Frequency

Tortoise Energy Infrastructure

Corp.

TYG

$0.71

58%

7%-10%

Quarterly

Tortoise Midstream Energy Fund,

Inc.

NTG

$0.77

35%

7%-10%

Quarterly

Tortoise Pipeline & Energy

Fund, Inc.

TTP

$0.59

60%

7%-10%

Quarterly

Tortoise Energy Independence

Fund, Inc.,

NDP

$0.48

55%

7%-10%

Quarterly

Tortoise Power and Energy

Infrastructure Fund, Inc.

TPZ

$0.105

75%

7%-10%

Monthly

TYG, NTG, TTP, NDP and TPZ (each, a “Fund” and collectively, the

“Funds”) distributions are payable on February 28, 2022, to

shareholders of record on February 21, 2022.

Discount Management Program

In addition to share repurchases which have been executed by the

Funds, the Board of Directors has approved tender offers as part of

the discount management program and announced conditional tender

offers for each of the calendar years 2022 and 2023. A Fund would

conduct a tender for 5% of the Fund’s outstanding shares of common

stock at a price equal to 98% of net asset value (NAV) if its

shares trade at an average discount to NAV of more than 10% during

either of the designated measurement periods. The first measurement

period will commence on February 1, 2022 and end July 31, 2022 for

2022, and the second measurement period will commence on August 1,

2022 and end July 31, 2023, for 2023. Should a tender offer be

required, it will be executed following the completion of each of

the aforementioned measurement periods. The Board will continue to

evaluate the effectiveness of share repurchases and tender offers

as part of the Funds’ discount management program, and may announce

additional actions in the future.

The Funds’ portfolio managers, officers and Board of Directors

will not tender their shares if a tender is required.

“We believe revising the distribution levels and managed

distribution targets, and the conditional tenders for each of 2022

and 2023, to be very positive for shareholders,” said Brad Adams,

CEO of Tortoise’s closed-end funds.

“We also have deep conviction in the closed-end fund structure

as it allows managers to invest with long investment horizons,

without constant inflows and outflows of cash and provides the

opportunity to invest in less liquid securities and private

placements, use leverage and provide high current

distributions.”

Sector Outlook

“Our outlook for energy infrastructure is incredibly bullish,”

said Matt Sallee, President – Tortoise. “Energy was the top

performing sector in 2021 with midstream energy outperforming the

S&P 500 for the first time in five years. We think several data

points indicate a favorable outlook for 2022. A number of Wall

Street firms have recommendations to increase energy and

infrastructure exposure to position for a higher inflationary

environment. From a fundamental perspective, companies have been

generating significant amounts of free cash flow and returning it

to shareholders. There are also signs the COVID-19 pandemic could

move to an endemic in 2022, a great boost for energy demand.

Finally, there are indications of global acceptance that natural

gas should be included as a sustainable energy source and

investment option as energy transitions. Although there are some

potential macro headwinds that are hard to predict including the

global pandemic and other geopolitical concerns, we believe that

all of these catalysts will lead to strong returns for energy and

power infrastructure companies and we want to pass along that value

to our shareholders.”

To learn more, watch our video with Matt Sallee and Mark

Marifian, Director-Client Portfolio Manager here.

For book purposes, the source of distributions for TYG and NTG

is estimated to be 0-10% ordinary income, with the remainder as

return of capital, and the source of distributions for NDP is

estimated to be approximately 30-40% ordinary income, with the

remainder as return of capital.

You should not draw any conclusions about TTP’s or TPZ’s

investment performance from the amount of these distributions or

from the terms of TTP’s or TPZ’s distribution policy.

TTP and TPZ estimate that they have distributed more than their

income and net realized capital gains; therefore, a portion of the

distribution may be return of capital. A return of capital may

occur, for example, when some or all of the money that you invested

in TTP and TPZ is paid back to you. A return of capital

distribution does not necessarily reflect TTP’s and TPZ’s

investment performance and should not be confused with “yield” or

“income.”

TTP and TPZ will report the sources for their distributions at

the time of the payment in the applicable Section 19(a) Notice. The

amounts and sources of distributions TTP and TPZ report are only

estimates and are not being provided for tax reporting purposes.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon TTP’s and TPZ’s investment experience

during the remainder of their fiscal years and may be subject to

changes based on tax regulations.

About Tortoise

Tortoise focuses on energy & power infrastructure and the

transition to cleaner energy. Tortoise’s solid track record of

energy value chain investment experience and research dates back

more than 20 years. As one of the earliest investors in midstream

energy, Tortoise believes it is well-positioned to be at the

forefront of the global energy evolution that is underway. With a

steady wins approach and a long-term perspective, Tortoise strives

to make a positive impact on clients and communities. To learn

more, please visit www.TortoiseEcofin.com.

Tortoise Capital Advisors, L.L.C. is the adviser to Tortoise

Energy Infrastructure Corp., Tortoise Midstream Energy Fund, Inc.,

Tortoise Pipeline & Energy Fund, Inc., Tortoise Energy

Independence Fund, Inc. and Tortoise Power and Energy

Infrastructure Fund, Inc.

For additional information on these funds, please visit

cef.tortoiseecofin.com.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains certain statements that may include

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical fact, included herein are "forward-looking statements."

Although the funds and Tortoise Capital Advisors believe that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. Actual results

could differ materially from those anticipated in these

forward-looking statements as a result of a variety of factors,

including those discussed in the fund’s reports that are filed with

the Securities and Exchange Commission. You should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. Other than as required by law,

the funds and Tortoise Capital Advisors do not assume a duty to

update this forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220118006274/en/

Jen Ashlock (913) 981-1020 info@tortoiseecofin.com

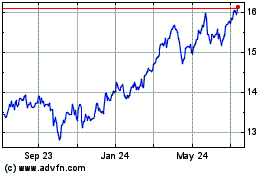

Tortoise Power and Energ... (NYSE:TPZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

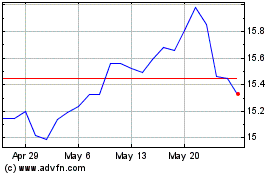

Tortoise Power and Energ... (NYSE:TPZ)

Historical Stock Chart

From Dec 2023 to Dec 2024